Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

A good result from Beamtree today.

Some background on a Rich Life here, and why it might be a takeover target.

Despite reporting an operating profit for the quarter of a tiny 100K, Beamtree still saw a cash outflow of 800K

Forecasting an operating profit for FY24.

Seems like Beamtree are using operating profit rather than positive free cashflow as a performance metric?

Wonder what made them go negative cash when they reported an operating profit. The only thing I can think of could be they capitalised their software development expenses.

Kelsey still has zero Beamtree shares.

Not held

Maintaining my price target / valuation based on Q3 FY23 Trading Update and FY23 Updated Outlook.

▪ Abbott partnership continues to deliver to expectations with 11 new licences in FY23 YTD compared to 27 over the previous 6 years. Recurring revenue from the partnership has doubled in FY23.

▪ Awarded an implementation of RippleDown into the Coventry & Warwickshire NHS trust, paving the way for wider NHS rollout.

▪ Second stage funded trial now installed in a large Asia Pacific Hospital Authority following the offline analysis of 50,000 patients in Q1.Trial involves integration with hospital’s IT systems.

▪ Paid ADI trial commenced at Milton Keynes University Hospital in England with another NHS Trust expected to commence in Q4 FY23.

▪ Awarded $1m health information management strategy contract in the Kingdom of Saudi Arabia alongside their partner Lean.

▪ Awarded preferred solution provider to audit coding data integrity for a large customer in a new international market ($0.5m p.a.)

.▪ Renewal of contract with the Health Service Executive in Ireland, their largest PICQ customer (coding, data & quality tool)

▪ Continued investment in developing a new 3 year strategy for their key customer, Health Roundtable based on investment in a new data platform infrastructure and enhanced member services. This follows agreeing an 8 year contract with Heath Roundtable in FY23.

▪ Significant Australian hospital group joined Health Roundtable during Q3, with annual contract value of ~$400k p.a.

▪ Reported revenue growth of +51%(3) versus the prior corresponding period (“pcp”), with strong organic revenue growth of +24%, and an operating profit improvement of +25% pcp driven by the success of contract wins both in Australia and internationally.

▪ Organic annual recurring revenue growth continues to track +20% with organic operating costs tracking around 10% growth driven by investment in developing their tech products such as the AI driven ADI and RippleDown.

Management reaffirms long term outlook of delivering annual recurring revenue of $60m by 2026.

Q3 trading supports FY23 organic recurring revenue growth forecast to be ~20%

Strategic international projects continue to underline growth going into FY24.

Continued focus on cost management with organic (like for like) cost growth estimated to be less than 10%.Increase investment in Q4 FY23 & FY24 to support international expansion.

Continued improvement in operating profit in 2H FY23.

Content to still hold a position in both my real life and Strawman portfolios.

- BEAMTREE AGREES NEW GLOBAL CONTRACT WITH ABBOTT

- CONTRACT TO DISTRIBUTE BEAMTREE'S RIPPLEDOWN® PRODUCTS

- EXPECTS AGREEMENT TO BE A MATERIAL CONTRIBUTION TO ITS TOTAL REVENUE

- ABBOTT RETAINS EXCLUSIVE DISTRIBUTION RIGHTS, EXCEPT FOR A SINGLE EXISTING DISTRIBUTION AGREEMENT

The kicker in the (clarified) announcement - Beamtree forecasts between 50 – 100 annual recurring large customer licences by the end of

the three-year term, each with a minimum annual value of USD$300,000.

Beamtree Holdings Limited (ASX:BMT) a leading provider of AI decision support and data insights solutions, announced today a key strategic partnership with Lean, Saudi Arabia’s leading provider of innovative health solutions. This strategic partnership follows the successful completion of Beamtree’s first major contract to support data transformation in public health services of the hospital network data analytics audit for Saudi Arabia.

Beamtree state it will extend their ability to provide further products and services into Saudi via this strategic partnership with Lean.

Beamtree has now received full payment for phase 1 of the data transformation project of US$1.45m (AU$2m). The next phase is the proposed implementation of Beamtree’s products across Ministry of Health hospitals and then more broadly across public and private hospital networks (over 450 hospitals in total).

The partnership with Lean is aimed at strengthening their offering in the Saudi market. The new partnership with Lean will promote Beamtree products and services in the Kingdom of Saudi Arabia and follows the successful completion of phase 1 of an audit of public hospitals in Saudi. The audit conclusions of phase 1 included strategic recommendations to improve analytics and use of important patient healthcare data for better patient outcomes, reduced wastage and operational efficiency.

Beamtree is a pioneer of AI data and decision support services and operates in 25 countries in the world – Saudi Arabia has put data and decision support at the heart of Vision 2030, its major national health reform program.

Lean is Saudi Arabia’s leading health technology enterprise, working as a key enabler of innovative health solutions in Saudi Arabia. Lean is contributing to digitalising the Saudi health ecosystem and boosting the health sector services by launching sustainable operational products and stimulating partnerships between the public and private sectors.

The partnership aims to support health services in Saudi Arabia improve the quality of hospital data and analytic insight through the audit and automation of clinical record classification.

Duane Attree, former CEO of Potential X and Chief Commerical officer seems to have been either let go or simply left Beamtree according to Linkedin...

He is also a subholder of Beamtree with shares escrowed for 2 years.

I didn't expect the share price to still rally. I suppose non-exec chairman Michael Hill could still be buying.

There is also no word or update on one of the NHS trials that was due this month.

Nothing yet from 6 month trial with NHS announced on 22 March 2022 with University Hospital's Coventry and Warwickshire. Looks like a delay which isn't good.

Did a bit of research into Beamtree's competitors.

The dominant player in Beamtree's space has to easily be Altera

Altera is owned by Harris Computer corp who bought out some of Allscripts healthcare software solutions in May 2022.

https://www.digitalhealth.net/2022/05/allscripts-re-branded-altera-digital-health/

The software solutions provided by Altera are very similar to Beamtree.

Altera would be the reason why Beamtree needs to do lengthy 6 month+ trials before a hospital makes a decision to go with them.

I think the fact we have an incumbent that is not disclosed in any of the call transcripts would explain why Tim Kelsey is not buying any stock on market whatsoever despite the bullish comments in the updates. I think he knows there are larger players in the space such as Altera and is not sure how to tackle this problem.

Instead Kelsey chooses to rely on obtaining stock via performance rights.

I put a few posts on HC about the stagnant share price of Beamtree, but will post this more detailed breakdown of my research into holdings here.

One important factor is CEO Tim Kelsey has no holding in Beamtree despite some board members holding shares namely Andrew Gray under HSBC Custody Nominees and Stephen Borness. So if he is so confident on the outlook, why doesn't he have a holding or bought on market?

However, I think much of the downtrend could be explained by the changes in top 20 over the period.

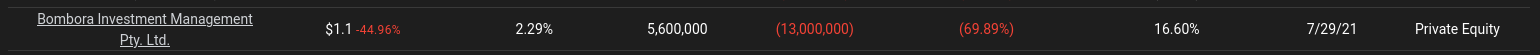

Firstly the snapshot from marketindex (July 2021):

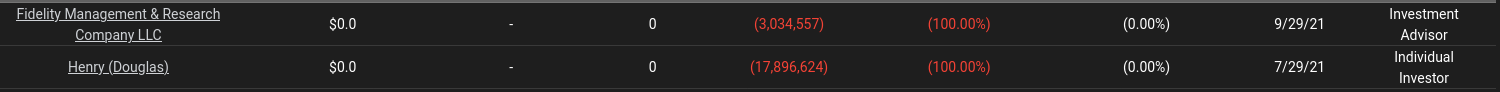

If I look up Tikr it appears Paul Richard O'Connor who retired when PKS/Beamtree acquired his company Pavllion Health had sold 9 million shares in July/August 2021. So his holding is actually 3.95%. Not sure where those shares went, maybe they ended up with Fidelity who then sold a few million in Sept 2021 (according to Tikr).

But more interesting is PE firm Bonbora Investments. Along with the 5.6 million shares in marketindex, they also had 13.1 million shares held in National Nominees ltd under Bombora Special Investments. These were sold as shown at end of July:

There is also an announcement dated March 2021 - Change in substantial holding which shows "Bombora Investment Management <Bombora Special Investments Growth Fund>" and National nominees.

My conclusion is that Bombora Special Investments Growth Fund had sold out most of their holding in BMT (give or take 100K shares) once they saw Paul sell 9 million shares on market.

On top of that, a few other funds sold at the same time Paul did. And also one notable holder/insider Douglas Henry who sold a massive 17.9 million shares (and interestingly former MD of Pavilion Health).

So in conclusion there's quite a few shares floating around unaccounted for. There's still a few more holdings I'm struggling to link up back to marketindex. But this demonstrates how great Tikr is as a tool for tracking down movements in shareholdings and "bad actors" in the share registry.

If only I knew how to use Tikr properly months back

Held (but reconsidering position after this research)

Old news but BMT director Stephen Borness bought 36K shares on 1st July @29.5c

Didn't quite get the bottom but reassuring nonetheless.

[held]