First straw after recently joining premium so go easy....the actual first trade on strawman was a while back purchasing airtasker for around $0.46. Continued to purchase on the way down being a very happy buyer at $0.16 recently in my personal portfolio. Hopefully we can get more posts on the company on strawman moving forward.

bull case

I believe the company ticks a lot of boxes, high level of founder ownership / founder led. No net debt, expanding into new markets after becoming profitable in AUS. In the recent reporting season, the day the company announced the share price did not move - they take a measured approach, there is slower growth but also become cash flow positive in the near future. Like many tech companies last year, they cut employment costs / staff which has helped with the above.

forecast

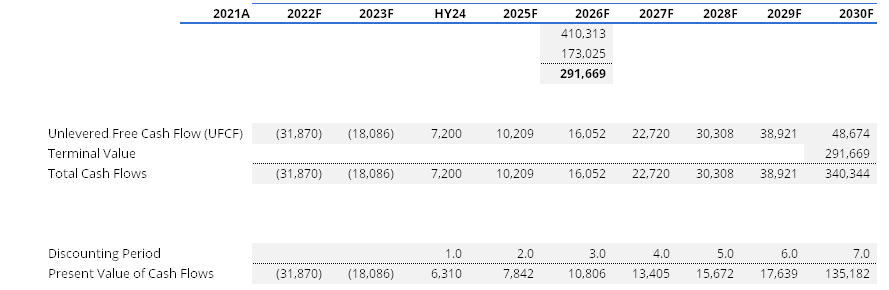

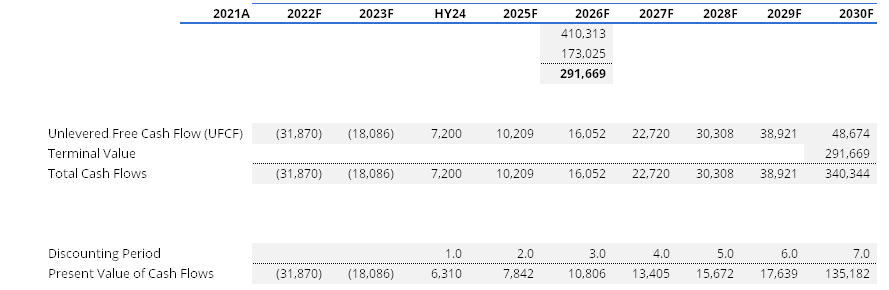

extrapolating the recent HY numbers out to June 2024 I have EBITDA of ~$4 MIL. This grows steadily with true free cash flow coming later in FY 2026. A lot of assumptions in these numbers at this point granted, but a good point to start an intrinsic value model to support the thesis. Will continue to refine the model as more financials flow through with actual profit figures.

The terminal value I have used is 291,669 which is high and will likely revert back to the EBITDA multiple 7.5x which is the $173,025.

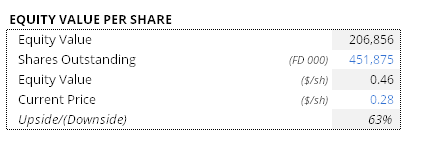

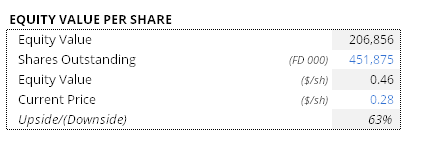

Would have expected fair value for airtasker to be around $0.36, however the current valuation, based on the 451.8 MIL shares on issue is $0.46 or approx. a 60% premium to the current $0.28 price. May be overcooking this and will continue to refine and provide an update once the QTRLY cash flows are scrutinised further. While it felt obvious to buy around $0.16-$0.17, the share price recently got to $0.34 before selling off. Aware the below valuation is a little stretched however I believe it will get there at some point in the next 24-36 months and this is a long term story.

Things to continue to monitor:-

- UK expansion via media agreement. This was how they achieved 20x growth in Australia - the agreement has given them $6.7Mil in advertising with other strategic initiatives. US is an unknown and could be a bonus, however they need to do well in the UK primarily.

- Gross margin per sale.

- Recently cash position has fallen back around $5 MIL, not sure is this is due to timing or planned inflection point.

- Free cash flow beyond FY24.

- The market may believe that airtasker will be caught up in gig-economy / ride share labour laws in the near future.

- Rebooking rates / time between bookings (one of the biggest challenges).

Will post some more detail on airtasker in the near future.

Good to be part of strawman for real.