The market doesn't like Adair's results -- shares are down 10% as I write this.

Let's see what's going on..

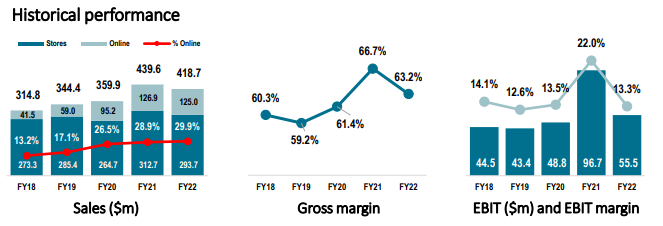

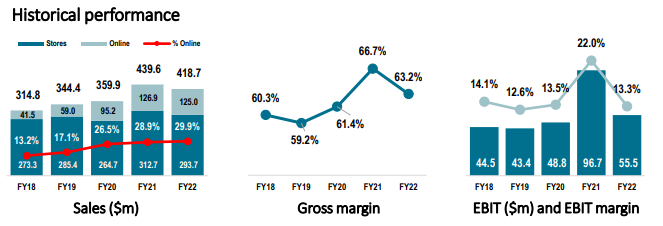

While total sales were up almost 13% for FY22, it's hard not to notice that the core Adairs segment (bed, bath, homewares products, which make up about 3/4 of total sales) saw a 4.8% drop in revenue and a substantial 42% drop in EBIT.

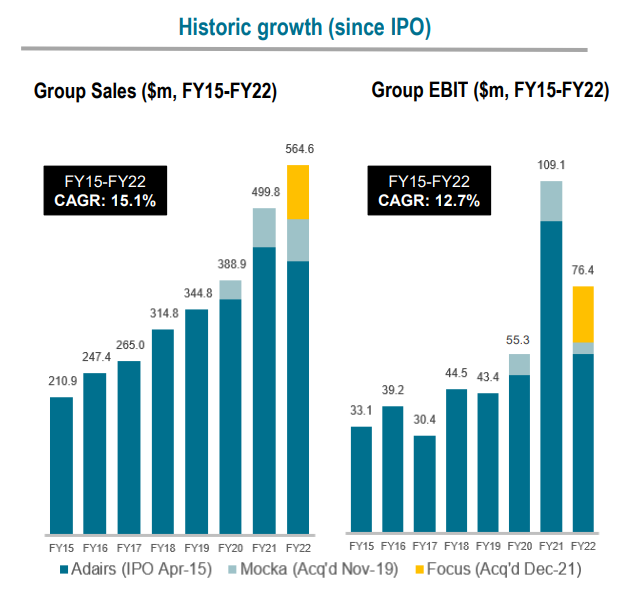

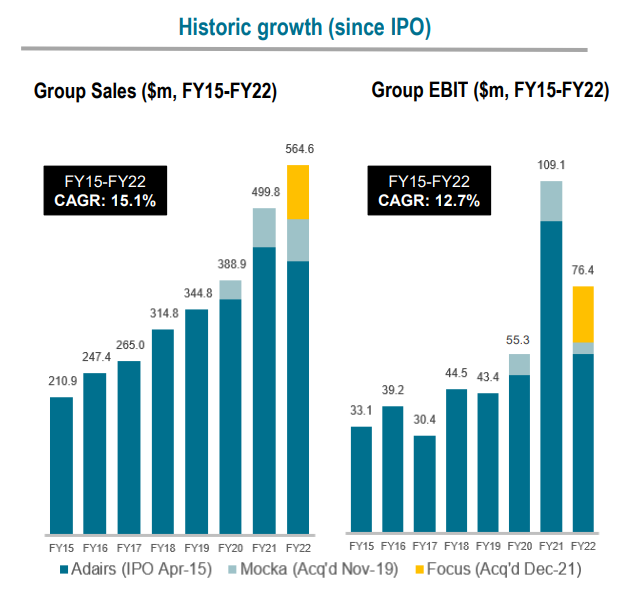

At the top line, you can blame the fact that Covid store closures meant there were 16% fewer trading days during the year, and an exceptional FY21 result. You can see below that the overall trend for Adairs store sales is quite respectable, averaging about 10%pa over the last 5 years (excluding Mocka and FoF). Or about 7%pa over the last 3 years.

Even with the store closers, like-for-like store sales were down only 3.3%. There was a 6% increase in the store footprint, and online sales are now 30% of the total and well up on FY20

BUT -- added supply chain and warehousing costs, higher staff costs and marketing effort all took a knife to margins. On a cash basis, added inventory levels also had a noticeable effect. Macro conditions are expected to remain difficult -- not a great environment for a discretionary retailer!

These kind of headaches are a big part of why I usually avoid retailers...sigh.

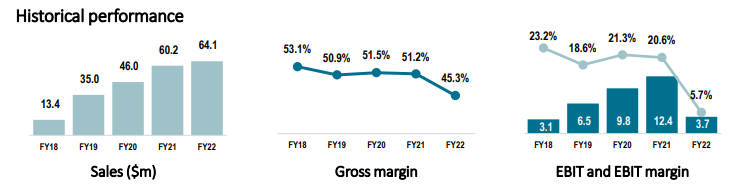

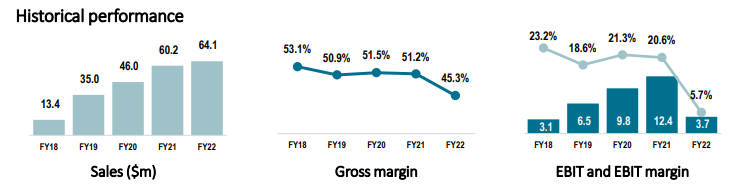

Then you have Mocka, which was very disappointing. While sales grew 6.5%, this was well below expectations following a weak second half, and there were also supply chain issues at play. More worryingly, there were "isolated product issues which led to adverse customer feedback and returns". This certainly helps explain a $1.2m inventory writedown. They've even put a new management team in place.

Another reminder that things can swing quickly in retail.

Focus on furniture, acquired in December 2021, was a standout. Although it represents just 13% of total sales, it was 22% of EBIT. It has the best margins of all segments and is expected to become a much more significant contributor to the group.

So the question here is whether or not FY22 results point to some difficult structural issues, or some nasty but temporary cyclical factors.

If the latter, the company looks pretty cheap.

They were able to sustain the final dividend, which puts Adairs on a yield of 7.8% fully franked. That's about 11% grossed up.

The PE is < 8.

And you have management guiding for growth -- albeit modest growth -- for the coming year. At the midpoint, management told the market to expect 14% revenue growth and 4.7% EBIT growth. The first seven weeks of the current FY are showing sales about 3.9% ahead of the same period last year.

They also reiterated expectations to hit $1b in total sales within 5 years (essentially double where they are now).

I think it's smart to assume lower margins going forward. Supply chain, FX and staffing costs could remain elevated for some time. Still, it's one of those situations where you really don't need growth to do well. In fact, so long as it can sustain an 18c per year dividend, investors will do ok.

The risk is that conditions deteriorate further. Lower than expected sales, combined with rising costs can be toxic. And it can be very difficult and expensive to turn things around. Worth emphasising that this is a company whose fortunes are closely aligned with the property market. People buying new homes and enjoying rising equity tend to splash out on homewares and furniture. Less so when things are going the other way..

I have a tiny holding (about 1.3% allocation), but am not tempted to increase this despite the apparent value. I'd just like to see evidence that margins can be stabilised and that sales growth can return to the core segment.

Results presentation here