Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Takeover offer off, from my reading more just price than anything untoward.

Reaffirmed guidance:

"We remain confident in AUB Group’s forecast FY26 financial performance and see significant opportunities to grow profits in FY27 and beyond.” AUB reaffirms its FY26 guidance for underlying NPAT, to be in the range of AUD215.0 million – AUD227.0 million, representing earnings growth of 7.4% to 13.4%."

Interesting to see the divergence with premium rise guidance between SDF and AUB previously - guess we get to see who was right/wrong or really is just product mix.

Both SDF and AUB look good to me especially if inflation comes back.

I've bought into both IRL today.

AUB announcement this morning: Under the terms of the Confidentiality Agreement, EQT was required to re-confirm its intention to proceed with the Proposal to acquire AUB at $45.00 cash for each AUB share to retain exclusivity. EQT has provided such re-confirmation.

..

The AUB Board notes that there is no guarantee that a binding agreement will be reached with EQT and therefore no certainty that the Proposal will result in a transaction.

…

so- from what it has seen in DD, EQT still wants to proceed. Still not-binding but harder for EQT to say business case doesn’t stack up after initial DD.

EQT proposed $45 per share bid for AUB had the following exclusivity terms:

Hard Exclusivity End Date means the date that is 20 business days after Thursday, 9 October 2025. Tomorrow is the 20th day after 9/10.

Exclusivity Period means the period commencing 8 October 2025 and ending at 5:00pm (Sydney time) on the earlier of: 5pm on Thursday 20 Nov (which can be extended if EQT commits to the transaction).

As I understand it the AUB board can negotiate with others if it forms the view in good faith that doing so would be in accordance with duties but no non-public info can be provided until the end of the Exclusivity Period.

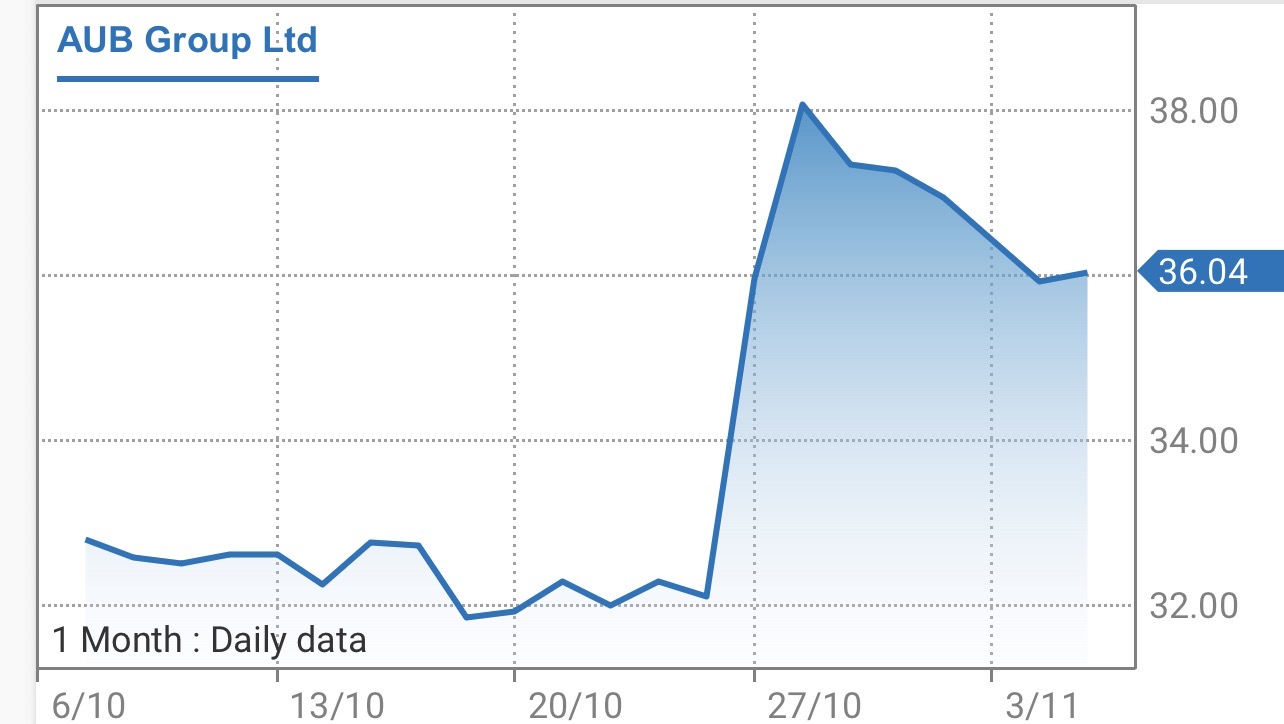

Meanwhile AUB share price is $9 below the offer price, suggesting a lack of confidence in a deal being done.

AFR Streetalk

Underperformer AUB Group in crosshairs of private equity suitor

ASX-listed insurance roll-up AUB Group, whose shares have underperformed peers including Steadfast Group over the past 12-months, is in play.

The $3.8 billion company has attracted the attention of Swedish private equity firm EQT Group, according to people with knowledge of the mooted deal, who requested anonymity.

Of note, it is unclear whether the high-level discussions have progressed or if EQT has submitted an informal takeover proposal to AUB’s Peter Harmer-chaired board.

Goldman Sachs is advising EQT Group and Macquarie Capital is tending to AUB Group, the sources said.

Board Ownership

Ordinary Shares Net Value at $31.40

David Clarke 30,837 $968,282

Mike Emmett 169,483 $5,321,766

Richard Deutsch 3,250 $102,050

Peter Harmer 3,415 $107,231

Andrew Kendrick 0 0

Melanie Laing 1714 $53,820

Cath Rogers 8,404 $263,886

Total 217,103 $6,817,034

Current Market Cap at $31.40 is $3.632B

Recent Buying from Board

Melanie Laing

· 31 May 2024 Purchase 1714 Shares at average price of $29.16 ($49,980.65)

Richard Deutsch

· 7 November 2023 Purchase 1250 shares at average price of $27.27 ($34,087.50)

Board Bios

David Clarke - Non-Executive Chair, Chair of the Nomination Committee

David Clarke was Chief Executive Officer of Investec Bank (Australia) Limited from 2009 to 2013. Prior to joining Investec Bank, David was the CEO of Allco Finance Group and a Director of AMP Limited, following five years at Westpac Banking Corporation where he held a number of senior roles, including Chief Executive of BT Financial Group. David has 40 years’ experience in investment banking, funds management, property and retail banking. He was previously employed at Lend Lease Corporation Limited where he was an Executive Director and Chief Executive of MLC Limited. David is Chairman of Charter Hall Group, Fisher Funds Management Limited and Resolution Life Australasia Limited. David holds a Bachelor of Laws from Victoria University in Wellington, New Zealand.

Mike Emmett - Chief Executive Officer and Managing Director

Mike has enjoyed a diverse career working across the Insurance, Consulting, and IT Industries in Australia, the UK and South Africa. Prior to joining AUB Group, Mike was the Group CEO for Cover-More, previously an ASX-listed global travel insurer and now part of the Zurich Group. Mike previously held senior roles in Australia at QBE as Group Executive, Operations, and EY leading the Financial Services Advisory business. Before moving to Australia, Mike spent several years working in London, including at IBM, leading the Insurance and Banking consulting teams and at Morse plc (Application Services) as Managing Director. Mike’s earlier career in South Africa included senior roles in Consulting at IBM, Accenture and PwC. Mike is also a Chartered Accountant (SA).

Richard Deutsch -Non-Executive Director, Chair of the Board Audit & Risk Management Committee

Richard is a Non-Executive Director of Bendigo & Adelaide Bank Limited. He is the Chair of the Movember Foundation and a Champions of Change Coalition Convenor and Advisor to CEOs and Boards. Richard brings extensive experience delivering complex audit and advisory services to Australia’s leading public, private, government and not-for-profit organisations for more than 30 years. Richard was the Chief Executive Officer of Deloitte Australia from 2018 to 2021. Prior to the CEO role, Richard was the Managing Partner of the Audit & Advisory Practice and a member of the Global Audit & Advisory Leadership Team. Richard’s career also includes more than 25 years working with PwC, including nine years on PwC’s Australian executive. Richard holds a Bachelor of Economics from the University of Sydney.

Peter Harmer - Non-Executive Director

Peter is the former CEO of IAG Limited, and has served previously as the CEO of CGU, Aon Limited UK, Aon Risk Services Australia Pacific, and Aon Re Australia. Peter has over 40 years’ experience in the industry spanning insurance, reinsurance broking, and insurance broking. He is a Non-Executive Director of Commonwealth Bank of Australia and nib Holdings Limited, and is the Chair of Lawcover Insurance Pty Ltd. Peter is also a member of the Advisory Council for Bain & Company, an Executive Mentor with Merryck & Co ANZ, and a member of the Advisory Council of EXL Services Asia Pacific.

Andrew Kendrick -Non-Executive Director

Andrew Kendrick is a former Non-Executive Director of Lloyd’s of London and the Lloyd’s Market Association. He has more than 40 years’ experience in the insurance industry in the UK, Europe and Bermuda. Andrew’s executive career includes leadership positions with Chubb and Ace, culminating in the role of President & Chairman, Chubb European Group. He began his career at Sturge Syndicate 210, and held a number of senior underwriting positions with Ockham Underwriting. Andrew is the Chair of Everest Insurance (Ireland) DAC.

Melanie Laing - Non-Executive Director, Chair of the People and Remuneration Committee

Melanie Laing is a Non-Executive Director of global, ASX-listed (US domiciled) digital education provider, Keypath Education International, and of ASX-listed Ridley Corporation, one of Australia’s leading agricultural companies. Melanie was group executive of HR at Commonwealth Bank of Australia, where she was responsible for the strategic planning, transformation and implementation of the bank's global people agenda and HR operations. Previously, she was global head of people and culture at Origin Energy, and has held senior HR leadership roles with Unisys, Vodafone, General Re and Times Mirror, in Australia and overseas. Melanie holds a Bachelor of Arts from the University of the Witwatersrand. She is a fellow of the Australian Institute of Company Directors (FAICD) and the Australian Human Resources Institute (FAHRI), a member of Chief Executive Women (CEW) Australia and certified chair with the Advisory Board Centre.

Cath Rogers - Non-Executive Director

Cath Rogers is a member of the Commercialisation Committee of the Heart Research Institute and was previously a Non-Executive Director of fintech Digital Wallet Pty Limited which trades as Beem It (2018-2021) and McGrath Limited (2016-2018). She has a background in financial services, private equity and venture capital both in Australia and overseas including with Antler, AirTree Ventures, Anchorage Capital Partners, Masdar Capital and Credit Suisse. Cath holds a Bachelor of Commerce from the University of New South Wales and an MBA from INSEAD. She is also a CFA Charterholder and a graduate of the Australian Institute of Company Directors.

The following is a part extract from this mornings ASX release which was a little more positive than anticipated.

I've added at current share price as imo I see this as a value buy with growth upside.

Upgraded and Updated Earnings Guidance for FY23 AUB Group Limited (AUB) today announced that, as a result of strong Q1 FY23 trading and completion of the Tysers acquisition on 30 September 2022, it is updating guidance for FY23.

FY23 underlying net profit after tax (UNPAT) guidance for AUB, including Tysers and Group debt costs, is expected to be in the range of AUD107.5mn to AUD115.0mn, representing growth of 45.2% to 55.4% over FY22.

AUB’s FY23 UNPAT (excl Tysers and cost of debt) is expected to be in the range of AUD90.0mn to AUD92.0mn, representing 21.6% to 24.3% growth over FY22.

Previous FY23 UNPAT guidance announced to the market on 24 August 2022 was in the range of AUD86.0mn to AUD91.0mn.

Additionally, following completion of the Tysers acquisition on 30 September 2022, AUB announced that Tysers is expected to contribute UNPAT in the range of AUD45.0mn to AUD52.5mn for the nine months to 30 June 2023.

1H21 Performance Overview

A record 1H21 result that positions AUB Group for another strong year

Summary

- Underlying NPAT1 $30.7mn (1HFY20: $21.3mn) up 44.2%.

- Underlying earnings per share 41.47 cents up 43.2%.

- Mixture of underlying organic and acquisition driven growth primarily in Australian Broking.

- Reported Net Profit After Tax $24mn (1HFY20: $16.6mn), up 44.5%.

- Fully franked interim dividend of 16.0 cents per share (1HFY20: 14.5 cps), an increase of 10.3%. Dividend Reinvestment Plan (DRP) remains activated.

- Excellent results in Australian Broking are a result of recent initiatives that will continue to drive sustainable improvement in revenue and underlying cost drivers.

- Accelerating growth in BizCover together with strong progress against FY21 Execution Priorities.

- Sale of Altius agreed, completing exit from Health & Rehabilitation Services.

- Continued focus to deliver on growth ambitions – Upgraded FY21 Underlying NPAT guidance of $63.0mn - $65.0mn, representing 17.9% - 21.7% growth on FY20.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02344610-2A1282144?access_token=83ff96335c2d45a094df02a206a39ff4