Last week ArchTIS announced its annual results, an acquisition and a capital raising!

The team has been busy, FY25 results were not great but they weren’t bad either. A drop in revenue from lumpy Services revenue was offset by AR9 demonstrating good cost control and prudent balance sheet management.

The acquisition of Spirion and capital raise is of more interest and not just because their logo  is so much better than AR9’s

is so much better than AR9’s  .

.

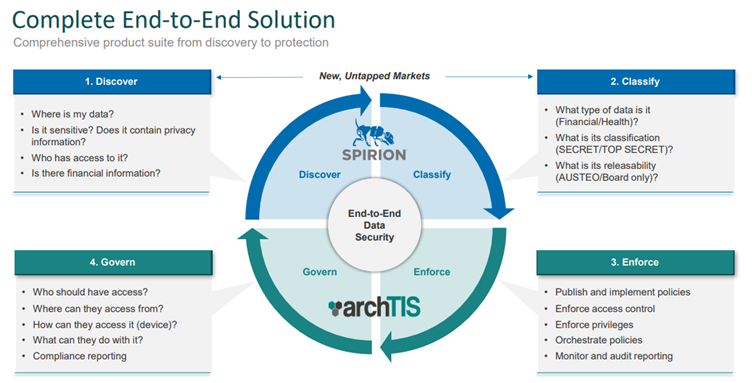

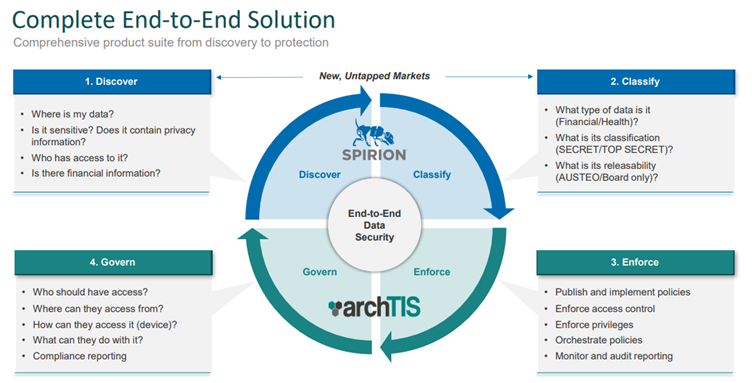

I’ve been an AR9 shareholder for 5+ years now and every time there is a major cyber breach I think to myself... why doesn’t (say) Qantas buy AR9’s Attribute Based Access Control technology? Actually, why doesn’t anyone buy it but the DoD? The answer being AR9’s tech requires some heavy lifting to implement. An organization needs to know where all its sensitive data is before they can decide what Attributes a user should have to access it.

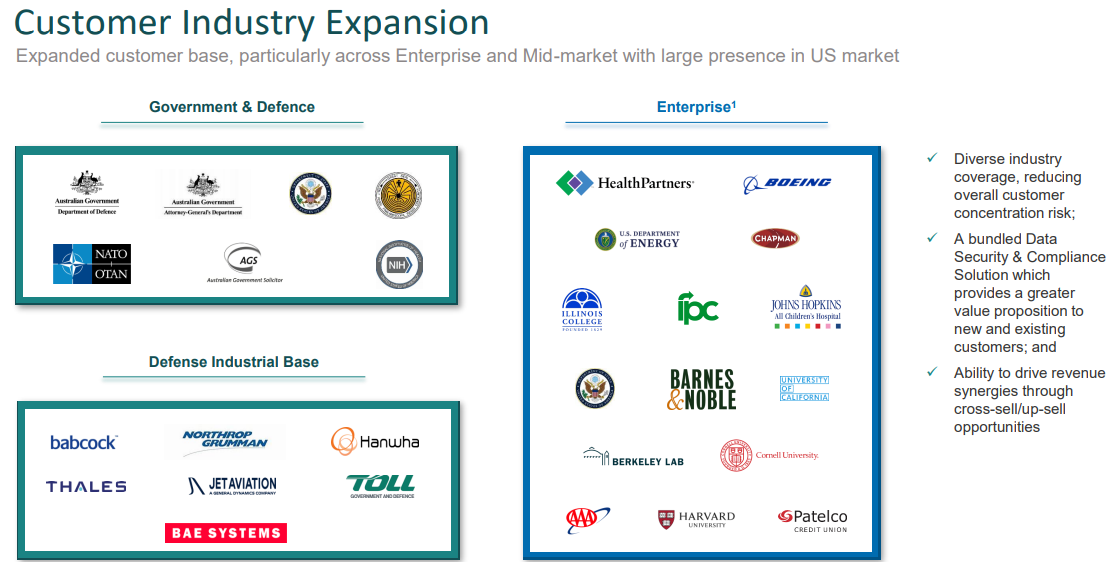

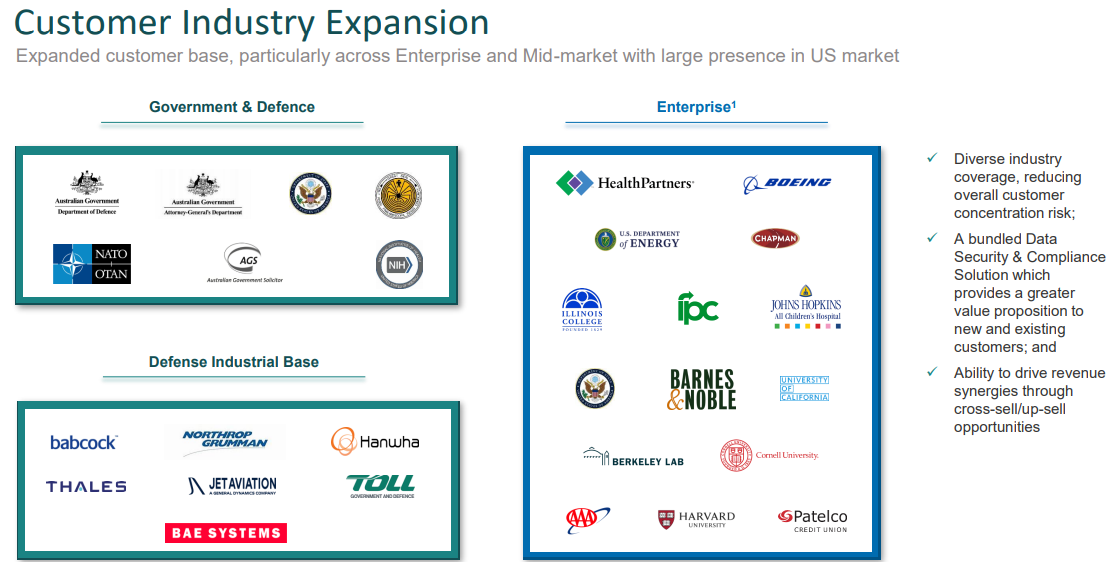

I assume the Defense industry buys it because they have a heightened understanding of the capabilities required to protect the secret squirrel stuff. EVERYTHING is Defense is sensitive; it all needs to be protected and only 007 can read it when his iPhone has the correct GPS coordinates… The downside trying to sell into Defense is that procurement is wrapped in massive bureaucracy, so uptake has been very VERY slow.

Spirion on the hand does the Data Discovery piece (hence the sniffer dog). Its software helps mostly industrial customers, locate sensitive data within the myriad of technology platforms companies use. I’d be willing to bet, within your organization, some junior accountant has a copy of spreadsheet that was extracted from the main operating system with all customers’ names, contact numbers and revenue generated. It was no doubt extracted for good reason, like doing some analytics the operating system isn’t capable of, but now that spreadsheet is sitting on a shared drive and multiple copies are sitting in various people’s inboxes. Spirion helps companies find their sensitive information, so they can then protect it.

This acquisition is about combining those capabilities, so that the ArchTIS and his new blue dog can offer the end to end process to both sets of customers.

However, all acquisitions come with risk, this is an asset sale, i.e. AR9 are about to try move physical assets, Customers, Suppliers and Employee contracts over to AR9. All of those things require willing 3rd party participants.

The headline read AR9’s are buying Spirion’s ~$45m investment in its technology stack for ~$16m, hmmm that sounds too good to be true, because it is. The delta lies in the pro-forma combination balance sheet where we are also taking on negative ($14m) cash on hand (The bank account is in overdraft I presume) and a $7m deferred revenue liability, i.e. the customer has paid, but Spirion/AR9 haven’t yet delivered.

Whilst the combination of adjacent Cyber capabilities sounds wonderful, Revenue Synergies are much harder to achieve than Cost Synergies. Bringing these two organizations together will require skillful execution and a bit of luck.

This could be the greatest thing since sliced bread, enabling AR9 to sell this combined tech into a much wider spectrum of customers OR… AR9 have just been convinced to catch a falling knife…. time will tell!

Tomorrow the cap raise offer opens and is priced at 15 cents per share, I will participate!

Cheers

JM

is so much better than AR9’s

is so much better than AR9’s  .

.