Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Hi guys.

See my thoughts here on my site:

https://forum.rareearthexchanges.com/threads/aru-quarterly-30-june-2025.1178/

Note - I have also asked the ARU team a bunch of question that will be answered in the meeting at 10:30am AEST.

https://wcsecure.weblink.com.au/pdf/ARU/02926853.pdf

My thoughts:

- This will be the first of the off take announcments to come in the next few weeks. They seem to be starting small and will build up?

- The terms are very very good for ARU. We have the Option to sell to Traxys. This shows the demand for ex-china NdPr.

- Also the CP for 31 Dec 2028 lets us know that construciton will be complete by then, and that means the FID will be beofre June 2025.

I'm super pumped for this. This is my largest holding ever. It has been a difficult hold. But as they say in mining, Finance It And They Will Come. Do they say that?

I can see the SP moving up with every annoucment now. There has been movement up in the last week. So we have a leaky ship. With so many particpants in this deal...always likely to be some leakage.

TIme to jump on the ARU rare earth rocket ship!

That being said....i would imagine the SP will only go to about 30-40 cents in the short term.

But as said in previous posts....lots of other macro issues will push this higher int he medium term too:

- Tariffs

- China bans

- War

- new demand form robotics and chanigng asset use in military (i will do a post on this later...).

Ask any questions you want. I'm happy to answer these.

Feels like news is coming. Some green with the SP of late.....

To meet the CEO's stated time frames (FID by end of June 2025), we would be expecting the cornerstone equity to be announced in the next few weeks, along with the off take.

I think that should then see the SP move substainally up....

Geeze these mega finance deals take forever!!!! Come on!!

So i have been playing around with some numbers. Was trying to work out how much Hancock can put in and not breach the 19.9% level.

HP currently owns 10.01% of ARU representing about 240 million shares. Post raise, if she wants to increase this to 19.9% she would want to own about 1.2 billion shares (based on a 30 cent raise and total 6 billion of shares). So she needs to buy about 960 million shares. So at 30 cents per share that is $288 million. Obviously she may not want to put that much in….but that is the max (at this stage…keep an eye out for creep (3% every 6 months is allowed)). Also I did not look at her daughter. Didn’t she buy into Arafura? I have assumed that is part of the current 10.01%.

Then I saw this video:

https://www.youtube.com/watch?v=WiF7hpdHHNo

So in this video of DC with Proactive Investors, at the 4:04 mark….DC said that ‘cornerstone equity’ will make up 60% of the equity. Previously this has been 50%. So this is great news. He then went on to say it could be 50-60%. We obviously have some competition from the cornerstones to jump on board the ARU equity train. And that is why he was saying 50-60% for the cornerstone equity. Also...it could change because of the raise price and Gina/HP wanting to maintain their 19.9% stake.

So ARU are raising AUS $1.2 billion in equity. So 60% is $720 million.

So I think the equity stack looks something like this:

- Cornerstone 1 - Hancock Prospecting* - $288m (this could be less if raise is below 30 cents. See my calc below)

- Cornerstone 1 - Posco - $250m

- Cornerstone 2 - Australian Government - $200m (Announced)

- Institutional 3 - Australian Super - $100m

- Institutional 3 - FUND A - $100m

- Institutional 3 - FUND B - $100m

- Exisiting Shareholders 4 - Retail via SPP - $200m

And remember that the ARU CFO Peter S said that they have lots of parties for each of the slices of equity. This gives us (some) confidense in the likely raise price.

Things are slowly progressing.

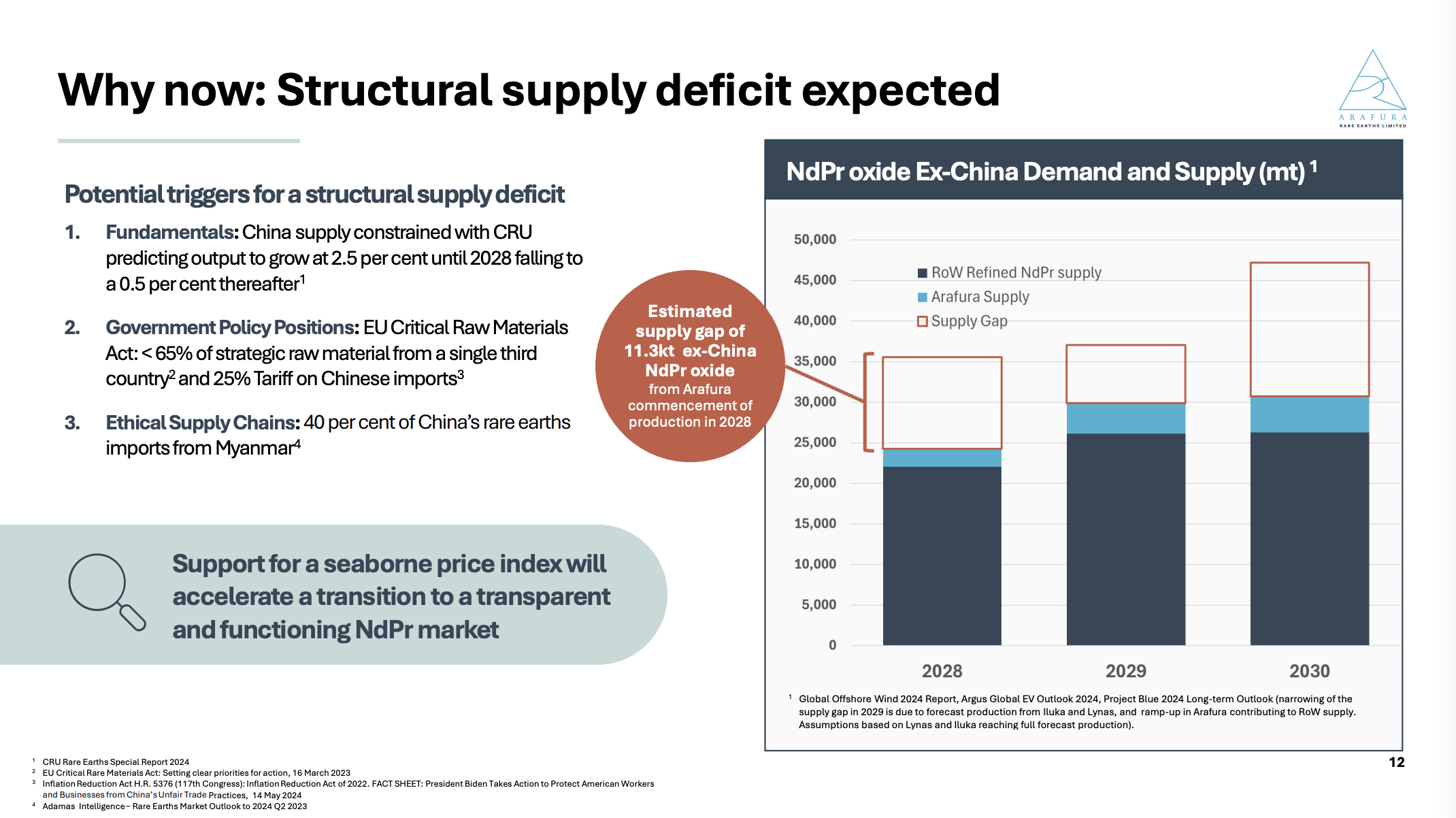

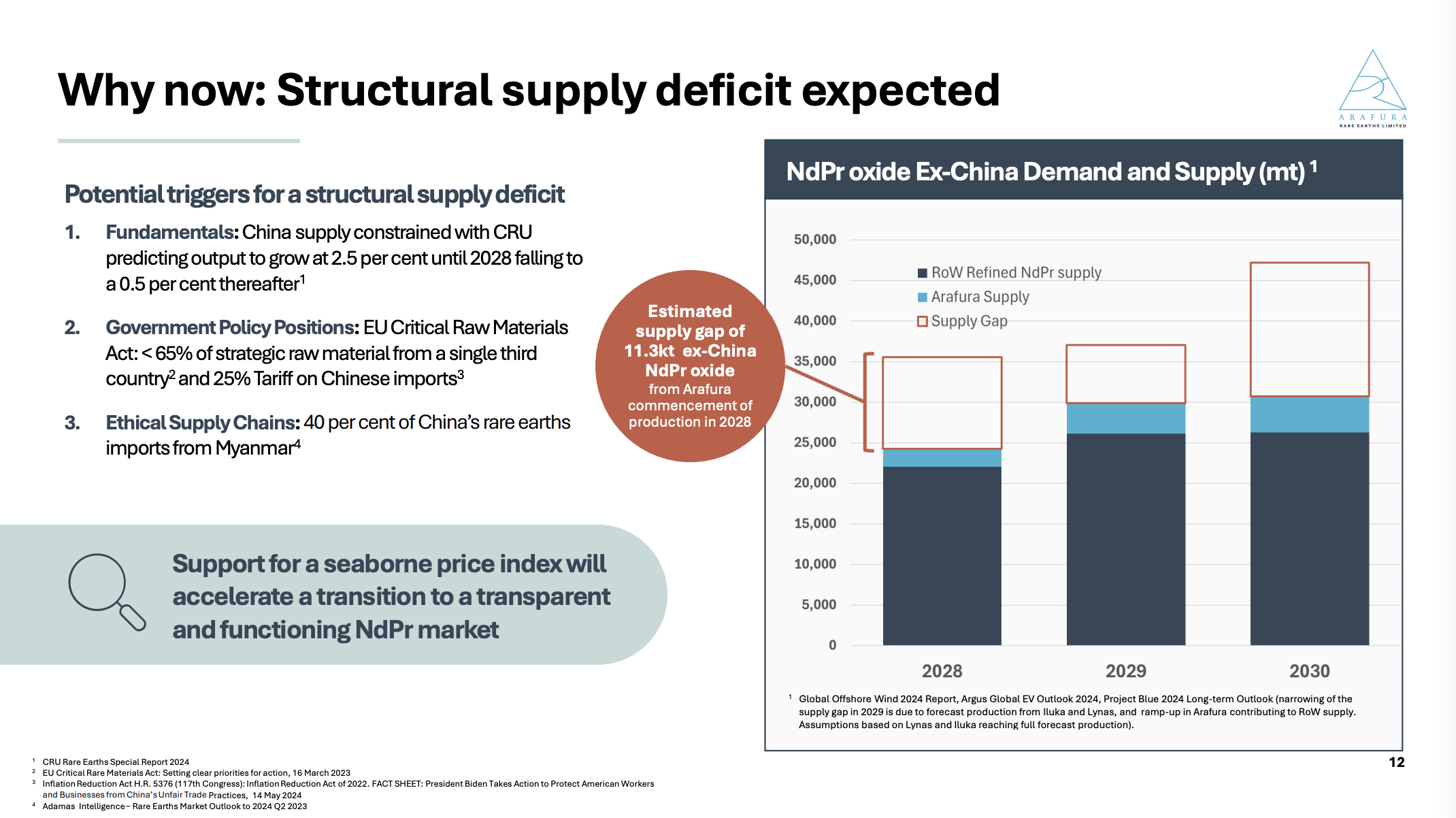

I would also note that from a macro perspective, things are always improving for us (being ex-china supply):

- Myanmar supplies about 30-40% of rare earth ore to china. And massive fighting from rebels has stopped a large chunk of this. Lots of issues. like chinese companies destroying the environment etc......but the main point is that supplies of ore into china are constrained.

- Australian government's Critical Minerals Production Tax Incentive (CMPTI) bill aims to encourage investment in processing and refining critical minerals. So this again makes ARU one of the cheapest producers of NdPr oxide globally.

- Tariffs going every which way. China applies restrictions on exports to USA (not yet NdPr...but it feels like it is coming). They have stopped all NdPr processing technology from being exported. Tarrifs on china from USA and Europe, will start to take effect in 2026

- have you noticed how much the words 'rare earths' are said. Every politican is talking about it. Trump wants everyone to give it to him...including Ukraine and Greenland.

- i could go on...but i need to do some other things. Have a look at my previous Supply Deficit work for more info.

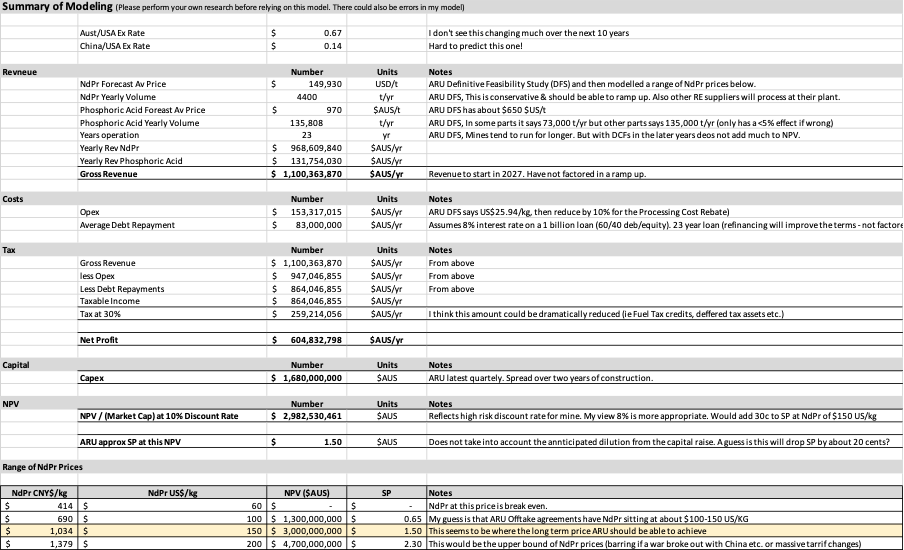

I have gone back and tested all the assumptions based on the last year or so of updates. Usual caveats….DYOR…I may have modelling errors…etc.

My key takeaway….ARU is not priced correctly at its current 13 cents. Maybe this is the market’s discount for not being fully funded yet and/or bit of market manipulation.

Here are the assumptions used in my model:

Here are the results of different NdPr prices and dilutions for Phase 1 (4,400) and Phase 2 (11,000).

Some points to make:

1 - Diluted to the Max - If ARU management had of raised when the SP was $0.70, exisiting shareholders would have been MASSIVELY in a better position than we are today. I think this borders on negligence because the board knew that ECE Nolans were going to sell on the market (creating downward momentum), short position was clearly going up, they knew the timelines of the finance etc. etc. It looks like we will be adding about 3-7 billion new shares to lock in the Final Equity Raise.

2 - Phase 2 is where it is at - It is clear we have a ‘gold plated’ project here. The cost is massive and we have contingency upon contingency. I understand that to reach finance on what the market perceives to be a risky project, they required all this gold plating and contingencies. But if management are up to the task, and can deliver Nolans and barely touch these contingencies, then combined with some of the first year ‘profits’ Phase 2 should be able to be built without raising more capital. If management can achieve that, I may forgive them for the failure in point 1 above. And this also does not factor in additional supply from other sources. So these SP’s are a lower bound.

3 - NdPr pricing is sensitive - Given everything that is going on with Trump and the rest of the world, NdPr pricing should go up, but by how much. My previous ex-china supply deficit modelling showed massive demand from 2026. This is a hard one to predict. But you want some skin in the ex-china NdPr game…..because the modelling shows the valuation is very sensitive to it.

4 - There is still value left!!! - From today's SP of 13 cents.....upon FID...my most likely scenario (in Yellow Box) will x2 your money. If you wait for Phase 2 (in Orange Box) (probably in around 2-3 years) will x7 your money. (obviously lots and lots of assumptions etc. etc.)

The analysis above is just looking at fair value using Net Present Valuation method. If the market was rational, it would be priced somewhere close to the above prices.

But there are some other tail winds that may cause SP to go up even more than the above:

- There will be a bunch of funds that were involved with the equity raise, that missed out, and would likely buy on the market (ie they have done the due diligence…and know what a great project it will be and happy to buy in a little above - or at least will provide a back stop if it drops).

- There will be lots of funds, institutions, family offices and retail that will not invest in a mine until it is fully funded.

- All the tariff talk is not only getting stronger, it is happening. This will be a wake up call to China and the west. None of this is factored into our SP.

- Once ARU achieve FID, watch all the other NdPr juniors out there contact ARU management to discuss processing. Expect lots of announcements around this.

- Also watch the phosphoric acid, and if we lock in much better terms due to ARU being pretty much the only unassigned ex China product!

Once FID is achieved, ARU will be the first NdPr mine (at scale) to begin construction since Lynas around 2010. That is 15 years ago. Back in 2010, NdPr demand was about 30,000 tpa. Today it is about 75,000 tpa and expected to double to about 150,000 tpa by 2035. ARU in phase one is only producing 4,400 tpa. Where is all the ex-china supply going to come from?

My notes from the Quarterly for period ending 31 Dec 2024.

Held via webcast on 30 January 2025.

Summary:

- Body language read that things are in control and being finalised

- Peter (CFO) looked like he had some sleep!

- Off takes have floor prices above current NdPr (which is up 25%)....there has been lots of talk that this will not happen. So amazing to hear this and great news and work by ARU.

- FID still on track for first half of 2025.

- Phase 2 to be funded out of savings from phase 1 (which should be massive)...and profits.

- Sulphuric Acid - if we partner with an off take that can take it from Merchant Grade to Battery Grade....lots more revenue. (also another industry that China dominates).

- This has taken much longer than I would have liked....but I can see light at the end of the tunnel (open pit).

CEO Intro

- ARU will be a great counter cyclical investment (ie production timed perfect for Supply deficit for ex-china NdPr)

- NRFC were confident in their investment with lots of DD. But took time because ARU had to match and not conflict with debt and shareholder interests.

- Supply - ARU the only ore to oxide to move into construction in the near term. Structural supply deficit coming.

- Off take - expect soon large off take linked to equity. 2-1 (ie double the demand for ARU supply).

- Costs - running better than forecast (with cash ok for runway).

- Read to rock (and roll) upon FID

- Market conditions - NdPr pricing hitting ‘firmness’….investors need to distinguish between short term and medium term pricing. China lost money by suppressing prices….doubling of demand over next decade, ex-china market being formed, tariffs…….ARGUS Media are modelling that NdPr needs to increase 2-3 times from what we have today.

Question - Ex-China NdPr Market? People talking about ex-china NdPr market being formed. Doubters always talk about Lynas low offtake rates and ARU/ILU with no off take locked in. Assume tier one players out there want to lock off take for all the geopolitical reasons. But won’t lock in until FID to maintain their relationships with China. Modelling shows a supply deficit. Why has the market not responded accordingly?

Answer - CEO

- When negotiating with tier 1 they value security of supply (ie Av EV is $53k and NdPr is $55). They see this playing out in discussions (EV and Turbines) AND HAVE FLOORS IN THESE CONTRACTS ABOVE CURRENT NDPR PRICES. [Cop that! Wow. Best part of the discussion]

- In terms of market dynamics, they said there will be a structural deficit, so supply security will be first and foremost in companies minds. Last time this happened, the market went up to $200+ for NdPr. So likely to see spikes.

- As a sector there will be a move to create an ex-china price index…they are talking to a forecaster willing to establish this index…ARU need to put volumes….ARU can do this by using the 20% of Phase 1 remaining. [I assume other ex-china will put on there as well and create this market]

Question - ARU Phase 2 - Will Phase 2 be funded from savings from Phase 1….and profits in the early years. No need to return to the market? Ie no more capital raises to fund Phase 2?

Answer - CEO

- Intention to fund phase 2 out of phase 1

- Don’t foresee raising further equity

- learn from phase 1 to make phase 2 capex/opex cheaper.

- Phase 2 will become a processing hub….bring in from other projects external to ARU….will unlock Australian rare earth sector providing an avenue for processing away from china.

Question - No change in off take negotiations in last 18 months

Answer - CEO

- Hyundai/Kia. Locked in. [They must of renegotiated the CP dates?] So this is good news.

- ARU are using remaining off take volumes to bring in equity.

- Expect any future announcements to have off take and equity linked.

Questions - Trump policies etc.

Answer - CEO

- Support for EV in USA…only 12% global sales…..not worried about impact on ARU. If read executive orders….they refer to rare earth diversification and security. Will be good for sector…and very good for ARU….we are ore to oxide (processing ex-china)…..most others depend on china….Also ARU are construction ready…other rare earth mines have some time to go.

- Greenland….average time to find ore to production is 18 years……ARU positioned well. Most rare earth mines are only early stage…..so long time to go for them.

Question - timing on construction

Answer - CFO

- Still targeting FID end of the first half of 2025. These off take/cornerstone investors have their own processes and DD. ARU responsive…to help their processes. He did note that these off take/cornerstone investors have their own pressure to lock in supply…they see the supply deficit coming.

Question - EV slowdown in Europe?

Answer - CEO

- ARU not worried….look at medium term….when ARU will be producing. There will be blips along the way to EV growth.

- Compare EV to conventional. EV costs coming down. Charging infra filling out. Solid state batteries have fast charge and range. All points to increase in EV uptake. Demand doubling over next decade. Other companies say more.

Question - Will ARU consider a move downstream further from oxide (ie to metal)

Answer - CEO

- ARU already doing 95% of the value chain to a metal (ie ore to oxide)

- ARU don’t see the return is worth it. And Ex-china strategy means we don’t need to.

Question - Sulphuric Acid

Answer - CEO

- Not currently under binding off take

- Confirmed it will be better than merchant grade acid (MGA)

- Confirmed the ARU economic model sold at MGA prices

- ARU will look for customers of the MGA who can take it to battery grade….maybe.

- BUT MGA is very good anyway.

Question - Equity - Are we speaking to multiple cornerstone or are we at preferred stage?

Answer - CFO

- Still talking to multipole players…and have redundancies.

- Well above 50% for cornerstone equity…..

- The Debt and off take has focused on Korean businesses…..and likely to be similar for equity side as well.

Question - Are GE still in the game

Answer - CFO

- Hyundai are a key off take party….they might do equity…..ARU and Hyundai have an MOU around equity…not yet binding….ARU still see them as a target.

- It has been hard for some of these off take parties to invest in ARU because they don’t tend to invest at mine level…so they have to skill up etc.

- GE have maintained engagement with off take. However, GE turbine division had a restructure. This hasn’t helped…..so a maybe….but have redundancy in place anyway.

Question - Shorting

Answer - CEO

- Monitoring. But it is difficult to know who is shorting ARU.

- Equity raises in the past….ARU gave a bias towards investors with a long term mandate.

- If look at the current shorting levels….quite low compared to others in the sectors.

- Best thing they can do is focus on FID…and construction.

Question - Gas Contract

Answer - CEO

- I missed part of this, but I think the 4th Feb was just a date extension to allow ARU/Gas suppliers to agree a CP extension date.

- Announcement on that new date very soon.

- However, Gas supply in NT is improving with time….means better longer term options…means cheaper.

- Risk around gas is reducing.

Question - Could new tech affect design of processing plant

Answer - CEO

- ARU have a Dr….who looks at new Tech

- Separation has some new tech…but rest of the processing doesn’t have any new tech.

- If new tech….would look at for phase 2. Needs to be proven.

Question - Update on Gina

Answer - CEO

- Hancock….they have been supportive. They are constantly updated and supportive of ARU funding strategy.

https://www.mining.com/web/arafura-rare-earths-gets-124-million-in-funding-from-australia/

Announcement to come today from Govt and on the ASX.

So ARU have convinced the Australian Govt through the Australian National Reconstruction Fund to invest AUS $200m as a convertbile note.

So the equity book build would look something like this:

- $200m ANRF

- $200m Hancock (Corner Stone)

- $200m POsCO (Hyundai maybe in the mix) (Cornerstone)

- $200m 2-4 Funds (Guessing one is Australian Super)

- $200m Retail (Underwritten by XXXX)

Australian Govt. seems to be willing to do anything in this sector to get it moving. Look at the recent investment in ILU and other smaller investments.

I was recently a buyer in my super for more of ARU at 11 cents.

I expect the SP to move up today. But we have been heavily manipulated for months. So it should be interesting. I don't expect any short squeeze. They made their exit at the last Cap Raise (helped by our Chairman Mark S.....this guy is useless and I believe has links with some of our equity arrangers...likely Canncord).

The recent gas supply contract extentions were made to 4 Feb 2025. This is a strange date (given the annoucements were made in Decemeber 2024). This is what got me investing more last time they extended....so that date could be nothing.

But If I was the arranger...i would be getting Aust Govt to commit first....then cornerstone shortly after.....then a club of Funds....then annoucment of the SPP for retail. This could be all done in the next 2-3 months. More likely 6 months. But at each step the SP should increase (assuming no manipulation).

FYI - I have been heavily targeted by Chinese paid operatives/AI bots on hotcopper. They have even managed to get some others banned for a month or two for exposing them. HC does nothing (they like the traffic it brings). But it is clear what their agenda is. And just makes ARU even more likely to go ahead. The Aust Govt knows this....and will make it go ahead....and at almost any cost.

As Kim Beazely (former Labor leader) said....Aust is better to fund a few Rare Earth Mines...then buy/build a few frigates for the Navy. This is the best way to maintain our security for Aust and our allies.

Who is this from?

So the above statement was released by the Governments of the Republic of Korea (ROK) and Australia, Canada, Estonia, Finland, France, Germany, India, Italy, Japan, Norway, Sweden, the United Kingdom, the United States of America, and the European Commission following the conclusion of the Minerals Security Partnership Forum’s Principals’ Meeting in Brussels.

What did they say?

focused on advancing and accelerating MSP projects on rare earth elements, as well as identifying new responsible mining, processing, and recycling projects for critical minerals in MSP Forum member jurisdictions.

ARU explicity mentioned......

At the ROK-led MSP Project Deep Dive meeting, participants discussed the challenges to developing specific MSP projects, including HyProMag’s rare earth elements recycling project in the UK, Germany and the US, and the newly added Arafura Rare Earths’ Nolans Project in Australia, and identified means to advance these projects. Additionally, the Korea Institute of Geoscience and Mineral Resources (KIGAM) provided a briefing on its REEs recycling technology and ongoing projects.

My thoughts:

- Something has not been adding up for me with the final capital raise for the US700m.

- It is taking forever.

- I have always questioned management why the USA has never been in any of their public statements. And they have always just brushed it aside.

- Now this comes out on the 12 Dec 2024...and it is not even announced by ARU? Why? Privately I got told that ASX said it was not material. But that doesn't mean ARU can't announce it?

- In ARU's private words to me (which they said they could publically tell me and why I am writing it here - go figure???), they said it could open other funding opportunities.

My hope is they have got some massive cash grant from the USA Dept of Defence.......

Standing back from it all. I still can't believe ARU has fallen to 11 cents. This project is going ahead. Too many Governments and their credit export agencies, and large teir 1 businesses have already committed. But i can't see any FID annoucment until mid Feb when all the parties boards/credit committees are back from holidays etc.

I'm probably going to load up another 20% of my holding in Late Janurary 2025.

Also note - that on H0tCopper, myself and some others have been targeted by a couple of downrampers. It has been pretty full on. They were using some type of AI to automatically generate negative responses and attack us...but when we f u cked with their algo....by inserting garbage text....they went quiet....for a few days...then have sprung back....with what feels like a real person now.

China has been using anything they can to get the west out of rare earths. Just look at all the games they are playing with Northern Minerals (ASX: NTU). Even after Treasury forced them to divest...they just create a new entity in Hong Kong....and almost were able to appoint a director onto th board. The Aust Govt just needs to step up.

There are 6 Resolutions to vote on in the upcoming ARU AGM.

Note the closing date for votes is 15 Oct 2024. The AGM will be held on the 17 Oct 2024.

Summary of my vote:

- Voting NO to Resolutions 1, 4, 5 and 6

- Voting YES to Resolutions 2 and 3

Resolution 1 – Remuneration Report To consider and, if thought fit, to pass the following as an ordinary resolution: “That for the purposes of section 250R(2) of the Corporations Act and for all other purposes, the Remuneration Report for the year ended 30 June 2024 be adopted.” Note: The vote on this Resolution is advisory only and does not bind the Directors or the Company.

My thoughts:

- Voting NO on this resolution.

- I'm pretty angry how the CEO's remuneration was put together and how it goes against the interestes of current shareholders.

- Put simply, Daryyl was put in charge around July 2023 (this is in the annual report), so his remuneration should be from that point...when our SP was about 34 cents. Instead, he gets his shares at 20 cents.

- They have mismanaged the budget. Having two cap raises at these low prices has destroyed shareholder value. And put us in a weak position for the final cap raise. ie if we had of raised about $200 million when our SP was about 30-40 cents...would have halved the current diluition.

- The Chair only took up $20k of his entitled $30k in the last cap raise. Considering this cap raise was his doing...and he allowed one of the institutions to get out of their short position is bascially illegal. We have raised it with ARU and ASIC....and got no response. https://wcsecure.weblink.com.au/pdf/ARU/02851557.pdf

- I have lots more points....but these are pretty damning. So i will stop here.

Resolution 2 – Election of Mr Michael Spreadborough as Director To consider and, if thought fit, to pass the following resolution as an ordinary resolution: “That Mr Michael Spreadborough, who was appointed by the Directors as an additional director during the year (and who holds office only until the conclusion of the Annual General Meeting in accordance with rule 7.1(c) of the Company’s Constitution), be elected as a Director of the Company with effect from the close of the Meeting.”

My thoughts:

- Voting YES on this resolution. (I was leaning to No...but will give him a chance)

- I did some digging (which is what you gotta do on mining stocks)...and he worked with our CEO on the BHP Olympic Dam project. So I am guessing he is aligned with our CEO.

- He does have some skin in the game with about $600k....so i do like this.

- He was on the remuneration committee AFTER the CEO's remuneration was agreed. Given all the letters that have been flying around on this topic, I given his $600k invested into ARU... he will be aligned with shareholders.

- I was going to vote No on this...but I think it is worth giving him a chance. And i think he strength will be during construction.

Resolution 3 – Election of Dr Roger Higgins as Director To consider and, if thought fit, to pass the following resolution as an ordinary resolution: “That Dr Roger Higgins, who was appointed by the Directors as an additional director during the year (and who holds office only until the conclusion of the Annual General Meeting in accordance with rule 7.1(c) of the Company’s Constitution), be elected as a Director of the Company with effect from the close of the Meeting.”

My thoughts:

- Voting YES

- But he didn't participate in the latest Cap Raise that destroyed so much shareholder value. So i'm pretty pissed about this.

- However, on 1 August 2024 bought $500k at 17 cents. https://wcsecure.weblink.com.au/pdf/ARU/02834709.pdf

- Has deep experience in mines around the world. Pretty sure he was suggested by Gina's team.

- Giving him the benefit of the doubt.....voting Yes.

Resolution 4 – Election of Mr Ian Murray as Director To consider and, if thought fit, to pass the following resolution as an ordinary resolution: “That Mr Ian Murray, who was appointed by the Directors as an additional director during the year (and who holds office only until the conclusion of the Annual General Meeting in accordance with rule 7.1(c) of the Company’s Constitution), be elected as a Director of the Company with effect from the close of the Meeting.”

My thoughts:

- Voting NO

- Finally they have a finance person on the board.

- He wasn't allowed to participate in the latest Cap Raise....but hope he starts to buy on the market soon.

- He is on board of BlackRock mining which has links to POSCO.

- Think he was put in by Gina's team (given POSCO links).

- BUT.....he has lots of experience with South African mines...and the quasi govt fund...Industrial Development Corporation of South Africa (who just lent BlackRock money). These guys give loans....then gather intel.....then end up taking over....to the detriment of shareholders. This is something I will be keeping a close eye on. I'm voting NO because I think they could have got an ex Lynas ot MP material director instead.

Resolution 5 – Appointment of Auditor To consider and, if thought fit, to pass the following resolution as an ordinary resolution: “That, for the purposes of section 327B(1)(b) of the Corporations Act and for all other purposes, BDO Audit Pty Ltd, having been nominated by a Shareholder and having given its consent in writing to act in the capacity of auditor of the Company, be appointed as auditor of the Company with immediate effect.”

My thoughts:

- Voting NO

- For no real reason....rather I just want to send a message to the board.

Resolution 6 – Ratification of previous issue of securities under December 2023 Placement To consider and, if thought fit, to pass the following resolution as an ordinary resolution: “That, for the purposes of Listing Rule 7.4 and for all other purposes, Shareholders approve and ratify the issue of 156,250,000 Placement Shares and 78,125,000 free-attaching Placement Options to various sophisticated and institutional investors under the December 2023 Placement for the purposes and on the terms set out in the Explanatory Memorandum.”

My thoughts:

- Voting NO

- ARU gave Options in the Dec 2023 cap raise to the institutions and not to retail. This was a slap in the face to all retail holders.

- One of the institutions in the Dec 2023 Cap Raise was shorting ARU and exitied part of their short position from this cap raise.

- This happened again in the latest cap raise in 2024. Unbelievable. Shows that the Chairman of ARU is asleep at the wheel...or is helping his mates.

- If we vote no to this....these options are not valid.

I hope that helps some people here.

Conclusion:

- I still believe that ARU will be a great medium/long term investment.

- But management and directors have destoryed the short term value of ARU for existing shareholders.

https://wcsecure.weblink.com.au/pdf/ARU/02842975.pdf

Just an MoU with Canadian company that has experience in extracting heavy rare earths...but interesting because Dysprosium (Dy) and Terbium (Tb) are some of the most sought after rare earths. Lets call them the rarest of rare earths? Haha.

Still lots of work to do in this space for ARU...so I would not factor this into my valuations, but if they can crack it, ARU could also be a heavy rare earth processor/supplier. I know LYC is working on this as well. But the ex China heavy rare earth supply is almost non-existant....so this would be very very valuable.

As always....these things take time...but this could be great for ARU.

https://wcsecure.weblink.com.au/pdf/ARU/02841373.pdf

Nothing really to note here.

But the Chairman and MD's reports at the start provides a great snap shot of why ARU will be a valuable company in the next few years. Def worth a read.

BTW - If I just happen to have found a mistake by the Auditor...what should I do? They have said they have audited the remuneration under Section 300A of the Corporations Act 2001. But they have not properly disclosed how the CEO's remuneration aligns with the company's financial outcomes.

For background the CEO was provided a dollar amount of options, which would be locked in at the SP at FID. So this means there is no incentive for him to maintain or increase the SP until after FID!!! How is that aligned to the current shareholders?

I'm back! Had alot of things on my plate (good things). And now I have a bit of free time again.

Alot has been going on with ARU.

First thing is the cap raise....very disappointing....and it has pushed the SP down to 16 cents. I imagine it will stay there until Sept when the raise is complete.

Second thing is the Final Cap Raise. The US $793 million. I met with the CEO a week ago and had provided questions beforehand. The meeting was a bit of complaints session from some retail holders which the CEO and CFO tried to deal with in a constructive manner. I had to jump in and talk about the future and what the Offer Price will be for the Final Cap Raise.

I told them that if they raise at 20 cents....that will erode all shareholder value in the short term. The CFO acknowledged this and said "the cornerstone equity investors can see past the current share prices". So that gave me some comfort that the raise will at least be above 20 cents. (i had originally thought the raise would be at about 40 cents...i'll explain why below).

I also asked if they had explored cash injetions from the Federal Australian Govt or the USA Dept of Defence? They didn't fill me with confidence. Kim Beezley has been saying that for global defence, the best way for the Govt to spend tax payer dollars...is to spend it on Rare Earths in Aust to help our global partners....rather than Aust. buying a new war ship etc. Here is the link:

He said $3-4 billion should be given to the Australian rare earth sector. He also said that China subsidies its rare earths and weaponises it by selling it below cost.

So....Right now....if they are to raise at 20 cents...this means a dilution of 74%.

The following tables model the likely diluted SP for different NdPr prices.

First tabe is for the current design of the processing plant for 4,400 t/pa.

Second table if for the proposed processing plant with the additonal NdPr of 11,000 t/pa.

Ok....so as you can see....if they raise at 20 cents....the SP should stay at 20 cents. However, some points to note:

- I think they will raise at around 25-35 cents. So that should see the SP move up a bit to about 30 cents (diluted).

- I think there will be a bunch of funds that miss out on the raise and will buy on market. They will have done all the due diligence...and can see it is a great long term investment.

- I think there will be some other funds, that have not been in the Final Cap Raise process, that will want to buy in and have not been able to because FID was not yet achieved. ie the rules of their fund prevents them investing in unfinanced miners (junior miners).

- We could then be near the $2 billion mark...and entry into the ASX200...which means some more ETF momentum.

- I also just think lots of people have thought for a very long time, a rare earth miner in Australia, will never get going...so with FID that may give them confidence.

But I'm not real happy with the way this is likely to turn out in the short term.

My short term play for ARU will only just break even for me or a small profit upon FID. I have been trying to work out where it has gone wrong. The amount of equity and debt to be raised is WAY more than the capex. The cost to build is about US $1 billion.....and we will be raising about US 1.5 billion. That extra US $500 million is for cost overruns!!! So when I did my modelling....it was always on a much smaller project cost and thus a smaller debt/equity amount of finance. And thus a much smaller dilution...and thus a better dilluted SP for us.

I spoke to the CEO about this....and his reply was interesting. First he said they had learnt from Lynas, and wanted a large buffer so they don't have to go back to the market and it was something the debt providers wanted. I did say that they have had 20 years to get the design right for the processing plant and hundreds of millions spent refining the design and pilot plants. So maybe this is over kill? He then replied and said, the money not used in these contingencies (US $500 million) and the cash flows from Phase 1....will then be spent on Phase 2 which will take ARU from 4,400 to 11,000 tonnes per annum! And his message to the market is, don't wait for a 'Phase 2 Cap Raise'....

So what does this all mean?

- Short term (and when FID is annoucned...likely Oct/Nov 2024), ARU fair value SP (diluted) is about 30 cents. Currently it is 16 cents. So if you invest now...should be able to double your money. The only risk is if it gets delayed by things like global down turn etc. Don't forget the Aust Federal Government has put in over $700 million in debt and guarentees. So they will make sure this goes ahead. I also think some FOMO from retail and funds will push it up a bit more.

- Long term (2-4 years) ARU will hopefully say, "hey...phase 2 is going ahead...and we have lots of room in our contingency for Phase 1 to build Phase 2". So bascially you can x3 the revenue for no additional capital. Once the market hears or thinks this....the SP is IMHO should be valued at about 83 cents (diluted).

- And this is what makes ARU intersting...the ex-Cina NdPr price is likley to go up substaintially AND there are lots of other Australian Rare Earth players already talking to ARU to process their Rare Earths. This magnifies the value of ARU and in time the SP.

Conclusion:

- Short term the likely dilution has screwed my modelled short term (ie upon FID) investment returns. Although I will be at about breakeven or small return.

- Long term, the current SP does not factor in the likely Phase 2 revenues for (almost) no additonal capex. Which should see a large SP increase up to about $1.55 (or a ten bagger from current SP of 16 cents).

- So my strategy from here is to HOLD and monitor the capex spend after FID. Phase 2 report should be completed about 6 months after FID which will have the estimted capex required. I have had a look at the modelled Phase 1 cash flows and the contingencies...and it is likley to be achievable.

https://wcsecure.weblink.com.au/pdf/ARU/02832044.pdf

https://wcsecure.weblink.com.au/pdf/ARU/02832131.pdf

https://wcsecure.weblink.com.au/pdf/ARU/02832189.pdf

https://wcsecure.weblink.com.au/pdf/ARU/02832278.pdf

Just the Gas Supply contracts being updated and pushed out to reflect the likely timelines (ie construction to begin in 2025...operational in 2028 etc.)

Interesting how much of the NT supply is being used by ARU.

FYI - I am meeting with CEO on Wed. Should be an interesting meeting.

I have been doing alot of calculations...and my short term hopes have been dashed...but ARU remains a great medium/long term investment. I'll write more after Wednesday.

https://wcsecure.weblink.com.au/pdf/ARU/02830993.pdf

Sorry for the slow turnaround. Been swearing my head off. And trying to get answers from the CEO.

So this is NOT the big $800m cap raise.

This is the working cap raise for $27-30m at $0.16. SPP capped at $30k. $20m already raised by instiutions/funds. $7-10m from retail and the SPP.

So apparently....this is to give ARU runway 'past the final equity raise so that investors are not worried about ARU's funding when in negoitations'. So in other words....this gives us leveridge. But my question is....at what cost! Fark me. I'm so angry. Why do a SPP. Can't Aunty Gina just put in the full $30m? Or one of her mates? Why let the shorters get any of this.

So i am trying to get this all clear in my head. So i'm just going to write down a bunch of points:

- Debt - They announced all the dept was conditonally approved yesterday. With any debt, you need a date you will start to draw down funds. If we have to delay that date, ARU would have to pay a holding cost. So ARU would have known this SPP was being dropped today...and timelines for the final equity. So i presume the debt draw down date has factored this in (guessing around mid 2026). The conditions of the debt would be Off take agreements (with certain paramters like price, quantity and timing) and equity being secured. These would all be conditons precedent. So that means that nothing material in the debt documents gets changed. Otherwise they all have to get reapproved by their credit committees.

- Off Take - The off take agreements have not been finalised. The CEO said yesterday that ARU was going to set a precedent. Maybe with all the US/Euro/UK tarrifs now in place, this has given ARU leveridge to get better terms? The longer this process takes...the more the world is waking up to the NdPr supply deficit for ex-china supply. So i'm not really worried about this part of the deal.

- Final Equity Raise - This is what is confusing me. We need $800 million.

- $150 million - Aunty Gina will take her full about so she is just under 20%

- $100 million - Posco - these guys want to be world leaders in ex-china magnets and have control of the the whole supply chain. Small investment for them.

- $100 million - Aussie super (or some other super fund).

- $200 million - Some energy transition funds (say $100m each)

- $150 million - Couple of other billionare friends of Aunty Gina

- $100 million - retail?

- So who in the above would be holding out? I don't have any real insights here....

- I was thinking about the presentation that ARU gave yesterday. They kept talking about Phase 2 with 150% more NdPr likely for modest capital outlay. Maybe this is positioning by one of the big players like Posco....so secure this.

- To put together a Cap Raise like the one today...would take a few weeks at a minimium. More likley 2 months. Especially when fully underwritten. So why announce the Debt yesterday?

Conclusion:

- Nothing has changed with the rare earth thesis. World is only just waking up to the ex-china supply deficit (btw - ARU modelling of the supply deficit is ball park with my modelling. Their modelling is natually a little more conservative)

- There is obviously some game being played by an equity participant. This is ARU perhaps saying, "hey....we won't be bullied around....we will raise more money and drag this out if need be...we want the right equity player involved".

- WIll i particpate in the SPP....i'll see how the SP plays out. Maybe the shorters will push lower.

- you know what is even rarer than rare earths.....a fully financed rare earth mine. Like trying to mine for hens teeth. But once we have it (FID)....wow. Life will be good.

Thats it for now. Time to open a cheap bottle of wine.......

PS....as for my 'perfect timing for my trade yesterday'.....ha! totally jinxed myself.

So i'm hoping for no Retail SPP and they have locked all the equity from the instiutions/Gina/off take partners......

Glad i loaded up at 3:59pm yesterday! ha. Have i for once done the perfect trade?

Anyone who is interested...here is some background reading on ARU and the Rare Earth Market

https://www.arultd.com/products/our-products/

https://www.arultd.com/products/supply-and-demand/

https://www.arultd.com/investor/factsheets/

https://www.arultd.com/investor/presentations/

https://wcsecure.weblink.com.au/pdf/ARU/02597137.pdf

https://www.iea.org/reports/global-ev-outlook-2024/trends-in-electric-cars

https://www.iea.org/reports/global-critical-minerals-outlook-2024

https://peakrareearths.com/rare-earths/

https://sourcemagnets.com/control-cost-of-neodymium-magnets-for-product-development/

https://www.publish.csiro.au/ex/pdf/aseg2018abt4_3e

https://www.aspi.org.au/report/reclaiming-leadership-australia-and-global-critical-minerals-race

https://www.energy.gov/sites/default/files/2023-05/2023-critical-materials-assessment.pdf

https://physicsworld.com/a/powering-the-green-economy-the-quest-for-magnets-without-rare-earths/

https://www.customsmobile.com/rulings/docview?doc_id=NY%20N309996&highlight=8501.33%2A

https://www.mining.com/can-beaten-up-junior-miners-fight-illegal-short-selling/

Quarterly:

https://wcsecure.weblink.com.au/pdf/ARU/02830474.pdf

Debt and Phase 2:

https://wcsecure.weblink.com.au/pdf/ARU/02830241.pdf

Presentation:

https://wcsecure.weblink.com.au/pdf/ARU/02830242.pdf

Great news:

- Debt now all secured.

- Phase 2 could have about 150% more NdPr! For a modest capital outlay. Study being done post FID to determine best path forward. This is def not factored into the SP!

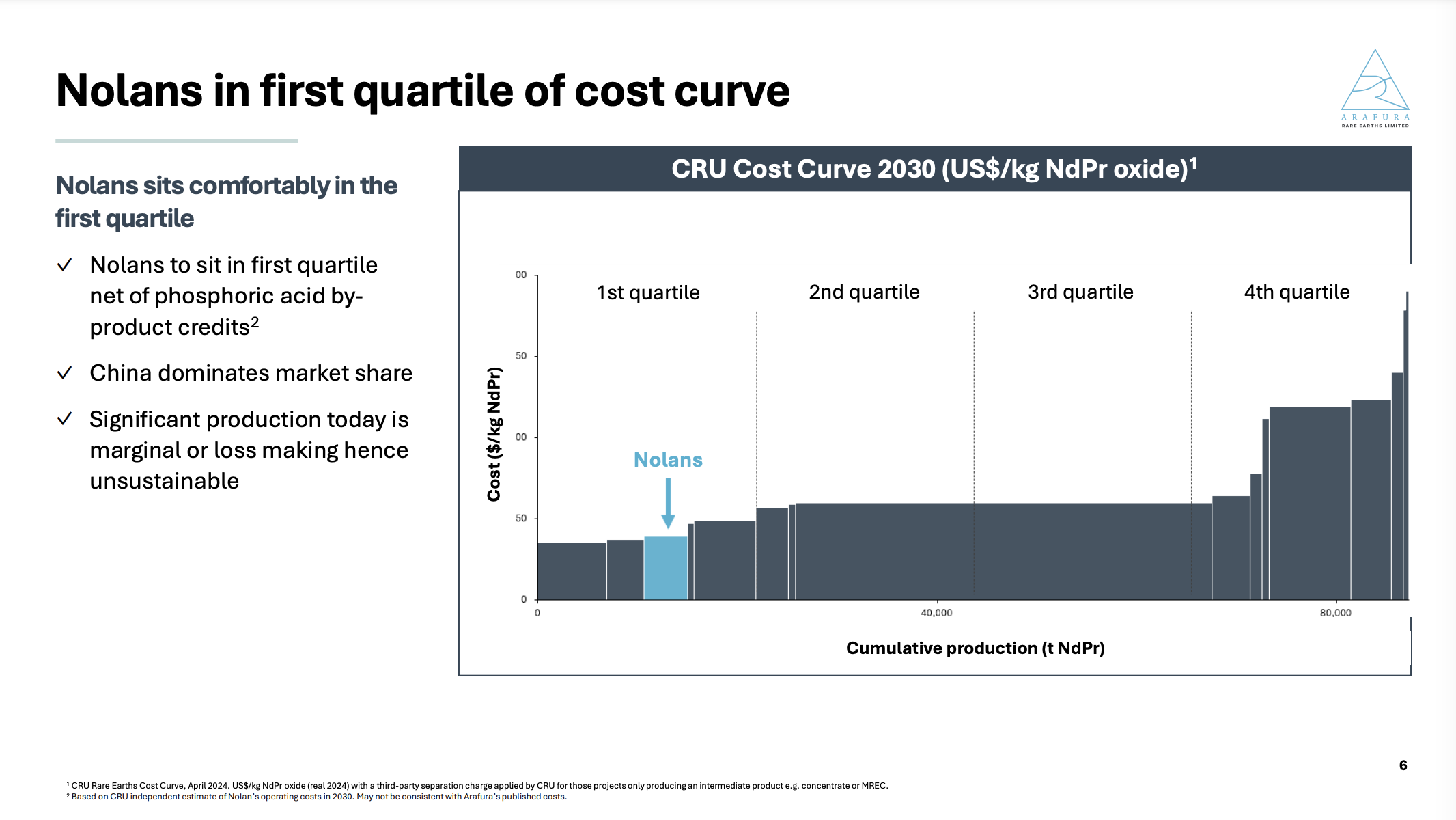

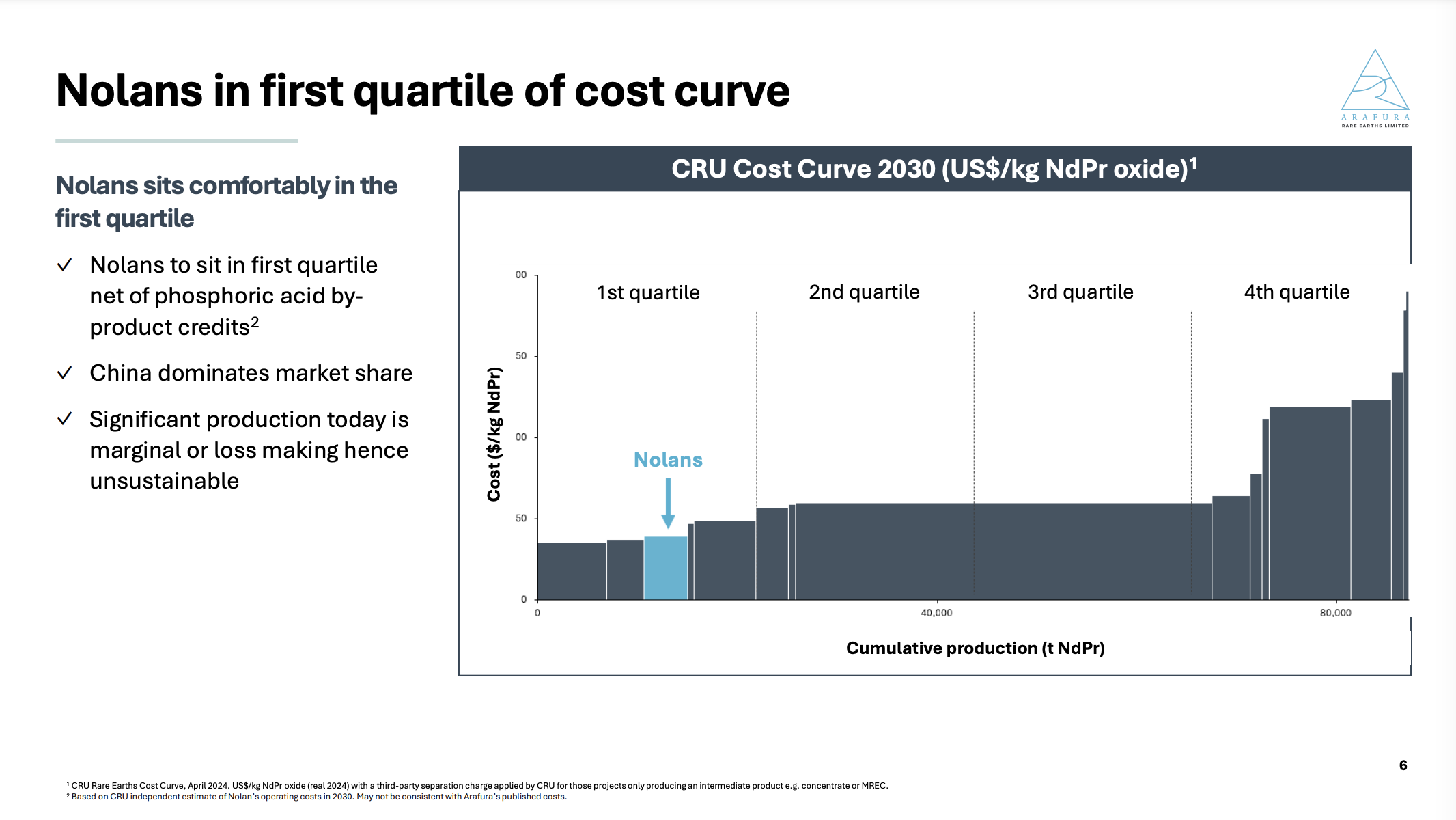

- Thier modelling is a touch less than mine regarding forecasting the impact of Tariffs. They have to be conservative....but this is an amazing graphic. Almost monolopistic.....our 20% of NdPr that we will be selling at spot prices....$$$. Also note the "Support for a seabourne price index......." China controls what prices we see.....the establishment of an ex-China NdPr Market....will show what the real cost is. The is again a decoupling of the market.

- This next slide is amazing...ARU one of the lowest cost producers. Even at these low prices....still profitable. I'm guessing that big one in the centre is most of China NdPr Production...

I listened to the webcast::

- First takeaway...super exeprienced team. World class. And paid in lots of options....so they are incentivised.

- Capital Raise.....will there be retail SPP....i'm still confused if they will give us a crack. I still think no. Even just the timelines to do a SPP takes about 6-8 weeks. I think they want to get cracking on the construction earlier.

- The rest just really went through the presentations etc.

- But there were some words from the CEO that really stuck in my mind...i can't remember the exact words (waiting for the video to replay)...but there were something like.....ARU will set a precedent in this market....

Anyway...i can't buy any more on Strawman...but I am buying in Real Life (RL). Time to load up! Back that truck up.....

Also there is this video from ARU CEO:

https://www.youtube.com/watch?v=28AC5oaHih8

https://wcsecure.weblink.com.au/pdf/ARU/02824445.pdf

ARU just announced another part of the debt pacakge. This was just the debt guarentee for the commercial loans. But another piece of the puzzle. So the last bit of debt to be locked in is the commercial package (ECA Covered Traches US$175m).

So what do we have to come:

- Commercial debt package US$175m (I expect this early next week)

- Off take agreements (this is unusual...because normally they would announce these before the debt and equity...but debt was apparently so comfortable...they have let ARU keep negotiating better deals). (i expect this late next week)

- Equity package. (i expect this between 15-19 July)

Looking at the trading patterns....someone is still layering the buy and sell to keep the SP where it is. But I have noticed the short position has started to drop (we only have week old data).

Hoping soon...ARU will boom.

https://www.politico.eu/article/precious-rare-earth-metals-belong-to-the-state-china-declares/

So a few months ago China stopped the export of all Rare Earth technology etc.

And yesterday it upped the ante.....and mandated a bunch of regulations that gives the state total control.

There was a large illegal chinese rare earth industry. About 15% of global supply (from memory). But they have forced these to become legit...or turn them away.

China has been controlling the rare earth prices....but this gives them even more control.

So why would they want to do this now (some random thoughts)?

- They obviously have some type of plan...these decisions do not just happen overnight.

- This is a good way to stop the illegal side of the industry...and also makes it hard for these illegal operators to export as well. So this is likely to reduce global supply (i'm guessing by less than 5%). These illegal operators also probably are the worst polluters.....so maybe they are trying to clean up the industry? Too many deaths and environmental damage?

- Are they preparing to restrict or ban rare earths exports? They might want to do this in retailiation for the EV tarrifs for their products in USA and Euro.

- Could they be preparing for war and the corresponding sanctions? I read a news article for a former CIA analyst that China has learnt from Russia's invasion of Ukraine....and stockpiling lots of things it will need (Semi conductors, minerals etc.). They might also restrict exports of rare earths to make it hard for USA to build its defense forces.

If we take a step back.....there is a clear directions here.......China sees Rare Earths as something it controls...and can use politically....and the west has woken up....governments are throwing money at it now.....but these projects take 10-15 years to come online (chemestry, approvals etc etc.).....and ARU are just 3-4 years away from production.....

Anyway....just some thoughts....what do others think?

Another Debt Annoucement

https://wcsecure.weblink.com.au/pdf/ARU/02823024.pdf

Another great accouncement. Almost all the debt secured. The Export-Import Bank of Korea (KEXIM) were always going to be the cork in the bottle. They came in late. So this is great news. I also know that the ARU team have been finalising the equity part in parallel with the Debt and Off take.

Also see the announcement last week that ARU director bought on market.

https://wcsecure.weblink.com.au/pdf/ARU/02819071.pdf

And other clue we are less than a month away from FID:

https://wcsecure.weblink.com.au/pdf/CTP/02817851.pdf

These guys are supplying gas to ARU onsite. This agreement was signed ages ago....but as part of that deal, ARU had to begin onsite by 30 June 2024. This annoucement gives a 1 month extension (so 31 July 2024) for ARU to begin onsite. So CTP would not extend for one month unless they were given assurances by ARU........

Summary:

- Almost all the debt is secured

- director buying on market

- key gas supply contract extension to 31 July 2024

- given all the above....FID likely this month!!!

So i pulled together this analysis.

Method:

- Align the Share Price movement, Short movement and NdPr Price movement along the same time series.

- Annotate the ASX anoucements.

- And have a good hard look.

Summary:

- To me this shows that the SP does not reflect the true value of the company.

Additonally:

- ARU was able to agree a one month extension to their gas supply contract. This was a CP to the gas contract (ie they had to start supplying by 1 July 2024). Why would they only pick a one month extension? Maybe becasue they are ready for FID?

- A few new people on LinkedIn have 'rejoined' ARU. ARU were constraining costs until FID. So with them coming back onboard now....FID is close?

- On HC one of the guys said they are starting back at Nolans next week. Again hard to know foresure....???

- These are all taken with a grain of salt.....but it adds to the overall picture.

Have a listen to this:

https://www.abc.net.au/listen/programs/am/china-s-control-of-critical-minerals/103990098

Nothing new but this article just shows the critical mineral/rare earth investment theme(s) are now mainstream.

So I have been working on a model to see what the new US EV Tariffs and proposed Euro Tarriffs might do for NdPr demand.

And wow.

I'll put these slides here....and tmrw will put up my modelling approach. But I have got my exPwC friends to review. And they were amazed by the effects...and couldn't find any issues in my model.

https://wcsecure.weblink.com.au/pdf/ARU/02810642.pdf

Export Development Canada has provided US $300 million. Which brings the secured Debt to 68%.

Great news...and once again....selling walls put up to hold the SP in place by manipulators.

Some of my thoughts:

- This is the first of many more annoucements to come to pump up the SP for a capital raise.

- I expect these other annoucements to include the final debt package from the Korean Export Credit Agency (or whatever they are called). I know from the CEO that these guys were late to the party and have been coming up to speed. So they will be the last part of the debt package.

- Then in the background the off take agreements have been in negotiation...with ARU having the upper hand and improving the terms. But these will then drop into an annoucement.

- Then the Cap Raise. As I have mentioned in other posts, I don't think retail will be included because the ASIC rules state the Offer Price has to be at a discount to the av monthly SP. And this will be too low. Whereas for instiutions they can have the offer price at any price.

- Over the weekend, a group of us ARU shareholders went over everything. Including many news paper articles, asking the authors who their sources were, speeches from US delegations in Australia, the White House policy annoucements etc etc.....And we think that there could be an annoucement 'soon' about Nolans Phase 2....and a US bueiness related to US Defence....taking a large % of Phase 2 and potentially finacning it. There is a bit of specuialtion in this......but there are too many public comments made in speeches etc. And US Govt is worried about China stopping/reducing export of NdPr.

So i'm probably going to add to my holding. I can't do this on Strawman because of the % rules.

Even if retail do get to partake in a cap raise...it will be at higher prices than now.

It has been a while since I have tried to value ARU. I have rebuilt my NPV model for ARU given the new information to date.

Notes on my model:

- I have used information from the Definitive Feasibility Study (DFS) (7 February 2019) and updated for recent events.

- My model tries to broadly look at the cash flows for 23 years (mine life). It is quite a ‘coarse’ approach but the results are broadly in line with the results of the DFS which would have generated its results from a much more detailed model.

- I’m not a tax specialist, so I have tried to be conservative with the tax assumptions.

- I’m unsure how much Phosphoric Acid is to be sold (ie revenue) and how much is retained to offset the opex costs. This is not clear in the DFS. But even if I am wrong, it is only a small amount in the total revenue <5%.

- I have used a discount rate of 10%. I think this is quite conservative (especially given the Govt backing). But I have kept it at 10% which was also used in the DFS.

- For those of you running your own model, be very careful with currencies and units. Lots of data is provided in Chinese, USA and Aust. And different units like Kg, Tonnes etc.

- It does not factor in the dilution that will happen in the final equity raise.

Key points to note:

⁃ NdPr Pricing - The NdPr price obviously is key to the profitability of ARU and its corresponding Share Price. So to invest in ARU you need to take a view of the future of NdPr pricing. So I note the following on NdPr pricing:

o ARU will have lowest opex cost to produce NdPr. So it will have higher margins but also importantly, if the China tensions disappear (unlikely) it can ride out the troughs of NdPr pricing. Also, there is only so long China can sell NdPr at a loss. Or if they do, it will make western countries nervous. They are backing themselves into a corner with this price suppression strategy.

o ARU has locked in NdPr Pricing in its offtake agreements that are well above current spot market pricing. This means ARU will be profitable in the short term.

o NdPr demand is growing (even with the recent media saying it is not). And there are just no other NdPr projects coming online soon at scale. This will give monopoly type pricing power for ARU for its remaining 15% of supply. And if we can ramp up production, just adds to the profitability.

o The USA (and soon Euro) China tariffs will create large demand. These tariffs could be increased if Trump wins. This is a massive tailwind for NdPr pricing. I’m yet to estimate the impact of these policies. But I would expect it to be quite large. Again….this is NOT factored into my model’s assumptions.

⁃ Additional Revenue - ARU should be able to process other companies’ deposits (Minhub?). This is another revenue stream not factored into the model. We have asked ARU to clarify what it can do in this respect. Also, ARU have stated they will seek approval for Phase 2 for Nolans with much more NdPr below 200m. Either of these events will warrant a rerate of the SP.

⁃ Cost Overrun Risk - Much of the risk for a rare earth project is getting the processing plant working as designed. Lynas had massive issues in the early days. ARU has been on a 20-year journey. So there has been a lot of work done in this space. And the Cost Overrun Facilities provide a good-sized buffer should things not be quite right. So I think this risk has been managed quite well. But something to keep an eye on towards the end of construction and into the ramp up phase.

⁃ Processing Cost Rebate - The 10% government Processing Cost Rebate is great. But if it is removed by the Liberal Party, it will not have a massive impact on ARU.

The ARU Model:

Here is a screen shot of the inputs/outputs from my ARU model:

Conclusions:

- The modelled cashflows show a SP around $1.00-1.50 is realistic.

- NdPr pricing is likely to be strong given the current and prospective geopolitics and commitment of Governments to the energy transition.

- ARU has great potential for additional revenues (more NdPr onsite, additional processing of others, acquisitions).

- Senior management’s incentives aligned with shareholders.

- Strong environmental credentials.

Note - I will also post on Hotcopper.

I'm back from my honeymoon! So back to 'work'.

I thought it wouid be good to provide an update on ARU and what we know/have and what is coming up.

What we know/have as of 16 May 2024:

- Aust Govt committed about $840 million in debt and guarentees and cost overrun facilities.

- Aust Govt, from 2027, will provide a tax rebate of 10% of the cost of production. The Arafura’s definitive feasibility study has opex at US$25.94 which is one of the lowest in the world. And now take 10% off that! Winning!

- US Govt has place large tarriffs on Chinese EVs. This should help build the western world car makers (US, Euro, Japan, Korea etc). They will need to source their NdPr from ex China. Also Europe will apparently put similar tarriffs in place. So a massive tailwind for ARU.

- NdPr Price....has gone up a little bit lately. However, still quite low. And this is preventing other rare earth projects progressing. This is good for ARU. When we are in full production Mid way through 2027....it will take other rare earth projects at least another 5 years to become producers. And ARU could then start it's acquisition plans (according to CEO).

What is to come:

- There are more Aust Govt cash grants to come form "priority critical minerals projects". Not sure if ARU will get any. But worth keeping an eye on it.

- Debt package - According to CEO....some of the parties are not working to ARU timelines, but working with their 'internal stakeholder' timelines. From my experience, Govt agencies, like the Export Credit Agencies...work to their own monthly timelines for their credit committees. This is like herding cats. But progress is beign made and it sounds like it WILL happen.

- Off take agreements - These are largely locked away....and the extra time has allowed for better pricing/terms for ARU. I think Debt and Off take will be announced in quick sucession.

- Equity raise - Lots of work happening in this space. Gina is obvious. POSCO (South Korea) are building an ex china supply chain for its business. And ARU have been talking to them for a long time. And they have a history of investment in their suppliers.

I have a question for the Strawman team - Are there any ASX listing rules about setting the Capital Rasie Offer Price ABOVE the current or recent share price? This would be good because there is less dilution. Also for the quick....could snap up some shares below the Offer Price. My quick read on the ASIC website says that for retail Share Purchase Plan (SPP) the Offer Price must be at a discount to the current SP. BUT for Insitutional Placement.....I think it can be set at any price? Can anyone confirm?

Conclusion:

- ARU will def go ahead.

- SP is being held down by people playing games

- Any of the above news to come....will bounce it up.

- Cost over run facilities de risk the construction, commisioning and ramping up

- Always good to be invested in a Govt backed project.

- Take overs unlikely due to many of the funding documents precluding it.

- Tail winds keep improving for rare earths and ARU in particular

Gina has been on a Lynas (LYC) buying spree. She how has 5.85%.

https://www.afr.com/companies/mining/rinehart-snares-big-stake-in-lynas-rare-earths-20240416-p5fkd4

She now has the following Rare Earth holdings:

- 10% Arafura (ASX ARU)

- 5.82% Lynas (ASX LYC)

- 5.3% MP Material in USA (NYSE MP)

- 5.85% Brazilian Rare Earths (ASX BRE)

It is clear Gina sees the potential in the rare earth sector. She also has the political influence in western parts of the world.

I just wonder what her playbook/strategy is?

- Leave them all separate

- Pros: Govt thinks there is lots of competition.

- Cons: Lots of management costs.

- Merge them all

- Pros: Saving on management costs, can control pricing (almost a monopoly in western world extraction and processing)

- Cons: Lots of scrutiny from Governments if looks and operates like a monopoly.

- Merge some

- Pros: Could get monopoly type prices without the scrutiny from Govt.

- Cons: Not as cost effective.

I’m just freestyling here…but I think a partial merger between them is good to extract monopoly pricing benefits, without pissing off Govt’s around the world.

So which ones would merge? There has been lots of talk between MP and Lynas. That would probably make sense. Would be able to build monopoly on prices, but keep ARU seperate to give appearance of there being a ‘market’. And then she could build ARU through acquisitions. The CEO of ARU told me this is ARU’s longer term plan to grow ARU (and that their Nolans deposit is much bigger).

Now the key question……how do we invest? I’m not sure how to do this type of analysis? How do people work out how to invest for potential mergers?

A lot been going on with ARU:

1 - Two new non-exec directors appointed:

https://wcsecure.weblink.com.au/pdf/ARU/02791328.pdf

Both have lots of mining experience. As expected. I have not done the digging on them yet. But reading between the lines, these appointments are probably a CP to one of the soon to be announced equity participants.

2 - New exec appointments

https://wcsecure.weblink.com.au/pdf/ARU/02794074.pdf

Dr Stuart Macnaughton commenced as Chief Operating Officer, Shaan Beccarelli commenced as Head of Corporate Affairs and Investor Relations and Tanya Perry was promoted to Head of Sustainability and Environment.

From what I have been told, the COO Stuart is a great hire. He will be onsite with his family in Alice Springs. And he is very aligned with shareholders given his remuneration package. Apparently it is hard to attract talent and compete on salary, so ARU has offered lots of share options. This type of remuneration will be across alot of the staff. And options set up in a way so that the staff have to back themselves. This is great for us as shareholders. Dilution for these will not be massive.

The other takeaway from this annoucement, is that these hires would not be happening unless there is certainity they project is going ahead.

3 - Funding package

The previous annoucement of Aust Govt funding was amazing. And not well understood by the market and not refledted in the SP. I understand that the debt particpants are many. And this has added to the compeltity of getting all parties signed up. I have worked on these types of deals....and delays happen all the time. Sometimes because some spanish banker has gone on holidays...and they need his approval etc.

I have previously been advised that equity discussions have been underway for some time. But I understand that the equity side is getting 'close'. Usually equity would not be 'close' unless debt is locked away. Ie equity want to see the compete funding package before commiting. So this is great news and gives me great comfort that the project will proceed to construction. And having the Aust Govt cost over run facility de-risks the construction and commisioning of the project. Remember that Lynas had massive issues commisioning their project.

4 - NdPr pricing

This seems to be on the way up. But it is controlled by China. And as previously mentioned, the western world wants ex-china supply (for certainity and for better ESG outcomes). There is lots of talk about countiries banning cars/products that have china supplied raw materials with terrible social and environmental effects. This will just add to the tail winds for ARU.

5 - Gina and MP Materials

Gina owns 10% of ARU and now 5% of MP Materials (a USA rare earth company). She also reportably owns alot of shares of Lynas (but she must own less than 5% because it is not reported). Lots of talk about Lynas and MP doing a merger.

My takeaway point is that Gina is setting herself up to be a powerhouse in rare earths. And she knows that Govertnments around the world will provide backing/incentives to build ex-china supply. Again a massive tail wind for ARU.

6 - Summary

Nothing has changed for me in my assessment of ARU. It will go ahead. And I think once all the finance has been announced we will see the SP go up quite a bit.

These Money of Mine guys have always hated ARU. I'd love to know why. They probably have mates who are short on ARU or have vested interests in other Rare Earth players?

https://www.youtube.com/watch?v=B96mQp0sFQE

To rebuff some of what they have said:

- The constantly say ARU's Nolan's project is not in a good location. But i disagree. It is less than 1 hours drive from Alice Springs. This means they can attract good young families to live and work there (schools etc). Also I know, from talking to the CEO that all costs are based on Fly In Fly Out workforce. So even if we only get a small percentage of employees living in Alice Springs...it will be a cost saving. Also there are already roads and rail all within 40km of the site. So transport really does not add that much to operational/transport costs. I mean Lynas moves it's product about three times across the world until it is ready to be sold. ARU will do it all onsite and then ship it. And ARU will be one of the lowest cost suppliers of Rare Earths in the world.

- The talk about the price of NdPr being low. Well they don't talk about how the Chinese companies are selling it below cost to stop other producers from around the world getting their mines started. And there is a massive demand for ex-china supply. These are major points that they just fail to talk about.

- The spoke about one of the Conditions Precedent being Due Dilligence. This is pretty standard for a Government commitment. So use that as a talking point? Having worked in Government and in finance...i know that if Govt makes a public announcement...they will do EVERYTHING to make it happen. Even if Government has to put in more money or improve the terms. The Money of Mine guys need to point out that with this level of Govt commitment....this project is going ahead. But they just try to cast doubt on it.

- The speak about cost overruns....well we have a massive Cost Overrun Facility...and because of all the delays with finance...much of the design has been done...with some savings. Also the $1.68 billion was prepared at the height of construction inflation. Which has stabilised. So again just more doubt they are trying to cast onto ARU.

Anyway.....this is how to make money. You have to be contrarian....

And I hope to hold these Money of Mine guys to account in about 3-5 years when ARU is massive!

https://wcsecure.weblink.com.au/pdf/ARU/02784883.pdf

Still digesting the details.

But great result.

The headline figure is a bit decieving. A large chunk of the money is for Cost Overrun Facility Gaurentees (ie if the bank has to increase it's cost overrun facility...then the Export Credit Agency (in this case the Export Finance Australia and Northern Australia Infrastructure Facility) with provide increased guarentees. But the other side of it, means that if there are cost over runs....we have money! So this has de-risked it somewhat. But the way it is presented is confusing. I think Govt wanted to make the largest number possible...so just threw all the numbers into the annoucement. But I still need to fully understand what it means.

This is a quick table i knocked up.

The key thing i'm trying to work out is the size of the major capital raise to happen in a few months time.

If my understanding of the Cost overrun facility is correct....then they need to raise about $640 million (aussie). Which is about what we were told a month ago.

Approx 110 million shares are short for ARU. Approx 5%.

With the Aust Govt funding news coming out, debt funding to be annouced shortly, off takes to be announced and equity.....there is alot of positive news coming. Will be interesting to see if the shorts decided to exit the ARU Rocket Ship in the next few days?

Fingers crossed.

So this came out last night. We are still waiting for the ARU annoucement.

But in summary:

- Govt commits to a total of $840 million.

- "Arafura’s funding – which includes about $495 million in loans from the Critical Minerals Facility, $200 million from the revamped Northern Australia Infrastructure Facility, and up to $115 million in federal export financing"

We were not expecting the $495 million.....This is epic! I assume that debt will stay the same size..and equity required is reduced meaning less dilution.

Lets see what today brings. But with lots of govt backing....ARU seems to be 99.9% going ahead!!!

ARU are in a trading halt. With an annoucement regarding "Debt Financing Support" to be released before Friday.

This should be good news and is in line with what I have previous said...Debt, then off take then final equity cap raise.

Also this was announced recently...and I'm hoping this is part of the offtake...finance package.

https://www.koreaherald.com/view.php?ud=20240312050533

"Posco International, the trading and energy arm of Korean steel giant Posco, announced Tuesday that it has recently secured a substantial order for rare earth permanent magnets, an essential part of an electric vehicle drive motor core, through its overseas subsidiaries."

"The permanent magnets secured by Posco International's overseas subsidiaries will not rely on rare earths from China, which accounts for over 90 percent of rare earths sourced globally, but will instead utilize raw materials obtained from the United States, Australia and Vietnam."

OK I'm back and married.

So mid last week I got the opportunity to meet online with the new CEO of ARU with around 10-12 others.

My notes are as follows:

- Finance - Debt is likely to be locked in first. It is tracking well and likely to be secured by end of March. The banks and other debt providers have been working with ARU closely on the off-take agreements, and they see that there is an oversupply of companies seeking off take agreements. In fact, Darryl said ARU have taken the extra time to improve the off-take agreements to ARU's benefit. These Tier 1 off-take companies are in competition with each other. He also said that the current low NdPr spot prices do not reflect the ARU off-take prices. So with Debt comfortable with the off-take situation, ARU are likely to announce they have locked in Debt first. Then off-take announcements. And after debt and off-takes have been locked in, they will lock in the equity. They have been working with around 7 strategic equity investors using UBS to arrange.

- No more small equity raises - Pulling back spend. Engineering, design etc. so that ARU have financial runway to get final equity raise locked in. We discussed at length how destructive the last cap raise was. It was very precautionary. I think with hindsight they may have used the previously cap raise to give themselves some more runway.

- They are focused on making some of the key hires soon. I had the feeling Darryl knows who he wants to fill these roles.

- We spoke a lot about the future demand. Darryl said that by 2030, the world will need x10 more Nolan/ARU projects. Which he said will put ARU in a great position. They will be in full production, with ability to expand the Nolans project (he said there is more NdPr in the Nolans deposit that the 4400t per year. And ARU can also process other NdPr. But he also spoke about potential for acquisitions etc.

- Change in CEO - Been in discussions for quite a while. Gavin was the explorer/sell the dream CEO. Darryl is the CEO that has proven experience delivering an operational mine.

My takeaway….I’m quite sure that ARU will get all the debt, off-take and equity and begin construction second half of this year. I think the change in CEO was always going to happen and is a good thing. I still think that ARU SP will move up and down until steady state production. So I will likely sell some after financial close…and then buy more closer to production/operational date. I’m also still considering buying more at this low price of about $0.12. There is a chance it may drop a little more if no debt annoucement by end of March.

Any questions…type a reply below.

Cheers

John

I’m super busy this week. So this will be short.

but yesterday ARU announced the long term CEO…Gavin is leaving. After 18 years. And they have a new experienced guy who has been in the ARU board for a little while. so he knows exactly what he is getting into.

normally when there is a change in CEO I would sell straight away.

but I think this is actually a positive.

gavin was the guy who got it to where we are today. But I think the finance parties would have wanted a delivery/operations leader.

in his contract his performance is linked to construction milestones and operational targets. So he would not have set those if he didn’t think finance is locked in.

i need to do some more research on him, so I can’t comment on him directly

also there has been no change in SP since this news

I think this is a positive for ARU to move forward

I’ll do some more research after my wedding this weekend!

My notes:

So I listened and had some of my questions asked and some answered. My notes are as follows:

The Cap Raise and SPP

- They did it to be very cautious in case things run longer. ie protection.

- I don’t agree with this point, but they said no options for SPP because administratively it would have been difficult.

- My read of the faces on the call, body language and the comments made is that the Chair pull rank and made the executive team do it.

Off takes:

- All very advanced.

- The off takers don’t really care about spot price/current price. They want non-china certainty. All the off take prices will make ARU profitable.

- GE is a bit more complex due to:

- GE is splitting into three parts with GE Vernova, the group's power division, being the entity that ARU would contract with. These guys generate revenue of about 30+ billion a year! So you can imagine that this is tiny agreement for GE Vernova. And management are probably busy with the demerger.

- Also ARU are buying some gas turbines from them

- GE Vernov are linked to the Canadian Export Credit Agency (Called something else) (Also I thought this was the German CEA so I was wrong)

- There was a comment that they have other off take groups ready to pounce too.

Funding

- Peter Sherrington spoke very well (the CFO).

- It is a massive exercise. With lots of moving parts.

- They have identified that the Korean CEA as the critical path due to them coming in so late. They are working closely with them fast track. They have helkped them get Australian legal and technical advisers.

- They said most of the legal and technical Due Diligence is almost complete (in my experience, this means they DD people are waiting to send the final letter when things are all about to be signed)

- Peter thinks this is a better than expected funding structure. Not sure exactly what that means.

- He kept saying the words ‘Final Funding Structure’ which bodes well

- The NdPr prices used in all the funding was very conservative. So no issues at the moment.

- They have been having discussions with equity participants for the final Cap Raise. Gina and other large pockets.

NdPr Pricing and market

- They acknowledged the falling price but made the following comments

- China still manipulating the prices

- China Northern is selling at below production cost

- Towards the end of 2023, China Northern had to up their quotas. Showing demand is still there.

- There are very few new NdPr extractors and even fewer extractor/processors coming online any time soon and not at ARU scale.

- They noted that the above point create a very different market dynamic compared to Lithium.

Summary:

- I feel like the ARU team is working hard to close the off takes, debt and final cap raise.

- I believe Peter Sherrington is across it all and he looked like a guy who is towards the end of a deal.

- Current low NdPr pricing is not a short or medium concern.

- I think given the market dynamics, the long term view is still that NdPr will go up. Making ARU quite valuable.

- I think they will achieve their off take and debt funding by the end of Q1 2024. WIth a final cap raise by June 2024…and construction can then begin!

PS I asked about the Aust Govt Critical Mineral Fund. They mentioned it. But then didn’t answer. Strange.

PSS I will be a buyer if it continues to drop below 11 cents. approx.

The announcment is that ARU has got another US$75 million from the Korean Credit Export Agency (KEXIM).

With GE stalling on their offtake (due to their turbine division internal issues), ARU will be going to the other major players. ARU will def find another teir 1 off take player. This could change the funding mix. Ie if the other off take player is not german, then they may have to use their Export Credit Agency etc. This has def slowed their Financial Close. But I feel like they should be able to get there by March/April 2024 and with little dilution (ie only a small capital raise). I just hope they don't screw retail investors if they do go down the cap raise.