Price History

Premium Content

Premium Content

Premium Content

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

27-Nov-2025: NRW Holdings (NWH.asx) held their AGM today and their Rem Report was voted down for the eighth consecutive year:

So eight consecutive "strikes" against the company's remuneration report under Australia's Two Strikes Rule.

The two strikes rule is an Australian law aimed at holding corporate directors responsible for the amount of executives' salaries and bonuses. Under the two strikes rule, a company's board members can be replaced if shareholders feel that the members are paying executives too much based on the company's performance. In essence, the two strikes rule is primarily intended to prevent executive salaries from growing out of control and to ensure that board members are held responsible for protecting the best interests of the company and its shareholders. Since it became law in 2011, the two strikes rule has had a largely positive effect on Australian businesses. It has kept executive pay in check, elevated shareholder engagement, improved corporate transparency, and increased focus on the question of whether executive pay is reasonable. Although there may be some potential drawbacks, the two strikes rule represents a concerted and mostly successful effort to ensure that executives are compensated in a fair and balanced manner.

Source: https://www.ebsco.com/research-starters/law/two-strikes-rule

Whenever an Australian listed company has the potential to receive a second strike at an AGM, they are required to put a "Conditional Spill Resolution" to their shareholders at the same meeting - and it's conditional on the company receiving the second strike, meaning that they receive a shareholder vote of 25% or more against their Rem Report Resolution, which is usually the very first resolution on the list every year.

If they do not receive a second strike, the Conditional Spill Resolution is withdrawn and/or has no effect. However, if they do receive a second strike (25% or more votes against the Rem Report) and if the Conditional Spill Resolution receives more than 50% of votes for the resolution, it is carried, and all non-executive directors on the Board must vacate their positions and another meeting must be held to elect a new Board. Those Board members who were "spilled" (were removed by the spill resolution) are entitled to put themselves forward for re-election at that subsequent meeting along with anyone else who meets the required criteria.

For the sake of continuity and to keep businesses running, those directors do not have to leave the Board immediately that a spill motion is carried - instead a "spill meeting" must be held within 90 days, where all non-executive directors and chairpeople must stand for re-election, unless they decide not to stand and instead retire from the Board.

In theory the idea is that if a company receives their first strike, they will liase with shareholders to understand why shareholders are unhappy with their remuneration structure (for the Board and senior Management) as detailed in the Rem Report and will make adjustments to try to avoid a second strike because they don't want to risk losing their jobs due to a spill motion being carried at their next AGM.

In practise however, a second strike has rarely resulted in a spill motion being carried and a board being removed, with statistics showing that the rule has had more symbolic power than practical effect. While 40 companies recorded two strikes between 2011 and 2013, only 6 of them were required to hold a spill meeting, a success rate of about 15% for a second strike triggering a spill motion.

Importantly, a spill motion has never resulted in a Board being rolled at the spill meeting, which suggests the rule is more window dressing than substance.

The following excerpt is from: https://www.afr.com/work-and-careers/management/push-to-scrap-two-strikes-rule-rejected-by-architect-20251120-p5ngzu [yesterday, Nov 26, 2025]

Excerpt:

While supporters argue the rule has helped to curb executive pay and empowered shareholders, critics note it has never led to the spill of a top company board and has become a tool for investors to express grievances over everything from a company’s share price performance to strategy.

“I think it has passed its use-by date in the current form,” says Neil Chatfield, chairman of gaming company Aristocrat and fruit and vegetable producer Costa Group. “It is almost a protest vote [unrelated to pay],” he says.

Kathleen Conlon, chair of Pilbara Minerals and a director of BlueScope and also at Aristocrat, says it puts more power in the hands of proxy advisers, which sometimes use rigid frameworks to assess remuneration models. This can be problematic for companies that employ executives based in the US, where pay structures are different.

“I don’t know that we needed [the two strikes rule] in the first place,” says Conlon, adding that shareholders have other avenues to express frustration over pay and other issues.

Fund manager John Wylie also argues the system is not working, noting the rule has become symbolic because it is never used to overhaul a board.

Wylie has called for annual elections for directors – common practice in the US and UK – which would alleviate the need for the rule.

“[The two strikes rule] has almost never resulted in a full board spill. It has acquired symbolic significance only, rather than being a real mechanism for accountability,” Wylie says.

Fels, who was appointed by the Rudd Labor government to work on the Productivity Commission inquiry in 2009 that led to the establishment of the rule, which became law in 2011, dismisses the complaints, adding that, if anything, the rule could be toughened.

“It’s had an effect and continues to have a positive effect,” he says. “There might be a case for reviewing it or even strengthening it, but it’s hard to think how it could be improved.

“The fact there hasn’t been a board spill does not show that it hasn’t had a significant effect because no board wants to put itself in a position where it faces the stigma of a spill.”

The “say on pay” rules in the US and UK are also non-binding, but do not carry the threat of a board spill. Some Scandinavian countries have adopted a binding vote by investors on pay. South Africa is the only other country to introduce a two strikes rule (it did so last year), but a strike is only registered at 50 per cent, not 25 per cent, and triggers a vote on the remuneration committee rather than the whole board.

There have been 26 strikes against pay so far this AGM season, putting it on track to come close to the record 41 and 40 strikes recorded against remuneration plans at top 300 companies in 2023 and 2024 respectively. In each of the previous four years the number of strikes was 26 or fewer.

Bear77 Note: NRW Holdings (NWH) would have been added in at equal 3rd top position after today's 73% vote against their Rem Report if the AFR had compiled those stats after NRW's AGM today. Their article was published yesterday.

Excerpt continued:

Supporters point to recent examples where the two strikes rule has been used by investors to pressure the board and temper executive pay.

ANZ’s board, led by chairman Paul O’Sullivan, this month stripped current and former executives of $32 million in bonuses after a series of failures. The action is viewed as a move by the board to avoid a second strike on the bank’s remuneration report before its AGM in December.

The board of Macquarie Group, led by the chairman Glenn Stevens, has also responded to pressure from investors over its weak response to regulatory breaches by docking chief executive Shemara Wikramanayake’s pay by $7.55 million over the past five years.

The cuts have been detailed in Macquarie’s CPS 511 statement, APRA’s new standard on remuneration disclosure which is being implemented by the banks and insurers this calendar year.

But critics argue there is still no real consequence of an AGM strike, with investors unwilling to spill an entire board. And after a second strike and failed board spill, the rule is reset so that a third strike is no worse than a first strike.

Allan Fels says the two strikes rule could be toughened. Eamon Gallagher

Despite this month’s fiery WiseTech AGM, where 49 per cent of investors voted against the remuneration report, nothing changed. Besieged founder Richard White teared up at the meeting, but the share price still rose 2.4 per cent by the end of the day.

Chatfield argues a strike by investors against pay does not carry the same weight it did five years ago, given the difficulty in pleasing all investors. He suggests raising the threshold for a strike from 25 to 40 per cent of shareholders, or reverting to a “say on pay” as an advisory vote.

“I would say we are less concerned about a strike,” he says.

“We [think about] shareholder relations and want to do the right thing by them, but we don’t avoid a strike for the sake of it. A strike is not a badge of honour, but it is not something to be avoided at all costs. You can’t please everyone,” Chatfield says.

Like many other senior directors, Chatfield bemoans the trend for the two strikes rule to become a means for shareholders to express dissatisfaction about a company in matters unrelated to executive remuneration.

It’s an issue which the Australian Securities and Investments Commission spelt out in its report examining private and public markets.

“This included concerns that the rule is not being used for its intended purpose,” ASIC said.

Directors complained the rule was eating up “significant management time and attention, distracting focus from the business, and that the 25 per cent threshold gave outsized influence to minority shareholders”.

But ASIC concluded the submissions only provided anecdotal evidence to support the claims the two strikes rule was deterring quality directors. The regulator said ultimately it was a policy question for the federal government.

The Macquarie board and executives prior to the company’s AGM earlier this year. Louise Kennerley

Gabriel Radzyminski, managing director at activist investor Sandon Capital, says the rule has been a game changer and should not be touched.

“It is without doubt one of the most effective tools in Australian governance, it allows investors to express a view” he says.

Research has also shown a “no” vote on remuneration can trigger significant share price drops – on average 15 per cent in the following year.

“Critics would say corporate voting in Australia has more in common with elections in North Korea, but the rule has forced much more engagement and collaboration on remuneration,” Radzyminski says.

“Some say it has little real consequence other than embarrassing the board, but that is a powerful tool within the small circles of corporate Australia.”

Other leading directors say they have learnt to live with the two strikes rule.

“I think the current rule is the least-worst option,” Wesfarmers chairman Michael Chaney tells BOSS.

“Removing and replacing it with annual re-election of directors could lead to undesirable outcomes. For example, demonstrating unhappiness with remuneration by removing a director from the board, such as the chair of the remuneration committee, when that director was making a worthwhile contribution in many other ways.

“The current rule allows investors to express their displeasure. The board can take that into consideration going forward, amending the remuneration arrangements if they think it appropriate or leaving them as they are if they believe that is in the interests of the company.”

Gabriel Radzyminski, founder and chief investment officer of Sandon Capital, says the rule should not be touched. Oscar Colman

Peeyush Gupta, a director of property group Dexus and investment company Magellan Financial, has also learnt to live with the rule. He is not worried about shareholders using the two strikes rule as a means of expressing various grievances. Even if investors’ anger is unrelated to pay, it still sends a useful message to directors that a problem exists.

“It is a good metric to gauge overall sentiment of shareholders with the performance and trajectory of the company. It can be a wake-up call that something is not right. It gives shareholders a voice,” Gupta says, adding “of course [directors] should care.”

David Gordon, chairman of NIB Holdings, agrees the two strikes rule may not be working strictly as a tool to express discontent with pay structures, but says it is a useful avenue for investors to push back against other aspects of performance.

“Personally, I don’t think that is bad. I’m in favour of shareholders having a voice,” says Gordon, suggesting the rule could be modified to specifically allow shareholders to express dissatisfaction with other aspects of the company, such as share price performance.

Kathleen Conlon, chair of Pilbara Minerals, says the rule puts more power in the hands of proxy advisers. Louise Kennerley

Yasmin Allen, director of oil and gas group Santos and chair-elect of insurer QBE, says the two-strikes rule has rightly forced directors to think more carefully about remuneration frameworks.

But she acknowledges that shareholders use the scheme to show discontent about other issues, such as environmental, people and wider performance issues, which can be “a bit difficult.”

“You could do that without a vote,” she says.

“Boards generally visit shareholders twice a year so they can tell you then [if they have grievances]. I don’t think you need a vote to show discontent.”

But overall, she is in favour of keeping the rule.

“I think it is OK. We are not spilling boards left, right and centre. We have got used to it.”

--- end of excerpt ---

Now back to NRW, and I'll repeat their AGM resolution voting results here:

NRW is an example of a Board who just don't care about their Rem Report being voted down because they know that every spill resolution will be defeated because there are very few people or insto's who want to go as far as rolling their Board. They received 73.16% of votes cast AGAINST their Rem Report (highlighted above in red) but then 97.06% of votes cast were AGAINST the spill resolution (highlighted in orange).

So they clearly have nothing to fear from their Rem Report resolutions being consistently voted down (eight AGMs in a row now) because it has no adverse affect on the company when all of the spill resolutions are failing.

The strike count resets after every spill resolution, so every two years for companies like NRW who get a strike every year, so despite receiving 8 consectutive strikes, they have only faced 4 spill resolutions, one every second year, and all of those spill resolutions have been very strongly defeated.

As suggested in the AFR article above, it appears that the vote against the Rem Report was just shareholders registering their frustrations and unhappiness with the company rather than any serious intention to replace anyone on the Board.

Until we look at Resolutions 2 and 3 (highlighted in Blue) which were only passed with a narrow majority - especially in the case of Resolution 2, the re-election of Michael Arnett, the Chairman of NRW's Board, who only scraped in with a 51.4% vote for his re-election and a 48.6% vote against him being re-elected. Jeff Dowling got 58.4% so that was slightly more comfortable but the protest votes are clearly going further than just the Rem Report.

The clearest example of this is their CEO/MD Jules Pemberton's Performance Rights (resolution 4) which was defeated 73% to 27%, so they'll have to find a different way to gift him those free shares.

It's my understanding that all of the proxy adviser firms are strongly against the huge amount of money that Jules is paid each year to run NRW. Google says it's A$2.86 million per year, comprised of 51.3% salary and 48.7% bonuses, including company stock and options. Apparently Mr Pemberton directly owns 1.76% of the company's shares, worth A$41.16M. I haven't independently verified that but that's what a quick Google search returned, and it sounds like it's in the ball park compared to what I've heard previously. He's certainly right at the top of the list for the most highly paid bosses of E&C (engineering and construction) and/or mining services companies here in Australia - NRW does both.

One of the things that he does seem to do well is smart M&A and I note that NRW Holdings' Resolution 6 at the AGM was to approve financial assistance, specifically granting security to financiers for loans related to NRW's recent acquisition of Fredon Industries. This approval was required by the Corporations Act and was a condition of the company's finance facility with its lenders; a 'no' vote could have triggered a default under the agreement. Resolution 6 was overwhelmingly supported with a 99.7% "for" vote.

So they like his acquisitions and the way he structures them, but they strongly dislike paying him close to $3 million per year in cash plus company shares.

Fair call.

Discl: Held. I voted "FOR" all resolutions because NRW has been a wealth winner for me and I don't mind executives being rewarded for providing good TSRs for their shareholders, but I also undertand why people think he's paid far too much.

[Jules is the one on the left]

8th October 2025: Fredon-Acquisition-completion--Guidance-Update.PDF

Source: Fredon-Acquisition-completion--Guidance-Update.PDF [08-Oct-2025]

Source: NRW-Full-Year-Results-Announcement-(21-Aug-2025).PDF

So they have now upgraded FY26 Revenue guidance from over $3.4 Billion to now over $4 Billion;

And they have upgraded FY26 Earnings (EBITA) guidance from between $218 and $228 million (midpoint of $223 million) to now between $255 and $265 million (midpoint of $260 million).

This guidance upgrade represents +17.6% more revenue and +16.6% more profit (earnings) than their guidance in August. As I said when they announced this Fredon Industries acquisition, it's another good one, and well structured, see below:

Source: From page 1 of NRW-Acquires-Fredon-Industries-(02-Sep-2025).PDF

No shares were issued as part of this acquisition, it was 100% debt funded, so it's certainly another earnings (EPS) accretive acquisition, and they haven't overpaid either, incentivising the Fredon management to stay with the business to ensure that Fredon performs to expectations so that the vendors earn the "up to" $60m earn-out for CY25. The deferred cash component (up to $18m) payable in 2 years also clearly has some hurdles, hence the use of the words "up to", so, again, NRW are bringing the acquired company management across to NRW and incentivising them to keep working hard.

Having only $122 million of this up to $200 million acquisition as an upfront payment is another smart move by NRW (NWH) management in my opinion, on a number of levels.

And who doesn't like a current year guidance upgrade?

Disclosure: Held.

2nd September 2025: NRW Acquires Fredon Industries plus NRW - Fredon Industries Acquisition Presentation

The market liked it:

They hit a new 10 year high today (intraday) of $4.18/share before closing up "only" +6.3% @ $4.04.

They've only been up above that $4.18 level only once in their history, way back in April 2012, so more than 13 years ago, and only for a couple of days; they then followed that high with a fall right down to 5 cents/share in early February 2016, when that big mining boom went bust and NRW almost went broke due to having bought a LOT of debt due to having bought a heap of mining and earthmoving equipment instead of leasing it, thinking that the good times would just keep on rolling on.

They ain't the same company now - they are much better - they've learned from their past mistakes and they now have more diversified revenue, more annual recurring revenue (ARR), a much stronger balance sheet, over half a billion dollars of liquidity - see my NRW (NWH) valuation update for the details of that - as shared by NRW last month in their FY25 full year report and their outlook plus guidance for FY26, they have better risk management, and they are just a much bigger and much better company; And their M&A track record has been a good one in recent years, and so far I can't see too much wrong with this acquisition either.

They're keeping the old management in place and incentivising them to perform, and the skill sets they are acquiring through this business are complimentary to what NRW can already do. It makes good sense all around, as I see it.

Sources: That lot above is all taken from their announcement today - to view their presentation, click on the image below.

Disclosure: Holding. All good. I like this one.

30-May-2025: NRW-Contract-Award-30May2025.PDF

Another new contract award by RIO to NRW's Primero division:

Contract Award

NRW Holdings Limited (ASX:NWH) is pleased to announce that its wholly owned subsidiary Primero Group Limited (Primero) has been awarded a contract by Rio Tinto for Hope Downs 2 Satellite & Bedded Hilltop Non-Process Infrastructure (NPI) Facilities. The contract forms part of the Hope Downs 1 Sustaining Project.

Under the contract, Primero will be responsible for the design, supply, installation, construction, testing commissioning and handover of NPI works required for the Rio Tinto Hope Downs 1 Operations in the Pilbara region of Western Australia.

The contract has an approximate value of $157 million. The contract is scheduled for completion in December 2026. Design and procurement work will commence immediately with site works expected to commence in Q4 2025, once all external approvals have been granted.

Primero’s Managing Director, Michael Gollschewski shared “This award represents the continuation of our long-term relationship with Rio Tinto through the delivery of world-class infrastructure projects.”

NRW’s CEO & Managing Director, Jules Pemberton stated, “This contract reinforces Primero’s reputation as a leading provider of engineering and construction services. We look forward to the successful completion of the project.”

--- end of excerpt ---

Source: NRW-Contract-Award-30May2025.PDF

Disclosure: I hold NRW (NWH) shares. Good to see them winning repeat work from bluechip clients like Rio Tinto. It means that their clients are happy with their work, including the quality and timeliness of the finished work. As I have been saying, the OneSteel (Whyalla) issue is a temporary issue, not a structural one, and it's BAU for NRW. And business is good.

20-March-2025: NRW-Holdings-Contract-Awards.PDF

Some positive news there with the biggest new contract announced today being worth around $100 million; from RIO for NRW's wholly owned subsidiary Primero Group Limited (Primero) to perform work at Rio Tinto's Coastal Water Supply Sustaining Project.

Under the contract, Primero will be responsible for the Structural, Mechanical, Piping, Electrical and Instrumentation (SMPE&I) Procurement and Construction works for the seawater desalination project at Parker Point, Dampier in Western Australia. This includes the seawater intake, treatment facility and conveyance piping. The Contract is scheduled to run for approximately twelve months commencing immediately.

And there are some smaller contracts announced in there as well.

NRW's share price remains well down from recent highs due to the issues around OneSteel and the Whyalla Steel Works, with NRW owed over $100m by OneSteel, which is now in Administration. I have covered this already here, so won't dwell on it except to say that because NRW had preemptively protected their position by becoming owners of (all of the shares in) Whyalla Ports and additionally have first ranking security over many of the Ports' major assets, and the Ports are used for more than just steel exports (they are multi-use Ports), NRW isn't going to have to write off the full amount owing from Gupta's OneSteel.

NRW may end up taking a haircut, but they'll get some and possibly all that they are owed; it just might take some time. NRW are still working those OneSteel contracts and are currently being paid by the OneSteel administrators for all work performed from the date of Administration, and that contract was due to finish up later this year anyway, unless it is renewed.

That OneSteel contract is just one of their contracts within one of their divisions, but the Market seems to remain very focused on it at this point, with NRW's share price likely to stay subdued until we get some positive news on that front.

I'm personally viewing that as an opportunity and have been adding more NRW (NWH.asx) to my two largest real-money portfolios as well as here on SM.

08-March-2025: A week ago (on Friday 28th, the last day of Feb) I wrote here about NWH's H1 report and commented that because it was released after market close, I would have to wait until Monday (March 3rd) to see the market's reaction to it - and it could be interesting. It was.

Here's what they looked like at market close yesterday (Friday 7th March 2025):

I would argue (and I am) that they've been oversold, unless there are reasons other than OneSteel and a less positive iron ore price outlook for the sell-off. Firstly, this is not unusual, however, despite repeated drawdowns (or pullbacks), their share price has been on a north east trajectory if you zoom out and look at a 10 year chart:

Here's that same 10 Year chart (below) using daily data points instead of the monthly data points used in the 10 Year chart above.

That second one is not as clean, but the results are the same: If you are prepared to ride out the share price volatitlity they do eventually make up lost ground and go on to make new highs, although sometimes it can take a while, like 4.5 years for them to get back up to their $3.38 high point achieved on 20th Jan 2020, which they passed again in July 2024.

However they are increasingly compensating us for waiting, through increasing fully franked dividends:

Source: All of these charts and tables were sourced from Commsec today and tidied up by me. I've changed the Dividend yield above: Commsec had 5.8%, however based on 16 cps p.a. (the 7c div just declared plus the last final dividend of 9 cps) and a $2.81 share price, it's 5.69%, not 5.80%. I have also added their grossed up dividend yield which includes the full value of the franking credits.

So you've got that income to compensate you for a choppy share price.

But what about the risks? Yeah, there are risks, as there are with any contractor, and especially contractors who are exposed to commodities and commodity price movements, however it pays to remember that NWH aren't miners, they are mining contractors who are awarded multi-year mining contracts (recurring revenue), so the real risk is if their clients cease production or go broke and that work ceases prematurely, or if the client doesn't pay their bills as they fall due.

And many punters probably think that's what has happened with OneSteel, one of NWH's clients, in the past few weeks, however it's not that simple. OneSteel was put into Administration by the SA Gov after they ran out of patience with the parent company not paying their bills, including $17 million owing to SA Water, plus not paying their contractors including NRW who it turns out are owed $113.3 million by OneSteel for past work performed.

NRW are continuing to work for the OneSteel Administrators and are being paid from the date of Administration, but are having to pursue the $113.3 million for work done prior to that. NRW say they are confident that they will be paid and they have NOT declared any impairments (write-downs) in their H1 accounts related to money owed to them by OneSteel/GFG.

OneSteel is part of the GFG corporate group and is the legal entity that owns and operates the Whyalla steelworks and associated mines. GFG is controlled by Sanjeev Gupta and rather than me describing the man and his business practises, it is probably more instructive to watch a 7:30 report piece from ABC TV broadcast on Feb 13: https://youtu.be/ETNzD2BddFE which is titled, "Gupta approved to develop mansion as Whyalla and Tahmoor face uncertainty". It's not just Gupta's SA operations that are in deep trouble. The South Australian Government recognised where this was heading and moved to bring it to a head before the Australian federal election is called next month (April 2025) and hopefully giving themselves enough time to find a buyer and new long-term owner of the assets before the SA State election in March 2026.

I would argue that this particular situation has more to do with Sanjeev Gupta than it has to do with iron ore and steel prices and their respective outlooks, even though those outlooks don't look stellar in the short to mid term. Gupta can't make money in coal either, and in other areas throughout his global empire - and he just doesn't seem to like paying his bills, and part of that appears to be that he has too many fingers in far too many pies and is struggling to keep all of the plates spinning, to mix up some metaphors.

But what is NRW's exposure to GFG and OneSteel? Well, one of the things I like about NRW is their much improved risk management since our last really big mining boom went bust - and NRW almost went broke themselves, with their SP getting down to around 4 cps in January 2016. Even I wasn't brave enough to be holding them at that point - I thought they would go broke, but they pulled through, and haven't approached debt in the same way since, and are proactive now in securing their rights in situations like the OneSteel debacle. Here is the timeline, impact and current status of that one from NRW's POV, taken from their H1 results presso on Feb 28th:

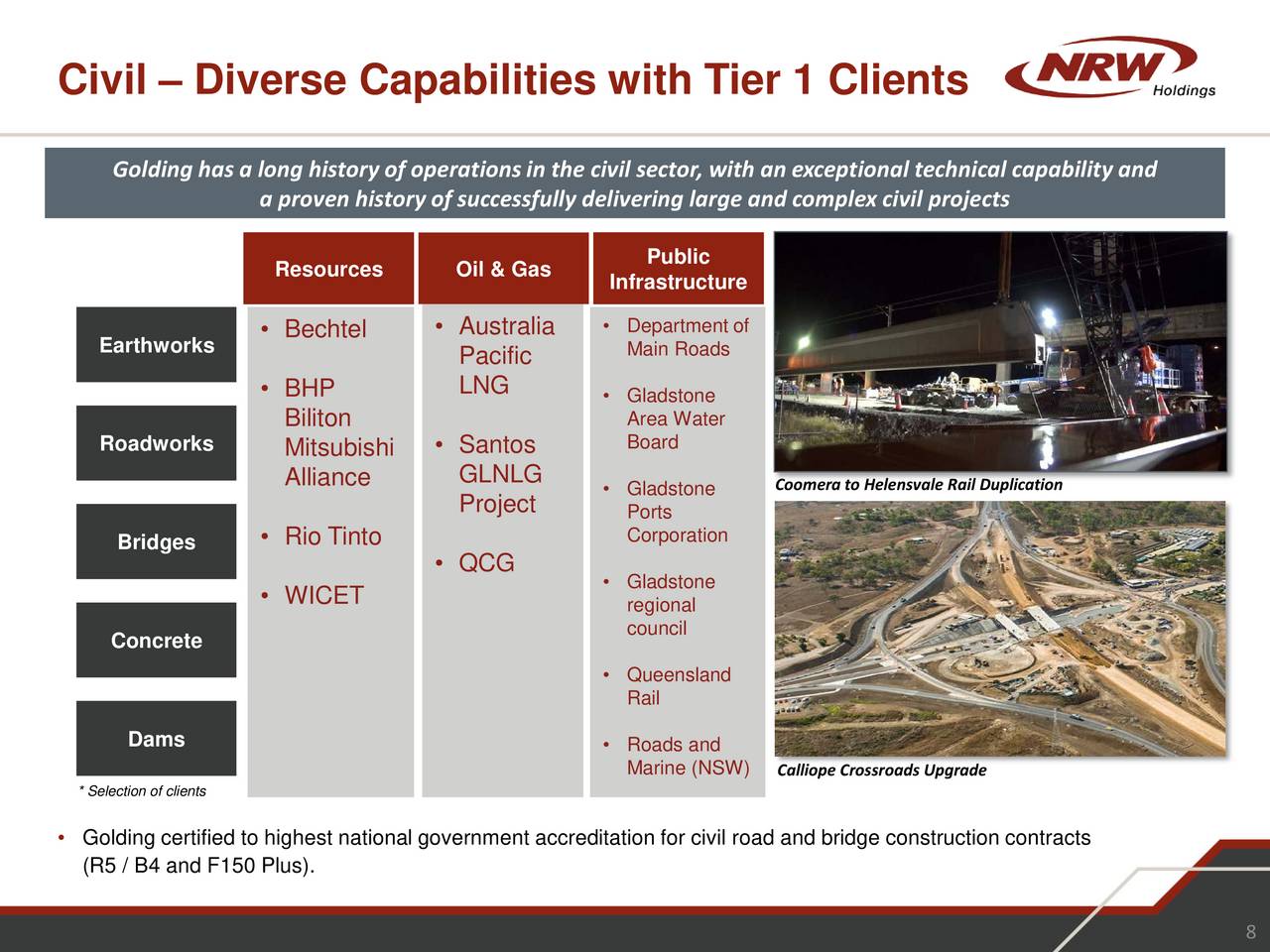

Note the third dot point in the timeline. Whyalla Ports is a multi-use port facility - not just used for steel exports - and NRW have first ranking security over all of the shares in Whyalla Ports and many of the Ports' key assets. Golding is a division of NRW by the way in case that wasn't clear.

Because of this and NRW working collaboratively with the OneSteel Admistrators (KordaMentha), I believe they'll get either all of their money or most of it, or else they'll end up with Whyalla Port assets they can sell to recoup some or most of that money owed to them. It's also worth noting that of NRW's major contracts, OneSteel (shown below as "SA Operations") is the one that was already scheduled to expire first, later this year, and their other Iron Ore mining contract (crushing and hauling) at Karara is due to expire next calendar year if not extended.

Which would leave NRW's commodity exposure (via mining contracts) to Gold (through EVN's Mungari gold mine) and Met Coal.

It should also be noted that while Mining remains NRW's largest division and the mining sector is also their largest sector exposure, NRW's Civil Revenue was up strongly (+40.6%) in H1 and MET (NRW's Minerals, Energy & Technologies division) was also up by +15.6%, and NRW's EBIT Margins improved in both Civil and MET, with EBIT improvements of +75.9% and +25.3% respectively, being greater in percentage terms than the corresponding increases in revenue for those two divisions.

On the one hand, the revenue generated by Civil and MET combined now exceeds the revenue generated by Mining, AND the profit margins on Civil and MET are improving, but on the other hand it's worth noting that the EBIT that Mining generated ($63.7 million) is still significantly higher than the combined EBIT from Civil and MET ($48.5m), so the margins are still clearly better within NRW's Mining division, despite that Mining division EBIT margin slipping this half compared to the p.c.p.

So it's a trade-off - they are achieving further diversification of revenue, which is positive when the commodities outlook is so mixed, but that diversification is into other sectors that have so far had lower profit margins than NRW have been achieving in their Mining division traditionally, albeit those other sectors are exhibiting improving margins while their profit margin in Mining is slipping, so all things considered I'm happy enough as a shareholder with this progression - and that trade-off.

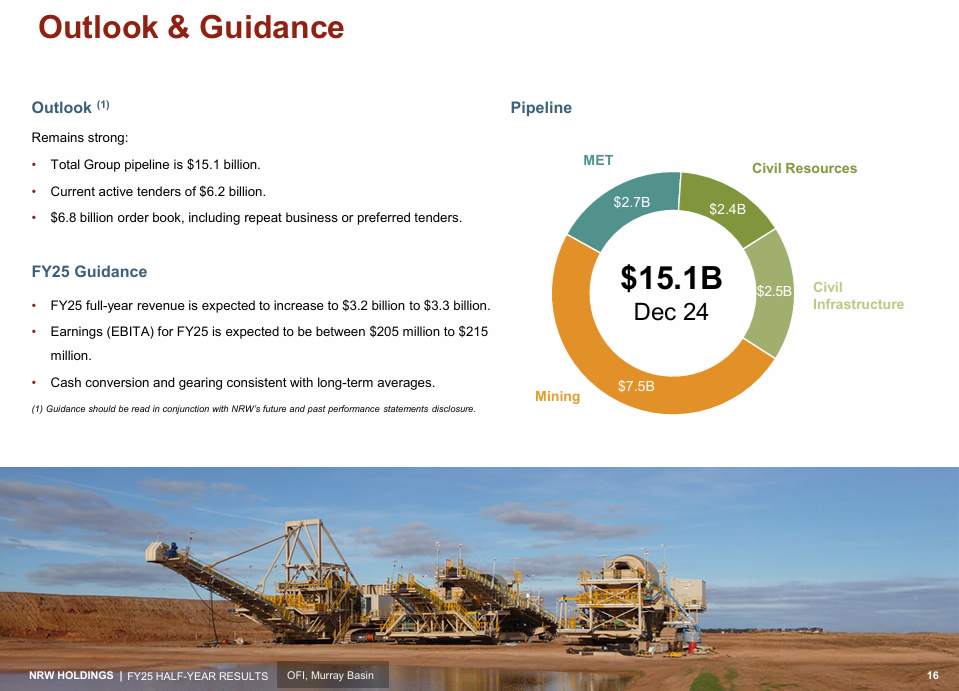

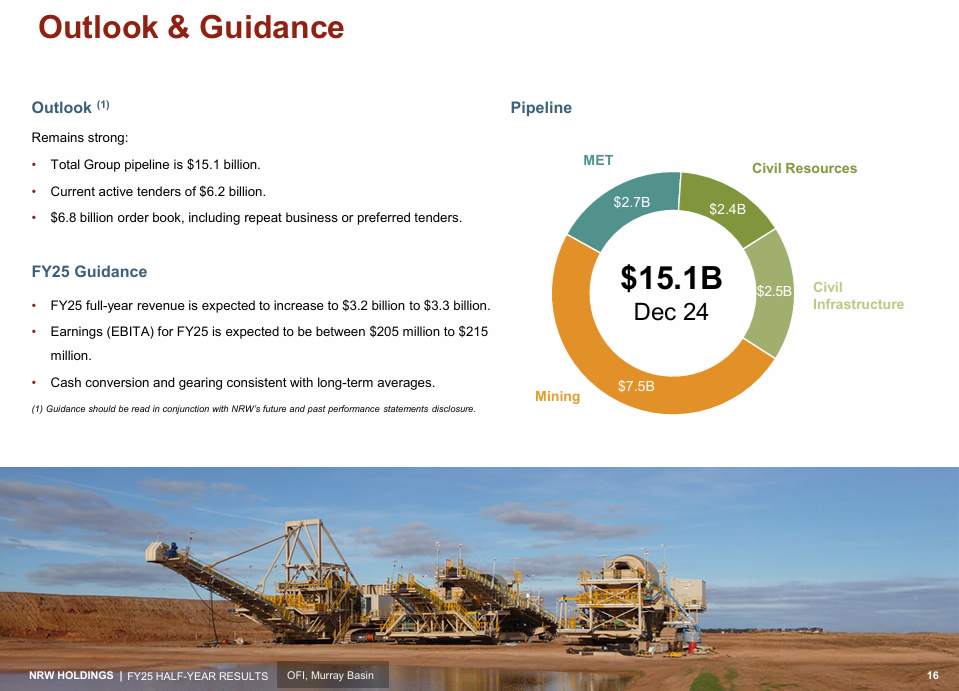

Their actual Revenue and Earnings (EBITA) for FY24 was $2.9 billion and $195.1 million (see NRW-FY24-Full-Year-Results-Announcement.PDF) so that guidance above for FY25 full year revenue of $3.2 to $3.3 Billion ($3.25 B mid-point) and FY25 full year earnings (EBITA) of $205 to $215 million ($210 M mid-point) represents improvements of +12% and +7.6% respectively over FY24, using those FY25 FY guidance midpoints, so overall they are guiding for a better year in FY25, but with a slight slip in margins overall (seeing as the earnings increase is forecast to be lower than the revenue increase in percentage terms).

I have written plenty here on NRW over the years, which you can access here: https://strawman.com/reports/NWH/Bear77

I topped up my NRW (NWH.asx) position in my SMSF yesterday and also added them to my income-orientated portfolio (outside of my super). I'll probably look to increase my NRW position here at some point also now that I've done it in my main real money portfolios.

I still don't like holding companies that look to me to have a share price that is more likely to go down than to rise in the near-term to mid-term, however that's not how I view NRW at this point - I see them as oversold and having an SP that could bounce at any time, just with a change of sentiment, a broker upgrade, and/or one item of positive news from the company. That's also my view on LYL, my largest position both here and across my real money portfolios, which is why I'm happy to hold both LYL and NWH during their current respective pullbacks. I fully accept that they might go further south before they recover, but I remain confident of that recovery, and I don't want to be on the sidelines when it happens, because it could easily be a decent and fast move back north, when they do start to recover. And it could happen any time, without notice.

- - -

Further Reading (while NRW were still in that trading halt, so before they released their H1 report and the info included above):

Whyalla steelworks fallout trips up $1.5b mining contractor

by Simon Evans and Phillip Coorey, AFR, Feb 23, 2025 – 12.23pm

NRW’s mining contracting business Golding is owed up to $120 million in the collapse of the Whyalla steelworks and the nearby iron ore mines that supplied raw materials to the Sanjeev Gupta-owned group.

Meanwhile, Treasurer Jim Chalmers on Sunday played down the prospect of the government taking an equity stake in the Whyalla steelworks, but flagged mandating quotas to ensure the plant’s product was used in government projects.

Sanjeev Gupta’s Whyalla steelworks. Ben Searcy

“We’re looking at the procurement part. I think already 75 per cent of the steel out of Whyalla goes to things like railways in Australia, infrastructure projects, so there’s already a big opportunity there, and if there’s more we can do, more that we can think through on that front, we will do it,” Chalmers said on ABC’s Insiders.

The $1.5 billion ASX-listed NRW has asked that a trading halt be extended until February 28 while it hastily recasts its first-half financial accounts following the dramatic move by the South Australian government to force Sanjeev Gupta’s Whyalla plant into administration.

NRW’s Golding contracting business is the largest single creditor to OneSteel Manufacturing, the corporate entity pushed into administration that owned the ageing Whyalla steelworks and associated iron ore mines operated by another Gupta company, SIMEC, about 60 kilometres from the plant.

Two sources with knowledge of the situation, both of whom requested anonymity because they are not authorised to speak publicly, said Golding was owed around $120 million.

NRW did not detail how much money it is owed in an ASX statement on February 21 when it sought a trading halt extension.

It had been scheduled to unveil its interim 2024-25 result on February 20.

“NRW therefore requests a voluntary suspension until the company is in a position to provide the markets with an update to the SIMEC position and the timing of the release of the half-year results, expected to be no later than Friday, February 28,” company secretary Kim Hyman said.

NRW, which provides mining contractor services around Australia, has suffered a 20 per cent fall in its shares since November 19, when the stock was trading at $4 and it became apparent Gupta was struggling to refinance his global steel operation.

Golding had about 600 workers at three iron ore mines in the Middleback Ranges when the $600 million three-year contract was announced in early 2022, running until January 2025. The Golding workforce had been progressively pruned back over the past few months as Gupta attempted to cut costs and prepared to take mining back in-house.

KordaMentha was appointed as administrator of the Whyalla steelworks and the iron ore mines on February 19. Prime Minister Anthony Albanese and SA Premier Peter Malinauskas collaborated on a $2.4 billion rescue package on February 20.

That included $292 million for buying railway lines to help underwrite production.

KordaMentha declined to comment on amounts owed to creditors, or the status of any specific creditor. The first creditors meeting is due to be held on March 3.

The SA government lost patience with Gupta over mounting unpaid bills that left the town of Whyalla, 380 kilometres north-west of Adelaide, reeling. Gupta’s unfulfilled promises about future upgrades of the plant angered many local businesses, and bigger ones too. ASX-listed rail freight operator Aurizon suspended hauling iron ore for several weeks because it was not getting paid.

Whyalla Mayor Phill Stone described the SA government’s move as a circuit breaker.

“It’s going to be a long, hard slog. There needs to be a regeneration, but it is going to take time,” he said. “But it has definitely lifted the town’s spirits, having a long-term injection of funds.”

SA government water utility SA Water is owed $17 million in the collapse. Malinauskas has diverted $600 million earmarked for a taxpayer-funded proposed hydrogen plant near the steelworks to the rescue fund for the steel plant instead.

--- ends ---

See Also: NRW-Half-Year-Results-Release.PDF [5:01pm, 28-Feb-2025]

And: NRW Half Year Results Presentation.PDF plus NRW Half Year Accounts.PDF [all released @ 5:01pm on 28-Feb-2025]

Disc: Holding.

28-Feb-2025: NRW Holdings (NWH) released their results after the market closed this arvo. They were originally slated to release them last week but OneSteel in SA being placed into Administration by the SA State Government caused NRW to call for a trading halt which was then rolled into a trading suspension while they acertained the likely damage to their Golding division who were owed $113 million by OneSteel and it's subsidiaries/parent companies, and NRW used up all of their available time seeing as they lodged their report after the market closed on the last day of Feb (the final day allowed for these reports, being the last day of the second month following the reporting period end date).

In today's results announcement, Jules Pemberton, NRW's MD & CEO said:

As previously announced, on 19 February 2025 the South Australian Government appointed KordaMentha as Administrators over OneSteel Manufacturing Pty Ltd (OneSteel). We are owed approximately $113.3 million in trade receivables and contract assets. Golding previously obtained a guarantee and indemnity from both Liberty Primary Metals Australia Pty Ltd and Whyalla Ports Pty Ltd (Whyalla Ports), as well as first ranking security over certain assets of, and the shares in Whyalla Ports. We believe that the security has sufficient value to allow recovery of amounts outstanding. We have various options regarding the enforcement of this security and will make a decision on the path forward based on the best interest of our shareholders and other stakeholders. There has been no financial impact recognised during the period, with no specific allowance associated with amounts due, being recognised for the period.

-- end of excerpt ---

Source: NRW-Half-Year-Results-Release.PDF [5:01pm, 28-Feb-2025]

See also: NRW-Half-Year-Results---Conference-Call-details.PDF, plus NRW Half Year Results Presentation.PDF and NRW Half Year Accounts.PDF [all released @ 5:01pm this arvo, 28-Feb-2025]

Also, in their results presentation today (link above), regarding OneSteel:

So NRW are saying today that they believe they can and should get paid the full amount ($113.3 million) considering their first ranking security over certain assets of Whyalla Ports and all of the shares of Whyalla Ports, plus the guarantee and indemnity they were given in December, as detailed above (slide 2 from today's NRW Half Year Results Presentation.PDF).

That could be their actual belief, or it could be positioning, because I imagine that if they had written down any of that $113.3 million owed to their Golding division by OneSteel in these accounts for H1 as bad/doubtful debts (which they have not done), that would have potentially signalled to the Administrators of OneSteel that NRW were amenable to talking a haircut on that figure (being paid less) and they do not want to signal that considering they took those steps in December to protect their position so as to not lose any of the amounts owing to them.

Regardless, they are saying today that they believe they can get paid the full amount, and if the outcome is different to that, they will have to write down any amounts not paid in their full year accounts in 6 months' time. No biggy.

I think they'll get the majority of what they're owed, or all of it, based on the security that they hold over Whyalla Ports.

OK, to the numbers that really matter:

Here's that a little larger:

That NPATN is Operating EBIT less interest and tax (at the 30% corporate tax rate), and is up only +0.7% (58.4m vs 58.0m in the p.c.p.) as shown below. So NPATN is up, but only by a bee's whisker, while Revenue and EBITDA are both up by double digits (+15.8% and +20.1% respectively) as shown above. EBITA is +5.3% up and the dividend is all sevens; being a fully franked 7 cps div, up +7.7% on the p.c.p. (a good omen for me)

Cash is also up, as shown below, however so is their debt, and their net debt has more than doubled to $159.3m, keeping in mind this is a company with a $1.5 Billion market cap, so their net debt is only around 10% of their m/cap. Their gearing ratio is now 23.9%, almost double their 12.1% gearing ratio 12 months ago, and their gearing excluding lease debt is now 16% (was 5.1% in the p.c.p.). It's getting up there, but not scary high for a company this large.

I would like to see that net debt reduce over the next 12 to 18 months, and preferably see them move back into a net cash position at some point soonish, like, in the next 3 or 4 years, if not sooner.

They have a good recent track record of using debt wisely - to pick up decent strategic acquisitions mostly, but also to gear up for large multi-year contracts - and then paying the debt off rapidly, and they have been in a net cash position a few times in recent years, so that's the pattern of behaviour I expect them to continue to follow.

I note there (above) that their NTA and their net asset value (including intangibles) have both increased while their intangibles (& goodwill) are essentially flat (down a smidge), so green ticks all 'round there.

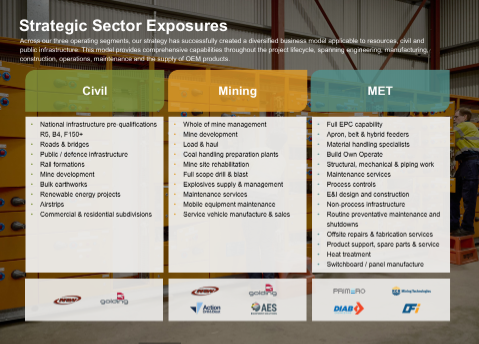

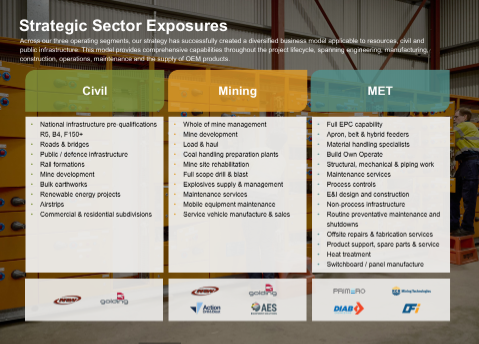

Those three segments (above) are explained in the slide below. MET stands for NRW's Minerals, Energy & Technologies division by the way.

I note that while Mining division EBIT revenue was up a little, Mining EBIT was down -8.5% on the p.c.p. and Mining remains their largest sector exposure and division in terms of both revenue and profit, however Civil Revenue was up strongly (+40.6%) and MET was also up (+15.6%) and EBIT Margins improved in both Civil and MET, with EBIT improvements of +75.9% and +25.3% respectively, being greater in percentage terms than the corresponding increases in revenue for those two divisions.

On the one hand, the revenue generated by Civil and MET combined now exceeds the revenue generated by Mining, AND the profit margins on Civil and MET are improving, but on the other hand it's worth noting that the EBIT that Mining generated ($63.7 million) is still significantly higher than the combined EBIT from Civil and MET ($48.5m), so the margins are still clearly better within NRW's Mining division, despite that Mining division EBIT margin slipping this half compared to the p.c.p.

So it's a trade-off - they are achieving diversification of revenue, which is positive when the commodities outlook is so mixed, but that diversification is into other sectors that have so far had lower profit margins than NRW have been achieving in their Mining division, albeit those other sectors are exhibiting improving margins while their profit margin in Mining is slipping, so all things considered I'm happy enough as a shareholder with this progression - and that trade-off.

Next, the all-important Outlook & Guidance slide:

Their actual Revenue and Earnings (EBITA) for FY24 was $2.9 billion and $195.1 million (see NRW-FY24-Full-Year-Results-Announcement.PDF) so that guidance above for FY25 full year revenue of $3.2 to $3.3 Billion ($3.25 B mid-point) and FY25 full year earnings (EBITA) of $205 to $215 million ($210 M mid-point) represents improvements of +12% and +7.6% respectively over FY24, using those FY25 FY guidance midpoints, so overall they are guiding for a better year in FY25, but with a slight slip in margins overall (seeing as the earnings increase is forecast to be lower than the revenue increase in percentage terms).

In terms of commodity exposure within their largest division, Mining, NRW Holdings (NWH) do have significant exposure to coal, iron ore and gold, in that order:

Interestingly, those are all multi-year contracts with the contract that is due to expire first being the OneSteel contract (SA operations) around the middle of this year, OneSteel being the company that went into Administration last week. The only other major iron ore contract is at Karara in WA - which is majority owned by China’s Ansteel Group – the Anshan Iron and Steel Group Corporation (52.16%) and Gindalbie Metals Limited (47.84%) - see here: https://www.kararamining.com.au/our-history/

Also worth noting that Mungari is one of the gold mines and mills owned and operated by Australia's second largest gold mining company, Evolution Mining (EVN), who are busy expanding that particular mine and extending its life using GNG (GR Engineering Services, a.k.a. GRES) as their main engineering and construction contractor there -

- See here: https://evolutionmining.com.au/mungari/

- and here: MUNGARI MINE LIFE EXTENDED TO 15 YEARS AT 18% LOWER AISC AND HIGHER PRODUCTION announcement by EVN [05-June-2023]

- and here: https://www.gres.com.au/projects/details/mungari-future-growth-project.aspx

- and here: https://www.gres.com.au/theme/grescomau/assets/public/Image/2023/Project_Focus_-_Mungari__Project.pdf

I hold NRW, EVN and GNG by the way; NRW and EVN in my SMSF, GNG in my larger portfolio outside of Super (alongside my largest position, LYL), plus NRW and GNG here on SM also.

Probably also worth noting that NRW's largest exposure is to Coal at various mines along Australia's east coast, but those mining services contracts are all Met Coal, there's no thermal/energy coal in there.

That's probably enough for tonight. I'm happy enough with this report - as a shareholder of the company. And we'll find out what the market thinks of it on Monday.

19-Feb-2025: NRW Holdings (NWH), which I hold both here and in my SMSF called a Trading-Halt.PDF this afternoon regarding their SIMEC contract in South Australia - for more details of that contract see here: https://www.australianmining.com.au/golding-and-simec-agree-to-600m-contract/ [02-Feb-2022]. Golding is a division of NRW (NWH).

When that contract was entered into, it was with OneSteel Manufacturing trading as SIMEC Mining. Not sure if the persistently low iron ore price is biting SIMEC and/or the US tariffs proposed on steel imports into the US.

SIMEC Group Ltd is a British international energy and natural resources business focused on resources, sustainable power, infrastructure, and commodities trading. It is part of the Gupta Family Group ("GFG") Alliance, owned by members of the Gupta family, which had a combined turnover of more than USD13 billion and combined net assets of more than USD2.3 billion. Its activities span renewable energy generation, mining, shipping, and commodities trading. (Source: Wikipedia).

According to Google, when I typed in: "Does SIMEC export steel to the USA?" the answer is "Yes, Grupo Simec, a Mexican steel company, exports steel to the United States. Simec is a major supplier of special steel in North America."

Also (from Wikipedia):

SIMEC Group in Australia:

In 2013, SIMEC Group refocused itself – mainly on to sustainable power, mining and infrastructure. Among many developments since then, in 2017 it acquired Arrium Mining and OneSteel operations in South Australia[4] for USD750 million.[1] The mining assets of the former company included iron ore (magnetite and haematite) mines in the Middleback Range[7][8] and a dolomite mine (to supply blast furnace flux) at Ardrossan, South Australia.[9]

In 2017, GFG Alliance purchased Arrium's Whyalla Steelworks in South Australia, announcing that a new AUD600 million investment would lift production to 1.8 million tonnes a year. In 2018 the company announced it would build a new steel manufacturing plant next to the existing one. It would be capable of producing 10 million tonnes a year – making it the largest in the western world – and have infrastructure to eventually double that capacity.[10]

SIMEC Mining acquired mining leases in 2018 for the Iron Sultan and Iron Warrior mines in the Middleback Range, 50 km (30 mi) south-west of Whyalla, reflecting the need for significant sources of iron ore for its expanding capacity.[10]

Another member of GFG Alliance, SIMEC Energy Australia Pty Ltd, acquired a controlling stake in South Australian renewable energy and storage technologies company, ZEN Energy Pty Ltd, in 2017 and formed a joint venture named SIMEC Zen Energy. Sanjeev Gupta said his company was investing in large-scale power projects to meet its own industrial requirements. Describing the high cost of energy for Australian consumers as "a crying shame for a country so rich in resources", he said "it has been a priority for us to take decisive remedial steps."[6]

References:

- a b John, Nevin (1 July 2018). "Stress reliever". Business Today. Retrieved 20 November 2020.

- ^ "SIMEC Group". SIMEC Group. 2020. Retrieved 20 November 2020.

- ^ "About us". SIMEC Group. 2020. Retrieved 20 November 2020.

- a b "Our History". GFG Alliance. 2020. Retrieved 20 November 2020.

- ^ "Company Overview of Liberty House Ltd". Bloomberg. Bloomberg. Retrieved 7 April 2016.

- a b "Whyalla steelworks owner Sanjeev Gupta buys majority stake in renewable firm Zen Energy". 20 September 2017. Retrieved 20 November 2020.

- ^ "Arrium Acquired by GFG Alliance". 1 September 2017. Retrieved 11 December 2018. GFG Alliance has completed the acquisition of the Arrium Mining and Steel businesses ... the former Arrium Mining has been renamed SIMEC Mining and OneSteel re-branded as Liberty OneSteel

- ^ "Middleback Ranges". Mines and Quarries. Government of South Australia Department for Energy and Mining. Retrieved 11 December 2018.

- ^ "Ardrossan Dolomite Operation" (PDF). Retention Lease Proposal. SIMEC Mining. March 2018. Retrieved 11 December 2018 – via Government of South Australia.

- a b Hosie, Ewen (11 December 2018). "GFG Alliance drives SA iron ore sector with Whyalla steel expansion". Australian Mining. Retrieved 11 December 2018.

Expecting the announcement either tomorrow (Thursday) or Friday morning before the market opens.

It's not a thesis breaker because it's just one contract, but it should be interesting anyway.

27-Nov-2024: NRW Holdings (NWH) 2024 AGM Presentation

Also: Chair's-Address-to-Shareholders-(NRW).PDF

And: Results-of-Meeting-(NRW).PDF

Three of the five resolutions voted on today at NRW Holdings' AGM were carried with over 95% of votes in favour, but two were carried with around one quarter of votes cast against them, being the Rem report (26.18% against) and the re-election of Fiona Murdoch, a professional (career) company director who is also on the Boards of Ramelius Resources (RMS) and Metro Mining (MMI), and who succeeded Peter Johnston (who retired from the NRW Board this year) as chairman of NRW’s nomination and remuneration committee last year. Interestingly, it is assumed that proxy advisers have recommended voting against Ms. Murdoch's re-election as a protest vote again the remuneration that the company gives to their executives - as she heads the Rem Committee.

This article: Unparalleled seventh consecutive ‘strike’ for NRW Holdings despite record year, by Sean Smith, published on The West Australian news website today at 2:16PM, explains it in a bit more detail. It's behind a paywall, so if you don't have access, the gist of it is that despite NRW engaging extensively with shareholders and proxy advisers on their concerns, which have included but are not limited to the size of Mr Pemberton’s remuneration package and tweaking its pay policies while insisting it needs to pay “appropriate” money to reward and retain senior management, NRW has incurred a remarkable seventh consecutive strike against its executive pay policies despite a record all-round year.

Due to following proxy adviser recommendations yet again, some of NRW's larger shareholders have delivered an unparalleled, unbroken series of strikes against its remuneration report since 2017. This seventh strike - another “first strike” after the counter was reset again last year - resulted from NRW's pay report being opposed by 26.2% of voted shares, well down from the previous year’s 58.5% opposition but still above the strike threshold of 25%. However, the strikes could now be so commonplace that they warrant little attention from shareholders more concerned about the company’s performance. NRW chair Michael Arnett, who last year defended Mr Pemberton as a “best of class” chief executive, did not even mention this year’s strike at the AGM and it elicited no questions from the handful of shareholders in attendance.

Interestingly, despite the Rem report being voted against by 26% of voted shares, the resolution to grant FY25 Performance Rights to NRW's CEO & MD, Jules Pemberton, was voted up with 95.56% of votes "for" that resolution and only 4.44% against. Go figure!

NRW Holdings CEO & MD, Jules Pemberton. Credit: Rob Duncan/Kalgoorlie Miner

Shares in NRW Holdings, which celebrated its 30th anniversary earlier this month, are trading at record levels on the back of acquisition-driven growth as well as organic growth under long-time chief executive Jules Pemberton that has seen revenue, profit and dividends growing at a good clip.

The meeting started on a sombre note as the Chairman acknowledged the tragic death in October of Barry Breslin, an Irish subcontractor working on one of the Mitchell Freeway's southbound off-ramps who was either hit in the head by the arm of an excavator or had something fall on him - I have read both versions, but either way, he suffered severe head injuries and died in hospital later that day.

Barry Breslin, 35, from Donegal, Ireland, was killed after he was struck by an excavator at a worksite in Perth on Thursday 3rd October, 2024.

A photo posted by CFMEU WA shows the digger that is believed to have struck the 35-year-old man. Credit CFEMU WA/Facebook.

CFMEU State Secretary Mick Buchan said the 35-year-old’s death was the 10th workplace fatality this year.

Source: https://thewest.com.au/news/disaster-and-emergency/mitchell-freeway-incident-man-dies-in-hospital-after-being-struck-by-excavator-while-doing-roadworks-c-16268460

And: https://thewest.com.au/news/wa/barry-breslin-gofundme-page-set-up-for-family-of-young-irishman-killed-in-workplace-incident-c-16306232

As far as NRW's FY24 financial results, we got those in August, and they were very good, so I won't go over those again. What I was more interested in was their guidance and division updates:

The company has diversified away from mining services although mining still does account for a fair chunk of their revenue.

[I believe that Bunbury workshop photo above is in the old RCR Steel Fabrication shed, a very tall building on the old Bunbury ring road, close to the turnoff to Donnybrook, which was acquired by NRW when they bought that part of RCR Tomlinson (for next to nothing) from the RCR Administrators after RCR went into Administration a few years ago - My wife and I were living in Bunbury for a couple of years up until we moved to Adelaide 28 years ago so I used to drive past that shed most days.]

...and NRW provided updates today for each of those three divisions:

Here's a snapshot of NRW's growth through sensible and strategic acquisitions over the past 8 years:

NRW (NWH) started 2016 with a 5 cps share price (closing SP on 1-Jan-2016), and were 70 cps a year later. They're now $3.90/share, and recently made an all-time intraday high of $4.02 - I sold some here on SM @ $4/share that day, but it was a small trim, not an exit.

I'm a believer in taking profits as the share price rises significantly. NRW's SP has been on a good run for the past 5 months:

I don't see anything concerning in today's updates and FY25 guidance.

Apart from earnings being a bit lumpy due to the nature of contracting, particularly civil and structural engineering and construction contracts, this is a decent company that is growing at a good clip and making some excellent capital allocation decisions, in my opinion.

[held]

08-Oct-2024: NWH-NRW-awarded-Mungari-Mining-Services-Contract.PDF

Another decent contract announced by NRW (NWH.asx), this time at Mungari (gold mine) for Evolution Mining, with an anticipated value of circa $360 million, commencing November 2024 and expected to be completed by mid-2030. The project will average 150 personnel on-site.

NRW does mining services, including loading, hauling, drill & blast, plus engineering and construction work. This Mungari contract includes load and haul, drill and blast plus construction of site supporting facilities.

A feature of this announcement is the location of the project, located in the heart of the WA Goldfields, 50km northwest of Kalgoorlie and 40km north of Coolgardie, which they have said in their announcement today: is ideally situated to allow NRW to engage with local businesses and further develop the local community partnerships established by the Mungari Operations.

Not sure why that has been added, but possibly (a) to underline that this is not a remote location and that NRW can use local Kalgoorlie / Coolgardie people to fill many of the 150-odd roles, and/or (b) to perhaps appease the locals in the wake of all of these services being awarded to NRW - a Perth-based company - instead of any of it being awarded to Kalgoorlie-based companies. However, in fareness to Evolution, NRW have an excellent reputation in the industry and are reliable, large, and have economies of scale, and will not be going broke, and these things matter. Also, NRW will likely be sourcing materials and workers from Kal, and could also subcontract some local construction services companies to do some of the construction at Mungari.

Disclosure: I hold NRW both here and in my SMSF.

15-Aug-2024: NRW-Full-Year-Results-Announcement.PDF

Plus: NRW Full Year Results Presentation.PDF

Disclosure: I hold NRW Holdings (NWH) shares. They are up +30cps at this point in the arvo today on the back of these results - at $3.49 (+9.4%), but we still have 7 minutes to go...

22-May-2024: Change-of-Director's-Interest-Notice.PDF

Let me set the scene - this $100K buy by David Joyce happened yesterday (Tuesday 21st May) - Here's what the NWH Board held prior to yesterday:

Context is important here - the only two directors there that do NOT own NWH shares were both appointed to the NWH Board in the past 2 months - Ms Adrienne Parker just nine days ago - see here: Director-Appointment-Ms-Adrienne-Parker.PDF

...and David Joyce, two months ago (on 19-Mar-2024) - see here: Director-Appointment-David-Joyce.PDF

And David has just purchased $100K worth of NWH shares on-market @ $2.75 each.

But it gets better. He did it by the book. He waited until there was a positive Contract-Awards.PDF announcement yesterday - made prior to the open as it should be - and he bought on-market along with everyone else - in an informed market.

NWH closed at $2.72 on Monday arvo. The announcement was made pre-open on Tuesday. On Tuesday NWH opened at $2.74, traded as low as $2.71 and as high as $2.78, then closed at $2.74. David paid $2.75 each for 36,363 NWH shares during the day ($100K worth). That's not signalling. That's positioning. He's on the Board now and he wants a piece of the company.

I posted a straw here about that Contract-Awards.PDF announcement yesterday - see here: https://strawman.com/reports/NWH/Bear77?view-straw=26143

Note: Unless the issue has been fixed, that link will take you to my "valuation" for NWH instead of to that straw, and the straw will be below that "valuation", so you may have to do some scrolling. My "Valuations" are more price targets with some history and some bull case. If the link system has been fixed, then it will go directly to the straw.

Disclosure: Along with 83% of the NWH Board now, I also hold NWH shares.

21-May-2024: Contract-Awards.PDF

Over the years - particularly in recent years - I've held and sold contract miners like MAH, and E&C contractors like MND, but one company that does both that I've held throughout is NRW Holdings (NWH). And that's because they are quiet achievers who do not have a high profile, rarely blow their own trumpet (they don't have promotional management) and just keep steadily growing the business and improving it over the years, including through smart and strategic acquisitions, most of them small bolt-ons.

NWH don't announce every contract they win, but every now and then they put out an announcement like today's where they bring us up to speed with a whole bunch of recent contract awards.

Nice!

I hold NRW Holdings (NWH) shares in all of my major portfolios, including my SMSF, and I also own them here in my SM portfolio. They are one of those steady growers. They almost went bust under previous management with a different business model when the last big mining boom went bust - and they got down to around 4 cents per share. I was not holding them then because they looked like they would go broke, and they narrowly missed out on that fate, and since then they have really focused on risk management, proper tendering, improving margins, and targeting work strategically, as well as maintaining a solid (strong) balance sheet. They do use debt, particularly for M&A when they do it, but they have a recent track record of paying down their debt quickly and regularly being in a net cash position, which is what I like to see.

It was their misuse of debt during the mining boom that almost sent them broke - they were buying earthmoving equipment and other gear for contracts they were winning back when margins were a lot higher and it looked like the mining boom would go for a lot longer than it did, and then when the bust came they soon found themselves stuck with a huge amount of debt and most of their equipment was sitting idle so not earning them any money. So lots of asset sales, and they just scraped through.

They do it all differently now. They own some equipment but they mostly lease equipment rather than own it and although margins have reduced across the industry for mining contractors they tend to sign up alliance-type life-of-mine or longer term contracts with their clients, and unlike Macmahon (MAH) who do that also, NWH have managed to grow revenue AND earnings, while also expanding into E&C through some well-priced acquisitions. There are issues with some projects sometimes, as there always are, but they have the management and the risk-management experience and track record more recently to navigate through or around those obstacles.

If you want exposure to a sector like Mining Services and/or Engineering & Construction - NWH do both - and both have been on the nose for a while now, so there has been some value in those sectors - with a few companies starting to get positive re-rates in recent months - we highlighted SXE here recently and their positive re-rate by the market. It's happening, and NWH isn't a tiny company any more, they now have a $1.2 Billion market cap, so they're going to get on fundies' radars when they want some exposure to these sectors as they get re-rated.

NRW Holdings - NWH - not a sexy name, but worth a look if you're into that sort of thing.

17-July-2023: NRW Holdings (NWH), one of Australia's largest mining services companies, and one of my favourites (I hold them here and in my two largest RL portfolios, one of which is my SMSF), are keeping busy. Their latest announcement of new work (today) was: Golding-awarded-Toowoomba-Flood-Recovery-South-contract.PDF

$113m in revenue over 15 months. Nothing to sneeze at. And they've been delivering a steady stream of "New work won" announcements - see here: ASX Announcements - NRW Holdings Limited (ASX:NWH)

For anybody who isn't familiar with them, and can handle the mining services sector (I understand many avoid it), NRW Holdings (ASX: NWH) are worth checking out. They are gowing, mostly organically, but also via some smart (reasonably priced or cheap) and strategic acquisitions.

Disclosure: I've held NRW shares for years, both here and IRL. They never let me down. Management are the "quiet achiever" types. Not into self-promotion very often, but they get the job done. And they are getting some insto's following them with positive views also now. Not many "Subs", but their market cap is over $1 billion now, so people can get decent exposure without buying 5% of the company. When sentiment towards the mining services sector turns positive again (it must do some day, surely!?!) I don't reckon NRW (NWH) will get left behind. And they've been doing OK even with the poor sentiment surrounding the sector.

They've got everything heading in the right direction. Their net profit margin is low, but that's the new winning business model in mining services these days, low to moderate margins on HEAPS of work. Volume of work is key, and volume is growing, and after a couple of years of dipping margins, NRW's profit margins were increasing again at last report, as shown below:

Oh, and did I mention, they are more than just mining services these days...

03-July-2023: NWH-Primero-awarded-EPC-contract-for-KCGM-Growth-Project.PDF

That's a very nice EPC contract for NRW (NWH) to pick up, worth just under $1 billion ($973m), for NRW's Primero division (Primero being one of their smart acquisitions over the past few years). I have mentioned recently that NRW/NWH is my favourite mining services company that does the actual contract mining for mine owners, and one of the reasons why I like them (and hold them) is because of how they have successfully diversified their revenue into Engineering and Construction, including expanding into civil engineering, road and rail construction (they are big in rail construction here in Australia having done a lot of rail work for some big mining companies) as well as the design and construction of mining infrastructure such as this lot (in this announcement) for Northern Star (NST) - who I also hold shares in.

It's interesting that NRW's Primero division have spent a year and a half working through this with Northern Star (as explained in the second last paragraph of the announcement, as shown above) before finally being awarded the contract. That's taking ECI ("Early Contractor Involvement") to a whole new level! But I guess NST had to get Board approval and announce the positive FID (Final Investment Decision) for the $1.5 billion project before they started announcing contract awards.

With their "Drill and Blast" division, their large mining division, their engineering and construction division, their RCR Mining Technologies division, plus other divisions (see here: https://nrw.com.au/) NRW Holdings (NWH) are now Australia's largest mining services company.

Mineral Resources (MIN, aka MinRes) is a much bigger company, and Chris Ellison often describes MinRes as a mining services company, but the market regards MinRes now more as an iron ore miner (because they own a number of mines themselves) - with lithium assets - who also have a large mining services division. So, in terms of pure mining services, NRW, while being about one tenth the size of MinRes, are still regarded as Australia's largest mining services company, although I did read today that the merger between DDH1 (DDH) and Perenti (PRN) could potentially create a slightly larger mining services company than NRW (NWH). Perenti used to be called Ausdrill of course, and they acquired (or merged with) the formerly privately owned mining services company Barminco, and then changed their name to Perenti Global the following year, and now are just known as Perenti Ltd.

Disclosure: I hold shares in NWH, NST and MIN, but not PRN or DDH. DDH was on my watchlist, but I never pulled the trigger.

Back to NRW (NWH). Their fundamentals are encouraging. All are heading in the right direction:

Their net profit margin WAS slowing, and isn't wonderful, but most contract mining is low margin work these days; they just need to compensate for the lower margins by having a LOT of work, i.e. more volume to compensate for the lower margins, similar to consumer staples retailers like Woolworths and Coles, except these mining services companies have a lot less customers to deal with, and the customers need a LOT of work done, usually for years, and sometimes over decades. NRW do have a lot of work, so that's a big tick. They are also working on increasing their margins, and we saw quite a good uptick in 2022, as shown above (after a few years of decreasing margins).

For those who may not know, KCGM stands for Kalgoorlie Consolidated Gold Mines, and their main asset is the huge Kalgoorlie Super Pit gold mine that sits on the edge of Kalgoorlie, and the associated mill and other infrastructure, plus surrounding tenements. A few years ago, KCGM was a 50/50 JV (joint venture) between the world's two largest gold miners at the time, Barrick Gold and Newmont GoldCorp (Newmont are currently acquiring Australia's largest gold miner, Newcrest Mining). Those two companies sold their stakes in KCGM to Northern Star Resources (NST) and Saracen Minerals (SAR) which was founded by and run by Raleigh Finlayson - who now runs Genesis Minerals (GMD). Saracen and Northern Star then merged, via the acquisition of Saracen by NST, so now KCGM is 100% owned by NST and they have recently announced they are going to spend around $1.5 billion to more than double the size of the Super Pit - check out my Monday 26th June post in the Gold as an investment forum for more on that. There's even more on that further down in the same post in the "Money of Mine (MoM) Podcast" update section. The MoM boys discuss the Super Pit expansion in their Thursday 22nd June podcast:

Is it worth $1.5 Billion to Double The Super Pit? | Daily Mining Show - YouTube

This award by NST to NRW (NWH) of the $973m contract for the design, procurement, construction, and commissioning of the process plant facilities as part of the KCGM expansion over the next 3 years is the first major contract announced as part of this $1.5 billion Super Pit expansion, and is clearly the biggest contract as well, as it accounts for around two thirds of the project's total $1.5 billion cost (as announced by NST on the 22nd June).

I like it when one of the gold miners I hold awards a decent contract to another company that I also hold. Profits all 'round. That's certainly the plan anyway.

2019 NRW Holdings Company video - YouTube

16-Feb-2023: "It's all about managing expectations" - unknown, has been said by heaps of people.

NRW-Half-Year-Results-Announcement.PDF

NRW Holdings (NWH): Revenue up +15%, EBITA up +7.4%, Profit ("NPATN") up +3.9%, interim dividend up +9% to 8.5cps. Share price down -5.4% (or -16 cents) to $2.80.

Magellan Financial Group (MFG): Shocker, as expected, everything well down, but they didn't slash their dividend by as much as expected, and they are sounding reasonably upbeat about the future. MFG closed up +6.35% (up 60cps to $10.05). Announced a 46.9cps 85% franked interim dividend.

So it's all about market expectations and whether you underwhelm the market or exceed their expectations. Or just do as expected, like South32 (S32) - who also reported today, in line with expectations (which they have managed well) and they closed up +0.87% (or +4cps) in line with the market - the ASX200 closed up +0.80% and the All Ords closed up +0.81%. Not punished or rewarded. Expectations managed and expectations met.

But back to NRW (NWH): Their dividend is up 9% to 8.5 cents, but is unfranked. They said, "Future dividend payments until early 2025 are expected to be unfranked as the Group continues to access the ATO’s temporary full expensing allowance."

Fair enough.

UBS described it as a, "Slightly soft result. Focus will be on 2H23 tender outlook and pathway to cash generation improvement. We continue to believe NRW's outlook is favourable given the level of expected resource investment and that risks to earnings guidance and UBS' consensus for FY23 remain firmly skewed to the upside." While revenue and EBITA were both in line with guidance, and revenue slightly beat UBS' own estimate (which was $1.31 billion and NWH reported $1.33 billion in revenue), UBS said that, "1H23 EBITA c.2% below UBS' consensus although importantly FY23 guidance range reiterated."

[Thanks @Remorhaz - see here: https://strawman.com/reports/NWH/Remorhaz?view-straw=21684].

Anyway, the market either wanted more, or else they were put off by the conservative commentary and cautious guidance, such as:

"Over the period we have extended a number of our long-term contracts, extracting additional value from the secured order book and have secured a number of new strategic contracts. We have maintained a very disciplined approach to bidding new work, which has meant that we have at times not won projects that we were well positioned to secure. Whilst disappointing to come second to a competitor, our people know the criticality of pricing our bids responsibly in line with current market conditions.

[Highlighting and underlining added by me]

Revenue and profits have increased relative to the prior comparative period, however margins have been impacted by the La Niña weather pattern, higher levels of overheads due to the delayed commencement of new work, longer tender cycles and investment in building capacity in Primero’s North American delivery capability to support growing client demand in Canada and the USA.

The Group’s cash balance decreased in the six months, which was expected, resulting from the unwinding of project advances received in prior periods, and the investment in working capital for the new long-term mining contract awards and extensions. This is expected to recover over the remainder of the year as these contracts mature."

And this:

"NRW’s total pipeline is $19.3 billion continuing the strong trend reported in FY22, and of this, $4.1 billion is submitted tenders. The value of work secured for FY23 is approximately $2.6 billion which is either in the order book or is expected as repeat business.

Guidance for the full year is reconfirmed with revenue expected to be between $2.6 billion to $2.7 billion and EBITA to be between $162 million and $172 million.

Tempering the positive near-term outlook is the macroeconomic environment where rising direct costs, together with high interest rates are delaying new project starts, particularly in the resources sector.

In addition, abnormally high rainfall levels in Queensland and some parts of Western Australia have caused delays on some of our current projects. This has impacted the results for the first half of FY23, which may carry over to the full year unless weather patterns return to long-term norms."

---

The bit I have underlined up there is a big tick IMO for NRW's management because they have learned from past mistakes not to bid too low and end up losing money on contracts. They would prefer to miss out on a contract win than to win the contract and then lose money on it. I like that discipline. SRG management also display the same sort of bidding discipline, and they reported today also, but didn't trade at all because SRG also called a trading halt this morning, announced another acquisition, and a capital raise (placement). They are a company that I still keep an eye on - even though I no longer hold - and I note SRG remain a top 10 position in Tony Hansen's EGPCVF portfolio.

I'm thinking NRW Holdings (NWH) are now the premier quality Australian mining services company - with MND (Monadelphous) being the best engineering and construction (E&C) company to the resources sector. NWH are the best contract miners with D&B (drill and blast) plus E&C capability as well. MAH are OK, but NWH are better.