Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Another reminder of how brutal retail can be.

Adairs today guided to essentially flat underlying EBIT for FY25 (at the midpoint), with a decent uplift at Adairs and Mocka offset by further deterioration at Focus on Furniture.

Sales at Adairs and Mocka are expected to grow 9% and 14%, respectively, with EBIT in those segments up 21% and 18%. That’s a decent result on paper.. though worth noting Adairs has been discounting heavily, with gross margin dropping from 9.3% in 1H to 6.8% in 2H. Adairs accounts for 70% of group sales and 60% of group EBIT, so it's really the thing to watch.

Focus, though, is the drag. Sales are expected to fall nearly 10% in the second half (after a 4% decline in the first), with EBIT down 34% for the year. The store format refresh continues, and capex has already been bumped up to as much as $18m in FY25.

The stock dropped as much as 30% on the news initially, and is still down over 20%.

It’s now basically back to where I sold my (thankfully small) position last year. Even with the forward PE around 10–11x, my inner bargain hunter isn't biting. Retail is just too variable -- and the operating leverage that magnifies profits when things are good works just as brutally in reverse.

If they can grow sales without leaning on discounts, and the multiple stays low… maybe. But I doubt it.

ASX announcement is here

Retailer $ADH released FY24 results today;

Summary

Quick observations: given the top line decline, the NPAT decline of -17.8% (probably more like -22-23% on a comparable basis) is not too bad.

This reflects their "cost out" focus to manage increases in CODB. I think this is the first retailer where I've seen CODB actually decline (on a comparable basis).

Interestingly, from a quick scan of the release and presentation I cannot see any references to LFL sales comparisons. Given total sales went back -6.6% on a comparable basis and net new stores were opened, I'm assuming it's not a pretty number.

One ray of light, in that Mocka now seems to be making progress again. Another, is that the new NDC is delivering benefits, after a shakey start.

OK result - not the highest quality retailer.

Disc: Not held (formerly held, but I exited (at a bad time!) and reallocated to $NCK and $BRG)

Adairs Limited today released its results for the 27 weeks to 31 December 2023 (1H FY24).

Whilst sales were impacted by a challenging macro-environment, compounded by isolated stock

availability and ranging issues within the Adairs business, the Group successfully delivered on its

key objectives of:

• growing gross margins across all three brands;

• reducing CODB in the Adairs business despite significant inflationary pressures through a

comprehensive cost-out program;

• taking operational control of the Adairs NDC with no business disruption whilst improving

service levels at a lower cost;

• turning around the Mocka business with an EBIT of $3.5m for the half (LY $0.3m);

• opening two new Focus on Furniture stores;

• materially reducing net debt; and

• resuming the payment of dividends.

1H FY24 financial summary (first 26 weeks1)

• Group sales of $291.4 million, down 10.1% on a comparable 26-week basis

• Improved gross margin rate (+220bps) which reduced the impact of a decline in sales with

gross profit down 6.8%

• CODB down 3.9% with cost management initiatives fully offsetting inflationary pressures

from higher wage rates, payroll taxes, rents and utilities

• Underlying2 Group EBIT of $28.6 million (27 weeks: $30.9 million), down 19.3% on a

comparable 26-week basis

• Statutory NPAT of $17.7 million and EPS of 10.2 cents

• Group net debt of $58.6 million, $15.4 million lower than June 2023

• Interim dividend of 5.0 cents per share (fully franked) declared and DRP remains active

Takeaway

The business continues to be challenged in a difficult macro environment, but most key numbers are moving in the right direction. The reinstatement of the dividend is welcome and provides a good signal for both adequate capitalisation and improved operating conditions for the full-year.

Of course, the recent rally in the shares, including a 15% jump today, means the market was already moving in anticipation.

Feeling good about my decision to sell Adairs (I suspect you share the same sentiment @mikebrisy)

All the results details are here, but very briefly, this is largely a story of falling margins.

Gross margins were down a full percent across the group (now at 58.6%) and EBIT margins were 3.2% lower at 10.3%.

That may not sound like much, but when you consider that revenue was 10% higher, even these declines were enough to drop operating profit by over 16%.

Of course, it's always nice to see the top line grow, but the previous year had lost trading days due to lockdowns and FY23 had a full year contribution from Focus (it only traded for 7 months in FY22).

As has been noted previously, their warehousing issues are a big part of the margin squeeze issue -- costs here were almost 17% over FY23. Higher delivery costs -- up nearly 20% -- meant that the cost of doing business was a full 15% higher. There were also higher employee costs.

Still, a 6.5% net margin aint terrible for a retailer, assuming they can stabilize that and return to stronger normalised top line growth. That's the big question here imo.

A lot of bad news was already priced into shares, but this morning we're seeing a further 11% fall (at time of writing) as Adairs said the first 7 weeks of FY24 have seen a 8.9% decline in sales and said that "the near term outlook is likely to remain challenging..".

No full year guidance, final dividend cut.

Shares on a PE of 6.7. No doubt good value if you think they can turn things around. I just think that they could be in for a very rough period and would want to see some signs that there operational issues have been resolved before i got interested again.

In this thread I explain why today I have, belatedly, exited my remaining position in $ADH. It is a long-winded thread, but I know that some here are interested in the selling decision process. It is also helpful more for my own purposes to diarise it.

I’ve said before that I am a reluctant seller – particularly of profitable companies – partly because our inclination to sell is often when it is least in our long-term interests to do so. We’ve discussed elsewhere how the selling process is so important, and this is an example of mine at work.

I came very close to exiting after 1H results. In fact I have reduce my exposure to $ADH through the year with my SM trades more or less matching my RL decisions. I summarised the factors weighing in my analysis in my straw after the SM meeting on 21 April, this year, when the SP was hanging around $2.22. (I won’t rehash the arguments, you can read them yourself if interested.) My range of valuations at the time were wide, from $2.00-$4.00, with an expected value around $2.75 (versus a market consensus at the time of ($2.40-$2.72-$3.10)). So, I agreed with the analysts, and my wider range can be reconciled when you understand the analysts range is a range of expected values and NOT a range of scenarios. (Big difference!) I felt my decsion to hold was rational.

Several smarter StrawPeople baled out between that time and when the Trading update came in June. But I stuck to my guns, only to see the SP collapse to $1.35. Having missed the boat, I decided that was definitely now a DUMB time to sell, with my view of value shifting to the lower end of my range as a result of the Trading Update, but still well above the new SP by 70%+.

Roll forward to 1-August for the NDC update. The market took this in its stride, but on digesting it, I don’t feel the thesis was intact. (Finally! You all say). What were the key points?

Background, $ADH had consolidated is warehousing last year to a since DC, managed under an 3PL contract with DHL. Startup of the DC had performance issues, impacting inventory management and customer service, and leading to expediting costs impacting margins and product availabilty.

However, at 1HFY23 we were told all about it and assured the restructured contract AND reputations all round, would lead to improved performance. At that time, I was prepared to accept the story. I know that reconfiguring the supply chain is a high-risk project and, combined with outsourcing, it is not unusual for the first 6-months or so to have significant problems. DHL are a best-in-class operator, and with their reputation so publicly exposed, everyone was incentivised to get things sorted out.

But on 1-August we were told that things had NOT worked out, and that $ADH have given notice of terminating this contract and taking DC operations back in-house. They laid out the costs of making this change, the longer term margin benefits and the steps to be taken. These were discussed in detail on the recent investor call. Bottom line, DHL are (reportedly) unable to meet $ADH’s expectations for customer service across their product range.

Now, at one level, you might applaud management for taking a tough call with a supplier who they have worked hard with to achieve improved performance over the last 6 months. And that would be fair enough. However, I see things differently, because it raises questions:

- Is all the bad news from the under-performance fully baked into the 2 June Trading Update OR will the ongoing NDC problems be a justification for under-performing the guidance?

- Going forward, we now have a new change project. Transferring management of the NDC back to $ADH operational control. However, this will take time, so we will have a period of 1H FY24 where the unresolved operational issues continue. And we don’t yet know how bad they are.

- As part of this upcoming change in management of the NDC, $ADH will also have to implement a new WMS, intgrate it into their systems, run it alongside DHL system before unplugging the DHL systems. So, a whole new tranche of operational risk. And, as I said earlier, it is not unusual for these projects to go through a rocky transition – particularly if there are new systems involved.

So, for $ADH, I see the following:

- A period of an unknown level of operational under-performance with an exiting supplier.

- A change in management of the NDH to $ADH. But I can't believe this to be a core capability (otherwise, why was it outsourced to $DHL in the first place?)

- A mission-critical systems implementation.

Now, logistics is a big part of retail. There is no argument. You have to be good at it, even if you outsource it. (By comparison, I last week heard Anthony Scali explain how Plush has been folded seamlessly into $NCK's supply chain, leading to increased margins and contributing to $20m synergies. Done. No nonesense. That's what good looks like.

$ADH 's supply chain issues get added to:

- The already-known problems at the Mocka acquisition, where we are either expecting to hear progress that they have been fixed or (potentially) enjoy a write-down of the value, which would certainly be in prospect if the new $ADH-installed management haven't been able to fix things - also supply-chain related.

- Pressure in the homeware and furniture category already captured in the Trading update, and likely getting worse in 1H FY24.

Now while I haven’t fully updated my valuations for $ADH, I can see my expected value range now looking more like ($1.40-$3.00), with an expected value sitting on $1.90-$2.00. But importantly, my conviction in the numbers themselves is shaken.

So, this morning I off-loaded my RL position at $1.765. (Capital has been reallocated to $NCK, mostly, but also $NEU and $BOT, over recent weeks).

So, it is an interesting case, where I have sold a stock for less than my view of its expected value because:

- My conviction has been shaken by clearly identified risks that everyone can now see;

- A macro-environment that is likely to be unforgiving, and therefore I have to limit my total portfolio exposure to the sector (retail – household goods);

- An alternative opportunity in the same sector ($NCK), which needs the same capital, for which I have higher conviction, and which has a more material upside in the valuation.

(Note: at no time have I considered my buying price, even though I know I am crystallising a loss.)

In arriving at the decision, the numbers were only part of it. I expect both companies will survive the current turbulent times and, in a few years, both will be riding high again. Both have clear growth strategies and are well-positioned in their respective markets.

But having heard the management teams of both companies on multiple occasions this year, it is as much about who do I feel most confident will do a good job growing my capital over the next 10 years. The analysis has helped in the decision, but it is confidence in management in delivering things that are under their control that matters even more.

$ADH report their results on Monday, and I will go along because I am genuinely curious to hear how they go. I may well be wrong. That's the thing - we never know for sure, until its too late. But even if they beat expectations, and we see a nice little SP pop (as would follow), it wouldn’t change my conviction on the risks ahead and the relative risk-reward exposures.

So, apologies for the long-winded not, but I know some are interested in the selling decision process.

Disc: Not held in RL and SM

Adairs have announced they are exercising their right to take over warehouse operations from DHL:

Adairs advises that it has entered into an agreement with DHL Supply Chain (Australia) Pty Ltd (DHL) under which it will take over operational control of its’ National Distribution Centre (NDC) from 6 September 2023.

I see this as positive medium term, even better longer term. Adairs will outlay $18 million to takeover the warehouse equipment and systems, plus $2 million more in "transition costs".

The company expects this to save $4 million in the first year after the transition and more following years. From the announcement:

Adairs expects this initiative will be modestly EPS positive from year one, with payback within four years.

In the long term i'd expect this to give them better control over service which should help the online channel.

Interesting to note that in the Strawman meeting in April management noted the issues with DHL and believed they had worked through them:

we've now get very clear SLAs and very reliable service.

Not clear why that's turned around so quickly: maybe DHL wasn't meeting the SLAs, or perhaps the cost/benefit meant it made sense.

A few months after my brief bear case straw based on the price action, it has played out as expected. The recent trading update has in fact taken it to new 52w lows.

Buyers at these levels may need to be patient as the macroeconomic headwinds, overlayed with the company-specific issues, are likely to delay any recovery in the operating performance of the business.

I like ADH, I do, but not in todays external climate and the Mocka Goodwill write off which is surely coming.

Here are my 8 reasons why I have retreated to the sidelines awaiting the recessionary pressures to abate.

(1) Inflationary effects on domestic household budgets

(2) Higher costs of servicing household interest burden driven by (a) increasing interest rates to date and likely continuing into the future (b) massive interest rate increases by the rollover of previously fixed rates at around 3% to close to 6% - massively increasing over the next six months (c) Strict APRA rules on ensuring new loans be stress proofed at 3% over current home loans rates of around 6% will restrict the volume and quantum of future loans

(3) Falling domestic dwelling construction (April 2023 down 8.1%) and liquidation problems in this industry presently. Adairs is a beneficiary of the need for hard and soft furnishings in these new dwellings

(4) Effective increase in wages by 6.25% by Fair Work Commission (June 2023) will push ADH wages as a percentage of sales from 19.4% to 20.6%. Sure I do understand that Ronan will look for greater productivity.

(5) Current hedging at around 72c USD will run out end of year and the direction of the AUD/USD is likely down – currently 66c

(6) The diabolical performance of Mocka – a likely FY23 EBIT of ZERO on an asset with a book value for goodwill and brand of around $72m – the results get worse each six months and the company has now had 4 half yearly time periods to make an improvement, instead it steadily gets worse.

(7) A total write off of the Mocka goodwill will take the net debt as a percentage of net debt plus equity to around 40%. Might raise the banks risk level and thus interest rate to be assessed on the $75m debt facility due to be renewed in July 2023

(8) Very likely a partial to significant Mocka Goodwill and brand acquisition write off in FY23 or FY24 (discussions with auditors probably happening right now as already foreshadowed in the fine print to the 1HFY23 results as follows:

“The cash flow forecasts assumed for the FY23 year reflect a substantial reduction on those applied in the previous impairment test at 26 June 2022 given the actual operating performance of Mocka for the 26 weeks ended 25 December 2022.” - And

“The above sensitivities in isolation do not result in an impairment of the Mocka CGU at 25 December 2022. However, additional adverse changes to any of the above key assumptions may result in the carrying value of the Mocka CGU exceeding its recoverable amount” Note the adverse conditions have emerged in 2h by my calculations as based on the recent trading update.

And might I say, the NDC issues and the still to be perfected delivery system for online might well be a ninth reason.

Things are tough in the retail..

Adairs lowers EBIT guidance (again), this time by about 16% due to falling sales.

If they hit the midpoint of this updated guidance, sales will be up 10% on FY22 (although that includes a full year contribution from Focus)

Based on this, it looks like the forward PE is around 10 or so. If the FY dividend drops back to 13cps, you have a >8% yield

Value or value trap? Had my fingers burnt on a small position with this one (sold out at around $2), and i'm increasingly wary of the current retail trading environment, so happy to watch from the sidelines for now.

Today’s Strawman meeting with $ADH’s CEO Mark Ronan and CFO Ashley Gardner came at a good time for me. The 1H23 result was ugly, and has been well-discussed here. I’d decided not to sell in the immediate aftermath of the bad news but to wait, expecting some recovery and then to re-evaluate my position (SP has recovered 10% in that time).

(Separately, I have managed down my RL discretionary retail exposure to 10% by exiting $SUL, which has performed strongly, delivering a modest profit on my investment.)

Herewith, my summary of key messages form the meeting.

Re-iterated that the portfolio has strong growth potential over 5+ Years

- Adairs to grow from 172 to 200-220 stores plus upsize 20-25 stores

- Additional potential to grow "Gross Level Area" by 5-10% p.a. as range covers more of the home

- Focus to grow from 23 stores to 50-60 (to be in line with $NCK and Freedom)

- Mocka eventually expects to have 10-20 stores because omni-channel reflects best long term model

- Several references were made to the strength of the omni-channel model. They observe that online sales increase in an area when physical stores open. Having a physical store nearby increases customer confidence to buy online (e.g., ease or returns or swaps if needed, or ability to check stuff out instore and buy at a later time.)

The business is well-positioned for a recession

- They see the environment as more of a down trend than a cliff. Customers have become more active in searchng for a good deal. This is well under way.

- Expect to benefit from “trading down” in mid-market at Adairs and Focus from premium brands

- 85% of Adairs sales are through “Linen Lovers” loyalty club offering potential for tailored offerings to customers

- Product range for the second half of this year will be fine-tuned to meet price-sensitive customers; care will be taken on inventory levels

- Supply chain costs have fallen (e.g., Focus furniture container shipping from 10x back to 1x) but prices are being maintained leading to an ongoing period of magin expansion

- Payout ratio at 65% is below 80% upper limit, allowing for debt from acquisitions to be paid down. Provides some headroom to maintain dividend should revenue/earnings soften

So far, sales are holding up – they expect this to continue, provided unemployment doesn’t increase too much.

Recent Operational Issues are Transient

- All Mocka delivery partners have been changed out with new providers and new SLAs. Performance is now "reliable" albeit with "higher costs". Stock levels have been reduced.

- It has been a challenge to settle down performance at the DHL-operated Adairs national distribution centre. The discussion here didn’t indicate that the issue is completely behind them, but they indicated there was a learning curve for the operator to meet requirements of the kind of business Adairs has. (Refer to more details on this at H1FY23)

- Overall, I was encouraged because both Mark and Ashley appeared at ease in discussing the problems. They clearly see them as transitory and not deflecting them from their overall strategy. (That said, I expect their answers are well-rehearsed as they will have been grilled by their insto shareholders over the last two months.)

- In response to a SM question, they appeared to acknowledge that they could come under pressure for a write down of Mocka, however, they pointed out that the early performance there had exceeded the acquisition case, and that the problems were temporary. Neither appeared unduly concerned.

My Key Take Aways

I went into today’s meeting with my hand poised on the “SELL” button. However, I emerged with the thesis intact:

- Well-managed mid-market, omni-channel retailer

- Strong management team

- Large, in-built growth potential across all three brands

- Integrated model provides access to higher margins and ability to differentiate customer offer

- 1 million+ loyalty club with investments to leverage this

- Undemanding P/E (8.8 trailing; 8.3 forward vs. 5-year average of 11-12) appears to have built in a significant fall in the next 1-2 years' earnings

I’m prepared to give the benefit of doubt for the recent operational problems, seeing these as a stumble along the way, rather than a roadblock or a major diversion. The proof will be how far they can demonstrate progress at the FY.

In addition, positioned in the mid-market for Adairs and Focus, $ADH has the potential to both benefit from trading down from premium brands as well as having the ability to make direct customer offers to its 1million+ loyalty club. Management also seem to be actively preparing for a more challenging retail environment in the second half of the year by fine-tuning the product offering. To be clear, I see these as mitigating/minimising a downside already reflected in the SP ... so it is a potential upside.

Even if unemployment increases and we see $ADH sales and earnings under-pressure in late 2023 / early 2024, I believe that Mark and Ashley will steer the ship through it, and emerge stronger out the other side. I’m happy to batten down the hatches for the ride.

My ongoing support is conditional upon a demonstration at the FY result that the operational problems have been resolved - demonstrated by margin recovery. With little over two months of the FY to run, the result does not at this stage appear to be vulnerble to a major impact from macro-conditions. Of course, the outlook into FY24 is a different matter.

Disc: Held IRL (1.9%) and SM (5.4%)

Terrific coverage of the 1HFY23 results by other Straw people, so I will simply cover the issues which I think are potentially coming our way in the full FY23 results.

Firstly, I just cannot see how the auditors (EY a tier 1 audit company with a reputation to defend) will allow ADH to retain a $95m acquisition cost for Mocka to remain on the Balance Sheet without agitating for a substantial write down. Sure, it’s a book write down not affecting the cash position, but it could be sufficient to plunge ADH into a statutory loss for the FY23 year. Think of the market’s reaction to such an event.

The recent results for Mocka are almost trifling in their nature. Can a HY EBIT of just $300k justify an asset cost base of around $95m (that’s my estimate of the original cost including the early $45m payout in Sep 2021 to just get the original Kiwi owners out of the company)? I don’t think so. Take the interest component out of such a huge investment and this division is underwater.

The Mocka results for FY22 weren’t brilliant either – a full year EBIT of just $3.7m. Again, this would hardly cover the notional costs of the interest component against this investment. The FY22 results show ADH debt at around BBSW + 2.05%

Mocka has been a disaster and a case could be made to suggest that the cheaper Mocka product range, its poor service and delivery have affected the Adairs culture. ADH does not enjoy the 'community love' it did say 3 to 5 years ago. Goodwill has been damaged.

Yes, Ronan has been upfront about the problems in Mocka, but the simple fact is that after two years this isn’t fixed and we are a long way from a fix, if indeed the Mocka business model is survivable in its current form. TPW and KGN might suggest the online business model needs tweaking. Maybe ADH should drop kick Mocka to the sidelines and concentrate on the main game, which is the ADH brand and Focus on Furniture. And particularly store expansion of both of these which has been palpably slow. But, as anyone who has been in business knows, the wonky wheels get all the attention, to the detriment to the good solid reliable wheels.

As to the NDC, I think we can cancel that ‘centralization’ cost savings bit. If savings are coming, they are down the track, two years minimum.

Disclosure: I hold ADH IRL because the ff dividends are attractive, but I have to say I have moved part of my investment over to my favourite retailer, the Shaver Shop (SSG), which is in a much better position to stave off a decline in retail consumer spending.

The straws immediately preceding this one have already covered off the fundamentals very well (thank you everyone!).

I just wanted to follow up on my TA note earlier (which looked promising, but was quickly unwound - indicating a swift change of opinion from the market).

The immediate reaction to the 1HFY23 results looked encouraging, with the stock holding the 30w MA, after a steep drop in the preceding couple of weeks from close to $3. However, it is trading below that level as of now - this level has to be reclaimed quickly, or the odds of further drops towards the 52w lows increase.

I attended the $ADH results call this morning. @Strawman has given a comprehensive report, which I will not repeat. Furthermore @Rick has given further analysis on some of the numbers, plus a brilliant summary:

· Adair’s margins challenged

· Mocka run amock

· Focus saved the day

So read those two straws first, as I only intend here to add some further colour and my own conclusion.

As @Strawman has written, management were pretty candid in thir presentation and open in answering the large number of detailed questions from the analysts. Candour by management, particularly where there are issues is a green flag for me.

Let's look at each brand in turn.

Adairs

In FY22 Adairs transitioned to a National Distribution Centre (NDC) operated by DHL. This was expected to deliver $3m in half year operational efficiencies. Wrong, they’ve had issues delivering operational KPIs, and operation costs were reported to be $5m higher. So, that’s $8m off where they planned – this on sales of $220m; so a 4% margin hit.

(I am sure DHL are very motivated to fix this. CEO and CFO were not shy in mentioning them several times, so there is a big reputational incentive for DHL to be mentioned positively in the next report. CEO Mark Ronan did make clear that they are “working collaboratively” to resolve the problems and have a restructured contract in place which is more favourable to $ADH. For now, the relationship sounds constructive.)

The contract with DHL has been restructured, and they are confident of getting the $5m back in H2. But in terms of the originally targeted $3m efficiencies, Mark said they didn’t see themselves getting this “any time soon”.

Both this and other supply chain challenges are expected to unwind in H2 FY23. So even though the EBIT% Margin has fallen to 8.5%, it should be back to >12% in H2. Of course, this depends on how much promotion and discounting they do in response to marco-economic headwinds.

My reflection on this is that it is important to recognise the logistics and supply chain is a big part of retail. Consolidating distribution centres and outsourcing are changes that carry high operational risk, as it is essentially a green-field project and there is always a learning curve. But it is fixable and shouldn't be a long-term detriment to the business. (We’ve also seen this happen to $BAP over the last 1-2 years.)

On the macro-econvironment, Mark said that they were still seeing footfall past the shop front, however, getting people in the door was the issue. He speculated whether people were spending time in the shopping centres more for entertainment rather than spending money? He also said they needed to sharpen "the offer", as customers appear more likely to walk away if they don't thing they are getting a great deal.

Fantastic Furniture

A great result. This recent acquisition is performing well and, quite frankly, it saved $ADH from a much more embarrassing result. They are still in the early days of moving from a Victoria-centric business to a national brand.

Underlying EBIT% margin was very high at 21.1%, driven by good product availability in the period, which gave them competitive advantage in having shorter delivery times for customers. A second factor was the absence of any new store openings.

One is reportedly close to being agreed in 2H. One drag on the pace of new openings is that there are reportedly few vacancy opportunities available in the Homemaker Centres they are targeting. This says to me that management are being selective on locations, which is a far-sighted strategy. Settling for lower quality locations will erode margins longer term.

I wonder, however, if a second reason for a measured approach that wasn't mentioned, is the expected consumer downturn. It can take a couple of years to establish throughput in a new location. This is probably harder in a downturn.

In terms of long-term expectations, they see EBIT% margins in the “mid-teens”, as new store openings will drag this back. However, they expect to maintain Gross Margins in the “low fifties” (most recent being 51.4%).

So, the good news is that Fantastic Furniture hasn’t missed a beat since the acquisition.

Mocka

Mocka emerged from FY22 with an almost complete failure of its delivery partner, which lead to brand damage and excess inventory that has largely been cleared earlier in 1H. Additionally, with customers moving back to in-store shopping, Mocka is seeing continued decline due to the re-opening headwinds. Its 27% sales decline puts in good company of other pure play online retailers like $TPW (-12%) and $KGN (-33%). Unlike Focus, this has been a poor acquisition, now making a negligible contribution at the EBIT level, albeit there should be some improvement in H2. Unlike FY22, which was a failure of execution, 1H FY23 is part of getting caught up in a macro-trend.

Overall Conclusion

Management has been transparent about their problems, and what it intends to do and has done about them. They've reiterated the vision of growing the business to $1bn in sales over the coming years.

Acquisitions are always risky. Mocka hasn’t gone well. Focus looks good. A 50% hit rate is not bad. Not all management teams are as transparent, until the writedowns come. (Think $XRO, Disc. held)

I initiated my position in $ADH in late 2021. At the time it seemed like a capable retailer with a good mid-market focus, room to grow, and an undemanding valuation. Had I known what the next 18 months would hold, I probably wouldn’t have acquired, because there are other better retailers (two of which I also own).

However, from this point forward, I am minded to hold. I agree with @Rick’s valuation. $2.75/share is a conservative place to start. If operational performance gets back on track, new openings continue, and the consumer downturn isn’t too deep or too protracted, then I believe patience will be rewarded (and that doesn’t rely on Mocka). In that event I expect a higher valuation would be justified (I haven't done my numbers yet).

Consensus for FY EBIT prior to the results stands at $80m (n=9, www.marketscreener.com), which is the top end of updated guidance, so there may be some further marking down on price targets. Consensus is at $2.88 prior to markdowns.

I do not have a high conviction, and the onus is now on management to deliver on guidance for the FY. I'm not going to sell on bad news, but unless there is a much stronger story at the FY, this capital may well be reallocated in due course.

Disc: Held IRL (2%) and SM (5%)

20/02/23

@Strawman has summed up Adairs 1H23 results nicely here and James Mickleboro from The Motley Fool has also discussed some key points from the results here.

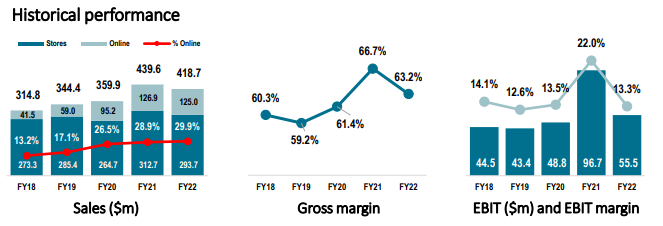

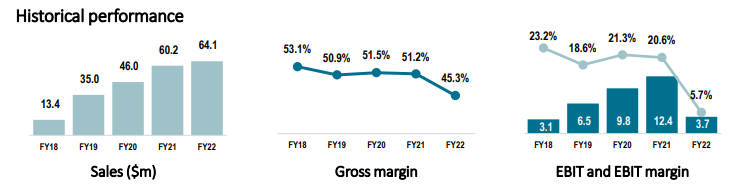

I think a few EBIT charts can tell a thousand words about how the group divisions have performed!

Adairs margins have been challenged!

Mocka has run amuck!

…and Focus has saved the day!

In fact if it weren’t for Focus on Furniture, the group results would have looked pretty dismal!

Overall group sales were up 33.4% on 1H22 and 80% on 1H21. Goods are walking out the door, but the cost of doing business has blown out nearly 32% knocking the stuffing out of the margins and earnings. The overall group result, thanks to Focus, was OK - the Underlying NPAT up 3.9% to $23 million for the half.

What about the second half?

Due to some strategies and trends already in place, the second half could be a little better. That is providing customers still have some spare cash to keep the sales moving.

► The first week of 2H FY23 saw record Boxing Day sales for both the Adairs and Focus brands

► Mocka sales for the first seven weeks were in line with expectations with trading gross margins +570bps above the prior corresponding period and +280bps above 1H FY23

► Cost-out programs have been initiated across the Group to manage the potential impact of a weaker economic environment

► Inbound freight costs are reducing and the Group’s hedging strategy has mitigated AUD weakness with USD purchases in 2H FY23 fully hedged at 72.5c

► Productivity at the NDC has improved over the last 5 weeks delivering better cost and customer outcomes. The new pricing agreement with DHL which applies from January 2023 will see average variable costs per unit despatched reduce by approximately 20% over 1H FY23 levels.

For the group, the first 7 weeks of 2H are almost flat (sales up 1.8% v 2H FY22), dragged down by Mocka which is still running amuck, down 31.7% pcp.

Sales guidance has remained unchanged, but due to increased cost of doing business profit guidance has been reduced by 7%.

So how does profit guidance compare with analyst expectations? According to S&P Global data on Simply Wall Street, prior to the announcement, the average FY23 profit forecast (8 analysts) was $50 million. If we take the low end of EBIT guidance taxed at 30%, that’s spot on with current analyst forecasts.

It’s anyone’s guess how the group will perform over the next 3 years. Up until now analysts have been forecasting annual earnings growth of 7%.

If the Adairs can grow earnings at 7% over the next 3 years, that would return investors 24% on equity in the business (ROE). This looks reasonable compared to historical ROE data:

Source: Commsec

Using McNiven’s StockVal formula and assuming a 70% payout ratio, 100% franking credits, and a required annual return of 15%, this puts Adairs on a current valuation of $2.75 (that’s at the lower end of FY23 earnings guidance).

Disc: Held IRL (1%), SM 0.1% (why bother! )

Adairs reported a 34% lift in sales, but this was cycling off covid-related store closures and includes a full 6m contribution from the Focus on Furniture acquisition.

As a stand alone, Adairs sales were up 13%, but this is against a period where nearly a 3rd of trading days were lost. As people returned to physical stores, the % of online sales dropped from 32% to 26%

Container rates and delivery charges (up 41%) impacted margins in a big way for this segment. Combined with higher costs of doing business, in part to the new distribution centre having poor "operational outcomes", the operating margin dropped from 12.5% to 8.5% -- which is a lot.

All of which means that despite a 13% lift in sales, EBIT dropped 23.4%. The Adairs segment is about 2/3 of total sales.

The online only Mocka segment wasnt great either, as people returned to physical stores. Add to that the costs associated with fixing past operating issues and reduced margins due to stock clearance and overall sales were down 27% and the segment was essentially break even.

Focus on furniture was the bright spot. Now accounting for over a quarter of revenue, it saw sales lift 20%. Because of high levels of product availability, and with newer stores maturing, they also had better margins which led to a 27% jump in EBIT. It's performing ahead of expectations.

For the rest of the year, the company reiterated sales guidance of $625-665, but added delivery costs have seen Adairs lower their FY EBIT guidance from $75-85m to $70-80m (about a 7% reduction).

Results presentation here

All told, not a fantastic update. They seem reasonably candid about the issues and are obviously trying to fix them, but this is all a good reminder of just how tough retail is. And this is in a space that will be impacted by any drop in consumer spending and lower housing turnover.

The market's reaction was quite tame given the reduced guidance -- then again, shares were already down about 20% in the last few weeks alone, and the company is now trading at a 6.5x EV/EBIT multiple. The yield is 6.6% fully franked (assuming 16cps for FY).

Shares seem pretty darn cheap if you assume there are no major structural issues and they manage to avoid any material and sustained slowdown in consumer spending. Even with the expectation for reduced margin in FY23, the forward PE is probably only around 10 or so.

Even if you assume no real growth from here, something yielding 6-7% fully franked aint bad.

BUT...

The worry, of course, is that it doesn't take much of a hit to sales or cost pressures to really bugger up the margins. As an example, at current gross margins, an 18% fall in sales wipes out ALL operating profit.

You can make the argument that even if the housing market and general consumer spending falls away, so long as the business can survive, and even if it takes 3 years to get back to the current (already somewhat depressed) per share earnings of (let's assume) 24c, there's probably decent available now. But it'd be a hell of a ride.

I retain a tiny position (about 1%) but am not tempted to increase at this stage. I was lured in by what now appears to have been a value trap, and am not looking to double down on that mistake (if that's what it ultimately is) until i see some signs that they've overcome some of their operating issues and that we don't see too much of a collapse in household spending.

Updated valuation, assuming PE of 10 and some steady growth in profits of say 10-12%, numbers my end are coming out around $2.70 at worst and $3.00 at best.

Someone on twitter linked the strong update from JBH today with the housing completion cycle (lots of completions due soon due to the boom). The Good Guys wasn't as strong as the head brand though, which I thought would be more linked being white goods, but anyway if right, you would have to think ADH should have a perhaps stronger than expected 6 months as a lot of completions occur which means homes and apartments need decorating,

Walking past Green Square in NSW and there must be 7 high rise apartment complexes due to complete this year. Might be able to shrug off some of the hosuing/consumer confidence slowdown... or not.

Totally @thunderhead - Adairs actually 50% off their low (around $1.80 - from memory). I have always liked the business, but the issues about their recent acquisition have held me back. I am eagerly awaiting the half year announcement to see if they've resolved those problems and if so, we're talking about a low PE, high ROE, low debt business that is worth an investment.

After a torrid back-half of last year, Adairs seems to have found some traction going into the new year, technically speaking. Breaking above the pre-Covid highs and holding there will be a good launchpad for further gains - perhaps the worst is already priced into the stock.

FY23 EPS of 28c 8% growth terminal of 4% and discount rte of 13% = $3.59

Agree with posts by @Rick and @Strawman, a solid AGM presentation.

Positives

The Focus on Furniture acquisition is performing above expectations with all 23 stores profitable and with a big opportunity to roll out further stores. Foresee 50-60 stores across Australia with annual sales being in the region of $250m within the next five years

Reaffirmed guidance given the 1st 16 weeks of trading where they saw stronger consumer confidence. The next two months of revenue sales are crucial to their final result and they do believe there will be a softening of confidence in the second half.

More solidity around the $1bn in 5 years (FY27)

Adairs $600m

Mocka $150m

F on F $250m

This implies a CAGR of 12.1% - down on the CAGR from IPO of 15%, but still an acceptable/okay result.

86% of expected USD purchases in FY23 are hedged @ 74c

Negatives

The National Distribution Centre (NDC) is ‘performing well below expectations in the areas of efficiency and productivity and is a key focus for management going forward’. This would suggest additional costs not necessarily included in the EBIT guidance estimates and possibly additional distribution costs as only ADH stock is totally within the NDC.

Mocka - The distribution and product issues of FY22 have been addressed operationally, but it will take longer to restore customer confidence. In FY23 Mocka is ‘focused on increasing customer confidence, restoring gross margins and ensuring a stable supply chain’. And so they should.

At the FY22 results conference MR commented that the 5.7% EBIT for Mocka will likely be 14-16% in FY23. Now got to be in doubt. Consumer confidence will be slow to return if you judge it on the ferocity and deep seated ill-will. Besides, online sales are flattening as customers return to bricks and mortar shopping.

Margins will likely fall given that there will be a greater contribution to revenue from F on F which has lower margins than Adairs, as does Mocka.

No comment on the wind back of stock which increased by $32m in FY22.

Adding to @Rick's Straw.

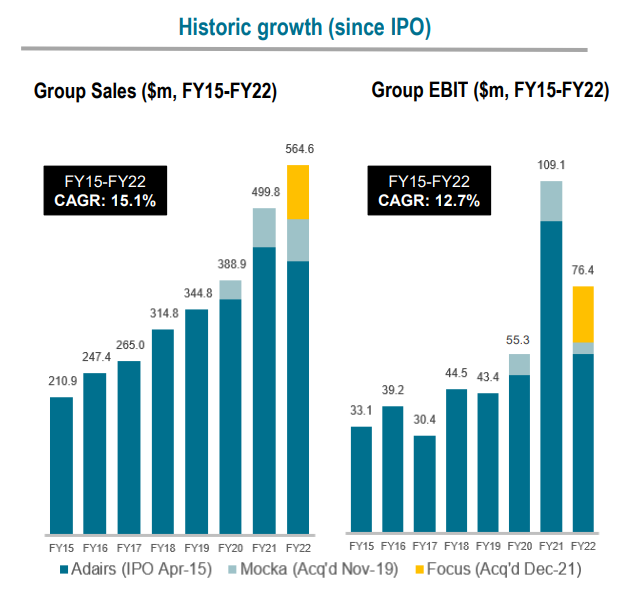

Adairs is trading below its 2015 IPO price. In the meantime, this is what the business has done:

Acquisitions have helped drive sales, but the core Adairs brand has continued to power ahead:

So why the pull back in 2022?

Partly, it was cycling super strong growth during covid which saw all of us buying more stuff online and tapping into that sweet home equity after house prices jumped some insane amount. Good times, but tricky to follow through on.

Also, Mocka had a misstep with quality issues and supply chain drama, which we can't ignore. Management reckon it's fixed, but we'll see.

Still, the trend is impressive and, taking management at their word, they hope to double sales in the next 5 years. That's through a combination of store roll outs and a growing loyalty program. Penetration seems low, so it's not unreasonable.

And as Rick has pointed out, they have had a solid start to the current year and reiterated EBIT guidance, which will be between flat and 12% higher.

But shares are on a PE of about 7 and a yield of 9.3%, fully franked.

So, what gives?

Well, no doubt the Mocka stumble has made the market a little nervous. But I dare say that there's some nervousness around the macro scenario. We are, after all, talking about a discretionary retailer whose sales are (I would suggest) very much tied to what's going on in the housing market. There's a also some debt -- $93m worth -- following the acquisitions of Mocka and FoF. This will take a few years to pay down and the cost of this debt will almost certainly rise (interest = the bank bill swap rate plus 2%). Of course, the ambitious store roll out plan will take plenty of capital.

As can be seen above, there's a good degree of operating leverage. A seemingly small change to gross margins can have an outside effect on net earnings.

All of this isn't to be overly bearish, but just to help put things in perspective.

If we were to go into a recession (and i'm not for a second suggesting we will -- but it's certainly possible), a retailer like this will hurt. Remember, the PE can rise not because the price increases, but because earnings fall.

The fact the market is trading this on a double digit grossed up dividend yield tells you that it doesn't see these dividends being sustained.

Of course, the market is often wrong. And this really could be a bargain. I hold a small amount because on a 'through the cycle' basis there appears to be value. But it could be a bumpy ride.

Today Adairs released its AGM presentation. Consumer spending has remained resilient and FY23 guidance was unchanged from August at $625 - $665 million revenue and $75 - $85 million EBIT.

Valuation:

Assuming FY23 NPAT of $50.5 m or 29.5 cps (forecast from 10 analysts S&P global data, Simply Wall Street, based on Adairs August guidance) and using the StockVal formula with a required annual return of 15%, this gives me a current valuation of $2.80. For a required annual return of 12%, my current valuation would be $3.80.

Disc: held IRL and Strawman

See @Strawman 's analysis of the FY22 results and examination of implications. I don't have anything to add on the numbers. For me a key question is are they a good retailer? What have we learned from today?

I aim here to complement Andrew's note with some more detailed observations, driving some of the adverse numbers.So its not an uplifting straw. I listened to the results call, and what was interesting is that the presentation was quite short, while the Q&A was rather in-depth. Mark Ronan provided candid and in-depth reponses to on several issues. There was robust questionning by analysts!

The standout disappointment was Mocka, acquired in late 2019. In late Q2/Q3 FY22, there were multiple issues relating to the failures by the Mocka delivery partner, which Mark admitted has damaged brand reputation, and signfiicantly impacted financial performance, due to customer refunds and discounts. These were discussed in H1, but we didn't see the full impact before today. Then, there were product quality issues in Q4 which resulted in some inventory writedowns. Mark believes the problems have been addressed and is hopeful that customers will given them another go. He still believes their is a place in the market for the Mocka product line.

Mark made clear, that several of the Mocka management have been replaced, selling this as a virtue in that it would make the management team more Australian-focused, which is where the major growth will be. Some changeout of staff associated with the founding management team has occurred as part of this (which is very common after the first year following a takeover), together with bringing in expertise in digital retailing. This strengthening of the bench has added costs and will be an ongoing drag on margins. Mark anticipated that FY23 would be a year of rebuilding with FY24 seeing a return to growth. Mark believes that growing Mocka to $150-200m in 3 to 5 years is still the likely plan (but presumably slipped... I haven't checked).

The second issue update was problems in establishing operations in the centralised DC. This is not uncommon. Starting up a brand new DC is like starting any large greenfield operation. It often takes time to get it right. ($BAP reported the same last week.) Mark report that everything is now under one roof, customer service is at the enhanced targeted level and that the operational efficiencies would start to be delivered through FY23, being fully realised in FY24 - later than planned.

So now to return to my question. Are Mark and his team good retailers? Mocka has been in the portfolio for 21 months, so I think it is squarely the responsibility of the current management team. Of course, the business has been through a lot with COVID and then the ongoing supply chain disruptions, so perhaps the usualy standards of judgement require some circumspection.

Coming into today, disappointment on the cost side was expected and, overall, I found the top-line sales number encouraging, including the FY23 outlook.

However, it is clear from the commentary that these bumps in the road are not instantly resolved. For this Mark is to be applauded for his candour. Howver, I suspect it explains the market reaction today. (Down 11-12% at time of writing).

To be honest, I acquired ADH without really having a view of the capability of the management team. (2% IRL; 5% SM) and more on the rationale that others here have also put forward (undemanding multiple, growth outlook, online channel capability, growing loyalty club, expanding to furniture to become a more complete home category).

Based on today's results and the discussion with the analysts, I would not buy ADH today if I didn't hold them. Partly because I am not convinced they are great retailers, partly because of the category headwind they face with a slowing housing market (near certain) and a tougher discretionary retail environment (likely, nothwithstanding positive household balance sheets and strong employment).

Why haven't I sold? Am I anchoring on being down 38% IRL on my purchase price?

As @Strawman points out, the multiple is now quite undemanding. Perhaps what is preventing me from bailing out is that on the call today the CEO provided candid and in-depth responses to a barrage of searching questions being very open about the problems faced, the impact they've had, and what's been done. It sounded like a very honest accounting of where the business is at.

Conclusion:

I am not going to buy any more and will see what progress has occurred in 6-months, keeping an eye on the the retail macro-environment in the meantime. But ADH is a lot lower on my conviction list, so if I need the capital elsewhere, I won't hesitate to cut my losses.

The market doesn't like Adair's results -- shares are down 10% as I write this.

Let's see what's going on..

While total sales were up almost 13% for FY22, it's hard not to notice that the core Adairs segment (bed, bath, homewares products, which make up about 3/4 of total sales) saw a 4.8% drop in revenue and a substantial 42% drop in EBIT.

At the top line, you can blame the fact that Covid store closures meant there were 16% fewer trading days during the year, and an exceptional FY21 result. You can see below that the overall trend for Adairs store sales is quite respectable, averaging about 10%pa over the last 5 years (excluding Mocka and FoF). Or about 7%pa over the last 3 years.

Even with the store closers, like-for-like store sales were down only 3.3%. There was a 6% increase in the store footprint, and online sales are now 30% of the total and well up on FY20

BUT -- added supply chain and warehousing costs, higher staff costs and marketing effort all took a knife to margins. On a cash basis, added inventory levels also had a noticeable effect. Macro conditions are expected to remain difficult -- not a great environment for a discretionary retailer!

These kind of headaches are a big part of why I usually avoid retailers...sigh.

Then you have Mocka, which was very disappointing. While sales grew 6.5%, this was well below expectations following a weak second half, and there were also supply chain issues at play. More worryingly, there were "isolated product issues which led to adverse customer feedback and returns". This certainly helps explain a $1.2m inventory writedown. They've even put a new management team in place.

Another reminder that things can swing quickly in retail.

Focus on furniture, acquired in December 2021, was a standout. Although it represents just 13% of total sales, it was 22% of EBIT. It has the best margins of all segments and is expected to become a much more significant contributor to the group.

So the question here is whether or not FY22 results point to some difficult structural issues, or some nasty but temporary cyclical factors.

If the latter, the company looks pretty cheap.

They were able to sustain the final dividend, which puts Adairs on a yield of 7.8% fully franked. That's about 11% grossed up.

The PE is < 8.

And you have management guiding for growth -- albeit modest growth -- for the coming year. At the midpoint, management told the market to expect 14% revenue growth and 4.7% EBIT growth. The first seven weeks of the current FY are showing sales about 3.9% ahead of the same period last year.

They also reiterated expectations to hit $1b in total sales within 5 years (essentially double where they are now).

I think it's smart to assume lower margins going forward. Supply chain, FX and staffing costs could remain elevated for some time. Still, it's one of those situations where you really don't need growth to do well. In fact, so long as it can sustain an 18c per year dividend, investors will do ok.

The risk is that conditions deteriorate further. Lower than expected sales, combined with rising costs can be toxic. And it can be very difficult and expensive to turn things around. Worth emphasising that this is a company whose fortunes are closely aligned with the property market. People buying new homes and enjoying rising equity tend to splash out on homewares and furniture. Less so when things are going the other way..

I have a tiny holding (about 1.3% allocation), but am not tempted to increase this despite the apparent value. I'd just like to see evidence that margins can be stabilised and that sales growth can return to the core segment.

Results presentation here

I listened to the ADH investor discussion on 1HFY22 results & they provided some ‘colour’ (to use an ‘analysts’ buzz word) around their supply line, distribution & delivery issues which accounted for an additional $3.9 million in additional expenditure in 1HFY22 results. I was very much aware there was tremendous customer dissatisfaction and was keen to hear their POV.

The crux of it is that (Mocka particularly), they were significantly let down by one of their large delivery suppliers. Quite possibly, there was a large element of “hiding” of the huge backlog of orders (thousands) which were sitting in the deliverers distribution centre, whereas they were marked delivered at the Adairs end.

The company has rectified this now by appointing multiple delivering firms and has significantly strengthened the communication between ADH & the delivery agents, as well as ADH and the end customer.

They did state that when contacting the disgruntled customers by phone, whilst they were disappointed, they were somewhat understanding of the situation. ADH stated they will be working extra hard to rebuild goodwill lost & have rolled out a marketing campaign to do so. Bottom line on this issue: it is a temporary, but regrettable scenario which will be rectified in 2HFY22. That said, these costs will remain elevated in 2HFY22.

The good news is that these additional costs in FY22 will not be present in FY23 and in the second half of FY23 they will begin to recoup the estimated $3.5 million in saved costs because of the new national distribution centre.

The other significant cost blowout was of course the costs of Covid of $15m in 1HFY22. Hopefully they will be a thing of the past going forward.

In terms of growth, the one thing that caught my ear was the intention of the company to roll out a physical presence for the Mocka brand. It won’t start until FY24, but could be significant (I think I heard potential for 70 stores in due course).

Plus ADH have designs on rolling out an additional 30+ Focus stores nationally.

As Peter Lynch always stated, retail is great because it is so easy to grow by opening a proven successful concept in different locations.

Whilst 1HFY22 was disappointing, the future does look assured.

I suspect this shock announcement comes on th back of a shocker of a Xmas trade - far worse than they were envisioning. Why? Well, director Trent Peterson, one of the sharpest retailers running around, shelled out $500k at $3.60 ish on 1st December - clearly he didn't see this coming.

I agree with Strawman, the business model isn't broken, much of these issues are 'one offs' but they are BIG one offs and this report masks some of the pain by hiding behind terminologies like 'underlying EBIT" where they conveniently don't account for the costs of the Distribution Centre cock ups. When you deduct these and the costs of the Focus purchase and some costs of completing the Mocka purchase, reportable EBIT will be much lower than the $30m.

Generally ADH management are solid to good performers but they completely messed up the supply lines and delivery on their online products and the consumer backlash has been very vocal and brutal. Goodwill damage has been done as their customer service recovery was poor. EPS and dividends will be downgraded as will IV valuations. Share Clarity follows ADH closely and they have already reduced their IV from $4.76 to $4.06

But when you follow the cash, things are not doomsday. Presuming working capital requirements were static then we used up $116.6m in cash and extra debt in the six months - which can easily be accounted for as follows:

Finalize Mocka acquisition $45.7m, Cash out on Focus acquisition of $61.5m and they shelled our $16.9m in dividends - total of $124.1m - so all the extra costs on the distribution centre/s and handling of supply line and delivery problems have been covered from operational cash.

I will take a stab at FY22 eps of 19c to 22c and dividends around 14c - but be warned, my knives are usually blunt.

Ouch.

Adairs gave the market an update on the expected H1 results for FY22, due on Feb 21.

The company is expecting to report $242m in sales for the 6 months through to the end of December, which includes a $12.5m contribution from the recently acquired Focus on Furniture (FoF). So on a like for like basis, that's a $230m result compared to $243m in the first half of FY21.

Underlying EBIT is expected to be between $32-33m, or around $30m excluding FoF. That's down from $60m in EBIT in the previous first half.

As can be seen above, like for like sales for the group were 2.7% higher, although that's due to a very strong performance from Mocka which masks a decline in Adairs stores.

The market's reaction has not been kind, which is perhaps understandable. But some context is needed.

The result was impacted by government mandated store closures which reduced the number of trading days by 31%. In NSW and VIC, the largest states, the number of trading days were essentially cut in half.

Management have tried to normalise for this, saying that Sales and EBIT would have been around $263m and $44m, respectively (excluding FoF).

The other major factor was increases in supply chain costs, something else that was beyond the company's control. That's acted to reduce gross margins (although these remain well above the levels of HY20.

What is within the company's control is promotional expenses, and these too increased and acted to reduce gross margins.

Online sales helped pick up some of the slack and are close to double where they were in FY20 and up 8.2% (excluding FoF) from the pcp. Workforce shortages, issues with the new DC and supply chain partner issues all had an impact.

As always, the key question when faced with disappointing results is "is this structural?"

I think the answer is no. These are all largely one-off factors, outside the company's control, and will resolve themselves in time.

It is, however, a good reminder of how harsh retail can be.

If we simply double the expected result for the half, Adairs is trading on a EV/EBIT ratio of about 7. That's not very demanding for a business that is experiencing pretty solid underlying growth.

When you dilute the FY21 results for Focus on Furniture (FOF) for the Covid ‘sugar hit’, the real EV/EBIT multiple of the deal is around 5.7x to 6.6x – about the same as projected for ADH in FY22.

Given there have been no quantified synergies stated, though doubtless they are there in some fashion, this deal is really a straight ‘shoot-out’ between the interest paid on the bulk of the acquisition cost v the likely EBIT from this separate business. From my quick study of the Annual Return the interest rate stated on the $90m unused facility is at BBSW + 1.85% - around 2%.

Presuming FOF meet the normalized FY21 estimates of an EBIT range of between $12m and $14m over a full year (FY23 to be the first such year), then this translates into the following on a per share basis

EPS from FOF acquisition alone– 4.2c to 5.0c

Divs from FOF acquisition alone – 2.7c – 3.25c

(Note ADH have affirmed the dividend policy to pay min of 65% in divs)

Grossed up divs from FOF acquisition alone - 3.85c to 4.64c

Yep, I can live with this and take the additional growth as a bonus.

Thesis

My thesis for Adairs is a pretty simple one, invest in what you know and love. Adairs is a speciality retailer of homewares and furnishings and as someone interested in interior design and how my house looks, I find myself going out of my way to see what Adairs has on display whenever I’m at the shopping centre. I’m always impressed with the layouts and displays of both the physical stores, online stores and social media accounts. I was also impressed by Adairs returning their JobKeeper subsidy.

I have bought from both Adairs and Mocka and found both to have great products and excellent customer service. After browsing multiple homewares stores I spent an embarrassing amount of money on pillows and a throw at Adairs to match the colours in my family room. I believe this is what drives the impressive returns on capital the company has been able to achieve; once you find something you like you’re willing to spend more on it as another store will rarely have the exact same product with regards to colour/design/texture. Strong website traffic trends for both Adairs and Mocka suggest the company has a desirable offering.

Adairs navigated the Covid pandemic exceptionally with double digit revenue growth and a strong increase in online sales. While my DCF spits out a ridiculous valuation, a sanity check shows that compared to other retailers ADH is still undervalued. The company has a strong balance sheet with zero debt, a 4 year average FCF/revenue of 13%, and a 2021 FCF yield of 15.9%. ROE was 39% last year and both ROIC and ROE have been high over the past 5 years. Adairs also pay a fully franked dividend.

Risks with this investment are my lack of experience with retail, a possible lack of understanding of the 2-3 most important factors driving continued success, as well as a lack of confidence in my DCF valuation. I believe these are mitigated by a company possessing a strong balance sheet, a long track record of success and a product I know and love. This is very much a Peter Lynch inspired investment.

Re: Straw by PortfolioPlus

Google Trends is a great way of generating insights between direct competitors, where you are comparing search frequency for one product compared with another (e.g. Xero vs. MYOB vs. Quickbooks). I urge extra caution if the products are not direct substitutes.

Out of curiosity (and because I am also trying to understand fair value for ADH in an uncertain future retail environment), I compared the frequencies in the data between Mar-Oct 2020 and Mar-Oct 2021. It was interesting as follows:

ADH: March-Sep 2020 = 49.5; Mar-Sep 2021 = 42.0 i.e. down 15%

TPW: March-Sep 2020 = 28.0; Mar-Sep 2021 = 28.4 i.e. up 1%

Not sure what to infer from that if anything, but thought you might find the analysis of interest.

ADH under-valued or TPW over-valued?

Responding to Bjart comment “Why on earth you would love linen so much is beyond me”

I see soft furnishing/linen as fast fashion for the home. The days of buying and using it till it is worn out are long gone for many.

Feed by home reno shows, Pinterest and Instagram, homewares has succumbed to fast changing trends and a constant “need” to update your look. This is coupled with the ability of retailers to quickly turnaround new product and respond to emerging trends and colours.

Redoing your kitchen regularly is not feasible, or possible if you’re a renter so the next best thing is to change your look though new pillows, throws, doonas, knick knacks, etc. It’s the quickest, cheapest way to get a fresh new look that’s on trend. The question is how often do you do that? I’d suggest in the right demographic it is more often than you think.

I agree the linen lovers club has enormous support and engagement. I think the trick is they offer more than a barrage of standard email offers as the member deals offer real value for the consumer. The quality of the product is also good and viewed as a step up from any major discount retailers and not daggy as current dept stores. In the bricks and mortar space they seem to have the leading product. Pillow talk is a competitor however their product ranging is never as sharp as Adair’s imo. There is an obvious overlap with some online retailers, but Adair’s have an established brand and look, consumers know what to expect from any product purchased online so I think that stands them in good stead. I have been surprised by the uptake of online sales, having overweighted the importance of being able to touch and feel the product.

I think, (as wanky as it sounds) Adair’s are successfully selling lifestyle aspiration not linen. (Look at the highly styled images on the website/socials) Buying homewares can be emotive for some people and while it is not always a necessity it is a “feel good” product at an acceptable price.

From a personal point of view, I lament the throwaway culture of fast fashion and equally despair the way homewares has encroached the same culture, although it is an obvious advantage for retailers such as Adair’s and Lovisa. The volume of waste from textiles we chuck in Australia is appalling.

Finally, Adair’s call the soft/home furnishing category “home styling” on their website, says it all.

A Tale of Two Companies

Company A & B sell exactly the same product mix in exactly the same way.

Company A is valued at $1.773bn (Enterprise Value) & Company B EV of $633m.

Company A sold $326m of goods for a GP margin of 31% and an EBIT margin of 5.92%

Company B sold $187m of goods exactly the same way (online sales) for a GP margin of 39% and an EBIT margin of 20.68%.

What’s more, the NPAT of Company A was just $19.1m for a $1.773bn company remember.

Whereas the NPAT of Company B when you also add in its bricks and mortar trading is $63.7m!!!!

Company A is Temple & Webster (TPW) and Company B is Adairs (ADH).

Sure, there will be those who say that growth in TPW is the missing link, but let me tell you, their FY21 sales were up 85% and NPAT in percentage of revenue went backwards!

The ADH online revenue increased 31.6% and is now some 37% of ADH sales.

Bottom line: The ADH profit is 233% more than that of TPW yet TPW is valued at 180% more than ADH.

Sorry, but I just don’t see the massive divergence in value of these two companies and believe ADH to be massively undervalued by the marketplace.

A pretty solid result for ADH and yet another one for those wanting growth, plus 'real' earnings and a very healthy ff dividend. Hard to explain the recent volatility but around $3.80 I reckon this is a forwrd looking gross dividend for FY22 of 38.5c - tell me, where can you get the famed 10% return as preached by The Richest Man in Babylon!

My concerns about margin and supply have been admitted by ADH, but I am pleased about two things.

Firstly, they have acted to bolster onshore inventories - up 56% on FY20

Secondly, they have wisely hedged 75% of FY22 inventory @ 75c - so this gives us a bit of a break.

They are confident we will continue sales momentum. An 8% increase in total shop sqm in FY21 will be repeated in FY22.

Online will continue to surge. Their subscription based (admittedly peanuts to join) Linen Lover Club is nealry 1m strong and accounst for 80% of revenue. Yep, the Adairs omni-strategy is powering.

The Mocka (they bought this online biz a year ago) FY21 EBIT of $12.4m was a tad disappointing on the back of falling margins and increased marketing spend, but I think the riot act has been read in those quarters with the founders shuffled on and a new CEO appointed.

Bottom line: The Covid drama does provide ADH with a tailwind; No international travel for quite sometime sees more money spent on the home and the home office.

I can see FY22 being a better year than FY21.

Rev of $590m NPAT of $77m eps of 45c Divs 27c

First half results for FY21

Record sales and underlying EBIT5 exceed guidance

Online sales now 37% of Group Sales

Adairs today released its results for the 26 weeks to 27 December 2020 (1H FY21). The Company has delivered record sales and profitability at a time when its 43 Greater Melbourne Adairs stores were closed for almost half the period1 due to COVID-19 related restrictions. Sales and underlying EBIT exceeded the December 2020 guidance after adjusting for the $6.1 million repayment of the JobKeeper wage subsidy benefit.

1H FY21 (compared to 1H FY20) snapshot2 :

~ Group sales up 34.8% to $243.0 million

-Adairs sales +20.9% (Online +95.2%, Stores+4.6%; Stores LFL +14.4%3 )

- Mocka sales +44.4%4 to $28.0 million

- Group online sales of $90.2 million, 37.1% of Group sales

~ Underlying Group EBIT5 up 166% to $60.2 million (1H FY20 $22.6m)

~ Gross margin up 500 bps

-Underlying Adairs gross margin +690 bps to 67.8%

- Underlying Mocka gross margin +230 bps to 53.4%4

~Statutory NPAT $43.9m up 233.4% and EPS 25.9cps (7.8 cps in 1H FY20)

~ Net cash of $22.1 million (compared to net debt of $1.0 million at June 20)

~ Interim dividend of 13.0 cents per share (fully franked) declared

~ Linen Lover membership now exceeds 900,000 customers

~ The Company will repay the JobKeeper wage subsidy benefit for the period ($6.1 million) to the Government

1 Greater Melbourne stores were closed from 6 August 2020 and re-opened on 28 October 2020.

2 See Appendix 3 of the Investor Presentation for a reconciliation of statutory and underlying results.

3 Like for like sales growth (“LFL”) has been adjusted for all store closures, including when Greater Melbourne and South Australian stores were closed due to COVID-19, and is calculated on a store-by-store daily basis (where only stores open on the same day in each corresponding period have been included).

4 For information only. Adairs acquired Mocka in December 2019.

5 Underlying EBIT and NPAT exclude the impact of (i) AASB 16 (Leases), (ii) JobKeeper wage subsidy benefit of $6.1m, (iii) oneoff costs associated with the transition to the new National Distribution Centre, and (iv) non-cash costs associated with the acquisition of Mocka. It does include the impact of the closure of Greater Melbourne stores for c.12 weeks.

16-Nov-2020: ADH Appointment of new Chairman

Adairs Limited is pleased to announce that it has appointed Brett Chenoweth as its new Non-Executive Chairman, effective today.

Brett is currently Chairman of Madman Entertainment, Canberra Data Centres (CDC) and The Advisory Board of HRL Morrison & Co. He is also a non-executive Board director of Vodafone New Zealand, NSW Land Registry Services and Janison Education Group.

Previously Brett was the Chief Executive Officer and Managing Director of APN News and Media and held senior executive roles at the venture capital firm Silverfern Group, Telecom New Zealand, ecorp, ninemsn and Village Roadshow.

With a wealth of experience in leading businesses across media, technology, entertainment and telecommunications sectors, Brett will add significant depth and diversity to the Adairs board.

Mr Chenoweth said: “I’m very excited to be joining the Adairs team. With a strong and aligned management team, a leadership position in the retail sector and clear growth opportunities ahead, I’m looking forward to leading a Board focused on supporting management in the execution of the Company’s growth strategies.”

Mark Ronan, Chief Executive and Managing Director said: “We are delighted that Brett will join our Board of Directors as Chairman. I look forward to working with him as we build upon our position as Australia’s largest omni channel specialty retailer of home furnishings.”

--- click on link above for the ful announcement ---

[I do not hold ADH shares, however I hold IFT (Infratil Ltd) shares, and IFT is managed by HRL Morrison & Co, and owns half of Vodafone NZ, plus 48% of CDC, so Brett Chenoweth is of interest to me. He seems well credentialled and experienced. Adairs have a great online business as well as their bricks-and-mortar store network, so they've done well through the lockdowns and should also do well coming out the other side.]