Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

This $42 million contract is the second largest project ever awarded to Acrow. Acrow will provide scaffolding and on-site blue-collar and white-collar labour over a 2.5 yr period for the Project Ceres Urea Plant development in Burrup, WA.

Proposed Ceres Urea Plant, Burrup WA https://www.saipem.com/sites/default/files/2024-07/Social-Impact-Assessment-Overview_2024.pdf

To put the project value in perspective, FY2024 revenue was $193 million. CEO Steve Bolland said “There are moments in a company’s history that are game changers and this is one of those moments for Acrow.”

Latest Guidance (12/11/2024)

On 12 November Acrow provided record revenue and EBITDA guidance for first half and full year 2025

Acrow also gave an update on the pipeline of work at 31 October 2024:

- Secured hire contracts wins were up 57% to $33.8 million for four months to 31 October 2024, over the previous corresponding period.

- Record pipeline of $198 million as at 31 October, up 5% on 30 June 2024

Valuation

The Ceres Urea Plant contract provides a solid footing for Acrow to achieve double-digit earnings growth over the next 3 years. Prior to this announcement analysts were forecasting FY2025 earnings of $0.11 per share, up 22% on last year (Consensus of 3 analyst, Simply Wall Street).

At $1.09 per share Acrow is trading on a PE multiple of 12 times FY2024 earnings. Based on analyst FY2025 consensus Acrow shares could be worth $1.30 next year (11cps x PE 12).

Using McNiven’s formula and assuming future ROE of 22%, and requiring a 13% per year return, I get a valuation of $1.25. Analysts are also forecasting Acrow to pay a 5.5% fully franked dividend in FY2025 (7.9% gross yield).

I think you could buy Acrow between $1.00 and $1.10 per share and still do quite. We already have a reasonable weighting of Acrow, so it’s probably a HOLD for us at the current share price.

Held IRL (3.2%), SM (4.7%)

Key Highlights

• Acrow’s second largest industrial access contract win to-date, behind Snowy Hydro

• Supply and management of scaffolding equipment and labour hire over projected duration of 2.5 years, commencing December 24

• Of significant strategic importance as provides a beachhead into Australia’s largest industrial access market

Acrow Limited (ASX: ACF) (“Acrow” or “the Company”) is pleased to announce that its Industrial Access division has been awarded a major contract by the Saipem Clough Joint Venture for the Project Ceres Urea Plant development, located within the Burrup Strategic Industrial Area, Burrup Peninsula, approximately 10 km from Dampier and 20 km north-west of Karratha on the Northwest coastline of Western Australia in Karratha, Western Australia.

The Project Ceres Urea Plant is set to become Australia’s largest gas stream ammonia-urea plant and one of the largest urea plants globally, expected to be completed mid-2027.

The contract is valued at approximately $42 million, commencing December 24, with a projected duration of 2.5 years. Acrow’s scope of work includes the supply and management of approximately 3,800 tonnes of scaffolding equipment, as well as the provision of on-site blue-collar and white-collar labour.

This landmark contract reinforces Acrow’s capability of delivering large-scale industrial access solutions across Australia.

Commenting on the contract, Acrow Limited CEO, Steven Boland said: “We are delighted to play a role in this landmark project and to have secured one of the most pivotal contracts in Acrow’s history. This agreement not only represents a substantial opportunity for revenue and profit growth but also lays a robust foundation for our expansion into what is arguably the country’s largest industrial access market. It also highlights Acrow’s increasing recognition as a leader in industrial access solutions. I would like to congratulate our staff responsible for securing this contract. There are moments in a company’s history that are game changers and this is one of those moments for Acrow.”

The Company looks forward to supporting the successful delivery of this critical infrastructure project and will provide further updates as the project progresses.

I might have been a bit too enthusiastic when I wrote my “Bull Case” straw for Acrow a few weeks ago. At that time shares were trading at $1.05 per share and I thought that was a bargain. Acrow shares have traded as low as 94 cps since reporting. So what happened?

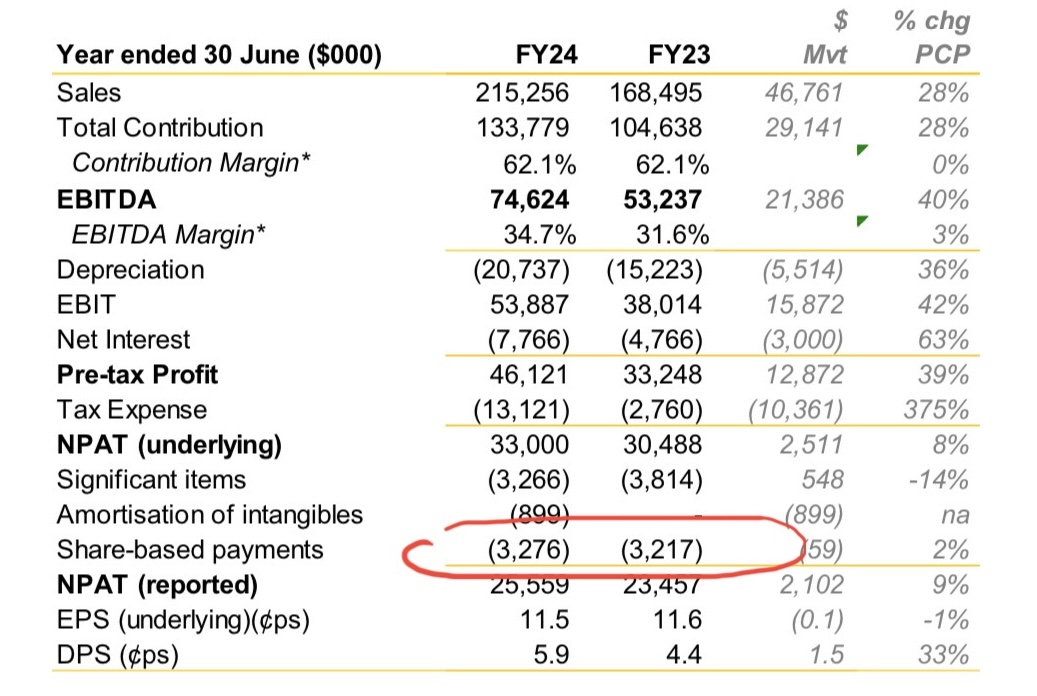

At a glance the key highlights looked OK:

• EBITDA of $74.6m up 40% on PCP

• Pre-tax profit (underlying) of $46.1m up 39% on PCP

• NPAT (underlying) of $33.0m up 8% on PCP, despite effective tax rate of 30% (FY23: 8%)

• EPS (underlying) down 1% on PCP to 11.5 cps, impacted by effective tax rate increase

• Final dividend of 3.0 cents (fully franked), up11% on PCP

• Return on Equity of 27.1% after factoring in higher effective tax rate

• Record new hire contracts secured up 17%, and pipeline up 33%

• MI Scaffold and Benchmark Scaffolding acquisitions expand Industrial Services division and bolsters group recurring revenue

• FY25 forecasting circa 20% revenue growth and double-digit EBITDA growth

However, I don’t think “underlying” NPAT and EPS were a true indication of normalised earnings. To arrive at these figures share based payments of $3.28 million were added back to the “Reported NPAT.” Share based payments are real costs to shareholders, have been on-going, and are not one-offs. Adding these back has boosted underlying NPAT by 13%.

I consider “normalised NPAT” to be $29.7 million, or 10 cps (up from a reported 7 cps for FY23). Normalised ROE comes back to 20% for FY24, not the 27% as stated by Acrow in the Key Highlights.

This year shareholders were diluted through capital raising for acquisitions, DRPs, and share based payments. The share count increased by 35.1m to 301.4m, an increase of 13.2% on the prior year. This was primarily due to the following:

- In November 2023, Acrow acquired MI Scaffolding. The acquisition was partly funded by a $15m capital raise, resulting in the issuance of 18.8m new shares;

- In March 2024, Acrow issued 1.8m new shares to the vendors of Benchmark Scaffolding as part payment for the acquisition;

- Acrow issued a total of 8.1m new shares as part of the dividend reinvestment plans (DRP) in November 2023 and May 2024, including a DRP shortfall underwrite of 6.6m new shares in May 2024, to assist in funding short and mid-term growth opportunities; and

- The balance of approximately 6.4m new shares came from the conversion of performance rights.

Debt increased from $51.3 million to $74.2 million, or net debt on equity of 48.7%. This is higher than I’d like to see it in the current economic climate.

Looking Forward

Management are forecasting 20% revenue growth and double digit EBITDA growth for FY25. Analyst Consensus is for EPS of 11 cps in FY25. This puts ROE at 23% going forward.

Valuation

Using McNiven’s Formula assuming current shareholder equity of 47 cps, forward ROE of 23%, reinvested earnings 34%, fully franked dividends at a 66% pay out ratio, and requiring a 14% annual return I get a valuation of $1.15. That’s a FY25 PE of 10.5 based on analyst consensus.

I still like Acrow and have been adding at around 94 cps before it goes ex-dividend on 30 October. At the current share price Acrow has an 8.9% gross yield which makes it a good dividend stock in the portfolio.

Held IRL (2.9%), SM (4.2%)

Acrow Formwork traded at $1.05 this morning. At these levels I think it’s a bargain so I’ve added another parcel IRL today.

I expect to see 14% earnings growth over the next few years and record profits again this year.

Analyst EPS consensus is FY24 10cps, FY25 12.4cps and FY26 13.1cps. At a PE of 12.5 that’s a valuation of $1.25 and a 12 month price target of $1.48.

Management has a solid track record of adding shareholder value with the share price increasing 8 fold in 4.5 years.

Last year ROE was 24% and should continue to improve for the next few years reaching 28% in FY26.

I expect 5% fully franked dividends (7% gross yield) over the next few years and a total ROI in excess of 30% per year at the current share price.

Held IRL and SM

On the 2 July 2024 Acrow Formwork announced that the FY24 sales pipeline finished at a record $189 million, growing 33% on the previous financial year.

Key contributors were increased tenders for the industrial scaffold and Jumpform products.

Recent News

- In June, Acrow secured a record $12.3 million in new hire contracts, marking another significant milestone. Secured hire contracts for the full year totalled $78.3 million, reflecting a 17% increase over the previous financial year.

- successful renewal of a key contract with Visy, a leading industrial player. The agreement ensures that Acrow will continue to provide industrial scaffold services to the Visy Tumut facility during its annual shutdown program. This renewal solidifies the Company's position as a key service provider in the industrial services access scaffold sector. With a contract term of five years and a total value amounting to approximately $16 million.

- recent acquisitions of MI Scaffold and Benchmark Scaffolding have been performing exceptionally well, contributing to the overall growth and success of the division.

- Looking ahead, the Company is committed to pursuing further growth opportunities in the upcoming financial year. The Company is adopting a proactive approach, leveraging both organic growth strategies and potential merger and acquisition opportunities to expand its market presence and enhance its service offerings.

Past Performance

Acrow Formwork has been a solid performer over the last 4 years, and has been a standout in our Superfund. Not only has the share price more than quadrupled in value, the business has paid out over 80% of its 2020 share value in fully franked dividends. An investment in Acrow Formwork in 2020 has returned approx 500%, not something you would expect from a small cap industrial stock.

Source: Simply Wall Street

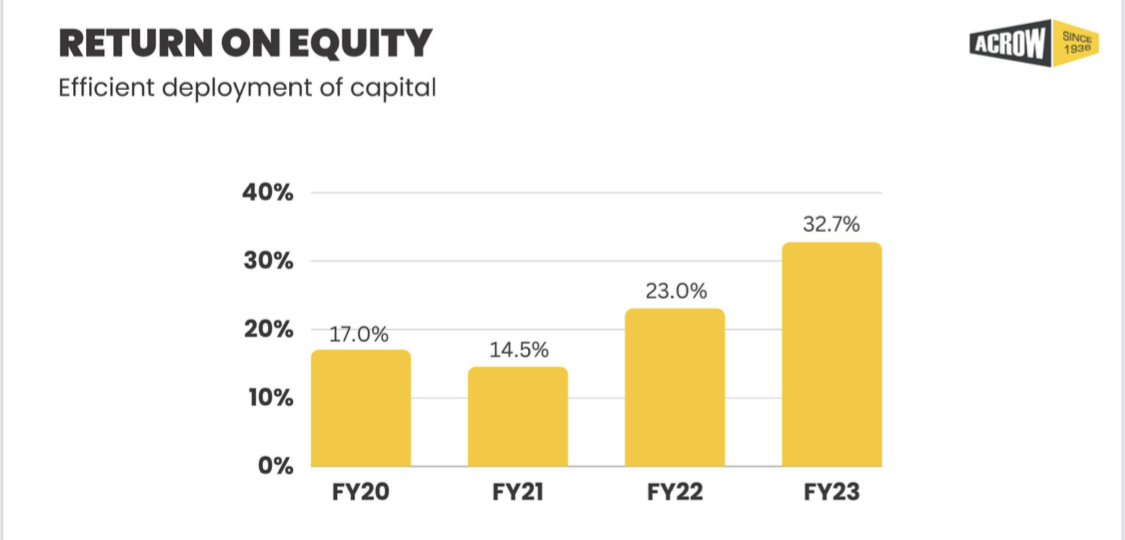

I believe much of Acrow’s success has been due to a strong focus on return on capital. Management has a strict minimum hurdle rate of 40% return on invested capital. This has resulted in the return on capital for the business increasing from 13% to 19% over 4 years and the return on shareholder equity (ROE) increasing from 12.8% to 23.9%.

Future Outlook

With Acrow’s record FY24 sales pipeline and its leading position in the Australian formwork, scaffold, screening and related engineering services industry, I think the outlook for Acrow over the next few years looks solid.

Consensus from the three analysts covering Acrow on Simply Wall Street is for EPS to grow by 12% per year over the next 3 years and for ROE to approach 28%.

Risks

There are a few risks to consider in buying a business like Acrow. Earnings growth depends on a solid pipeline of national construction projects. This has been solid for a few years now, and the next year looks promising. This could turn quickly if the Australian economy is under pressure and governments cut budgets on construction projects.

The other thing to watch with Acrow is the growing debt. Acrow management makes no apologies for using debt to fuel growth. Over the last 3 years Acrow’s debt has increased from $23 million (43% debt to equity) to $70 million (56.4% debt on equity).

Source: Simply Wall Street

Source: Simply Wall Street

I’m not concerned about the increasing debt while management continues to adhere to their strict investment hurdle rate of 40% return on capital. What we don’t need is fewer construction projects and higher interest rates at the same time!

Valuation

Using McNiven’s formula assuming equity of 43 cps, ROE of 28%, 42% of earnings reinvested into growth, and a 5% fully franked dividend, and a required annual return of 15% I get a valuation of $1.40 per share. That makes the current share price of $1.07 look cheap. According to McNiven’s formula Acrow could return investors paying the current share price more than 17% per year over the next few years.

Looking at a PE valuation, Acrow is currently trading on 11.9 x FY23 earnings, 11 x forecast FY24 earnings, 9.6 x forecast FY25 earnings, and 8.7 x forecast FY26 earnings. This is probably in line with historical PE valuations. However, I’m surprised there hasn’t been a PE re-rate for this business given this will be the third consecutive year where Acrow has returned more than 20% on shareholder equity. While the share price has done very well, I think the business is still undervalued..

What do the analyst think? Looking at Simply Wall Street data the 1 year target price is $1.35 (3 analysts)

Summary

This is one of the best performing businesses we’ve ever owned and it’s seems likely that double digit earnings growth will continue for the next few years. However, there are risks in owning a business that depends on a strong pipeline of construction projects, especially with growing company debt and increasing interest rates. Weighing everything up though, I think Acrow is looking relatively cheap given the future prospects. I think a PE of 10 for a business that is consistently returning over 20% on shareholder’s equity is due for a re-rate. I have Acrow on my buy list under $1.06.

Held IRL (2.4%), SM (5%)

Thank you @PortfolioPlus for taking the lead on this one. Secretly I was hoping you would.:) I started writing this straw a few days ago, found it a bit too hard, and then moved on to other companies reporting. I’ve owned Acrow since 2021 and have added shares along the way. It now makes up 2.8% of our IRL portfolio, and 5.2% on Strawman.

In November last year CEO, Steve Boland, sold $1.6 million worth of shares into a capital raise, offered to institutional investors only at a 7% discount (80cps) to partially fund the MI Scaffolds acquisition. I didn’t like that much so I sold a small parcel of shares. However, at the same time two directors bought shares, Peter Lancken bought $500,000 worth and David Moffat bought $20,000 worth of shares for 80cps, the same price the CEO sold his shares for. Another thing that worried me was the CEO never mentioned the minimum 40% hurdle rate for ROI on new capital investments on MI Scaffold like he generally does. Instead the announcement only talked about the acquisition being immediately earnings accretive. That threw me a bit at the time because ‘earnings accretive’ tells you nothing about the quality of the earnings. Will the acquisition improve ROIC or dilute it? That’s what I’m more interested in.

Anyhow, I find out in the results report that management had stuck to their strict 40% ROI on new capital investments which it has been doing for several years now.

What happens to a business when management consistently focuses on returning a minimum 40% ROI on all new invested capital? The quality of its earnings just keeps on improving, and that’s what has been happening with Acrow.

With CEO Steve Boland at the helm, Acrow has improved ROE from 1.7% to c. 20% in just 5 years (based on statutory earnings). That’s an incredible turn around for this $322 million microcap.

However, I’m confused about what ROE I should be using to value the business after the latest result. Acrow claim their ROE is 32%. I don’t think this is correct. I think the ROE is overstated as it’s based on the underlying earnings for 1H24 and total equity at 30 June 2023 (ie. $16.5 million x 2 / $103 million = 32%).

The underlying earnings add back share based payments and acquisition costs to the statuary NPAT (see below). These are real costs to shareholders, cash we’ll never see! What are your thoughts @PortfolioPlus?

Source: Half Yearly Reports & Accounts

For valuation purposes I’d prefer to use the statutory NPAT and total equity at Dec 2023. That would be $12.3 million x 2 / $124 million = 20%. That’s a big difference!

Debt has increased to $63.4 million resulting in debt on equity increasing to 51%. I think this is still OK given the debt is used in the business at a ROE is 20%.

Priorities and Outlook

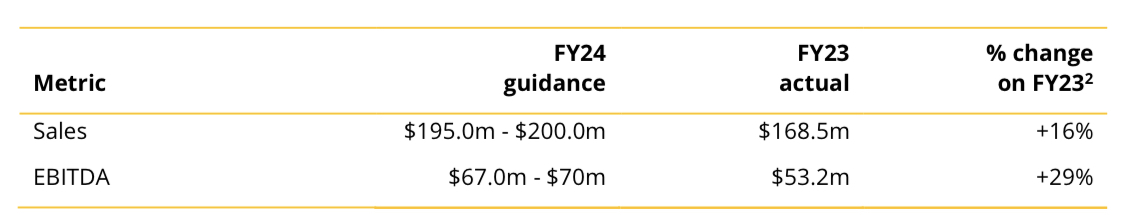

The Acrow Board re-iterated FY24 revenue and EBITDA guidance, underpinned by the following:

• record secured hire contract wins of $34.8m (+18% on PCP);

• a record pipeline of $150.9m (+39% on PCP);

• asset acquisitions and MI Scaffold to contribute an estimated $12.4m in incremental EBITDA ($17.1m annualised)

• revenue and profit to be generated from FY23 and 1H FY24 capital expenditure program

Longer-term, the key drivers of growth are expected to include:

• Jumpform / screens – synergies between our Jumpform and screens businesses will continue to drive cross-sell opportunities;

• Organic growth – market share gains through the deployment of our extensive product portfolio into new markets;

• Industrial Services – we will continue to explore M&A opportunities, particularly around North Queensland, South Australia and Western Australia. MI Scaffold also provides additional capabilities to assist in expanding into new markets; and

• New product development – the design and delivery of proprietary new equipment for the Australian formwork market.

Valuation

Based on FY24 guidance and EBITDA of $74 million, we might expect 35% EBITDA to flow through to the bottom line, ie NPAT of $26 million (In IH24, $12.3 NPAT flowed through from $35.2 in EBITDA). I don’t know how valid my pro rata assumption is here?

Statutory FY24 EPS = $26 million / 292 million shares = 9 cps, which means ACF is currently trading at 13 x FY24 statutory earnings which sounds a bit high on historical multiples, but its OK given the improvement in the quality of the business.

For valuation I’m assuming:

Equity = $124 million / 292 million shares = 42.5 cps.

Future ROE = 20%

Reinvested earnings = 40% (historical)

Dividend franking 100%

Using McNiven’s Formula I get a return to investors of 11.5% at the current price of $1.18. At a 12% return I get a valuation of $1.10. I’m thinking that given the level of risk. Acrow is fully valued at the current share price.

Disc: Held IRL (2.8%) SM (5.2%)

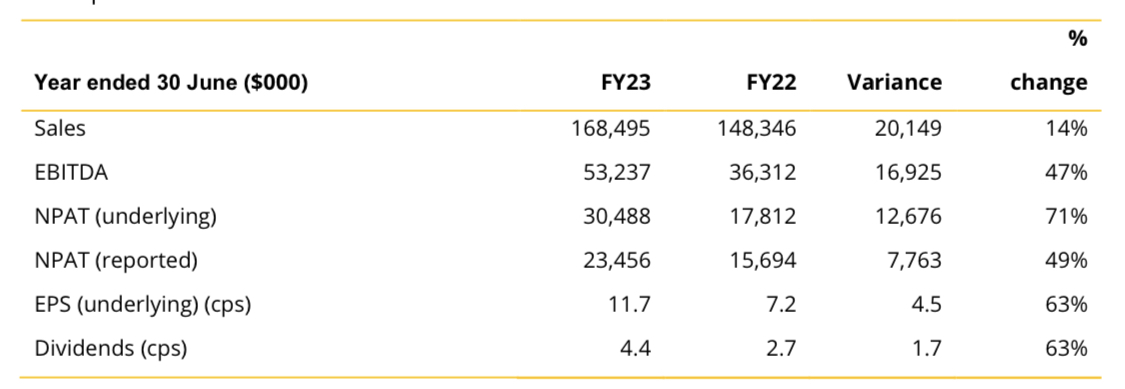

Late yesterday Acrow Formwork released its FY23 results with underlying NPAT at the top of its latest guidance range. Here are the key highlights:

• Record financial results

• NPAT (underlying) up 71% on PCP, EPS (underlying ) up 63% on PCP

• Final dividend of 2.7 cents, fully franked

• Return on Equity of 32.7%, up 9.7 ppts

• Record new hire contracts secured up 34%, and pipeline up 70%

• Strategic capital investment across Jumpform, premium screens and panels assets

• FY24 guidance for EBITDA growth of 29% on PCP

Key financial highlights include:

• Group revenue up 14% on PCP to $168.5m, assisted by a strong trading performance in the formwork division, up 29% on PCP and commercial scaffold division, up 9%. Performance continues to be predominantly organically generated

• Sales contribution of $104.6m, up 29%, with 77% of uplift generated from stronger equipment hire across all divisions. Margin up 7.3 ppts to 62.1%, benefitting from the mix change towards hire revenue as a proportion of total revenue

• Underlying EBITDA of $53.2m, up 47%, accelerating in 2H FY23 due to scale benefits. EBITDA margin of 31.6%, up 7.1ppts

• Underlying NPAT of $30.5m, up 71%

• Underlying Earnings Per Share up 63% to 11.7 cents per share

• Full year dividend per share up 63% to 4.4 cents per share

• Net debt to EBITDA reduced to 1.0 times vs. 1.1 times in PCP. Includes only 2 months of earnings contributions from asset acquisitions reported in May 2023 against directly associated borrowings of $16m

• Return on Equity at a record level of 32.7% up 9.7 ppts

Acrow Formwork reminds me of the 1930’s kids story, “The Little Engine That Could”. For those not familiar, the story is about a little locomotive that put itself in front of a great heavy train when other larger engines refused. As it went on the little engine kept bravely puffing faster and faster, "I think I can, I think I can, I think I can” until it pulled the great heavy train up over the mountain and down the other side!

We’ve held Acrow for over 3 years now and have continued to add more shares along the way as it keeps on surprising us! The management led by CEO Steve Boland keeps putting out stretch targets that it consistently outperforms.

No one tells the success story better than the CEO Steve Boland as he comments proudly on the FY23 results:

“I am thrilled to reflect on our incredible journey over the past five years. Our mission was to become the leading engineered formwork sales and hire equipment solutions provider in Australia, and I'm proud to say that we have achieved that goal.”

“I'm particularly pleased about the remarkable progress we've made in expanding our market presence. Our products, engineering expertise, and national footprint have allowed us to become involved in most major transport infrastructure projects across the country. Additionally, our recent entry into the industrial scaffold market has opened new opportunities for us to replicate our formwork market success in the maintenance shutdown market and general industrial sectors.”

“Our unwavering commitment to efficiently deploying capital has resulted in substantial value creation for our shareholders. The scale benefits we've achieved across the group have driven record profits, margins, operating leverage, and returns. Our return on equity of 32.7% in FY23 is undoubtedly one of the highest returns achieved in the industry, and it reinforces our dedication to maximizing shareholder value as well as the success of our disciplined capital investment program.”

“Our Formwork division had an exceptional year in FY23, marked by several key milestones. We successfully launched the Jumpform business, made strategic acquisitions of premium screens and panel assets along with accompanying contracts, and developed and deployed proprietary formwork products specifically designed for the Australian market. Our first product Powershore 150 was launched into the market during the year, with our second product Acrowdeck due to launch in the first half of this year. Over time we will continue to develop and deploy new Acrow designed products into the market.”

“Market share gains and the deployment of our extensive product portfolio around the country resulted in some notable achievements during the year:

• Queensland and New South Wales delivered strong growth, up 46% and 41%, respectively;

• the screens business reported record revenues and profits; and

• early revenues generated from our new Jumpform business have been very promising.

We secured some pleasing contract wins in the June/July period and generated a robust $26m pipeline within just two months of active marketing.”

“Improvements in hire rates and volumes continued into the second half of the year in the Commercial Scaffold division, largely due to higher funding costs leading customers to opt for hiring equipment instead of purchasing.”

“As previously guided, the Industrial Services division experienced softer conditions in the second half of the year due to fewer maintenance shutdowns scheduled during the period. Nevertheless, I am very confident that FY24 will bring a return to an enhanced program of work for this division.

Outlook

The Acrow Board is pleased to provide FY24 revenue and EBITDA guidance, underpinned by the following:

• record secured hire contract wins of $67.5m (+34% on PCP);

• a current pipeline of $142.3m (+70% on PCP);

• an additional 10-months of EBITDA contributions of approximately $8m, associated with the premium screens and panels acquisitions in April/May 2023; and

• full year contributions from the FY23 capital investment program.

My Takeaway

I’m so pleased we jumped on board “The Little Train That Could” three years ago. With the share price up over 160% it’s one of our better performers. It just keeps chugging away!

I don’t think you can underestimate Steve Boland’s unwavering focus on achieving a minimum return on invested capital of 40%. During FY23 Acrow achieved an annualised return on investment of 58%.

Since 2018, Acrow has increased ROE from 1.7% to 32.7%, now one of the highest in the industry. That’s an incredible achievement.

Valuation

Using McNiven’s Formula and assuming ROE of 30%, FY23 equity of 38.9 cps, reinvested earnings at 62%, franking at 100%, and a required annual return on investment of 15% I get a valuation of $1.35 per share.

At $1.35 per share that’s a PE of 11.5 times FY23 underlying earnings of 11.7cps. I know that’s a long way from the current share price of 90cps (potential upside of 50%), but I think that’s reasonable for a solid little business with excellent management and one of the highest returns on equity in the sector. I’m hoping to add some more shares.

Disc: Held IRL (2.6%), SM (5.2%)

Today Acrow Formwork announced its largest contract ever won by an Acrow business. The contract with Future Generation on the Snowy 2.0 project is for a minimum spend of $55.6M over 5 years. To put this into context, total FY23 revenue is expected to be c.$173M.

Acrow will release its FY 23 results this Tuesday (15th August), as well as providing initial guidance for FY 24 Year. To date, Acrow Formwork has always beat its guidance.

Today ACF is trading up 8.9% at 86 cps. At a PE of 7.5 (based on FY23 midpoint guidance of 11.5 cps) the share price still seems very reasonable given future ROE is expected to be over 26% and over 50% of earnings are reinvested into growth.

Disc: Held IRL (2.4%), SM (4.7%)

ASCROW WINS $55.6M CONTRACT WITH FUTURE GENERATION ON SNOWY 2.0

Acrow Formwork and Construction Services Limited (ASX: ACF) (“Acrow” or the “Company”) is pleased to announce that it has signed the following contract with Future Generation on the Snowy 2.0 project.

Key Highlights

• Labour hire contract with Future Generation for the provision of industrial scaffold services on the Snowy 2.0 project

• Estimated contract spend of $55.6m over 5 years, charged on a schedule of rates

• Contract to commence effective 7 August 2023

• There are no material conditions required to be fulfilled to instigate commencement of the contract

• Largest single contract secured in Company history

Acrow has today signed a contract with Future Generation, the primary contractor on the Snowy 2.0 project for the provision of labour hire for scaffold services. The contract commenced on the 1st of August 2023 and will operate for a minimum period of five years.

Fees will be charged based on a schedule of rates, with an estimated minimum spend over the life of the contract of $55.6m.

Commenting on the announcement, Steven Boland, CEO of Acrow, said: “We are very pleased to be awarded this contract with Future Generation, which represents the largest contract ever won by an Acrow business, and particularly given it is on such a marquee project.”

“When completed, Snowy 2.0 will provide on-demand renewable energy and large-scale storage to the National Electricity Market for many generations to come.”

“Our involvement with the Snowy 2.0 project already spans a period of 2 years, having both sold and hired Industrial Scaffold and Formwork equipment and provided labour hire services over this time. It is a testament to the service and quality of the industrial services team that Future Generation has committed to a long-term contract with Acrow for the provision of labour hire for scaffold services.”

“Since being acquired in 2020, as part of the Uni-span acquisition, the Industrial Services division has grown fourfold., expanding into new states and markets, and becoming an integral part of Acrow’s long-term growth strategy. I congratulate the team on such an incredible achievement and look forward to continued growth. The success of the team in securing this lucrative long term contract will underpin the performance of this division going forward.”

“I look forward to the release and presentation of our FY 23 results on Tuesday , as well as providing initial guidance on the FY 24 Year .”

On The Call today David Lane from Ords Minnett said their analysts like Acrow Formwork and Construction and have upgraded it to a BUY with a share price target of $1.08.

Daniel Ortisi from The Stock Doctor also likes the business and called it a SPEC BUY.

Disc: Held IRL 2%, SM 4.7%

Acrow Formwork has upgraded underlying NPAT guidance by 7%. FY23 ROE should now be in excess of 30% and with a forward PE ratio of less than 7, the business is starting to look incredibly cheap.

My previous valuation of 95 cps (based on a ROE of 26%) should be achievable when the market realises how the performance of this business has changed over recent years (FY21 ROE 8.2%, FY22 ROE 21%, forecast FY23 ROE 30%). This is due to a number of smart acquisitions that have achieved the minimum CAPEX ROIC benchmark of 40%.

The Acrow share price has been under pressure since the federal government made cuts to infrastructure spending to fund defence projects.

Disc: Held IRL 2.3%, SM 4.7%

Acrow is continuing to build on its growth capex program initiated a couple of years ago with the recent purchase of Heinrich Screens (4/04/23).

Acrow’s disciplined capex growth program targets a minimum 40% return on investments.

Acrow anticipates that the return on investment by Heinrich Screens in its first year will exceed the company’s required hurdle rate for growth capital investment (40%+) and therefore has the potential to make a material positive contribution to the Company’s FY 24 earnings.

Acrow paid $11.5 million for Heinrich Screens exceeding the expected additional capital expenditure for 2HFY23 of $6 million, bringing the new total for FY23 to $26.5 million. Even though Acrow has spent more than previously indicated on growth capex for this year, I am pleased they have grasped the opportunity to acquire yet another business with ROIC expected to be higher than 40%.

During 1H FY23 Acrow achieved annualised return on investment of 53%. Over the last 3 years Acrow’s ROE has increased from 12.8% to 21% and ROE is expected to increase to 25% over the next 3 years according to analyst forecasts. This is testament to Acrow’s disciplined capex strategy.

I am happy for Acrow to continue using some debt to accelerate growth and to improve the quality of its earnings. I think there are a lot of other businesses that could learn from from Acrow’s savvy, patient and disciplined acquisition approach.

Acrow is one of the few businesses that I have continued to add shares in as the price goes up. I have built a lot of trust in the management under CEO Steve Boland. At the current share price of 79 cps I am still expecting returns on my investment of over 15% per year through fully franked dividends and capital growth (McNiven’s Formula).

If I didn’t have other businesses on my hit list with even higher expected returns on my investment (eg. EGG where I am expecting ROI of 21% at the current price), I would be adding more ACF. As always, with limited capital you need to find the best incremental return on each investment you make…just as Acrow does!

Disc: Held IRL (2.3%), SM (4.8%)

ASX Announcement, 04 April 2023:

ACROW ACQUIRES HEINRICH SCREENS ASSETS AND SECURED HIRE CONTRACTS MOMENTUM CONTINUES

Acrow Formwork and Construction Services Limited (ASX: ACF) (“Acrow” or the “Company”) is pleased to announce the following:

Key Highlights

• Acquisition of Heinrich screens assets, intellectual property, and both existing and confirmed forward contracts for $11.5m, with ROI expected to exceed Acrow's required growth capex hurdle rate in Year 1

• Secured hire contracts up 34% for nine months to 31 March 2023 on the PCP Acquisition of Heinrich Screens Assets

Acrow has today acquired the screen assets from Heinrich Plant Hire (“Heinrich), including the intellectual property and existing and secured hire contracts. The purchase price of $11.5m will be funded by a combination of cash at bank and debt. There are no material terms with this agreement still required to be met with settlement now completed.

Acrow anticipates that the return on investment in Year 1 will exceed the company’s required hurdle rate for growth capital investment and therefore has the potential to make a material positive contribution to the Company’s FY 24 earnings.

Commenting on the acquisition, Managing Director, Steven Boland said: “We are very pleased to have acquired the screens assets and contracts from Heinrich, one of South-East Queensland’s largest formwork contractors, and a long-term client of Acrow.”

“The assets will complement Acrow’s existing screens business, providing additional flexibility and product versatility to an already strong market position. “

“We also see further market growth opportunities over time, as we look to roll out the Heinrich screens system across our national footprint.”

Secured Hire Contract Wins Update

Secured hire contract wins for the nine months to 31 March 2023 have increased by 34% on the previous corresponding period. This exceeds the 28% growth reported for the six months to 31 December 2022.

The month of March recorded hire contract wins of $6.8m, representing the second largest month in the company’s history and included a third Jumpform contract win and the first in the Western Australian market.

Commenting on the update, Steven Boland said: ”Acrow is experiencing another year of strong growth in FY23 and our continued success in securing new hire revenue contracts, our most important lead indicator, plus the opportunities arising from the national rollout of Jumpform and now the important acquisition of the excellent Heinrich screens assets and associated contracts, bodes well for the prospects of another year of growth in FY24.”

For anyone interested in Acrow who missed the 1H23 results investor briefing on 23 February 2023 (including myself) the audio recording is now available on the Company’s websiite: https://www.acrow.com.au/presentations-interviews/

Today Tony Yoo from The Motley Fool shared a view on Acrow Formwork by Gregg Taylor, Small Cap Fund Manager for Salter Brothers - The obscure ASX share with 45% upside one small-caps expert is backing right now:

“Dirt cheap for ‘defensive growth’

Acrow Formwork and Construction Srvc Ltd (ASX: ACF) provides services and formwork solutions for the civil construction industry.

Those in the know have flocked to the stock, seeing the share price rocket more than 39% over the past year.

Taylor’s team reckons there’s still upside in excess of 45% above the current share price over the next couple of years.

The business is “consistently growing” its revenue and earnings, as seen over the five years that it’s been listed on the ASX.

“It’s also generating good cash, has a good balance sheet, is quite profitable and is dividend-paying — fully franked yields of close to 6%.”

Despite the rise in share price, Acrow shares are still trading at a price-to-earnings multiple of seven to eight times, which is a bargain in Taylor’s eyes.

“So you’re not paying a lot for that defensive growth.”

A 45% upside on today’s share price would make Acrow worth $1.10.

Disc: Held IRL (2%), SM (4.5%)

Acrow Formwork and Construction Services (Acrow) released their 1H23 results and lifted FY23 guidance yesterday after close of trading. Here are the key highlights from the ASX announcement and presentation:

Key Highlights

• Revenue up 14% on PCP

• EBITDA up 38% on PCP

• NPAT (underlying) up 52% on PCP

• Interim dividend of 1.7 cents, 85% franked (4.8% yield)

• ROE 26.1% - more than doubles over 4 years

• Record new hire contracts secured

• Record sales pipeline

• Upgraded FY23 guidance – EBITDA up 34%, Underlying NPAT up 46%, EPS up 39% on PCP

Here are the comparative half year figures here:

My Takeaways

Acrow has a very disciplined approach to capital management. @Winitalked about incremental return on equity (ROE) in his straw for XRF, “Ultimately it is the incremental return on equity that drives share prices rather than the absolute level.”

Acrow continues to target a minimum 40% return on its capital investment program. During 1H FY23 Acrow achieved an annualised return on investment of 53%.

This discipled approach to capital management has more than doubled Acrow’s ROE over the last four years to over 26%.

While talking about the upgrade to FY23 profit guidance (underlying NPAT is expected to be up 46% on FY22) CEO Steve Boland said “Whilst not increasing revenue guidance, the significant increase in profit guidance is indicative of a greater proportion of revenue arising from equipment hire which generates a higher quality of earnings.”

Shifting the business mix is continuing to improve Acrow’s ROE.

The Natform business is shaping up to have its highest revenue in history:

Interestingly, Steve pointed out that inflation has been a tailwind for Acrow, ”Within both the Industrial and Commercial Scaffold divisions we have experienced improvements in equipment hire rates and volumes. This is in part attributable to inflationary pressures increasing the cost of new equipment for participants in these markets. At present, this is resulting in a shortfall in available hire equipment and pushing up hire rates. Pleasingly, Acrow’s strategic positioning allows us to capitalise on either trend.”

Steve said “one of the major driving forces in Acrow’s tremendous growth in recent years has been the development of our engineering capabilities. Over the last four years, we have almost tripled our engineering team to 43 and are winning contracts, assisted by our solutions based approach. As the team grows and evolves, our skillset continues to augment with the inclusion of design engineers to our team, focussed on developing market leading systems, specifically for the Australian formwork market.”

Outlook

In summing up on the outlook Steve said ““FY23 is shaping up to be another record year. The hire contracts secured in FY22 and the first half of FY23 are leading to record levels of hire revenue being generated. This is a strong indicator as to the success of our growth capex program of the past couple of years as can also be seen by the trajectory of our Return on Equity.”

“In the civil formwork market, many of the marquee projects that we are engaged on have several years to run, and we remain well positioned to secure additional packages as they are presented for tender. Furthermore, there is a broad pipeline of new projects that will be commencing in the not too distant future that I believe will continue to deliver considerable growth opportunities for Acrow over the next decade.”

This slide for major transport infrastructure projects in Australia also looks very promising:

Overall, I’m very excited about the future of Acrow as a business. It’s well managed, it has a discipled approach to growth capex with a minimum requirement of 40% return on invested capital, it has been incrementally improving ROE, and it has a solid pipeline of projects.

Valuation

Using McNiven’s StockVal formula assuming normalised ROE of 26%, dividend payout ratio of 43% (historical), franking at 85%, and a required return on your investment of 15%, I get a valuation of 90 cps. If you were happy with a 12% required return on your investment you could pay up to $1.30 per share providing Acrow’s ROE remains at 26% or above.

Disc: Held IRL (2%), SM (4.3%)

It was a relief to receive confirmation yesterday from Acrow that the company has no debt exposure to failed Clough Engineering. The news sent the share price up over 4% today to a 5 year high of 61.5 cps.

I’m still cautious about the knock on effects for Acrow in the Snowy Hydro 2 project, even though it has no direct contracts with Clough. Acrow assures us that Future Generation (the company contracting Acrow) is carrying on as usual on the project.

Even though Acrow is very well managed and has performed exceptionally well over the past 2 years, I have concerns more construction companies might go under in this high interest, high inflationary environment, and Acrow could get caught up in the aftermath.

Disc: Held IRL and SM

Acrow would like to advise that the company has no debt exposure to Clough Engineering. It has been incorrectly reported in some media outlets that Clough is the builder of the Snowy Hydro 2 project. For all works carried out by Acrow on this project, the company is contracted to Future Generation. Clough is one of the participants in this JV as we understand.

We have been assured by senior representatives of Future Generation that business is carrying on as usual on the project.

Should any circumstances change in relation to this we will advise the market accordingly. This release was approved by the Acrow Board of Directors.

Acrow Formwork has maintained its previous FY23 guidance of 9.0 - 9.4 cps and highlighted several opportunities for future growth at the AGM Presentation today. In response the share price jumped over 8% today to a five year high of 59 cps. At the midpoint of guidance, that puts ACF on a FY23 PE multiple of 6.4 which doesn’t look expensive.

If ACF continues to grow earnings at c. 20% per year (analyst forecasts), forward ROE will be over 23%. This is excellent performance by the formwork, scaffold and engineering service specialist.

ACF is moderately leveraged with a debt/equity ratio of 40%, however, debt is well covered by operating cash flow (32%).

FY23 dividend should be upwards of 6% partly franked (60% in FY22).

Disc: Held IRL and SM

ACROW MARKET UPDATE – STRONG START TO FY23 LEADING TO UPGRADED FY 23 GUIDANCE

Acrow Formwork and Construction Services Limited (ASX: ACF) (“Acrow” or “the Company”) is pleased to update the market on the achievement of a stronger than expected start to the new financial year.

Our lead indicator secured hire contracts has continued to grow strongly. For the three months to September 2022, we recorded a 32% increase on the previous corresponding period. Year to date trading results have also been very strong with the highlights being:

• continued strength in the civil construction formwork markets, across Queensland, New South Wales, Victoria and Western Australia;

• the new contracts secured in our Jumpform business have commenced and are performing above initial expectations; and

• substantially improved hire rates being realised across our commercial scaffold business.

The strength of the current results coupled with the forward outlook, have provided the Board with the confidence to upgrade FY23 guidance, previously provided at the time of the FY22 financial results (ASX release 23 August 2022).

In summary, sales revenue guidance remains unchanged due to the change in sales mix, with hire revenue contributing a larger proportion of total revenue. The higher sales contribution margin from the hire business translates to a higher pass through of revenue, resulting in an upgrade across underlying EBITDA, NPAT and EPS guidance of 6%, 7% and 8%, respectively.

Commenting on the release, CEO Steven Boland said: ”We are pleased to see activity levels continue to remain at extremely hstrong levels across the vast majority of our business units. Our recently secured Jumpfrom contracts have commenced trading and we have high expectations for this business over the coming years.”

“These factors coupled with the strength of our forward order book, brought about by our continued success in converting market opportunities to revenue, has given the Board the comfort to announce this upgrade to our FY23 guidance that will see the company enjoy another year of substantial growth.”

“We were also pleased to hear the Federal government’s recent announcement to maintain a commitment of investing heavily in rail and road infrastructure across the country, a segment of the market which is very much in our sweet spot.”

“ I look forward to providing more colour on both our FY 22 results and the buoyant trading outlook for FY 23 at our AGM to be held on Tuesday the 15th of November “.

Disc: Held IRL and Strawman

Here is a nice graphical, picture filled presentation that highlights Acrow’s rapidly expanding business. There’s no point in me repeating any of this here! https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02556934-6A1105725?access_token=83ff96335c2d45a094df02a206a39ff4

The results will be presented by CEO & Managing Director, Steven Boland, and CFO Andrew Crowther, on an investor and analyst briefing call at 11.00am AEST today.

To access the call please use one of the following dial-in numbers:

Dial in number(s)

Australia Toll-Free: 1800 093 431 Hong Kong Toll: +852 3005 2399 Japan Toll-Free: 0120 200 683

New Zealand Toll-Free: 0800 452 257 New Zealand Toll: +64 9 307 1606 Singapore Toll-Free: 800 120 6856 UK Toll-Free: 0800 026 1552

US Toll-Free: 1 877 788 9032 International: +61 2 8047 9393

Participant PIN Code

17922757#

Acrow has just released an exceptional FY22 Preliminary Financial Result announcement, and is guiding for a 20% increase in EBITDA for FY23. This little Aussie business is on fire!

Key Highlights:

• Revenue of $148.3m up 40%

• EBITDA of $36.3m up 49%

• Underlying NPAT of $17.8m up 104%

• Statutory NPAT of $15.7m up 296%

• Underlying EPS of 7.2c up 79%

• FY23 EBITDA guidance of $43m to $44m up 20% (midpoint)

Acrow Formwork and Construction Services Limited (ASX: ACF) (“Acrow” or the “Company”) is today pleased to report the FY22 Full Year Financial Results. For the 12 months ended 30 June 2022, the Company reported record sales revenue, EBITDA, and underlying NPAT, up 40%, 49%, and 104%, respectively. A final dividend of 1.5 cents per share (60% franked) was declared. Dividends paid and declared for the full year were 2.7 cents per share (42% franked).

Key financial highlights include:

• Group revenue up 40% on PCP to $148.3m, attributable to a strong trading performance across all divisions and states, led by Industrial Services, up 110%. Performance was all organically generated

• Sales contribution of $81.4m, up 32%, driven primarily by growth in the Formwork hire business

• Underlying EBITDA of $36.3m, up 49%, and EBITDA margin of 24.5%, up 1.5ppts

• Statutory NPAT up 296% to $15.7m, assisted by a substantial decline in significant items

and share-based payments, down 48% to $2.1m

• Underlying EPS up 79% to 7.2 cents per share

• Net debt to EBITDA down from 1.2 times to 1.1 times1.

• Operating Cash Profit of $23.0m, up 92%

Commenting on the results, Acrow CEO, Steven Boland, said: “This has been a watershed year for Acrow. We have reported record financial results, with underlying earnings per share growing 79% to 7.2 cents per share on the prior year. Moreover, we have now achieved an EPS cumulative average growth rate of 57% over the four years to FY22.”

“Most pleasing is that all divisions and all state markets reported improved performance on the prior year and that this growth was achieved entirely from organic growth initiatives. During the year we continued to strengthen our relationships with our key customers, securing a record $50.4m in new hire contracts which was up 28% on the previous year. This is the most important lead indicator to future performance of our business.”

”Acrow prides itself on operating to a rigid investment hurdle of no less than 40% on our growth capital programs. In the three years to FY22 we acquired and deployed $32.5m in additional formwork and industrial services equipment, and have achieved a cumulative annual average return of 46.7%2”

Key operating highlights during the period included:

• The record results were achieved entirely through organic growth across all divisions and states;

• Another period of record hire contract wins, with $50.4m in new hire contracts in the 12 months to 30 June 2022, up 28% on the PCP;

• An $84m pipeline, up 14% on the PCP, with formwork related projects comprising 87% of the pipeline;

• Formwork hire revenue increased by 37% to $39.8m;

• The Industrial Services division continued its strong growth trajectory with revenue and sales contribution up 110% and 53%, respectively;

• Significant steps were taken to minimise the impact of supply chain and logistics.

Priorities and Outlook

The Company is guiding for another strong year. Management is currently projecting FY23 revenue to be in the range of $165m to $175m up 15% and underlying EBITDA of $43.0m to $44.0m up 20% on the prior year.

Disc: Held IRL (2%) and SM (3%)

In today’s ASX Announcement Acrow said it had entered the Jump Form market with two new contracts worth circa $4 million in revenue , and a 10 year exclusive licensing arrangement with Jacking Systems on two marquee Queensland projects. CEO, Steven Boland believes this is one of the most significant developments in the business over the past few years. The Acrow share price jumped over 5% on the news.

”These are landmark contract wins for the company as it fast tracks entry into this lucrative market. Jump Forms are one of the most important critical path items on any multi-level construction project and Acrows entry into this market further enhances its position as the leading provider of Engineered Formwork Sales and Hire solutions to the Australian construction is market. The total amount of revenue and profit from these contracts will be realised in FY 23”

Commenting on the significance of this to Acrow, CEO Steven Boland said, “We have had a keen interest in the Jump Form market for some time and we recently entered into a 10 year exclusive licensing arrangement within Australia, with New Zealand company Jacking Systems, whose proprietary system is one of the most technically advanced, highly re-usable and adaptable Jump Form systems available in the Australian market. Securing these two new contracts initiates our entry into this market and we will now fast track the development of our Jump Form business unit.”

“I am very excited by the prospects for this new division as we open another significant new revenue channel in one of the most important formwork areas on any project. Further to this, Jump Form systems perfectly complement our existing suite of formwork and screen systems and will enhance utilisation and revenue opportunities across our fleet.”

“The combination of our industry leading Engineering expertise coupled with the superior technology of Jacking Systems product, will provide a very compelling case to potential customers as we seek to grow a national footprint in this market. I believe this is one of the most significant developments in our business over the past few years. A big well done to our team who have delivered on this opportunity. This additional revenue stream will help underpin our FY 23 revenue and profit results of which we believe significant further growth is likely.”

“We look forward to announcing our FY 22 results on August 24, along with details of our final dividend for the year and initial guidance on the FY 23 year.”

Disc: Held IRL and Strawman

Further growth in contract book to bolster Acrow’s FY23 revenue base

Key Highlights:

• Acrow signs two new contracts, together valued at $11 million, with existing clients

• A new $6 million contract was secured on the Snowy Hydro 2.0 project

• An additional contract for $5 million was secured at Origin Energy Surat Basin

• New Hire revenue contracts locked in by Acrow over May totalled $6.3 million, the second-best monthly performance by this metric in the Company’s history

• Acrow records $45 million in new hire contracts over the first 11 months of financial year 2022, up 28% on the same period last year.

Acrow Formwork and Construction Services Limited (ASX: ACF) (‘Acrow’ or ‘the Company’), a leading provider of engineered formwork, scaffolding and screen systems, is pleased to announce two new contract wins that will bolster the Company’s Industrial Services revenues in its 12 months ended 30 June 2023 financial year (FY23).

Acrow continues to convert pipeline of opportunities into contracts

Acrow has secured two new contracts with existing clients, the revenues from which will mostly be brought to book in the Company’s FY23.Neither of these contracts have any material conditions requiring to be satisfied to proceed. Broad details of these latest additions to Acrow’s contract book follow:

• A further $6 million order for the sale of scaffold as well as the provision of scaffold labour services on the Snowy Hydro 2.0, the largest committed renewable energy project in Australia. This marquee project will aid Australia’s transition to a lower carbon emissions economy. It involves linking two existing dams, Tantangara and Talbingo, through 27 kilometres of tunnels and building a new underground power station. Snowy 2.0 has a lengthy construction phase, with first power from it not expected to be delivered until 2025, followed by a progressive commissioning of its six generating units. The revenue from this Industrial Services division contract will be generated between May 2022 and April 2023.

• A $5 million contract with Origin Energy Surat Basin, also secured by Acrow’s growing Industrial Services division. It represents a deepening of the existing relationship Acrow has with this major Australian Energy sector company. It will see Acrow provide Industrial Scaffold services for a series of major shutdowns at Origin’s Surat Basin-based LNG facility over the next 18 months.

Acrow Hire’s revenue base continues to expand

Indicative of the continued momentum in Acrow’s operations, new Hire Revenue contracts secured for the month of May totalled $6.3 million, the second-best individual month in the Company’s history. This strong showing took total revenues secured by this metric over the 11 months to May 2022 to $45 million, up 28% on the equivalent period in FY21.

Acrow Formwork and Construction Services Limited CEO Steven Boland said: “These two contract wins highlight the continued ability of the Acrow team to convert opportunities in our contract pipeline into revenues. From a divisional perspective, we are thrilled that both of the contracts announced today add to the growth trajectory already evident in our Industrial Services division These new Snowy 2.0 and Origin Surat Basin contracts have another clear-cut positive attached to them. They represent a deepening of the relationships we have with both these existing clients and reflect their satisfaction with the services we have to date provided to them. This return business has also placed us in an advantageous position going forward, as both projects are long term in nature. In the case of Snowy 2.0, it is and will continue to be one of Australia’s premier Civil Infrastructure construction projects over the next decade. As such, it is likely to be a key source of contract opportunities for Acrow over coming years.

While there is still one month to go in our 2022 financial year, recent sustained growth reported by the Company’s secured hire revenue contract book is particularly pleasing. With this key lead indicator of our future performance showing a strong head of steam, all the portends are there for further robust gains in both revenue generation and profitability into our 2023 financial year.”

Disc: Held IRL and SM

Acrow upgrades prior strong FY22 earnings guidance on robust 3Q22 performance.

Key Highlights:

• Acrow upgrades its FY22 earnings guidance, as the Company continues to leverage off strong Australian construction markets, especially in the Civil Infrastructure sector

• FY22 underlying NPAT of $16.3-17.3m is now expected, at the mid-point up 93% on the previous corresponding period (PCP)

• This strong profit guidance is premised on forecast FY22 revenue of $144-147m, which at the midpoint is 37% above PCP

• March 2022 quarter (3Q22) hire revenue of $13.9m was a record quarterly result

• Acrow continues to win significant new work on marque projects, including the Cross River Rail, Melbourne Metro, Bruce Highway, Melbourne Western Distributor and Snowy Hydro 2

• Aided by Acrow’s strong contract book and pipeline, the Company successfully negotiated a $7.5m increase in its existing Equipment Finance facility with Westpac

Disc: Held IRL and Strawman

25/08/21 - Today ACF announced its FY21 results and FY22 guidance - Preliminary Final Results and Full Year Results Presentation

Key Highlights:

- Revenue growth of 22% inline with guidance

- EBITDA of $24.3m at top end of guidance range

- Final dividend of 1.15cps (fully franked)

- Successful $10.5m capital raise in July 2021 for growth opportunities

- Targeting FY22 growth of 20%+ for Revenue & EBITDA and 40%+ for Underlying NPAT and EPS.

Total dividends paid and declared for the year were 1.90cps, up 81% on FY20.

Key financial highlights include:

- Record Group revenue up 22% on PCP to $105.7m, attributable to a very strong trading performance from the Industrial Services business, a significant uplift from the Formwork division across the east coast markets, the strategic focus on expanding product sales, and an additional 4-months contribution from the Uni-span acquisition

- Sales contribution of $61.4m, up 18%

- Underlying EBITDA of $24.3m at the upper end of guidance, up 25%, and EBITDA margin of 23.0%, up 60bps

- Underlying Pre-tax Profit up 35% to $10.2m

- Underlying Net Profit After Tax up 10% to $8.7m, impacted by a higher effective tax rate (+19% pts)

- Significant items of $2.5m primarily relating to final Uni-span integration costs, redundancies, and a one-off pre-acquisition tax payment

- Net gearing of 26.7%, up 6.7% pts on 30 June 20 levels

- Operating Cash Profit of $13.2m, up 18%

Acrow CEO, Steven Boland, said: “The strategic decision to pivot the business almost three years ago towards the highly engineered Civil Formwork and more recently the Industrial Services markets, and assisted by the acquisitions of Natform and Uni-span, has totally transformed our Company from the one that listed in April 2018.”

“Acrow’s expanded product range and capabilities are now enabling the Company to tap into the substantial pipeline of government funded civil transport projects around the country, which are forecast to remain elevated for several years. In addition, our entry into the industrial services shutdown & maintenance markets has created a new business vertical with considerable opportunities outside of the business’ incumbent Queensland market, which we have already commenced developing and is reflective of our FY21 results.”

During the year Acrow achieved a number of notable milestones that position the Company well for the new financial year, and beyond. These included:

- Another year of record secured hire contract wins, up 34% on the PCP, to $39.3m, with strong growth achieved across all key divisions;

- $74m pipeline, up 3% on 1H21;

- The Industrial Services business achieved record sales and profit from a successful expansion outside of its incumbent Queensland market;

- Continued strong Formwork division growth following its expanded product and service offering across its key east coast markets;

- Natform’s continued success across the east coast markets, particularly in Qld and NSW, with revenue up 31%;

- Product sales continuing to become a strategically important tool in the acquisition and retention of clients, with the business now representing 35% of group revenue; and

- The increasing pipeline of cross-sell opportunities arising from Acrow’s expanded product suite, national operational footprint and service capabilities.

Outlook

Record new hire contracts secured over the six months to 30 June 2021, and a robust pipeline of opportunities provide a positive leading indicator for the commencement of the new financial year.

The Acrow Board remains positive on the outlook for FY22, with current targets (based on a similar level of growth capital expenditure to FY21) for Revenue & EBITDA growth to exceed 20% and Underlying NPAT to exceed 40% on the FY21 levels. During FY22 the key drivers of growth are expected to include:

- the increasing recognition of Acrow’s expanded product suite and engineering capabilities to generate cross-sell opportunities across Acrow, Uni-span & Natform;

- an uplift in Queensland building activity levels as projects including Cross River Rail, the Bruce Highway upgrade, amongst many others, continues to ramp up;

- improved results from the NSW division, primarily in the formwork area with very large contracts secured on both the Waterloo and Crows Nest, Sydney Metro rail stations;

- further penetration of Natform into the Queensland and Victorian markets;

- pursuing new market opportunities for the Industrial Services business across various new industries and states; and

- converting on currently available product sales opportunities.

In concluding Steven Boland said: “Our record secured contract wins, particularly in 2H21 has set Acrow up for a strong start to the new financial year. In addition, the funding from the successful capital raise in July 2021 provides the resourcing for further anticipated contract wins across the pipeline of substantial government funded civil project packages that will be put to tender during the year, plus the opportunities we see within the Industrial Services business.”

My Take

I thought this was an excellent result with record revenue and EBITDA and record underlying NPAT of $8.7 million up 10% on FY20. The market thought otherwise, trading down 5.6% at 42.5c in the first few hours after opening.

Was the market expecting more? Revenue was in line with expectations, EBITDA was was at the upper end of guidance and NPAT was up 23% on analyst expectations (Simply Wall Street data).

Management are executing well, pivoting the business to become a leader in industrial scaffolding and formwork to line up with an accelerating pipeline of Australian projects (see attachment).

Acrow is also expandeding it's product suite and engineering capabilities to generate cross-sell opportunities across Acrow, Uni-span & Natform which will help to increase future revenues.

Valuation

Using Acrow's earnings projections for 2022, Value = E x PE

Value (2022) = $8.7 million x 140%/ 249 million shares x 20^ = 98c

Discounted at 10% per year = 98c x 0.9 = 88c (up from my July valuation of 72c)

^I'm using a PE of 20. I think this is reasonable given forecast growth of 40%, ROE of approx 20%, and 26.7% gearing.

I'm dissapointed in Acrow management today. Individual shareholders have just been diluted in a discounted placement offered exclusively to institutional and sophisticated investors.

The share placement was taken up at $0.38 per share, a 13.3% discount to the 5-day Volume weighted price of $0.438. In the placement 27.8 million new shares will be issued effectively diluting individual shareholders by 12.4%.

On the brighter side Acrow said the funds raised will ensure that this division, as well as the Formwork division, remain well resourced to capitalise on opportunities as they expand. Acrow said they have a strict 40% ROI hurdle rate on growth capital, and Added they are very confident that investments that are the beneficiary of this raise will return far better than this benchmark.

Acrow raises $10.5m via a placement to institutional and sophisticated investors.

Highlights

- Acrow successfully completes $10,500,000 capital raise (“Placement”) (before costs)

- Proceeds will be used to fund growth in both the Industrial Services & Civil Formwork businesses

- Placement well supported by existing and new institutional and sophisticated investors.

Acrow Formwork and Construction Services Limited (ASX:ACF) is pleased to advise that it has received binding commitments from institutional and sophisticated investors, including existing shareholders, to successfully raise $10,500,000 (before costs).

The Company received bids significantly above the Placement requirements.

The capital raised will primarily be used in the immediate future to fund the capital investment requirements of the fast- growing Industrial Services division and to capitalise on the numerous civil infrastructure opportunities on the horizon.

The balance of the funds will add strength to the Company’s balance sheet and provide flexibility to act quickly as compelling further growth opportunities present themselves.

Commenting on the Placement, Acrow CEO, Steven Boland said: “It is very pleasing to have received strong support from our existing shareholders and new shareholders which share Acrow’s vision of being the leading engineered formwork and industrial services scaffold solutions provider in Australia.”

“As highlighted in recent ASX announcements, the Industrial Services division has been successfully expanding its operations both within its incumbent Queensland market as well as into new east coast markets, especially NSW. The funds raised ensures that this division, as well as the Formwork division, remain well resourced to capitalise on opportunities as we continue to expand. Acrow has a strict 40% ROI hurdle rate on growth capital and I am very confident that investments that are the beneficiary of this raise will return far better than this benchmark.”

The Placement will result in the issue of 27.6m new ordinary shares at an issue price of 38 cents per share. The issue price for the Placement represents an 11.6% discount to the last traded price, and an 11.4% discount to the 10-day VWAP.

New shares issued under the Placement will rank equally with Acrow’s existing fully paid ordinary shares.

The Placement will be made under Acrow’s existing placement capacity under ASX listing rules 7.1 and 7.1a and does not require shareholder approval.

Settlement of the Placement is scheduled to occur on Tuesday, 27th July 2021, with the issue and trading of Placement shares scheduled to commence on Wednesday 28th July 2021.

Acrow Formwork (ACF) is in a trading halt. The trading halt has been requested pending the release of an ASX announcement regarding a material capital raise.

It is expected the trading halt will end on the earlier of the commencement of normal trading on Thursday, 22 July 2021, or when an announcement on the material capital raise is released to the market.

ACF has a healthy balance sheet (35% debt/equity). I suspect ACF is taking over another business.

Disc: hold shares

Acrow Industrial Services Division Secures Further $4.2m in New Contracts.

Key Highlights:

- Further success expanding into the New South Wales Industrial Services market

- Maintenance shutdown contracts secured across Bayswater, Eraring, and Mt Piper power stations

- Contract wins totalling $4.2m, to be realised in 1H22

- FY22 target revenue and sales contribution for this division upgraded by 7%, respectively

Commenting on the recent contract wins, Acrow CEO, Steven Boland said: “Contract success of this nature gives me a high degree of confidence that our targeted FY22 EBITDA improvement of circa 20% growth above our FY21 result will be achieved and likely exceeded."

Key Highlights:

- Acrow Secures Expanded Debt Facility for Growth Opportunities

- Refinance of debt facility with Westpac

- Expanded headroom by $13.5m

- Improved flexibility and confidence to continue pursuing growth opportunities

- Re-iterate EBITDA guidance of $23.5-$24.5m for FY21 and expected very strong start to FY22

- Targeting circa. 20% EBITDA growth in FY22

Commenting on the announcement, Acrow CEO, Steven Boland said: “We are delighted to have re-negotiated our debt finance facility with our long-supporting banking partner, Westpac.”

“The tailwinds from the growing profile of infrastructure projects around the country and the increasing recognition for our quality, service, and equipment range are creating an unprecedented opportunity for growth. This was best demonstrated by our record March month and quarter for secured hire contract wins. The additional headroom and extended maturity profile now provide Acrow with the flexibility and confidence to continue pursuing the growth opportunities that we are seeing across the formwork and industrial scaffold markets in Australia.”

‘We strongly welcome the Federal government’s recent budget commitment for an additional $15.2bn in investment across road, rail and community infrastructure projects, as part of its $110bn infrastructure investment pipeline over the next 10 years. We now expect to be well positioned to bid for packages across newly announced marquee projects including the Great Western Highway Upgrade ($2bn), Melbourne Intermodal Terminal ($2bn), North-South Corridor - Darlington to Anzac Highway ($2.6bn) as they come up for tender.”

“As previously outlined in the ASX release, dated 1 April 2021, Acrow is now guiding to a strong finish to the financial year with EBITDA in the range of $23.5 -$24.5m, up 21%-26% on the PCP, and an equally solid start to the new financial year. We are now targeting circa. 20% growth in FY22 to that achieved in FY21.

Acrow is a leading hirer of formwork and scaffolding systems to large construction and civil infrastructure providers across Australia.

Key Highlights:

- New Record of Secured Hire Contract Wins

- Record March month secured new hire contracts up 92% on pcp

- Record March quarter contract wins up 50% on pcp

- Record Natform hire contract win

- 4Q21 forecast to be most profitable quarter in Company’s history

- Hire revenue for June forecast to be at record levels of circa $4.5m

- Recent hire contract wins points to very strong start to FY22

Acrow Formwork and Construction Limited (ASX:ACF) is today pleased to announce a record month of secured hire contract wins. During March 2021, Acrow secured $5.9m in new hire contract wins, up 92% on the previous corresponding month and 18% above the previous best recorded month in November 2020. This included a stellar month from Natform, which reported $1.9m in new hire contract wins, up 41% on its second-largest month (July 2020).

Notably, the three highest months in terms of new hire contract wins in the Company’s history have now occurred over the last five months (November 2020, February 2021, and March 2021).

During March quarter 2021, the Company reported $11.2m in new contract wins, up 50% on the previous corresponding period, and an acceleration from the 28% growth announced to the ASX on 10 March 2021, for the two months to February 2021. During the quarter, Queensland was the standout market, with very strong results across all sectors.

For the current financial year, the Company maintains its recently upgraded EBITDA guidance of $23.5m - $24.5m.

Looking towards the FY22 year, CEO Steven Boland noted: “The exceptional March quarter performance of secured hire contract wins has set the Company up for a tremendously strong start to the new financial year. Our current forecasts show that 4Q21 EBITDA will be at record levels for the business, primarily off the back of what is forecast to be a new high in monthly hire revenue in June of circa $4.5m.”

“I expect 1Q22 will see this momentum continue as we reap the benefit of the great successes we are achieving in securing new contracts. The results we are seeing are a testament to the innovative, customer solutions focus of our market-leading engineering team as well as the strong ability of our sales teams to convert opportunities into revenue.

“Acrow remains very well positioned to benefit from the substantial infrastructure development program earmarked over the next 3-5 years in Australia and most likely beyond.”

About Acrow

Acrow is a leading hirer of formwork and scaffolding systems to large construction and civil infrastructure providers across Australia, operating a network of formwork and scaffolding branches in six states and employing approximately 245 people. The business services a diversified customer base of approximately 1,300 customers.

Acrow has a high quality and versatile portfolio of assets and has identified a number of near term growth opportunities, most particularly through the investment in capital equipment to take advantage of a range of opportunities in the growing East Coast civil infrastructure market, particularly in New South Wales and Victoria where the business is still underrepresented.

What does ACF do?

Acrow is a leading hirer of formwork and scaffolding systems to large construction and civil infrastructure providers across Australia, operating a network of formwork and scaffolding branches in six states and employing approximately 245 people. The business services a diversified customer base of approximately 1,300 customers. Acrow has a high quality and versatile portfolio of assets and has identified a number of near term growth opportunities, most particularly through the investment in capital equipment to take advantage of a range of opportunities in the growing East Coast civil infrastructure market, particularly in New South Wales and Victoria where the business is still underrepresented.

What is the earnings guidance?

Key Highlights:

• Secured hire contracts wins up 28% in two-months to Feb 2021 vs pcp

• $3.7m in major new product sales and hire contract wins on four key projects

• FY21 EBITDA guidance upgraded to $23.5m - $24.5m

• NPAT guidance of between $8.7m - $9.5m

• FY21 revenue guidance to be at a record level of circa $106m

Why is ACF an attactive buy right now?

- Trading 35% below intrinsic value

- PE 8.5

- PEG ratio less than 0.7. (PEG is PE divided by Forecast Growth. Less than 1 is great value)

- PB ratio 1.3

- Future earnings growth 24.5% per year over next 3 years (2 analysts)

- Cash flow positive

- Future ROE 15.4% (3yrs)

- Debt equity ration 35%

- Dividend 4.29% (trades ex dividend April 22, 2021)

- Board member with approx 15% skin in the game

- CEO bought shares @ 35c on 1 March 2021

Australian Infrastucture Pipeline

Major Australian transport infrastructure projects forecast to increase by 71% over the next 2 years ($14Bn in 2021 to $24Bn in 2023). See page 7 in the Investor 'Roadshow Presentation' ACF ASX announcements

Intrinsic Value

DCF calculation 54c (Simply Wall St)

Disclaimer: I own shares in ACF on the ASX

Post a valuation or endorse another member's valuation.