Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Spending a fair bit of time at the beach in Adelaide it is interesting to see Aerometrex get this contract for 3d modeling of sand movement. At beaches in WA sand replenishment is a big issue in Perth and Geraldton. I am sure it is an issue in various East coast locations too. Not a huge contract for approximately $0.34 million up to $0.68 million but an interesting market niche.

The SA government spends a lot of money pumping sand from North to South to replenish the beaches. They have to cart away all the weed before they can collect, then wash the stones out of the sand and pump it down the coast.

It will be interesting to see the results in progressive images.

South Australian Department for Environment and Water has awarded Aerometrex a contract to produce a high resolution 3D reality mesh project for volumetric sand analysis over the Adelaide Metropolitan coastline

Monthly capture of the relevant areas of interest (by helicopter) for 12 months commencing September 2024 and is expected to be completed in September 2025.

The contract reinforces Aerometrex’s position as a world leader in providing high resolution 3D imagery for use in environmental applications

“This is an important project that shows the value of high-resolution 3D reality mesh in environmental management of coastal protection"

Customer use cases associated with coastal environmental solutions in Australia and other locations represent one of Aerometrex’s target market segments.

I am a little surprised Mr Market didn't go harder than a 10% drop based on some pretty average results. How a company can keep a straight face and use a metric like EBITDA for an operation that is so reliant on P,P&E is beyond me (they literally don't have a product without the planes) but they tried. I am guessing they wouldn't hire the person who attempted to write; Flat revenue (only saved by government data set sale at the death), costs escalation outstripping any pricing power, Net Loss of $4.2m which is 7x worse than the prior year.

I don't own but have previously, think i might be on the sidelines for a little longer

Half year results for FY23

Revenue overall is down. Project photomapping revenue ceased and merged into Metromap. Growth in Metromap did not outpace the loss in revenue (2.2m v 800K).

LIDAR revenue got impacted by aviation and weather factors (sounds a bit similar to Elders?)

Operational cashflow increased but also payments for intangibles increased from previous period which I believe is due to all their work upgrading their sensors. Hoping this is a one-off increase

Finally overall expenses increased. Guess this is due to the US work the company commenced in the year (travel/employee expense) and the new sensors being rolled out (D&A).

My assumption is the market wasn't too happy due to the drop in revenue vs the increased expenses. Probably need to wait till next period to see if any of the increased spending is reaping rewards.

[held]

Captial Raise History

· December 2019 Raised $25m at it’s IPO

Acquisition

· April 2020 $1.5m Spookfish – Australian Aerial Imagery company from US company EagleView https://www.asx.com.au/asxpdf/20200424/pdf/44h72kgbmxv3b1.pdf

Contract Wins/ Sale Annoucements (not include MetroMap updates)

· January 2023 Australian Federal Government Agency $1.88m purchase order – largest LiDAR contract win. https://www.asx.com.au/asxpdf/20230113/pdf/45km94ss9c9zwz.pdf

· July 2022 Rio Tinto $0.85m to be undertaken in the Pilbara region. Work is a combination of ortho-photographic and LiDAR imagery capture. ttps://www.asx.com.au/asxpdf/20220720/pdf/45c0p7cdmmyq7k.pdf

· June 2022 Australian Federal Government Agency $2.5m purchase order for the transaction for an off-the-shelf sale of datasets. https://www.asx.com.au/asxpdf/20220624/pdf/45b702gy1rjsfj.pdf

· October 2021 Terrestrial Software A$250K brought a data licence to Aerometrex’s very high resolution 3D model of San Francisco. https://www.asx.com.au/asxpdf/20211006/pdf/451bry2nr5050f.pdf

· March 2021 Queensland Government spatial Imagery program awards 4 major projects include South East Queensland, Galilee Basin East, North Queensland, Scenic Rim Towns. https://www.asx.com.au/asxpdf/20210322/pdf/44tw94tzcsvx10.pdf

· October 2020 Suncorp and PSMA contribute $1.01m annualised recurring revenue (ARR) https://www.asx.com.au/asxpdf/20201008/pdf/44nh72z61n0f04.pdf

· March 2020 Queensland Government aerial imagery contracts – has won 5 projects of the Queensland Government Spatial Imagery Subscription Program, managed by the department of Natural Resources, Mines and Energy, totally $1.0 million + GST https://www.asx.com.au/asxpdf/20200313/pdf/44g0dwx4p1b1r5.pdf

Inside Ownership

Market cap $49.2m at $0.52 *Current closing price today is $0.69

Inside Ownership Ordinary Shares % AMX Issued Net Value at $0.52

Mark Lindh (Chair) 373,958 0.39% $194.5K

Peter Foster (Director) 50,000 0.05% $26K

Matthew White (Director) 12,177,927 12.87% $6.33m

CEO Steve Masters 178,572 0.19% $92.9K

COO David Bryne 8,583,850 9.07% $4.46m

CFO Chris Mahar 97,051 0.10% $50K

Total Current Management 21,461,358 22.69% $11.16m

Ex CEO

Mark Deuter 11,400,865 12.05% $5.93m

Ex Chief Pilot

Scott Tomlinson 7,300,000 7.72% $3.8m

Ex Chief People Officer

Beata Serafin 6,000,000 6.34% $3.12m

Total 46,162,223 48.80% $24m

On Market Management Buying

Steven Masters

28 Sep 2022 178,572 shares at $0.42 ($75,000.24)

Mark Lindh

28 Sep 2022 47,620 shares at $0.42 ($20,000.40)

Aerometrics has announced their largest LiDAR contract to date.

They have been awarded a significant contract of work with an Australian Federal Government Agency.

The value of the contract is $1.88M and comprises a number of areas of interest.

The market seems to like it with a strong bounce in the share price.

https://www.asx.com.au/asxpdf/20230113/pdf/45km94ss9c9zwz.pdf

Following @Wini’s review of the AGM and pointing out the potential for the 3D datasets AMX announced sale of selected USA high-resolution 3D models to a leading consumer technology company. However despite being the single largest sale the revenue was deemed immaterial. These off the shelf datasets can be sold many times so hopefully this leads to further revenue down the track.

Represents the single largest sale to date from Aerometrex’s USA off-the-shelf 3D model catalogue.

Aerometrex’s 3D models in Australasia and the USA are being used widely in industries as diverse as urban planning, civil engineering, computer gaming, asset management, mining and coastal erosion. The 3D content can be consumed and displayed in web browser applications, geospatial software, virtual reality systems and gaming engines. Aerometrex strongly believes that high-quality, high-resolution, accurate 3D data will become the dominant data type in mapping and planning activities in the short- to medium-term, and will play an increasing role in communication, visualisation and measurement.

AMX did $5.1m EBITDA in FY22, below my $6m forecast. However the larger development since then was NEA getting acquired on 7x ARR or 40x FY21 EBITDA (FY22 had some one-offs).

Admittedly NEA has much more scale and no project based revenue, but even 15x FY22 EBITDA would be roughly 80c. Given the focus on optimisation I suspect EBITDA will grow in FY23 but the market is waiting for execution on that front.

Seek notification just served this up. It seems Aerometrex is hiring more pilots.

AMX reminding us Metromap is still growing albeit a bit slower this quarter.

MetroMap annual recurring revenue (ARR) grew to $6.35 million at 31 March 2022, up 49% YoY (Q3 FY21: $4.26 million) and up 5.5% QoQ.

https://www.asx.com.au/asxpdf/20220422/pdf/45870s5fjlktlz.pdf

Not really sure why Aerometrex released an Investor Presentation today, maybe they just wanted to remind everyone that Nearmap weren't the only game in town.

https://www.asx.com.au/asxpdf/20220329/pdf/457g0fskc0c15n.pdf

I too, have held NEA since May 2014 and enjoyed todays announcement though they had already guided in December 2021 that Group ACV would come in between $150M and $160M.

While todays share price jump is welcome it is a far cry from the $4 plus I trimmed it at in June 2019 - if only they all worked out that well.

I think they both have their strengths and I'm hopeful AMX will give me some exposure to the Metaverse via their 3D offering.

I still hold a 1.5% holding in NEA along with a 1% position in AMX.

MetroMap and US Operations deliver strong revenue growth.

Aerometrex Limited (ASX: AMX) today announced its results for the half year ended 31 December 2021 (1H22) delivering strong revenue growth in its key service lines of MetroMap, LiDAR and its 3D operations in the US.

Commenting on the half year results, Aerometrex Acting CEO Mr David Byrne said:

“We are pleased with the continued growth of MetroMap reflected in the increase in statutory revenue which was up 80.4% on the same time last year to $2.72M and the growth in the annual recurring revenue which was up 81.4% year on year to $6.01M.

The strategy of focusing on the MetroMap subscription business sees this revenue stream now contribute 24.0% of the group revenue, up from 17.6% for the same period last year.

We are also extremely pleased with the contribution that the US operations have made in this half year with revenue contribution of $620k, up from zero in the prior corresponding period.

While the revenue to date is still relatively small, we have made significant strides in growing the awareness and potential of our world leading 3D business within the US.

The revenue was derived from a combination of project and off-the-shelf data sales including the delivery of the San Francisco data models to Google.

We ended the half with $12.27M in cash with undrawn debt facilities available to fund growth initiatives and momentum for the second half.”

AMX strategy to convert MetropMap to subscription based appears to be progressing well while their US 3D offering is showing potential.

Not held on SM but held in RL

https://www.asx.com.au/asxpdf/20220214/pdf/455y9cjj8xhrgh.pdf

I see two big risks to the AMX investment thesis. The first is a clear one; MetroMap is going head to head with a massive incumbent competitor in Nearmap who is much larger and well capitalised. There are some signs AMX is making headway and it may be in their favour that NEA is focusing so hard on US expansion which may allow MetroMap to poach unsatisfied clients.

The second risk is that AMX has committed to ending their project based revenue. This is not an insignificant amount and means AMX is about to go through the same challenges many software business who have pivoted to ARR have found. Short term financial performance gets messed up as reported revenue takes a hit.

Management have stated there is $3.2m to complete largely in 1H22:

That amount is roughly in line with previous half years so numbers in the coming report may not be impacted. For 2H22 and beyond, management are expecting $1-3m of that revenue to migrate to MetroMap:

If that number is at the lower end it leaves them with a big revenue hole to fill. At the higher end project work would largely be replaced with higher margin recurring revenue which would be a great outcome. Watching MetroMap ARR over the next couple of updates will be crucial as AMX may have to win their project based clients to MetroMap vs Nearmap.

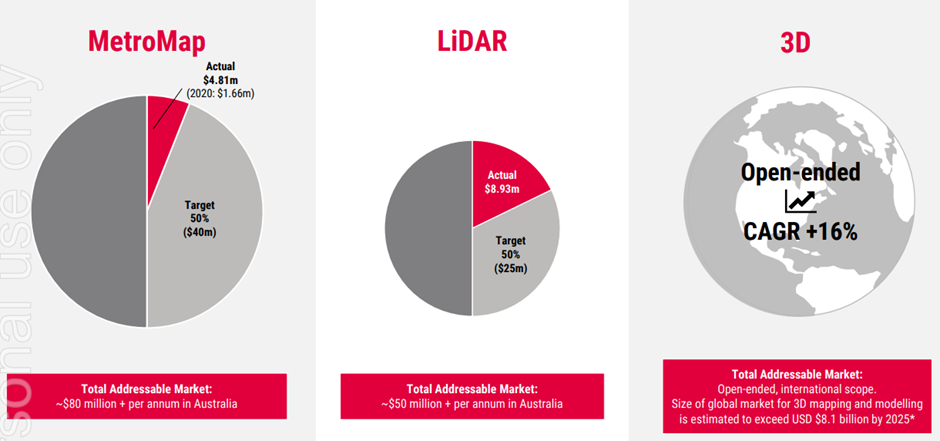

AMX breaks their operating business into three segments; MetroMap, LiDAR and 3D. MetroMap is a subscription service for AMX's database of 2D aerial imaging, LiDAR uses laser technology to scan for distance and density and 3D meshes images to create a digital model of a 3D space. AMX has hinted at bringing their LiDAR and 3D offerings into the MetroMap subscription but for now they are still project based. Management provides market share on each segment in their presentations:

With a 6% market share of the Australian subscription aerial imagery market, AMX has a long way to catch the incumbent Nearmap who has over 90% market share. That said, AMX management is confident they have a better offering than NEA and importantly competing strongly on value with a fixed subscription amount compared to NEA who charges based on usage. See my Industry/competitors straw for my take on AMX competing with NEA.

AMX are more established in LiDAR with 18% market share and have invested further in space with a fourth laser sensor and upgrading the remaining three.

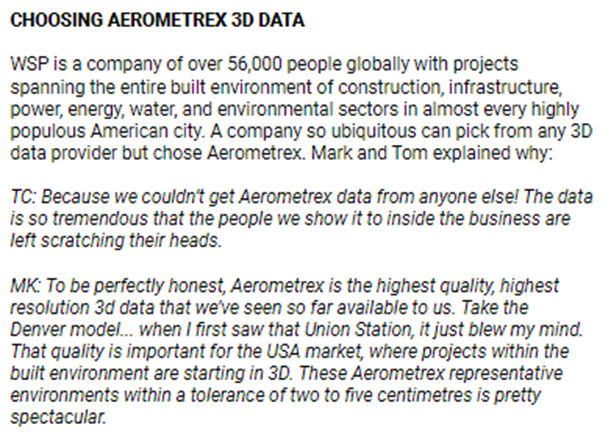

Despite being conservative with MetroMap and LiDAR TAM's, management have an "open-ended" TAM for 3D largely because the space is growing so quickly. Like other technologies, as the quality of the product improves it is opening up further use cases that were previously not possible. It represents the blue sky in the AMX investment thesis and helping it is the fact AMX has leading edge tech in the space. Engineering giant WSP was an early client of AMX's 3D data and have continually scaled up as AMX capture more cities and improve their offerings:

Beyond "traditional" use cases in surveying and mapping, AMX is also selling their 3D datasets to metaverse customers who are looking to mirror the real world in a digital setting. They sold their San Francisco model to the Lunaverse project for $250k and have partnered with the Omniscape project to map various US cities to eventually be used in their metaverse. Importantly, AMX is project agnostic, they continue to own the 3D dataset and licence it to whichever metaverse projects would like to use it.

With the pivot from project based revenue to the MetroMap subscription model, AMX has put themselves squarely across the ring from the 800 pound gorilla in the industry Nearmap. The initial growth was strong, but it was always difficult to tell how much was eating into NEA's market share and how much was a transfer of AMX's own project revenue to the subscription model. The latest update in October showed a slowdown in the September quarter which management attributed to some deferred renewals of subscriptions that management expect to be taken up in the December quarter:

I will be keen to see the growth of MetroMap in the upcoming half year results to see if AMX was able to re-accelerate growth from a slow September quarter.

Trying to look ahead, Macquarie recently downgraded NEA primarily due to increased competition from AMX and website traffic does show MetroMap having a very strong January. While we will need to wait for results to get a clearer picture, I do rate Macquarie's channel check research, they were well ahead of other brokers in downgraded Appen after speaking with customers.

AMX was founded in 1980, but it's current iteration began in 2011 when there was a management buyout of the business and ownership was split among key staff and directors. The chart below from the prospectus shows KMP ownership prior to the IPO and the 50%+ ownership that remains today:

Prior to the IPO AMX was a profitable business but a combination of increased investment and Covid meant the business swung to modest operating losses since listing:

Virtual-property prices are going through the roof

Investors are paying hard currency for software real estate

Jan 1st 2022

“RIDICULOUS AND cool.” That is the architectural brief for a new office tower under construction in the Crypto Valley, a business district of Decentraland, a virtual platform built on the Ethereum blockchain. The edifice—owned by Tokens.com, a blockchain investor—will be a cross between a nightclub in Ibiza and the Bellagio resort in Las Vegas. In a fantasy world unencumbered by something as pedestrian as physics, a rotating company logo will float above the tower as nearby clouds shoot out company-branded thunderbolts. The tower’s purpose—to provide office leases for firms and event space for crypto conferences—is humdrum by comparison.

Gamers have traded pixelated property and other digital assets for years. Now the activity has been turbocharged by the growth of unique digital artefacts known as non-fungible tokens (NFTs), and by the hype around the metaverse—a emerging virtual market which could, depending on whom you ask, ultimately generate revenues of between $1trn and $30trn.

Real money is changing hands. Some sales involve replicas of the physical world. Users of Legacy, an NFT-powered recreation of London, have spent $54m on plots of land in the game (which is still in development with no launch date). SuperWorld, a virtual planet where people can buy digital versions of any place on Earth, says the average user spends some $3,000 on property purchases. The Taj Mahal and the Eiffel Tower are selling for the cryptocurrency equivalent of around $200,000 and $400,000, respectively. Their current owners paid under $400 each.

Wholly invented worlds are also drawing investors. In November Republic Realm, a company that manages and develops digital real estate, paid $4.3m for land in a platform called the Sandbox, the biggest virtual-property investment to date. That same month Tokens.com spent $2.4m for a plot in Decentraland’s Fashion Street district. Nightclubs and casinos where users can win virtual money line the streets of the gambling district. In its art district Sotheby’s, a real-world auction house, has opened a virtual gallery. Smaller parcels that fetched around $20 apiece when Decentraland launched in 2017 can now sell for as much as $100,000. Somnium Space, a competing platform, reported more than $1.8m of land sales by its users over a 30-day period in November. In other virtual worlds, concert halls stream performances by the digital avatars of pop stars such as Justin Bieber and Ariana Grande. Empty virtual shops could soon be leased by fashion houses such as Gucci, Dolce & Gabbana, Burberry and Balenciaga, all of which have sold branded items in one metaverse or other.

Will the digital-property boom last? As in the physical world, profits depend on footfall and people’s willingness to spend real money. For that to happen at scale the user experience must improve. Popular metaverse platforms such as Decentraland and the Sandbox are clunky. The average user may not want to shell out on the graphics cards, virtual-reality headsets and superfast broadband that gamers use to make cyberspace feel more real.

The second risk is volatility. Virtual-property sales typically involve the exchange of the cryptocurrency unique to a given metaverse. Decentraland has MANA;Sandbox uses digital tokens known as SAND. The price of these can swing wildly, even relative to established crypto monies such as bitcoin or ether, themselves hardly a predictable asset class. They could crash to zero if a particular metaverse bombs.

To lower the risk, early investors such as Republic Realm are diversifying their holdings. The firm says it owns land in 23 metaverse platforms. But unlike physical land, the value of which is in part a function of its scarcity, each virtual realm is in effect limitless. So, in principle, is their number. Hundreds of wannabe metaverses already exist and more will emerge as crypto technology improves. That points to a paradox. Soaring virtual-property prices are predicated on the metaverse taking off. But a booming metaverse means less scarcity and lower prices. The laws of physics may prove easier to work around than the law of supply and demand.

------------------------------------------------

From the Economist.

I have slowly been catching up on the meetings and presentations and was intrigued by the Metaverse deal.

Interesting space to be in, but clearly there are lots of others doing this already.

MD, Mark Deuter talks all things Aerometrics (ASX:AMX) in this short AusBiz video yesterday.

26-Nov-2020: Taylor Collison: Aerometrex Limited (AMX): Initiating Coverage - Outperform

Analyst: CAMPBELL RAWSON, [email protected] +61 415 146 725 www.taylorcollison.com.au

- Recommendation: Outperform

- Market Capitalisation: $112m

- Share price: $1.19

- 52 week low: $0.70

- 52 week high: $2.60

Our View

AMX operates in an industry where having leading technology is crucial to success. In all operating areas, AMX is the leader or equal leader in aerial image capture and processing with regards to technological capability. Limited access to capital has meant this capability has to date, not led to the corresponding leadership in market share and revenue. Following an IPO 12-months ago, AMX has invested heavily in more technology, people and marketing with the effects only now beginning to flow through the P&L. FY21 will likely see minimal EBITDA growth due to continued investment however we forecast 76% growth for FY22 as recent initiatives take hold and believe FY22 will be a sustainable earnings baseline. Trading on 10.8x our FY22E EV/EBITDA forecast we expect to see multiple expansion as earnings traction increases through 2H21 and the market begins to price in FY22. Furthermore, we expect AMX to take market share in the subscription-revenue space from Nearmap which trades on an 47x FY22E EV/EBITDA multiple. We believe AMX’s 77% discount to Nearmap is too steep given the growth outlook and the industry leading nature of AMX’s assets.

Long-Term Attractions

- AMX has industry leading capture and processing technology across all divisions. The design of its own cameras and processing tools now allows AMX to maintain significant IP and produce higher quality imagery than competitors. This is highlighted in 3D where no competitor globally is producing imagery to the same detail (2cm resolution).

- AMX has a first mover advantage in 3D modelling having begun 3D operations in 2012 and only in recent years has it become more widely utilised in many industries. This provides a significant competitive advantage with most competitors years behind in development. AMX has recently begun operations in the USA where we estimate the market to be worth ~$500m.

- AMX has a difficult to replicate personnel base with most operational staff being experts in their field. Specialised operators are attracted to AMX based on the technological leadership prevalent in the business model. This has led to significant levels of expertise and we expect this experience to keep AMX at the forefront of industry innovation.

- The Australian aerial photography and LiDAR market is worth $150m (excluding 3D). AMX has a realistic opportunity to capture 50% of this through increased awareness of its services, driven by leading technology.

We see the following as the biggest risks to AMX’s future earnings

- AMX is currently in a heavy investment phase with a focus on building out its MetroMap image base and growing 3D revenue in the USA. Despite superior technology and early signs of traction, there remains execution risk in the USA. Additionally, $5-$6m p.a. will be spent on image capture to build out the MetroMap platform and once again, despite strong growth rates to date, there is a risk subscription-based revenue may not grow to cover this cost as the near-monopoly incumbent, Nearmap (NEA), could alter pricing or strategy.

- Whilst employee expertise is one of the biggest assets, it also provides keyman risk. We note this is particularly evident in 3D where the capture of images is fundamental to produce high quality models. Few in the market have this expertise. Many employees are subject to confidentiality agreements and all are well incentivised by salary and share options with 80% currently owning AMX shares.

--- click on the link at the top to view the entire TC report on AMX ---