Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

A curious move from Tyro, given its own struggles and low share price. Not sure it is the right time in the company's own business cycle to be making moves like this.

I would have expected Tyro itself to be a takeover target. Seems ripe for a trade buyer or PE to pick the bones and initiate a turnaround.

Tyro Payments Ltd | ABN: 49 103 575 042 | A: L18/55 Market St | Sydney, NSW 2000 Australia | W: tyro.com

TYRO RESPONDS TO MEDIA SPECULATION

Sydney, 17 March 2025 – Tyro Payments Limited (Tyro) (ASX:TYR) refers to media

speculation over the weekend regarding a potential transaction between Tyro and Smartpay

Holdings Limited (NZX:SPY / ASX:SMP) (Smartpay).

Tyro confirms that it has issued a non-binding indicative offer to the Board of Smartpay,

which included an offer to acquire 100% of Smartpay’s issued share capital at a price of

NZ$1.00 per share, with the consideration comprising mostly Tyro shares as well as a cash

component, with the proportion to be determined.

Tyro is in preliminary discussions with Smartpay regarding the proposal. There is no certainty

that any transaction will result, or if so on what terms. Nothing in this announcement or

Tyro’s proposal comprises a notice of intention to make a takeover offer for the purposes of

the New Zealand Takeovers Code.

Tyro will keep the market updated in accordance with its continuous disclosure obligations.

AFR: Labor is preparing to outlaw debit card surcharges in a broad crackdown on consumer fees as the Albanese government attempts to ease financial pressures on families in the lead up to a federal election next year.

Tyro is down 10% today I’m assuming due to this story

Share Price reacted: up 14% today.

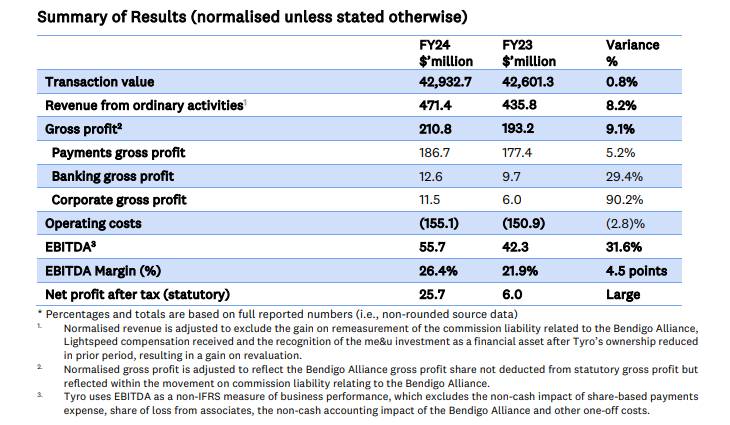

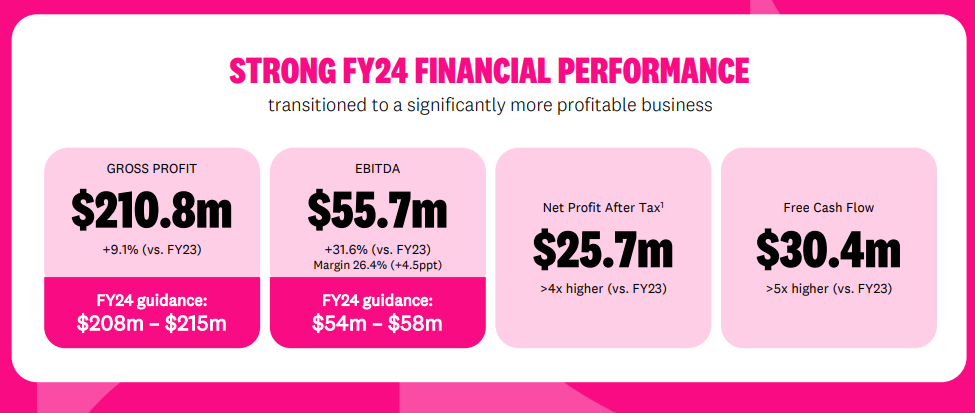

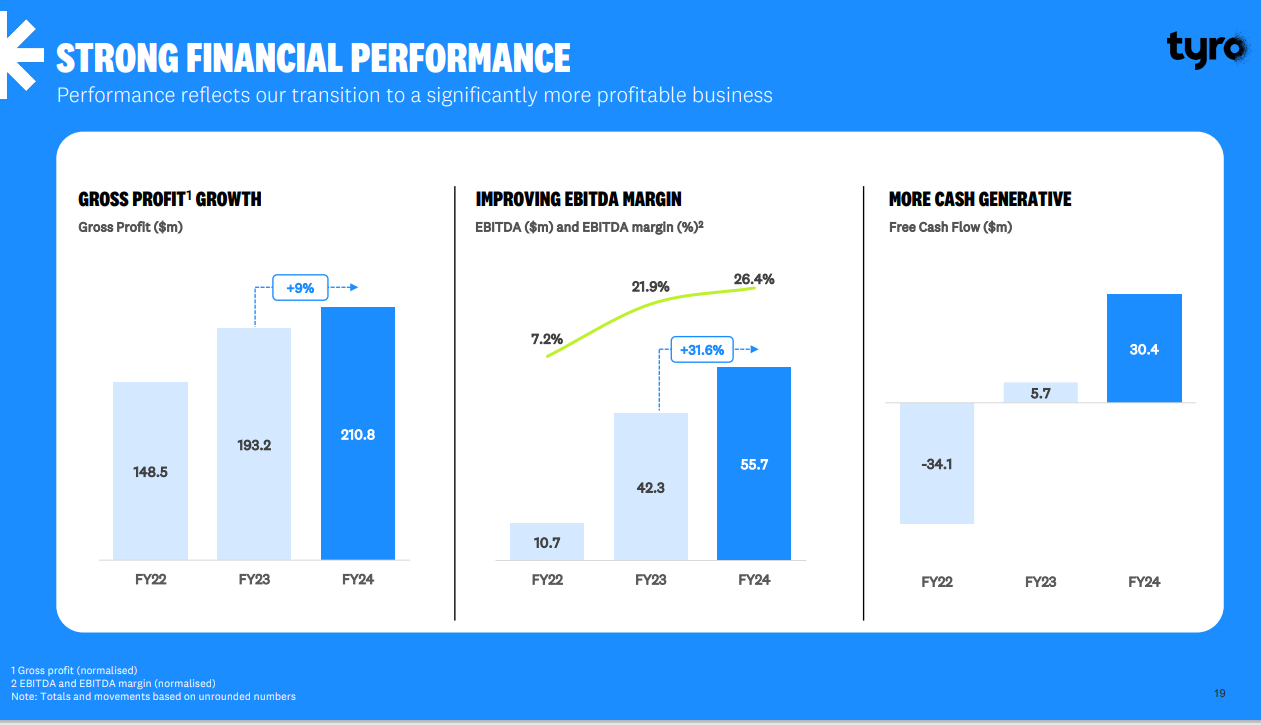

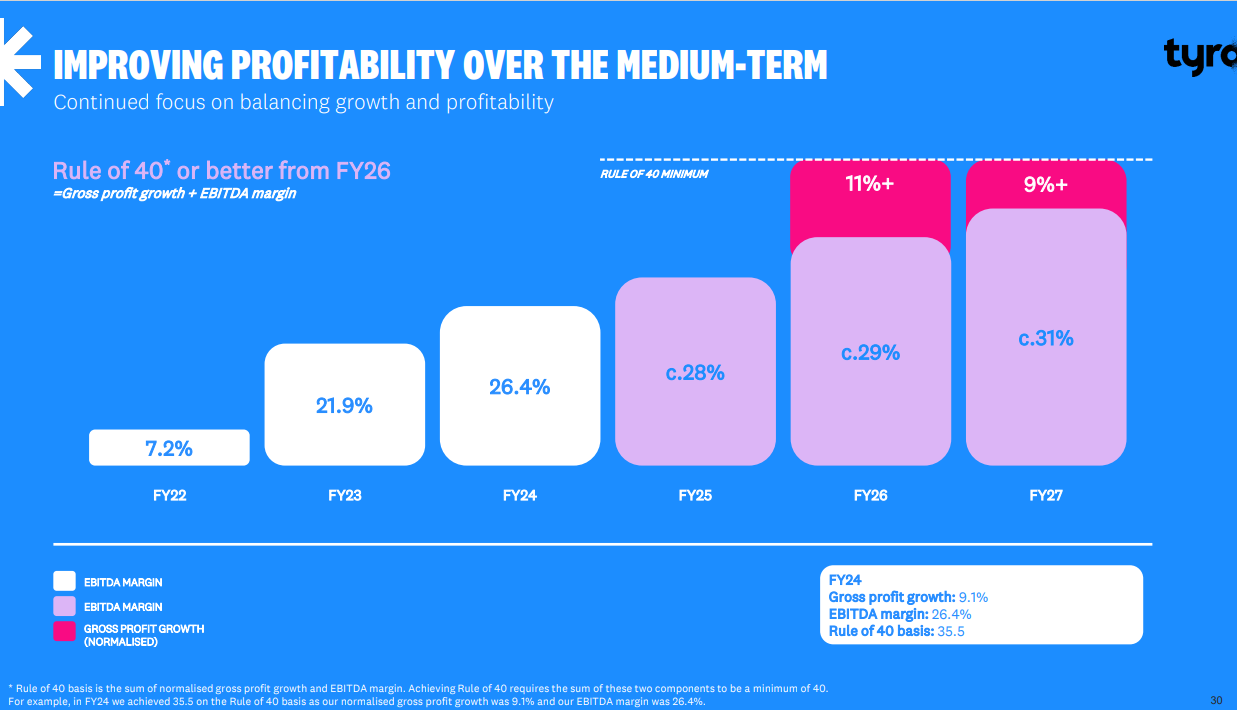

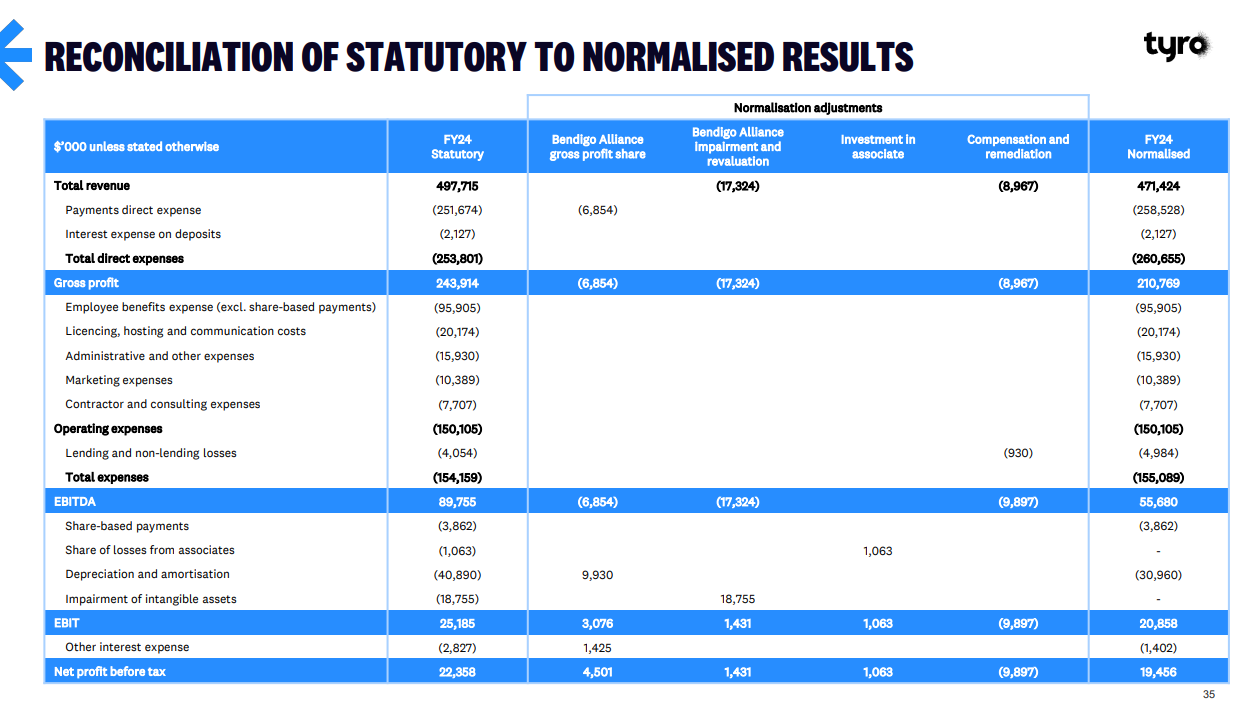

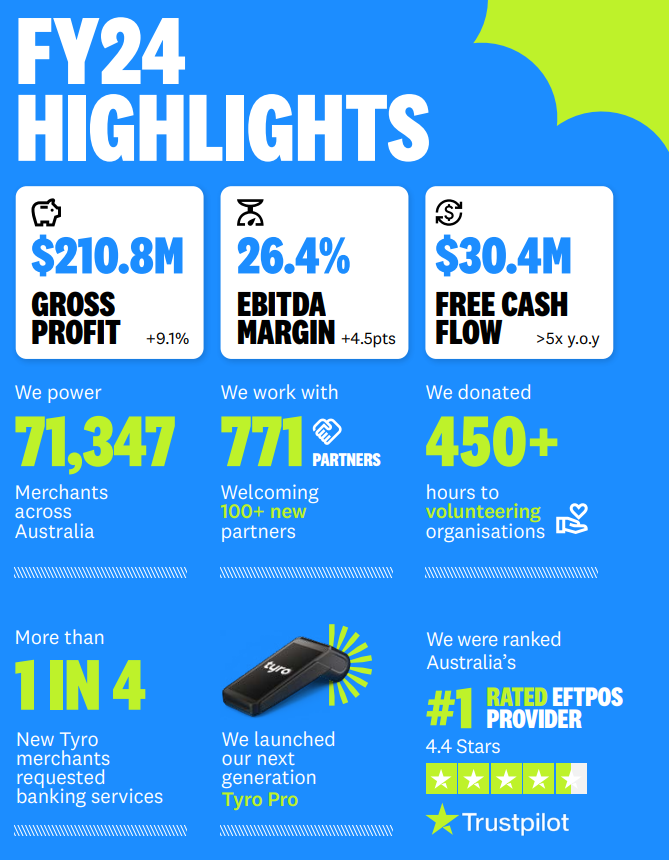

FY24 Highlights

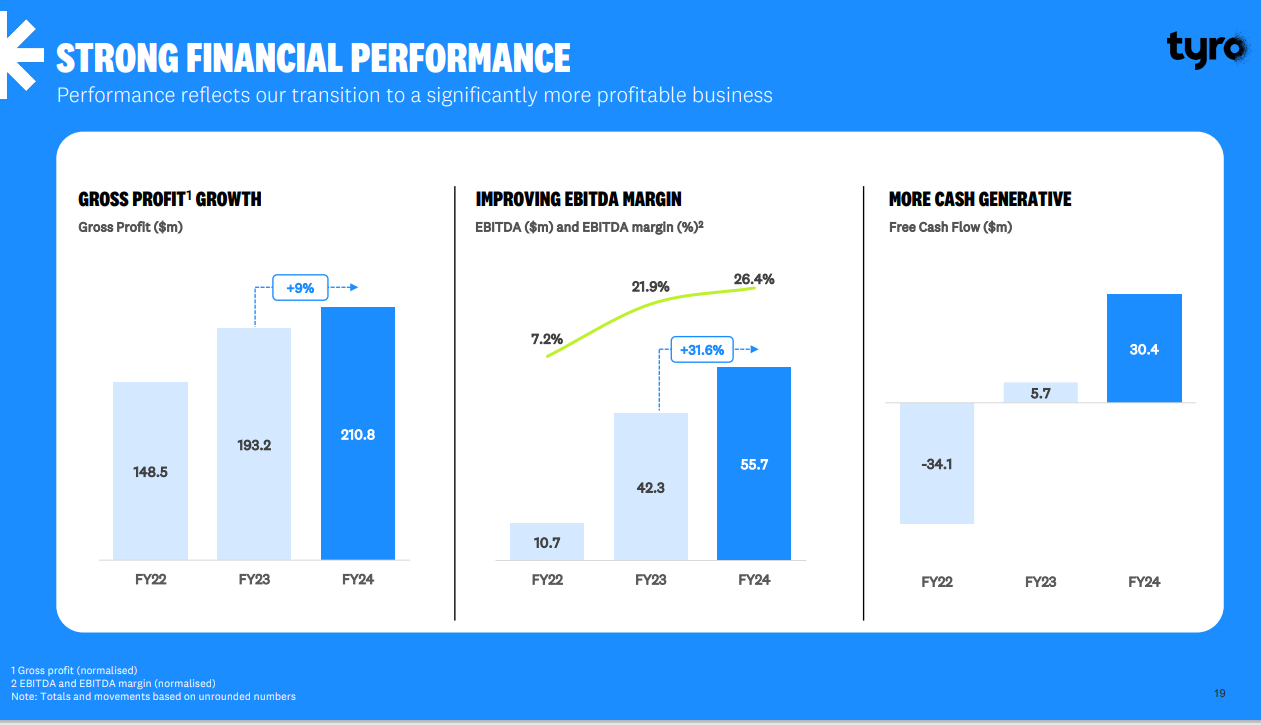

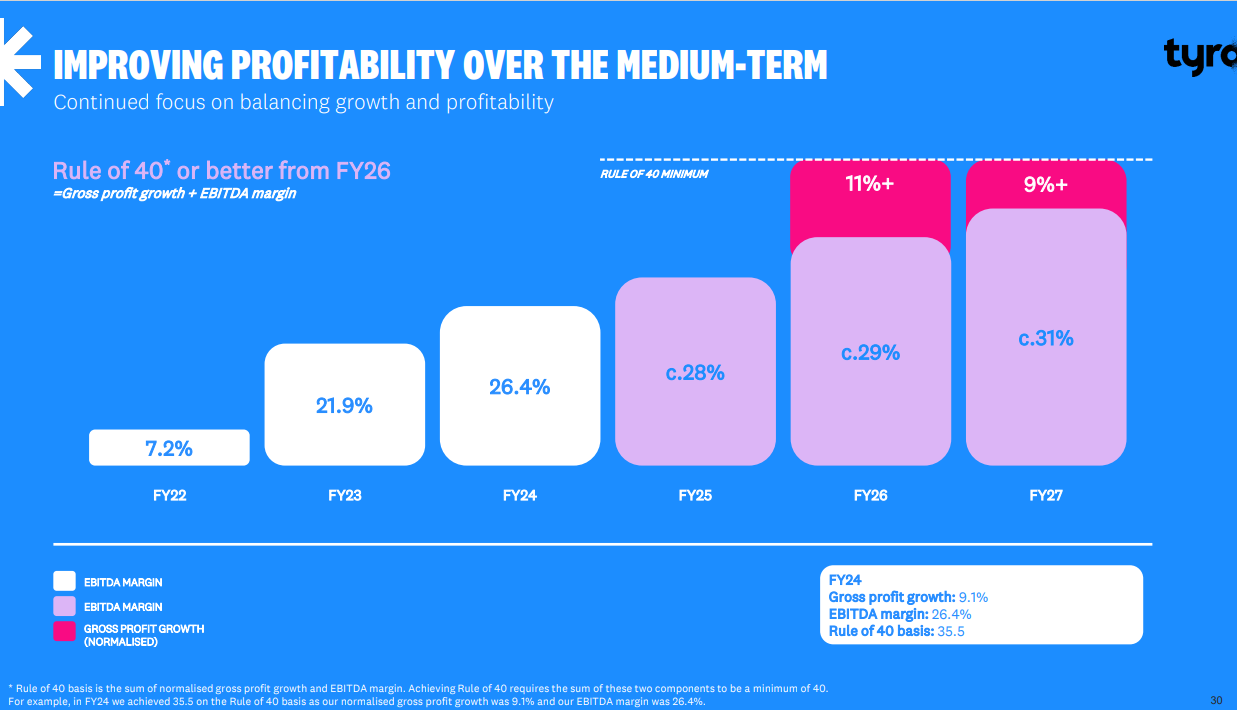

• Gross profit grew 9.1% year-on-year to $210.8 million driven by: o Successful pricing transformation. o 21% growth in Health transaction volume. o Strong uptake of integrated banking, with a 27% increase in banking users and 29.4% increase in banking gross profit.

• EBITDA grew 31.6% year-on-year to $55.7 million, with an EBITDA margin of 26.4%.

• Net profit after tax (statutory) increased four-fold to $25.7m (FY23: $6.0m).

• Free cash flow grew five-fold year-on-year to $30.4 million (FY23: $5.7m)

Observation:

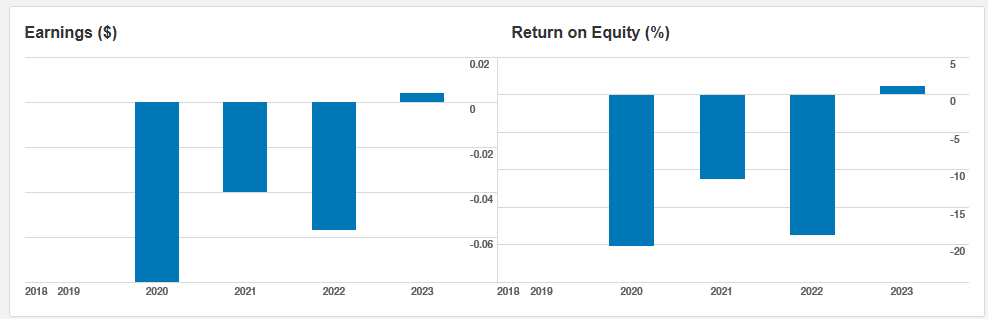

TYR been 'in trees' in recent in years, fundamentally as below:

Return (inc div) 1yr: -7.76% 3yr: -31.27% pa 5yr: N/A

Annual Report:

EFTPOS Machines, Loans, Bank Account & Business eCommerce | Tyro

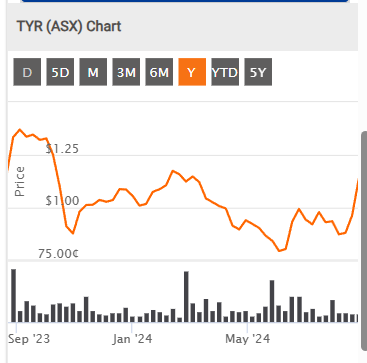

Wild volatility on the report released, with the shares trading erratically, initially reaching $1.30 and then dumping all the way to $1 before settling at $1.09.

Looks like it has become a plaything to the institutions on the register jockeying for quick gains, especially Regal, who have some form in this area.

The report itself looked fine (if not spectacular), and didn't seem to merit such a significantly negative reaction on a quick skim of the numbers.

The Potentia(l) takeover negotiations have concluded with a no-go, after extensive engagement over several weeks. This seemed likely given the market's lack of enthusiasm for the shares in the lead up.

It's all on the management to restore the lost value to shareholders now. On the plus side, the most recent trading update was largely encouraging.

Looks like Potentia is readying itself for another stab at the company.

It is still very much in play, and from the looks of the recent price action, the market is anticipating an improved bid too.

https://www.afr.com/street-talk/tyro-potentia-camps-break-bread-agree-dd-terms-20230205-p5chyu

Valuation based on the company's trading update for its unaudited first half results for FY23. The Company also issued improved guidance for FY23 following strong results for the half-year.

Key highlights for H1 FY23

• Strong H1 FY23 result leads to improved full year guidance for all key operating metrics - EBITDA range improved to between $37 million to $41 million at a target operating leverage of ~79%.

• Payments transaction value up 37% on pcp to $21.7 billion – payments normalised gross profit up 36%.

• Banking business growing strongly with loan originations up 101% to $72.7 million and banking gross profit up 73%.

• Cost reduction program on track to achieve an $11 million reduction in annualised cost base – H1 FY23 operating leverage of 80% achieved, down from 96% in the pcp.

• On track to reach positive free cash flow exiting FY23.

• Accelerated delivery of key strategic priorities achieved including the Tyro Go reader, the Tyro Pro next generation terminal, and automated onboarding.

Following the release of results for H1 FY23, Tyro has updated its FY23 earnings guidance with forecast transaction value increased to a range of $42.5 billion to $43.5 billion (up from $40.0 billion to $42.0 billion). This will result in an improvement to gross profit of between $187 million to $191 million and a targeted operating leverage of ~79%.

An interesting set of results. I had a number of concerns following H1 (see my previous straws); some of these have eased, while others remain.

Highlights

- Gross profit 148m, 24% YoY increase

- EBITDA 10.7m, which is impressive following the 2.8 reported in H1

- In general, H2 was much stronger than H1 – the core business performed much better. Q4 was particularly strong.

- Transaction up 34% YoY

- Merchants up 10% YoY

- Loan originations 99m, an increase of 283% YoY

- Transaction value churn was 9%, while merchant churn was 10.5%. This is pretty consistent with the last two FYs.

The best way to analyse this report is to split it into H1 and H2 – we know the former was disappointing, so I am really interested in how the business fared in H2 in isolation. The below articulates this pretty well. In short, H2 was an excellent half for transaction volume, payments gross profit and banking gross profit.

The payments business looks to be doing well – more of the same essentially. Strong growth and slight margin improvement in Q3 and Q4 (which is good, further margin deterioration in H2 would have been an enormous red flag)

The banking side is where lots of the blue sky exists for me, mainly due to the higher margins and opportunities to grow. This also provides Tyro with some differentiation in the market i.e., it isn’t just a payment facilitator. This is really important, as the gross profits in lending are upwards of 80%. This part of the business is starting to see some positive growth too, while average loans also increased from 35m to 47m. The business highlighted the strategy to expand this offering and leverage off the banking licence.

When you minus the 5m Tyro paid in remediation payments in FY22, they are nearing cash flow positive (-3m). The business is trying to achieve this milestone in FY23 – as it should.

Relating to costs: interchange, integration and support fees were again expensive in H2, even more so than H1 (-75m to -175m). This is a major cost indicator for Tyro, so its not good to see that again increase. Other core costs are payments to staff (moved from 44 to 99m) and ‘other operating expenses’ (from 28m down to 21m in H2) which as a term shits me to tears. No notes, so investors can’t actually see what this refers to.

An update was also provided re: FY23. There has been a strong start to the FY, with transaction value up 57%. Loan originations for the period (July – August) were 19.6m, up 91% pcp. The group also provided guidance:

- Transaction value 40-42b

- Gross profit 175-181m

- EBITDA 23-29m.

- Management think current cash and investments (122m) is sufficient to support the business through to positive free cash flow.

I am still holding my small parcel. If costs don’t decrease in H1 FY23 I will be cutting my losses.

Tyro’s transaction value volumes in the last few months have been nothing short of impressive. They have also started FY23 with significant volume increases (see below).

Due to their transparent reporting of volumes, we know the business recorded a 34% increase in transaction volumes in FY22. In FY23, they are currently sitting at 49% year-to-date.

The big question mark, as indicated in my Straw five months ago, relates to their cash flow and CapEx costs. If these continue to spiral out of control – like H1 FY22 reflected, alongside deteriorating margins – the thesis is well and truly busted and the impressive volumes we are seeing become redundant (at least for me). That said, if they reign in the costs, and continue to increase transaction volumes at 30%> annually, it becomes another proposition altogether.

I am also looking forward to seeing how Tyro’s lending business is ticking along, particularly in the current climate.

The business is currently trading on a P/S multiple of 2x (compared to Square and Novatti, which are both trading at 3x).

This is a bear case valuation that assumes Tyro will continue on its current trajectory and finish FY22 with negative cash flow from operations (around the -5m to -6m mark) and CapEx remain inflated at -24m. I think this is something to consider given the dismal report that was H1 FY22 -- which revealed increased costs and high CapEx requirements (see Straw/rant yesterday for more details).

I forecast that FY22 revenue should come in around the 320m mark. I also think FY23 and FY24 revenue projections of 350m and 390m are realistic, if anything a touch conservative.

Using my standard discount rate of 8.4%, I reach a company value of 787m. Divide this by shares outstanding (516m) and I reach a valuation of $1.50.

Should the business succeed at reining in costs – noting I expect improvements due to some unfortunate one-off payments in H1, including the movement to a new HQ – I think its reasonable to consider that shares have been oversold. The business is currently trading on an LTM P/S multiple of 3x (for a comparison, both SMP and EML are trading at a 4.3x multiple). But then again, this requires some improvements in H2 FY22.

Holding Tyro recently....

Apologies in advance for this being a long wall of text. But I felt a need to properly document my views on H1 FY22 so I can then refer back to them in H2. Thought I would include the analysis on Strawman in the event others are interested.

Pre-November 2021, Tyro was sitting on fairly lofty multiples. There was an expectation that the business could continue to acquire merchants and take market share from the big 4. To be fair to them, they have nailed this. Merchant acquisition and transactions processed by Tyro merchants have both seen remarkable growth in FY22 (68% and 31% increase vs pcp). Further, ongoing trading updates provided by Tyro suggest transaction value continues to increase (35% in Jan 22 and currently 44% in Feb 2022). So the H2 outlook looks positive in this regard.

But a trading update in November 2021 resulted in apprehension that gross profits had been impacted – primarily the result of the Bendigo Bank Alliance revenue share (the company arguably made a mistake not highlighting this in more detail prior). This spooked the market.

The company’s H1 FY22 report released weeks ago highlighted additional issues, mainly concerning increasing losses. They didn’t run away from these issues in fairness to them, and the following graphic speaks for itself – which starts well and gets worse the more you read down:

The report confirmed that there was real issue with increasing transaction value/revenue converting to Tyro’s bottom-line. Straight up, thats an issue. But I don’t subscribe to the view that the Bendigo Alliance was a poor deal – Tyro has still increased market share, transaction volumes and grown its presence Australia wide – all crucial for where it sits within its growth phase. It is also 10m gross profit better off as a result of the alliance. The gross profit increase, excluding Bendigo’s cut, was a 25% increase pcp. With Bendigo’s cut, the increase drops to 19% pcp. While the details provided by Tyro are at times difficult to interpret – and provided I have these calculations right – I don’t think this is too much of an issue, despite the terms of the revenue share not being ideal.

Further inspection reveals a 67% decrease to EBITDA. This is a huge red flag, noting that my biggest reservation with Tyro in the previous reporting period was actually CapEx (not included in EBITDA).

Pleasingly, and I wont be saying this too much more hereon, eCommerce transactions continued to grow strongly, with a 836% increase to 36.5m – albeit off a low base. But we also saw a reduction in gross profit margins (44 down to 41bps). As for the Bendigo merchants, gross profit margins were 39bps. Again, not ideal, but not a deal breaker.

CapEx was impacted by terminal purchases (9m), ‘other CapEx’ (10m) – which included Tyro’s movement to a new office premises, noting they didn’t tell us how much of the 10m this accounted for…someone has to pay for those swanky office views and bean bags, right? – and remediation-related payments (4m).

For some context, in FY21, CapEx jumped significantly to 24.1m in what I considered to be a direct consequence of the bricking issue. As per this report, CapEx didn’t decrease like I suspected, it increased to 24.2m! The below highlights the impact this had between FY20 and FY21 – noting that top line is cash flow from ops and middle line is CapEx, with the third representing FCF:

A steady increase in cash flow coincided with a whopping increase in CapEx. Now, arguably my mistake here was thinking this CapEx was strictly bricking related and would decrease in time post the units (and back ups) being sent out to customers. I may have been badly wrong here. But not only that, cash flow from operations, which was 11m in FY21, currently stands at -6m following H1 FY22. So we have a business that appears increasingly capital heavy but is going backwards in cash flow from operating activities. The rest, as far as I am concerned, is noise at the moment. So, with sharp revenue increases being recorded, what drove the losses in H1 FY22? Increasing interchange, integration and support fees paid (75m), increasing personnel expenses (44m), increasing terminals purchased (9m), and a hefty 28m on ‘other operating expenses’ (WTF, are these IPO related? That is a huge amount to not provide any additional info/notes). It gets worse when you factor in additional remediation payments (4m) and a 8m to -5m turnaround in ‘movement in customer loans’. Movement in deposits also decreased to 25m from 53m. There is a good case to suggest the last two, being related to Tyro’s banking/lending business, are lumpy/seasonal – so these figures might shift for the better and provide some much needed relief to Tyro’s cash flow activities in H2. But I don’t have confidence in this occurring, and quite frankly I have no idea what they will do.

Loss at the end of the H1 was almost a whopping 20m, leaving them with a precarious 67m in the bank. At this rate, they will need to raise funds in 12-18 months time. This is problematic, given the awful sentiment that surrounds Tyro at the moment following what has been a pretty horrific 6-month period for the share price. Instead of a capital raise at levels around $4, they might have to raise at a price around $1.20-1.40 which would cause some serious dilution.

Lets say total cash flow from ops lingers around the -6m mark and CapEx remains consistent. The impacts on FCF are below, noting its bloody grim:

Lets also say that revenue increases 15% in H2 – perhaps a tad conservative noting the impressive 30% increase the company just reported. This provides a revenue estimate of $321m. I will also estimate a full loss of 33m in FY22, which requires slight improvements in H2. My previous valuation of $3.30 drops to $1.50. This suggests Tyro are currently trading around fair value following a dismal reporting period.

I previously indicated Tyro was an easy company to judge. I was concerned primarily with the metrics of transaction value and merchants acquired. Well, now I have egg on my face because Tyro – as it stands – are not running the business as well as I would have hoped from a capital perspective. I didn’t concern myself too much with the cost side of things, largely due to me being a fan of Robbie Cooke. Well, Robbie, its time to prove me right. Tyro has been given a kick up the arse and rightly so – an acknowledgement that the market wants to see significant improvements to increasing and unsustainable costs.

Long term holding, as we all know, has many peaks and troughs. I am happy to hold through said troughs provided I have conviction and belief in the company at question. My conviction took a pretty significant hit following H1 mainly due to costs, as outlined above. But I will give Robbie and the team the next six months to get it together and hopefully recognise why the market has acted the way it has. I also acknowledge that some of those costs might have been the result of unfortunate timing (IPO costs, remediation expenses, moving office, seasonal loans/deposits moving in/out, terminal shipments). But another poor six months of this will essentially result in my thesis being bust, because as it stands, Tyro is operating more like a retail/customer service business than the fintech I initially invested in.

And one final thing, both Robbie Cooke (CEO) and David Thodey (BOD, Chair) recently purchased more shares on market following the share price dump. This at the very least suggests confidence from Tyro's leaders.

Disc: held

Highlights from H1 FY22

Record 61,554 merchants choosing Tyro as their payments solution – up 68% (H1 FY21: 36,720).

Record $15.8 billion in transactions processed by Tyro Group merchants – up 31% (H1 FY21: $12.1 billion).

Record payments revenue of $146.0 million – up 36% (H1 FY21: $107.7 million).

Record payments statutory gross profit of $68.1 million – up 25% (H1 FY21: $54.3 million).

Australia’s 5th largest merchant acquiring bank by terminal count – 103,935 terminals up 52.1% (H1 FY21: 68,338).

Growing merchant deposits with total deposits of $100.8 million at 31 December 2021 (30 June 2021: $75.5 million).

Rebound in merchant loan originations to $36.2 million – up 1,279% (H1FY21: $2.6 million).

Low churn rates – merchant churn 10.1% + transaction value churn 9.0% (FY21: 11.3% + 8.7% respectively).

EBITDA2 $2.8 million vs $8.5 million H1 FY21 – reflecting deferral of annual merchant pricing adjustments + no JobKeeper. Balance sheet strength with $157 million in total cash + financial investments (30 June 2021: $173 million).

Total capital ratio 45% (30 June 2021: 73%).

Appointed as Telstra’s exclusive partner offering merchant acquiring solutions to Telstra’s business customers.

Tyro | Bendigo Bank Alliance tracking to expectations.

Tyro Connect gaining traction – 17 industry leading apps signed + 274 active merchants + 14 POS partners.

eCommerce continuing to scale – up 1,634% with $255.9 million in transactions processed (H1 FY21: $14.8 million).

Market certainly doesn’t like!

Disc: Not held

Don't know how I got looking at APRA website, but I just discovered that Tyro Payments has a banking license (to the extent that it can take debit card transactions but not take money deposits).

They have to meet a requirement of holding >$2mill in Tier 1 capital at all times.

For this privilege, they are in the handful (now becoming much much larger) of companies classified as Authorised deposit taking institutions. Hence they are covered under the Financial Claims Scheme which is a government backed guarantee of up to $250k per account.

Commonwealth Bank change merchant pricing structure following feedback from small business

In my opinion this is actually quite interesting for Tyro, Square and a range of smaller fintech companies that operate in this space. As a Tyro shareholder, I have included this straw here but this arguably applies to many companies across the ASX.

I think this decision by CommBank is an attempt to 'stem the tide' of businesses (particularly small businesses) leaving the big banks; seeking better customer service and more competitive fees elsewhere. But perhaps at a deeper level disruption has been able to occur due to growing discontent with the banks – Commbank included – and how they have disregarded merchants and more broadly speaking customers. Is it too little, too late? Probably not. CommBank still have the largest EFTPOS presence across the country (see below graph), so I think there are still opportunities for them to try and keep hold of these customers. This announcement in particular targets small business owners – where arguably they are most regularly losing merchants to other payment providers. I think it is something to keep an eye on (speaking as a Tyro shareholder) but it doesn’t change the long term view for me.

I remain of the opinion that the banks will slowly (continue to) lose market share to smaller players and disruptors – not only relevant to payment solutions but banking, loans etc – across the board. Sentiment is not on their side, particularly with the 40 and under age bracket.

Going forward

I remain a bull heading into the future; for Tyro, Square and to a lesser extent smaller fintech providers. I will gradually start to trim my Tyro holdings in my satellite portfolio and shift it into my Super – returns have been 30%> pa, so from an investment perspective this has been a solid performer. That said, I think Tyro is starting to become better suited to my Super portfolio, as it matures as a company and (hopefully) continues to achieve steady growth going forward.

I think the turnaround story still exists for this one though. NSW and Vic represent approximately 60% of Tyro’s transaction volume and these states have obviously been severely impacted by Covid. Despite this, Tyro continues to see solid increases in transaction volumes YoY, despite the lockdowns. This makes me optimistic for the next 12-24 months. I foresee these figures will continue to be impressive – and record steady increases as both of those states start to shift out of lockdown and return to their new ‘normal’. This is the key metric to judge Tyro on in my opinion (transaction volume). Other key things I am keeping an eye on include its expansion into e-commerce and any strategic acquisitions made by the company - similar to the Bendigo alliance.

DISC: HELD

My investment thesis continues to play out, with August transaction volumes up 20% in comparison to last year’s figures. The company continues to report impressive increases – which bodes well for FY22 figures and more specifically Q1. September YTD figures are up 23%.

What was initially provided by the company to ensure transparency during Covid-19 is now an excellent measure to provide insights into where the company is at. I remain confident in the direction Tyro is heading. Yes, the market is quite saturated, but there is room for multiple players and, provided Tyro continues to attract and appeal to merchants and record steady increases in transaction volumes, I remain bullish.

In other good news, Tryo has also been added to the ASX 200 index (which will occur at the next rebalance in a few weeks’ time). This essentially means index tracking funds will have to buy shares. It will also put the company on the radar of funds with stringent investment mandates.

DISC: HELD

In addition to @jwrostagno27’s Straw below, a few comments/thoughts of my own:

Highlights

• Gross profit recorded at $119m, an increase of 28% in FY21.

• Statutory FY21 loss of $29m (including two acquisitions) in comparison to FY20’s 38m loss.

• Significant uplift in transaction value to 25.5 billion, an increase of over 25% since FY20.

• A significant increase in merchant numbers, up 81% (58,186 up from 32,176).

• A decrease in interest income on loans, part of which was intentional by Tyro due to increased loan requirements to protect themselves from an unpredictable financial market

• This correlated with a decrease in loan originations (down 57%).

• eCommerce transaction value up over 500% in FY21.

Similar to @jwrostagno27 – I think these figures are pretty impressive. Payments revenue and associated income continues to drive Tyro’s bottom line, reporting an increase of 13.5% in FY21. This accounts for the majority of Tyro’s revenue. In contrast, lending and investment income increased by 77% but off a low base. This figure accounts for a tiny fraction of Tyro’s revenue.

The report also highlights how important the Bendigo Bank Alliance was. Using June 2021 as an example, Bendigo Bank merchants consisted of 17% of Tyro’s transaction volumes, while they accounted for around 32% of Tyro’s total merchant share.

The balance sheet looks strong. This is important; Tyro have strategised achieving growth through both organic growth and acquisition/alliances. Both of Tyro’s acquisitions/alliances in FY21 appear impressive – although this doesn’t surprise me as Robbie Cooke (CEO) is a darn good operator and knows what he is doing.

Relating to my investment thesis – I hold Tyro, primarily due to the assumption that it is well placed to disrupt a lazy, unpopular banking sector that disregarded payment platforms and merchants. In my opinion, due to this, I am most interested in monitoring the below metrics:

• Merchants onboarded: 32,176 to 58,186, an 81% increase since FY20.

• Merchant acquiring bank by terminal count: 62,722 to 104,827, an 67% increase since FY20.

• Transaction volume: 20b to 25.5b, an increase of over 25% since FY20.

The goalposts haven’t changed here – Tyro has continued to close the gap on the ‘big 4’ throughout FY21, while benefiting from the recent Bendigo Bank Alliance.

I think management has steered the ship well during an unpredictable time, which has seen its business model significantly impacted. The tailwinds for the company are lockdowns coming to end and transaction volumes increasing – as Australia’s two largest states start to shop more, go to more pubs, and resume their smashed avo outings on the weekends. Looking forward, the company needs to continue disrupting the banks while keeping churn rates at minimal levels. Happy shareholder for the time being.

DISC: HELD

@jwrostagno27

Agreed mate, the numbers are pretty positive in my opinion.

I do want to point out one thing though (and this is not to say you have suggested otherwise) - I think these numbers are definitely skewed with the integration of Bendigo's merchants. I think we would be seeing a pretty significant decline without these merchants onboarded.

If anything it suggests the integration was a great bit of business by Tyro though. I think the real value will be in the numbers when lockdowns in Vic and NSW come to an end.

I see payment systems as consisting of 3 separate areas:

- backend banking/transaction processing

- physical POS processing

- non-physical website/social media order taking - now moving into different transaction types such as subscription and BNPL

These three areas have been converging for quite a while. Examples:

- Shopify - started off at 3, found a solution for 1Square - started off at 3, found their own solution for 1, now moving to 2

- Big four banks - started off at 1 & 2, moved into 3 helping people setup eShops

- POS providers mainly hospitaility based with workflow capabilities - started at 2, bolting on 3 & 1, accelerating into the 3 space in a big way with apps and data analytics offerings

- Paypal - started as 1, now moving to 3 (create your own website)

- Companies like eWay who used to integrate 1 & 3, have now been effectively squeezed out of this space

Thanks jwrostagno27 - I didn't know about hicaps on Tyro. Now I'll have to investigate hicaps on big four.

I also see Tyro as a stronger competitor for hospitality, basically because their commission rates are more affordable.

Many of the newer payment systems charge 2-4% (I didn't know Square charged 4-6%!)

But banks charge 0.9-1.5% as a general rule for a hospitality business. Tyro has been known to match rates. Square/Shopify/Stripe/Fat Zebra etc just doesn't stack up for hospitality where margins are tight and many transactions are under $10.

I don't know, as I type and consider this, I'm more likely to put my bets on a big bank with a forward thinking, creative team. If they can get their development and infrastructure setup quickly, they can win this race. Emphasis on the IF. And that is the problem isn't it? Technology agility.

Thanks jwrostagno27 the healthcare aspect for TYR was something I missed.

I’ve been observing payment/terminal systems for sometime now and in the past year I have seen Square increasingly used and have been considering the impact on Tyro.

My observations are:

Generally regional vic terminals are CBA and Bendigo bank, this is across all business types.

Bendigo may have the edge in rural places as it is often the only bank branch available in town. From this perspective I consider Tyro taking on Bendigo accounts as a positive.

However, over the past year or so I have seen greater adoption of square products in regional vic. Usually POS systems in hospitality and phone based systems in micro businesses, such as gyms. New cafes appear to use the square system more often than not.

In contrast, regular visits to Melbourne have showed the uptake of the Square system was wide spread in inner city cafes over a long period of time.

Last week in Officeworks, Shepparton there was a whole bay of Square products, (I don’t frequent Officeworks so they could have been there for sometime) but it does show a broad acceptance of the product.

For a small hospitality business the square POS and payment system looks to have the edge. The system is obviously harder to use in different industries.

I have been watching Square encroach on Tyro’s space and wondered how/if they can compete. So the detail on the healthcare systems was a positive aspect I had not considered and can see how that is an edge for Tyro. (FYI in the small town near where I live, there are two medical providers, one uses Tyro and the other hicaps)

I’m also not sure how easily business such as local mechanics etc can integrate with Square, so perhaps there is an advantage for TYR there as well.

Smartpay, I have not come across any terminals in rural vic so not sure how it fits in. The “numbers” growth sound good at this point, but it is coming from a low base in Aust.

It will be interesting to see how SQ/APT affects the space

Held pa TYR APT