Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

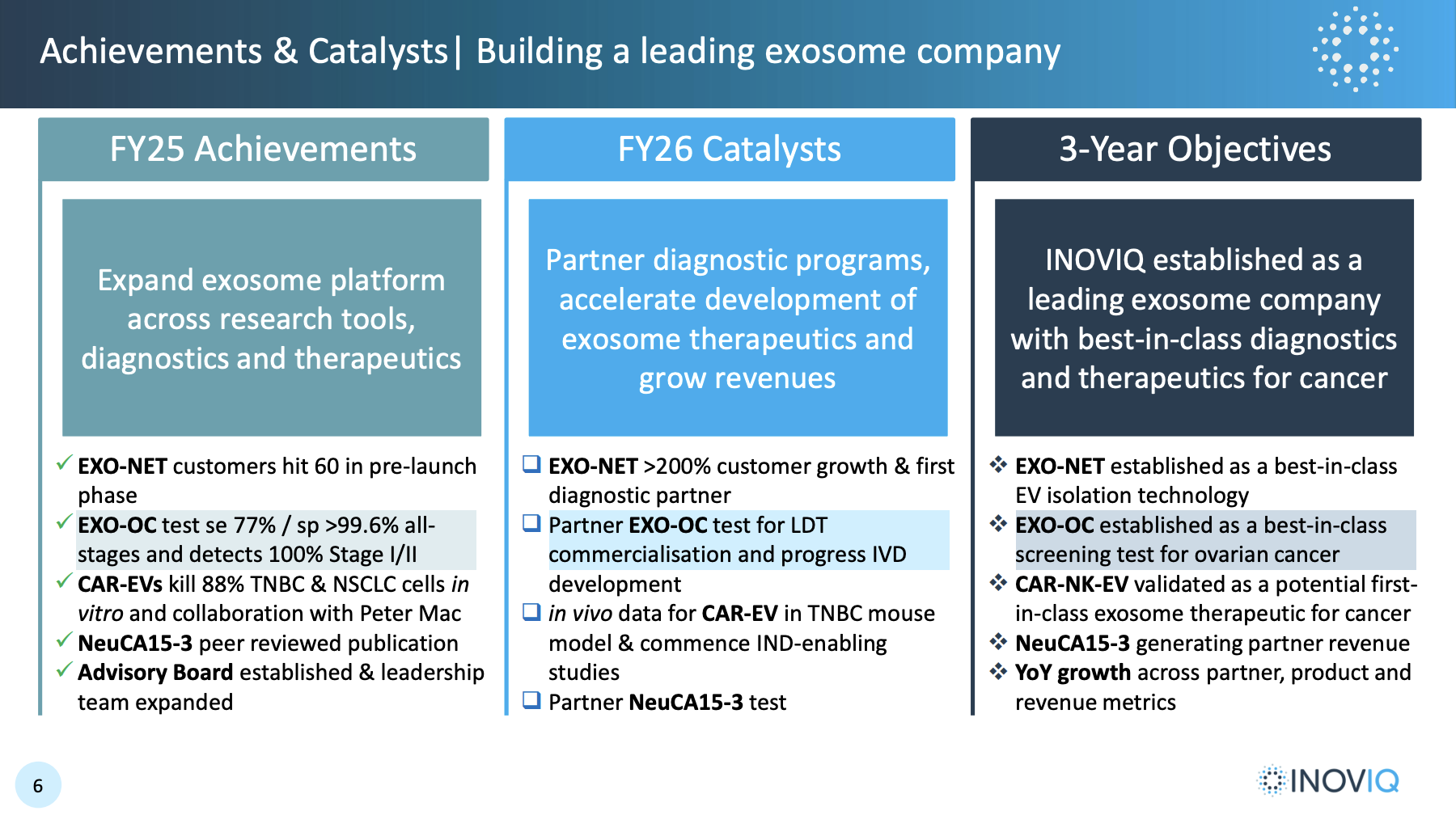

Alongside another momentum-crushing $9-11m raise, Inoviq have released a good company update including the following:

Given the sentiment towards both Inoviq and pre-revenue bios in general this year and what these now unambiguous goals suggest, this looks like a good set-up to me.

They've now got a Chinese investor, Tian An Medicare, with *edit* $5m or almost 10%, who runs a bunch of hospitals on the mainland. While potentially a good advocate, this also makes me wonder since they don't exactly have a good track record of honouring patents in that shining beacon of industrial-scale theft. But if you want access to China, I guess you have to find somebody eventually. Perhaps being Hong Kong based makes them more reliable? And apparently, we are only 3 years out for a ovarian cancer screening product.

Following a speeding ticket from the ASX IIQ released an announcement saying nothing to see here but wait until Monday for news.

"The new information to be delivered in the Poster presentation at the ASCO Annual Meeting 2025 on 1 June 2025 in Chicago is considered price sensitive. This poster presentation is currently confidential, tightly held and under embargo by ASCO and due for public release at 7:00 AM (CT) / 8:00 AM (ET) on the day of presentation (Sunday, 1 June 2025) and will be announced to the ASX before market opens on Monday, 2 June 2025."

"University of Queensland is currently drafting an Australian Provisional Patent Application (APPA) to protect its intellectual property rights covering the exosome ovarian cancer test. This draft patent application relies on the new data and results contained in the Poster which have been maintained as a trade secret and remains confidential. The draft APPA is not sufficiently final and is expected to be completed and lodged with the Australian Patent Office by 4:00 PM AEST on Friday, 30 May 2025 and relies on the Poster information remaining confidential until then."

ASX announcement: Notably, the EXO-OC test is particularly accurate in identifying early stages of ovarian cancer, achieving a sensitivity of more than 90% and specificity of 96% for stage I.

The AGM can be replayed. A good overview on early Exo-Net sales and the pipeline for diagnostic products (ovarian and breast) and therapy (triple negative breast cancer). Followed by DW quizzing the CEO and CSO for extra details to help us understand the strategy and timelines.

I can see how the strategy of selling the 'platform' Exo-Net globally through Promega while developing in-house ovarian and breast cancer diagnostics should create a positive feedback loop around technology validation, clinical uptake and crowd-sourced innovations. I appreciated the details on what it takes to get a new diagnostics test to market.

33 exo-net customers since August. Across universities, pharma and hospitals. Sales will build slowly as ideally the feedback loop takes effect. The relationship with Promega sounds well-supported and close.

December early-stage data expected (maybe some this week?):

- Ovarian cancer screening test biomarker validation. There is no existing ovarian test. The product might only get to market in 2029 (unless it gets unmet need fast-track), but positive news here would generate buzz around the Exo-net platform product and encourage researchers to try it for themselves.

- Breast cancer therapy in vitro proof-of-concept.

A breast cancer monitoring product could reach market as early as Q4 2025.

Inoviq announced today that their process to isolate brain-derived exosomes from a blood sample can be used to detect Parkinson's disease. In July they said they had similar success isolating markers for Alzheimers.

The process increases bio-markers by 5 to 8 times when compared with unprocessed blood, which implies diseases might be detected earlier.

Following on from DW's comments in the Strawman meeting about platforms an extension of the agreement to distribute the EXO-NET platform from IIQ. "I am impressed with Promega’s intended approach to marketing by leveraging AI to gain broader reach in presenting the benefits of scalable and efficient exosome isolation to researchers worldwide.”

Building upon last year’s successful Co-Marketing Agreement (ASX: July 6, 2023), this agreement extends the commercial relationship between INOVIQ and Promega.

The agreement grants Promega rights to market, distribute, and sell INOVIQ’s EXO-NET PanExosome Capture products, with an expected first order imminent.

The agreement is worldwide, allowing researchers and industry easy access to exosome research tools and solutions.The initial term is three years.

The companies jointly developed the high-throughput EXO-NET system and successfully delivered several scientific posters, conference presentations and webinars that received excellent feedback. Promega will use this knowledge to promote our products in market and thereby hit the ground running.

Definition: Exosomes are extracellular vesicles generated by all cells and they carry nucleic acids, proteins, lipids, and metabolites. They are mediators of near and long-distance intercellular communication in health and disease and affect various aspects of cell biology.

Broker report commissioned by IIQ. "We value IIQ at A$195m or A$2.11 per share (undiluted), using a risk-adjusted net present value (rNPV) method to discount future cash flows through to 2043, consistent with the expiry life of patent families. "

No projection of +ve cashflow up to CY24. A long term hold for me in RL and SM

EXCELLENT SUBB2M BREAST CANCER TEST DATA

• Griffith University releases additional data on BARD1’s SubB2M technology showing 100% specificity and over 95% sensitivity for detection of all stages of breast cancer

• BARD1 aims to develop and commercialise SubB2M-based blood tests for breast cancer to enable earlier detection, inform treatment decisions and improve women’s health outcomes

OUTSTANDING SUBB2M OVARIAN CANCER TEST DATA

~ Griffith University releases data on BARD1’s SubB2M technology showing 100% specificity and sensitivity for detection of all stages of ovarian cancer

~ Paper presenting this data at the Australia New Zealand Gynaecological Oncology Group (ANZGOG) Conference 2021

Melbourne, Australia, 11 February 2021: BARD1 Life Sciences Limited (ASX:BD1) (BARD1 or the Company) is pleased to announce that Griffith University’s Institute of Glycomics has released data showing that SubB2M can be used to detect all stages of ovarian cancer with 100% specificity and 100% sensitivity.

SubB2M is a protein that binds specifically to a sugar molecule called Neu5Gc which is present on a range of cancers. In humans, Neu5Gc is only found on human tumour cells and tumour-associated molecules, potentially making Neu5Gc a highly specific pan-cancer biomarker. BARD1 holds the exclusive worldwide license for the use of SubB2M to detect any cancer.