Going to keep this short as I gather most would not prefer to invest in a tech company via a large cap such as AGL...

In case no one noticed, back in June 2024, AGL announced a strategic partnership with software tech company Kaluza which included paying $150m in return for a 20% stake in Kaluza.

The payment values Kaluza at $750m.

Kaluza's largest customer appears to be Ovo Energy in the UK which serves more than 6 million smart meters in the UK.

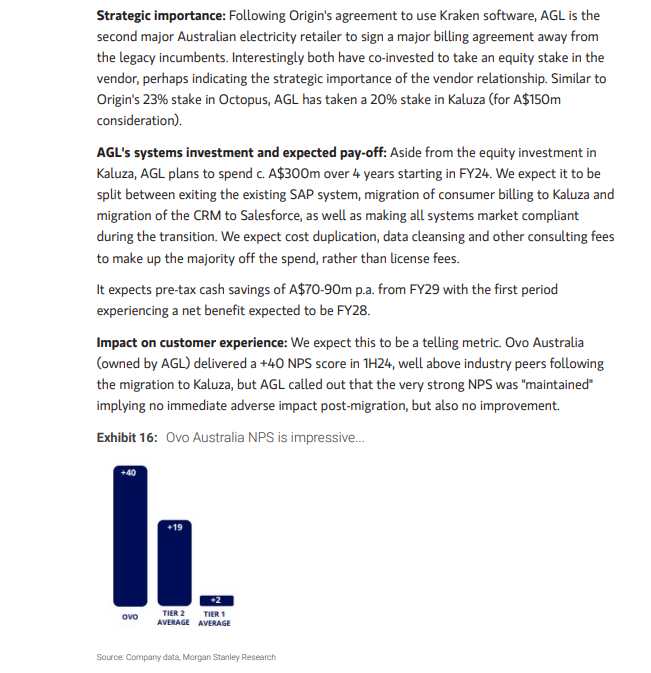

Kaluza already migrated 80K customers of the Australian arm of Ovo Energy. The migration of AGL to the Kaluza platform from legacy SAP will take around 3 years and is expected to be completed in 2028. AGL expects savings to be around $70-$90m

This cash injection is important as the funding for Kaluza doesn't just help in the technology transformation of AGL, but also international expansion of Kaluza. Kaluza already has a partnership with Mitsubishi in Japan.

In other words, Kaluza starts breaking out of the "long tail" of the niche utilities market players and starts challenging Kraken and Gentrack. More details of the investor briefing are now on Youtube.

Note that this $150m investment is in addition to the expected $300m to be spent over 4 years on implementation of Kaluza at AGL.

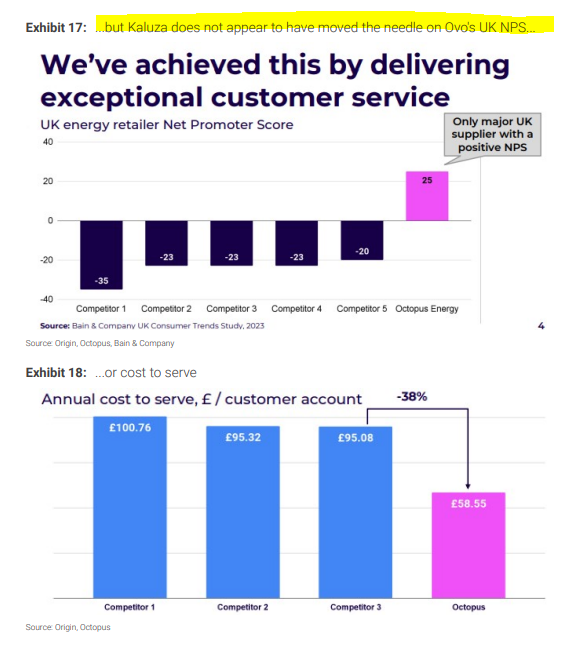

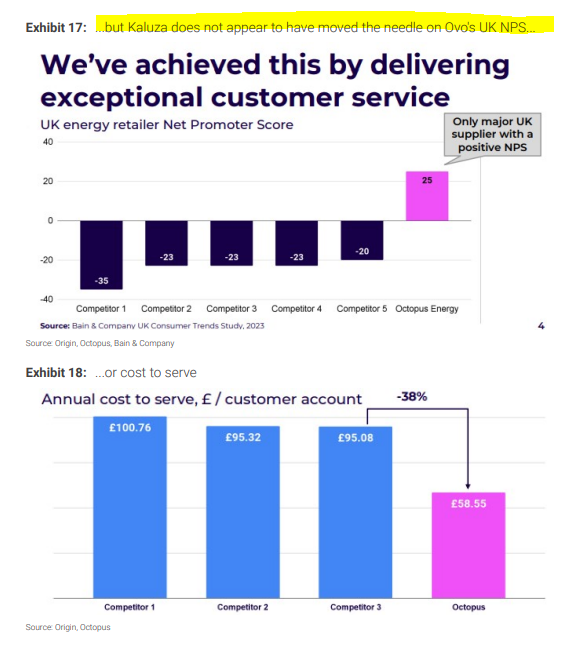

However, Kaluza is not without problems. Ovo Energy UK scored worse in the Ofgem customer satisfaction survey with Octopus Energy scoring the highest rating.

E.ON/Next which uses both Gentrack (through npower) and Kraken scored above the average.

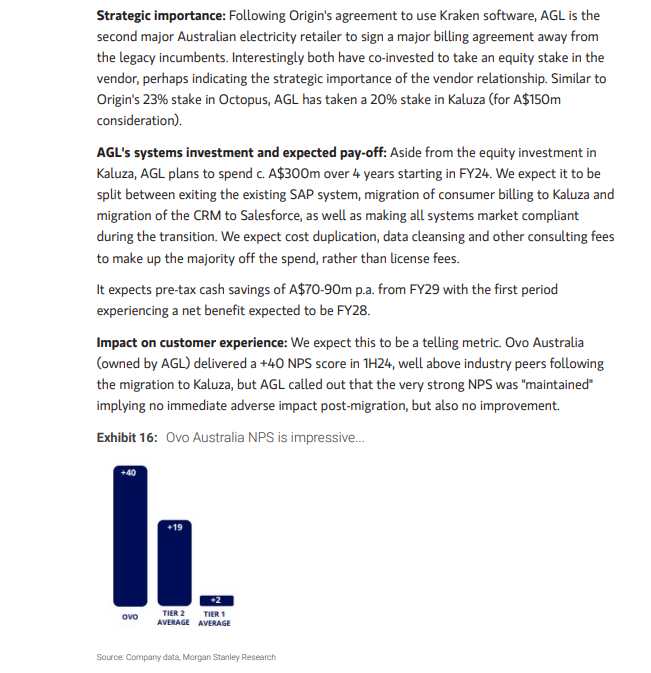

Morgan Stanley also mentions the Net promoter score (NPS) of Ovo Energy is lower than Octopus in their coverage of Gentrack.

Overall this is a big high-risk investment for AGL on a new enterprise billing platform with the expectation of a similar return from Origin's investment with Octopus/Kraken if Kaluza can expand successfully into other regions where others have failed (ie: Powercloud - no offence to Hansen investors).

If Kaluza performs as expected, we should see a rerating on AGL stock with the Kaluza investment included in the company valuation on analysts' radars.