Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

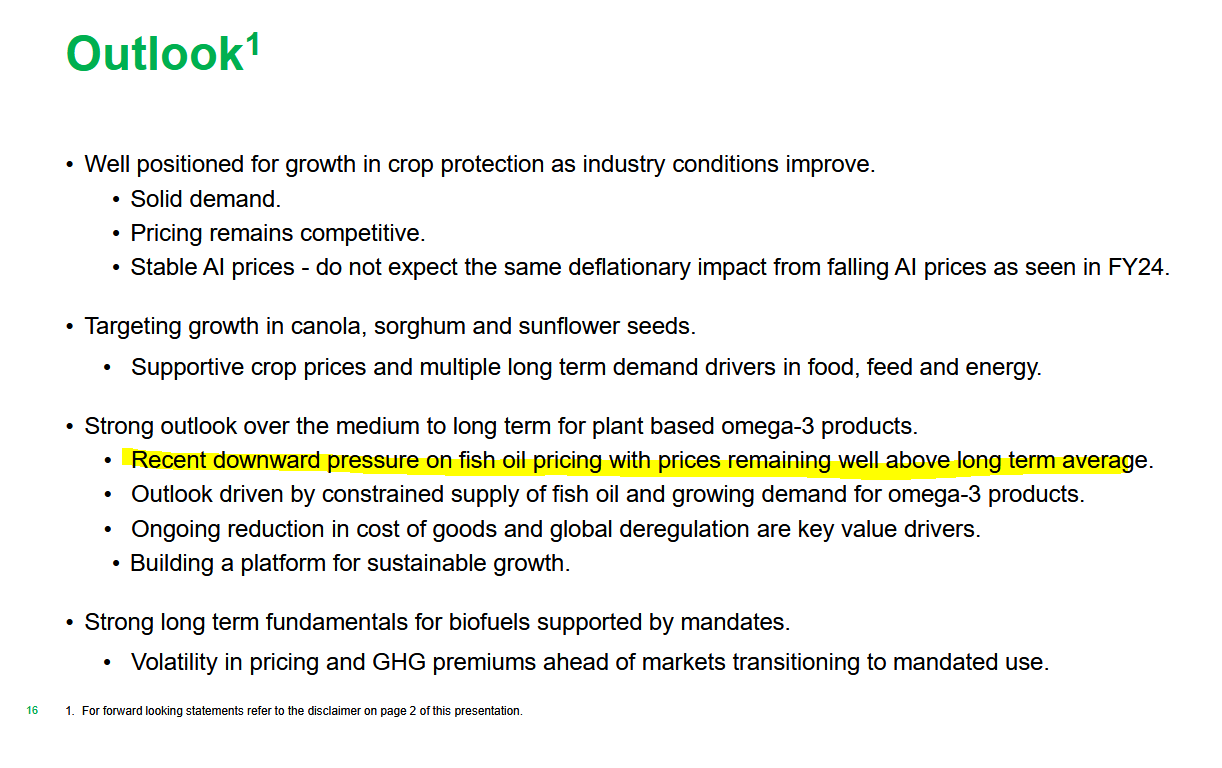

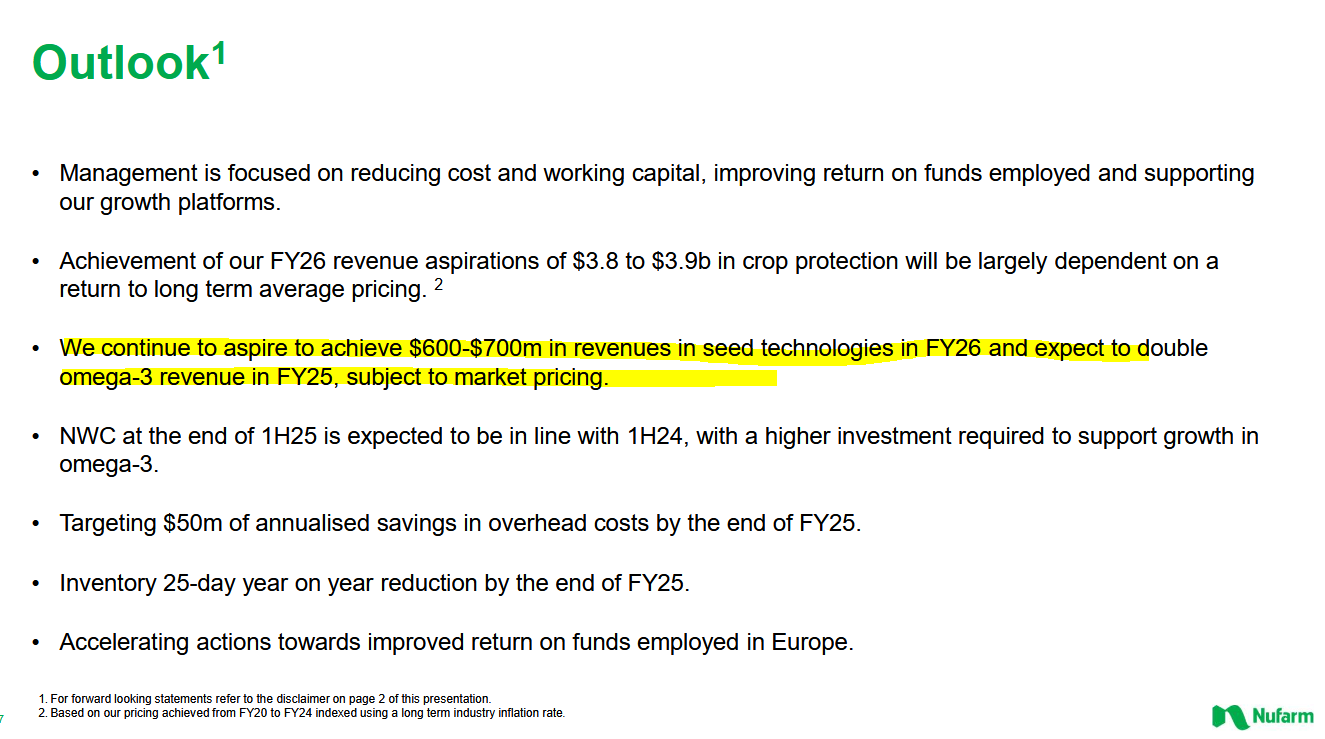

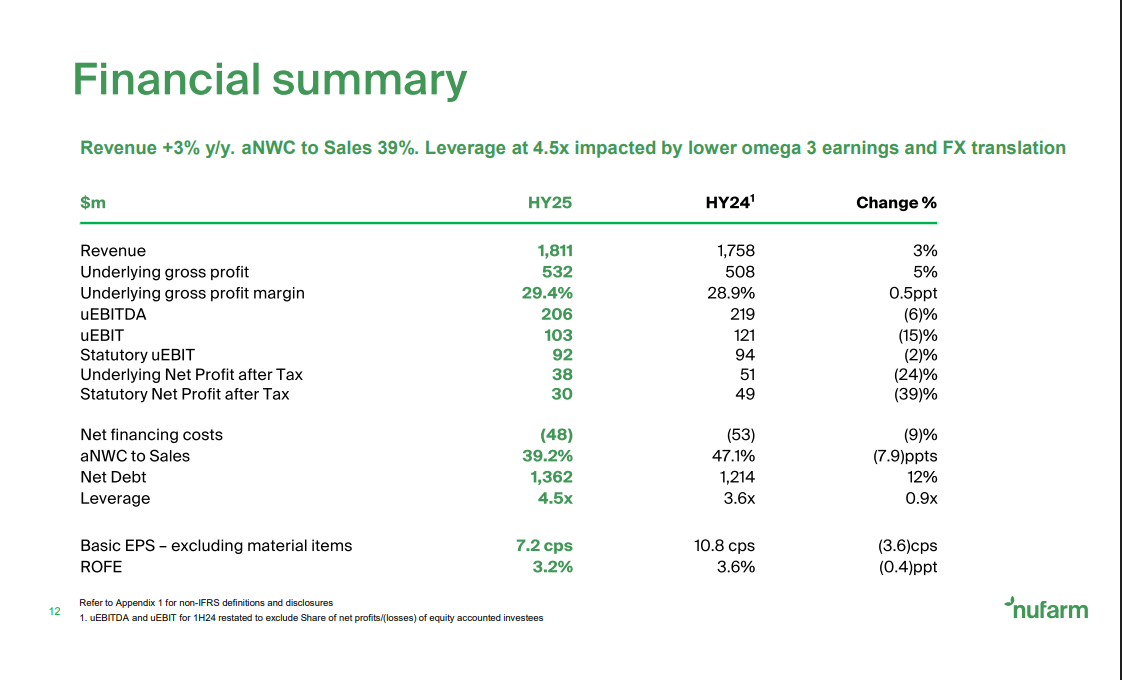

Nufarm's results came in at a beat with a positive outlook up to FY26.

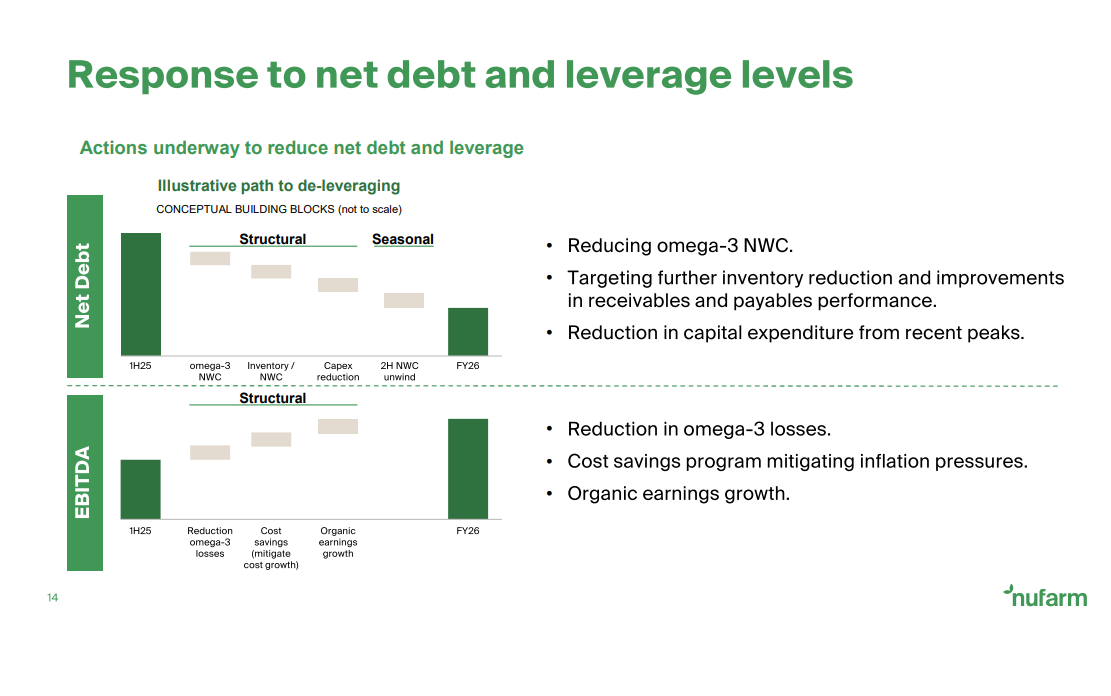

Increasing the dividend but not sure if that's a good idea given the debt is 0.8x of EBITDA.

I would have kept dividend flat and pay off the debt unless they are bullish about growth prospects going forward which is hard to see given some of the extreme weather events having a negative impact on agriculture overall.

Still holding considering the previous on market purchase from the CEO during the selldown from Sumitomo where no participated in the bookbuild.

[held]

Bit of FOMO happening here although the GICs sector that Nufarm is a part of is rallying quite well.

Apparently Nufarm is a chemical company even though they serve the Ag sector

Anyone brave enough to top up at the lows when Sumitomo Chemical sold out deserves a pat on the back although they were also underperforming too.

The fact debt hasn't reduced much is a bit worrying unless there is massive growth on the horizon (see previous straw)

[held]

Nice to see CEO Greg Hunt buying a fair chunk on market

I guess he is still confident on hitting those ambitious revenue forecasts.

[held]

Finally have a good news cyclical agricultural story.

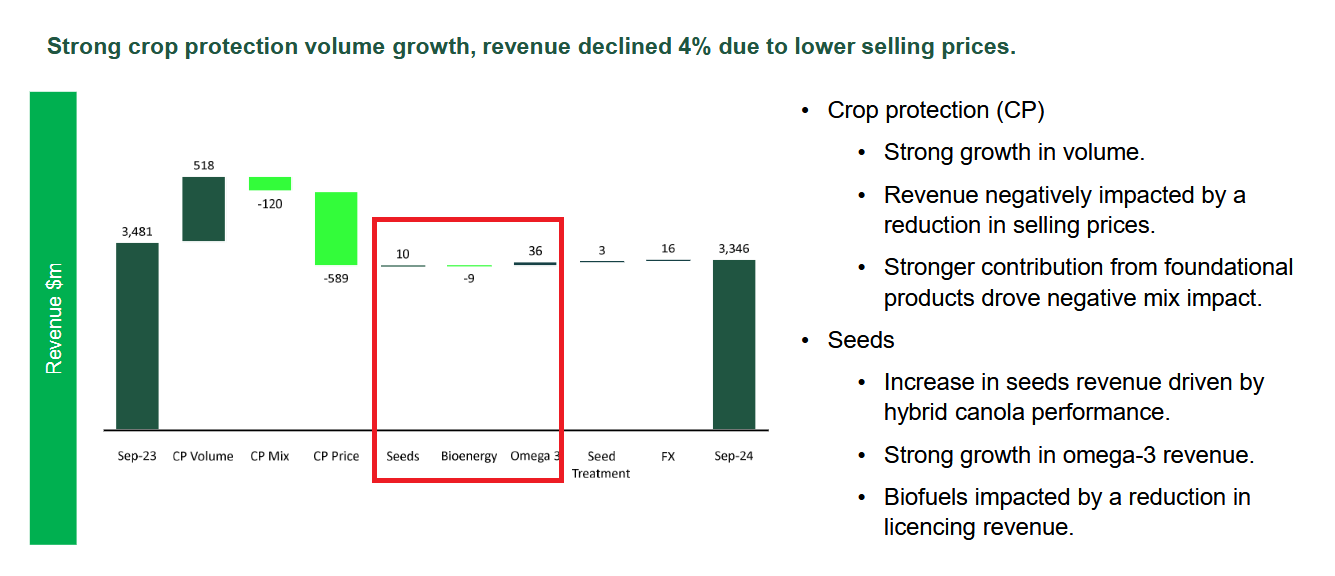

Nufarm released results and comfortably beat expectations sending the share price rallying 14%.

EPS came above consensus and dividend up from 4 to 5 cps.

Sales down but still above analyst consensus. Nufarm is reiterating their aim of growing revenue to $4.6B pa by FY26

Working capital and inventory for America would be the only negative but they expect that will be drawn down next period. Also the debt growth is another negative.

The ones who sold yesterday would be having a pretty bad day today.

To be fair to those that sold yesterday, today's trading doesn't make trend.

And probably no one expected anything special given the results from Elders and Incitec Pivot

[held]

Probably not the update I was looking for on North America but will accept it nonetheless. I have a feeling everyone was looking for an update on the impact of drought in North America like myself..

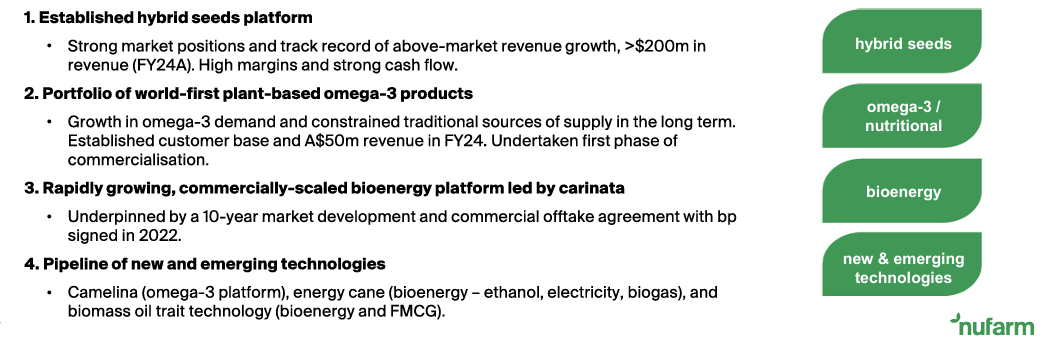

Norway approves Aquaterra Omega-3 oil for use in aquafeed

[held]

Firstly Norway is the biggest salmon aquaculture producer in the world

Getting the approval from Norway is significant for Aquaterra as it means big dollars to Nufarm. Unfortunately Nufarm has not communicated clearly on the revenue numbers. So the only way to look at is the most recent investor slides to get a good idea of the market opportunity.

Let us assume that most of the Aquaterra sales are coming from Chile and a minority from North America.

From the 1st chart on Salmon production, there is obviously a large opportunity to capture some meaningful revenue when comparing Chile and North America (USA and Canada) with Norway.

With the drive to replace smaller fish feed (ie: sardines etc.) with something more sustainable and easier to produce, Nufarm could be well placed in generating lots of revenue, particularly in Norway.

Yes it is a recession and Yes people can forgo nutrition for days. But Aquaterra is a new market opportunity that could displace normal sources of fish feed for aquaculture.

And also rains appear to have returned to the American wheatbelt. Maybe Nufarm can start runninig down their inventory in USA

The selling is well overdone. Aquaterra could potentially the peaks and troughs of other areas and give Nufarm some much needed consistency in earnings.

Topped up on the morning dip before the late buying in the afternoon.

[held]

Nufarm hits 52 week low without much effort.

My guess would be due to the headlines about El-Nino being more likely with less rainfall.

I still see Orbis (Allan Gray) and L1 Capital still large holders. Perhaps they still hold faith that Nufarm can still deliver the large revenue target for FY26

Also State Street has increased holding perhaps to hand out stock for short sellers

Given the situation, not going to average down here.

[held]

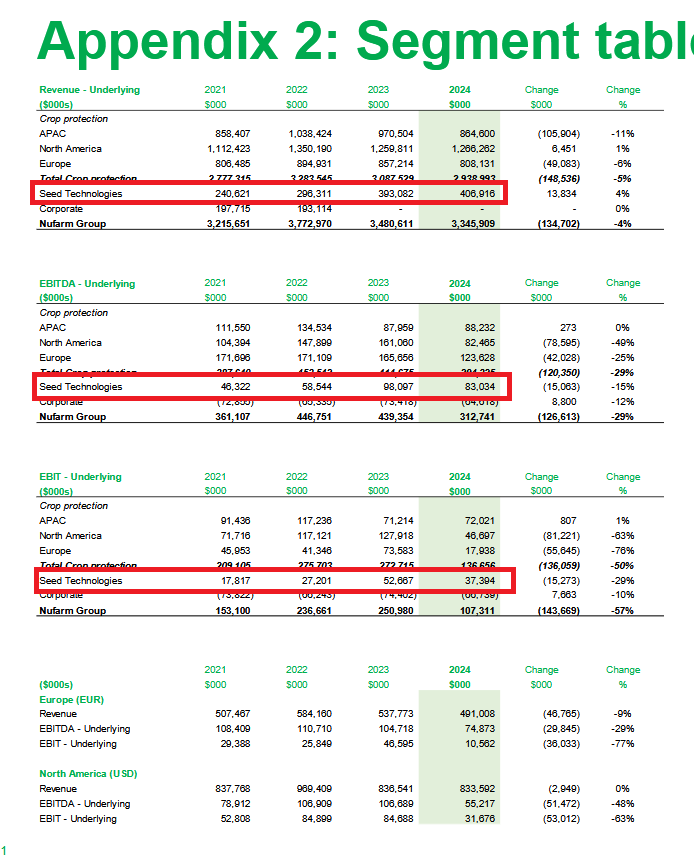

With prices of Fish Oil mooning at the chemist and supermarkets, you would think that Nufarm would be printing money in their Seeds business especially Aquaterra which is used to boost Omega-3 in farmed fish.

However, it seems their Seed business has gone backward and hitting those revenue targets are less likely

As discussed in the Santos posts, being a primary commodity producer is such a hard business.

At least the outlook seems optimistic. Still I can't see how Nufarm can hit 700m in revenue from these segments alone when the contributions are tiny and profitability went backward from last year.

I'm glad I'm not holding any more.

https://hotcopper.com.au/threads/ann-nufarm-hy25-results-presentation.8591172/

NUF crashes to $2.50

Last

$2.50

Change

0.030(1.21%)

Mkt cap !

$957.4M

From Livewire

https://www.livewiremarkets.com/wires/have-you-got-enough-food-in-your-bunker

We most recently re-entered NUF in October 2021 when the stock was trading at ~AUD4.50/share or ~80% of book value, which compares to our current DCF derived valuation of ~AUD6.40/share (WACC10%).

There are 2 key points with our valuation that we point out

a) It includes a heavily risked valuation for Nuseed, that we suspect will derisk over time

b) We have discounted the whole business at the same cost of capital however we believe ultimately the Nuseed business deserves to trade at a higher multiple given the proprietary nature of technology and stronger growth potential than the core crop protection business.

My notes: I've noticed lots of off screen buying in the last few days and "manipulation" of the sell side perhaps to create a diversion from potential buyers? Anyway I bought IRL at $6. Seems like a good turnaround play.