Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Insurance premiums have been moderating and this has weighed on the share price.

The disasters impacting QLD with the floods and fires in VIC are likely to start seeing premiums rise again would be my guess. As a broker SDF would be one medium term beneficiary I imagine from the disasters.

Takeover speculation - Steadfast Group targeted by Blackstone in $7bn buyout talks | The Australian

AUB’s larger insurance broking rival, Steadfast Group, is now the topic of private equity interest, with talk that New York-based powerhouse Blackstone is assessing a possible buyout of the $5.5bn business.

It comes at an opportunistic time, with Steadfast’s share price still to fully recover after chief executive and managing director Robert Kelly became the centre of a workplace complaint, from which he has since been cleared.

The shares fell from a $6.63 high for the year and closed on Thursday at $5.

Mr Kelly is the founder of the business, which launched in 1996 with 43 brokerages and has over 52 years of industry experience.

He has grown the company to become Australia and New Zealand’s largest general insurance broker network and group of insurance underwriting agencies.

Also hurting share price performance is that insurance premium growth has come under pressure, with forecasts downgraded.

It comes just days after private equity firms CVC Capital and EQT walked away from a plan for a joint $5.3bn bid for Steadfast’s smaller rival, AUB.

While it’s unclear what spooked the private equity bidders, sources say the logical reason is that the company’s premium growth was lower than they anticipated, causing them to determine the company was not worth $45 per share amid due diligence.

Steadfast said at its October annual general meeting that the first three months of the 2026 financial year had seen a lower increase in the premium rate in Australia compared with its expectations of a three to five per cent increase when the 2026 financial year guidance was originally set.

“We now anticipate the average premium rate increases for the full year will be between one and two per cent,” Steadfast chairman Vicki Allen said in her speech.

AUB said at its AGM that it had not observed the same industry trends surrounding premium rates during the first quarter, and rather, observed premium rate rises in Australian broking in the range of 5 to 7 per cent.

In October, Blackstone bought a major stake in India’s Ace Insurance Brokers.

The private equity firm is the world’s largest asset manager with more than $US1 trillion ($1.5 trillion) under management and has owned other insurance brokers in the past.

However, some were cautious about whether Blackstone would move on the target, given the sheer size of the company, making a deal tougher to execute.

Adding a 30 per cent premium, buying Steadfast would cost Blackstone over $7bn.

But further consolidation is expected in the insurance broking space.

Last year, the Australian-listed PSC was sold to Ardonagh for $2.26bn.

Private equity firms are drawn to insurance brokers because they are capital-light, have recurring revenue streams and it is a fragmented market that is ripe for consolidation.

It also has defensive characteristics.

Another drawcard is that the groups hold cash that they receive from customers that they can earn interest on before making payments to insurance providers for products.

Some coverage of the complaint here -

https://www.afr.com/companies/financial-services/steadfast-ceo-stands-aside-pending-sexual-harassment-investigation-20251030-p5n6n0

Unfortunately for investors, the "senior executive" under this cloud is Robert Kelly himself.

Why can't some of these folks keep it in their pants? Is it just me, or do these kinds of instances seem to be on a steady rise in recent times?

News Summary

*DJ Steadfast Shares Halted Amid Investigation of Senior Executive

SDF$6.20-$0.09 (-1.4%)$6.20$5.78

30 Oct 2025 10:40:02

Steadfast Technology LARGEST GENERAL INSURANCE BROKER NETWORK IN AUSTRALIA MORE THAN 400 BROKERAGES AND ANGENCIES UNDER ITS UMBRELLA.

• Acquired Insurebot, an online broker platform that streamlines the quoting process for brokers, enabling them to deliver multi-quotes from any digital source. The addition of the Insurebot tech team brings further capability to our current AI team

• Introduced Steadfast Apps, a streamlined broker management system that integrates and automates existing broker capabilities with workflow features that transform administrative processes to help brokers processes and increase client interaction efficiently

https://hotcopper.com.au/threads/ann-steadfast-group-fy25-results-investor-presentation.8739862/

Per Macquarie:

Key Points Jun '25 was a strong pricing month for Business Pack and Workers Comp. Weaknesses remained in Commercial Motor, Home and Strata. We estimate a portfolio with SDF's product mix would have achieved +7.2% pricing in the Jun '25 qtr, compared with their guidance of mid-single-digit. SDF is trading at a ~20.8% discount (vs a 2.3% long-term premium) to international brokers.

Comprehensive report into strata insurance

$6.80 Price Target

The CHU factor: We estimate CHU (owned by SDF, capacity with QBE) had a ~43% market share in FY24 (down from ~50% in FY22). This is significant given we estimate Australian Strata risks are now one of QBE Group's top-three catastrophe exposures, and would be adversely affecting the cost of their Group reinsurance covers. In response, QBE has purchased a ~12.5% Quota Share, and will exit the Flex business, whilst also picking up lower share on SDF's contestable platform. As a result, new entrants such as Hutch are quickly picking up share, and with Sure recently changing its capacity to AXA XL (from Liberty), customers appear likely to receive more choice going forward.

...

IAG and SUN’s market-share losses align with their strategies to pull back from a product that earned sub-optimal returns for a long period of time

QBE (via the CHU agency) effectively became the buyer of last resort in FY22, but this began to turn in FY23 as Lloyds and Allianz capacity begun taking share. In the last 12 months, Hutch has entered the market and Sure Underwriting Agency changed its Strata capacity to AXA XL (from Liberty), thus we expect CHU's market share to continue to contract in FY25. Overall, the additional competition should be good for customers and assist brokers to source three quotes

....

We estimate ~25% of CHU's GWP is up for renegotiation in CY24/25. Þ If we assume a fixed-cost base for CHU, should a quarter of the 25% of GWP be redirected away from CHU (~7% of the total), we estimate this could equate to ~4.7% of SDF Group EPS in FY23, excluding the impact to SDF's Strata brokers (e.g., BAC and BCB). Having said that, to our understanding, all contracts have been retained thus far.

Use of broker platforms is significantly below that of Business Package, or even Commercial Motor products, because very few broker platforms have a Strata offering. This adds to the inefficiencies across the broker market

Outlook • The Strata market is likely to continue to garner negative press over the medium term, spurred by affordability challenges. Ongoing uplift of disclosure in NSW is already in train, and we would expect this to follow in other states. For brokers, the pathway to improvement has been outlined in the Trowbridge report for some time, and we expect media attention to be the catalyst for industry-wide change

...

Appendix A: What is Strata insurance? • Strata insurance typically covers a building, as well as contents/property in common areas (as defined on the title of the property) in the event of loss or damage. Strata insurance must also include liability cover in the event people are injured on common property. This form of insurance is compulsory under each Australian state’s legislation for both residential and commercial Strata properties.

Volumes: Asset volume growth has been very strong due to: #1) a construction boom pre-Covid in Australia and #2) migration towards more urban living pre-COVID. This supported ~3.8% growth pa of Strata schemes nationally over 2018-20. Þ According to a University of NSW study in 2022, nearly 10% of Australians and almost 14% of households live in apartments.

• Pricing: Price rises have been consistently strong, ranging mostly 8%-12% on average between 2018 and 2021, accelerating until Dec '22, and now stabilising at 14%-17%. Pricing was led by reinsurance costs, claims cost inflation and higher distribution costs. Looking forward, we believe the reset of sums insured and higher regulatory costs will lead prices higher, while the Rate On Line could stabilise.

Vertically Integrated Insurance Brokers Under Regulatory Scrutiny

Nathan Zaia

Senior Equity Analyst

Analyst Note | by Nathan Zaia Updated Sep 10, 2024

Steadfast's, and to a lesser extent, AUB Group's, shares fell materially following an ABC report concerning strata insurance commissions. The crux of the allegations being that Steadfast brokers are conflicted in recommending strata insurance because Steadfast owns the largest strata agency in the country, CHU. And as a result, premiums are rising for customers because of Steadfast’s market dominance. Another claim, which Steadfast did not dispute, is the existence of joint ventures between brokers and strata managers that potentially skirt the strata managers' disclosure requirement as it is not “commission.” This is a bad look, adding an unnecessary financial incentive to use one broker over another. Considering all this, the chair of Australia’s competition regulator is calling for a ban on strata insurance commissions. Nevertheless, we think both narrow-moat firms are undervalued, with the potential regulatory intervention in the sector rattling confidence.

Steadfast equity-owned strata insurance brokers contributed around 5% of fiscal 2024 group profit. The agency business is much more heavily weighted to strata, though—we estimate the total contribution to profit from strata is between 15% and 20%. AUB has a smaller exposure to strata, making up 5% of gross written premium, or GWP, in fiscal 2024.

We lower our Steadfast fair value estimate by 8% to AUD 6 per share and AUB Group's by 3% to AUD 34 per share on downward revisions to agency earnings. For Steadfast we assume some market share loss and downward pressure on premium rates in strata. Increased oversight on brokers to ensure all policies are in the client’s best interests, even if it becomes overly cautious, could see more volume go to other insurers. CHU may be forced to compete more on price, even if a competing policy is not entirely comparable, to reduce the risk of customers feeling they are being given dud advice.

down 6% and now in a trading halt.

https://amp.abc.net.au/article/104321746

doesn't look good. I have had this one on my watch list for some time.

do not own

I hold AUB and SDF.

It's a classic "clip the ticket" business model, whilst taking none of the risk of the underlying insurance policy. Since the takeover of PSC, the only two players of any size left are AUB and SDF. They have both been serial acquirers of smaller broking businesses, and have integrated them well into their existing businesses. We are all painfully aware of the recent increase in insurance policy costs, and whilst I own for the logical assessment of the business, my irrational pleasure in seeing insurance costs rise is because I will benefit from my ownership of these companies. Not enough to compensate from the increased costs. Irrational.....! I don't own toll road operators (because of the multiples) but I would imagine people who do would also get a smile every time they drive through a tunnel and get charged.

Both companies will probably get taken out at some point, the industry is very much driven by increasing scale (Thx to MJ, for his recent analysis) but this isn't a core part of the thesis.

The following is an excerpt from the Morningstar website.

Higher insurance premiums are a tailwind for the insurance broking and underwriting industry but were not the sole driver of Steadfast’s strong fiscal 2024 result. Underlying earnings before interest tax and amortization rose 23% to AUD 529 million, aided by volume growth, new joiners to the network, acquisitions, margin improvement, and higher interest income earned on premium payments. Fiscal 2024 earnings came in at the top end of guidance and broadly aligned with our expectations. Acquisitions remain a core contributor to growth, and Steadfast has a good track record of buying and integrating businesses. Organic and acquired EBITA growth was split roughly 55/44 in the year. At group level, EBITA margins improved by 100 basis points to 31.5%.

We raise our fair value estimate by 3% to AUD 6.50 on the time value of money. We expect Australia’s largest insurance broker to benefit from higher premiums again in fiscal 2025, with our EBITA forecast of AUD 600 million, implying 13% growth, at the top end of guidance. We include upside from around AUD 300 million Steadfast expects to spend on acquisitions. This is the normal course of business, given part ownership stakes in many associates. Shares trade in line with our fair value estimate, adequately capturing the 10% per year earnings per share growth we forecast over the next five years.

Australian listed insurers expect mid to high-single-digit average premium rate increases in fiscal 2025 to cover claims inflation, this should flow through to Steadfast earnings in higher commissions. The other drivers of Steadfast’s earnings growth include attracting more brokers to the network, more customers using a broker instead of purchasing directly from insurers, and acquisitions, mainly by increasing the equity stakes of brokers within the group. Over the medium term, we expect a slowdown in premium rate increases (and commissions for Steadfast) but expect margin improvement as some discretionary technology spending wanes.

Inside Ownership Ordinary Shares Net Value at $5.80

Frank O’Halloran Chair 1,096,521 $6.359m

Robert Kelly 3,012,572 $17.44m

Vicki Allen 55,837 $323K

Joan Cleary 42,996 $249K

David Liddy 105,837 $613K

Gai McGrath 67,979 $394K

Greg Rynenberg 1,030,775 $5.978m

Total 5,412,517 $31.39m

*Note Percentage of ownership for all directors was under one percent of all share issue so have no include in the table above.

Frank O'Halloran AM - Non-Executive Chairman (independent)

Frank had over 35 years’ experience at QBE where he was Group CEO from 1998 until 2012. He also worked with Coopers & Lybrand for 13 years where he started his career as a Chartered Accountant. Frank was President of the Insurance Council of Australia from 1999 to 2000 and was inducted into the International Insurance Hall of Fame in 2010. Frank received his AM for services to the insurance industry and philanthropy.

Robert B. Kelly AM - Founder, Managing Director and Chief Executive Officer

Robert co-founded Steadfast and has over 52 years’ experience in the insurance industry. He was voted the second most influential person in insurance by Insurance News, and was awarded the ACORD Rainmaker Award in 2014. Robert is a Qualified Practising Insurance Broker, a Fellow of NIBA, a Senior Associate of ANZIIF, a Certified Insurance Professional, a Fellow of the Australian Institute of Company Directors and is the Chair of the ACORD Board in New York. Robert is also a Director of ASX-listed Johns Lyng Group Limited and not-for-profit organisation KidsXpress.

Vicki Allen - Non-Executive Director (independent)

Vicki has over 30 years of business experience across the financial services and property sectors. She held senior executive roles at a number of organisations including Trust Company, MLC Limited and Lend Lease Corporation. Vicki is currently the Chair of the BT Funds board, and a Non-Executive Director of Bennelong Funds Management. She is a fellow of the Australian Institute of Company Directors.

Joan Cleary - Non-Executive Director (independent)

Joan has over 30 years' of finance and leadership experience in the general insurance and reinsurance industry. She held senior executive roles at a number of organisations in Australia and England including QBE Insurance Group Limited, and GE’s London Market reinsurance operations. Joan holds a Bachelor of Laws from the University of Exeter. She is a Fellow of the Institute of Chartered Accountants in England and Wales (ICAEW) and is a Graduate of the Australian Institute of Company Directors.

David Liddy AM -Deputy Chairman & Non-Executive Director (independent)

David has over 45 years’ experience in banking, including postings in London and Hong Kong. He was Managing Director of Bank of Queensland from 2001 to 2011. David is a Director of Emerchants Limited. He is a a Fellow of the Australian Institute of Company Directors. David received his AM for services to the banking and finance sectors and the community of Queensland.

Gai McGrath -Non-Executive Director (independent)

Gai has over 35 years’ experience in the financial services and legal industries, including 12 years with Westpac Group as General Manager of Westpac’s retail banking businesses in Australia and New Zealand. Gai is currently Chair of BT Super and Humanitix. She is a Director of Genworth Mortgage Insurance Australia, HBF Health Limited and Toyota Finance Australia. Gai is a Graduate of the Australian Institute of Company Directors.

Greg Rynenberg -Non-Executive Director (independent)

Greg has over 40 years’ of experience in the insurance broking industry, with 36 years spent running his own business, East West Group. East West Group is a Steadfast Network Broker not owned by Steadfast. Greg is a Qualified Practising Insurance Broker, a Fellow of NIBA and an Associate of ANZIIF. He holds an Advanced Diploma in Financial Services (General Insurance Broking) and was named NIBA Queensland Broker for 2014.

Andrew Bloore - Non-Executive Director (independent)

Andrew has over 35 years of experience in the Australian superannuation administration technology sector.He is highly experienced in the design and delivery of disruptive technologies and distribution models to improve efficiencies in superannuation administration. He has a strong strategy and profitability focus and involved in corporate transactions throughout his career.Andrew also sat on a wide range of Australian Tax Office and Treasury Committees. He is currently the Chair of Guild Group and its subsidiaries, including Chair of Guild Insurance and is a Director of Meridian Lawyers. Additionally, Andrew is a Director of Insignia Financial Ltd, Simonds Ltd and Simonds Family Office.

Assumed 3 scenarios ranging from growth at 20% - 10%. Share count increasing to 1374.5m and Net Margin 20%. Discounted back giving me intrinsic value of $7.33

SDF Capital Raise History

· November 2023 Raised $348m, $280m Institutional at $5.14 per share, Retail $68m

· August 2022 Raised $233.4m , $225m Institutional at $5.14, $8.4m Retail at $4.76 per share

· August 2021 Raised $253.1m, $200m Institutional at $4.51 per new share, $53.1m at $4.51 per share

· August 2019 Raised $119m , $100m Institutional at $3.28 per share, Retail $17m at $3.38 per share.

· December 2017 Raised $107.76m, $100m Institutional at $2.83 per share, $7.76m Retail at $2.75 per share

· February 2015 Raised $300m, $186m Institutional, $114m Retail at $1.26 per new share.

· October 2023 acquire 100% of ISU Group (ISU). ISU is one of the largest privately owned independent insurance agency networks in the United States of America. US$55m https://announcements.asx.com.au/asxpdf/20231006/pdf/05vrrqgrgz1r40.pdf

· August 2022 acquire 100% of Insurance Brands Australia (IBA), and its subsidiary companies. IBA is one of Australia’s largest privately owned insurance distribution businesses established in 1983 and is predominantly focused on the SME sector. https://announcements.asx.com.au/asxpdf/20220817/pdf/45cxvvmdsf9476.pdf

· August 2021 acquire 100% of Coverforce. $411.5m Coverforce is one of Australia’s largest privately owned insurance brokers which is predominantly focused on the SME sector. https://announcements.asx.com.au/asxpdf/20210816/pdf/44zbdvx767pv48.pdf

· April 2021 increases its shareholding in unisonSteadfast to majority stake of 60%. https://announcements.asx.com.au/asxpdf/20210419/pdf/44vntmg6vg3qsp.pdf

· July 2019 takeover bid for IBNA. IBNA is an unlisted public company and network of insurance brokerages, with approximately 80 IBNA broker members across Australia. https://announcements.asx.com.au/asxpdf/20190729/pdf/446yd11w95x7m2.pdf

· December 2017 acquire 100% of Whibread Insurance Group a leading general insurance broker and Axis Underwriting Services (“Axis”), an underwriting agency specialising in niche areas of property and liability. WIB, established in 1978, is focused on the small-to-medium enterprise general insurance market with offices in Melbourne, Sydney and Brisbane. Axis, established in 1999, is a specialist underwriting agency focusing on niche areas of property and liability. The broking operation will join Steadfast Group’s existing portfolio of equity-owned brokers while Axis will become the 25th member of the Steadfast Underwriting Agencies portfolio. https://announcements.asx.com.au/asxpdf/20171204/pdf/43pvlw7qqq9s4n.pdf

· June 2017 acquires stake in unisonBrokers. Acquire a non-controlling stake in unisonBrokers (“unison”) to grow the global distribution platform for both networks. Unison, based in Hamburg, Germany and Chicago, USA, is among the largest networks of general insurance brokers worldwide1 with an international presence which includes 200 brokers across 130 countries and $US17 billion of gross written premium. unison brokers are able to offer multi- jurisdictional coverage to their clients by leveraging the network’s global footprint. unisonBrokers was founded in 2005 by Wolfgang Mercier who has operated as CEO since inception. It is among the largest networks of general insurance brokers worldwide with 200 brokers across 130 countries and $US17 billion of gross written premium. It facilitates multi-jurisdictional transactions for brokers who are part of the network. https://announcements.asx.com.au/asxpdf/20170608/pdf/43jty71pq71pt4.pdf

· November 2016 Ruralco a subsidiary of Steadfast announce two acquisitions. Ruralco has entered into agreements to acquire a 50% joint venture interest in Ausure Consolidated Brokers Pty Ltd (ACB), currently a subsidiary of the Steadfast Group (ASX:SDF), including merging the assets of Ruralco Insurance Pty Ltd (Ruralco Insurance) into ACB. Ruralco’s wholly-owned subsidiary, Roberts Limited, has entered into an agreement to acquire the business of TP Jones Pty Ltd (TP Jones), a CRT member operating out of four retail locations in the North, North West and Midlands regions of Tasmania. https://announcements.asx.com.au/asxpdf/20161115/pdf/43cwypc6y0g8ct.pdf

· February 2015 acquires the Australian and New Zealand business of IC Frith (excluding its warranty business and New Zealand based insurer), a founding member of the Steadfast Network. https://announcements.asx.com.au/asxpdf/20150216/pdf/42wmdnr1tvk4h1.pdf

· February 2015 QBE today announces that it has entered into an agreement with Steadfast Group Limited (Steadfast) for the sale of 100% of QBE Australian & New Zealand Operations’ Australian agency businesses CHU Underwriting Agencies Pty Limited (CHU), Corporate Underwriting Agencies Pty Limited (CUA) (also known as Body Corporate Brokers or BCB) and Underwriting Agencies of Australia Pty Limited (UAA). A$348m. https://announcements.asx.com.au/asxpdf/20150216/pdf/42wmdjyfryy3dd.pdf

· August 2014 acquire Calliden Group $55 million. Steadfast has today also entered into an on-sale agreement with MHA to acquire the general insurance operations, including the net tangible assets of Calliden Insurance Limited, and its Business Package and Commercial agency operations immediately following implementation of the Scheme (On-Sale Agreement) . Upon implementation of the Scheme Steadfast will own the remaining eight agency businesses being all of ARGIS Farmpack, Builders’ Warranty, Calliden Home, Dawesmotor, IUA business interruption, Mansions and Accident and Health and 50% of QUS strata. https://announcements.asx.com.au/asxpdf/20140827/pdf/42rs7qrhj5xdrd.pdf

· August 2014 Steadfast partners with Steadfast Re. Steadfast Re, formerly Beach & Associates Sydney, was established in 2004 as a reinsurance broker. It has pioneered the brokering of casualty facultative and introduced insurance-linked securities (ILS) reinsurance to the Australian and New Zealand markets. Its analytical work and innovation plus its unique relationships with both rated paper and ILS reinsurers have enabled Steadfast Re to deliver creative solutions and value to its clients. https://announcements.asx.com.au/asxpdf/20140805/pdf/42r8zb2jfnrvws.pdf

· August 2014 announced that it has agreed to acquire 72.3% of Ausure Group. an Authorised Representative (AR) network of insurance professionals in 150 locations across Australia. Ausure Group was founded in 1996 and became a Steadfast member in 2012, the same year it merged with AFM Insurance Brokers. Ausure has a total of 336 brokers in 150 branches across Australia. Each branch is independently owned and managed by an insurance broker who is a member of Ausure. With head offices in Newcastle and Brisbane, Ausure provides its brokers with network services including training, networking events, centralised back office services and IT systems. https://announcements.asx.com.au/asxpdf/20140801/pdf/42r7yvcqmk13js.pdf

· July 2014 acquires Allied Insurance Group. The second largest broker network in New Zealand. https://announcements.asx.com.au/asxpdf/20140704/pdf/42qmyfvsc5srtd.pdf

· June 2014 acquires IMC thorugh its wholly owned subsidiary NCIB (National Credit Insurance (Brokers) Pty Ltd. IMC is a specialist boutique trade credit insurance brokerage that was established in 2008. IMC has been a member of the Steadfast Network since July 2013. NCIB, established in 1985, is a leading specialist trade credit insurance broker in Australia with offices in New Zealand and Singapore. NCIB joined the Network when it was acquired by Steadfast in August 2013. https://announcements.asx.com.au/asxpdf/20140618/pdf/42q8jf8x25lq02.pdf

· May 2014 acquired an interest in the MECON Winsure Insurance Group, ultimately, 76% of the MECON business and 100% of the Winsure business. MECON Winsure is an underwriting agency that specialises in providing insurance to the building and construction industry across Australia. They offer tailored end to end insurance solutions exclusively through broking partners. Established in 2003, MECON Winsure now has offices in Sydney, Melbourne, Perth and Brisbane. https://announcements.asx.com.au/asxpdf/20140505/pdf/42pf70jd87v1pb.pdf

· April 2014 70% of Nautilus Marine. Nautilus Marine established in 2005, is a leading underwriting agency operating across Australia and New Zealand that specialises in marine and motorcycle insurance. The remaining 30% equity will be owned by key management personnel at NM insurance. https://announcements.asx.com.au/asxpdf/20140402/pdf/42ns8rpnjrnjlk.pdf

· Dec 2013 60% of Protecsure a non-aligned underwriting agency. Protecsure’s specialised products, which are distributed through insurance brokers and financiers, include a specialist general property cover on equipment, a public and products liability offering, and a recently introduced suite of marine transit products. The products suit a range of clients from tradesmen to clients with specialised equipment or school students with laptops. The Sydney-based underwriting agency provides an end to end solution, including claims, for both clients and insurers. https://announcements.asx.com.au/asxpdf/20131213/pdf/42llw1bq6w8fn8.pdf

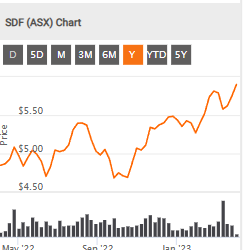

@nessy Yep the fundamentals look good: ROE nice growth, debt to equity ok, Net profit Margin in the mid teens. Just the share price has gone nowhere in the last 12 months. The share price trend does not look good. So i am on the side-lines with SDF. I have had better returns on SUN with a lower 'Net profit Margin' of ~10

Yep insurance should out perform, be a strong sector but it has not performed during the interest rate reset we had to have.

Hi @THOR , @Garfield and @thunderhead who hold SDF and @raymon68 who has posted about SDF, what are your thoughts on the acquisition of Sure Insurance. I have held SDF IRL for some time now as a recommendation from another service and without doing a deep dive into them I have always been impressed by management producing a steady flow of positive results. The chart below shows everything you usually want to see - bottom left to top right. I like the fact that they are not an insurance company (subject to natural disasters) but more of a clip the ticket broker. The founders of Sure are retaining 30% of the company which should drive continued motivation to do well. They expect the acquisition to to be immediately EPS accretive

For more detailed info - SDF Investor-Presentation Nov 2023.PDF

- Summary: Appendix 3Y

Name of Director: Vicki Allen

Value/Consideration: details and estimated valuation $27,950 ($5.59 per share)

Securities held after change 50,000

More about SDF

Board And Management - Steadfast

Vicki Allen

Non-Executive Director (independent)

Vicki has over 30 years of business experience across the financial services and property sectors. She held senior executive roles at a number of organisations including Trust Company, MLC Limited and Lend Lease Corporation. Vicki is currently the Chair of the BT Funds board, and a Non-Executive Director of Bennelong Funds Management. She is a fellow of the Australian Institute of Company Directors.

The Business:

Our underwriters have years of experience in local and open markets. We look to provide a holistic solution to your insurance needs, using our expertise as well as the latest technology and resources.

Exotic Car Insurance link below

Equity brokers (including Network) aggregate underlying EBITA +27.7% (refer slide 20)

Underwriting agencies’ aggregate underlying EBITA +15.7% (refer slide 21) Diluted EPS growth

Diluted EPS growth driven by organic and acquisition growth Acquisition growth

Completed EPS accretive acquisitions for an outlay of $574.2m1 including IBA (refer slide 7) Future growth

As at today, debt facility capacity of $378.5m available to fund acquisitions (plus free cash flow

Participating on the SCTP across four product lines – Commercial Property & ISR, Strata, Liability and Professional Indemnity

You dont like paying insurance.. Well buy these dudes: SDF

Return (inc div) 1yr: 10.90% 3yr: 22.73% pa 5yr: 16.71% pa

Steady growth.

Put the premiums up .. they will pay

Notice of FY23 Results

Steadfast Group (ASX:SDF) will be releasing its FY23 results on Thursday, 17 August 2023

Fillin the truck ....errr the Van up with more units.......

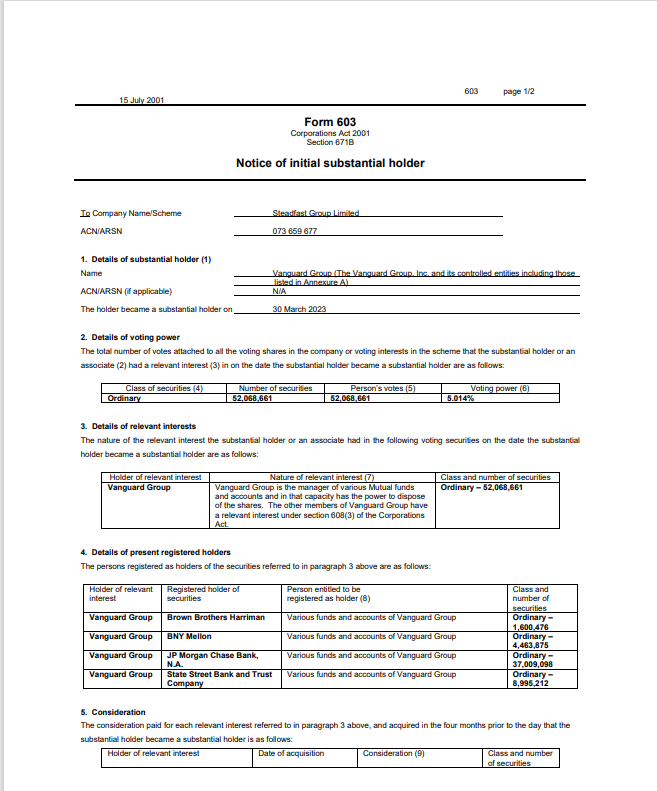

Class of securities Number of securities Person’s votes Voting power

Ordinary 52,068,661 52,068,661 5.014%

SDF had a good year Quality stuff here Some capital growth , EPS growth is good

Gross Divi at 3.3%

Pe ratio is up high 20% signs of quality stuff here..

Inflate the Premiums the customer will pay..

Steadfast Group Limited (SDF) provides services to steadfast Network brokers, distribution of insurance policies via insurance brokerages and underwriting agencies, and related services. The Group's corporate structure includes equity investments in insurance intermediary entities (insurance broking and underwriting agencies), premium funders and complementary businesses. They majorly operate in Australasia, with growing operations in Asia and Europe.

1H21 financial highlights1

- Underlying revenue of $437.8m, up 6.6%

- Underlying EBITA of $125.4m, up 19.3% ? Underlying NPAT of $60.4m, up 19.3%

- Underlying EPS (NPAT)2 of 6.98 cents per share, up 17.1%

- Interim dividend (fully franked) of 4.4 cents per share, up 22.2% ? Statutory NPAT of $73.4m (1H20 loss of $71.9m)

1 Statutory P&L results have been adjusted to assist in making appropriate comparisons with prior periods and to assess the operating performance of the business. Underlying P&L results exclude non-trading items.

2 1H20 EPS share count of c.849.5m assumes 1 July 2019 commencement for IBNA and Steadfast PSF Rebate offer.