I have been doing a bit of work on KME, just because they have started reporting a bunch of metrics they previously did not. While I think reporting contribution margin is important, there's two issues: Firstly, KME is a far more complex business than it was pre-covid when it was just a high margin franchisor and secondly they have an issue with expense escalation. I think the new metrics are probably designed to try and give a better understanding of thinking about the business, although I think management still does quite a poor job of explaining what's going on under the hood.

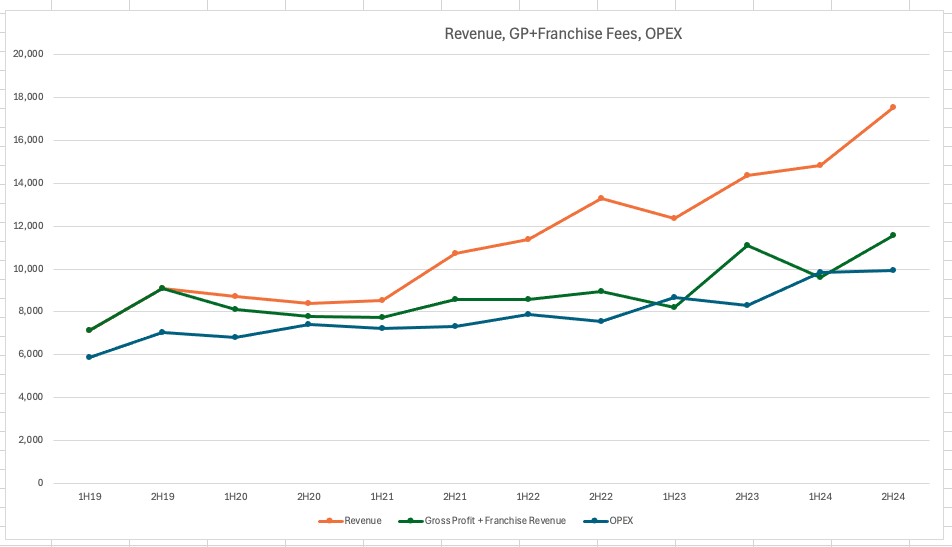

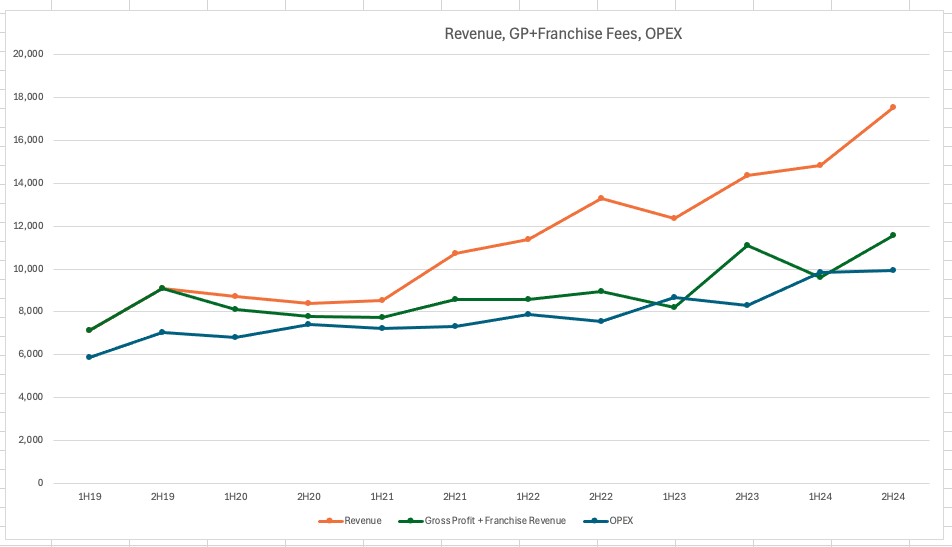

So my way of thinking about KME is to push some of the opex into the COGS line and then get a "gross profit" that is franchise revenue + the GP of the corporate centres and TF (there are some assumption here around what % KME keeps). It at least gives me some basis to compare to 2019. As you can see the issue is that while revenue has grown strongly, the change in the nature of that incremental revenue – high margin franchise to low margin student lessons – has not been able to support the opex cost escalation. Granted, part of that is they have had to invest through front ended expenses in the p&l. But I think most investors (and the SP) would agree the main issue here has been quite undisciplined expense control.

So my interest here is that with a bit of cost discipline, like from say a new chairman, there is potentially a lot of latent operating leverage that could flex over the next 12-18 months. The AGM trading update was positive but more interesting to me was the outlook of focussing on ROC, expectations of reducing capex spend and potentially some margin expansion.

I'm still not convinced about TF, it seems like a massive distraction for a business that brings in ~$500k or so, but maybe they take a view that it is part of the expansion into the US. The franchise business seems to have a lot of potential, it is low capex and high ROIC given they already have a presence in AU/UK, I would see it as a positive if they decided to try and juice that a bit more rather than try and crack the US. But down here, I think the odds are in my favour and they really only have to not do stupid things and the SP should do quite well. The test will be watching what happens to the gross profit, opex cost jaws.