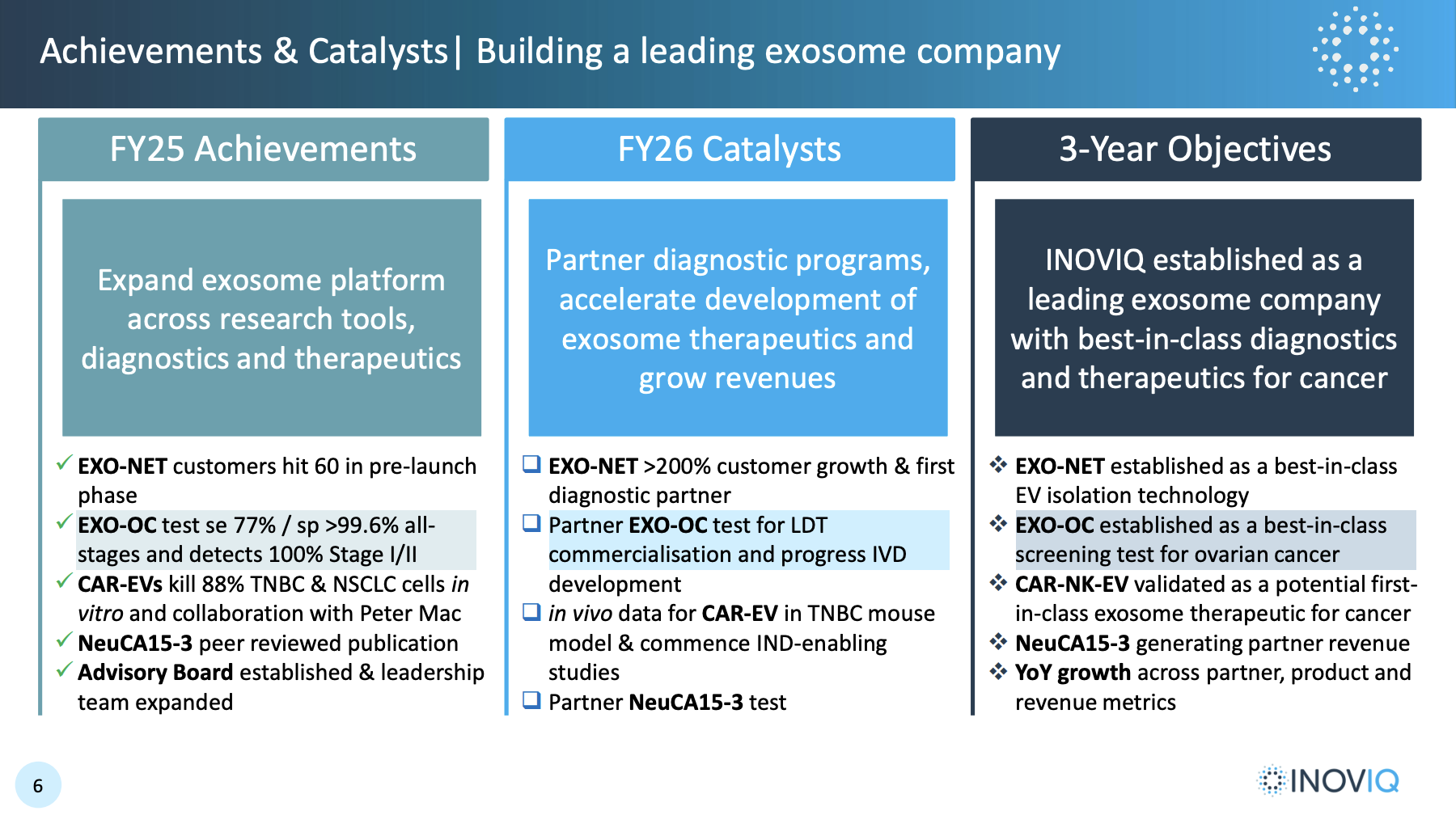

The AGM can be replayed. A good overview on early Exo-Net sales and the pipeline for diagnostic products (ovarian and breast) and therapy (triple negative breast cancer). Followed by DW quizzing the CEO and CSO for extra details to help us understand the strategy and timelines.

I can see how the strategy of selling the 'platform' Exo-Net globally through Promega while developing in-house ovarian and breast cancer diagnostics should create a positive feedback loop around technology validation, clinical uptake and crowd-sourced innovations. I appreciated the details on what it takes to get a new diagnostics test to market.

33 exo-net customers since August. Across universities, pharma and hospitals. Sales will build slowly as ideally the feedback loop takes effect. The relationship with Promega sounds well-supported and close.

December early-stage data expected (maybe some this week?):

- Ovarian cancer screening test biomarker validation. There is no existing ovarian test. The product might only get to market in 2029 (unless it gets unmet need fast-track), but positive news here would generate buzz around the Exo-net platform product and encourage researchers to try it for themselves.

- Breast cancer therapy in vitro proof-of-concept.

A breast cancer monitoring product could reach market as early as Q4 2025.