Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

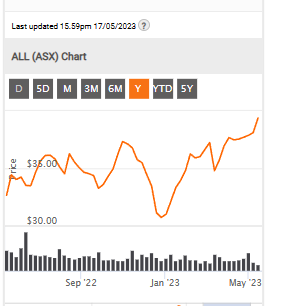

18/5/2023: Growth Return (inc div) 1yr: 27.68% 3yr: 17.11% pa 5yr: 8.02% pa

Next Forecast Ex Div Date: 26/05/2023 (8 days away) : AUD 0.30cps up 15%

Franked:100%

My price target ( for 2023 ) $37.95 = 34.50 x 1.10pa

...........................................March 202 ....Sept 2022

Annual Report Sept 2022:

Chair & CEO message:

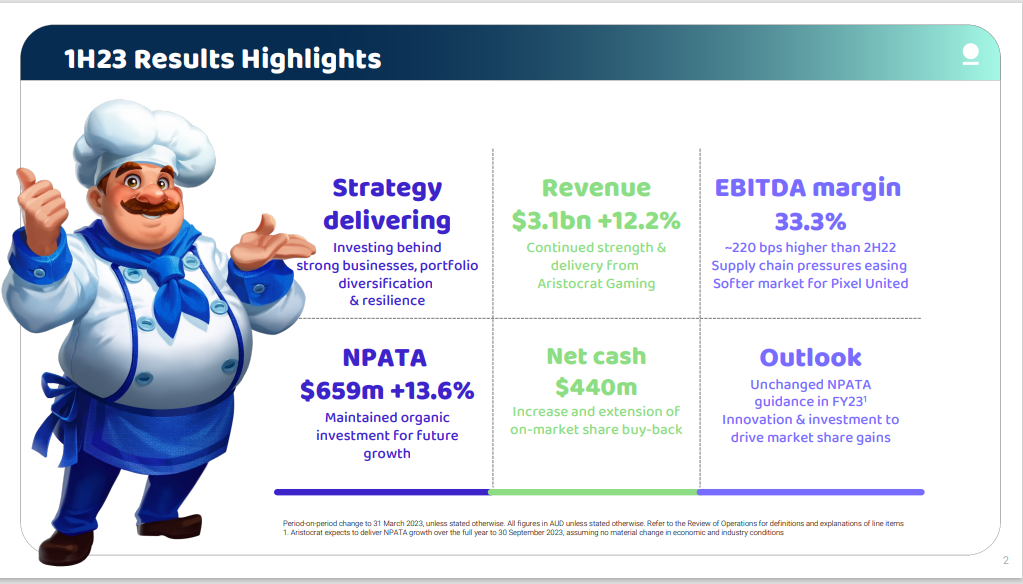

Net profit after tax and before amortisation of acquired intangibles (NPATA) of $1,099.3 million was 27% above the prior corresponding period in reported terms (20% in constant currency) compared to the $864.7 million delivered in the prior financial year. This was driven by exceptional performance in North American Gaming Operations and global Outright Sales, despite supply chain disruptions and mixed operating conditions across key markets. Pixel United delivered resilient performance in a challenging environment, as overall mobile bookings moderated post COVIDdriven peaks in the prior period.

ESG - 'extra social govenor'

Aristocrat also continued to execute against our ambitious Environmental, Social and Governance commitments across the year, with a disciplined focus on our most material issues. This included preparatory work to allow the Group to set a science-based greenhouse gas emissions reduction target in calendar 2023. In addition, we made meaningful progress in our responsible gameplay (RG) agenda, with highlights including the launch of an Australianfirst trial of cashless payment technology on gaming machines, and the rollout of proactive RG messaging, tools and information to players of our social casino games. In addition, we delivered enhanced anti-modern slavery training across the Group and achieved an above-benchmark employee engagement score for the year that places Aristocrat in the top quartile of technology companies globally.

Revenue up 5% in constant currency; reported revenue up 12%

• Revenue growth driven by strong performance of North American Gaming Operations and global Outright Sales

• Pixel United revenues reduced in local currency in a challenging macro environment where it continued to take share

• EBITA broadly stable in constant currency, with positive revenue drivers offset by lower margins in Gaming and Pixel United reflecting: o Continued, but easing, supply chain challenges o Product mix favouring Outright Sales o Sustained investment over time in great talent, technology and product underpinned strong performances

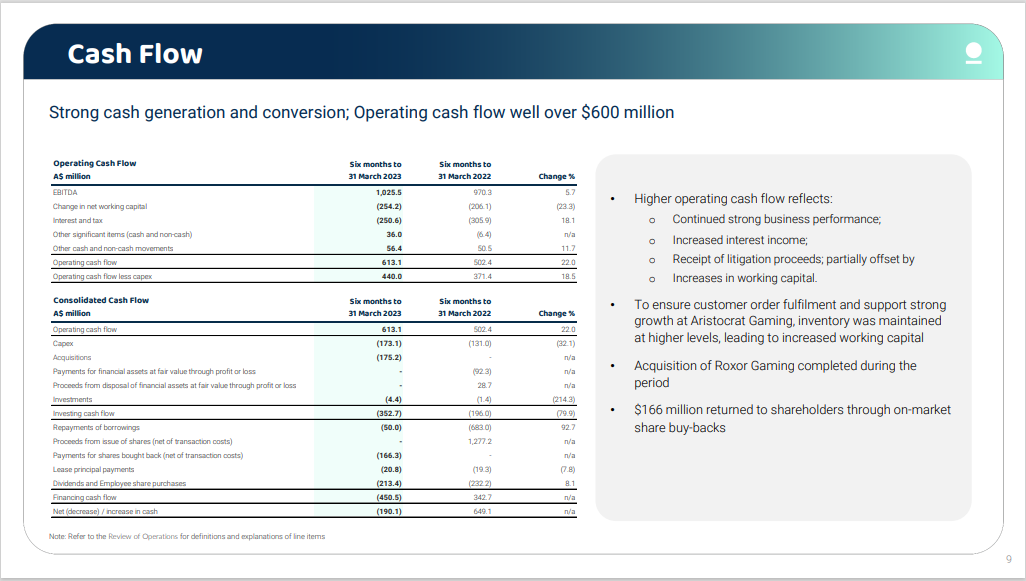

• Strong operating cash flow and superior financial fundamentals maintained

• Conservative balance sheet and ample liquidity, with higher interest income benefiting net interest

• $338 million cash returned to shareholders through dividends and on-market share buy-backs, while maintaining full investment optionality

More 2924-02667167-2A1449951 (markitdigital.com)

Aristocrat has announced the proposed acquisition of 100% of NeoGames S.A. (“NeoGames”) for a cash price of US$29.50 per share (the “Acquisition”) • NeoGames is a compelling strategic acquisition for Aristocrat to deliver its online RMG ambitions and comprises four complementary business units •

NeoGames' iLottery business is an industry leading global iLottery full technology PAM providing solutions and services to national and state-regulated lotteries • AspireCore is a leading B2B PAM and managed services provider globally serving 30+ partners with a full suite of products •

Pariplay is a leading aggregator and content provider in the iGaming industry with over 15,000 multiplatform games across a significant network of >140 operators • BtoBet offers a fully customisable sportsbook solution in the attractive Online Sports Betting segment •

Acquisition values NeoGames' fully diluted equity at approximately US$1.0 billion ($1.5 billion) and implies an enterprise value of US$1.2 billion ($1.8 billion)1 and represents a premium of 104% to NeoGames' 3-month volume weighted average price as at 12 May 2023 of US$14.45 •

Represents a valuation multiple of approximately 15x NeoGames' Adjusted EBITDA2 for the twelve months to 31 December 2023

trading update and extension of Share buyback today announced.

Simply put Aristocrat continues to take market share in gaming with strong revenue and profit growth expected. Pixel continues to have some slow down in this competitive market.

the extension of the buy back seems sensible given the amount of money on the balance sheet following the failed attempt to acquire playtech. It is another 500mil worth already spending 500mil to buy shares back at these lower prices. This will obviously improve EPS.

PE wise ALL is on its lower end around 20x. incredible growth over the years the 10 year chart is unreal and pays a nice dividend. Obviously some ESG issues with this business due to the pokies so you need to put your own filter on that.

Impressive management and long term looks handsome if you have the patience.

one of my largest positions IRL

Dear shareholder, 2023 Annual General Meeting On behalf of the Board, I am pleased to invite you to attend the 2023 Annual General Meeting (AGM or Meeting) of Aristocrat Leisure Limited (Company or Aristocrat), which has been scheduled as follows:

Date: Friday, 24 February 2023 Time: 11.00am (Sydney time) Registration opens from 10.00am Venue: Aristocrat Head Office, Building A, Pinnacle Office Park 85 Epping Road, North Ryde New South Wales, 2113

29/07/20 A very rough analysis

Positives:

- Global player in gaming machines, online gaming operating in over 90 countries. Second largest gambling manufacturer globally.

- Proven company; with sales, cash flow and EPS compounding above 20% for last 10 years.

- Digital segment growing, currently accounting for ~46% of total revenue from last 1H20 report.

- Net margin above 15% past 5 years

- ROIC > 10% past 5 years

- CEO Trevor Croker owns about $AUD9.5m worth of shares. Considering his annual salary is $1.6m (excl ST/LTI), this is respectable

- $871m in cash

- Pays a small fully franked dividend ~ 2% though 1H20 dividend was suspended.

- No recent director selling

Negatives:

- High debt levels - $2.7b+, acquired Plarium and Big Fish in 17/18. Net debt/equity currently at 1.3x, interest cover ~ 8.

- COVID19 - impact on 2H20 earnings. Interesting to note most casinos have reopened in the US. https://www.americangaming.org/research/covid-19-casino-tracker/

- Washington lawsuit from 2019 - approx $30m settlement cost if approved.

- Withdrawal of government handouts could impact on discretionary spending

- Regulatory changes as expected in this space

Comment:

All in all, I like ALL (pardon the pun). Historically ALL has had big pullbacks in its share price, but over the long term it has very much outperformed the market. COVID19 may be a blessing in disguise, bringing forward plans to expand the digital segment of the business. Short term pain, long term gain. I back the management to ride out the COVID19 impact. However the active risks need to be monitored closely as per outlined above.

At the current price, it is looking a little too expensive. Happy to add below ~$22.

Disc: [I hold ALL shares]