Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

KME provided an update for the first 4 months of trading of 1H FY25 - Looks Good

There were certain red flags as well

I could count the number of AI mentions. I hope Storm doesn't invest in some crazy AI idea now.

The migration of Silver Franchises to Gold Franchises is accelerating. Very soon, all Silvers will go, and then hopefully, KME can increase gold franchises or keep the existing ones and grow them.

I have put together my thoughts in the article below:

https://arichlife.com.au/kip-mcgrath-education-centres-asx-kme-fy-2024-show-stronger-second-half/

Kip McGrath reported 1st half 2024 result today.

Main issue as i see it is ongoing investment in the business. It increased revenue by $2.5m but increased employee expense by $2.6m.

This increase in employee expense increase probably coming from corporate centers ( management flagged recent corporate center acquisitions incurred additional cost of $250,000.

It seems like it lost the Abu Dhabi schools' contract after AGM i.e lost $510,000 profit and it is the probably the reason why it subtly downgraded the full year outlook

From "Expect FY24 full year NPAT to exceed prior year" at the time of AGM in November to now " FY24 full-year profit is expected to align with the prior year result"

The market has lost patience and I am not sure how long current shareholders can keep faith in management.

Bag holder.

Here is an interesting chart.

KME is increasing its Revenue/Share but in the last 5 years, it has also invested heavily in corporate rollout / online shift / US expansion. Hence, increased Revenue/Share hasn't been contributing to an increase in earnings/share in the last 5 years. Hopefully, We are at the end of this investment cycle.

This morning KME published the AGM presentation as a generic announcement.

It did have Q1 FY24 updates and FY24 guidance - I am not sure why it wasn't a price-sensitive announcement.

Q1 FY24 Highlights

- Revenue grew by 20%

- Student numbers up 4%

- Lesson numbers up 5%

- Tutorfly revenue 0.433m for Q1 ( up from 0.068m)

- New opportunities in California, Maryland, and NJ

- Contracted services reached 3m for FY24 ( up from 2.6m at the end of FY23)

- Established partnerships with 14 school districts ( up from 11 at the end of FY23)

- Expanded presence to 10 states ( up from 7 at the end of FY23)

- 7% increase in Customer Lifetime value

- fee increases

- increasing tutoring weeks per year

- Corporate Center

- Increase 6 corporate centers in first quarter

- Total 35 corporate Quartner ( up from 29 at the end of FY23)

- US Expansion

- New US center to open by March 2024 in Frisco, Texas

- Investments Continue

- Buying back Corporate Center + US expansion will impact half-year results

There was no option to join AGM online so no idea what was discussed.

It seems like the company is increasing revenue and growing but also increasing investment at the same pace - It comes down to, do you have trust in the Management that the investment it is doing is effective or burning cash.

Don't think issue is of alignment - as Storm has significant personal wealth tied to the business...so questions just come down to his skill and ego etc. -- Your guess is as good as mine -- Revenue is growing so hopefully at some stage he will stop investment and cash will flow... or AI will eat its business ??

I like the progress KME is making so will keep on holding..

Kip McGrath released its FY23 report and the following are the graphs,

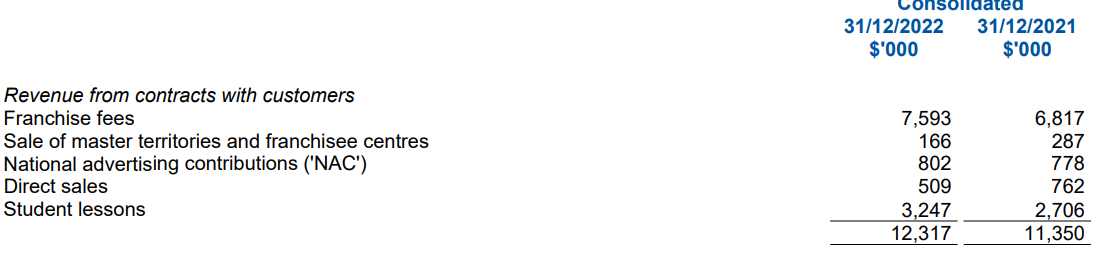

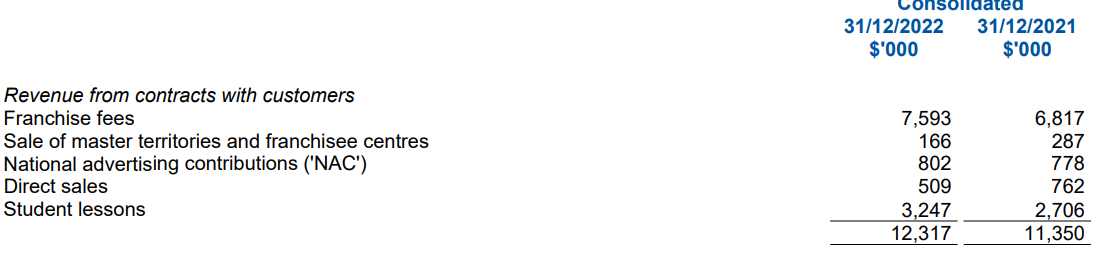

Revenue:

Customer Receipts:

Expense:

Operating Cash

No. of Shares

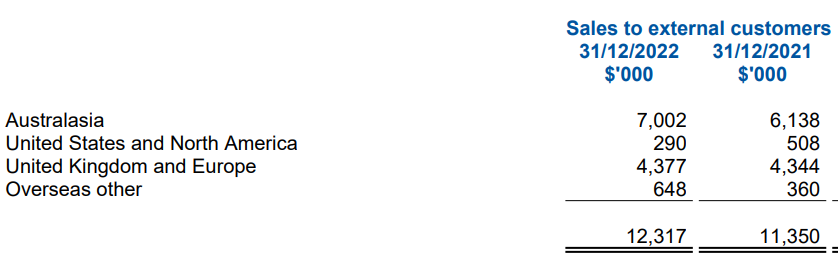

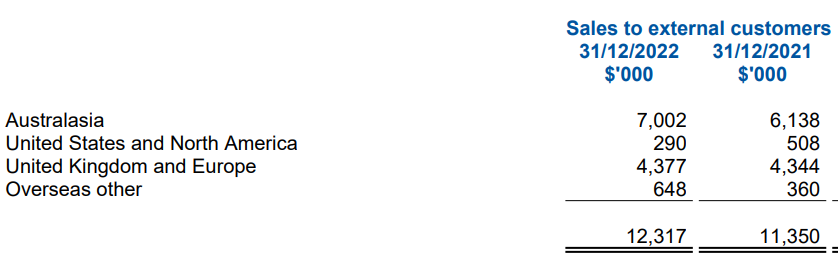

Geographic info ( USA is dragging the performance)

Revenue breakdown

Franchise fees are increasing because the Silver franchise is getting converted to Gold. Overall Student lessons are bringing higher revenue. ( at the end of the day that's the most important matric to see )

Some encouraging traction for Tutorfly

Corporate Center

Yes, Tutorfly is a drag but its a relatively small part of the business. The Franchise Network and Corporate Center are going in right direction. Hopefully based on the comments from the Annual Report, Tutorfly will come good in FY24. Overall happy with the result.

Monthly Newsletter_July_2023_Digital_230712_093419.pdf

Page 13 : Australasian Emerging Companies Fund comments

KME updated the market this morning with following are lower range of updates

Rev : 26.9m

EBITDA : 6.4m

NPAT : 1.7m

Now at Share price of 0.42 --KME's market cap is ~24m

That means currently it sits on PE of ~14

If you expect KME to grow and increase its market share from investment in the last 3 years, then it looks pretty cheap at this price.

If you expect KME services will be redundant through AI innovation then probably its value is zero. ( as everyone will use AI tutor and no one wants to use KME service)

My opinion is that AI innovation will add value to existing tutoring services as opposed to replacing it and as it stands today KME's online competitors like BYJU or CLUEY are not sure they would be around 2 years from now.

Nice article explaining current state.

https://www.edweek.org/technology/what-chatgpt-could-mean-for-tutoring/2023/05

Based on the reading it seems to me that tutors work will be assisted by AI. Tutor won't be replaced by AI completely but it will reduce lot of admin work for tutors and allow them to focus on main goal i.e students progress. and my thinking is that is good for KME as it will increase efficiency and ideally reduce operating expenses.

Now not every company will be able to create their own AI powered system so i expect some technology company bringing platform to provide that service to tutoring centers. It would be interesting to see how it pans out.

Tutorfly's performance was a major drag on Kip McGrath's performance in 1H FY23. with promising words about 2nd half in report.

Seems like the new revenue stream: drop-in tutoring" is working (https://www.dropintutor.com/)

https://gmcs.org/2023/01/free-on-line-tutoring/

KME Reported its FY23 report and the share price has gone downhill ( i.e no change after the result as it was going downhill before the result as well)

It seems that the market didn't like that NPAT has gone 29% down or it didn't like that revenue only increased by 9.2%.

Yes, the result wasn't great but to my eyes, It wasn't bad at all compared to what I was expecting or fearing that inflation will seriously hamper its tuition numbers.

Some of the bright spots in the results for me

- The corporate business continues to scale and has achieved profitability for the first time

- May be market didn't like the cashflow shown but the underlying net cash flow from operations was $3.1M

- Cash flow from operations this half was affected by $2.3M in outflows to franchisees

- Revenue from Franchise fees and Student lessons are trending in the right direction

- Revenue performance was hampered by UK/Europe and the USA. Now I have noticed the trend that most of the reported companies had issues gaining growth momentum in UK/Europe in this period and for USA, KME is saying that there were some delays with Tutorfly Director comments as below:

- " We have contracts in place for the second half to see revenue return to last year’s levels for the full year and are now working with 4 school districts up from 1. We have also developed a new revenue stream for ‘drop-in tutoring.’ Currently, in use at one school district, a click button provides an instant help feature. We believe this new service for drop-in tutoring provides an exciting new business opportunity more widely throughout all operations"

So in nutshell, Yes company didn't had a great half but I think it has been punished way more than it should ( in my opinion - anyway) probably illiquid nature has to do with it. Hopefully, the same illiquidity will at some point act in shareholder's favor - I shall wait for such time.

As KME did their AGM only face-to-face and not provided online options ( I don't really know what was said in AGM)

I actually requested if they can provide an online AGM for someone like myself who is not Sydney based to attend - the response that came back was along the line of " KME is a small company and the cost for the hybrid meeting are prohibitive"

Well, I like the cost-conscious view but setting up a hybrid meeting isn't that difficult nowadays - in my opinion, but anyway...

There were some mixed comments on the presentation

- KME expects a skew towards the second half ( First half trading is seasonally lower) - In my mind, this is a nice way of saying that the first half will be soft

- Tutorfly is scoring goals it seems - ( FY23 YTD contracted work is currently equal to the total for FY22, with 8 months remaining to secure additional work)

- Middle east growth is picking momentum ( 4000 students/week up from 2500 students/week)

- Corporate centers growth is intact ( 2700 students per week up 20% from June 2022)

Seems like the franchise is probably suffering in an unfavorable macro environment. but KME will sustain reasonable growth because of Tutorfly, the corporate center, middle east

Overall, I am not too concerned about it.

KME has provided guidance so the following is what I am expecting

Things I want to know in FY22 reports

- How Corporate centers are performing? What level of margin can be expected and when we will see effect on bottom line?

- How blended tutoring is working? Online tutoring percentage? further technology investment required?

- Tutorfly progress? What's the plan for the near and medium term for tutorfly?

One of the online learning platforms Cluey released its half-yearly result today.

Revenue has increased significantly from the previous period but I am not sure if the model is going to survive longer.

The way I read it, They had to spend 4.5m in marketing to get 15.7m revenue.

15.7m revenue required 7.2m cost to generate 8.5m gross profit

To increase gross profit, they increased their marketing 15 times, Admin roughly 10 times, and employee expense 10 times.

Most of the employee expense is also the cost of sales for this business as without tutors there is no classes. [ so in fact gross margin would be very less if you factor that also in]

Q1 FY22 updates

- 8% lesson growth rates

- 21% higher revenue compared to FY21

- 5 additional corporate centers by early 2022

Outlook

- Revenue, profit, and profit margin will continue to grow

Post a valuation or endorse another member's valuation.