Pinned straw:

08-March-2025: A week ago (on Friday 28th, the last day of Feb) I wrote here about NWH's H1 report and commented that because it was released after market close, I would have to wait until Monday (March 3rd) to see the market's reaction to it - and it could be interesting. It was.

Here's what they looked like at market close yesterday (Friday 7th March 2025):

I would argue (and I am) that they've been oversold, unless there are reasons other than OneSteel and a less positive iron ore price outlook for the sell-off. Firstly, this is not unusual, however, despite repeated drawdowns (or pullbacks), their share price has been on a north east trajectory if you zoom out and look at a 10 year chart:

Here's that same 10 Year chart (below) using daily data points instead of the monthly data points used in the 10 Year chart above.

That second one is not as clean, but the results are the same: If you are prepared to ride out the share price volatitlity they do eventually make up lost ground and go on to make new highs, although sometimes it can take a while, like 4.5 years for them to get back up to their $3.38 high point achieved on 20th Jan 2020, which they passed again in July 2024.

However they are increasingly compensating us for waiting, through increasing fully franked dividends:

Source: All of these charts and tables were sourced from Commsec today and tidied up by me. I've changed the Dividend yield above: Commsec had 5.8%, however based on 16 cps p.a. (the 7c div just declared plus the last final dividend of 9 cps) and a $2.81 share price, it's 5.69%, not 5.80%. I have also added their grossed up dividend yield which includes the full value of the franking credits.

So you've got that income to compensate you for a choppy share price.

But what about the risks? Yeah, there are risks, as there are with any contractor, and especially contractors who are exposed to commodities and commodity price movements, however it pays to remember that NWH aren't miners, they are mining contractors who are awarded multi-year mining contracts (recurring revenue), so the real risk is if their clients cease production or go broke and that work ceases prematurely, or if the client doesn't pay their bills as they fall due.

And many punters probably think that's what has happened with OneSteel, one of NWH's clients, in the past few weeks, however it's not that simple. OneSteel was put into Administration by the SA Gov after they ran out of patience with the parent company not paying their bills, including $17 million owing to SA Water, plus not paying their contractors including NRW who it turns out are owed $113.3 million by OneSteel for past work performed.

NRW are continuing to work for the OneSteel Administrators and are being paid from the date of Administration, but are having to pursue the $113.3 million for work done prior to that. NRW say they are confident that they will be paid and they have NOT declared any impairments (write-downs) in their H1 accounts related to money owed to them by OneSteel/GFG.

OneSteel is part of the GFG corporate group and is the legal entity that owns and operates the Whyalla steelworks and associated mines. GFG is controlled by Sanjeev Gupta and rather than me describing the man and his business practises, it is probably more instructive to watch a 7:30 report piece from ABC TV broadcast on Feb 13: https://youtu.be/ETNzD2BddFE which is titled, "Gupta approved to develop mansion as Whyalla and Tahmoor face uncertainty". It's not just Gupta's SA operations that are in deep trouble. The South Australian Government recognised where this was heading and moved to bring it to a head before the Australian federal election is called next month (April 2025) and hopefully giving themselves enough time to find a buyer and new long-term owner of the assets before the SA State election in March 2026.

I would argue that this particular situation has more to do with Sanjeev Gupta than it has to do with iron ore and steel prices and their respective outlooks, even though those outlooks don't look stellar in the short to mid term. Gupta can't make money in coal either, and in other areas throughout his global empire - and he just doesn't seem to like paying his bills, and part of that appears to be that he has too many fingers in far too many pies and is struggling to keep all of the plates spinning, to mix up some metaphors.

But what is NRW's exposure to GFG and OneSteel? Well, one of the things I like about NRW is their much improved risk management since our last really big mining boom went bust - and NRW almost went broke themselves, with their SP getting down to around 4 cps in January 2016. Even I wasn't brave enough to be holding them at that point - I thought they would go broke, but they pulled through, and haven't approached debt in the same way since, and are proactive now in securing their rights in situations like the OneSteel debacle. Here is the timeline, impact and current status of that one from NRW's POV, taken from their H1 results presso on Feb 28th:

Note the third dot point in the timeline. Whyalla Ports is a multi-use port facility - not just used for steel exports - and NRW have first ranking security over all of the shares in Whyalla Ports and many of the Ports' key assets. Golding is a division of NRW by the way in case that wasn't clear.

Because of this and NRW working collaboratively with the OneSteel Admistrators (KordaMentha), I believe they'll get either all of their money or most of it, or else they'll end up with Whyalla Port assets they can sell to recoup some or most of that money owed to them. It's also worth noting that of NRW's major contracts, OneSteel (shown below as "SA Operations") is the one that was already scheduled to expire first, later this year, and their other Iron Ore mining contract (crushing and hauling) at Karara is due to expire next calendar year if not extended.

Which would leave NRW's commodity exposure (via mining contracts) to Gold (through EVN's Mungari gold mine) and Met Coal.

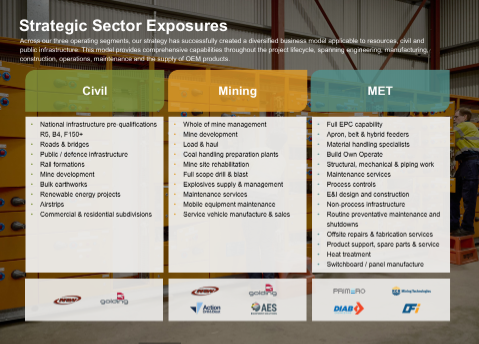

It should also be noted that while Mining remains NRW's largest division and the mining sector is also their largest sector exposure, NRW's Civil Revenue was up strongly (+40.6%) in H1 and MET (NRW's Minerals, Energy & Technologies division) was also up by +15.6%, and NRW's EBIT Margins improved in both Civil and MET, with EBIT improvements of +75.9% and +25.3% respectively, being greater in percentage terms than the corresponding increases in revenue for those two divisions.

On the one hand, the revenue generated by Civil and MET combined now exceeds the revenue generated by Mining, AND the profit margins on Civil and MET are improving, but on the other hand it's worth noting that the EBIT that Mining generated ($63.7 million) is still significantly higher than the combined EBIT from Civil and MET ($48.5m), so the margins are still clearly better within NRW's Mining division, despite that Mining division EBIT margin slipping this half compared to the p.c.p.

So it's a trade-off - they are achieving further diversification of revenue, which is positive when the commodities outlook is so mixed, but that diversification is into other sectors that have so far had lower profit margins than NRW have been achieving in their Mining division traditionally, albeit those other sectors are exhibiting improving margins while their profit margin in Mining is slipping, so all things considered I'm happy enough as a shareholder with this progression - and that trade-off.

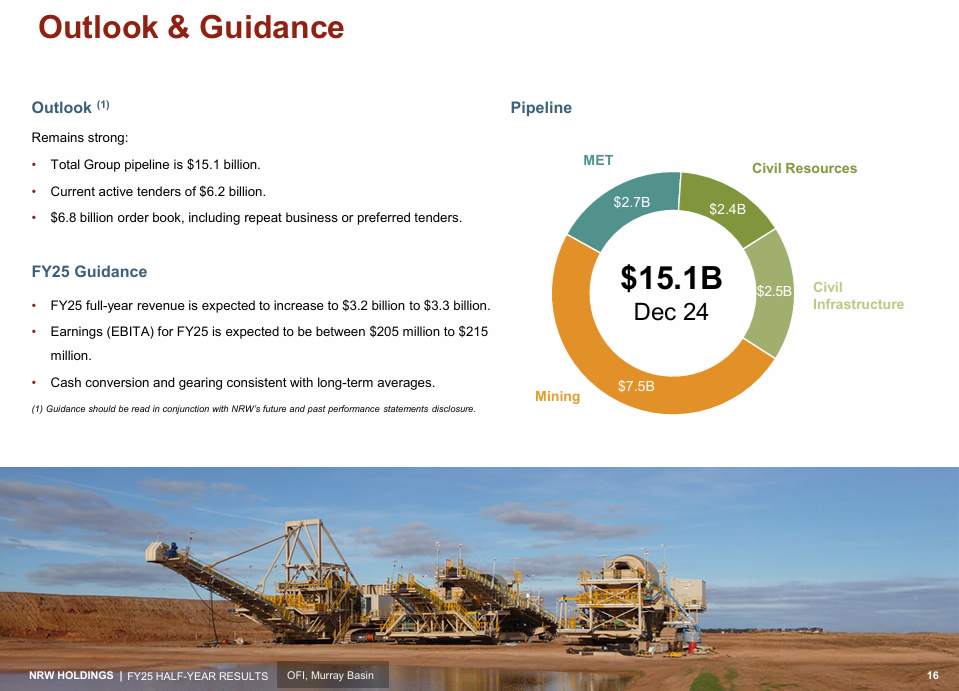

Their actual Revenue and Earnings (EBITA) for FY24 was $2.9 billion and $195.1 million (see NRW-FY24-Full-Year-Results-Announcement.PDF) so that guidance above for FY25 full year revenue of $3.2 to $3.3 Billion ($3.25 B mid-point) and FY25 full year earnings (EBITA) of $205 to $215 million ($210 M mid-point) represents improvements of +12% and +7.6% respectively over FY24, using those FY25 FY guidance midpoints, so overall they are guiding for a better year in FY25, but with a slight slip in margins overall (seeing as the earnings increase is forecast to be lower than the revenue increase in percentage terms).

I have written plenty here on NRW over the years, which you can access here: https://strawman.com/reports/NWH/Bear77

I topped up my NRW (NWH.asx) position in my SMSF yesterday and also added them to my income-orientated portfolio (outside of my super). I'll probably look to increase my NRW position here at some point also now that I've done it in my main real money portfolios.

I still don't like holding companies that look to me to have a share price that is more likely to go down than to rise in the near-term to mid-term, however that's not how I view NRW at this point - I see them as oversold and having an SP that could bounce at any time, just with a change of sentiment, a broker upgrade, and/or one item of positive news from the company. That's also my view on LYL, my largest position both here and across my real money portfolios, which is why I'm happy to hold both LYL and NWH during their current respective pullbacks. I fully accept that they might go further south before they recover, but I remain confident of that recovery, and I don't want to be on the sidelines when it happens, because it could easily be a decent and fast move back north, when they do start to recover. And it could happen any time, without notice.

- - -

Further Reading (while NRW were still in that trading halt, so before they released their H1 report and the info included above):

Whyalla steelworks fallout trips up $1.5b mining contractor

by Simon Evans and Phillip Coorey, AFR, Feb 23, 2025 – 12.23pm

NRW’s mining contracting business Golding is owed up to $120 million in the collapse of the Whyalla steelworks and the nearby iron ore mines that supplied raw materials to the Sanjeev Gupta-owned group.

Meanwhile, Treasurer Jim Chalmers on Sunday played down the prospect of the government taking an equity stake in the Whyalla steelworks, but flagged mandating quotas to ensure the plant’s product was used in government projects.

Sanjeev Gupta’s Whyalla steelworks. Ben Searcy

“We’re looking at the procurement part. I think already 75 per cent of the steel out of Whyalla goes to things like railways in Australia, infrastructure projects, so there’s already a big opportunity there, and if there’s more we can do, more that we can think through on that front, we will do it,” Chalmers said on ABC’s Insiders.

The $1.5 billion ASX-listed NRW has asked that a trading halt be extended until February 28 while it hastily recasts its first-half financial accounts following the dramatic move by the South Australian government to force Sanjeev Gupta’s Whyalla plant into administration.

NRW’s Golding contracting business is the largest single creditor to OneSteel Manufacturing, the corporate entity pushed into administration that owned the ageing Whyalla steelworks and associated iron ore mines operated by another Gupta company, SIMEC, about 60 kilometres from the plant.

Two sources with knowledge of the situation, both of whom requested anonymity because they are not authorised to speak publicly, said Golding was owed around $120 million.

NRW did not detail how much money it is owed in an ASX statement on February 21 when it sought a trading halt extension.

It had been scheduled to unveil its interim 2024-25 result on February 20.

“NRW therefore requests a voluntary suspension until the company is in a position to provide the markets with an update to the SIMEC position and the timing of the release of the half-year results, expected to be no later than Friday, February 28,” company secretary Kim Hyman said.

NRW, which provides mining contractor services around Australia, has suffered a 20 per cent fall in its shares since November 19, when the stock was trading at $4 and it became apparent Gupta was struggling to refinance his global steel operation.

Golding had about 600 workers at three iron ore mines in the Middleback Ranges when the $600 million three-year contract was announced in early 2022, running until January 2025. The Golding workforce had been progressively pruned back over the past few months as Gupta attempted to cut costs and prepared to take mining back in-house.

KordaMentha was appointed as administrator of the Whyalla steelworks and the iron ore mines on February 19. Prime Minister Anthony Albanese and SA Premier Peter Malinauskas collaborated on a $2.4 billion rescue package on February 20.

That included $292 million for buying railway lines to help underwrite production.

KordaMentha declined to comment on amounts owed to creditors, or the status of any specific creditor. The first creditors meeting is due to be held on March 3.

The SA government lost patience with Gupta over mounting unpaid bills that left the town of Whyalla, 380 kilometres north-west of Adelaide, reeling. Gupta’s unfulfilled promises about future upgrades of the plant angered many local businesses, and bigger ones too. ASX-listed rail freight operator Aurizon suspended hauling iron ore for several weeks because it was not getting paid.

Whyalla Mayor Phill Stone described the SA government’s move as a circuit breaker.

“It’s going to be a long, hard slog. There needs to be a regeneration, but it is going to take time,” he said. “But it has definitely lifted the town’s spirits, having a long-term injection of funds.”

SA government water utility SA Water is owed $17 million in the collapse. Malinauskas has diverted $600 million earmarked for a taxpayer-funded proposed hydrogen plant near the steelworks to the rescue fund for the steel plant instead.

--- ends ---

See Also: NRW-Half-Year-Results-Release.PDF [5:01pm, 28-Feb-2025]

And: NRW Half Year Results Presentation.PDF plus NRW Half Year Accounts.PDF [all released @ 5:01pm on 28-Feb-2025]

Disc: Holding.

Bear77

No problem @DrPete - There's been a new development yesterday & today relating to the OneSteel Administration and Whyalla Ports that will likely impact NRW Holdings (NWH):

14th May 2025: Trading-Halt.PDF

See here for details on the SA Gov's latest move: https://www.abc.net.au/news/2025-05-13/whyalla-port-ownership-new-legislation/105287056

Whyalla steelworks port ownership dispute triggers introduction of new legislation

[ABC.net.au/news] 13th May 2025.

The SA government says the former operator of the Whyalla steelworks leased the port to one of its subsidiary companies without government approval. (ABC News)

The state government has moved to clarify the ownership of the Whyalla port amid ongoing legal action to wrest control of the facility from former steelworks owner GFG Alliance.

Premier Peter Malinauskas on Tuesday notified parliament that the government would introduce amendments to the Whyalla Steelworks Act 1958, around three months after placing the steelworks into administration.

Mr Malinauskas said maintaining access to the port of Whyalla was "essential for the Whyalla steelworks' operations".

He said the amendments were designed to clarify that the port was owned by former steelworks owner OneSteel Manufacturing.

In February, OneSteel — the GFG subsidiary which ran the steelworks — was placed into administration by the South Australian government after long-running financial woes plunged the operation into crisis.

But that legislation did not allow the government to seize control of the port, with Whyalla steelworks administrators KordaMentha launching legal action in April to seize control of the facility.

The legislative changes run in conjunction with that legal action by stating that the Whyalla port is owned by OneSteel, not Whyalla Port Pty Ltd.

The Whyalla steelworks went into administration in February 2025. (Supplied: GFG Alliance)

The government argued this was always the case but Mr Malinauskas said the amendments would clarify the matter.

He said administrators KordaMentha had already spent millions to address maintenance and safety risks at the steelworks.

"However, not all risks arise from the apparent lack of maintenance and critical spend by the previous ownership," he said.

"The administrators have advised the state of a reported lease agreement granted by OneSteel to Whyalla Ports Pty Ltd, a separate company owned by GFG.

"The lease was entered into without prior consent of the state of South Australia."

KordaMentha previously told the Federal Court that the port facilities were essential to present the steelworks to a potential new buyer.

"The sale process cannot commence until the port issues are resolved," administrator Michael Korda told the court earlier this year.

Mr Malinauskas said the port was used to export iron ore and receive key supply shipments.

"The state has seen fit to clarify the status of the land which is subject to the purported lease of which OneSteel is the registered proprietor for the purpose of operating the port of Whyalla," he said.

"The bill has been drafted out of an abundance of caution to clarify the effect of the failure to obtain prior consent, and make it clear that the purported lease agreement granted by OneSteel to Whyalla Ports never had legal effect from the beginning."

Steelworks creditor Roger Jordan says he welcomes the state government's intervention on the Whyalla port. (ABC News)

Whyalla business owner and steelworks creditor Roger Jordan said the Premier's statement in parliament "looks very promising".

He said when the state government tipped the steelworks into administration on February 19 this year, "there were several things that were left unanswered, and the port was one of them".

"The mediation on the port was unsuccessful as far as we know, and it was supposed to land in court for a final decision," he said.

"But I can only guess that our state government have had legal opinions on where they stand and they've taken matters into hand."

A spokesperson for GFG Alliance said the port ownership issue was "a matter for the court to decide and we will respect its decision".

"The South Australian government has been aware of the lease and the ownership by Whyalla Ports of $200M of assets for many years and did not raise any objection," they said.

--- ends ---

Source: https://www.abc.net.au/news/2025-05-13/whyalla-port-ownership-new-legislation/105287056

So it appears at this stage as though this could be a positive for NRW (NWH) - and I note that their indicative price (that they might resume trading at) based on the current overlap between the bids and offers is actually in the green - a couple of cents above where they closed yesterday, but that can change in an instant of course.

For those who might not be aware, as explained in the 3rd dot point below - from my previous straw about this - NRW's Golding division had previously obtained first ranking security over some of the assets of Whyalla Ports and the shares in Whyalla Ports from the Gupta entity (within the "GFG Alliance") that is supposed to have owned those assets - separately to OneSteel which was also a Gupta (GFG Alliance) controlled company. Sanjeev Gupta is the Executive Chairman of GFG Alliance and the Gupta family owns and controls the GFG Alliance.

My previous assumption was that NRW Holdings (NWH) having first ranking security over those Whyalla Ports' assets and shares probably gave NRW a big advantage in terms of getting paid the $113m that OneSteel owed them prior to OneSteel being placed into Administration by the SA Government.

This could therefore be good or bad. It could be good if the SA Government recognises NRW's first ranking security, but it could be bad if the SA Government instead changes the law so that Gupta's GFG Alliance never had the right to hold Whylla Ports or its assets in a separate company structure to OneSteel (the Steelworks) or to lease those assets from OneSteel - and therefore could not have legally transfered those assets or granted NRW security over those assets to NRW or anyone else because he (Gupta) and his company GFG Alliance did not own them outside of the Whyalla Steelworks - which was enirely within OneSteel.

The point being that the SA Gov is seeking to pass legislation that Whyalla Ports is part of the Steelworks and is therefore included in the Steelworks Administration. Gupta's position has clearly been that Whyalla Ports is separate and should not be included in the OneSteel (Steelworks) Administration.

NRW, as always, will be seeking to get paid what they are owed, nothing more and nothing less.

The whole point of NRW being granted first ranking security over the Ports and its assets by Gupta/GFG was to give NRW confidence that they would get the money that Gupta/OneSteel owed them at some point. If NRW's Golding division had NOT been given that security over Whyalla Ports and its assets back then, NRW would likely have taken legal action back then to force Gupta's OneSteel to pay NRW what they owed them, and that could have forced OneSteel into Administration even sooner.

The possible downside for NRW here is that what the SA Government is doing now potentially makes NRW's position weaker, and puts them back on par with all of OneSteel's other creditors, and if that was to occur it increases the chances that NRW will get less than what they are owed in terms of that $113m owed to them prior to the OneSteel Administration.

NRW have continued to work for the OneSteel Administrators (crushing, hauling and loading iron ore for the steelworks) since the date of Administration and have been paid by the Administrators for that work. It's the $113m still owing to NRW from before the Administrators were called in that is in doubt.

My concern is that this move by the SA Gov might take away any advantage NRW had over any of the other creditors - so puts them back in the pack - however I don't have all the facts, and this could play out in a few different ways.

I always considered that NRW taking a haircut on that $113m owed to them by OneSteel was a real possibility, and I thought the chance of them getting nothing was pretty low. Those odds may be changing. We shall see.

If NRW has to eventually write off the full $113m, it would NOT be a company killer. It would certainly be material to them, but it wouldn't affect them too much. They are a large company now - with a $1.3 Billion market cap - and their FY24 Revenue was $2.9 billion (up 9.2% on FY23). $113m is less than 4% of their $2.9 billion FY24 revenue, so perspective is important here.

They may also have insurance to cover such circumstances - i.e. clients going into Administration leaving money owed to NRW, but even if they could not claim insurance, a write-off of up to $113m doesn't change the investment thesis for me, and such a write-off would be the worst case scenario.

So, a resolution of this matter, one way or the other, would be welcome. It would remove the uncertainty. I'm not sure if we're going to get that certainty when NRW resume trading, but we'll get something hopefully.

We should at least have a clearer idea of whether that first ranking security that Gupta granted NRW over certain assets of and shares in Whyalla Ports is worthless, or worth something.

Bear77

I've just edited that post to reflect that the amount owing to NRW Holdings (NWH) by Sanjeev Gupta's GFG Alliance-controlled OneSteel (prior to OneSteel being placed into Administration by the SA Government over royalties and other money owed but not paid) was $113 million, not $100 million, however that doesn't change anything as $113m is still less than 4% of NRW Holdings' FY24 Revenue.

Bear77

Companies owed hundreds of thousands of dollars by Whyalla Ports fear debts will never be paid

https://www.abc.net.au/news/2025-05-14/whyalla-steelworks-administrator-gives-creditors-an-update/105289854

ABC.net.au News 14th May 2025 4pm.

KordaMentha has given steelworks creditors and employees an update on the administration. (ABC News: Brant Cumming)

The South Australian government's move to clarify Whyalla port's ownership by introducing amendments to legislation in parliament has caused a stir among companies still owed money by the port's owner.

Premier Peter Malinauskas told parliament on Tuesday the government would introduce amendments to the Whyalla Steelworks Act to show the port was owned by former steelworks owner OneSteel Manufacturing.

It comes amid ongoing legal action to wrest control of the facility from former steelworks owner GFG Alliance.

The state government forced the steelworks into administration in February after the business, owned by GFG Alliance, failed to pay tens of millions of dollars in royalties to the government and millions in unpaid bills to creditors.

During an update on the administration of the Whyalla steelworks today, companies that are owed significant debts raised concerns about how they would recoup their losses.

Finding out 'the hard way'

One creditor, who wished to remain anonymous, told the ABC they were owed $100,000 to $200,000 by Whyalla Ports.

They said they feared they may never receive the money due to the dispute over Whyalla Ports's ownership.

"I don't think it's going to happen unless we put a letter of demand in to GFG, Sanjeev Gupta and his stakeholders," they said.

Whyalla Port Pty Ltd is not included in the administration. (ABC News: Che Chorley)

Another creditor who did not want to be identified said they were owed $20,000, outstanding for around seven months past the due date of payment.

They said they did not realise Whyalla Ports was a separate company until a few weeks ago.

"If we had known that, we probably would have done things a little bit differently in regards to the Whyalla Ports," they said.

"[It's] a bit disappointing we had to find out the hard way."

The creditors have received funds from the South Australian Business Creditor Assistance Scheme for debts arising from One Steel Manufacturing.

However, though Whyalla Ports is a subsidiary of GFG Alliance, debts owed by Whyalla Ports are not covered by the scheme.

KordaMentha partner Sebastian Hams said the administration was over One Steel Manufacturing Pty Ltd only.

"[Whyalla Ports] is not in administration, and therefore I should assume that company is solvent and that's going to pay its debts as and when they fall due," he said.

A government spokesperson said there were already a range of assistance schemes to assist businesses impacted by the situation.

Steelworks turns a corner

During the meeting, Mr Hams informed workers and creditors that $100 million had been spent on restoring inventory, sustaining capital expenditure and improving the site's safety.

He also said two site visits from prospective buyers had occurred, with more scheduled for the coming weeks.

KordaMentha partner Sebastian Hams says the blast furnace is at full capacity again. (ABC News)

Mr Hams said the blast furnace at Whyalla was now operating at its full capacity of 2,800 tonnes a day, "which means it's now running in a stable environment", but its life span was uncertain.

"The new buyer will come in with new technology and a different mindset, so it's entirely dependent on what a new buyer wants to do," he said.

The state government placed the Whyalla steelworks into administration in February. (ABC News: Che Chorley)

Mr Hams would not reveal how much the loss in daily profit had been reduced.

"The loss pre-appointment was running at about $1.5 million a day," he said.

"It moves on a daily basis, but it's significantly less.

"We're really focused on seeking a buyer that is a manufacturer who understands steel … and understands the value in the mines."

Safety and transparency first

Steelworks employee Sue Kelly said the safety of the plant had been seriously lacking under GFG Alliance, but it had got "a lot better" since KordaMentha took over.

"Even to the degree of our … PPE [personal protective equipment]," Ms Kelly said.

Sue Kelly says safety at the steelworks has improved. (ABC News)

Australian Workers Union local branch organiser Shane Karger said it was "fantastic to have the real situation put out to the people".

"To develop a relationship that we have now with KordaMentha that is open and honest is definitely something that we would like to maintain going forward with new buyers," he said.

"We'd hate to get to a situation where it's all cloak and dagger again, it's all secrets behind closed doors, and eight years down the track we're [saying]: 'Oh no, the steelworks is in trouble again.'"

GFG Alliance has been contacted for comment.

--- ends ---

Source: https://www.abc.net.au/news/2025-05-14/whyalla-steelworks-administrator-gives-creditors-an-update/105289854

Disclosure: I hold NWH shares, and NRW Holdings (NWH) were owed $113 million by OneSteel at the time it was placed into administration, MUCH more than the amounts mentioned in this story above (published today by ABC News) that are owing to those interviewed for the story. NRW Holdings had previously (last year) sought and been granted first ranking security over some of the assets and shares of Whyalla Ports, to protect their own interests while OneSteel was falling way behind in paying NRW for ongoing work crushing, hauling and loading iron ore to feed the steelworks and for export from the Whyalla ports, however this move by the SA Government to pass legislation that effectively invalidates what GFG Alliance did by creating a company called Whyalla Ports Pty Ltd (which is NOT currently in Administration) and then arranging for OneSteel (also owned at the time by Sanjeev Gupta's GFG Alliance) to lease Whyalla Ports and its assets to Whyalla Ports Pty Ltd and then granting security over many of those assets to NRW Holdings, may now end up being of little help to NRW in getting all or most of that $113 million paid to them.

The short version is that it is now possible, due to this latest move by the SA Government, that NRW's security over the port assets will be invalidated.

Which means NRW Holdings may now rank equally with all of the other creditors that are owed money by OneSteel, as described in the article above, despite NRW being one of the largest creditors if not THE largest creditor of OneSteel.

As I said earlier today, worst case scenario is that $113 million is a total write-off for NRW, in which case perspective is helpful, as $113 million is less than 4% of NRW's group revenue last financial year (which was $2.9 billion).

The reason I first posted a straw here titled "Opportunity?" (in early March) was that I felt that the market was overreacting by selling down NRW (NWH) as much as they were sold down.

I still think that's the case, and it might get worse still from here. NRW were trading as high as $4/share in mid-November and they bottomed out at $2.29 intraday on April 11th after closing at $2.31 two days earlier (on April 9th). That's a -42% fall in the share price in just under 5 months, and while that's not ALL due to Whyalla and OneSteel, a lot of it clearly was.

My thoughts are that $3.50 is close to a fair price for NRW (NWH) so when they got up to $4, a small correction wasn't totally unexpected, but below $3 they looked oversold to me (still do) - so I was loading up, particularly below $2.70.

I'm not sure what's going to happen when they emerge from this latest trading halt - which may get rolled into a trading suspension as it did last time if they need the extra time to properly assess the new situation - but I'm prepared for them (their share price) to go lower if their situation in relation to that $113 million owing has deteriorated. The fact remains however that - unless they do something silly like take court action and then lose that court action and get costs awarded against them - the worst case scenario is a total write off of the full $113 million, which represents less than 4% of their annual group revenue so in that context, yeah, they still look oversold here, and I'd probably be a buyer if they fall back down below $2.50 again.

Bear77

15th May 2025: 9:17am: NRW-Response-to-Proposed-SA-Govt-Whyalla-Legislation.PDF

Main Points:

- If the Proposed Bill is passed by the South Australian Parliament in the form described in the Ministerial Statement, NRW is concerned that any recovery of the outstanding indebtedness via Golding’s first-ranking security in respect of Whyalla Ports assets will be seriously impaired. In this event, and in line with the relevant accounting standards, NRW will take a prudent position and raise an impairment provision for the amount of $113.3M as a non recurring item in our financial results for the period ending 30 June 2025.

- NRW notes that Whyalla Ports was incorporated and operated as its own entity and business for approximately six years prior to ownership by GFG Alliance. Whyalla Ports was incorporated on 14 September 2011. On 29 August 2016, KordaMentha, when appointed as Administrators of Arrium, filed a Report as to the Affairs in relation to Whyalla Ports, which listed and valued the plant and equipment owned by Whyalla Ports Pty Ltd at $199,386,602.91. On 31 August 2017, KordaMentha sold the shares in OneSteel and Whyalla Ports from Arrium to the GFG Alliance. To the extent the South Australian Government purports to say it was unaware of the lease, specifically from at least 9 July 2021, the State of South Australia has been on notice about the lease between Whyalla Ports and OneSteel.

- On 2 April 2025, the Administrators of OneSteel commenced Federal Court proceedings VID 420 of 2025 against Whyalla Ports seeking relief that the lease be declared void, unenforceable and of no legal effect. If granted such relief would seriously undermine Golding’s security in respect of Whyalla Ports as Golding may not be able to enforce Whyalla Ports’ rights under the lease, including its rights to use the assets of Whyalla Ports and to remove those assets located on the leased premises. Given the implications for Golding, Golding was granted leave by the Federal Court to be joined as a party to the proceeding so that it could participate in an expedited trial, which has been set down for 2 June 2025.

- On 13 May 2025, South Australian Premier Peter Malinauskas issued a Ministerial Statement advising that his Government had drafted a new piece of legislation called the Whyalla Steel Works (Port of Whyalla) Amendment Bill 2025 (Proposed Bill). The Ministerial Statement says the Proposed Bill has been drafted to clarify the status of the land that is the subject of the Whyalla Ports lease. The likely effect of the Proposed Bill is to cause the lease agreement granted by OneSteel to Whyalla Ports to have never had legal effect from the beginning.

- As at 14 May 2025 Golding retains first ranking security interest over the assets of Whyalla Ports as personal property. The Ministerial Statement makes it clear the Proposed Bill will enable OneSteel to usurp that personal property by declaring it void and part of the land, with ownership vesting to OneSteel without any mention of compensation to Whyalla Ports. NRW is extremely disappointed and concerned that the proposed and unprecedented intervention by the South Australian government will seriously impair and undermine Golding’s security over Whyalla Ports. Further, the South Australian Government’s sudden intervention will in effect determine certain issues that are before the Federal Court for determination at a trial due to commence in less than three weeks’ time.

- Despite NRW now taking the prudent position of raising a $113.3 million impairment provision for FY25 (as discussed in point 1 above), NRW, via Golding, will continue to pursue all recovery options available to it and reserves all of its rights.

- My understanding is that the possibility of NRW suing the SA Gov over their latest move is not entirely off the table, but I have no comment on the likelihood of NRW being the ultimate winners in such litigation if it was to occur, or how long such a case might take, however NRW do note that the legislation is only proposed at this stage, so the legislation has not yet been passed nor is it available for public review, so still at a very early stage. However, because the proposed legislation is clearly designed to deal with the possibility that the Federal Court expedited trial in relation to Whyalla Ports ownership that is set down for 2nd June - in less than 3 weeks - might have an outcome that the SA Gov and the OneSteel Administrators aren't hoping for, I would expect that this proposed legislation is likely to be rushed through fairly quickly if they can manage to do that.

It has turned into a mess for NRW, much as I outlined in my comments here yesterday, and they've done the right thing in taking the $113 M impairment, which should be the worst case scenario unless they engage in legal action and incur additional costs.

NRW have been sold down to as low as $2.21 this morning which was -23.8% below their last close (of $2.90), however they're back up at $2.65 now, so are now trading at only -8.6% below their last close. I didn't buy any more NWH at the lows today (or at all) because I was doing other things when the market opened and I missed that drop - but I already hold decent positions in NRW and I'm comfortable to maintain those positions and possibly add to them if they drop back below $2.40.

I said last night that below $2.50 would likely be a buy zone for me, but based on today's early price action I reckon I can lower that now to below $2.40.