FWIW UBS have released an "Australian Engineering & Construction" research report which covers a number of companies in the space (ALS(neutral), DOW(neutral), MND(neutral), SVW(buy), WOR(buy), IMD(buy)) as well as NWH - note their "top picks" were Worley, Seven Group & Imdex

NRW Holdings

Buy rated. 12m price target A$3.15/sh

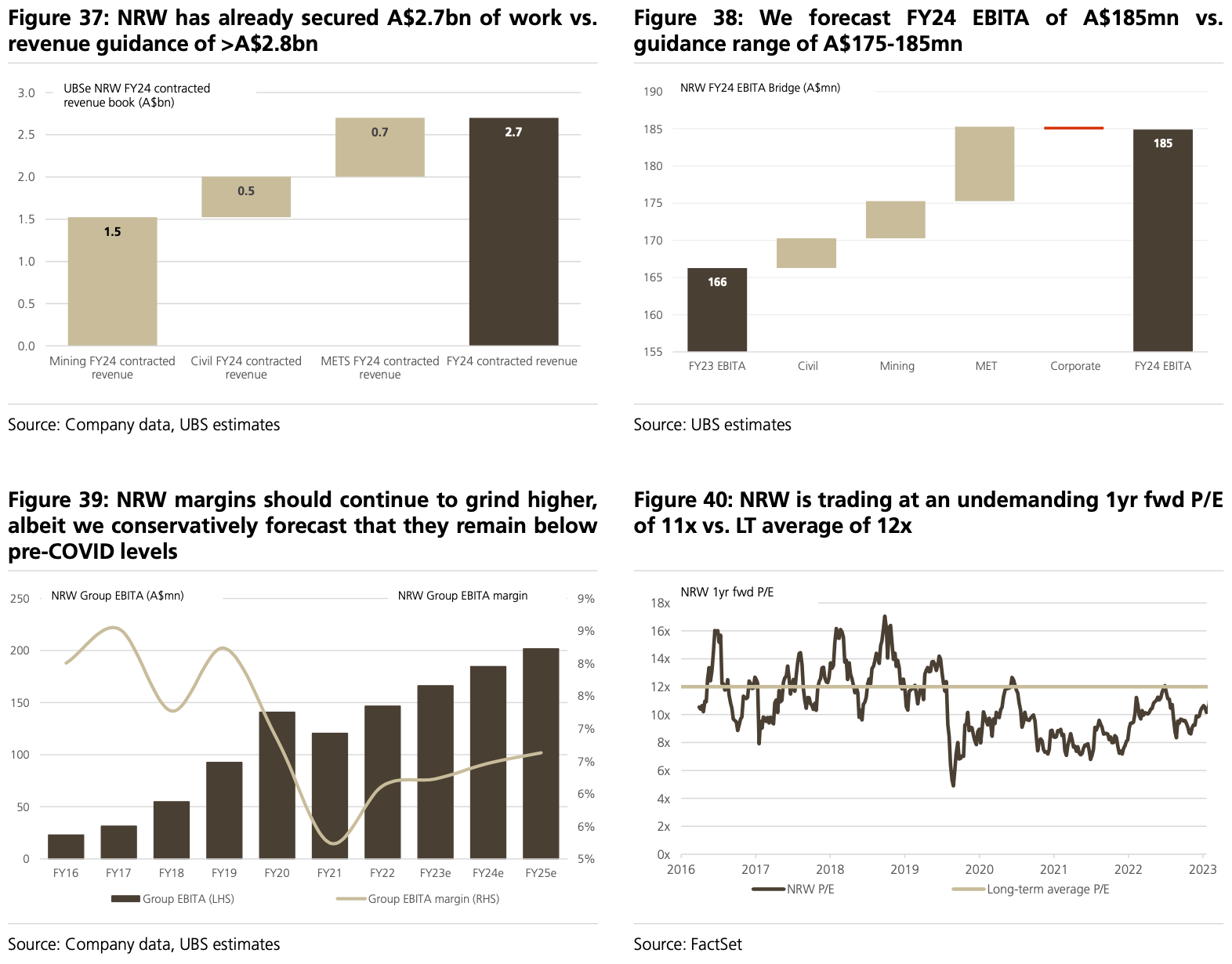

UBS View: We are Buy-rated on NRW, on the basis that we see the stock offering solid earnings leverage to the upcoming resource capex cycle (i.e. lithium/iron ore). This capex cycle underpins our forecasted +12% 3yr EPS CAGR, which we view as attractive given NRW is trading at a 1yr fwd P/E of 10x vs. LT average of 12x and prior cycle peaks of 16x. NRW and its subsidiary, Primero, have a proven win rate record on Civil Lithium iron ore projects, with the key focus remaining on successfully executing the large pipeline of resource investment

Key takeaways from the FY23 result:

FY23 result in line: NRW delivered FY23 EBITA of A$166mn, in line with guidance of A$162-172mn, and UBSe/consensus A$165mn. The Mining division was the standout (FY23 EBITA +26%) on the back of a strong margin delivery (FY23 EBITA margin 9.3% vs. 2H23 EBITA margin 8.0%). On the negative, the METS division saw an unexpected earnings deterioration in the second half. The division, namely, Primero, was significantly impacted by cost overruns on one of its last remaining fixed price construction projects (Strandline). This drove FY23 EBITA of A$31mn, -37% vs. UBSe

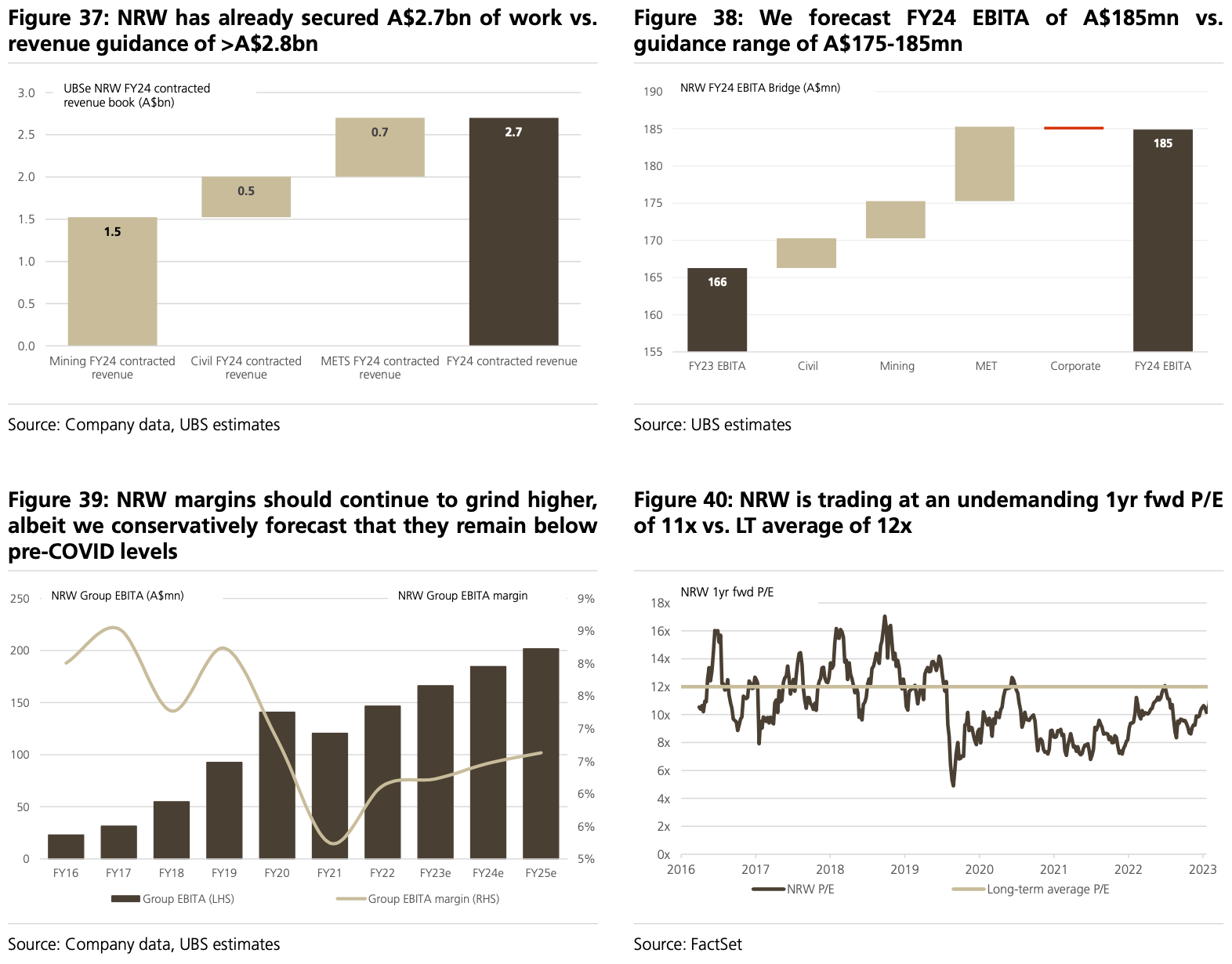

FY24 guidance: As expected, NRW provided FY24 earnings guidance, with revenues to be >A$2.8bn and EBITA of A$175-185mn (UBSe A$185mn). The company also noted that A$2.7bn of revenue is already secured for FY24 (and A $2.5bn secured for FY25, c.90% of cons.). We are forecasting FY24 EBITA of A $185mn, representing 11% growth vs. pcp

DISC: Held in SM & RL