Atomos FY Results

Atomos ($AMS) reported their results yesterday. It has been a tough year, so to their credit, CEO & CTO Trevor Elbourne and CFO James Cody fronted two investor calls – one yesterday and one today.

As usual, I’ll outline: 1) reported highlights, 2) key insights from the call and 3) my key take-ways. As part of 1) I will add my own summary of “low-lights”. I conclude by stating how I have assessed value, the decision taken and rationale.

1) Reported Highlights

- Record revenue of $82.0m, up 4.3% on pcp (previous corresponding period) with a record Q4 result of $37.5m

- Underlying EBITDA of $4.5m (5.5% of revenue)

- Successfully launched Atomos Cloud Studio and new Series 2 ‘connected’ products in Q4

- Executing on strategy of expanding into connected and cloud products and services

The challenges $AMS has faced this last year are well-discussed here on SM, so I wont repeat. For me, the standout “low-light” was that this business has in one year turned from generating a FCF of almost $8m in FY21 to a result of -$32m in FY22.

To management’s credit, there was a fair amount of air time given to this in the presentation and the Q&A.

Key drivers were:

- Inventory build to mitigate pandemic-induced supply chain issues

- A fall in receipts due to a failed sales and marketing strategy in Q3, reported as quickly rectified in Q4

- Margin reduction and inventory write-offs due to Series I models coming to the end of their life cycle and overstocking of models where demand failed to be realised

- Exceptional staff charges due to “unnecessary” hires

(If, I had my way, I would mandate that firms be obliged to communicate at summary level, the 5 most significant things that went well in the year, and the 5 most significant things that didn’t go well.)

2) Key Insights from the Investor Presentation

Summary, Strategy and Outlook

Trevor began by reminding us of the progress of the company since first sales in 2011 and gave an update of the strategy and the outlook. Slides 8-12 are a very clear summary, so I’ll let them speak for themselves. The big themes are continuing to innovate with new connected products; launch and add services to the Cloud platform; and augment existing sales channels with direct-to-customer sales, including innovative ways for customer to pay for hardware/software bundles.

By 3-5 years they aim to get to an EBITDA margin “towards 20%” getting to “well into the teens” in 2-3 years.

Financial Review

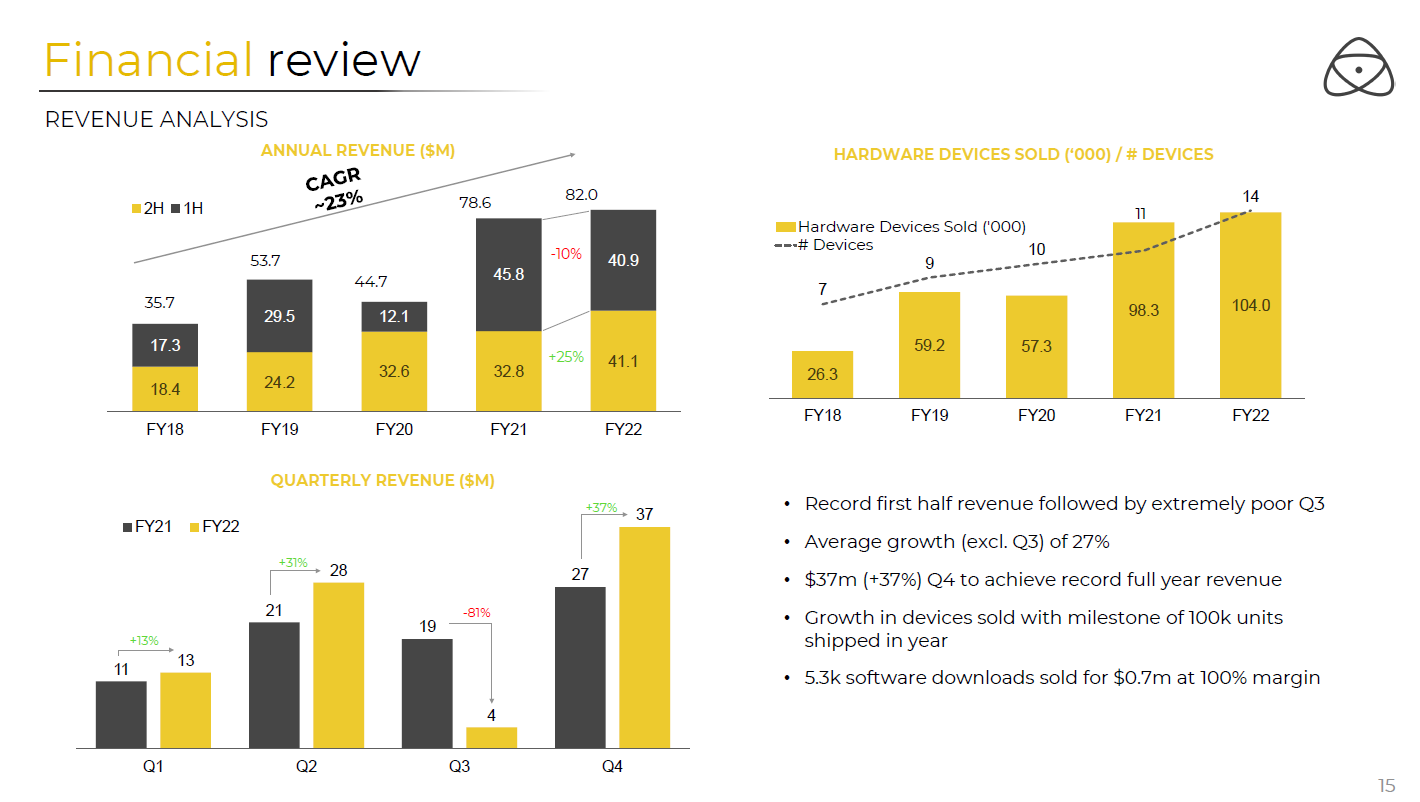

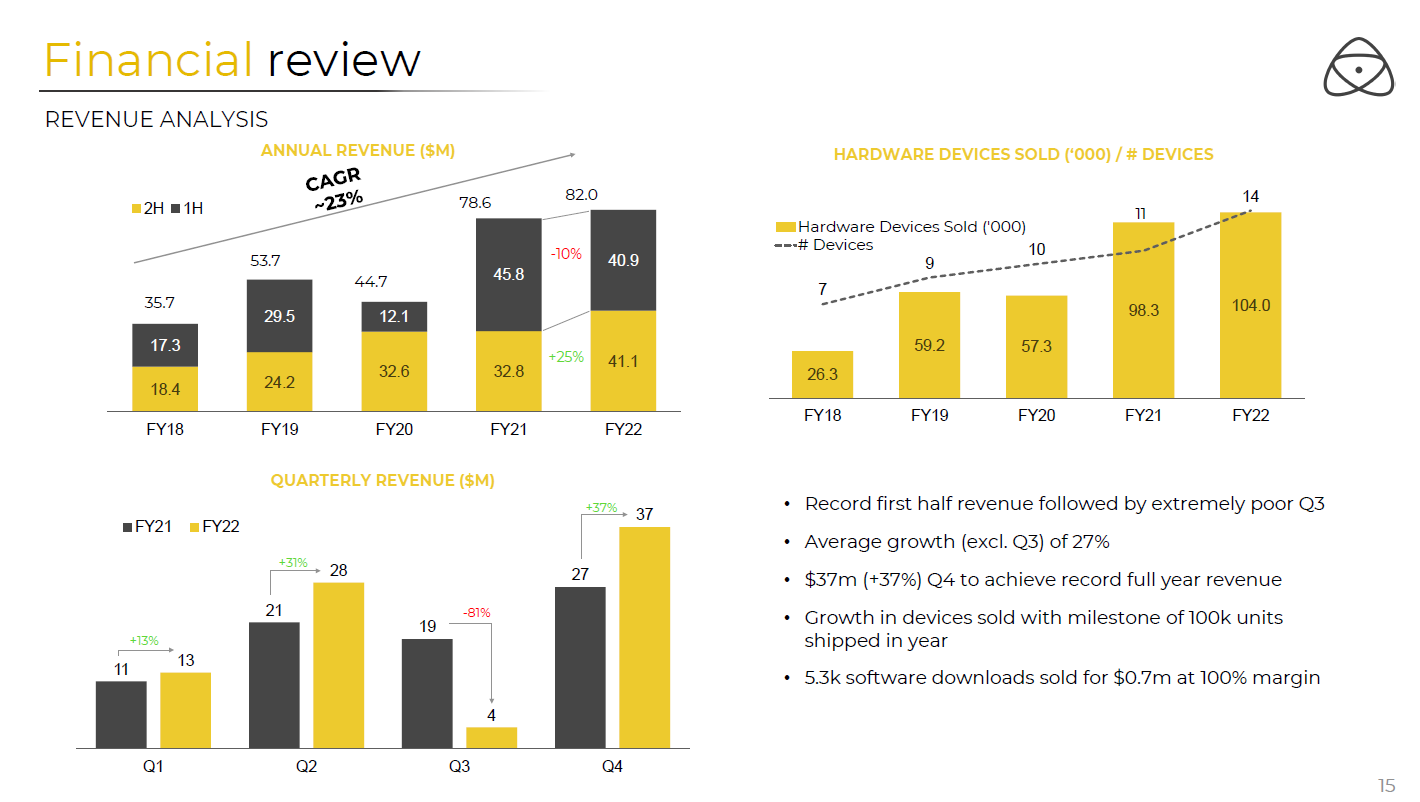

The bottom left-hand chart below shows part of the issue last year – a collapse in sales in Q3, which was reported in June as due to a “change in marketing approach and lower promotional activity”. I’ll come back to this later. The timing could not have been worse, because inventories has been built to mitigate supply chain issues, including shutdowns in China.

The bursting back to life of revenue in Q4, was as a result of promotional activity and discounting – also foreshadowed in June – rapidly getting the new cloud-enabled products into the market.

Upon further discussion, we learned there had also been discounting and write-down of the old Series I models and clearance of discontinued products.

So, in terms of core operational performance is was a perfect storm: big inventory build + sales shock (quickly corrected) + margin reduction due to discounting and clearances. Ouch.

Consumer electronics are generally not super-high margin products, so that explains a horrible change in cash flow fortunes.

But there’s more.

Staffing and Organisation

We were told about “significant further headcount added under previous leadership – largely unwound”. When we dug into this in the Q&A, it was stated that a bunch of senior, highly paid sales and marketing personnel has been added in the USA (by you know who). Once Trevor took over, it was decided that these resources were not needed, so they were let go as part of a larger “right-sizing” of the organisation. All of this then also drives an increase in “professional services.

(So this gave us some insights into what happened under the previous CEO, and I speculate, a wider dislocation in organisation performance as these changes took place. I am trying to be measured with my words here.)

Trevor made clear that there is a strong leadership team in place that has a lot of experience in the company. He himself has been there since the early days, and James has been CFO since 2017. However, they are looking to fill several key roles:

- Chief Commercial Officer (they’ll be running direct sales in parallel with the current channel partners. Trevor believes they won’t cannibalise partners, and having AMS being more involved in direct marketing will build the brand. )

- Chief Product Officer (necessary because Trever has stepped up to CEO)

- Head of Manufacturing and Supply Chain (they are diversifying manufacturing from China by adding Malaysian capability).

Supply Chain

In the Q&A we probed on the current supply chain situation. As we have been told earlier, Trevor confirmed that all key products had been engineered/re-engineered to be made of components that are available and for which suppliers will hold suitable stocks. He is confident that FY23 sales will not be constrained by supply chain.

Cash

As you can tell from other posts on SM, fellow StrawPeople were aghast at the turnaround in the cash position. $5.0m in the kitty at year end, and the $12m debt facility (expanded after the Q3 nightmare) largely drawn. Gulp!

So, on the calls yesterday and today, your faithful fellow Strawpeople asked about the capitalisation of the firm and the need for a capital raise. From the responses on both days, CEO and CFO do not yet see this as necessary. The main reason is that they expect to see a significant improvement in working capital as inventory levels are reduced, and the receivables from the big Q4 sales push are paid.

(In addition to @mushroompanda‘s analysis, I have done some quick and dirty cals, Provided sales continue, if they are able to return the key working capital levers back to the FY21 levels (as a proportion of revenue), I could see them getting to a cash position of $10-$15m by the end of 1Q23. My analysis is very rough, and I haven’t assessed the risks around this. But if the ship is steadied, a highly dilutive raise should be able to be avoided. So, I will give Trevor and Cody the benefit of the doubt. In fact, Cody stated on both days that the cash position has improved since YE22.

3) My Key Takeaways

I’ll be brief. In my opinion, FY22 is a case study of how quickly fortunes can change when there is a macro-shock combined with leadership misalignment/discontinuity. I’ll leave it at that.

I don’t doubt that the products are great and that customers are going to value enhanced connectivity and functionality enabled via the cloud. At its heart, a core capability of $AMS is product development and delivery. But businesses need much more than that, as we have learned.

The direct-to-customer strategy is unproven, and the vacancy of Chief Commercial Office is a key gap. (I’m not convinced the S&M resources hired in the USA were “unnecessary”. But there are several reasons why they might have been classified so.)

It is certainly a comfort, given everything that has happened, that we have continuity in Trevor and James.

The overstocking and write-downs were perhaps a necessary risk given the information available when key decisions were made in their height of the pandemic. I am not going to be a hindsight hero.

However, the investment thesis has changed, the story revealed today highlights a range of risks going forward. The trials and tribulations of the last 12 months raise real questions in my mind as to whether $AMS has the capability to execute its refined strategy.

What do I value AMS at?

Tough to do this, so I’ll keep it simple. If we assume ongoing revenue growth of 25% p.a. out to YE 2026, and that EBITDA margin at that time is 20%. I assue some share dilution to 250M SOI. Then using two methods, discounted back to today at 10% discount rate I get.

- Use revenue multiples of 1 and 1.5, reasonable for the sector: $0.55 to $0.82 / share.

- Using EV/2026EBITDA of 7 (again reasonable for the sector), I get $0.77.

But these valuations assume success in implementing the strategy. There has to be a reasonable chance they fall short, so I can't value $AMS today at much more than $0.40 - $0.50/share.

Limitation - I haven't assessed the upside. But even trying to be objective, I can't bring myself to do this today.

In RL, with the SP dropped, I was reduced to a 1.5% holding in $AMS. The paper loss hurts, but this risk profile around the above valuation is too high.

Personal Lesson learned: $AMS was way too high risk to hold a 4.5% position, even though this had run up from an initial investment of 2.0%. And when the short-lived CEO exited, I should then have re-assessed risk and reward. I didn't. I paid for it. But, on a positive note, my maximum position sizing "policy" for high risk firms saved my bacon and I live to fight another day.

Decision: Sell 50% of $AMS holding (Executed). Hold at 0.75%