I put a few posts on HC about the stagnant share price of Beamtree, but will post this more detailed breakdown of my research into holdings here.

One important factor is CEO Tim Kelsey has no holding in Beamtree despite some board members holding shares namely Andrew Gray under HSBC Custody Nominees and Stephen Borness. So if he is so confident on the outlook, why doesn't he have a holding or bought on market?

However, I think much of the downtrend could be explained by the changes in top 20 over the period.

Firstly the snapshot from marketindex (July 2021):

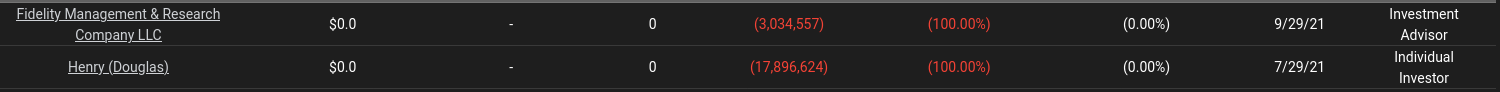

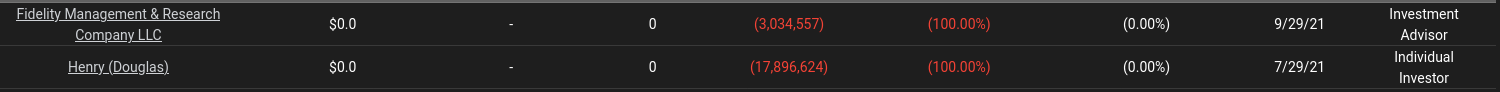

If I look up Tikr it appears Paul Richard O'Connor who retired when PKS/Beamtree acquired his company Pavllion Health had sold 9 million shares in July/August 2021. So his holding is actually 3.95%. Not sure where those shares went, maybe they ended up with Fidelity who then sold a few million in Sept 2021 (according to Tikr).

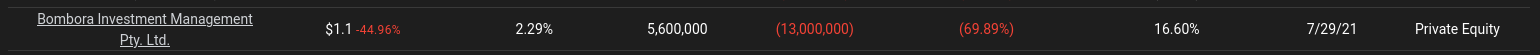

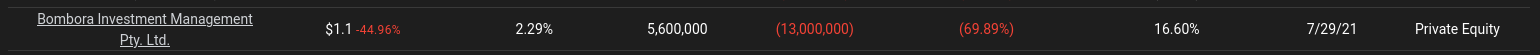

But more interesting is PE firm Bonbora Investments. Along with the 5.6 million shares in marketindex, they also had 13.1 million shares held in National Nominees ltd under Bombora Special Investments. These were sold as shown at end of July:

There is also an announcement dated March 2021 - Change in substantial holding which shows "Bombora Investment Management <Bombora Special Investments Growth Fund>" and National nominees.

My conclusion is that Bombora Special Investments Growth Fund had sold out most of their holding in BMT (give or take 100K shares) once they saw Paul sell 9 million shares on market.

On top of that, a few other funds sold at the same time Paul did. And also one notable holder/insider Douglas Henry who sold a massive 17.9 million shares (and interestingly former MD of Pavilion Health).

So in conclusion there's quite a few shares floating around unaccounted for. There's still a few more holdings I'm struggling to link up back to marketindex. But this demonstrates how great Tikr is as a tool for tracking down movements in shareholdings and "bad actors" in the share registry.

If only I knew how to use Tikr properly months back

Held (but reconsidering position after this research)