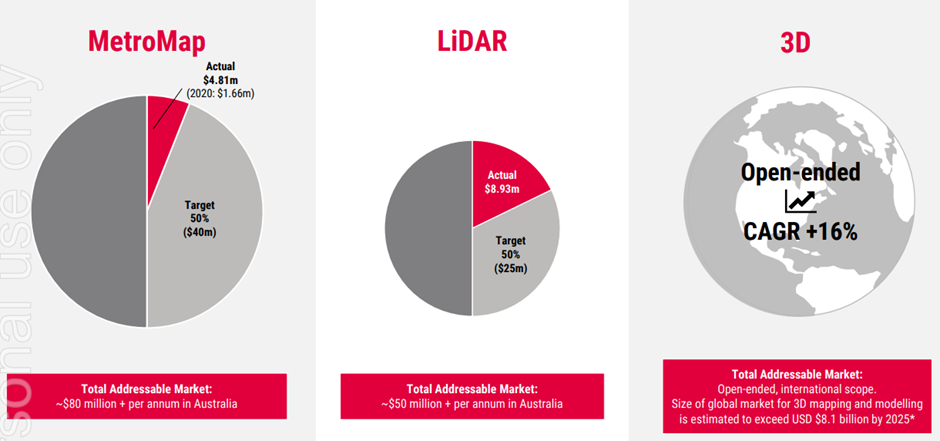

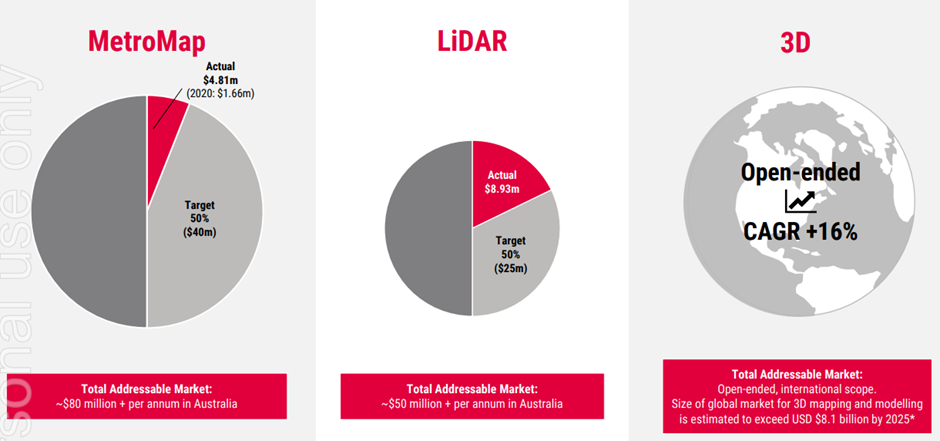

AMX breaks their operating business into three segments; MetroMap, LiDAR and 3D. MetroMap is a subscription service for AMX's database of 2D aerial imaging, LiDAR uses laser technology to scan for distance and density and 3D meshes images to create a digital model of a 3D space. AMX has hinted at bringing their LiDAR and 3D offerings into the MetroMap subscription but for now they are still project based. Management provides market share on each segment in their presentations:

With a 6% market share of the Australian subscription aerial imagery market, AMX has a long way to catch the incumbent Nearmap who has over 90% market share. That said, AMX management is confident they have a better offering than NEA and importantly competing strongly on value with a fixed subscription amount compared to NEA who charges based on usage. See my Industry/competitors straw for my take on AMX competing with NEA.

AMX are more established in LiDAR with 18% market share and have invested further in space with a fourth laser sensor and upgrading the remaining three.

Despite being conservative with MetroMap and LiDAR TAM's, management have an "open-ended" TAM for 3D largely because the space is growing so quickly. Like other technologies, as the quality of the product improves it is opening up further use cases that were previously not possible. It represents the blue sky in the AMX investment thesis and helping it is the fact AMX has leading edge tech in the space. Engineering giant WSP was an early client of AMX's 3D data and have continually scaled up as AMX capture more cities and improve their offerings:

Beyond "traditional" use cases in surveying and mapping, AMX is also selling their 3D datasets to metaverse customers who are looking to mirror the real world in a digital setting. They sold their San Francisco model to the Lunaverse project for $250k and have partnered with the Omniscape project to map various US cities to eventually be used in their metaverse. Importantly, AMX is project agnostic, they continue to own the 3D dataset and licence it to whichever metaverse projects would like to use it.