Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Not following or held, but as a positive signal they have just inflected into EBITDA profitability and expect next Q sales to be stronger than Q1 26

Cash outflows appear to be in an improving trend which they will need positive soon given where the cash balance is at: 1.5M, with another 1M available via debt facility

Had a random thought about Atomos this morning, a former market darling that hit $1.50 in 2021. I was shocked to see its share price under a cent -- representing 99% destruction of capital for shareholders that bought at the peak and hung around.

They recently signed a 13.7m debt facility, through a company associated with one of their directors.

Since 2019, shares outstanding have increased by 172m to 1.2b. The big one though looks like it came in 2023, when it went from 400m to 1.2b in a year -- evidence of how damaging a diluting cash raise can be when the vultures are circling.

Anyone following or know enough about their journey to comment? Where did it go so wrong?

Atomos requested voluntary suspension, under listing rule 17.2, pending the release of HY23 financial statements.

Trading commences 15 March 2023 or earlier lodgement of the financial report.

This suspension was requested as there is some unresolved matters which will delay the auditors review of the financial report.

Red flags galore with AMS.

It was an underwhelming trading update from Atomos today, the main features being:

- Black Friday sales - a historically important period for them - were soft (though not quantified)

- As a result, the financial outlook has been withdrawn

- Undertaking a cost out program expected to reduce the cost base by 30% by mid-2023

- The good news is the cost out program will lead to breakeven at around $60m of revenue. The bad news is that when you put out a number like that at the same time as withdrawing guidance, the market will gravitate to that number as the expectation for FY23. (Revenue in FY22 was initially $82m before being revised down to $73.3m after the pesky auditors insisted on the accounts being compliant).

- Some hope is being put on their ability to commercialise 8K functionality. Much of the effort being put into that appears to be in sale or licensing to other camera makers, rather than organic growth.

It's been a severe fall from grace by AMS over the past 18 months. I really want to like them but once a question mark develops around whether you've been cooking the books over the past few years, a big red flag gets raised and it takes a long time to win back trust.

[Not held]

I think this might be the worst cap raise I have seen and a textbook example of being forced to raise capital to survive rather than choosing an optimal time. As PinchOfSalt points out a massive turnaround in the fortunes of the company over a 12 month period, that I am still struggling to get my head around how it all happened.

Everything stems from the change in CEO and the 3rd (FY22) quarter massive drop off in sales whilst also investing heavily in old model inventory that they are still having trouble selling. The problem I have is that it doesn't really add up for me - either the company is a fraud and has always been such and the the replacement CEO exposed it (I think unlikely, but possible, especially given the $8.7M of revenue that the auditor didn't let them include in last years accounts, channel stuffing?). Or they have made some/many terrible decisions in 22/23 and now they are just trying to keep then lights on. Either way no need for me to play with them currently, but I think if they aren't fraudulent and can start to turn around their cashflow position in 2H23, and start to deliver on their new strategy then I think they could look really interesting again. The quality of the company and board though is a lot lower than I previously thought it was and I think there is an even chance that they will be bankrupt by 2024.

So they have raised $17.9M @$0.10, with most of it being used to pay down debt ($5.5M), and to provide operating cash ($5M). $2M for improved marketing to generate sales, $3.4M to invest in Mavis technology which is needed to support their new cloud connected device strategy and $1M to commercialise their new 8K sensor. The kicker for this being a shocker of a raise is $1M was spent on the raise itself. Dilution for shareholders is massive with shares on issue rising from 230M to 410M. The retail component of the offer ($8.5M) was under subscribed by $5.4M so the underwriters have 54.8M shares to offload over the coming months. So I expect this will go below 10c and maybe closer to 5c when the poor numbers (based on the poor Q1) for the half year report are released in Feb. So of the $17.9M only $4.4M is being spent pn what I would consider investments to support company growth rather than just survival.

The debt facility they have is also being reduced from $12 to $8M, so even with the $5M debt repayment they are still maxed out and are paying 10.5% interest.

I am still watching this as I think it is informative to monitor failed investments to learn from them or possibly re-enter, but for now and I think probably for a while the question I will be asking myself, whenever I start to think about re-entering is- Is this the best place I can put my money? A- Not currently

Further to @Rocket6 post about directors resigning you have the announcement below this morning adjusting reported FY22 figures at their auditors request.

It's a significant change too. Although they say it only relates to sales over four days, those four days account for more than 10% of the entire year's revenue (per the 4C). That in itself sounds a bit off. If you were an Atomos bull you might say it gives FY23 a huge free kick, but if you can't trust their accounting you have to start to second guess everything. I do note that the Chairman's letter in the annual report gives a little more detail to what is provided below and Deloitte have given them an unqualified audit opinion (based on the revised figures).

Board changes

On 30 September, Atomos advised that independent non-executive directors, Stephen Stanley and Lauren Williams, were resigning from the board, effective immediately. The announcement provided some insight, which I found really interesting: 'both have expressed their concerns over board effectiveness and misalignment in decision making'.

This is yet another red flag -- arguably the biggest one in the last few months. It is one thing to have an ex-employee causing issues externally, but two board members resigning effective immediately based on existing concerns with the structure and decision making of the board? Sheesh. All is not right with Atomos. I was initially keeping an eye on them given the share price battering in recent months -- thinking maybe there is an opportunity here -- but this is increasingly looking like a value trap with some glaring internal issues.

I think this is also a key example of the 'share price can always go lower'. It reminds me of what Gaurav was saying in his recent interview with us -- pack up and sell when the investment thesis changes or the water starts to become cloudy. Props to the Strawman members that acknowledged this a few weeks/months ago and cut their losses. I think the worst is yet to come for Atomos and the resignation of two board members further demonstrates this.

After the poor 2022, I wanted to put some numbers down as benchmarks check against for the next 3-5 years. This is what they want to achieve over next 5 years. Guidance for 2023 is for it to be stronger than FY22 (revenue, margin & earnings) but will skew more to second half.

So from this I am putting some conservative assumptions of 5% revenue growth per year and EBITDA margin increasing from 5.5% (2022) to 18% by 2027. I'm not trying to forecast accuracy here just using it as a thought exercise of different scenarios. I think a PE of 10 is appropriate for the current period before moving back up to 20 as the strategy is executed and FCF is positive again. At a PE of 10 it is pretty fairly valued at the current price of 18c. If the strategy execution is going well then they should be making a NPAT of 6-8m in 2-3 years and probably deserve a PE of 15, which would give them a 57c fair value (discounted back 10% is 41c today). I have a terminal value of $1.30 (55c today) in 2027 if their strategy is successful, and their EBITDA margins is at 18%. To me there is enough upside potential here to remain interested, but it does all hinge on getting back to positive FCF in the next quarter and avoiding a cap raise. If they can do this it might start to look very cheap. I am estimating the probability of a cap raise at <20%.

Refer to my Straw yesterday.

Valuation based off EBITDA and Revnue multiples and benchmarks using the Strategy and Plan set out in the FY22 presentation.

Assumes 25% revenue growth y-o-y to end 2026 and 20% EBITDA margin at this time.

Discounted back to start of FY23 at 10%,

Further discount of 33% applied to reflect execution / capability risk.

Upside to 25% revenue CAGR not assessed. (Historial 10 year CAGR is 42%, but from a miniscule base).

AMS released a response to an AFR article in which former CEO Estelle McGechie has accused the company of "rampant illegality".

AFR article here

Atomos have responded this morning with an announcement

I have no idea if what she's alleging is true or not but as the old saying goes "where there's smoke, there's fire". I am exiting my position today and copping the loss.

Disc: Was holding IRL and Strawman but will be exiting today.

Atomos FY Results

Atomos ($AMS) reported their results yesterday. It has been a tough year, so to their credit, CEO & CTO Trevor Elbourne and CFO James Cody fronted two investor calls – one yesterday and one today.

As usual, I’ll outline: 1) reported highlights, 2) key insights from the call and 3) my key take-ways. As part of 1) I will add my own summary of “low-lights”. I conclude by stating how I have assessed value, the decision taken and rationale.

1) Reported Highlights

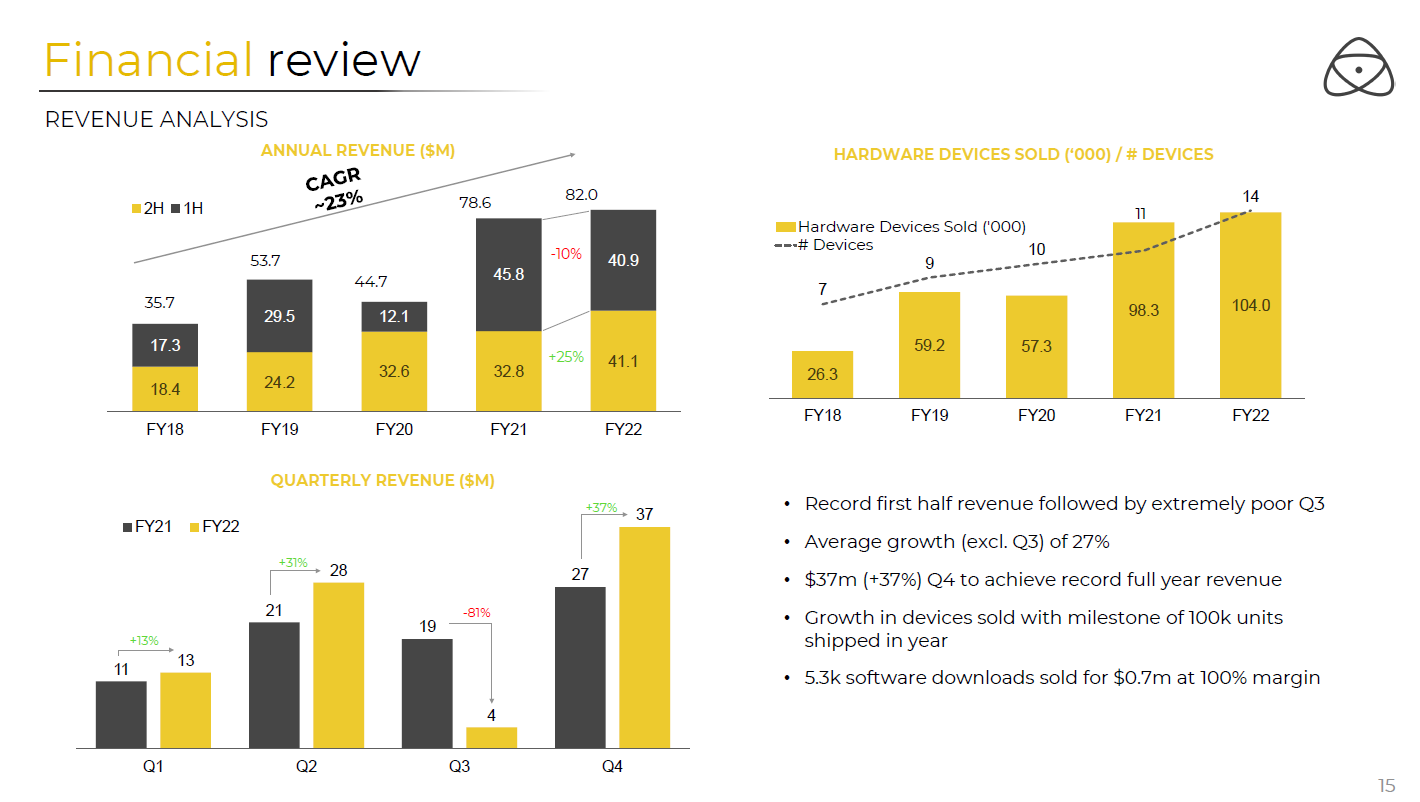

- Record revenue of $82.0m, up 4.3% on pcp (previous corresponding period) with a record Q4 result of $37.5m

- Underlying EBITDA of $4.5m (5.5% of revenue)

- Successfully launched Atomos Cloud Studio and new Series 2 ‘connected’ products in Q4

- Executing on strategy of expanding into connected and cloud products and services

The challenges $AMS has faced this last year are well-discussed here on SM, so I wont repeat. For me, the standout “low-light” was that this business has in one year turned from generating a FCF of almost $8m in FY21 to a result of -$32m in FY22.

To management’s credit, there was a fair amount of air time given to this in the presentation and the Q&A.

Key drivers were:

- Inventory build to mitigate pandemic-induced supply chain issues

- A fall in receipts due to a failed sales and marketing strategy in Q3, reported as quickly rectified in Q4

- Margin reduction and inventory write-offs due to Series I models coming to the end of their life cycle and overstocking of models where demand failed to be realised

- Exceptional staff charges due to “unnecessary” hires

(If, I had my way, I would mandate that firms be obliged to communicate at summary level, the 5 most significant things that went well in the year, and the 5 most significant things that didn’t go well.)

2) Key Insights from the Investor Presentation

Summary, Strategy and Outlook

Trevor began by reminding us of the progress of the company since first sales in 2011 and gave an update of the strategy and the outlook. Slides 8-12 are a very clear summary, so I’ll let them speak for themselves. The big themes are continuing to innovate with new connected products; launch and add services to the Cloud platform; and augment existing sales channels with direct-to-customer sales, including innovative ways for customer to pay for hardware/software bundles.

By 3-5 years they aim to get to an EBITDA margin “towards 20%” getting to “well into the teens” in 2-3 years.

Financial Review

The bottom left-hand chart below shows part of the issue last year – a collapse in sales in Q3, which was reported in June as due to a “change in marketing approach and lower promotional activity”. I’ll come back to this later. The timing could not have been worse, because inventories has been built to mitigate supply chain issues, including shutdowns in China.

The bursting back to life of revenue in Q4, was as a result of promotional activity and discounting – also foreshadowed in June – rapidly getting the new cloud-enabled products into the market.

Upon further discussion, we learned there had also been discounting and write-down of the old Series I models and clearance of discontinued products.

So, in terms of core operational performance is was a perfect storm: big inventory build + sales shock (quickly corrected) + margin reduction due to discounting and clearances. Ouch.

Consumer electronics are generally not super-high margin products, so that explains a horrible change in cash flow fortunes.

But there’s more.

Staffing and Organisation

We were told about “significant further headcount added under previous leadership – largely unwound”. When we dug into this in the Q&A, it was stated that a bunch of senior, highly paid sales and marketing personnel has been added in the USA (by you know who). Once Trevor took over, it was decided that these resources were not needed, so they were let go as part of a larger “right-sizing” of the organisation. All of this then also drives an increase in “professional services.

(So this gave us some insights into what happened under the previous CEO, and I speculate, a wider dislocation in organisation performance as these changes took place. I am trying to be measured with my words here.)

Trevor made clear that there is a strong leadership team in place that has a lot of experience in the company. He himself has been there since the early days, and James has been CFO since 2017. However, they are looking to fill several key roles:

- Chief Commercial Officer (they’ll be running direct sales in parallel with the current channel partners. Trevor believes they won’t cannibalise partners, and having AMS being more involved in direct marketing will build the brand. )

- Chief Product Officer (necessary because Trever has stepped up to CEO)

- Head of Manufacturing and Supply Chain (they are diversifying manufacturing from China by adding Malaysian capability).

Supply Chain

In the Q&A we probed on the current supply chain situation. As we have been told earlier, Trevor confirmed that all key products had been engineered/re-engineered to be made of components that are available and for which suppliers will hold suitable stocks. He is confident that FY23 sales will not be constrained by supply chain.

Cash

As you can tell from other posts on SM, fellow StrawPeople were aghast at the turnaround in the cash position. $5.0m in the kitty at year end, and the $12m debt facility (expanded after the Q3 nightmare) largely drawn. Gulp!

So, on the calls yesterday and today, your faithful fellow Strawpeople asked about the capitalisation of the firm and the need for a capital raise. From the responses on both days, CEO and CFO do not yet see this as necessary. The main reason is that they expect to see a significant improvement in working capital as inventory levels are reduced, and the receivables from the big Q4 sales push are paid.

(In addition to @mushroompanda‘s analysis, I have done some quick and dirty cals, Provided sales continue, if they are able to return the key working capital levers back to the FY21 levels (as a proportion of revenue), I could see them getting to a cash position of $10-$15m by the end of 1Q23. My analysis is very rough, and I haven’t assessed the risks around this. But if the ship is steadied, a highly dilutive raise should be able to be avoided. So, I will give Trevor and Cody the benefit of the doubt. In fact, Cody stated on both days that the cash position has improved since YE22.

3) My Key Takeaways

I’ll be brief. In my opinion, FY22 is a case study of how quickly fortunes can change when there is a macro-shock combined with leadership misalignment/discontinuity. I’ll leave it at that.

I don’t doubt that the products are great and that customers are going to value enhanced connectivity and functionality enabled via the cloud. At its heart, a core capability of $AMS is product development and delivery. But businesses need much more than that, as we have learned.

The direct-to-customer strategy is unproven, and the vacancy of Chief Commercial Office is a key gap. (I’m not convinced the S&M resources hired in the USA were “unnecessary”. But there are several reasons why they might have been classified so.)

It is certainly a comfort, given everything that has happened, that we have continuity in Trevor and James.

The overstocking and write-downs were perhaps a necessary risk given the information available when key decisions were made in their height of the pandemic. I am not going to be a hindsight hero.

However, the investment thesis has changed, the story revealed today highlights a range of risks going forward. The trials and tribulations of the last 12 months raise real questions in my mind as to whether $AMS has the capability to execute its refined strategy.

What do I value AMS at?

Tough to do this, so I’ll keep it simple. If we assume ongoing revenue growth of 25% p.a. out to YE 2026, and that EBITDA margin at that time is 20%. I assue some share dilution to 250M SOI. Then using two methods, discounted back to today at 10% discount rate I get.

- Use revenue multiples of 1 and 1.5, reasonable for the sector: $0.55 to $0.82 / share.

- Using EV/2026EBITDA of 7 (again reasonable for the sector), I get $0.77.

But these valuations assume success in implementing the strategy. There has to be a reasonable chance they fall short, so I can't value $AMS today at much more than $0.40 - $0.50/share.

Limitation - I haven't assessed the upside. But even trying to be objective, I can't bring myself to do this today.

In RL, with the SP dropped, I was reduced to a 1.5% holding in $AMS. The paper loss hurts, but this risk profile around the above valuation is too high.

Personal Lesson learned: $AMS was way too high risk to hold a 4.5% position, even though this had run up from an initial investment of 2.0%. And when the short-lived CEO exited, I should then have re-assessed risk and reward. I didn't. I paid for it. But, on a positive note, my maximum position sizing "policy" for high risk firms saved my bacon and I live to fight another day.

Decision: Sell 50% of $AMS holding (Executed). Hold at 0.75%

Atomos released their FY22 result today.

The FY22 webinar will be held today at 11am and also 12pm on Wednesday.

You can join here:

11:00am Tuesday- https://us02web.zoom.us/webinar/register/WN_vg__EERMSHGwhQ4xbHhtCQ

12:00pm Wednesday- https://us02web.zoom.us/webinar/register/WN_Ac9PZKEmTz-DOo-zErtVsQ

It will be interesting to hear if they tackle the departure and claim/complaint from previous CEO Estelle McGechie.

FY22 results are out for $AMS. There is only one slide and one question for me that matters.

Slide 20 Cashflow

Question: What is your plan to ensure the business remains sufficiently capitalised during FY23?

Disc: Held IRL and SM

Claim from former CEO

Former CEO, Estelle McGechie, has filed an employment-related complaint against the company in the US. The company has advised that the claims are unfounded, and consequently will defend any claims that are made if/when served.

Not ideal…. it is difficult to provide much further without speculating, but as we all know the market doesn’t like uncertainty. The share price has been whacked today (16% at time of writing).

Update 10/08/2022

Recent announcement that Trevor Elbourne will take over the CEO role permanently and there was an update last month in regards to FY22 sales.

Management expecting around $82m of Revenue which is at the lower end of updated guidance given in May. EBITDA also expected at the lower end of guidance so around 6%.

Q4 saw a huge turnaround after the previous CEO left (may be a reason for her departure) and I expect that this may lead to some good momentum heading into FY23.

Will update valuation based on 20x EBITDA but waiting on full year results and potential guidance for further updates.

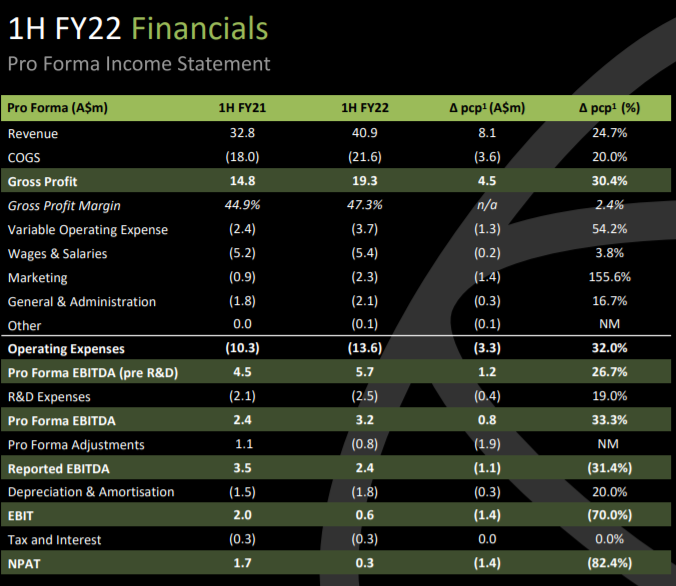

Update 07/05/2022

Lo and behold management have downgraded guidance 2 weeks after reiterating them when the CEO left. Guidance is now at $80-90m Rev and 6-8% EBITDA so taking the low end ($80m and 6%) EBITDA should equate to around 4.8m. Almost exactly double of their 1H FY22 results. I was expecting quite a strong 2H as is usually season with this business but obviously with the latest update this is not going to happen. If I just do a simple double of 1H results then NPAT will be around $0.6m which is well below their FY21 results of $4.2m.

Hard to value this on a PE basis given this update so I'm just going to update and give them a P/S of 1x. Conviction is very thin at the moment.. Looking more like a sell at this point with June 30 coming up..

EDIT: 18/02/2022

Revisiting my valuation post their 1H FY22 results.

Management have still guided for 12-15% EBITDA from 95m+ which is around $11.4m at the low end of guidance. This means that they are expecting quite a strong 2H FY22. This is assuming that they are stating that this EBITDA figure is at least the "Pro Forma EBITDA" before they take off $1m for Videogram expenses. If this figure is "pre R&D" then they'll actually have made less EBITDA than FY21 ($13.2m). Given these assumptions, I may have underestimated their Depreciation and Amortisation and Tax and Interest and so NPAT may come in around $5.6m.

I'm going to be a bit more conservative and give them a PE of 40 which would alter the valuation to around $1.

Original Valuation

Management have guided for $95m+ of revenue and EBIDTA margins of 12-15%. If we take the low end of guidance then EBIDTA will come in at around $11.4m.

Subtract $1m for opex costs from their investment in Videogram and assuming stable depreciation, amortisation, tax and interest will give an NPAT of around $6m representing around 25% growth compared to FY21. See table below for their FY21 results.

A P/E of 50 is not unreasonable if they can continue to grow at 25% CAGR which results in a valuation of $1.35.

Disc: Held IRL and on Strawman.

https://newswire.iguana2.com/af5f4d73c1a54a33/ams.asx/3A598522/AMS_CEO_Appointment

Trevor Elbourne has been appointed as CEO. I'm relieved and here's why.

Leadership has been one of several drags on $AMS SP, given the reported failed on-boarding of the previous external hire who left after reportedly not being willing to relocate to Australia from USA. We then later find out of a return to strong sales performance under Trevor's leadership on returning to the pre-existing (implied prior to the new CEO) marketing strategy.

Trevor is a tech leader, is one of the original employers, and a member of the team that has developed $AMS great tech portfolio.

External hiring executives is always a risk, particularly for smaller caps who simply often aren't able to attract top talent. Clearly, the Board has decided to give Trevor a go. And I agree.

I believe the downgrade cycle and sell-off in a market unforgiving of tech mis-steps has been over-done. I am patient and am looking forward to $AMS recovering, as the head-winds of tech bear market and chip shortage begin to ease.

Disc: I still hold my full allocation IRL and SM ... although heavily beaten up!

Atomos is one that I’ve followed for quite some time. While never seeing it as a high quality company, it’s still a global leader in its category - monitor/recorders add-ons for video cameras.

It’s been a really rough couple of years for the company. The initial pandemic stopped sales in its tracks and hit some of their primary customers - those that film weddings, sports, conference events - the hardest.

And the punches to the face didn’t stop. The founder/CEO quit the company, chip shortages, supply chain issues, lockdowns in their Chinese manufacturing plants and then the new replacement CEO was moved on …

The share price was sitting at all-time highs of $1.76 in September 2021 is now just $0.33. Enterprise value is currently around $57m, $82m+ revenue for FY22e, high-40s gross margins, breakeven-ish, and made $4.2m NPAT in FY21.

It’s interesting to me for 3 reasons. 1) It’s cheap. 2) It’s a global leader in its space and 3) I believe it’s now better positioned that it was 2-3 years ago - I’ll elaborate a bit more on this.

At the heart, Atomos’ value proposition is the enabling of the computerisation of video cameras. Japanese camera companies are world class at hardware, imaging and sensor/lens technology - but they suck at software. Atomos monitor/recorders provides a big, bright monitor, with high level software features, time sync, increased storage options, and the ability to record in more editing software friendly file formats.

The company is currently in the process of refreshing its line of devices to have network connectivity (wifi, ethernet, mobile) and cloud services. The latter will enable workflows such as live streaming, remote switching, remote editing, and remote control. It’s really bringing the dedicated video camera kicking and screaming into 2022 level expectations and allow video teams to work where and how they want. Network connectivity and cloud services will add tremendously to the value proposition of Atomos’ products.

There are also some tailwinds with the file format Atomos is backing - Apple’s ProRes and ProRes RAW. ProRes is the recommended file format for Apple’s popular video editing software Final Cut Pro. There are a bunch of other professional video formats such RED’s REDCODE (RAW) and Blackmagic’s BRAW. However ProRes has one key advantage.

When Apple transitioned from Intel to Apple Silicon, they built ProRes hardware accelerators into all their “Pro” range products - anything with a M1 Pro or Max chip. They’ve also built it into their new, recently released M2 chip - so the entire range of Apple computers and the next iPad Pro will have ProRes hardware acceleration! What does that mean? Editing ProRes on Apple machines is much faster than other comparable formats. More film crews may start considering recording in ProRes RAW due to this advantage, and this may lead into the purchasing of Atomos hardware.

Atomos is interesting and worth checking out.

Spot the effect of a poor CEO - Estelle started as CEO at the start of Q2 (Sep 21) and was terminated mid April 22. On these numbers its safe to say that the new sales strategy she implemented was not working. The 80% decline in sales during quarter 3 was a lot more than I was expecting, especially given the board was still reitirating the old guidance at this time. Was Estelle keeping them in the dark or were they asleep at the wheel? I guess its good that the sales numbers support that it was a leadership/strategy/ execution problem rather than a broader strucutal product quality/demand type problem.

It is also positive that they were able to move the inventory stockpile that they had built up during quarter 4, but i was hoping their margin guidance would have been for the high rather than the low end of the 6-8% range. Still happy to hold my existing stock and monitor the recovery. I was thinking it was looking very cheap at 20c, but I am wanting to see further positives regarding continued sales momentum and margin re-expansion back to the 12% range, before I am willing to chase this rally and add to my positions.

Atomos FY2022 results

Atomos met revised guidance of $80-$90m with $82m in revenue for FY22. Although this was at the lower end, I think the market was expecting a further downgrade with the share price jumping at 30% this morning.

Its notable that growth was only 4.3% year on year; However, majority of sales was seen in Q4 which had 37% growth pcp ($37m in sales).

Insiders have recently been buying shares.

Market cap is $50m (PS 0.60x)

Expected EBITDA 6-8%

sales update:

AMS reports strong end to the year with a strong Q4 with revenue in excess of $37.5m showing an extremely strong qtr and indicating good momentum heading into FY23.

EBITDA to be at the lower end of the 6-8% guidance range which was downgraded in May.

I have held this for some time in Strawman but fortunately only purchased IRL at the lows as I thought it was oversold heading in to Tax Loss selling season. Another reason for buying was a lot of insider buying and an improvement in chip supply.

DISC- held

As commented earlier, this is a lot of (coordinated) insider buying. Do any other StrawPeople have any insights? Perhaps the Chairman got beat up by investors due to low insider holding? (I’ve had various interactions with Chris Tait,.. should we invite him to a SM meeting?)

With Jeremy Young leaving, new CEO leaving and miss on guidance plus exposure to global semiconductor crunch, all my analysis has said “sell” over the last year. But I’ve held despite a 60+% paper loss.

While I’m no expert, this company makes great products, in a high growth area, has great ongoing innovation, and a core group of management and board who have been around for a while (e.g. acting CEO, Chair). My gut has told me to hold and I have, despite the analysis. It’s my second largest high risk holding IRL.

This is the first tangible indication in two years that maybe I was not wrong. I can’t buy more (due to personal concentration rules) but I am going to continue to hold.

Disc: Held on SM and IRL

Several members of the Atomos board and management team have been buying shares shares on market.

Approximately 3m shares (1.3%) of the shares outstanding have recently been bought back by insiders. This includes the CEO, CFO, COO and non-executive directors.

It seems that after the recent revenue downgrade and departure of the CEO, the current management team feel the company is undervalued and have taken the opportunity to increase their holdings.

Current market cap is $65m and expected revenue FY22 is $85-$90m. 1H22 PE is 23 but expecting reduced earnings for FY22 due to increased costs.

This is a good step by management to show a strong united belief in the future of the company. I continue to hold shares but as mentioned by others in the strawman community, the management team can’t keep on put another foot wrong or there may be even further downgrades.

I think your right GavCo in that this selloff is overdone for what was released and I agree the company will come good but I think it might take a while to recover the trust.

Over the day as I have thought more about AMS prospects I don't really see the SP doing much until they either beat their revised guidance, or when better numbers start to come through in 2023. Like you, I find it hard to understand how this company is now worth less than it was during the initial COVID selloffs, and at this price (1x EV:Rev) it is being valued at no future growth. It has 17m of cash in the bank and is a real buisness with high quality products. I am thinking that based on the rule of 3 this should be our final negative- 1- Founder moved on, 2- new CEO replaced 3- long standing guidance revised.

I just did some numbers to see what the 2nd half will now look like. In the old guidance H2 was already doing the heavy lifting in getting the EBITDA margin up to the 12-15% range for the year, so I think the FY22 numbers will look pretty unexciting.

In the Old guidance (Rev ->95m EDITDA margin 12-15%) --> this gives a EDITDA range of 11.4-14.25m, which would have been a 39-73% increase over the FY21 numbers (EBITDA - 8.2m) and I was expecting an increase in NPAT to >5m.

In the H1 22 results their EBITDA margin was only 7.8% (10.4% in FY21), so to maintain the previous guidance H2 was going to have to perform well. I missed this during the H1 results, partly as I was trusting management on their guidance that margins would expand to 12-15%. Likewise the NPAT in H1 22 was only 0.3m vs 4.2m in FY21.

Based on todays guidance (80-90m rev 6-8%margin) I think we can only expect the FY22 EBITDA of between 4.8-7.2 (H1 was 3.2m of this), so a decrease of between 13-70% on the FY 21 numbers, depending on whether they hit the worst (80m rev, 6% margin) or best (90m rev, 8% margin) guidance combo. I am unsure whether we will be profitable on these numbers but probably around breakeven would be my guess.

Interestingly if I was better at technical analysis, then I would have given more weight to the multiple market signals to sell :)

Good call by @Vanderlay to sell your holdings when the CEO resigned. I think I might need to add this to my investing rules. It is rarely ever for a good reason that the boss quits so soon.

Just to add to @Slideup Atomos post:

They have reduced revenue guidance by approx 10% and the share-price has fallen 50% off an already low base.

I agree that the departure of the original CEO, new CEO and now reduced guidance doesn't look good.

But, I think shares have been oversold based on this recent announcement.

The company has a lot of work to do to get share-holders back on their side.

I have purchased more shares in the sell-off. However, similar to @Slideup I will be keeping an eye out for any more bad news.

Current Market Cap is $75m for a company that should produce $85m in revenue for FY22 and is trending towards positive free cashflow.

The company is in a growing industry and developing products in the audio visual space with new products offering cloud compatibility and collaboration.

Well this came as a pretty big surprise to me and i'm guessing by the 50% drop on open that the market isn't impressed either.

The guidance is now for 80-85m rev with EBITDA margin of 6-8% compared to previous of >95m at 12-14% margin. So a pretty big shift. The annoying thing is that the reaffirmed guidance only 2 weeks ago, raises a pretty big red flag. The mention sales have been slow for the first four months of the year - so this isn't a new problem and probably partly behind the CEO change a few weeks ago.

On the upside the new products have won awards at the recent trade show and feedback has been positive, so no problem with the quality of their products, just the exceution at the moment. I still think there is a good buisness here, but wont be adding any more until they start showing the result. I'm not ready to dump my holdings yet, but another negative surprise, will make me reassess the quality of the management. I think the new CEO needs some time to see if he can get this buisness moving forward again. I hope this downgrade has been driven by him assessing things now that he is in charge, as I don't think the board could re-confirm the old guidance 2 weeks ago under any other scenario.

They have maintained there ARR guidance for FY23 and 24 of $3 and 6m, so they are confident of there new strategy, unfortunately until they rebuild some trust their guidance is next to useless. The guided margin compression is due to accelerated promotional activity to get more users onto the cloud --> "Management anticipates that this activity could increase the installed base of its heroproduct, Ninja, currently at 150,000, by 15% by the beginning of FY23."

This is my favourite line from the update -

"Management has implemented strategies that may result in an outperformance to revised forecast

revenue, however the Company believes it is prudent to update the market at this time."

My translation

Negative view- We really hope, and all our fingers are crossed that we sell some units!

Positive view- I reckon my ideas are pretty good and we will beat the new guidance, but better cover my ass just in case.

I thought this was a pretty good webinar and the new products look very good and the explanation around how this will transistion the company for its next phase of growth sounded realistic to me.

3 new products to be launched this year and 5-6 next year.

The new products are in pre-production now and they plan on having 2-3 months of stock available in the shops by June, said they are managing supply chain problems and don't forsee any problems on stock availability this year.

The timecode aquisition from a while back is embedded into all of the new devices and this is what enables the cloud compatibility and collaboration potential. All products can talk to each other and the new devices are really about enabling collaboration and remote workflow capabilities which is what customers have been requesting. They want to own the ecosytem of video creation through cloud connectivity.

A positive is the move from entirely hardware sales to software enabled sales and they gave ARR guidance of 3M (end FY23) and 6M (end Fy24 monthly run rate). They will initially have a 3-4 month free period and then convert people to a range of maonthly plans from free (limited features) to $10/month for basic functions collaboration type function to $30/month for simple live production capabilities up to hourly rates for professional plans for live event broadcasters.

Initial feedback from professional broadcasters (live events etc) was transformational and enables them to react to things in real time.

A lot of positives for me and no real negatives and now it is just a matter of seeing them execute on their plan and monitoring stock availability and uptake of subscription plans.

First impressions of the interim CEO (Trevor Elbourne) was good, he seems pretty straightforward, he clearly knows the company, its products and their customers well and I think he will do a good job in this role. He is definately not a smooth talking salesman but if he was I would be worried.

Atomos will be hosting a webinar tomorrow (Friday 22nd April at 9.30am) regarding the announcement of a new product.

We will also hear from the interim CEO Tevor Elbourne.

The following link can be used to register:

https://us02web.zoom.us/webinar/register/WN_Iv_KVGEzQmCHS9ce-I-cTg

This is a pretty surprising annoucement and has not been taken well by the market. I feel for the WAM guys as they hold 7% of AMS and have been buying recently in the 90c area so they get a quick 25% hit for them as a happy easter gift.

When Estelle was appointed CEO last year I thought it looked like a win fopr the company. She looked well experienced and connected in the technology space and knew the product area. I thought she seemed like a good option to growth the business and replace the founder who was leaving for new challenges. It seems like the only real issue is that she changed (?) her mind about wanting to move back to Australia and the board required that.

The positives -

- The board acted quickly to remove her when she wouldn't replocate to Australia so hopefully any internal damage is minimal.

- The interim CEO is the old CTO/ product designer and has been with the company since 2012, so should be very familiar with the product space and can navigate the new product launchs that are expected at the upcoming trade shows in late April.

- Guidance has been repeatedly maintained. Rev- >$95M, EBITDA margin 12-15% (2021 - Rev $78M, 12-15% margin)

- The company itself hasn't done anything wrong and has managed supplky chains and have built up inventory to insulate against chip shortages.

The negatives-

- More distraction for the company to find a new CEO and the risk of staff or momentum loss while it is all being sorted out.

- AMS will need a lot more time and to get some solid runs on the board before it gets back to its previous highs.

- Market sentiment seems pretty low.

On balance I think that a 25% drop on this announcent is a big overreaction and I will look to add some more to my portfolio.

Change of CEO

Atomos announced that Estelle McGechie appointment as CEO has ended. Her appointment was only made in Sept 2021 and the expectation was that she would return to Melbourne, Australia from the US to lead the business. Estelle has not yet relocated back to Australia and thus her term as CEO has concluded.

Trevor Elbourne who has been the CTO for the last 6 years will be the interim CEO whilst the board search for a new CEO.

Revenue guidance was also reaffirmed at $95m+ and EBIDTA margins of 12-15%.

Link to their Announcement : 2924-02510534-3A591749 (markitdigital.com)

Not sure what to make of this just yet, sounds like the board had a falling out with Estelle because she did not want to relocate back to Australia. Her credentials were very well regarded and was seen as a very positive appointment by Atomos at the time to further their growth. This doesn't change my thesis but will be watching to see who they appoint in the near future.

Disc: Held IRL and on Strawman.

Atomos today released their 1H FY22 results. From their announcement:

- Record revenue of $40.9m, up 25% on pcp (previous corresponding period)

- Proforma EBITDA of $3.2m (7.8% of sales) up 33% on pcp, 1H FY21: $2.4m (7.3% of sales)

- Inventory investment protecting against supply chain interruptions

- Atomos expects new product launches to drive sales growth in 2H FY22 and maintains revenue guidance of $95m+ for the full year as well as EBITDA of 12-15%

Overall a decent result given current supply chain issues. Management have stated they are launching new products in 2H FY22 which will likely increase revenue so that guidance is met.

Looking through their cash flows I was actually surprised that they were not operating cash flow positive this half with outflows of over $5m. I suspect this may be related to higher distribution expenses as stated in the presentation. May be something to keep an eye on with $17m in cash and $5m debt facility available. Will review at full year results as 2H is expected to be stronger.

I will likely need to adjust my valuations as profitability was not as high as previous year given an increase in expenses and also several one off items.

Disc: Held IRL and on Strawman

Below is a Black Magic add in the latest New Scientist promoting a multi device streaming product. Thought this was an interesting avenue to advertise, I’m unaware how widespread the marketing campaign is, but the direct marketing makes sense given the online collaborations that now take place across all industries.

There are companies in the US also chasing the multiple cameras, streaming options, as is Atomos. Impossible to say at this point who will succeed, but my gut feel is the simplest option will win. The customers looking to use this type of product are not professional operators, they may not even be particularly tech savvy, so it simply needs to connect easily and work. (Easier said than done)

What I find interesting is Black Magic used to be a different product range to Atomos. However now both companies are now developing similar products, with hardware recorders and now multi streaming device options.

Founded in 2010, AMS is a global software and hardware technology company supporting the ‘democratisation’ and expansion of high-quality and accessible video content creation. The company created the world’s first video monitor-recorder. They partner with a wide range of technology providers including Apple, Adobe, Sony, Canon, JVC Kenwood, Nikon, FUJIFILM and Panasonic.

AMS recently posted their first profit, having generated losses since inception. They generated 7.1m of cash in FY21 to compliment what is now a strong balance sheet of 26m. They also have access to a 5m working capital facility. R&D investment was 5m last year and the company has indicated they will continue to reinvest in growing the business. This is important for AMS as their new technology has resulted in higher profit margins.

They posted record revenues of 78m in FY21 primarily driven by the pro video segment (53m). Their gross profit margins grew from 39% to 47% and they continue to scale well - revenue increases didn't result in significant increases in COGS - benefiting AMS' bottom line.

My DCF uses a four-year forecast, with my projection using free cash flow. My assumptions are that AMS will record 8.5m FCF in FY22, and 11m in FY23.

Using my standard discount rate of 8.4%, I reach a CV of 238m - divide this by shares outstanding and I reach a valuation of $1.10.

DISC: Not held

Atomos released a 3Y a few days ago showing directors exercising options, and then selling in the case of one director.

Copied from their release:

- Sir Hossein Yassaie sold 750,000 shares and exercised 870,722 options resulting in a net increase of 120,722 shares; with a remaining balance of 1,954,579 shares.

- Chris Tait sold 636,260 shares (500,000 held personally and 136,260 held indirectly) and exercised 217,679 options, resulting in a net decrease of 418,581 shares; with a remaining balance of 894,882 shares.

Hard to read into the effect of this on the overall company as the directors actually have quite limited ownership of the business (less than 10% of the business between 4 directors)

They did add on underneath which I found somewhat interesting:

"Atomos wishes to advise that despite the well-publicised global challenges with component supply, the Board remain comfortable with full year Broker consensus in relation to FY22."

I guess time will tell in regards to whether chip shortages will overall also impact Atomos as has been well publicised for Audinate.

DISC: Held IRL and on Strawman

16-Feb-2021: Ord Minnett: Atomos Limited (AMS): Back on track

Analyst: Jason Korchinski, Research Associate, (02) 8216 6348, [email protected]

- Last Price: A$1.06

- Target Price: A$1.35 (Previously A$1.24)

- Recommendation: Buy (Previously Speculative Buy)

- Risk: Higher

- ASX Code: AMS

- 52 Week Range ($): 0.30 - 1.24

- Market Cap ($m): 231.6

- Shares Outstanding (m): 218.5

- Av Daily Turnover ($m): 4.7 3

- Month Total Return (%): 23.3

- 12 Month Total Return (%): -14.2

- Benchmark 12 Month Return (%): -3.7

- NTA FY21E (¢ per share): 16.1

- Net Cash FY21E ($m): 18.3

The 1H21 result illustrated a return to form for AMS. As a global business, the early stages of COVID-19 had a drastic impact. However, by shoring up its supply chain and releasing new products, AMS is now benefitting from shifting trends in how individuals consume video content. The rise of Netflix and other online streaming/video platforms driven by lockdowns means there was surplus demand for original and high-quality content, for which AMS’ hardware helped to meet. AMS management has also demonstrated its ability to manage its fixed cost-base, maintaining a rate of ~$1.6m per month vs ~$2.3m per month pre-COVID. Management view this rate as the new norm and have called out relatively modest increases going forward. The view that AMS is likely to benefit further from the accelerated shift towards new content creation, combined with the positive gross margin reversion, gives us the confidence to upgrade our recommendation to a BUY and increase our price target to $1.35 (representing a TSR of 27%).

1H21 result

1H21 revenue of $32.8m showed strong signs of recovery, growing significantly on the 2H20 (+178% hoh). Gross profit margins also saw an improvement on the second half, with gross margins of 44.9% (+4.2%pts on OMLe), largely driven by a reduction in discounting and some new products. The reduced opex and strong GP margin resulted in an EBITDA result of $2.5m ($1m ahead of OMLe). Positive cash flow helped to bolster AMS’ balance sheet, with the company well placed with ~$23.3m. Management have called out the potential for M&A opportunities in the near future as a means of deploying the cash.

Changes to forecasts

AMS management, whilst not providing explicit guidance, did outline that 1H sales momentum is expected to continue into the second half and that it anticipates further margin improvements off the back of new products and revenue streams. Therefore, we have made modest increases to revenue, EBITDA and NPAT off the back of the 1H21 result. See page 3 for more details.

Key risks

The key risks for AMS include:

- Supply chain risks,

- Product obsolescence,

- Competition, and

- Global macro events.

--- Click on the link above for the full OM report on AMS ---