A little bigger than what is preferred by the Strawman community but this seems to be an attractive place highlighted by a few fund managers - AUB and SDF.

The reason it is attractive is as brokers they take a clip of the premium, so higher premiums are good. We are in a premium hardening cycle for most types of insurance and the increased prevalence of natural disasters seems to be a tailwind. They take no underwriting risk as brokers. The factor that perhaps may weigh on premium increases in the future, is higher bond rates so insurers may start to lower premium increases as they are finally being compensated with a return on their float.

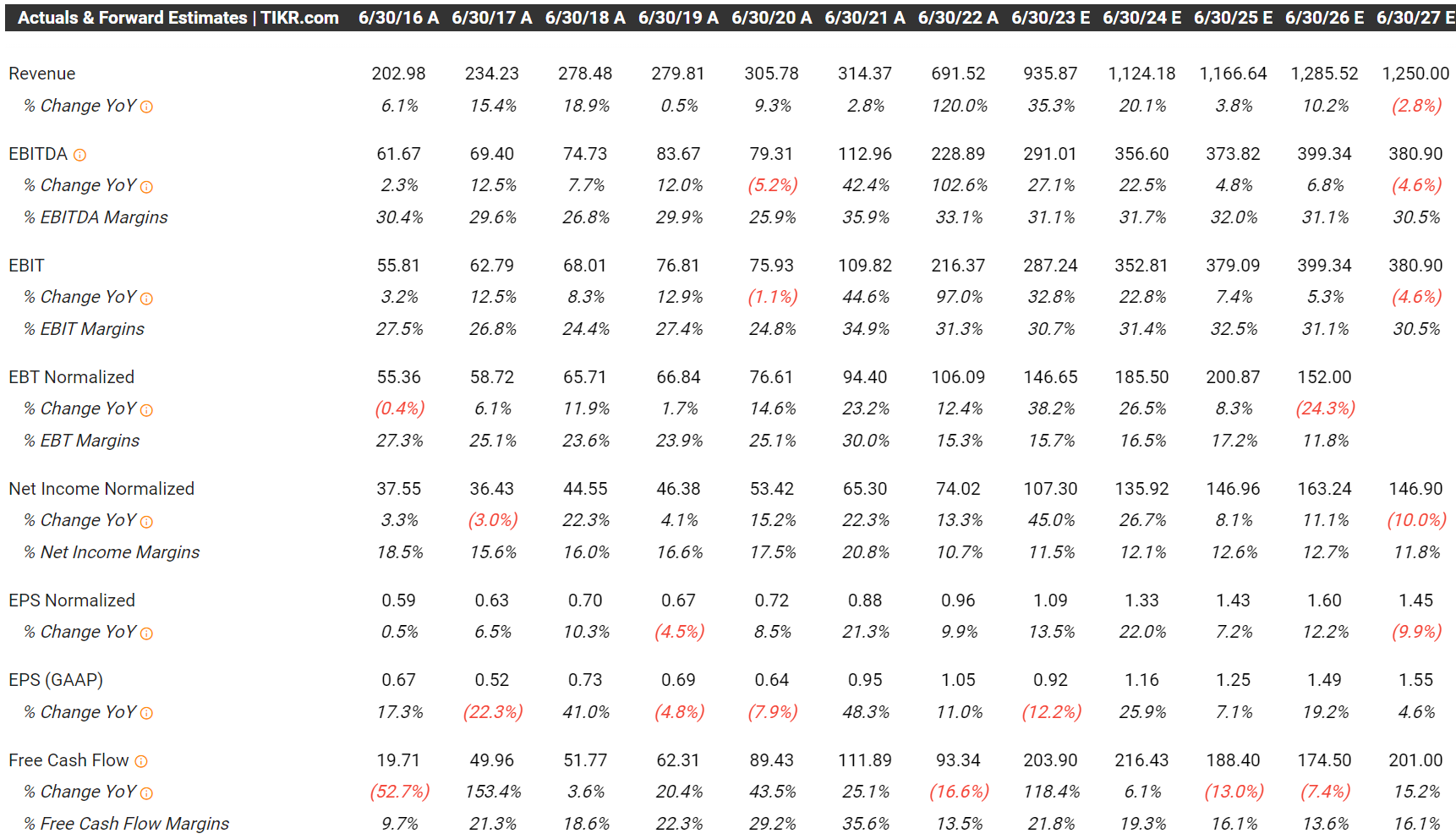

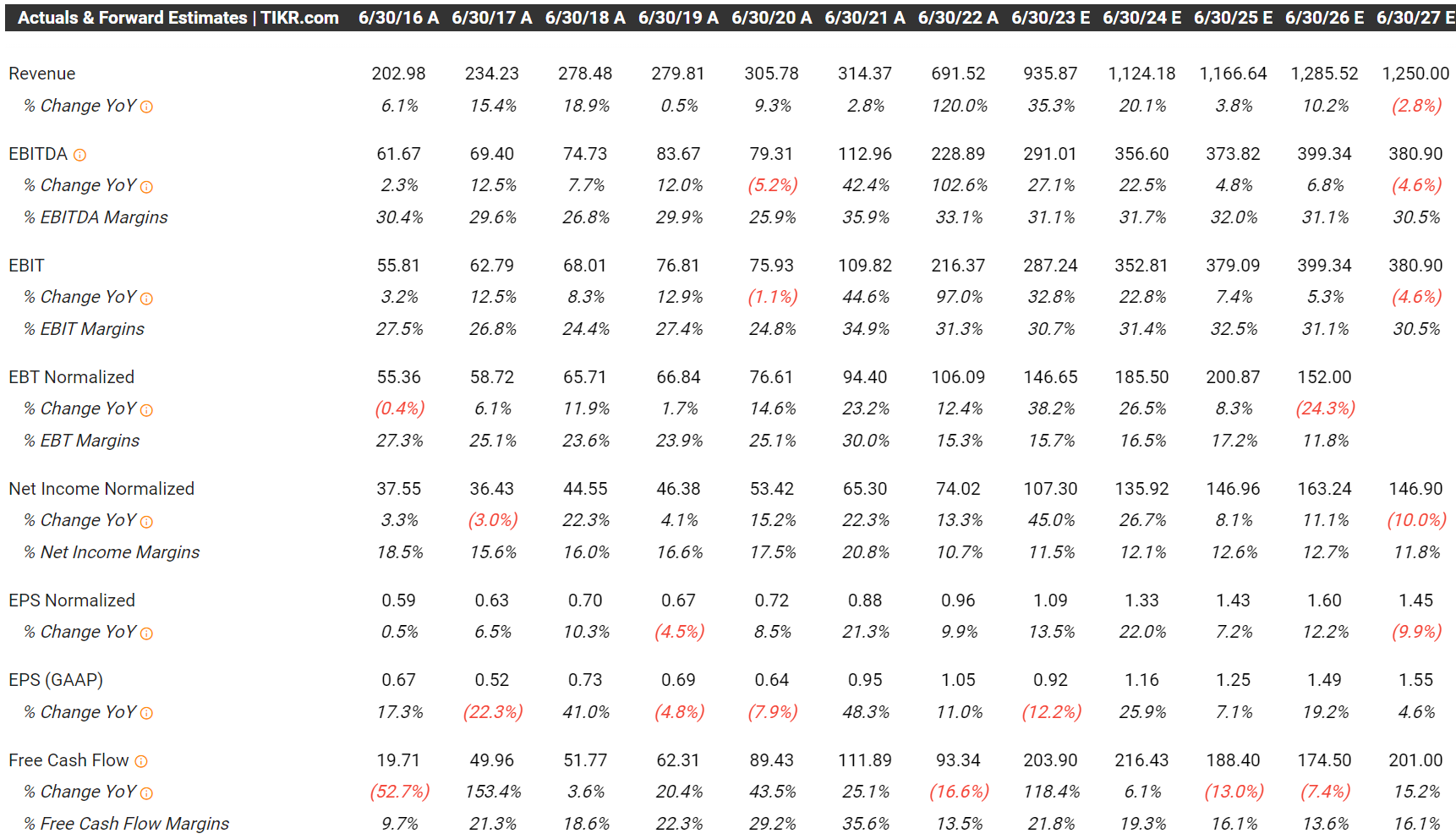

AUB looks quite attractive with management guiding for underlying NPAT of $86M to $91M in FY23 excluding the Tyser acquisition. If we look at Tysers acquisition multiple of 12x EV/EBITDA and a $880M purchase price we make a few adjustments can expect Tysers to contribute about $45M in NPAT if it was for a full year.

Taking the lower of guidance of $86M plus $45M equals $131M in NPAT. Noting that Tysers acquisition isn’t complete so won’t contribute for the full year (likely only get 6 months in FY23). EV of $1.8B with potential derferred consideration for Tyers of $187M. Lets be conservative and call it $2B EV so looking at about NPAT/EV multiple 15.2x for a relatively defensive business if you annualise Tysers earnings.

Looking to keep the same dividend payout ratio of 50-70% of NPAT. Using the lower payout ratio of 50 %of NPAT looking at 3.3% fully franked (conservative) with plenty of growth - both organic and inoranic - ahead. Those who just want income and some growth it may be worth a look.

I’d note Morningstar has a fair value of $28 and broker consensus if $27.20 so 35% upside or so from current prices.