Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

27-Nov-2025: NRW Holdings (NWH.asx) held their AGM today and their Rem Report was voted down for the eighth consecutive year:

So eight consecutive "strikes" against the company's remuneration report under Australia's Two Strikes Rule.

The two strikes rule is an Australian law aimed at holding corporate directors responsible for the amount of executives' salaries and bonuses. Under the two strikes rule, a company's board members can be replaced if shareholders feel that the members are paying executives too much based on the company's performance. In essence, the two strikes rule is primarily intended to prevent executive salaries from growing out of control and to ensure that board members are held responsible for protecting the best interests of the company and its shareholders. Since it became law in 2011, the two strikes rule has had a largely positive effect on Australian businesses. It has kept executive pay in check, elevated shareholder engagement, improved corporate transparency, and increased focus on the question of whether executive pay is reasonable. Although there may be some potential drawbacks, the two strikes rule represents a concerted and mostly successful effort to ensure that executives are compensated in a fair and balanced manner.

Source: https://www.ebsco.com/research-starters/law/two-strikes-rule

Whenever an Australian listed company has the potential to receive a second strike at an AGM, they are required to put a "Conditional Spill Resolution" to their shareholders at the same meeting - and it's conditional on the company receiving the second strike, meaning that they receive a shareholder vote of 25% or more against their Rem Report Resolution, which is usually the very first resolution on the list every year.

If they do not receive a second strike, the Conditional Spill Resolution is withdrawn and/or has no effect. However, if they do receive a second strike (25% or more votes against the Rem Report) and if the Conditional Spill Resolution receives more than 50% of votes for the resolution, it is carried, and all non-executive directors on the Board must vacate their positions and another meeting must be held to elect a new Board. Those Board members who were "spilled" (were removed by the spill resolution) are entitled to put themselves forward for re-election at that subsequent meeting along with anyone else who meets the required criteria.

For the sake of continuity and to keep businesses running, those directors do not have to leave the Board immediately that a spill motion is carried - instead a "spill meeting" must be held within 90 days, where all non-executive directors and chairpeople must stand for re-election, unless they decide not to stand and instead retire from the Board.

In theory the idea is that if a company receives their first strike, they will liase with shareholders to understand why shareholders are unhappy with their remuneration structure (for the Board and senior Management) as detailed in the Rem Report and will make adjustments to try to avoid a second strike because they don't want to risk losing their jobs due to a spill motion being carried at their next AGM.

In practise however, a second strike has rarely resulted in a spill motion being carried and a board being removed, with statistics showing that the rule has had more symbolic power than practical effect. While 40 companies recorded two strikes between 2011 and 2013, only 6 of them were required to hold a spill meeting, a success rate of about 15% for a second strike triggering a spill motion.

Importantly, a spill motion has never resulted in a Board being rolled at the spill meeting, which suggests the rule is more window dressing than substance.

The following excerpt is from: https://www.afr.com/work-and-careers/management/push-to-scrap-two-strikes-rule-rejected-by-architect-20251120-p5ngzu [yesterday, Nov 26, 2025]

Excerpt:

While supporters argue the rule has helped to curb executive pay and empowered shareholders, critics note it has never led to the spill of a top company board and has become a tool for investors to express grievances over everything from a company’s share price performance to strategy.

“I think it has passed its use-by date in the current form,” says Neil Chatfield, chairman of gaming company Aristocrat and fruit and vegetable producer Costa Group. “It is almost a protest vote [unrelated to pay],” he says.

Kathleen Conlon, chair of Pilbara Minerals and a director of BlueScope and also at Aristocrat, says it puts more power in the hands of proxy advisers, which sometimes use rigid frameworks to assess remuneration models. This can be problematic for companies that employ executives based in the US, where pay structures are different.

“I don’t know that we needed [the two strikes rule] in the first place,” says Conlon, adding that shareholders have other avenues to express frustration over pay and other issues.

Fund manager John Wylie also argues the system is not working, noting the rule has become symbolic because it is never used to overhaul a board.

Wylie has called for annual elections for directors – common practice in the US and UK – which would alleviate the need for the rule.

“[The two strikes rule] has almost never resulted in a full board spill. It has acquired symbolic significance only, rather than being a real mechanism for accountability,” Wylie says.

Fels, who was appointed by the Rudd Labor government to work on the Productivity Commission inquiry in 2009 that led to the establishment of the rule, which became law in 2011, dismisses the complaints, adding that, if anything, the rule could be toughened.

“It’s had an effect and continues to have a positive effect,” he says. “There might be a case for reviewing it or even strengthening it, but it’s hard to think how it could be improved.

“The fact there hasn’t been a board spill does not show that it hasn’t had a significant effect because no board wants to put itself in a position where it faces the stigma of a spill.”

The “say on pay” rules in the US and UK are also non-binding, but do not carry the threat of a board spill. Some Scandinavian countries have adopted a binding vote by investors on pay. South Africa is the only other country to introduce a two strikes rule (it did so last year), but a strike is only registered at 50 per cent, not 25 per cent, and triggers a vote on the remuneration committee rather than the whole board.

There have been 26 strikes against pay so far this AGM season, putting it on track to come close to the record 41 and 40 strikes recorded against remuneration plans at top 300 companies in 2023 and 2024 respectively. In each of the previous four years the number of strikes was 26 or fewer.

Bear77 Note: NRW Holdings (NWH) would have been added in at equal 3rd top position after today's 73% vote against their Rem Report if the AFR had compiled those stats after NRW's AGM today. Their article was published yesterday.

Excerpt continued:

Supporters point to recent examples where the two strikes rule has been used by investors to pressure the board and temper executive pay.

ANZ’s board, led by chairman Paul O’Sullivan, this month stripped current and former executives of $32 million in bonuses after a series of failures. The action is viewed as a move by the board to avoid a second strike on the bank’s remuneration report before its AGM in December.

The board of Macquarie Group, led by the chairman Glenn Stevens, has also responded to pressure from investors over its weak response to regulatory breaches by docking chief executive Shemara Wikramanayake’s pay by $7.55 million over the past five years.

The cuts have been detailed in Macquarie’s CPS 511 statement, APRA’s new standard on remuneration disclosure which is being implemented by the banks and insurers this calendar year.

But critics argue there is still no real consequence of an AGM strike, with investors unwilling to spill an entire board. And after a second strike and failed board spill, the rule is reset so that a third strike is no worse than a first strike.

Allan Fels says the two strikes rule could be toughened. Eamon Gallagher

Despite this month’s fiery WiseTech AGM, where 49 per cent of investors voted against the remuneration report, nothing changed. Besieged founder Richard White teared up at the meeting, but the share price still rose 2.4 per cent by the end of the day.

Chatfield argues a strike by investors against pay does not carry the same weight it did five years ago, given the difficulty in pleasing all investors. He suggests raising the threshold for a strike from 25 to 40 per cent of shareholders, or reverting to a “say on pay” as an advisory vote.

“I would say we are less concerned about a strike,” he says.

“We [think about] shareholder relations and want to do the right thing by them, but we don’t avoid a strike for the sake of it. A strike is not a badge of honour, but it is not something to be avoided at all costs. You can’t please everyone,” Chatfield says.

Like many other senior directors, Chatfield bemoans the trend for the two strikes rule to become a means for shareholders to express dissatisfaction about a company in matters unrelated to executive remuneration.

It’s an issue which the Australian Securities and Investments Commission spelt out in its report examining private and public markets.

“This included concerns that the rule is not being used for its intended purpose,” ASIC said.

Directors complained the rule was eating up “significant management time and attention, distracting focus from the business, and that the 25 per cent threshold gave outsized influence to minority shareholders”.

But ASIC concluded the submissions only provided anecdotal evidence to support the claims the two strikes rule was deterring quality directors. The regulator said ultimately it was a policy question for the federal government.

The Macquarie board and executives prior to the company’s AGM earlier this year. Louise Kennerley

Gabriel Radzyminski, managing director at activist investor Sandon Capital, says the rule has been a game changer and should not be touched.

“It is without doubt one of the most effective tools in Australian governance, it allows investors to express a view” he says.

Research has also shown a “no” vote on remuneration can trigger significant share price drops – on average 15 per cent in the following year.

“Critics would say corporate voting in Australia has more in common with elections in North Korea, but the rule has forced much more engagement and collaboration on remuneration,” Radzyminski says.

“Some say it has little real consequence other than embarrassing the board, but that is a powerful tool within the small circles of corporate Australia.”

Other leading directors say they have learnt to live with the two strikes rule.

“I think the current rule is the least-worst option,” Wesfarmers chairman Michael Chaney tells BOSS.

“Removing and replacing it with annual re-election of directors could lead to undesirable outcomes. For example, demonstrating unhappiness with remuneration by removing a director from the board, such as the chair of the remuneration committee, when that director was making a worthwhile contribution in many other ways.

“The current rule allows investors to express their displeasure. The board can take that into consideration going forward, amending the remuneration arrangements if they think it appropriate or leaving them as they are if they believe that is in the interests of the company.”

Gabriel Radzyminski, founder and chief investment officer of Sandon Capital, says the rule should not be touched. Oscar Colman

Peeyush Gupta, a director of property group Dexus and investment company Magellan Financial, has also learnt to live with the rule. He is not worried about shareholders using the two strikes rule as a means of expressing various grievances. Even if investors’ anger is unrelated to pay, it still sends a useful message to directors that a problem exists.

“It is a good metric to gauge overall sentiment of shareholders with the performance and trajectory of the company. It can be a wake-up call that something is not right. It gives shareholders a voice,” Gupta says, adding “of course [directors] should care.”

David Gordon, chairman of NIB Holdings, agrees the two strikes rule may not be working strictly as a tool to express discontent with pay structures, but says it is a useful avenue for investors to push back against other aspects of performance.

“Personally, I don’t think that is bad. I’m in favour of shareholders having a voice,” says Gordon, suggesting the rule could be modified to specifically allow shareholders to express dissatisfaction with other aspects of the company, such as share price performance.

Kathleen Conlon, chair of Pilbara Minerals, says the rule puts more power in the hands of proxy advisers. Louise Kennerley

Yasmin Allen, director of oil and gas group Santos and chair-elect of insurer QBE, says the two-strikes rule has rightly forced directors to think more carefully about remuneration frameworks.

But she acknowledges that shareholders use the scheme to show discontent about other issues, such as environmental, people and wider performance issues, which can be “a bit difficult.”

“You could do that without a vote,” she says.

“Boards generally visit shareholders twice a year so they can tell you then [if they have grievances]. I don’t think you need a vote to show discontent.”

But overall, she is in favour of keeping the rule.

“I think it is OK. We are not spilling boards left, right and centre. We have got used to it.”

--- end of excerpt ---

Now back to NRW, and I'll repeat their AGM resolution voting results here:

NRW is an example of a Board who just don't care about their Rem Report being voted down because they know that every spill resolution will be defeated because there are very few people or insto's who want to go as far as rolling their Board. They received 73.16% of votes cast AGAINST their Rem Report (highlighted above in red) but then 97.06% of votes cast were AGAINST the spill resolution (highlighted in orange).

So they clearly have nothing to fear from their Rem Report resolutions being consistently voted down (eight AGMs in a row now) because it has no adverse affect on the company when all of the spill resolutions are failing.

The strike count resets after every spill resolution, so every two years for companies like NRW who get a strike every year, so despite receiving 8 consectutive strikes, they have only faced 4 spill resolutions, one every second year, and all of those spill resolutions have been very strongly defeated.

As suggested in the AFR article above, it appears that the vote against the Rem Report was just shareholders registering their frustrations and unhappiness with the company rather than any serious intention to replace anyone on the Board.

Until we look at Resolutions 2 and 3 (highlighted in Blue) which were only passed with a narrow majority - especially in the case of Resolution 2, the re-election of Michael Arnett, the Chairman of NRW's Board, who only scraped in with a 51.4% vote for his re-election and a 48.6% vote against him being re-elected. Jeff Dowling got 58.4% so that was slightly more comfortable but the protest votes are clearly going further than just the Rem Report.

The clearest example of this is their CEO/MD Jules Pemberton's Performance Rights (resolution 4) which was defeated 73% to 27%, so they'll have to find a different way to gift him those free shares.

It's my understanding that all of the proxy adviser firms are strongly against the huge amount of money that Jules is paid each year to run NRW. Google says it's A$2.86 million per year, comprised of 51.3% salary and 48.7% bonuses, including company stock and options. Apparently Mr Pemberton directly owns 1.76% of the company's shares, worth A$41.16M. I haven't independently verified that but that's what a quick Google search returned, and it sounds like it's in the ball park compared to what I've heard previously. He's certainly right at the top of the list for the most highly paid bosses of E&C (engineering and construction) and/or mining services companies here in Australia - NRW does both.

One of the things that he does seem to do well is smart M&A and I note that NRW Holdings' Resolution 6 at the AGM was to approve financial assistance, specifically granting security to financiers for loans related to NRW's recent acquisition of Fredon Industries. This approval was required by the Corporations Act and was a condition of the company's finance facility with its lenders; a 'no' vote could have triggered a default under the agreement. Resolution 6 was overwhelmingly supported with a 99.7% "for" vote.

So they like his acquisitions and the way he structures them, but they strongly dislike paying him close to $3 million per year in cash plus company shares.

Fair call.

Discl: Held. I voted "FOR" all resolutions because NRW has been a wealth winner for me and I don't mind executives being rewarded for providing good TSRs for their shareholders, but I also undertand why people think he's paid far too much.

[Jules is the one on the left]

Skip to the bottom for the latest update.

Early 2019: My original $1.80 price target has already been exceeded. My next valuation of $2.15 - which was based on their various new contract announcements - that we have already seen, and assuming there is more to come, and that the FAL project issues don't hurt NRW very much - has now ALSO been exceeded. Based on their 1HFY19 report + contracts already awarded, I'm lifting my target price to $2.77 now. I am factoring in some new contracts - which would be normal conversion of their tender pipeline into WIH. Just a few sub-$100m contracts over the next 6 months. Any larger $100m+ contracts will likely see another upward revision of this price target.

17-Apr-19: Bugger - they've just passed my new revised, revised, target price. SLOW DOWN NWH! This time, it was on the news that they're entering the ASX200 on May 3rd (replacing TME). I sold some at $2.82 and then some more at higher levels.

17-Nov-19: The new contract announcements for NRW (ASX:NWH) have slowed down somewhat, however they are very busy with a heap of existing contracts, and their FY19 full year report in August was solid, with no surprises. No reason to change my valuation, so I'm leaving it at $2.77.

28-Nov-2019: The BGC Acquisition is another very positive one for NRW IMHO, and is highly EPS-accretive, so I'm raising my valuation accordingly - initially to $2.97, but probably higher still once we get some more news, such as earnings guidance upgrades and/or further new contract announcements.

19-Mar-2020: OK, things have changed somewhat. NWH is down to $1.14 today. Bugger! Or is that a bad thing? Looking at what NWH do, which is contract mining and construction, and what their clients do - many of them are actually gold miners - and that NWH are involved in a number of infrastructure projects for various Australian state Governments now as well, and we should see some fixed-asset infrastructure spending (think: transport infrastructure, particularly train tracks and roads in NWH's case) as part of the stimulus needed to get the economy moving again (once the worst of the medical crisis has passed), and that only a small number of NWH's clients are likely to be seriously challenged by this situation (in terms of whether they can continue on as a going concern or not I mean), NWH has clearly been oversold. They were trading at over $3 in Feb ($3.18 on Feb 21), and they're now down to $1.14. They raised capital recently at $2.85 and that raising was 200% over-subscribed. And now they're $1.14. This is where we can see the effect of fund redemptions. ETFs and other index tracking funds have to sell stock as people cash out, and they have to sell those stocks indiscriminately. It presents some great opportunities, and this is clearly one of those. NWH aren't going broke. No chance. When this situation normalises, even if it takes a year or two, NWH (NRW Holdings) are going to be trading a lot higher than $1.14.

16-Sep-2020: Update: NRW (NWH) are actually a bigger and better company now than they were when they were trading between $2.70 and $3 in April and May last year. They're also the same company that they were when they were trading above $3 in January and February this year. COVID-19 hasn't hurt them. They are doing very well. I am a happy shareholder. $2.97 still looks like a good PT to me. Should get there within 12 months, but I'll give them 18 for a margin of safety.

One thing which people perhaps don't realise is that they do a lot of infrastructure construction work OUTSIDE of the mining and energy sectors, particularly rail line construction, but also roads. If the massive infrastructure stimulus that has been tipped to be in the forthcoming federal budget is indeed there, NWH could well be one of the many beneficiaries of that government spending on infrastructure. Particularly if it involves new rail. Downer EDI is another obvious winner in that scenario, and I also hold DOW. I've been waiting for years for a federal Treasurer and/or an Australian Prime Minister to get serious on big new infrastructure project spending across Australia, and COVID-19 might be the excuse they need to get it across the line this time... hopefully!

18-Mar-2021: Update: Still good. $2.97 is fine. Been above that in Jan and early Feb, and will be back up there again. Might take a little bit of good news to push them past $3 however. Very high quality management team in my opinion. I hold NWH in two of my RL portfolios as well as on my Strawman.com scorecard.

16-Sep-2021: Update: $2.97 is still OK. They had a ripper FY report (in August) - and rose +17.42% on the day (from $1.665 to $1.955) but they've given some of that back, closing at $1.815 today. My $2.97 PT is around +64% higher than where NWH are today, but they were trading at over $3/share in that December-to-early-Feb period (just prior to my last update), and I would argue that they are actually a better company today than they were then, and are worth at least that much. Their prospects certainly have not diminished. It's simply a sentiment thing, and the mining services sector has very poor sentiment around it currently. That will change. $2.97 within 12 months, so by mid-September 2022. I hold this one in two RL portfolios as well as in my SM portfolio.

12-Nov-2022: Update: $2.97 is still OK, and they have been moving up towards it recently. I've been trimming my NWH positions recently too, but I still retain significant exposure to them in my main real life portfolios.

Source: NRW-2022-AGM---CEO-Address--Presentation.PDF

Friday 26th May 2023: This one was marked as "stale" so I've reviewed it, and it's fine, I'm still happy with a price target of just shy of $3. The company's SP rose above $3 briefly at the end of January (2023) and I did trim my positions at those levels, because this is a company that tends to trend up and down for months at a time, so they will give me more opportunities to load up at lower levels.

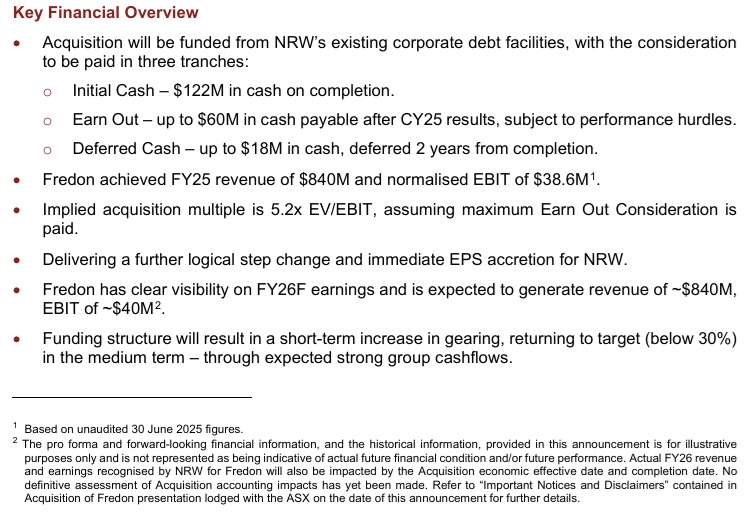

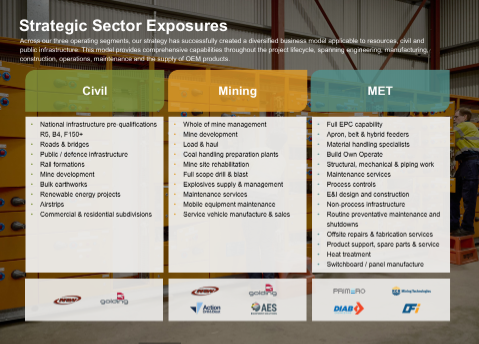

I believe that there is still significant demand for the metals and minerals that NRW's (NWH's) clients produce, and that demand is going to increase for the most part, over time, not diminish. As one of Australia's leading mining services contractors, as in companies that do the actual mining on behalf of the mine owners, NRW is well placed to continue to benefit from that demand.

Additionally, due to some very smart and well-priced acquisitions over the past 5 years they have succesfully expanded across to Australia's east coast (through Golding, who were already well established in the east) and they now work right across Australia. And they have a division that does EPC and EPCM work (Engineering, Procurement, Construction, and project Management), as today's announcement highlights: Primero-awarded-NPI-contract.PDF

This means they are now directly competing with companies like Monadelphous (MND) who are an engineering and construction company with a maintenance services division. Mono's used to be one of the larger companies in the sector, however NWH's m/cap is now just over $1 billion, and MND's m/cap is only $1.25 billion, so it's certainly conceivable that NRW (NWH) could become larger than MND, because MND are basically a mature company, and NRW are a growing company.

Part of that growth is via acquisitions, which have so far been well targeted, strategic fits, and they have not overpaid, but NRW have organic growth as well. MND sometimes struggle to replace work as it runs off, with new work of the same value. MND rarely make acquisitions and the few they have made over the past 10 years have been tiny compared to their own market cap, and the extra revenue derived from those small acquisitions has NOT been particularly material.

MND tend to win some of the largest EPC contracts on some of the largest projects, but those wins don't come around every year, so their E&C division often has lumpy revenue and earnings from year to year. MND's Maintenance and Industrial Services (MIS) Division IS growing, and MIS does have far more predicatable revenue and earnings, but their E&C (Engineering and Construction) division can drag down their results every now and then.

I have noticed that more recently, and today's announcement (link above) is a classic example of this, that NRW is winning contracts from some of the larger miners (like RIO in this case) where both MND and NRW already work for those miners with various ongoing contracts and both companies have a good history with those miners. I can't imagine that MND did NOT bid for that non-process infrastructure (NPI) work at RIO's Western Range mine site; they both would have bid for it for sure, but NRW won the contract, which says something I reckon.

One of the biggest mistakes that these companies can make of course is tendering for contracts at prices that are so low that while they might win the contracts, they might also struggle to make a profit on those contracts, particularly if things turn don't go exactly to plan; things like Covid outbreaks, tradespeople shortages, wages and salary pressure resulting in unexpected cost increases, material shortages, freight delays, weather events, and cost overruns for any other reason.

NWH made some of those mistakes in that 2009-2011 period, and they almost went broke in 2015, but they learned a lot from that experience and they are a different company now. They don't ALWAYS make a healthy profit on EVERY contract, but their losses are generally few and far between, not usually very material, and for the most part have been either unavoidable, or due to circumstances that could not reasonably have been foreseen. Point is, they are a lot more sensible with their tender pricing these days, and they allow for contingencies, and this includes having their clients share the risks of cost blowouts. These contracts are now structured so that the contractor doesn't have to wear these cost increases alone - the client shares the pain in most cases, or covers a lot of these increased costs. Companies who don't structure contracts in this way usually don't last too long.

I hold shares in both MND and NWH, but I am more excited about the future of NWH, because they are the one that is growing.

Here are some other recent announcements by NRW (ASX:NWH):

27-March-2023: Acquisition--METS-contract-awards.PDF

08-March-2023: NRW-2023-Rottnest-Conference-Presentation.PDF

27-February-2023: NRW-awarded-contract-by-Bellevue-Gold.PDF

16-February-2023: NRW-Half-Year-Results-Announcement.PDF

and NRW-Half-Year-Results-Presentation.PDF

Here's an excerpt from page 1 of those H1 FY2023 Results that they announced in Feb:

They'll be back up and over $2.97 soon enough. And their dividends have been increasing too, which is a nice bonus.

Update: 19-Jan-2024: They keep coming back up to my $2.97 PT.

I'll likely raise that after their half year results are released in February - they keep on performing. They're the quiet achievers in the mining services space - and they are getting more and more work outside of mining now - as today's announcement shows: NRW-named-as-Preferred-Proponent-for-Reid-Hwy.PDF [19-Jan-2024]

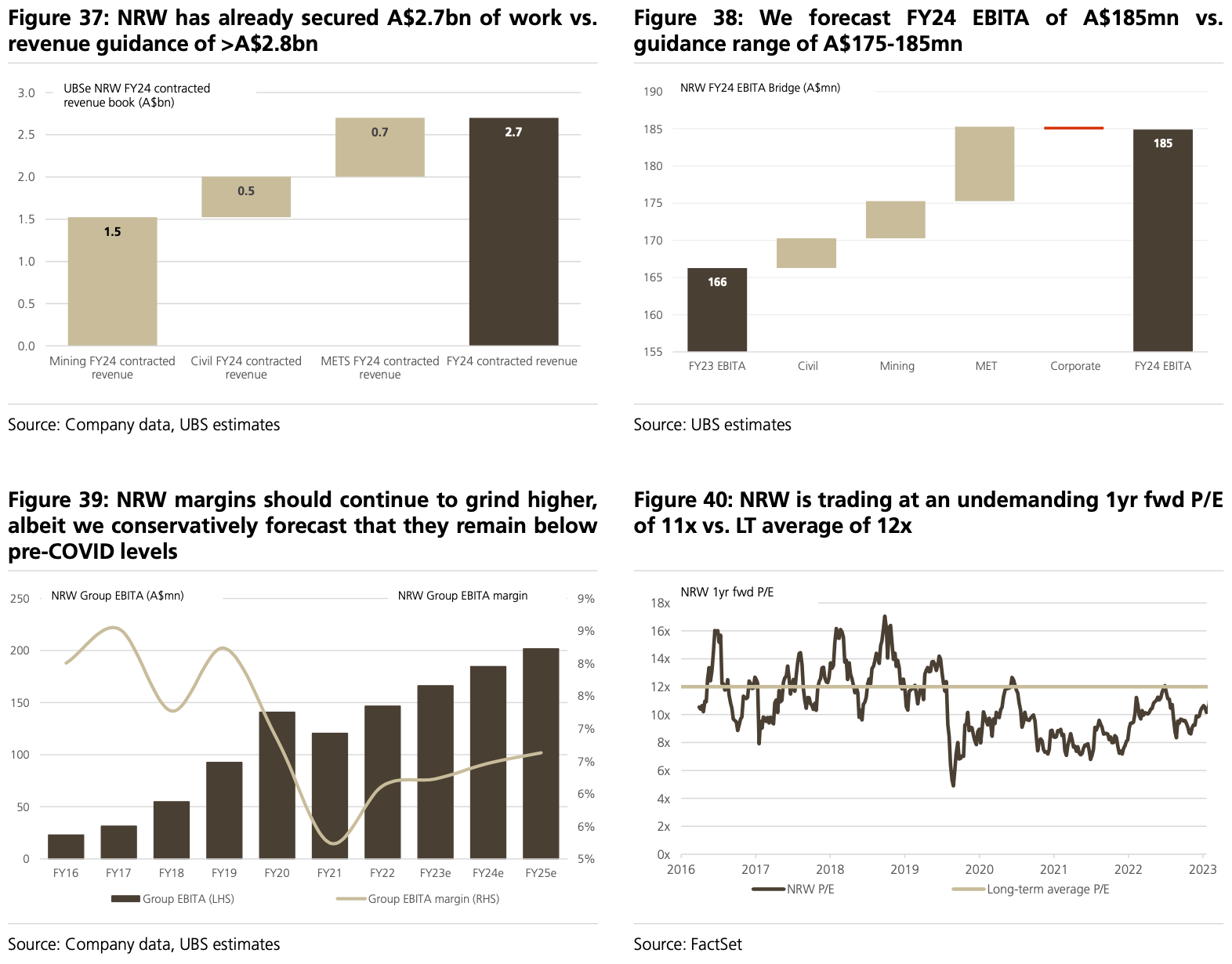

Margins aren't high in the sectors in which they work - engineering, construction and mining services - but they have been excellent at risk management in recent years and they have a LOT of work on. NRW (NWH) are now a $1.2 Billion company, so they're a decent sized company, and as I mentioned above, their dividends have been increasing every year since 2018.

Their revenue and earnings can be lumpy because they have a mix of recurring revenue (multi-year maintenance and operations contracts as well as mining services contracts) and one-off revenue (E&C: Engineering and Construction, project work), and their shares on issue (highlighted below in orange) have been growing due to both acquisitions and staff remuneration, however the overall trajectory of their EPS (earnings per share) has been increasing, as shown below, and they have been growing their book value (per share) and their NTA (per share).

Source: Commsec [on 19-Jan-2024]

Other positives are their double digit ROE (second last line above and the graph at the top right (linked by that blue line on the right) which is decent for the industries that they operate in, and their revenue growth. They have grown their revenue every year for the past 7 years and their EPS has been lumpy but trending up (as shown above, top left).

Their gearing (debt level) is low, and they tend to pay down their debt quite quickly, however they do use debt to partially fund strategic acquisitions (they use both equity and debt) so their debt levels can increase when they make acquisitions, but they always pay that debt down at a good clip in years when they haven't acquired anything.

The main two things I like about the company is the growing earnings per share, so despite the growing share count, each share is earning more profit each year, on average - i.e. based on the overall trajectory of their EPS (as shown above) AND their disciplined approach to M&A - every acquisition they've made has been smart and they have not overpaid for any of them.

As I have said previously, high debt levels almost sent the company broke in late 2015/early 2016, and their share price was trading at around 5 cps in early Feb 2016. This was at the time that the last big mining boom went bust, and NWH had geared up big time for not only all of the work they were winning, but also for a heap more work they expected to win in future years. Back then they were buying earthmoving equipment outright (using debt), thinking the good times were not going to end any time soon. These days, they use equipment leasing a lot more. They have learned a lot of valuable lessons from that period, and they show no signs of making the same mistakes again.

They are now very disciplined with how they use debt, and they always pay it down quickly when the have any (they are often in a net cash position) - and they have intentionally diversified their revenue across more sectors, as well as targeting more recurring revenue through multi-year contracts for either mining services or for operations and maintenance of infrastructure and other assets.

So I love the growing EPS and the strategic and disciplined M&A, and I also love the growing dividends, and the strong balance sheet. I also like the fact that they tend to stay under the radar of many fundies and retail investors, despite them being worth over $1 billion now. They tend to keep a low profile, and that can be a good thing. This is a company that almost went broke 8 years ago and is just out there proving that they're not going to do that again. They operate differently now, as I have explained. And they are letting their runs on the board do the talking.

The company is also trading at an undemanding PE ratio - as highlighted there in dark blue, not as cheap as they were a year ago, but still reasonable value IMO. However I'm not buying up here - I like to buy them at closer to $2.50 or below - and they were down there between March and July this year - so they do seem to provide opportunities to enter or top up positions reasonably often as sentiment waxes and wanes.

Many people either don't follow them or don't know about them, but if you don't mind the sectors that they operate in (mining services, plus engineering and construction across a variety of sectors such as mining, infrastructure, governments/transport, specialising in rail, roads and bridges) then they are right up there as worthy of serious consideration.

FY23 Full Year Presentation (nrw.com.au)

The 9 images above all have links behind them, so you can click on them to go to different sections of the NRW Website.

(21) NRW Holdings: Overview | LinkedIn

nrw.com.au/wp-content/uploads/2023/10/NRW-Holdings-Annual-Report-2023-Digital.pdf

I hold this company my two largest real money portfolios as well as here.

15-Aug-2024: Update: FY24 Full Year Results:

Have to use a screenshot there as my computer is not allowing me to save Paint 3D images again after I edit them. If you can't read that, NRW (NWH.asx) reported today and made a new decade high price this morning (of $3.53). For context, they have been above this level only once before, a very brief spike above $4/share in 2012 during that big mining boom, but they had expanded rapidly using debt and bought a heap of gear and when the boom went bust they almost went into VA - with their share price getting down below 5 cents/share at the end of 2015 and the start of 2016. They scraped through by the skin of their teeth and are now a much stronger and better company than they were back in 2012. The main difference is that they have a very solid balance sheet, and they lease a lot of equipment instead of buying it all outright, so they are not leveraged to the gills like they were then.

This company was a staple of my largest real money portfolio - which I sold up in June, and they remain a core position in my SMSF - having been in there for years - and I hold them here on SM also. Here are the highlights of today's results for the full year:

NRW delivers another record result in FY24 and expects continued growth in FY25.

FY24 record results summary:

- Revenue $2.9 billion, up 9.2% on FY23.

- EBITDA(1) $334.8 million, up 15.9% on FY23.

- EBITA(2) $195.1 million, up 17.4% on FY23 at a 6.7% margin.

- NPATN(3) $123.8 million, up 18.6% on FY23.

- Cash holdings of $246.6 million, 94.9% conversion.

- Normalised EPS(4) 27.3 cps, up 17.7% on FY23.

- Strong order book of $5.5 billion, (inclusive of repeat business).

- Pipeline of near-term prospects is very solid at $16.4 billion, with $5.5 billion of active tenders.

- Fully franked final dividend of 9.0 cents per share, total FY24 dividend 15.5 cents per share up 11.1% pcp (on a comparable franked basis), 57.0% payout ratio.

- Dividends have been raised every year for the past 6 years (since 2018).

Notes:

- EBITDA is earnings before interest, tax, depreciation, amortisation of acquisition intangibles and non-recurring transactions.

- Operating EBIT / EBITA is earnings before interest, tax, amortisation of acquisition intangibles and non-recurring transactions.

- NPATN is Operating EBIT less interest and tax (at a 30% tax rate).

- Normalised Earnings per share (Normalised EPS) is EBITA less interest and tax (at a 30% tax rate) over number of shares.

Their 6.7% EBITA margin isn't stellar, but they are a steady earner - not shooting the lights out, but getting on with it. The days of massive margins for mining services companies are done and dusted, those are in the past, the best mining services companies now have low margins but their advantages are that they have a LOT of work (so volume) and it's consistently profitable, and they are VERY good at risk management.

And NRW (NWH) have good management that manage risk very well, are very disciplined and strategic with their M&A (buy well, and always earnings accretive acquisitions that make strategic sense and strengthen the overall business), and are looking after their shareholders with excellent TSRs.

They are no ProMedicus, but they are a consistent company that does what they do well, and keeps growing and providing good returns for their shareholders, since 2016.

At this point, before their share price rise today due to these excellent results, my return here on SM for the NWH shares that I hold here has been +51.77 p.a. - so a return over 50% per year over 6 years - I added them here back in June 2018.

That compares to my +54.41% p.a. return on my PME which I added in Feb 2020 @ just over $20/share.

These returns are money-weighted total shareholder returns, so they include the value of the dividends, but not the value of franking credits. There are different ways to make money - you don't have to jump on a rocket that shoots to the moon (PME) - although that's certainly a good ride when you manage to do it - you can also do it through low-profile, boring, companies that have mediocre margins but just keep making more and more money on more and more revenue, and increase their dividends along with those increased earnings.

28-Oct-2024: Update:

Raising price target to closer to $4, however once they break through $4 with conviction they could go to $4.50 I reckon, but they might take a couple of attempts to break through $4.

Nothing has changed with NRW Holdings (NWH.asx) except that their share price has risen, so they don't look as undervalued as they did a year ago.

Or three years ago:

Plenty of liquidity - $3m worth of shares traded today, being 2,763 trades, and 822,378 NWH shares changed hands.

Nice rise, but I do note that we saw a retrace in 2022 when they went over $2, then again in 2023 when they went over $3 - almost back to $2 again before rising up to $3/share at the end of 2023, but it took 3 attempts to break through $3 with conviction, i.e. they broke through and went on with it in June this year after trying to break through $3 in December '23 and March '24 and failing both times.

There's something about these whole dollar amounts that seems to slow the momentum or makes the market second guess the valuation at the time perhaps.

But look at what they've done since June - $3 to $3.80 in 4 months - plenty of north east momentum at this point.

But they could still have a couple of goes at breaking through $4.

They're a good size now - they're a $1.72 Billion company, so not a microcap any longer by Australian standards, and one of the best run mining services companies in terms of companies that actually do the contract mining, drill & blast, crushing, loading, etc. MinRes is bigger - at $6.7 Billion - and the parts of MinRes (MIN) that are mining services - rather than mine owners and operators - are bigger than NWH, however MinRes is complicated - there are a lot of moving parts - and NRW is both a simpler and more straightforward business in terms of getting your head around it and valuing the business, as well as having superior management to MinRes, in my opinion. So NRW is my main mining services exposure both here on SM and in my real-money portfolios.

NRW also do E&C (engineering and construction), so that division of NRW could be considered to be competing with two of my other larger positions, being Lycopodium (LYL) and GR Engineering Services (GNG), however I don't view it that way, as LYL & GNG tend to specialise in certain types of industrial processes, such as gold mills and other industrial processes where chemical engineering is required as part of the design (engineering) element, whereas NRW are competing more with companies like Monadelphous Group (MND) who do structural engineering and construction along with electrical and pipework. The stuff that LYL and GNG do is more complicated and has higher margins.

So, yes, NRW have skinny margins, but they have a LOT of work, and there are a few different ways to make money; you can do a small amount of high margin work, or a large amount of lower volume work, and still make the same dollars in profit, or more.

Despite their skinny margins, NRW reported FY24 NPAT (Operating EBIT less interest and tax) of $123.8 million, up 18.6% on FY23, on FY24 Revenue of $2.9 billion, up 9.2% on FY23. So their NPAT growth was double their revenue growth - I like that a lot!

Plus June 30 cash holdings of $246.6 million, Normalised EPS (EBITA less interest and tax over number of shares) of 27.3 cps, up 17.7% on FY23, a strong order book of $5.5 billion, and a pipeline of near-term prospects valued at $16.4 billion, with $5.5 billion of active tenders (as at June 30, 2024).

They have a 57.0% payout ratio and have been raising their dividends every year for the past 6 years (since 2018).

As with all contractors, it all comes down to execution and risk management, which includes building contingencies into contracts so that the contractor doesn't have to wear cost blowouts that are not their own fault, and only chasing profitable work, not lowering prices to almost breakeven levels just to keep busy, and NRW has become a LOT better at that stuff than a few years back when they almost went broke and their share price got down to 4 cents - because most people expected them to go into VA at the time - I can't see that happening to them again - a great number of things would all have to go very badly for them for that sort of scenario to repeat - because their contracts are structured a lot better, they pay their debt down quickly whenever the use debt - usually for EPS-accretive bolt-on acquisitions - and are often in a net cash situation - their net gearing was 12% at June 30.

It's hard to go broke with low or no debt, when you remain busy and profitable.

Commsec has their ROE at 20.4%, so not too bad. That's the highest it's been for 10 years, so that's another positive sign. They are actually getting more profitable as they grow. MND have been going the other way.

That'll do. Nothing much to add since their August report but I managed to waffle on for a few paragraphs regardless. I blame the shiraz.

Disc: Yep, holding NRW Holdings (NWH.asx) shares.

29th May 2025: Update:

No change to my $3.94 PT for NRW despite them trading at around $2.80 or just below this week and recently having traded below $2.50/share.

Much of that SP fall from around $4/share to below $2.50/share in recent months can be attributed to uncertainty and conjecture over whether NRW Holdings (NWH) are going to get paid all, some, or none of the $113 million that the then-Sanjeev Gupta controlled OneSteel in South Australia owed to NRW before OneSteel was forced into Administration by the SA Government over millions of dollars owing in state royalties and fees including a very large unpaid bill from SA Water.

I've written a fair bit about that saga in a straw here and also in an attached forum thread which you can find here.

I note that at 3:32pm (Sydney time) this afternoon, MQG (Macquarie Group) lodged a new "Becoming a Sub" notice for NWH which has a Securities Lending Agreement on page 59 suggesting that those shares probably have been or could be lent to shorters, which prompted me to check the latest shorting data for the company:

Interesting that there was a sharp spike up in the first half of April, albeit to just under 1% of NWH's SOI sold short (0.98%) but that immediately fell back down to 0.3% and then on May 15th when NRW released this: NRW-Response-to-Proposed-SA-Govt-Whyalla-Legislation.PDF ...the short level immediately dropped further, from 0.27% right down to 0.07%, which is almost nothing. The last recorded short position was 0.08%, as at 23rd May 2025, as shown above.

NRW is a $1.3 Billion company these days, and they're in the S&P ASX 200 Index, so they are widely held and can easily be shorted, so it's interesting that the short interest hasn't even risen up to 1% during this period - and is now almost nothing.

As I said elsewhere, that $113 million, if it had to be fully written off as a bad debt that was not recoverable, is less than 4% of NRW's FY2024 annual revenue, which is very manageable, and that's the worst case scenario.

There is one scenario that's possibly worse still, which is that NRW take legal action against the SA Government - who are proposing to introduce a law in relation to the Whyalla Ports and associated assets which would effectively strip away NRW's first ranking security over the shares of Whyalla Ports and certain assets of Whyalla Ports which they were granted by OneSteel last year to provide NRW with some assurance that they would get what they were owed from OneSteel - and that having taken legal action, NRW then lose that case and have costs awarded against them.

I think that's a low probability. NRW haven't taken anything off the table and say they reserve the right to take any action they deem appropriate, including possible legal action, to get what they are owed, but if they were to take such legal action, they would have strong legal advice beforehand and I would think it unlikely they would have costs awarded against them if they lost such hypothetical legal action, but it is still a possibility.

Another possibility is that they take a haircut but get some of that money. Another is that they have insurance to compensate them for some of the losses that can result from clients being forced into Administration by a third party and NRW not getting paid all of what they are owed.

But, yeah, no change to my price target for NRW (NWH). They do have that temporary setback, but nothing structural, and while it might take them a year or two to get back to just under $4/share, they should get there sooner or later.

I continue to hold NRW Holdings shares both here and in my real money portfolios.

30th August 2025: Update post-FY25-Results:

OK, NRW (NWH) have now written off the full amount of $110.5m that was still owing to them on June 30th, of the $113m owed to them by Sanjeev Gupta's OneSteel or another Gupta-controlled entity when the SA Government forced OneSteel into Administration earlier this year over millions of dollars of state taxes and SA Water bills not paid by OneSteel.

As I pointed out a couple of times here around that time, it represented less than 4% of NRW's FY24 annual revenue, so it was NOT a major deal or a company killer, and the market took the impairment (write-down) in its stride, probably happier now that there's no further downside financial risk from that matter, apart from possible legal fees, but I don't think NRW are going to spend much money chasing that written-off debt now that the SA State Gov have effectively stripped NRW of their Whyalla Ports assets via new SA state government legislation.

As I understand it, at some point in the past there was an agreement between the SA State Gov and OneSteel for OneSteel to manage the Whyalla Port because they were the main users of the port, but that it always remained available for others to use also, and NRW were convinced by Sanjeev Gupta or somebody within one of his companies that OneSteel was in a position to sign over the Whyalla Ports assets to NRW as security over the $113m that NRW was owed by OneSteel at the time, in December (2024), so after ceasing work at OneSteel's iron ore mines due to not getting paid by OneSteel, NRW agreed to return to work after having those Whyalla Port assets signed over to them by OneSteel.

Then in the past couple of months, after forcing OneSteel into Administration, the SA State Gov has pushed through a new piece of legislation that made it retrospectively not possible (or not legally possible) for Gupta's OneSteel or any of his companies to have owned Whyalla Ports in the first place, because the SA Gov say it should always have always remained a government / public asset, not a private asset.

This severely disadvantaged NRW but made the Administration process at OneSteel a lot simpler for the Administrators apparently. NRW then moved to have Whyalla Ports placed into Administration also, and that has now been done, different Administrators to OneSteel, who have KordaMentha; Whyalla Ports have Michael Brereton, Sean Wengel, and Rashnyl Prasad from William Buck, who were appointed on June 6, 2025.

This ABC News article covers it well:

Administrators reveal staggering debts of Whyalla Ports with at least $194 million owed

By Arj Ganesan, ABC North and West SA, Thu 19 June 2025.

The Whyalla port has been the subject of an ownership dispute in the Federal Court. (ABC News: Che Chorley)

In short:

William Buck, the administrator of Whyalla Ports Pty Ltd, revealed the company owed at least $194 million to creditors.

The figure could be higher with administrators still awaiting key financial documents from the company.

What's next?

It is understood that the company will more than likely apply for a deed of company arrangement (DOCA) at its next meeting.

The administrators of Whyalla Ports Pty Ltd have told creditors the company owes at least $194 million, but the true amount is still unclear.

Accounting firm William Buck held the first creditors' meeting for the company on Thursday, revealing $25 million was owed to trade creditors with a further $63 million listed as a lease liability.

The largest slice is owed to Golding's and its parent company NRW, a key mining contractor, with a secured debt of $106 million.

However, administrator Michael Brereton said they were waiting to receive financial records from Whyalla Ports directors.

"One of the first things we did on our appointment was to issue a notice to the directors to complete what's called the report on company affairs and property," Mr Brereton said.

"That was issued immediately … [and] we have yet to receive those from the directors, so we don't have all the financial information.

"[I] think one of the problems they face is that the company operated on the basis that it held the port.

"Based on the litigation and the legislation that's been passed, it's become apparent that maybe the company didn't have control of the ports.

"So I suspect they're having some problems trying to work through 'What are the financial records of the company?'"

How did this happen?

Whyalla Ports owes at least $194 million to various creditors. (ABC News)

In early June, the ports became another casualty in the ongoing fallout since the Whyalla Steelworks was tipped into administration by the state government.

The company, Whyalla Ports Pty Ltd, was involved in a Federal Court case launched by Whyalla Steelworks administrators KordaMentha, which wants control of the port so it can sell the steelworks as an integrated asset.

Parent company GFG Alliance said when the state government passed new laws to "clarify" that the port was [never] owned by OneSteel, it was left with "no option" but to push the port into administration.

KordaMentha has since abandoned the legal action it began. However, a counterclaim from GFG Alliance is still being pursued over the ownership of some assets.

During Thursday's meeting, Mr Brereton said a lease agreement between OneSteel and Whyalla Ports was terminated on March 27.

"The company was not trading on our appointment," Mr Brereton said.

"The company was dispossessed of all its plants and equipment at that time and its right to provide services to customers."

Law changes concern creditors

One Whyalla creditor, who wished to remain anonymous, previously told the ABC they were owed between $100,000 and $200,000 by Whyalla Ports.

They said they feared they may never receive the money due to the dispute over the port's ownership.

Sudel Industries CEO Kevin Moore. (Supplied: Kevin Moore)

CEO of Sudel Industries and creditor Kevin Moore said he was owed roughly $20,000 from Whyalla Ports.

"Basically, I've already written that money off. I don't think we'll see it."

Although the paperwork has not been filed, it is understood that the company will more than likely apply for a deed of company arrangement (DOCA) at its next meeting.

--- ends ---

Source: https://www.abc.net.au/news/2025-06-19/whyalla-ports-creditors-meeting-reveal-debt/105435952 [19th June 2025]

So NRW are still weighing up their options but they've made the sensible decision to book an impairment for the full amount still owing ($110.5 million) in their FY25 full year accounts.

So, looking at their actual FY25 results:

Underlying Revenue and Earnings growth, and still booking a statutory profit - and paying a final dividend - despite the significant write downs (impairments) as detailed below, however $27.7m NPAT in FY25 is a big drop from the $105.1m NPAT they made in FY24.

Some Positives:

And Some Negatives:

However they aren't down to the bones of their arse yet:

They have plenty of liquidity. They are after all an ASX200 company with a $1.76 Billion market capitalisation. They still have over half a billion ($595.2m) of available liquidity and only $145 million of net debt ($411 million of total debt including lease liabilities and $266 million of cash and cash equivalents).

Their total gearing has increased from 12.1% to 23.8%, or excluding lease debt from 5.1% to 16.1%, so not terrible. Net cash would be better, but it's not scary debt levels, and they've been able to pay down debt rapidly in prior years.

Slide and Info Sources not otherwise credited are the following announcements on August 21st by NRW Holdings (NWH):

Appendix 4E & Full Year Statutory Accounts

Full Year Results Presentation

Full Year Results Announcement

They've come back up to my $3.94 price target or close enough to it (closed at $3.91 on Wednesday 27th August after reporting on the 21st August) - so I'm raising my price target now to $4.45.

It was quite the drop they took from January through to their $2.21 low point in April, and I'm glad I was buying around $3 and below, but they're back up around the $4 mark again now, without that potential $100+ million write down hanging over their heads any more (because they've done it now - the impairment has been booked), and, as I was suggesting, it was more of a mole hill than a mountain, and the cyclone in the tea cup has passed now, so I expect NRW Holdings (NWH) to get back to some decent growth over the next few years.

Disclosure: Held.

8th October 2025: Update:

Raising my price target again, this time to $4.85, as NRW have made another excellent acquisition and have now upgraded their FY26 Guidance.

Previous FY26 Guidance (from August 21st):

Source: NRW-Full-Year-Results-Announcement-(21-Aug-2025).PDF

And here's their new guidance:

Source: Fredon-Acquisition-completion--Guidance-Update.PDF [08-Oct-2025]

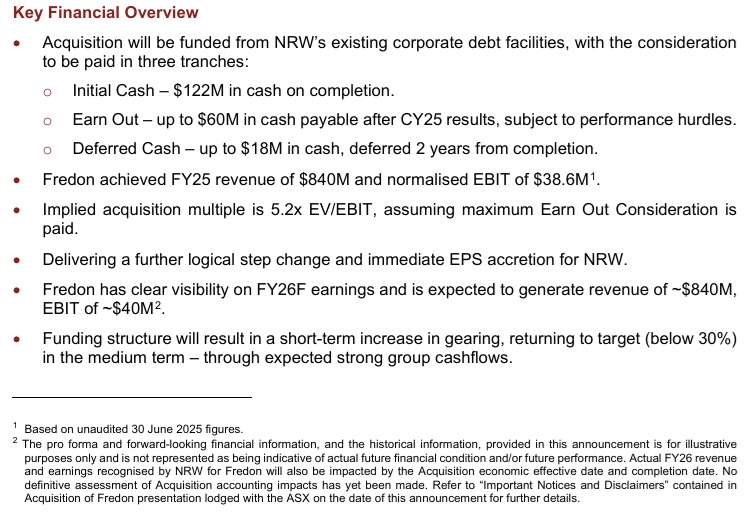

This guidance upgrade represents +17.6% more revenue and +16.6% more profit (earnings) than their guidance in August. As I said when they announced this Fredon Industries acquisition, it's another good one, and well structured, see below:

Source: From page 1 of NRW-Acquires-Fredon-Industries-(02-Sep-2025).PDF

No shares were issued as part of this acquisition, it was 100% debt funded, so it's certainly another earnings (EPS) accretive acquisition, and they haven't overpaid either, incentivising the Fredon management to stay with the business to ensure that Fredon performs to expectations so that the vendors earn the "up to" $60m earn-out for CY25. The deferred cash component (up to $18m) payable in 2 years also clearly has some hurdles, hence the use of the words "up to", so, again, NRW are bringing the acquired company management across to NRW and incentivising them to keep working hard.

Having only $122 million of this up to $200 million acquisition as an upfront payment is another smart move by NRW (NWH) management in my opinion, on a number of levels. And who doesn't like a current year guidance upgrade?

So, they're continuing to get bigger and better, with both organic and smart inorganic (acquisitive) growth. I like what they buy and how they buy it. I like their risk management. I like their growth, including their growing dividends. The only thing I don't like is how much they pay Jules Pemberton, their CEO and MD, and the fact that they receive a strike on their Rem Report at their AGM every single year and that it doesn't bother them. So while I still hold NRW (NWH) shares in my SMSF - and here - the positions are not as large as they have been previously. I've been taking some money off the table and recycling it into other ideas.

But I still hold. They are certainly well run and have a good industry position.

8th October 2025: Fredon-Acquisition-completion--Guidance-Update.PDF

Source: Fredon-Acquisition-completion--Guidance-Update.PDF [08-Oct-2025]

Source: NRW-Full-Year-Results-Announcement-(21-Aug-2025).PDF

So they have now upgraded FY26 Revenue guidance from over $3.4 Billion to now over $4 Billion;

And they have upgraded FY26 Earnings (EBITA) guidance from between $218 and $228 million (midpoint of $223 million) to now between $255 and $265 million (midpoint of $260 million).

This guidance upgrade represents +17.6% more revenue and +16.6% more profit (earnings) than their guidance in August. As I said when they announced this Fredon Industries acquisition, it's another good one, and well structured, see below:

Source: From page 1 of NRW-Acquires-Fredon-Industries-(02-Sep-2025).PDF

No shares were issued as part of this acquisition, it was 100% debt funded, so it's certainly another earnings (EPS) accretive acquisition, and they haven't overpaid either, incentivising the Fredon management to stay with the business to ensure that Fredon performs to expectations so that the vendors earn the "up to" $60m earn-out for CY25. The deferred cash component (up to $18m) payable in 2 years also clearly has some hurdles, hence the use of the words "up to", so, again, NRW are bringing the acquired company management across to NRW and incentivising them to keep working hard.

Having only $122 million of this up to $200 million acquisition as an upfront payment is another smart move by NRW (NWH) management in my opinion, on a number of levels.

And who doesn't like a current year guidance upgrade?

Disclosure: Held.

2nd September 2025: NRW Acquires Fredon Industries plus NRW - Fredon Industries Acquisition Presentation

The market liked it:

They hit a new 10 year high today (intraday) of $4.18/share before closing up "only" +6.3% @ $4.04.

They've only been up above that $4.18 level only once in their history, way back in April 2012, so more than 13 years ago, and only for a couple of days; they then followed that high with a fall right down to 5 cents/share in early February 2016, when that big mining boom went bust and NRW almost went broke due to having bought a LOT of debt due to having bought a heap of mining and earthmoving equipment instead of leasing it, thinking that the good times would just keep on rolling on.

They ain't the same company now - they are much better - they've learned from their past mistakes and they now have more diversified revenue, more annual recurring revenue (ARR), a much stronger balance sheet, over half a billion dollars of liquidity - see my NRW (NWH) valuation update for the details of that - as shared by NRW last month in their FY25 full year report and their outlook plus guidance for FY26, they have better risk management, and they are just a much bigger and much better company; And their M&A track record has been a good one in recent years, and so far I can't see too much wrong with this acquisition either.

They're keeping the old management in place and incentivising them to perform, and the skill sets they are acquiring through this business are complimentary to what NRW can already do. It makes good sense all around, as I see it.

Sources: That lot above is all taken from their announcement today - to view their presentation, click on the image below.

Disclosure: Holding. All good. I like this one.

30-May-2025: NRW-Contract-Award-30May2025.PDF

Another new contract award by RIO to NRW's Primero division:

Contract Award

NRW Holdings Limited (ASX:NWH) is pleased to announce that its wholly owned subsidiary Primero Group Limited (Primero) has been awarded a contract by Rio Tinto for Hope Downs 2 Satellite & Bedded Hilltop Non-Process Infrastructure (NPI) Facilities. The contract forms part of the Hope Downs 1 Sustaining Project.

Under the contract, Primero will be responsible for the design, supply, installation, construction, testing commissioning and handover of NPI works required for the Rio Tinto Hope Downs 1 Operations in the Pilbara region of Western Australia.

The contract has an approximate value of $157 million. The contract is scheduled for completion in December 2026. Design and procurement work will commence immediately with site works expected to commence in Q4 2025, once all external approvals have been granted.

Primero’s Managing Director, Michael Gollschewski shared “This award represents the continuation of our long-term relationship with Rio Tinto through the delivery of world-class infrastructure projects.”

NRW’s CEO & Managing Director, Jules Pemberton stated, “This contract reinforces Primero’s reputation as a leading provider of engineering and construction services. We look forward to the successful completion of the project.”

--- end of excerpt ---

Source: NRW-Contract-Award-30May2025.PDF

Disclosure: I hold NRW (NWH) shares. Good to see them winning repeat work from bluechip clients like Rio Tinto. It means that their clients are happy with their work, including the quality and timeliness of the finished work. As I have been saying, the OneSteel (Whyalla) issue is a temporary issue, not a structural one, and it's BAU for NRW. And business is good.

20-March-2025: NRW-Holdings-Contract-Awards.PDF

Some positive news there with the biggest new contract announced today being worth around $100 million; from RIO for NRW's wholly owned subsidiary Primero Group Limited (Primero) to perform work at Rio Tinto's Coastal Water Supply Sustaining Project.

Under the contract, Primero will be responsible for the Structural, Mechanical, Piping, Electrical and Instrumentation (SMPE&I) Procurement and Construction works for the seawater desalination project at Parker Point, Dampier in Western Australia. This includes the seawater intake, treatment facility and conveyance piping. The Contract is scheduled to run for approximately twelve months commencing immediately.

And there are some smaller contracts announced in there as well.

NRW's share price remains well down from recent highs due to the issues around OneSteel and the Whyalla Steel Works, with NRW owed over $100m by OneSteel, which is now in Administration. I have covered this already here, so won't dwell on it except to say that because NRW had preemptively protected their position by becoming owners of (all of the shares in) Whyalla Ports and additionally have first ranking security over many of the Ports' major assets, and the Ports are used for more than just steel exports (they are multi-use Ports), NRW isn't going to have to write off the full amount owing from Gupta's OneSteel.

NRW may end up taking a haircut, but they'll get some and possibly all that they are owed; it just might take some time. NRW are still working those OneSteel contracts and are currently being paid by the OneSteel administrators for all work performed from the date of Administration, and that contract was due to finish up later this year anyway, unless it is renewed.

That OneSteel contract is just one of their contracts within one of their divisions, but the Market seems to remain very focused on it at this point, with NRW's share price likely to stay subdued until we get some positive news on that front.

I'm personally viewing that as an opportunity and have been adding more NRW (NWH.asx) to my two largest real-money portfolios as well as here on SM.

08-March-2025: A week ago (on Friday 28th, the last day of Feb) I wrote here about NWH's H1 report and commented that because it was released after market close, I would have to wait until Monday (March 3rd) to see the market's reaction to it - and it could be interesting. It was.

Here's what they looked like at market close yesterday (Friday 7th March 2025):

I would argue (and I am) that they've been oversold, unless there are reasons other than OneSteel and a less positive iron ore price outlook for the sell-off. Firstly, this is not unusual, however, despite repeated drawdowns (or pullbacks), their share price has been on a north east trajectory if you zoom out and look at a 10 year chart:

Here's that same 10 Year chart (below) using daily data points instead of the monthly data points used in the 10 Year chart above.

That second one is not as clean, but the results are the same: If you are prepared to ride out the share price volatitlity they do eventually make up lost ground and go on to make new highs, although sometimes it can take a while, like 4.5 years for them to get back up to their $3.38 high point achieved on 20th Jan 2020, which they passed again in July 2024.

However they are increasingly compensating us for waiting, through increasing fully franked dividends:

Source: All of these charts and tables were sourced from Commsec today and tidied up by me. I've changed the Dividend yield above: Commsec had 5.8%, however based on 16 cps p.a. (the 7c div just declared plus the last final dividend of 9 cps) and a $2.81 share price, it's 5.69%, not 5.80%. I have also added their grossed up dividend yield which includes the full value of the franking credits.

So you've got that income to compensate you for a choppy share price.

But what about the risks? Yeah, there are risks, as there are with any contractor, and especially contractors who are exposed to commodities and commodity price movements, however it pays to remember that NWH aren't miners, they are mining contractors who are awarded multi-year mining contracts (recurring revenue), so the real risk is if their clients cease production or go broke and that work ceases prematurely, or if the client doesn't pay their bills as they fall due.

And many punters probably think that's what has happened with OneSteel, one of NWH's clients, in the past few weeks, however it's not that simple. OneSteel was put into Administration by the SA Gov after they ran out of patience with the parent company not paying their bills, including $17 million owing to SA Water, plus not paying their contractors including NRW who it turns out are owed $113.3 million by OneSteel for past work performed.

NRW are continuing to work for the OneSteel Administrators and are being paid from the date of Administration, but are having to pursue the $113.3 million for work done prior to that. NRW say they are confident that they will be paid and they have NOT declared any impairments (write-downs) in their H1 accounts related to money owed to them by OneSteel/GFG.

OneSteel is part of the GFG corporate group and is the legal entity that owns and operates the Whyalla steelworks and associated mines. GFG is controlled by Sanjeev Gupta and rather than me describing the man and his business practises, it is probably more instructive to watch a 7:30 report piece from ABC TV broadcast on Feb 13: https://youtu.be/ETNzD2BddFE which is titled, "Gupta approved to develop mansion as Whyalla and Tahmoor face uncertainty". It's not just Gupta's SA operations that are in deep trouble. The South Australian Government recognised where this was heading and moved to bring it to a head before the Australian federal election is called next month (April 2025) and hopefully giving themselves enough time to find a buyer and new long-term owner of the assets before the SA State election in March 2026.

I would argue that this particular situation has more to do with Sanjeev Gupta than it has to do with iron ore and steel prices and their respective outlooks, even though those outlooks don't look stellar in the short to mid term. Gupta can't make money in coal either, and in other areas throughout his global empire - and he just doesn't seem to like paying his bills, and part of that appears to be that he has too many fingers in far too many pies and is struggling to keep all of the plates spinning, to mix up some metaphors.

But what is NRW's exposure to GFG and OneSteel? Well, one of the things I like about NRW is their much improved risk management since our last really big mining boom went bust - and NRW almost went broke themselves, with their SP getting down to around 4 cps in January 2016. Even I wasn't brave enough to be holding them at that point - I thought they would go broke, but they pulled through, and haven't approached debt in the same way since, and are proactive now in securing their rights in situations like the OneSteel debacle. Here is the timeline, impact and current status of that one from NRW's POV, taken from their H1 results presso on Feb 28th:

Note the third dot point in the timeline. Whyalla Ports is a multi-use port facility - not just used for steel exports - and NRW have first ranking security over all of the shares in Whyalla Ports and many of the Ports' key assets. Golding is a division of NRW by the way in case that wasn't clear.

Because of this and NRW working collaboratively with the OneSteel Admistrators (KordaMentha), I believe they'll get either all of their money or most of it, or else they'll end up with Whyalla Port assets they can sell to recoup some or most of that money owed to them. It's also worth noting that of NRW's major contracts, OneSteel (shown below as "SA Operations") is the one that was already scheduled to expire first, later this year, and their other Iron Ore mining contract (crushing and hauling) at Karara is due to expire next calendar year if not extended.

Which would leave NRW's commodity exposure (via mining contracts) to Gold (through EVN's Mungari gold mine) and Met Coal.

It should also be noted that while Mining remains NRW's largest division and the mining sector is also their largest sector exposure, NRW's Civil Revenue was up strongly (+40.6%) in H1 and MET (NRW's Minerals, Energy & Technologies division) was also up by +15.6%, and NRW's EBIT Margins improved in both Civil and MET, with EBIT improvements of +75.9% and +25.3% respectively, being greater in percentage terms than the corresponding increases in revenue for those two divisions.

On the one hand, the revenue generated by Civil and MET combined now exceeds the revenue generated by Mining, AND the profit margins on Civil and MET are improving, but on the other hand it's worth noting that the EBIT that Mining generated ($63.7 million) is still significantly higher than the combined EBIT from Civil and MET ($48.5m), so the margins are still clearly better within NRW's Mining division, despite that Mining division EBIT margin slipping this half compared to the p.c.p.

So it's a trade-off - they are achieving further diversification of revenue, which is positive when the commodities outlook is so mixed, but that diversification is into other sectors that have so far had lower profit margins than NRW have been achieving in their Mining division traditionally, albeit those other sectors are exhibiting improving margins while their profit margin in Mining is slipping, so all things considered I'm happy enough as a shareholder with this progression - and that trade-off.

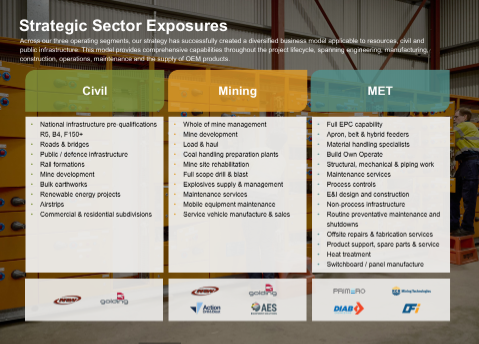

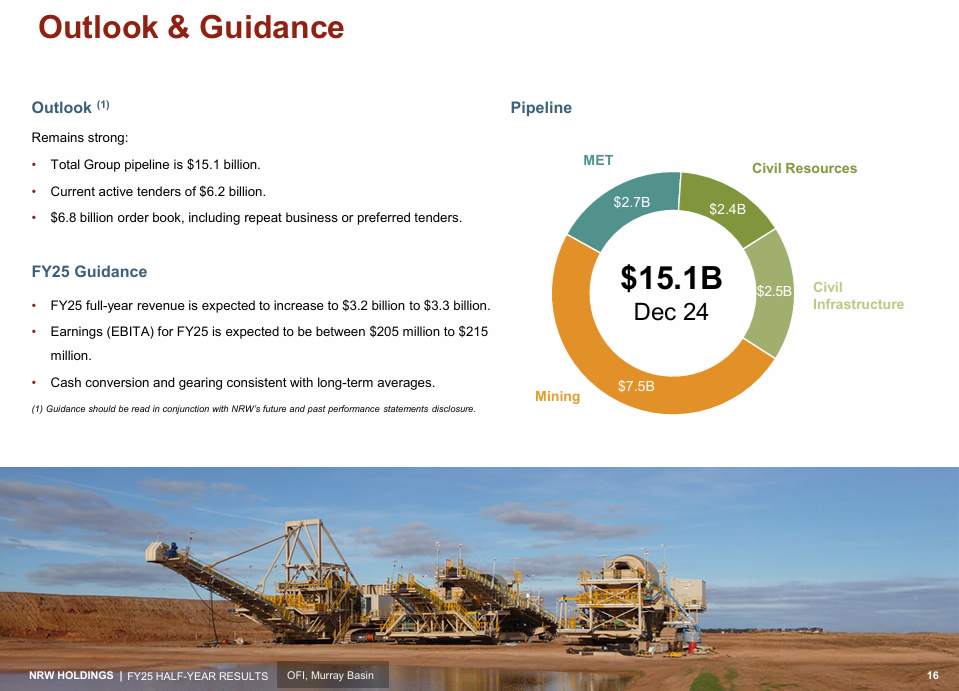

Their actual Revenue and Earnings (EBITA) for FY24 was $2.9 billion and $195.1 million (see NRW-FY24-Full-Year-Results-Announcement.PDF) so that guidance above for FY25 full year revenue of $3.2 to $3.3 Billion ($3.25 B mid-point) and FY25 full year earnings (EBITA) of $205 to $215 million ($210 M mid-point) represents improvements of +12% and +7.6% respectively over FY24, using those FY25 FY guidance midpoints, so overall they are guiding for a better year in FY25, but with a slight slip in margins overall (seeing as the earnings increase is forecast to be lower than the revenue increase in percentage terms).

I have written plenty here on NRW over the years, which you can access here: https://strawman.com/reports/NWH/Bear77

I topped up my NRW (NWH.asx) position in my SMSF yesterday and also added them to my income-orientated portfolio (outside of my super). I'll probably look to increase my NRW position here at some point also now that I've done it in my main real money portfolios.

I still don't like holding companies that look to me to have a share price that is more likely to go down than to rise in the near-term to mid-term, however that's not how I view NRW at this point - I see them as oversold and having an SP that could bounce at any time, just with a change of sentiment, a broker upgrade, and/or one item of positive news from the company. That's also my view on LYL, my largest position both here and across my real money portfolios, which is why I'm happy to hold both LYL and NWH during their current respective pullbacks. I fully accept that they might go further south before they recover, but I remain confident of that recovery, and I don't want to be on the sidelines when it happens, because it could easily be a decent and fast move back north, when they do start to recover. And it could happen any time, without notice.

- - -

Further Reading (while NRW were still in that trading halt, so before they released their H1 report and the info included above):

Whyalla steelworks fallout trips up $1.5b mining contractor

by Simon Evans and Phillip Coorey, AFR, Feb 23, 2025 – 12.23pm

NRW’s mining contracting business Golding is owed up to $120 million in the collapse of the Whyalla steelworks and the nearby iron ore mines that supplied raw materials to the Sanjeev Gupta-owned group.

Meanwhile, Treasurer Jim Chalmers on Sunday played down the prospect of the government taking an equity stake in the Whyalla steelworks, but flagged mandating quotas to ensure the plant’s product was used in government projects.

Sanjeev Gupta’s Whyalla steelworks. Ben Searcy

“We’re looking at the procurement part. I think already 75 per cent of the steel out of Whyalla goes to things like railways in Australia, infrastructure projects, so there’s already a big opportunity there, and if there’s more we can do, more that we can think through on that front, we will do it,” Chalmers said on ABC’s Insiders.

The $1.5 billion ASX-listed NRW has asked that a trading halt be extended until February 28 while it hastily recasts its first-half financial accounts following the dramatic move by the South Australian government to force Sanjeev Gupta’s Whyalla plant into administration.

NRW’s Golding contracting business is the largest single creditor to OneSteel Manufacturing, the corporate entity pushed into administration that owned the ageing Whyalla steelworks and associated iron ore mines operated by another Gupta company, SIMEC, about 60 kilometres from the plant.

Two sources with knowledge of the situation, both of whom requested anonymity because they are not authorised to speak publicly, said Golding was owed around $120 million.

NRW did not detail how much money it is owed in an ASX statement on February 21 when it sought a trading halt extension.

It had been scheduled to unveil its interim 2024-25 result on February 20.

“NRW therefore requests a voluntary suspension until the company is in a position to provide the markets with an update to the SIMEC position and the timing of the release of the half-year results, expected to be no later than Friday, February 28,” company secretary Kim Hyman said.

NRW, which provides mining contractor services around Australia, has suffered a 20 per cent fall in its shares since November 19, when the stock was trading at $4 and it became apparent Gupta was struggling to refinance his global steel operation.

Golding had about 600 workers at three iron ore mines in the Middleback Ranges when the $600 million three-year contract was announced in early 2022, running until January 2025. The Golding workforce had been progressively pruned back over the past few months as Gupta attempted to cut costs and prepared to take mining back in-house.

KordaMentha was appointed as administrator of the Whyalla steelworks and the iron ore mines on February 19. Prime Minister Anthony Albanese and SA Premier Peter Malinauskas collaborated on a $2.4 billion rescue package on February 20.

That included $292 million for buying railway lines to help underwrite production.

KordaMentha declined to comment on amounts owed to creditors, or the status of any specific creditor. The first creditors meeting is due to be held on March 3.

The SA government lost patience with Gupta over mounting unpaid bills that left the town of Whyalla, 380 kilometres north-west of Adelaide, reeling. Gupta’s unfulfilled promises about future upgrades of the plant angered many local businesses, and bigger ones too. ASX-listed rail freight operator Aurizon suspended hauling iron ore for several weeks because it was not getting paid.

Whyalla Mayor Phill Stone described the SA government’s move as a circuit breaker.

“It’s going to be a long, hard slog. There needs to be a regeneration, but it is going to take time,” he said. “But it has definitely lifted the town’s spirits, having a long-term injection of funds.”

SA government water utility SA Water is owed $17 million in the collapse. Malinauskas has diverted $600 million earmarked for a taxpayer-funded proposed hydrogen plant near the steelworks to the rescue fund for the steel plant instead.