Ukraine & Russia business update

Nufarm Limited (ASX: NUF, Nufarm) provides the following update regarding Nufarm’s businesses in Ukraine & Russia.

Managing Director and CEO Greg Hunt said, “Nufarm has nascent operations in both Ukraine and Russia and our first priority has been to ensure our people in both countries are safe and supported.

“Secondary to the safety of our people, we are focused on ensuring the security of supply for our customers and continue to monitor developments closely and prepare accordingly. Food security is a fundamental human right and Nufarm plays a part in ensuring growers can access the products they need to support global and local food supply.”

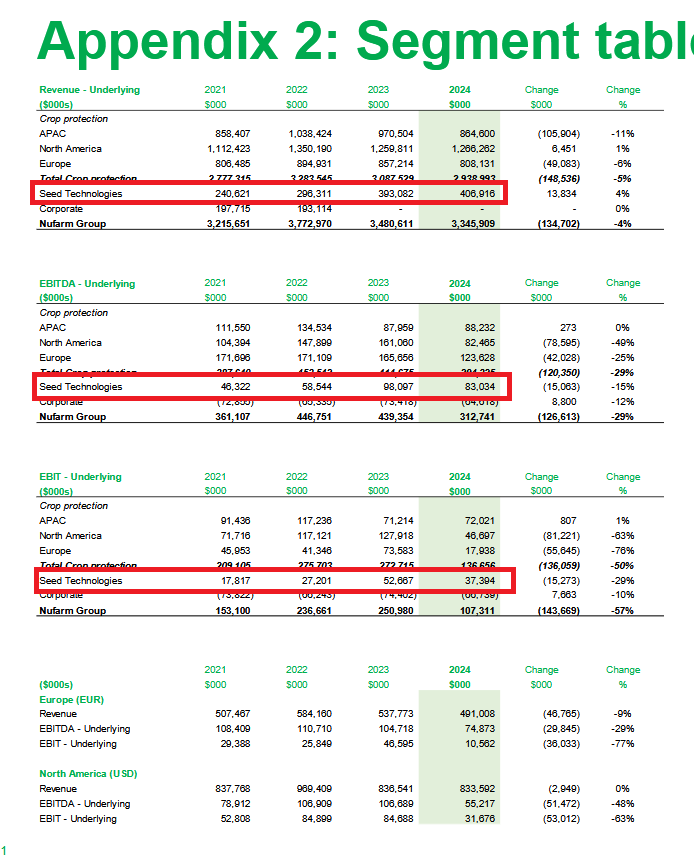

The FY21 contribution to underlying EBITDA from both countries combined was not material.

Nufarm is taking a prudent approach to assessing the recoverability of its inventory and receivables and associated assets held in both Ukraine and Russia. The total maximum exposure in terms of inventory and receivables held in both countries is less than 2% of total Group inventory and receivables.

Given the current uncertain situation in the region, Nufarm expects to raise a provision in the range of $30 million to $40 million, pre-tax. Any provisions raised are expected to be non-recurring and to be reported as a significant item. Hence, any provision would not impact underlying EBITDA. Any provisions raised are subject to external audit procedures as a matter of course.

1H22 earnings update

Nufarm expects to report underlying EBITDA of between $320 - $340 million for the first half of 2022 (1H22).

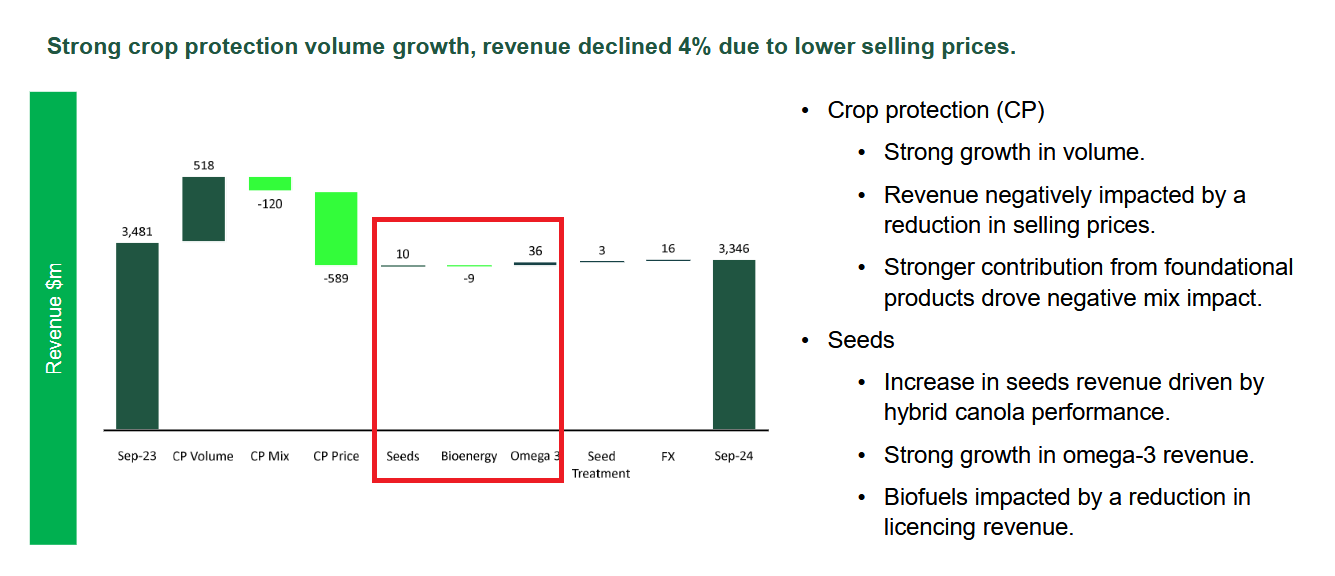

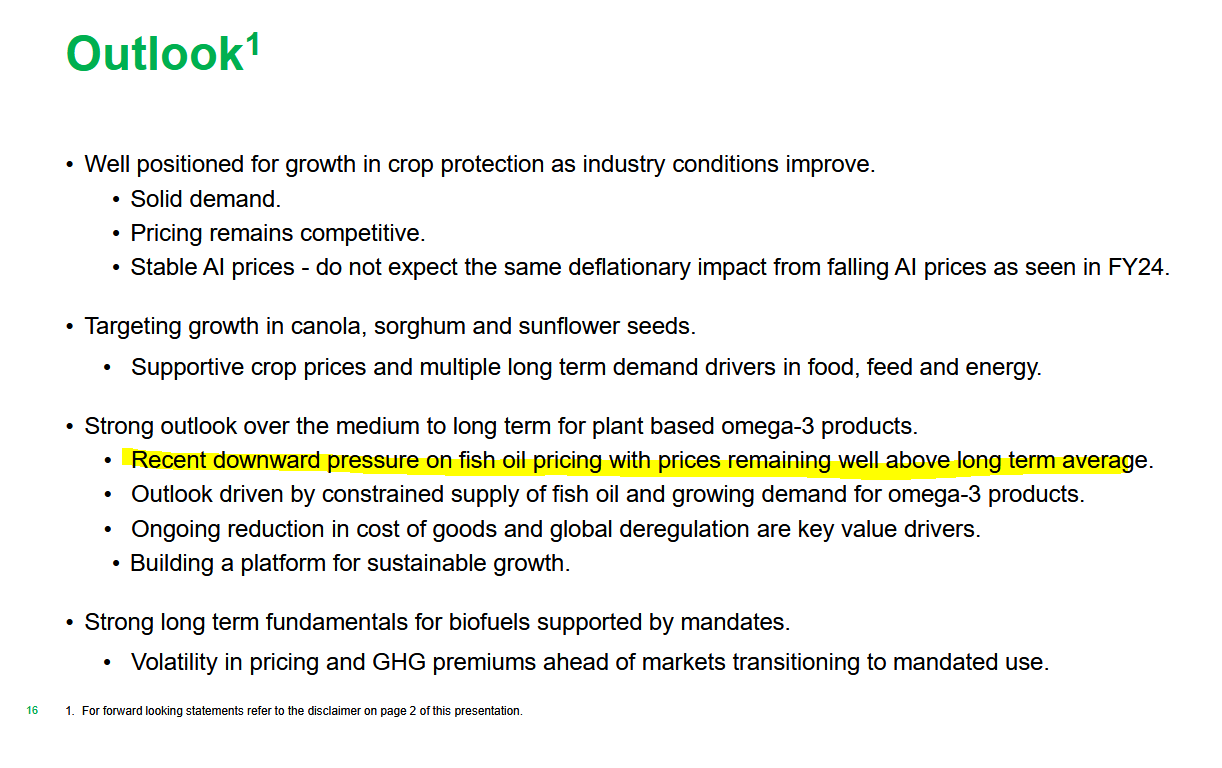

Mr Hunt said, “Nufarm has seen strong demand and increased revenues for our crop protection and seed products during the first half. This is a result of the soft commodity prices and favourable trading conditions in each of the regions we operate in, our strategic initiatives and the investments we have made in our portfolio. This is consistent with the positive outlook highlighted at our investor day in February.”

Nufarm notes that there continues to be uncertainty and volatility in relation to active ingredient pricing, global supply chain and logistics challenges. This uncertainty has contributed to an increase in forward sales in the first half.

Nufarm, therefore, anticipates that underlying EBITDA in FY22 is likely to be more skewed to the first half of the financial year than was experienced in FY21.

Nufarm will provide further details on the 1H22 result and outlook for FY22 as part of our half year results announcement briefing on 19 May 2022.

Taken from https://nufarm.com/announcements/ukraine-russia-business-and-1h22-earnings-update/