Will AEF collect a performance fee for FY22?

Australian Ethical gave guidance for UPAT for FY22 which will be between $9.8m and $10.2m. This is before calculation of performance fees which are due on June 30 2022. AEF only charges a performance fee on their "Emerging Companies Fund" and "High Conviction Fund".

According to their website, AEF charges a performance fee of 15% for the "High Conviction Fund" and 20% for the "Emerging Companies Fund". Both of these funds performance are listed on their website.

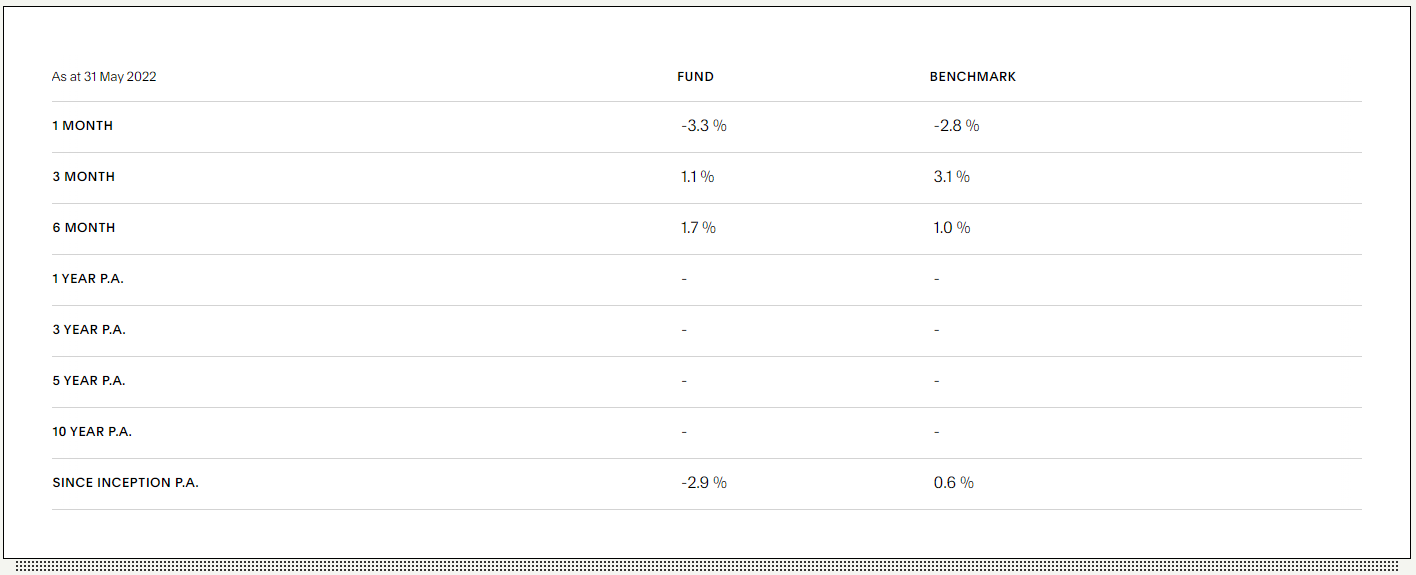

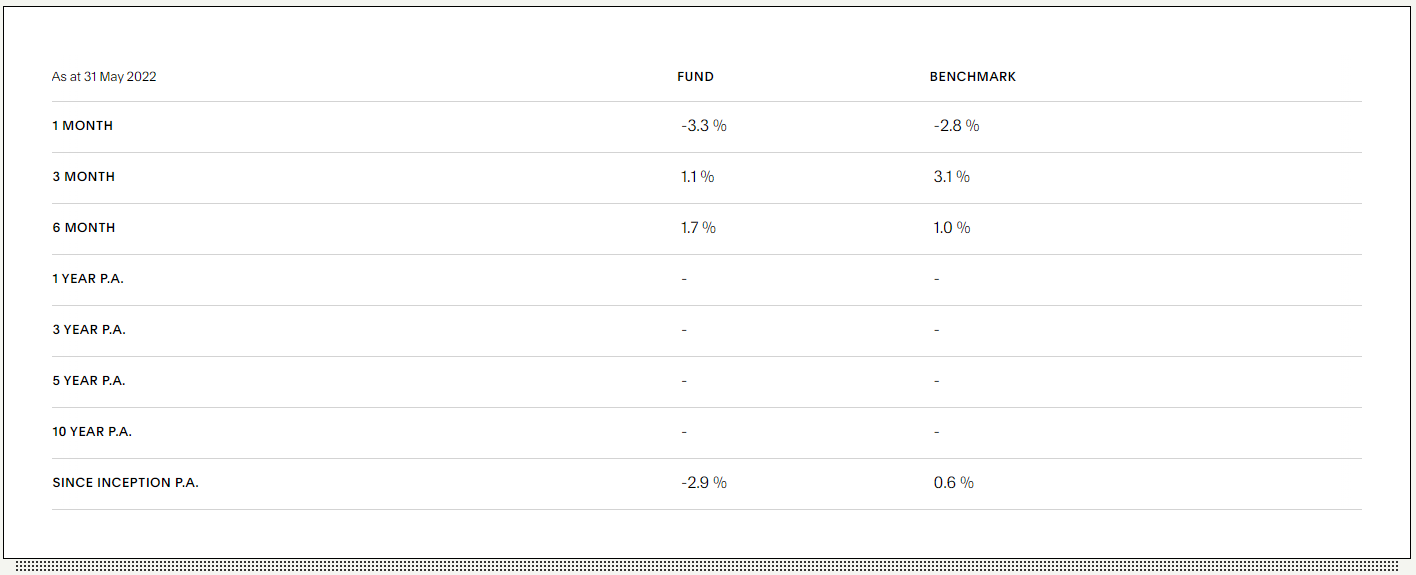

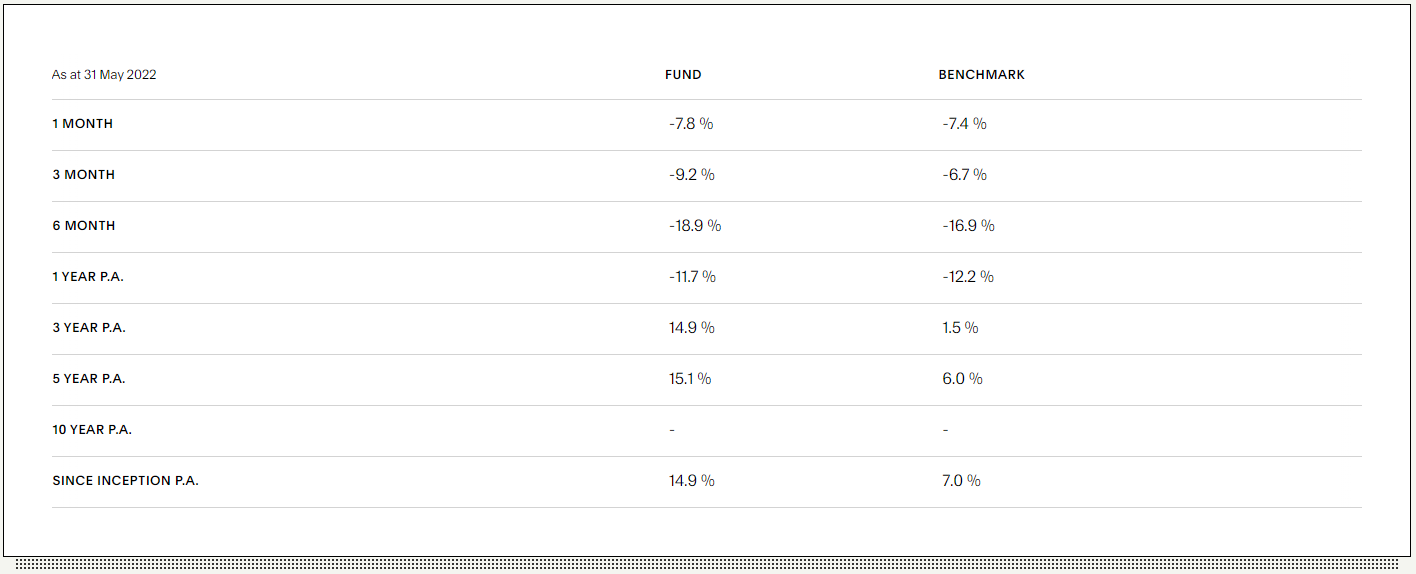

High Conviction Fund Performance:

*Note that the inception date for this fund was 01/10/21

Benchmark for this fund is the ASX300 Accumulation Index

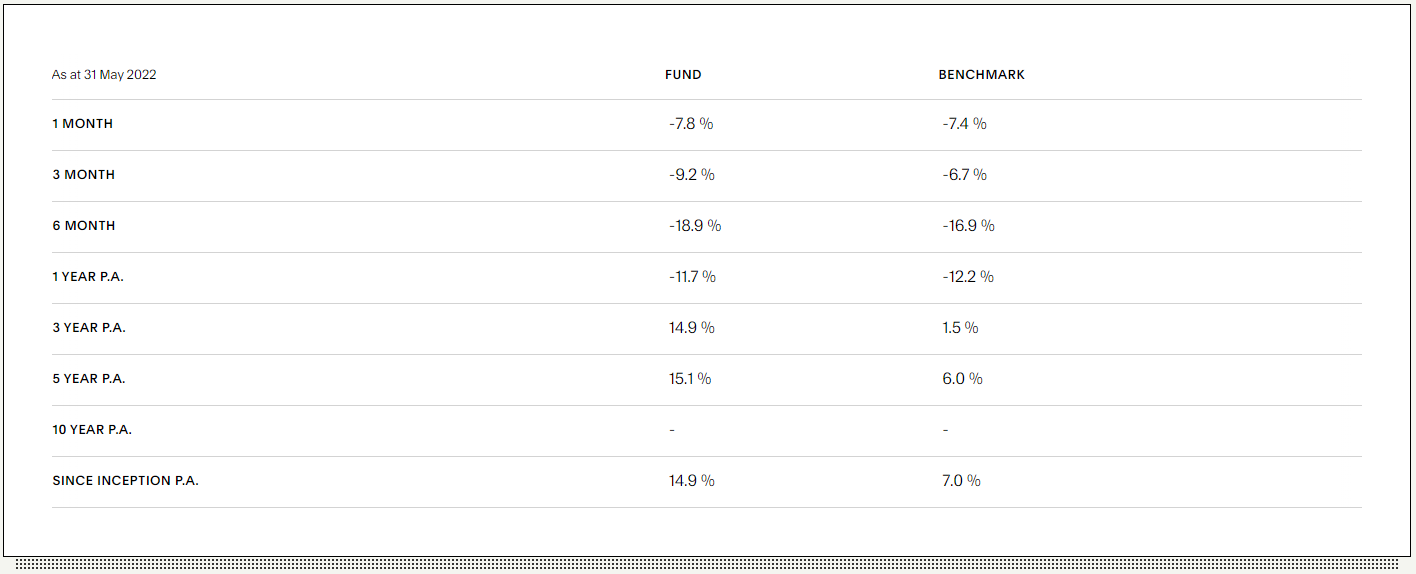

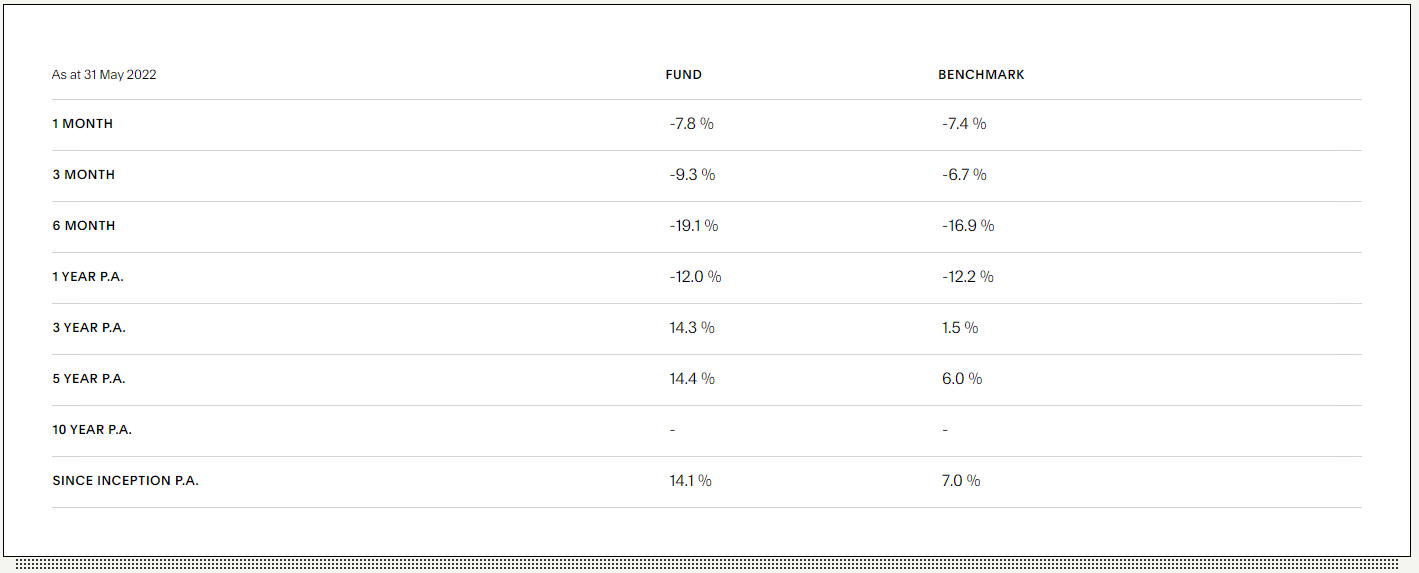

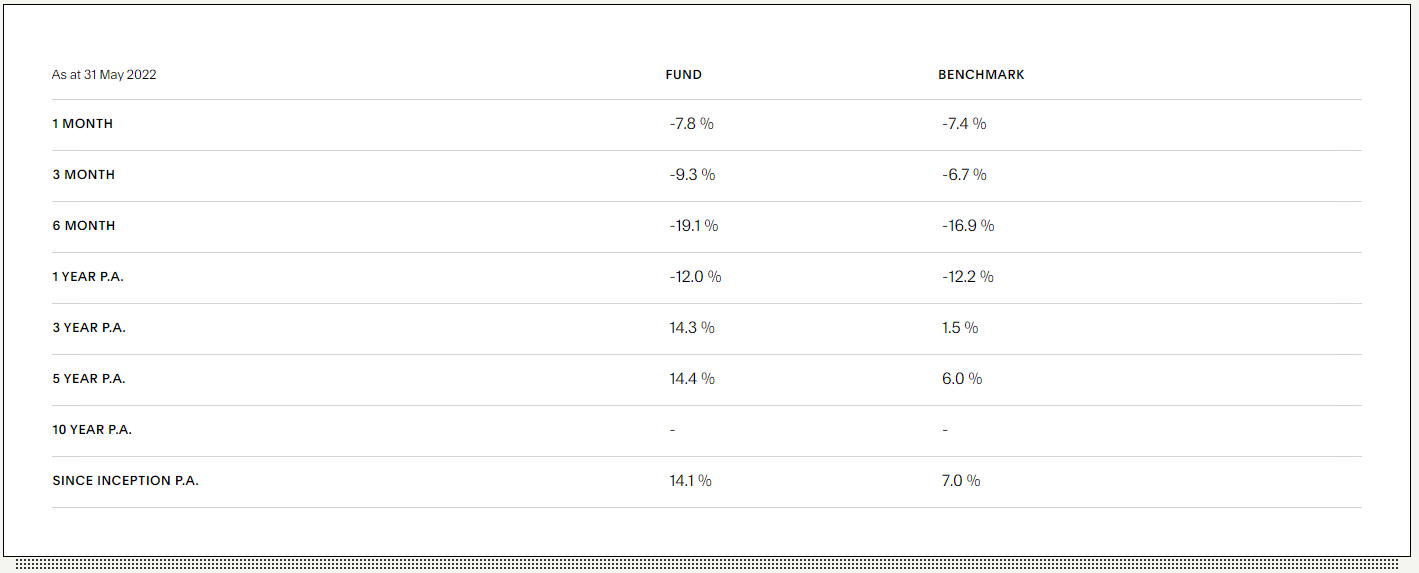

Emerging Companies Fund Performance:

Wholesale:

Retail:

Benchmark for this fund is the S&P/ASX Small Industrials Accumulation Index.

Now interestingly, the performance fee is calculated daily, with any "negative performance" carried forward until there is "positive performance" against the benchmark. If I'm reading this correctly, I believe they may still collect some performance fees on both funds as performance in the first 3-6 months of the financial year/since inception outperformed the benchmark. However in the last 6 months, both funds have definitely underperformed the benchmark and I think that they may end up carrying forward these "negative performance" into the next financial year.

So lets assume UPAT of $10m prior to calculating performance fees. In FY21 they collected $2.9m in performance fees from only 1 fund (there are now 2 funds collecting performance fees) of which 1.9m flowed directly into profit (UPAT for FY21 was around $11.1m). If I was generous, I'll say that they may collect around $2m in performance fees of which perhaps around $1.2m-1.3m will flow through to UPAT giving them total UPAT of around $11.2m-$11.3m (so basically flat year on year).

Disc: Not Held.