EOL

EOL

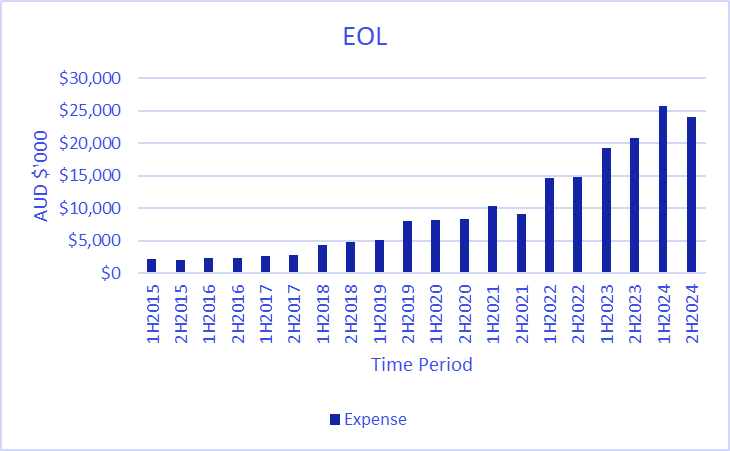

FY24 Result

Pinned straw:

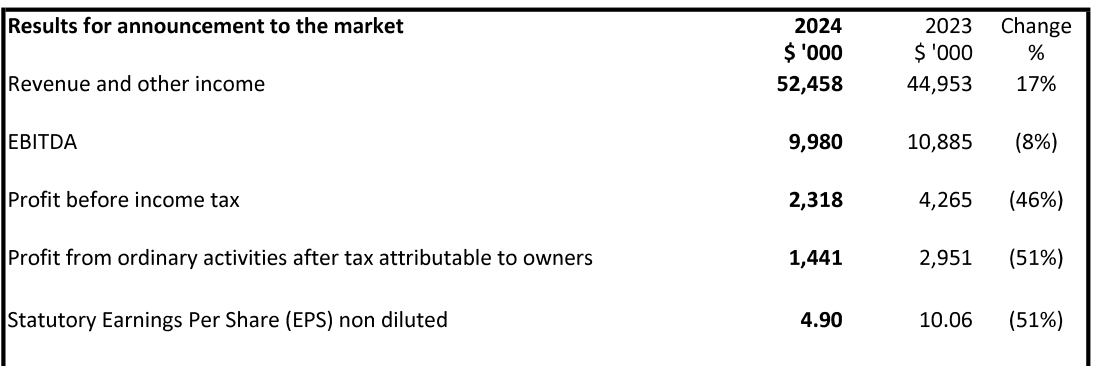

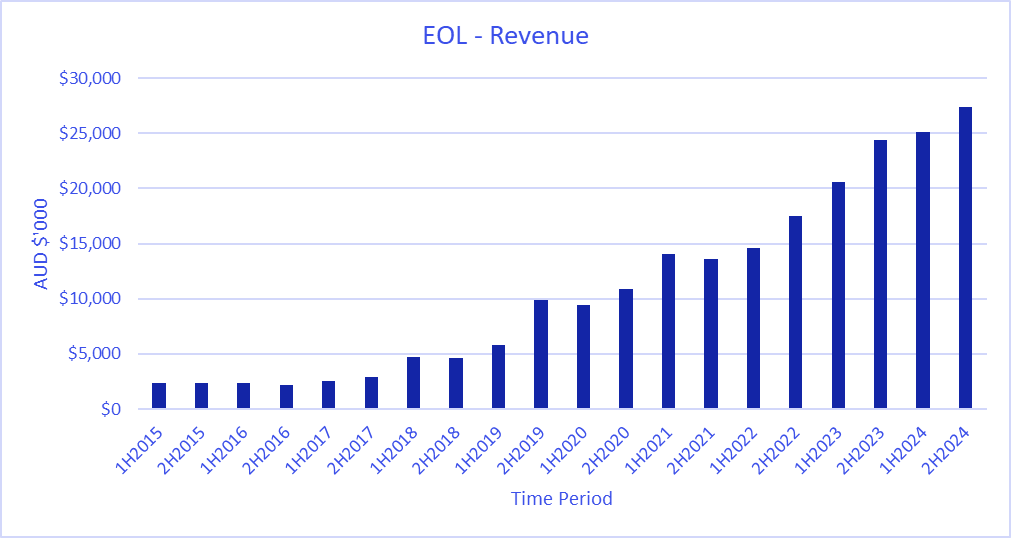

The transformation of this business from Australia focused with a UK offshoot to a pan-European business with an Australian arm is starting to show in the revenue.

Everything is a bit messy because this transition has taken place, with the global operations project front loading some opex and that being done against the backdrop of some one off costs running through the business around the cyber incident and M&A. Hopefully that all washes out over the next couple of periods and the growth story comes back to the fore. Held IRL.

17