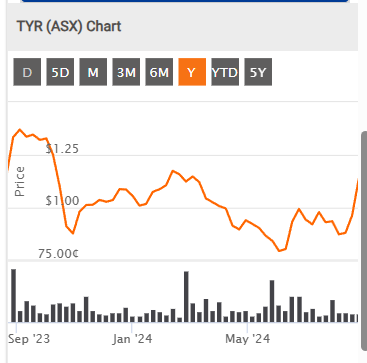

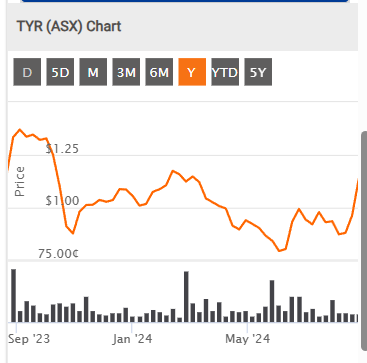

Share Price reacted: up 14% today.

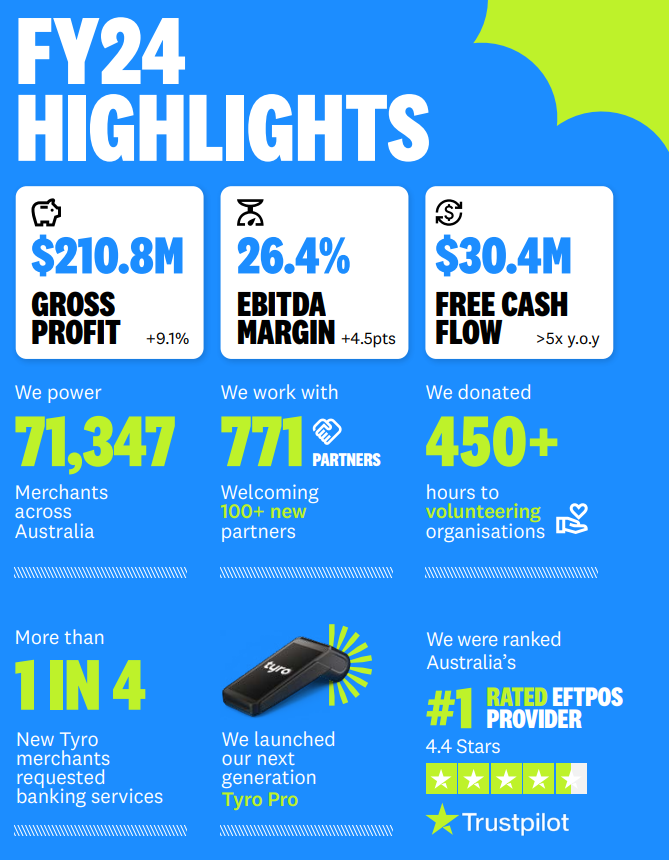

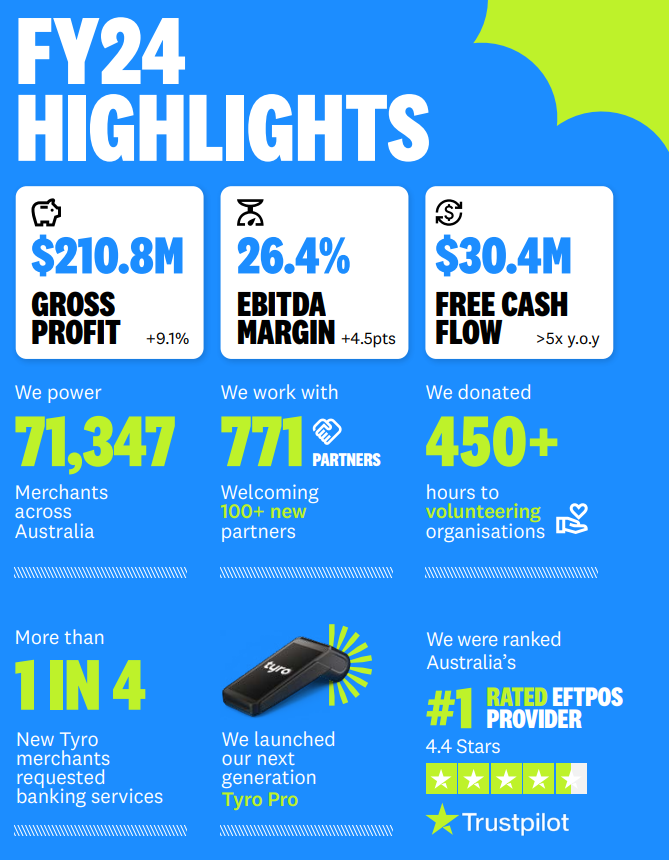

FY24 Highlights

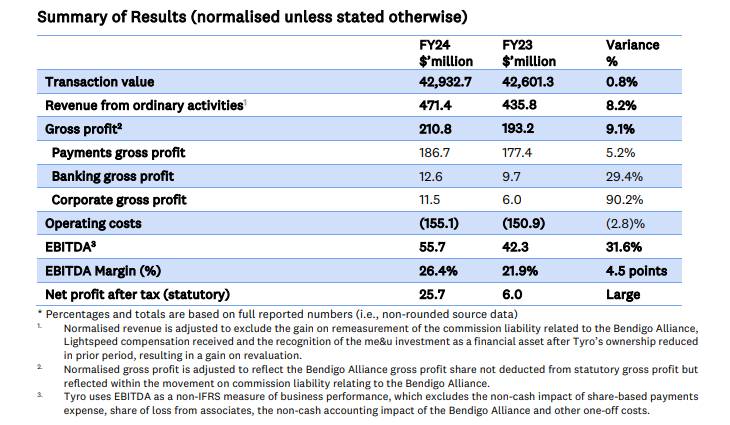

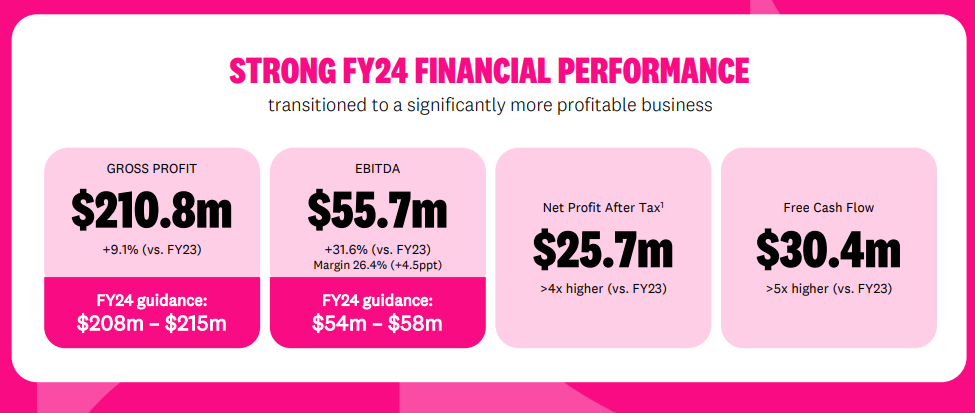

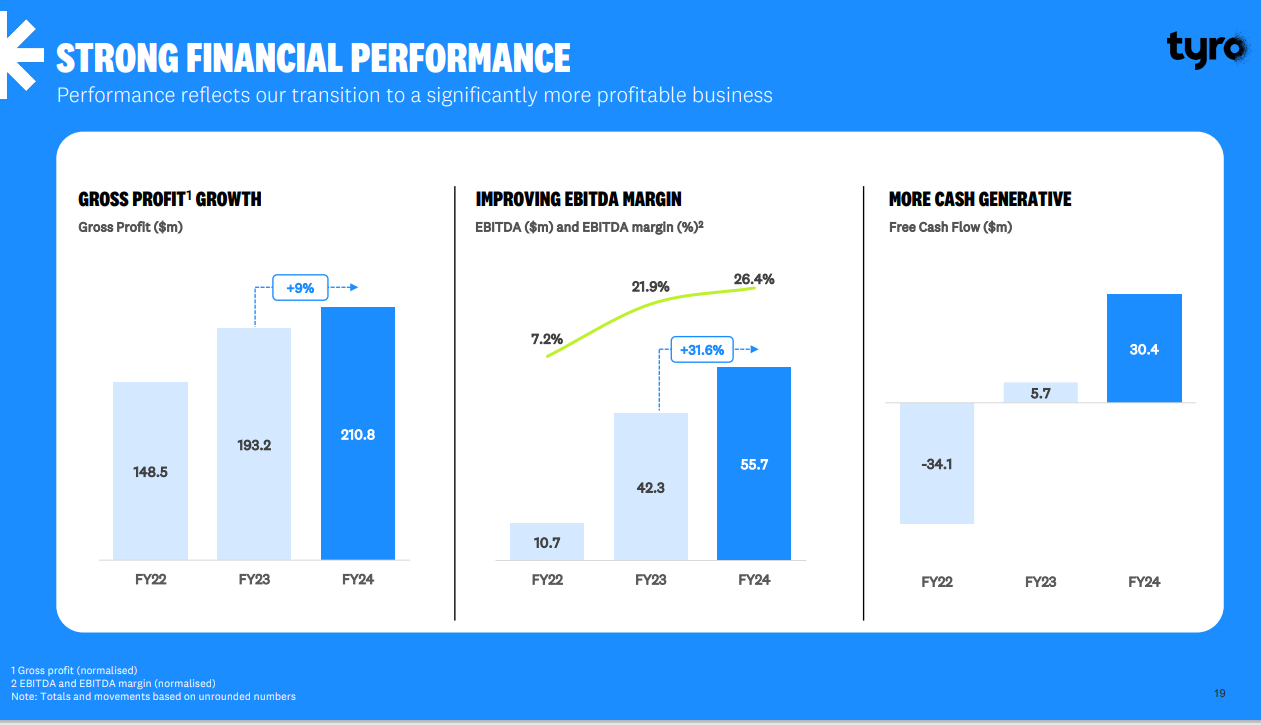

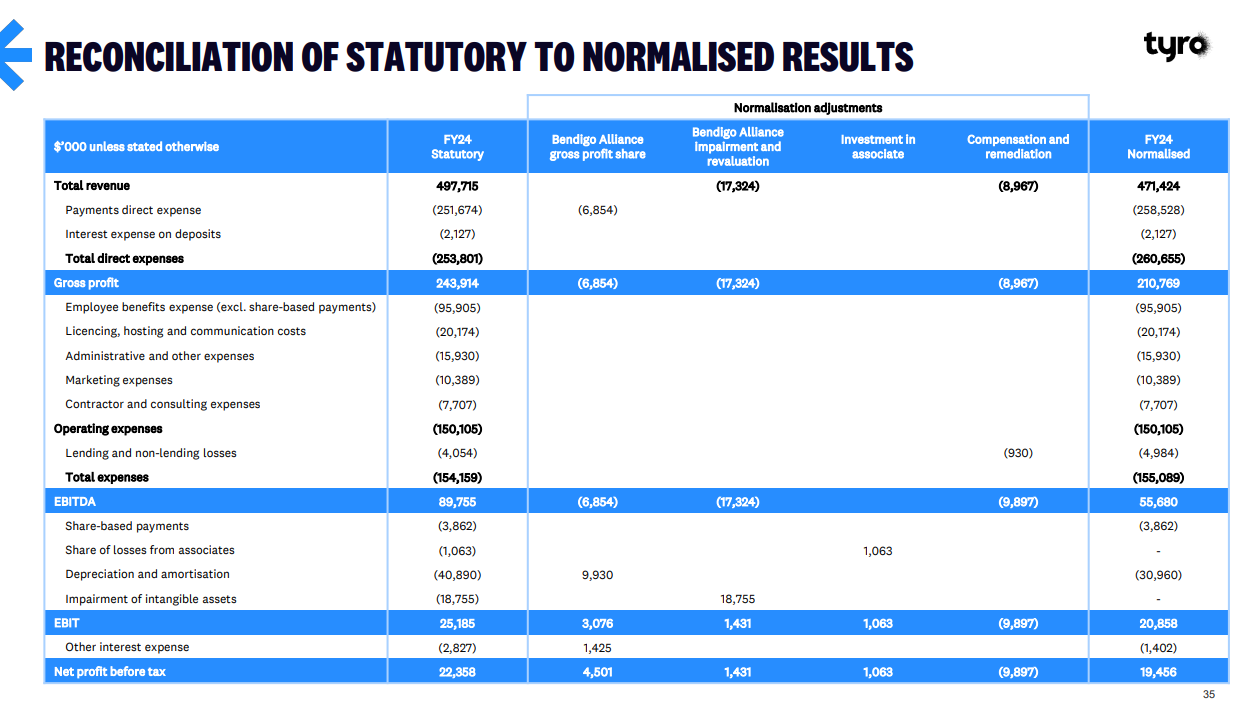

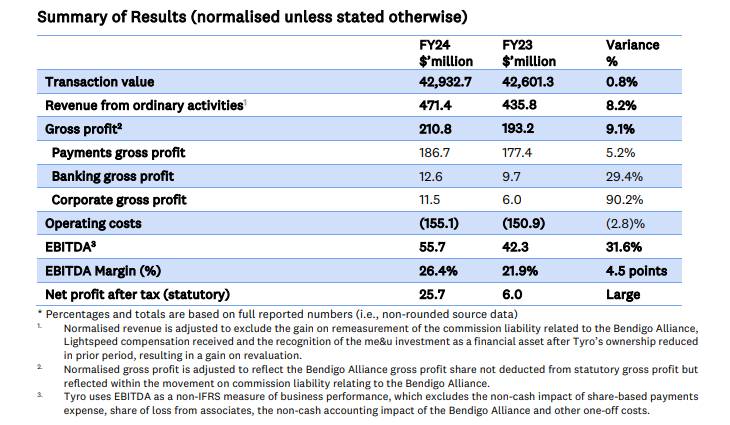

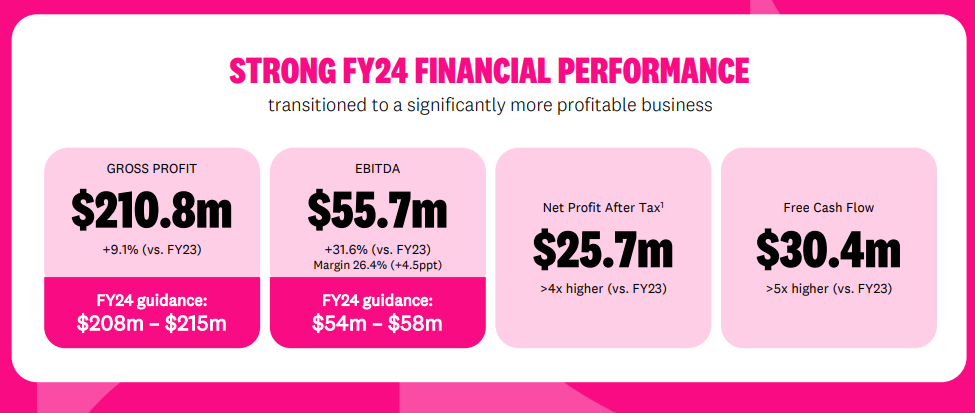

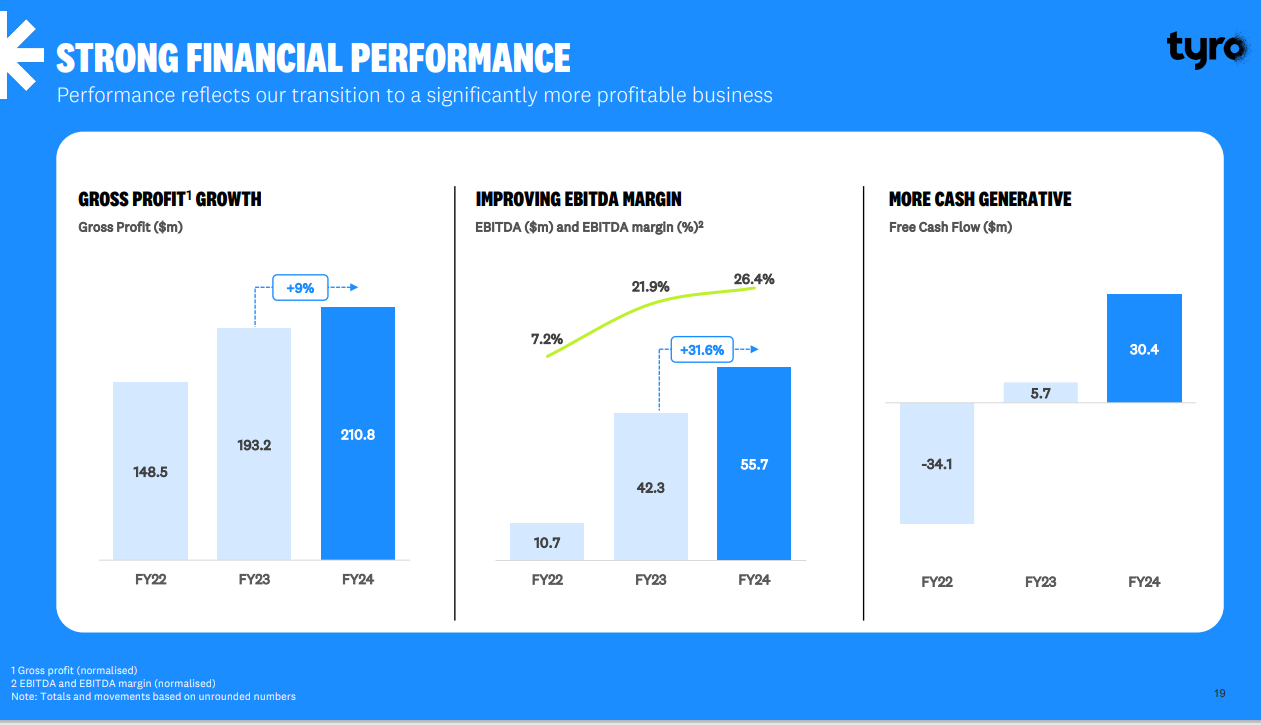

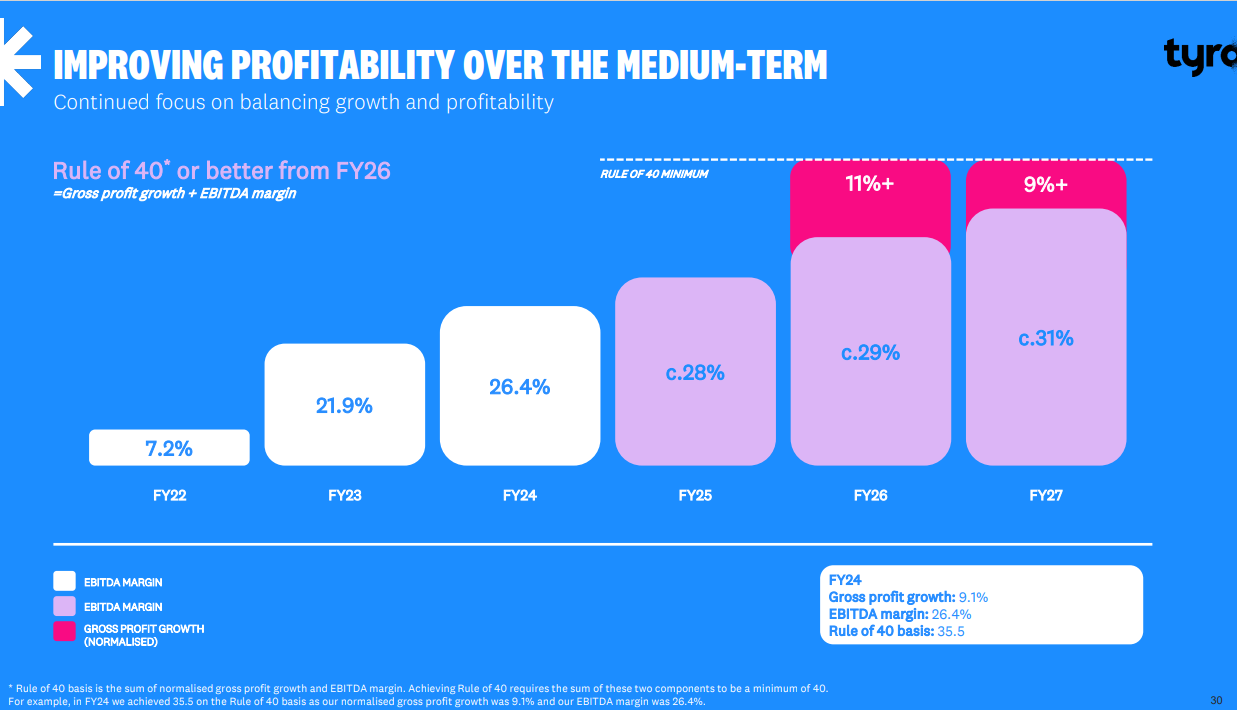

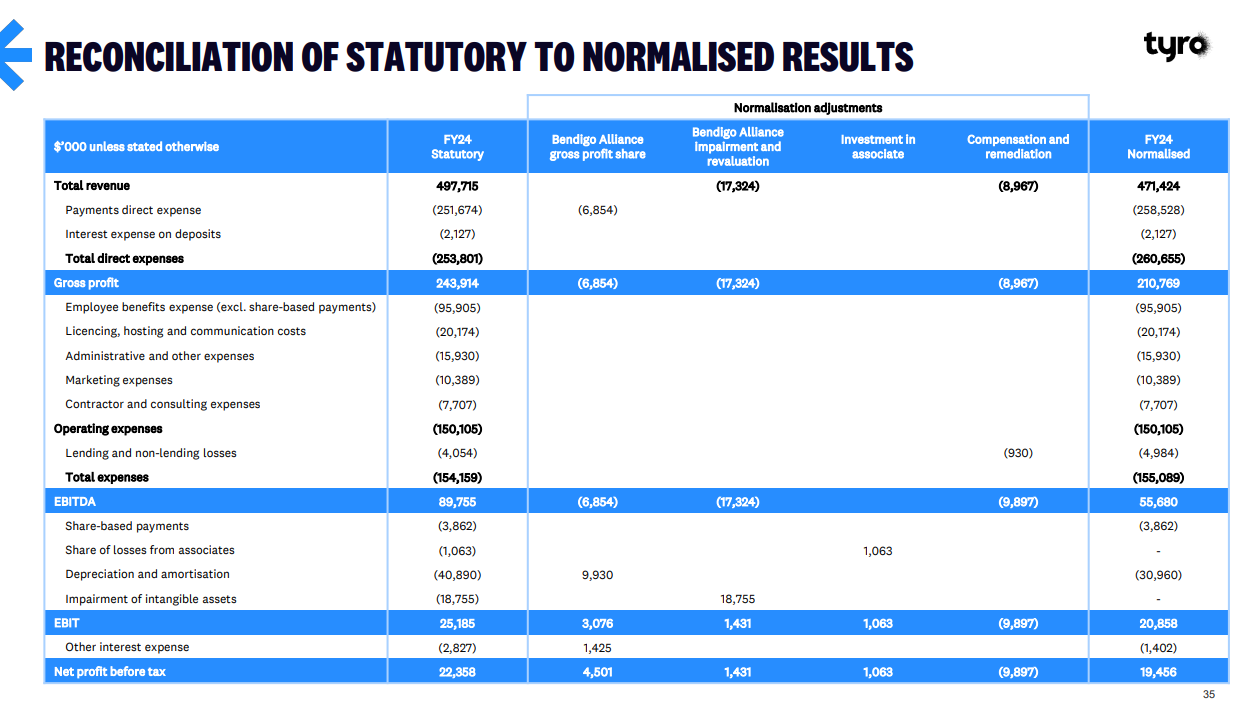

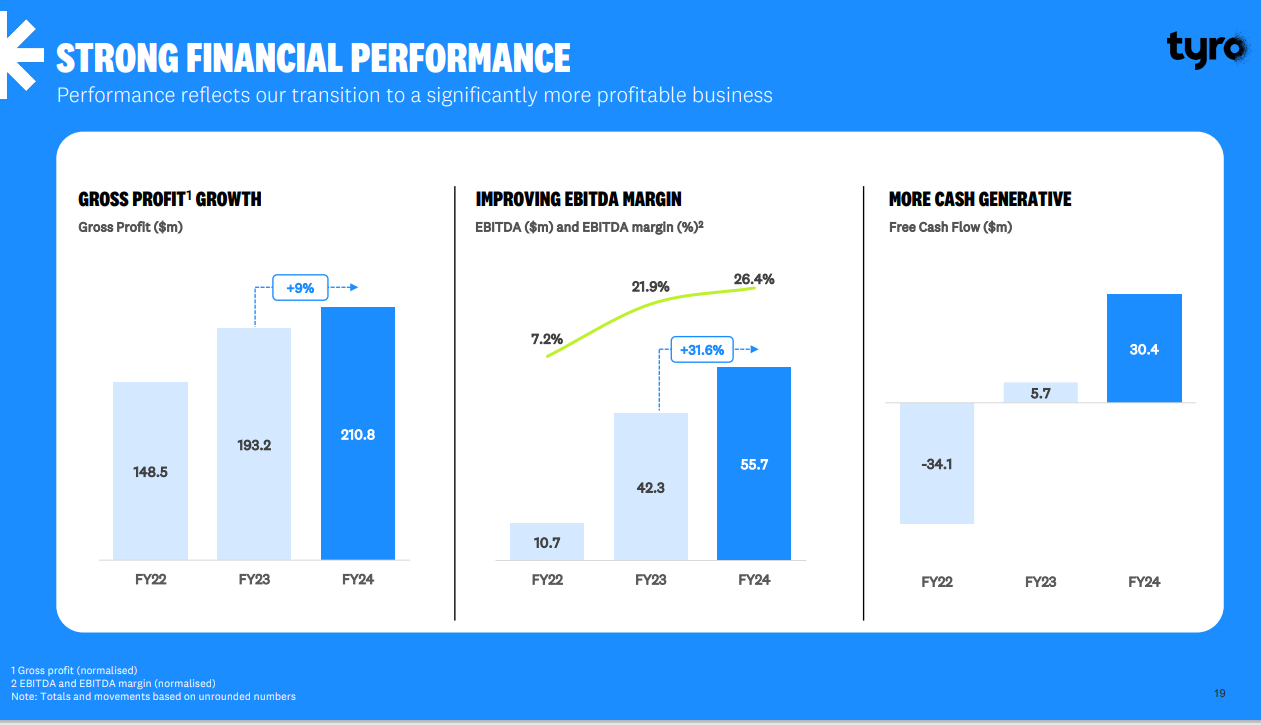

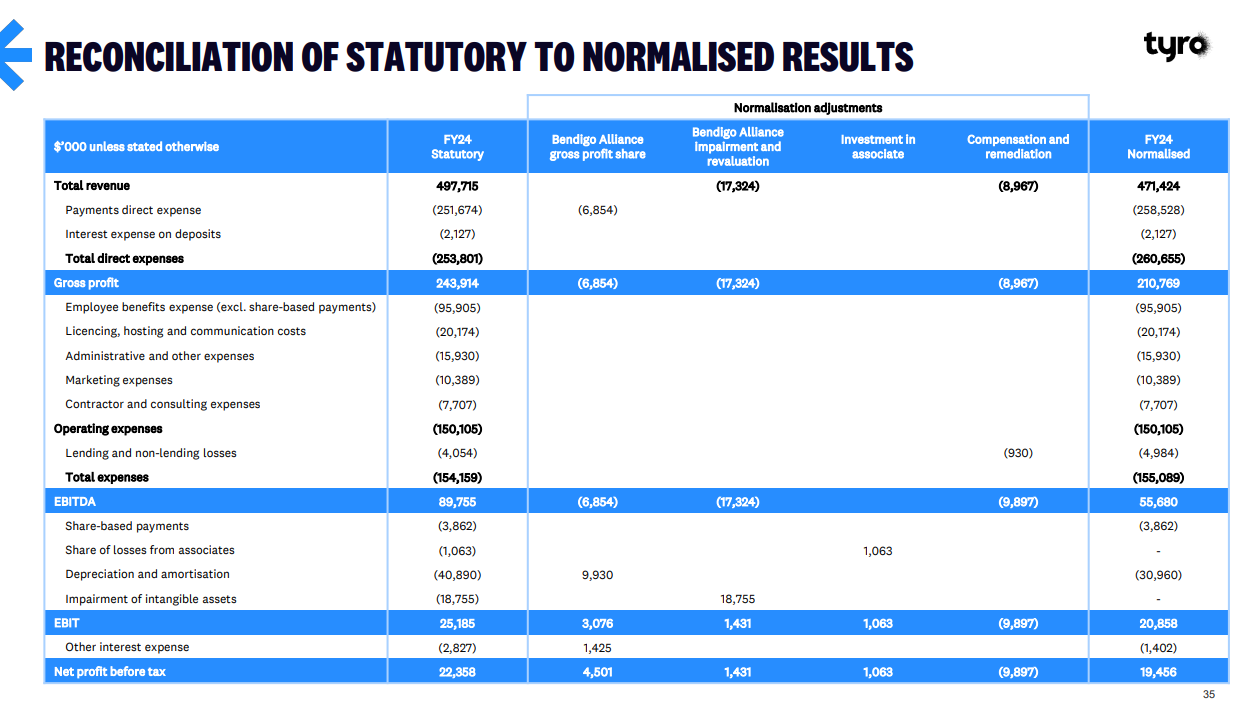

• Gross profit grew 9.1% year-on-year to $210.8 million driven by: o Successful pricing transformation. o 21% growth in Health transaction volume. o Strong uptake of integrated banking, with a 27% increase in banking users and 29.4% increase in banking gross profit.

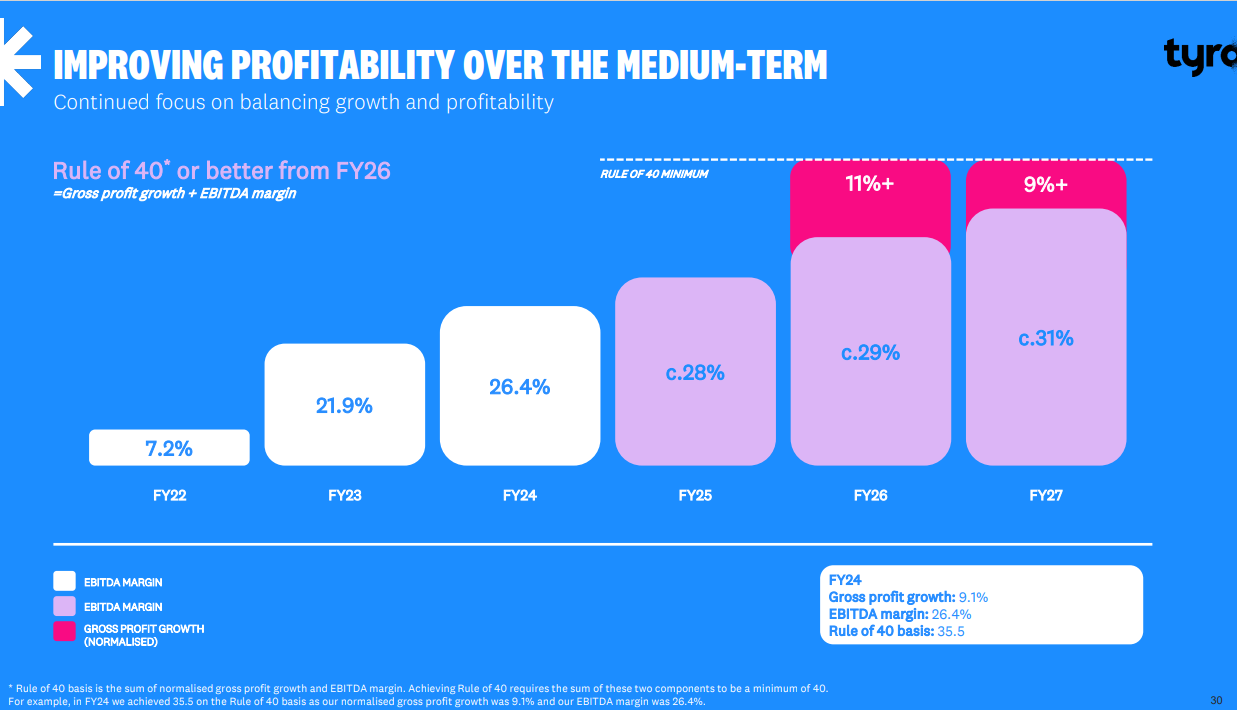

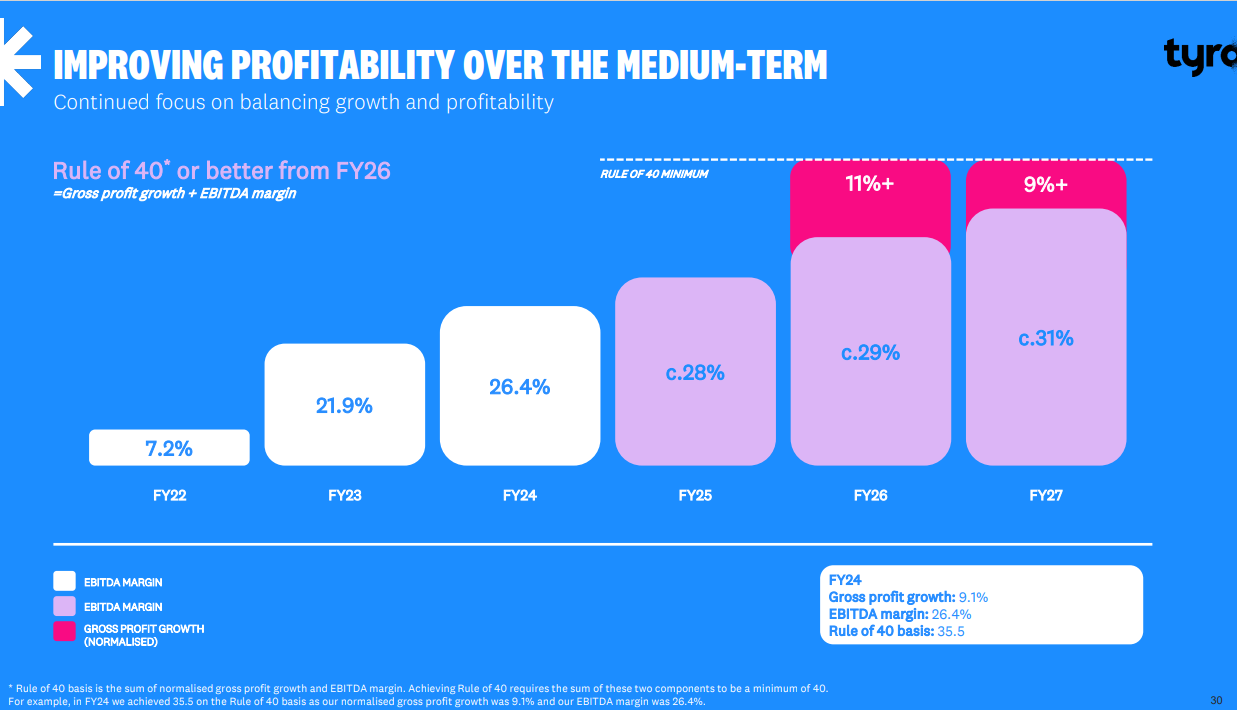

• EBITDA grew 31.6% year-on-year to $55.7 million, with an EBITDA margin of 26.4%.

• Net profit after tax (statutory) increased four-fold to $25.7m (FY23: $6.0m).

• Free cash flow grew five-fold year-on-year to $30.4 million (FY23: $5.7m)

TYRO PAYMENTS LIMITED (ASX:TYR) - Ann: Tyro FY24 Full Year Results Media Release, page-1 - HotCopper | ASX Share Prices, Stock Market & Share Trading Forum

TYRO PAYMENTS LIMITED (ASX:TYR) - Ann: Tyro FY24 Full Year Results Investor Presentation, page-1 - HotCopper | ASX Share Prices, Stock Market & Share Trading Forum

Observation:

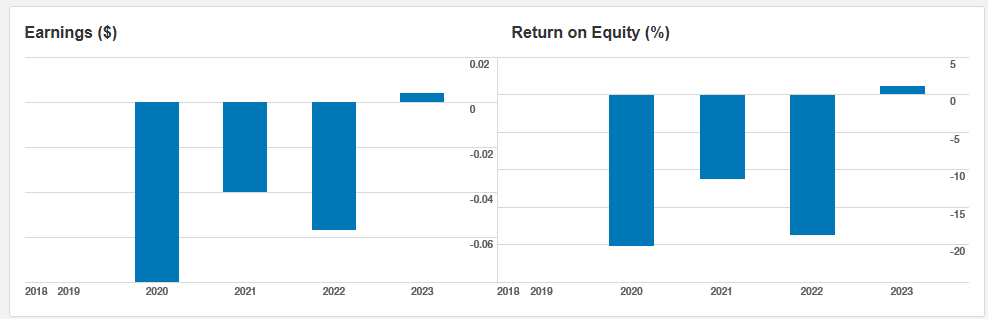

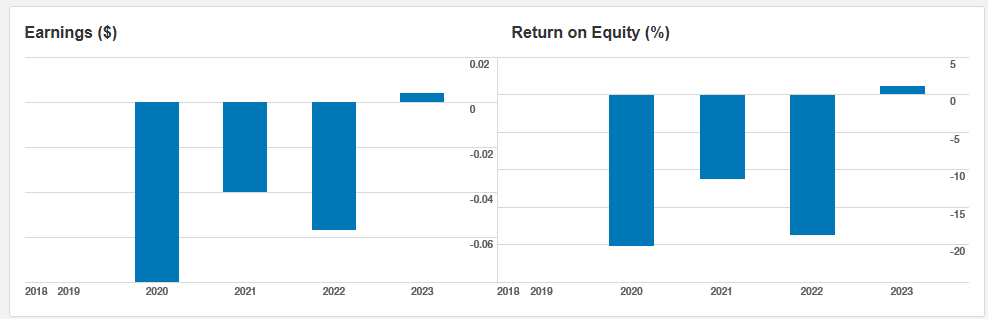

TYR been 'in trees' in recent in years, fundamentally as below:

Return (inc div) 1yr: -7.76% 3yr: -31.27% pa 5yr: N/A

Annual Report:

EFTPOS Machines, Loans, Bank Account & Business eCommerce | Tyro