Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Nice little 30 minute presentation for the Bell Potter Unearthed Conference this year:

Been watching the share price past few days since the SPP announcement.

There is a condition that the price will either be the lower of 90c or the 5 day VWAP before 13th of June

Explains the recent price action.

Looks like a deep discount. No offtakes yet, just LOI (Letter of Intent) from customers

A4N has already raised 175m from institutional investors after completing DFS as part of FID on Stage 2

2027 will be when money will start to flow in. Hopefully A4N get some binding offtakes by then as you can't sell HPA on the at spot price as explained in my last straw

As not many people follow Alpha HPA, I wasn't going to plan to write much but it would not be fair to withhold some of my research and thoughts that I found during the last couple of weeks.

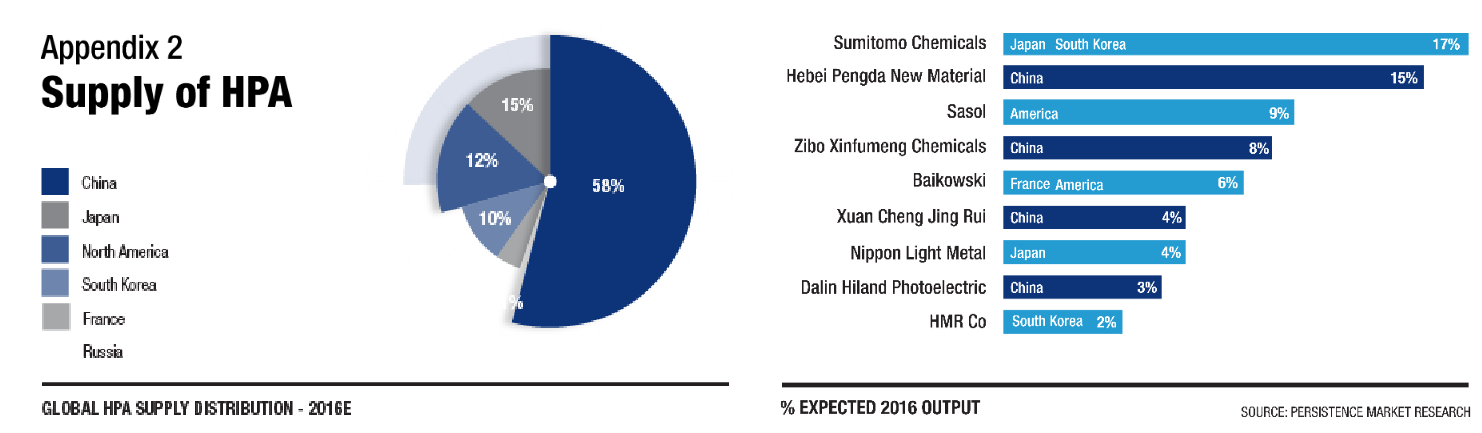

Firstly, the challenges faced by Alpha HPA in getting offtakes could be summed up in this chart (source Alpha HPA presentation 2019 AGM)

Taking the other side, I don't think the issue is China preventing the offtakes as they are producing HPA for companies within the country that are in the EV and LED sector. Therefore we can probably assume there is no supply chain risk for HPA to the western world.

Instead, the charts presents a distinct pattern. Some of the companies in the chart are based in or near countries with an established manufacturing base.

Take the largest producer Sumitomo Chemical based in Japan where we can assume that there are lots of companies such as Sony that will need HPA for their electronics and auto companies such as Nissan and Toyota that need HPA for LIBs. We can also assume China would need HPA from Sumitomo Chemical as well.

We can say the same for Sasol that is based in America and home to auto companies Ford, GM and as well as Tesla. Balkowski in France is home to Renault and Citroen plus BMW and Mercedes in Germany.

Alpha HPA sits nowhere near these geographies with these manufacturing bases and this isolation presents a dilemma to these fast-paced industries that want product almost immediately and not trapped on a ship for days or months.

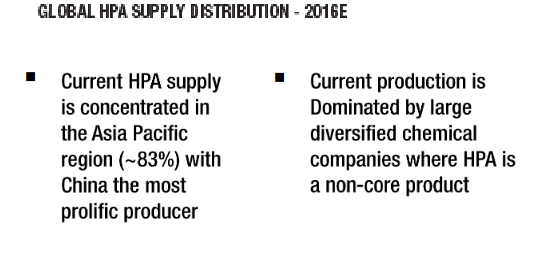

Another point to make is that HPA does not appear to be a standard commodity. It is a chemical manufactured to exact specifications as required by the customer as seen in the HPA products page from Sumitomo Chemical.

This specialisation also gives Sumitomo a distinct advantage over emerging HPA producers in that they have created a brand that customers can trust. So we can also say with certainty the leading HPA companies in the chart would have an established reputation with customers.

This established reputation creates a barrier to entry into the HPA market that will be hard to crack for new entrants such as A4N.

I believe geographic isolation and barriers to entry by existing HPA producers is making it difficult for Alpha HPA in securing offtakes.

However, we should give credit that Alpha HPA knows these problems.

- They have a product page already and recognise HPA is a chemical rather than a commodity unlike Cadoux (FYI resources) and Andromeda Minerals who simply think they can sell HPA like in a open market.

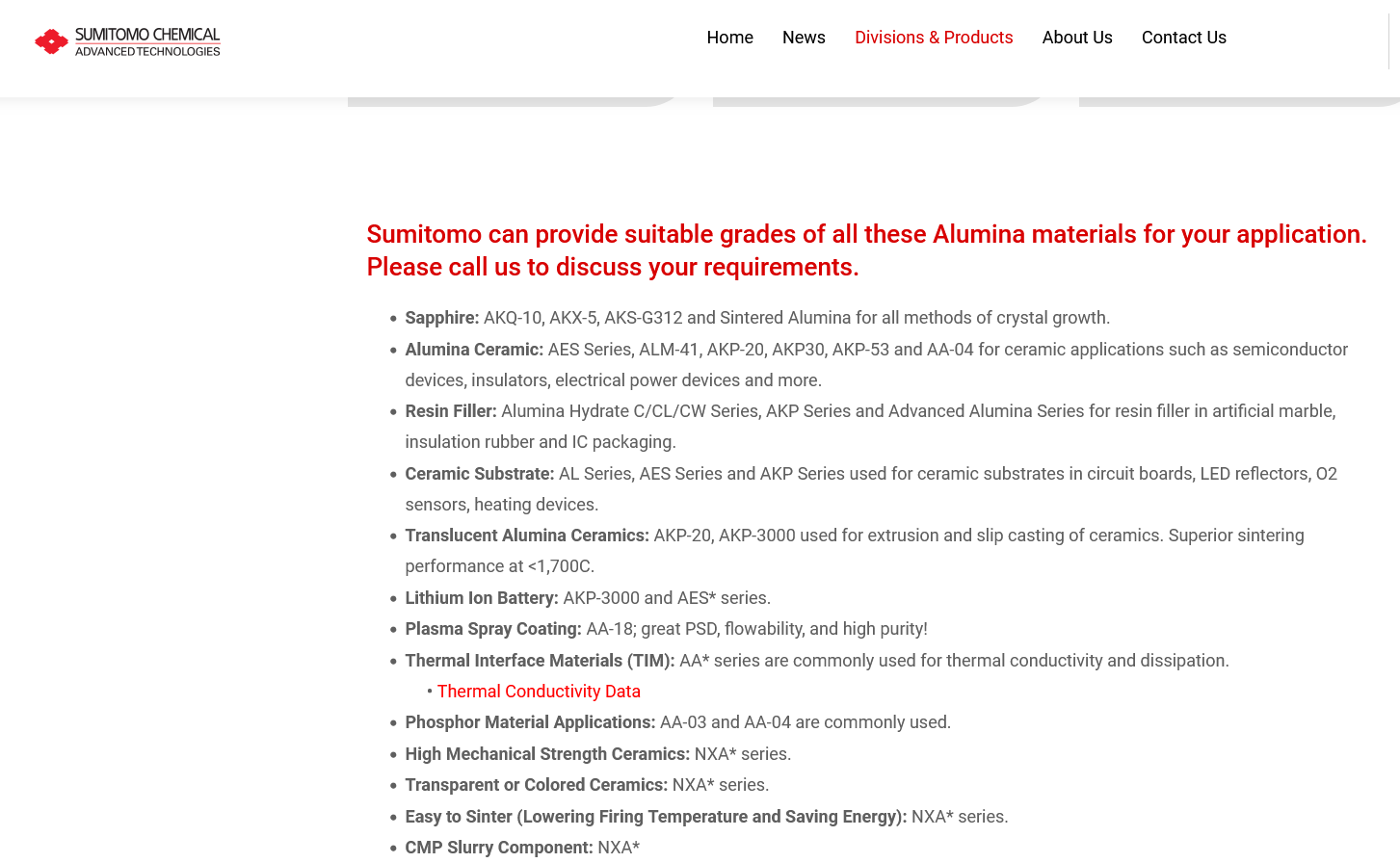

- The company is looking at options to enter the USA although it is only an MOU (Bell potter unearthed Feb 2023)

However, the situation would be different if Australasia had a manufacturing base that produced cars and high end electronics. Unfortunately that was snuffed out ages ago when Holden closed down which forced the other car companies to close shop.

Fortunately the current government recognises this but given what happened to Holden, it will take time to rebuild manufacturing in Australia either locally or by overseas investment (ie: Toyota comes back etc...).

So unless we see miraculous growth in the manufacturing base in Australia/Oceania region, maybe still a bit early for Alpha HPA and the market cap might have gone a bit ahead of itself.

[not held]

Couldn't find the latest Bell Potter report on Factiva but managed to find a report floating loose from the Bell potter site dating from Nov 2023. Mainly talks about Sapphire glass funding instead of HPA (High Purity Alumina)

Might help others here understand the investment thesis behind Alpha HPA

Which I still find hard to understand versus even something like a biotech would you believe mainly due to hardly any details on customers, offtakes, competitors, market pricing etc...

Overall a very challenging company to understand.

Prime Minister Anthony Albanese did a tour of the Alpha HPA facility as well as a press conference after coming out of trading halt from receiving government finance.

$400m Australian Government support to establish Australia’s first, commercial scale high purity alumina products facility

Plus watched a segment aired on ABC's "The Business" on A4N tonight.

Looks quite promising for a company not earning revenue yet and sitting near a market cap of $1bn

To rub it in a bit more, I had this on my watchlist when it was 10c

The stock that no one understands and with a huge market cap puts in a bit of a rally for the last week

I found a bit of news about battery fires that seems interesting:

Courtesy of Murdoch and shared here so you don't have to add to the Newscorp revenue!

Tech breakthrough tackles deadly battery fires

27 March 2024

The Australian - Online

Gladstone-based Alpha HPA has unveiled a breakthrough in the technology to combat potentially-deadly battery fires.

With lithium-ion (li-on) batteries causing a reported 1000 home fires in Australia last year, the producer of high-purity aluminium has announced a way to reduce the threat. Apha managing director Rimas Kairaitis says the company’s solution builds upon a process developed by world-leading battery anode manufacturer BTR New Materials in the 2010s, using high-purity aluminium nitrate to coat the battery anode with a fine layer of aluminium oxide.

The process has demonstrated a 100 per cent reduction in “thermal runaway events,” ensuring the safety of li-ion batteries. “Until now, commercialisation of this technology has been hindered by the lack of high-purity aluminium nitrate,’’ Kairaitis says.

Kairaitis says news reports of a battery being blamed for a fire that killed two people in Lake Macquarie last week was a tragic reminder of the hidden dangers of the batteries. “At its core, the li-ion battery operates on controlled oxidation reactions.

However, under certain conditions such as trauma or using lower quality materials, these reactions can become rapid and uncontrolled, leading to battery fires,” Kairaitis says.

Alpha has the flexibility to either provide the aluminium nitrate to customers, or apply the coating directly. The company is currently in discussions with 13 anode manufacturers and developers, with the aim of commercialising the technology.

Alpha’s penetration into the battery sector has been assisted by the recent appointment of Annie Liu as a company director. Liu was previously an executive director at Ford, and formerly managed Tesla’s multi-billion-dollar battery supply chain.

ASX-listed Alpha HPA is set to double its workforce to 120 and invest hundreds of millions of dollars over the next two years as it ramps up production of highly pure alumina products for use in computer chips and lithium ion batteries.

@Strawman Were we able to secure a meeting with A4N?

A4N, ASM and Lynas up on news that they attended a roundtable on with PM Anthony Albanese on setting up $4bn worth of funding for critical material projects.

https://www.afr.com/politics/federal/albanese-doubles-critical-minerals-subsidies-to-4b-20231024-p5eeiz

Citing A4N because it has the largest market cap and short positions

In addition, A4N has no offtake agreement yet.

I still don't understand the tech enough in A4N so don't hold given also the market cap is still over $700m with no earnings. It would be most helpful if someone can provide a much needed overview on what A4N does, their competitive advantage and why it justifies a 700m market cap given they are just a processor.

I also think it is still too early to imply any funding guarantees for the roundtable attendees

I added ILU since they already got funding from the government on building a rare earths processing plant.

Maybe I have missed something but anyone know why this is still trading strongly at the current market cap after they announced a loss in December?

Is there a link to the latest feasibility study and not some old one done pre-inflation times?

Can't believe I had this on my watchlist at around 20 cents in 2020

Alpha released its 4C and corporate update today:

Highlights:

- As mentioned previously, the commissioning of the Stage 1 plant is complete and the focus has turned to tuning production capacity and quality, well underway

- This has triggered the first tranche of the government's Critical Mineral Development Program Grant and A4N has received $6.82 of the $15.5M Grant.

- Increased sales and marketing activity with multiple sample orders placed for potential production quality volumes. Nice to see a little more detail here than from previous announcements. Even more would be better!

- Continued investment in Stage 2 Design & Engineering and progressing to FID

- On the product development front, Successful development of Tri-Hydroxide (ATH). Following interactions with several significant lithium-ion cathode manufacturers and a global advanced materials company, Alpha’s product development team successfully developed a 4N+ Al(OH)3 (ATH) product with a sample product having now been shipped and under qualification testing. This product is a potential high-volume product across a diverse spectrum of applications, including lithium refining and as a dopant in cathode and speciality glass manufacture.

- Continuing collaboration and investment from Orica: In November Alpha signed a non-binding Memorandum of Understanding (MoU) with Orica to mutually investigate the technical and commercial feasibility of establishing a new manufacturing facility in North America to produce high-purity aluminium products for the rapidly expanding future-facing industries in the region. Concurrent with the establishment of its North American MoU, Alpha and Orica executed and completed a Subscription Agreement with Orica acquiring a 5% equity interest in the Company.

- Cash on hand $28M

Lowlights:

- Actual booked revenue from sales is insignificant. Given the talk up in the release of the scale of sample and product testing, the booked revenue is virtually non-existent. Now they are through commissioning the Stage 1 Plant, getting sales beyond a much talked about pipeline and into the bank.