As not many people follow Alpha HPA, I wasn't going to plan to write much but it would not be fair to withhold some of my research and thoughts that I found during the last couple of weeks.

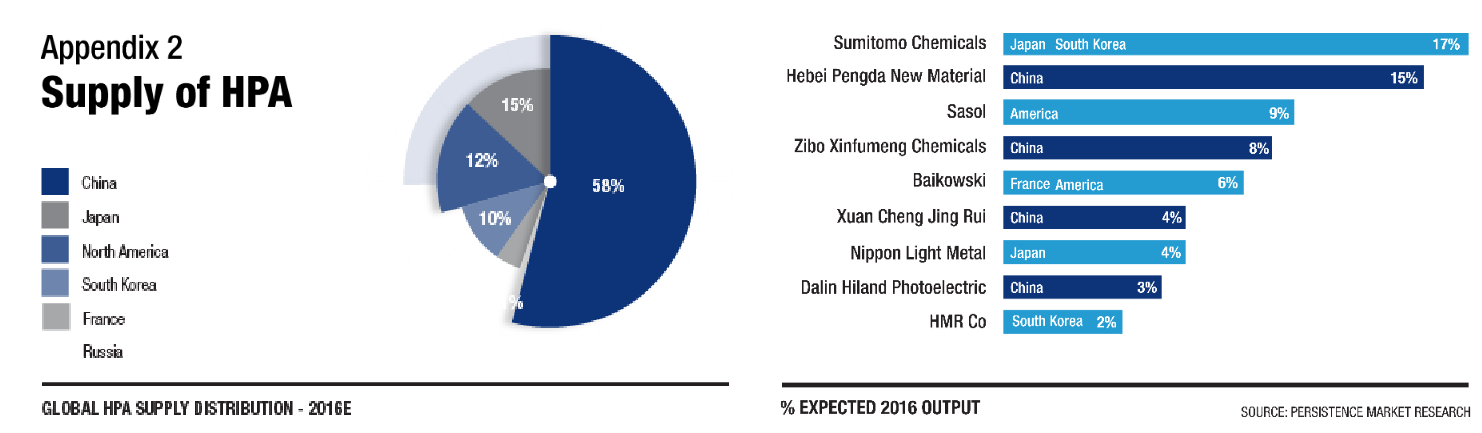

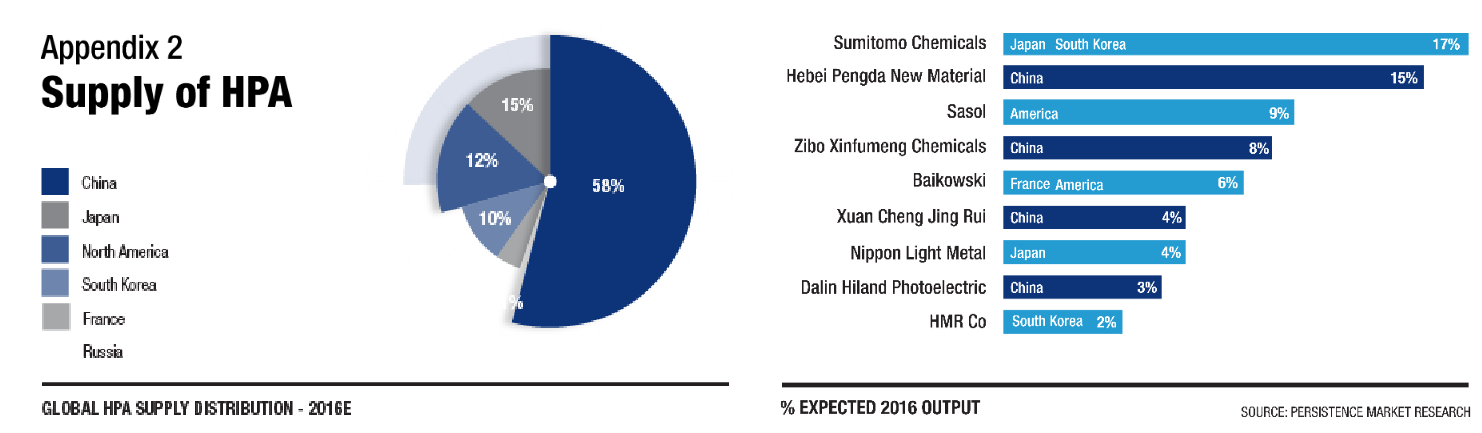

Firstly, the challenges faced by Alpha HPA in getting offtakes could be summed up in this chart (source Alpha HPA presentation 2019 AGM)

Taking the other side, I don't think the issue is China preventing the offtakes as they are producing HPA for companies within the country that are in the EV and LED sector. Therefore we can probably assume there is no supply chain risk for HPA to the western world.

Instead, the charts presents a distinct pattern. Some of the companies in the chart are based in or near countries with an established manufacturing base.

Take the largest producer Sumitomo Chemical based in Japan where we can assume that there are lots of companies such as Sony that will need HPA for their electronics and auto companies such as Nissan and Toyota that need HPA for LIBs. We can also assume China would need HPA from Sumitomo Chemical as well.

We can say the same for Sasol that is based in America and home to auto companies Ford, GM and as well as Tesla. Balkowski in France is home to Renault and Citroen plus BMW and Mercedes in Germany.

Alpha HPA sits nowhere near these geographies with these manufacturing bases and this isolation presents a dilemma to these fast-paced industries that want product almost immediately and not trapped on a ship for days or months.

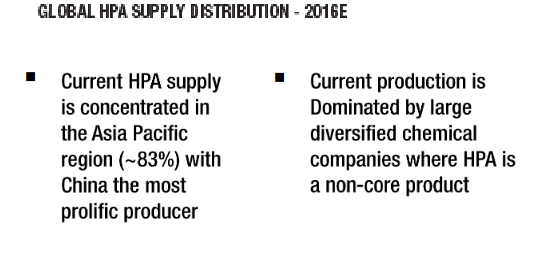

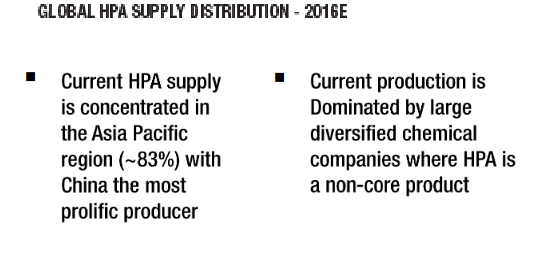

Another point to make is that HPA does not appear to be a standard commodity. It is a chemical manufactured to exact specifications as required by the customer as seen in the HPA products page from Sumitomo Chemical.

This specialisation also gives Sumitomo a distinct advantage over emerging HPA producers in that they have created a brand that customers can trust. So we can also say with certainty the leading HPA companies in the chart would have an established reputation with customers.

This established reputation creates a barrier to entry into the HPA market that will be hard to crack for new entrants such as A4N.

I believe geographic isolation and barriers to entry by existing HPA producers is making it difficult for Alpha HPA in securing offtakes.

However, we should give credit that Alpha HPA knows these problems.

- They have a product page already and recognise HPA is a chemical rather than a commodity unlike Cadoux (FYI resources) and Andromeda Minerals who simply think they can sell HPA like in a open market.

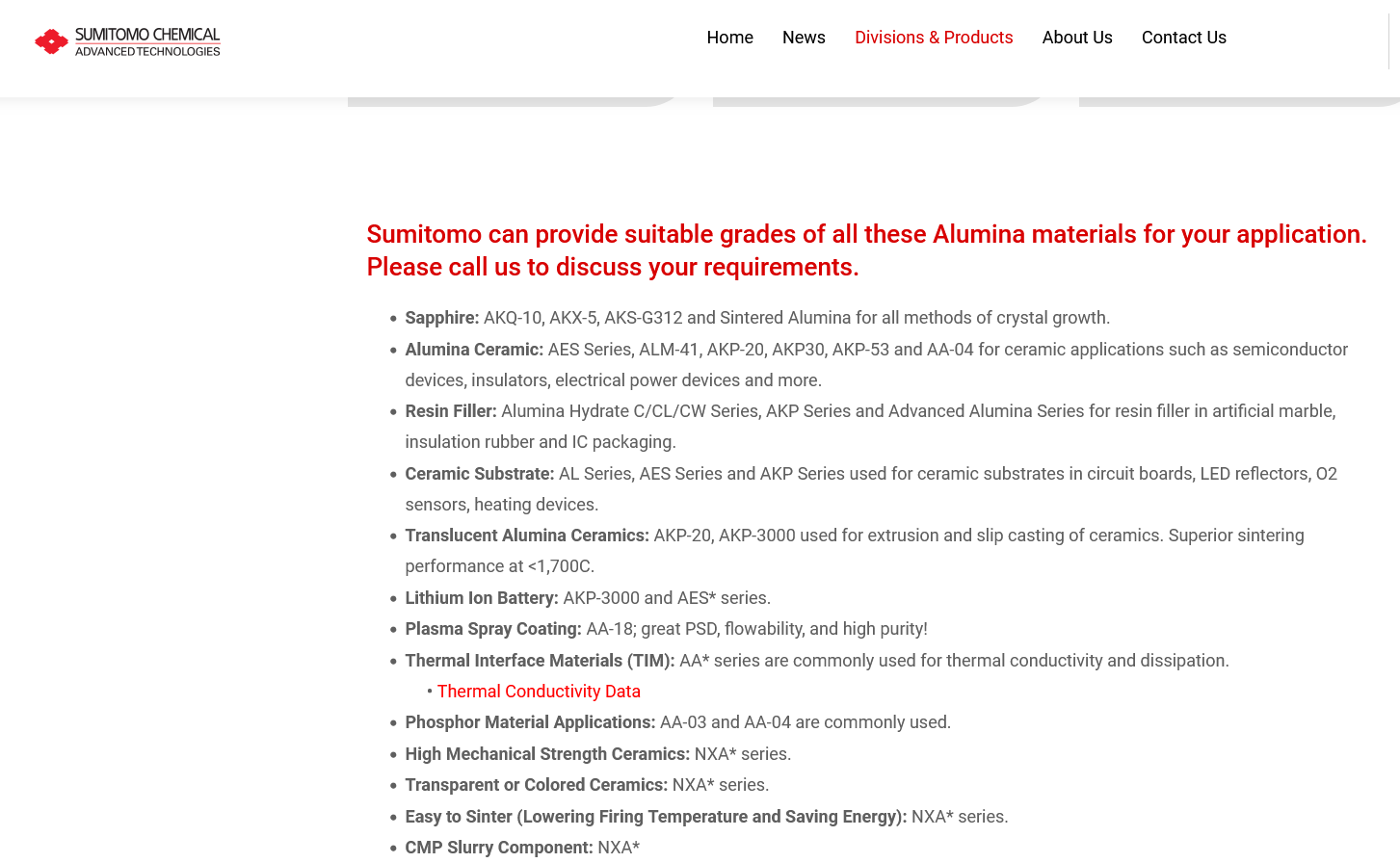

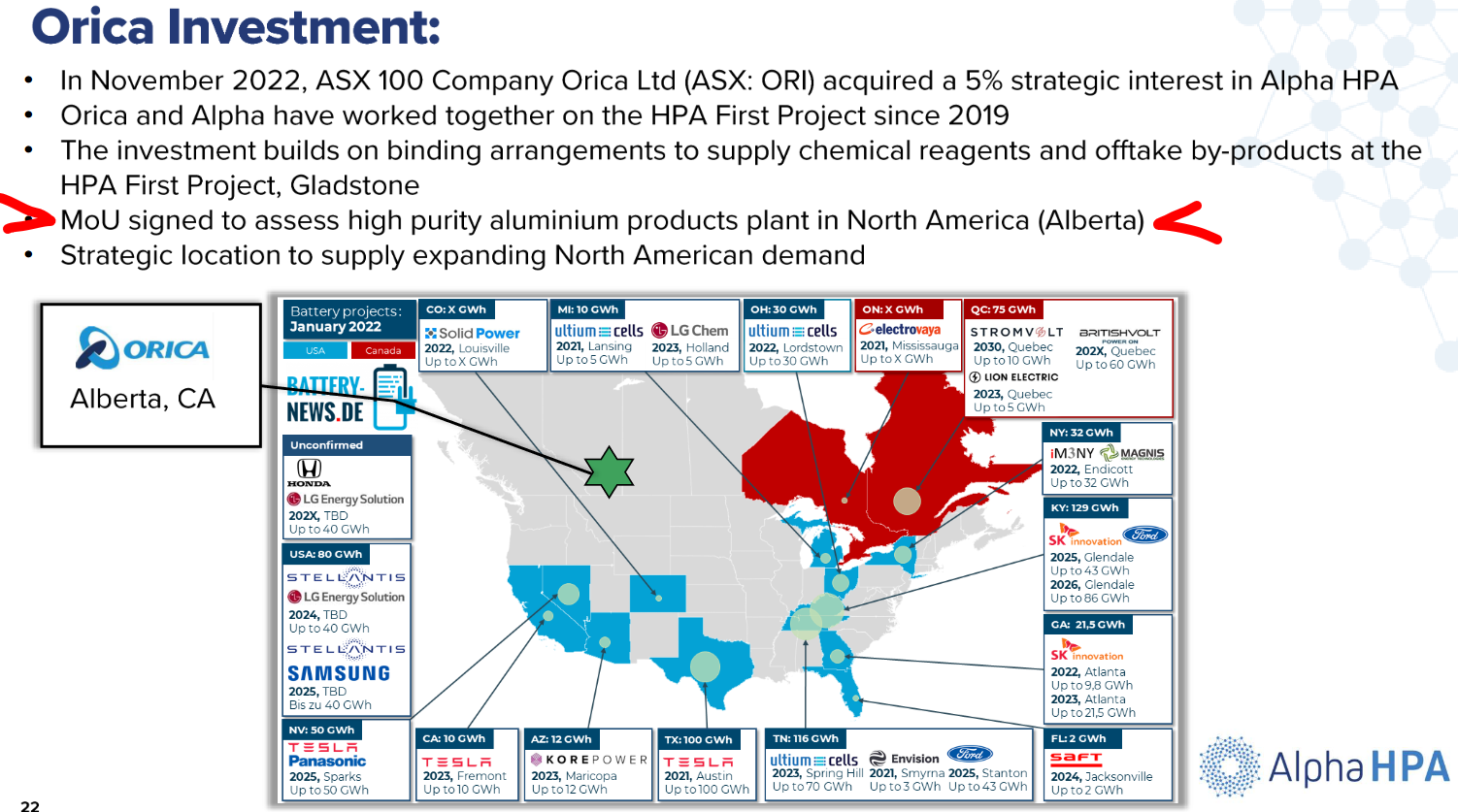

- The company is looking at options to enter the USA although it is only an MOU (Bell potter unearthed Feb 2023)

However, the situation would be different if Australasia had a manufacturing base that produced cars and high end electronics. Unfortunately that was snuffed out ages ago when Holden closed down which forced the other car companies to close shop.

Fortunately the current government recognises this but given what happened to Holden, it will take time to rebuild manufacturing in Australia either locally or by overseas investment (ie: Toyota comes back etc...).

So unless we see miraculous growth in the manufacturing base in Australia/Oceania region, maybe still a bit early for Alpha HPA and the market cap might have gone a bit ahead of itself.

[not held]