Fillin the truck ....errr the Van up with more units.......

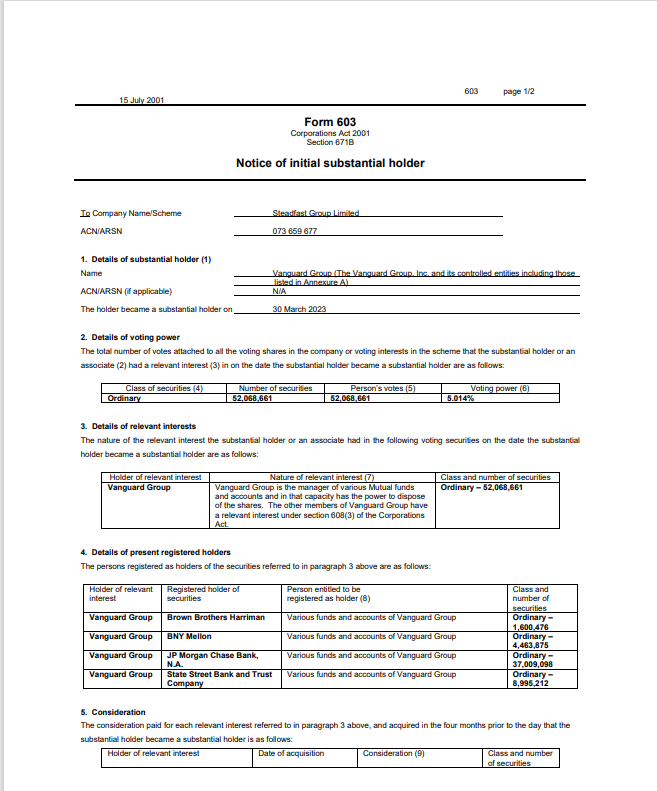

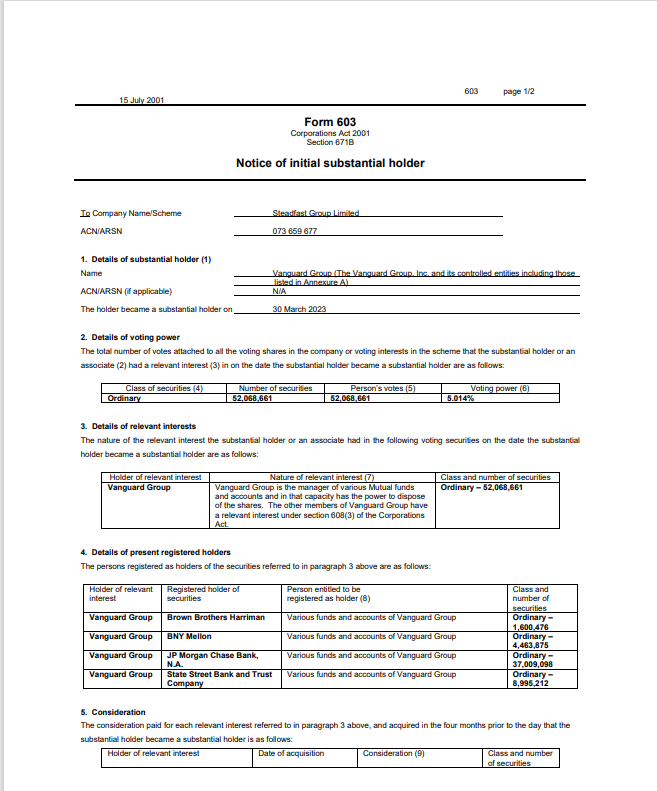

Class of securities Number of securities Person’s votes Voting power

Ordinary 52,068,661 52,068,661 5.014%

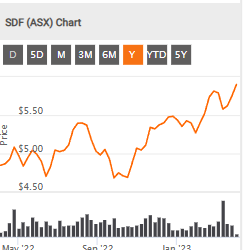

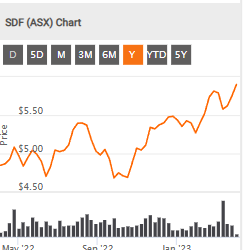

SDF had a good year Quality stuff here Some capital growth , EPS growth is good

Gross Divi at 3.3%

Pe ratio is up high 20% signs of quality stuff here..

Inflate the Premiums the customer will pay..

Steadfast Group Limited (SDF) provides services to steadfast Network brokers, distribution of insurance policies via insurance brokerages and underwriting agencies, and related services. The Group's corporate structure includes equity investments in insurance intermediary entities (insurance broking and underwriting agencies), premium funders and complementary businesses. They majorly operate in Australasia, with growing operations in Asia and Europe.