Ok, this is a “boring” large cap. Most of you probably wouldn’t pay much attention to it, same as me. I am going to make the case that you should take a look.

Intro

AMC is a big, global packaging company. They mainly do flexible and rigid packaging.60% is for “nutrition” (food and beverage), 25% for “health, beauty and wellness” and the remainder “speciality applications”. Around half of sales are in North America, 28% in Europe, the rest mostly in emerging markets.

The company was started in 1896 in Melbourne. It has grown both organically and by a series of acquisitions. Notably, Amcor pulled off a $US 6.8 billion merger/acquisition of Bemis (a North American packaging company) in 2018. This acquisition is widely regarded as having been successful, and delivered synergies in excess of the $180 million that was promised.

The latest deal is a similarly ambitious merger/acquisition of Berry, another packaging company, mostly in the US, but with a significant presence in Europe. It’s big, $US8.4 billion (equity) or $US13 billion (including debt). The deal went through on April 30 this year. Again, AMC management are promising synergies - $US650 million by fiscal 2028. Time will tell if they can deliver, the market appears to be sceptical.

Why is Amcor Cheap?

AMC is primarily listed in the US, but trades in Australia as CDIs. The current price is $12.60. That’s a little over 10 times management’s earnings guidance (the $US price is $8.30, earnings guidance is 80-83 cents US). The dividend yield is over 6% (unfranked).

You don’t get big companies for 10 times earnings without some warts. So what are they?

1. Synergies. The market is sceptical. But AMC has a successful history with acquisitions. Superficially, it makes sense that combining 2 big packaging companies, if you can get it past anti-trust regulators, will reduce costs and increase pricing power. I am inclined towards optimism here.

2. Debt. Net debt is US$13.3 billion, or around 3.5 times EBITDA. Yes this adds risk, but in the normal course of events it should be manageable

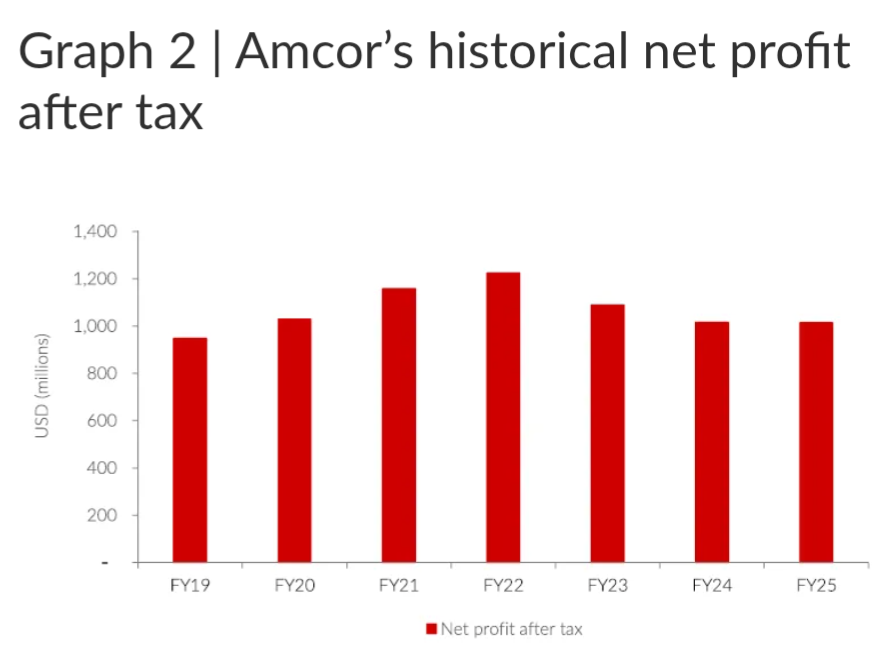

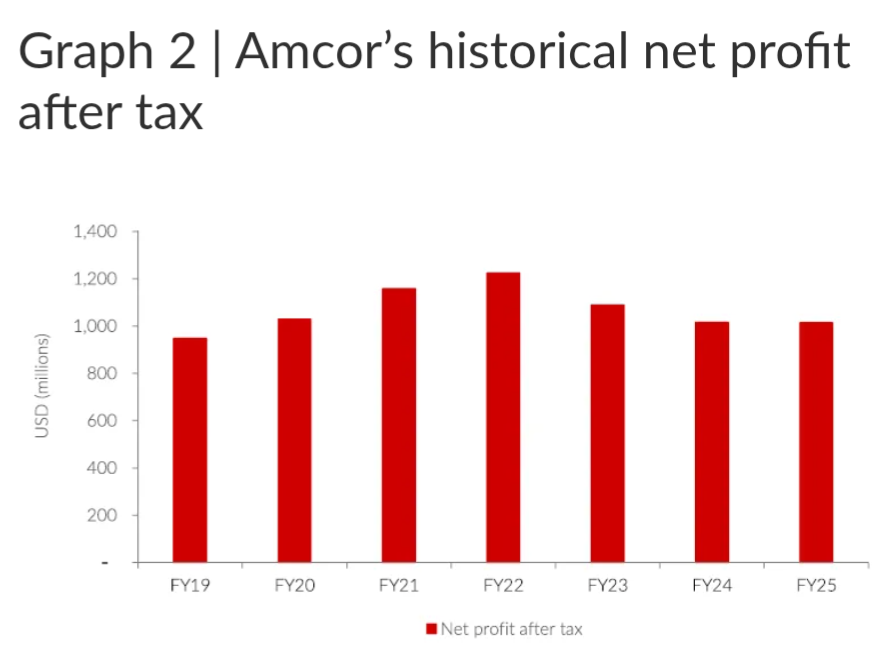

3. Earnings. Growth in earnings has been disappointing, particularly if you look at the graph since 2022. However, partly this is the same covid-induced stockpiling-destocking cycle that has affected a lot of companies. There is a decent chance that the reality going forward is less bad than what the market anticipates.

4. Industry headwinds. If there was a push to move away from plastic packaging, this would obviously be bad for Amcor. However a quick look around my local supermarket suggests that this is unlikely anytime soon. Amcor is of course well aware of the risk and has various sustainability initiatives in place, including a commitment to use 10% recycled plastic by the end of 2025.

5 Index rebalancing. It has just been announced that AMC will be removed from the ASX 20 on December 22nd. So there will be some passive (dumb money) selling, with no regard to value. Anticipation of this by smart(er) money is probably responsible for a bit of recent share price weakness. Gifting you and me a slightly better short-term buying opportunity

Summary

So what we have is a big, multinational packaging company trading on a bit over 10x earnings guidance and paying a dividend of over 6%. As outlined above, I believe that the market concerns are overstated. There is a decent chance that earnings do ok from here, synergies largely get delivered and the current share price looks cheap a couple of years down the track. Even in a moderately disappointing scenario, the stock is cheap enough that you aren’t going to lose a lot of money.

A classic defensive value stock, with a margin of safety.

NB. Some great info in this article:

https://www.allangray.com.au/is-amcor-the-whole-package/