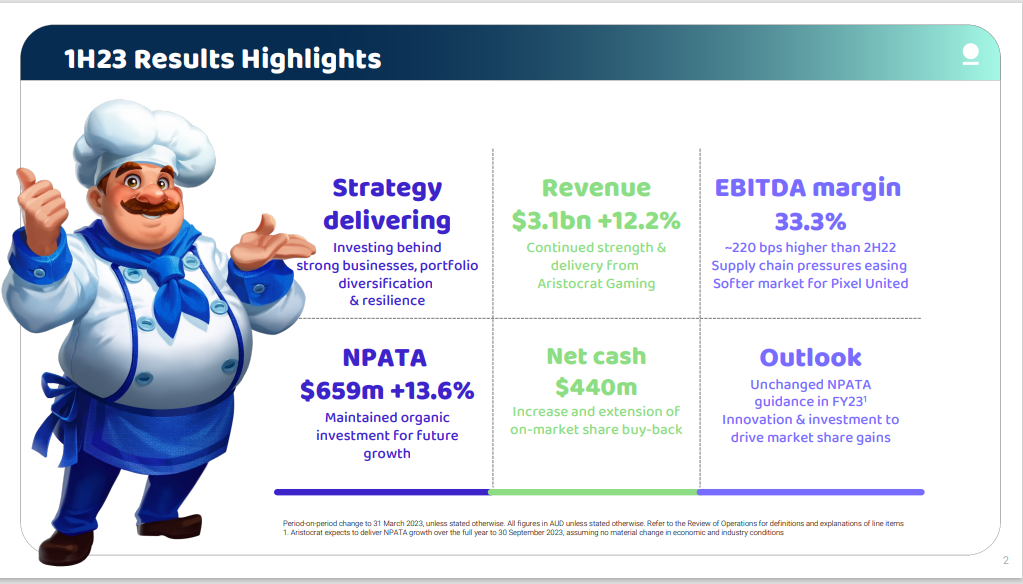

Revenue up 5% in constant currency; reported revenue up 12%

• Revenue growth driven by strong performance of North American Gaming Operations and global Outright Sales

• Pixel United revenues reduced in local currency in a challenging macro environment where it continued to take share

• EBITA broadly stable in constant currency, with positive revenue drivers offset by lower margins in Gaming and Pixel United reflecting: o Continued, but easing, supply chain challenges o Product mix favouring Outright Sales o Sustained investment over time in great talent, technology and product underpinned strong performances

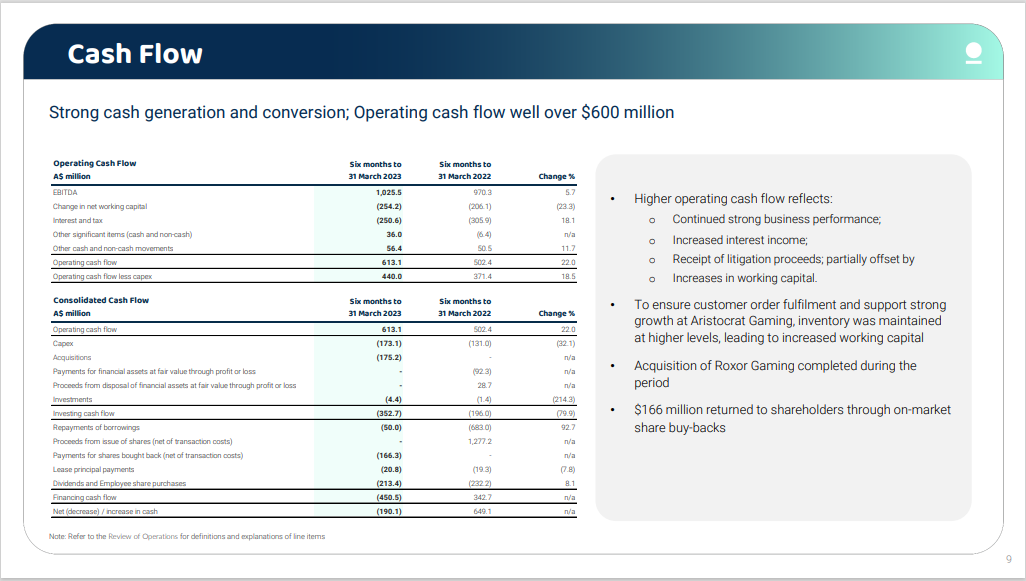

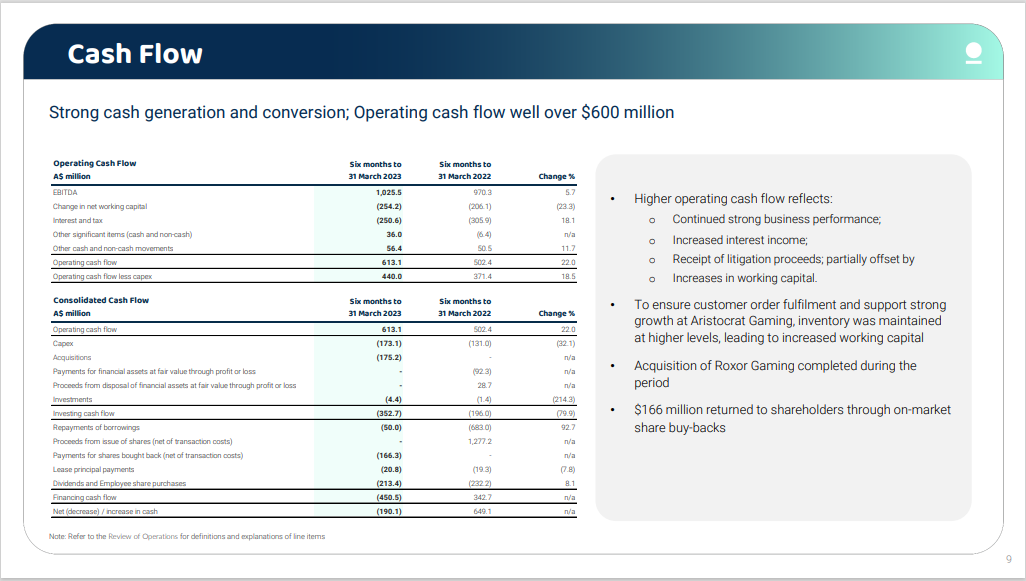

• Strong operating cash flow and superior financial fundamentals maintained

• Conservative balance sheet and ample liquidity, with higher interest income benefiting net interest

• $338 million cash returned to shareholders through dividends and on-market share buy-backs, while maintaining full investment optionality

More 2924-02667167-2A1449951 (markitdigital.com)