Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

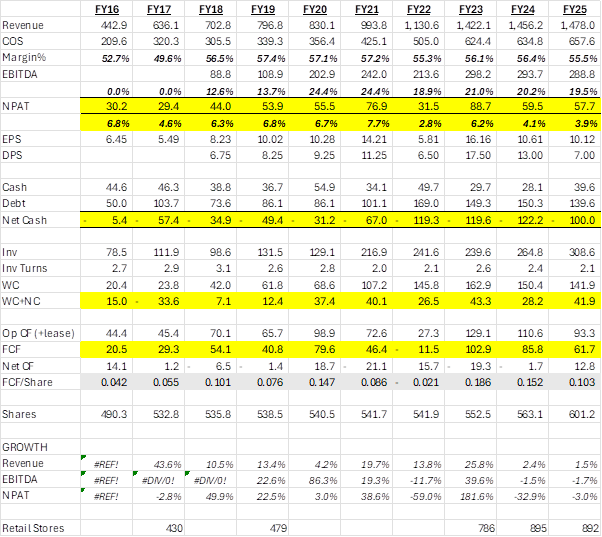

Having followed and held Accent pre-Covid (2016-18) I have held a favourable view of the business with it having had exceptionally strong sales and EPS growth to that point, high and defendable margins from mostly exclusive brand products. However about 7 years ago, from FY19 the sales growth and strong margin position has failed to convert into strong shareholder EPS returns, leaving only dividends or getting your timing right for a capital gain.

7 Year Itch

From FY19 the company seems to have frozen in time as far as shareholder returns are concerned. The top line has shown good growth (Sale up 85% and stores up from 479 to 892 FY19-25) but EPS is flat with NPAT up 7% in line with share count.

A question directly on this disparity between sales growth and EPS growth was asked at the AGM, the chairman offered no explanation, simply a hart felt desire to return to EPS growth but no plan to do so, effectively not answering the question. Investors got the message, selling it down to $0.95, the lowest since 2017 outside of the Covid dip, with no growth priced.

Other changes in the business over the period include an increase in negative net cash balances, this has been in line with sales growth and also working capital growth, so reasonable and appropriate in my view. FCF over the period is in line with NPAT with most (90%) being paid out as dividends, so little investment back into the business. However, Inventory Turns have dropped to 2.1 from high 2’s as inventory has grown faster than sales.

Sales per store is the same in FY25 as it was in FY19 at $1.66m per store, yet the profitability per store has fallen from $113k to $65k in line with NPAT% dropping from 6.8% to 3.9%. I assume prices increase over the period, so either volumes have fallen or sales ranges have started to skew towards lower price/quality products (cost of living?).

It doesn’t look like rental costs changed much or are possibly down from $194k to $172k per store (rent reductions over Covid provide a reason why). Due to how rent is accounted under lease accounting rules which changed in FY20, I have used cash payments for FY25 to compare to expenses for FY19, so it’s not fully accurate, but should be a good proxy.

Employee costs have increased from $339k to $361k per store which is only 6.6%, given the wage inflation between FY19 and FY25 would by much large than this, it indicates headcount reductions per store. Due to a lack of growth in sales per store, this has resulted in employee costs increasing from 20.4% of Sales to 21.8%, a 1.4% increase which explains about half the 2.9% drop in NPAT% from 6.8% to 3.9% from FY19 to FY25.

Another possibility/explanation for the drop in lease costs and subdued employee cost growth is that new stores are being opened in less popular locations. Lower rent, less staffing required but lower sales compared to prime locations, hence growth requires expanding via less profitable locations.

The other part of the drop in NPAT% is due to gross margins dropping -1.9% from 57.4% to 55.5%, which is normally not a big issue when sales go up 85% over the period. The problem is that the cost base has shown no economies of scale, in fact it has show diseconomies of scale with employee costs increasing faster than sales, offset slightly by lower lease costs as a proportion of sales. They have to run faster to stand still – saturation of the market?

Value With or Without Growth

The November trading up date of “challenging” retail conditions for the first 20 weeks of FY26, Like for Like sales down 0.4% and gross margins down -1.6% have reinforced/highlighted the issue. The companies purchase/partnership with Frasers Group to add the Sports Direct business provided $49m in capital at a 5% dilution comes with plans for 50 new stores over the next 6 years, so about a 5% store count growth to offset the share count 5% dilution (ie no EPS growth). Also the MySale business (an online side hustle of Frasers included in the deal) is being wound down having clocked $3.5m in EBIT losses in just 4 months to October 2025.

The addition of Sports Direct expands the Sports retail portfolio which is more resilient than the Lifestyle retail portfolio that many of Accent’s brands fit into. It is a large store format, so the economics of the store may be better, but margins will be lower because ranging will include more non-exclusive product via a broad range. It does provide Accent an additional channel for exclusive brands and also adds some new quality exclusive brands (see below).

The first store was opened at Fountain Gate in November and 3 more are planned in FY26, so even if it’s a raging success it will not move the dial for quite a while due to representing such a small part of the company. It is however a growth opportunity, and the company is continually closing underperforming stores and opening new ones and experimenting which should at least ensure they remain relevant and competitive.

If there is no growth but earnings are maintained a PE of 10 would provide a 10% return. A PE of 12 would assume system growth rates around 2%. Neither assumption is particularly demanding and as such the current price looks reasonable. However, I would expect the dividend to drop as capital is needed to expand Sport Direct beyond that already provided. The dividend for the last half was 1.5c, which is a warning of this with the previous being 5.5c. The full year dividend dropped from 13c to 7c FY24 to FY25, still a 10% yield if franking credits are included at the current price of $0.95, but be prepared for the dividend to go lower.

If they can get earnings growth of 5-7% on a sustained basis, then a PE of 17-20 would be justified (assuming interest rates around current levels). So the price per share could easily double, where it was back in May and many times over the last 7 years.

Conclusion

So failing bad news, the current price looks good and is a bargain if they can find some growth soon. Sports Direct may help over the next couple of years, but they really need to find a way to improve the business economics. Early FY26 figures say that isn’t going to happen, but their full year EBIT expectation of $85-95m suggests low single digit growth, which is all they need to provide good returns to shareholders from here.

It is probably a favourable asymmetric bet at this point, I am still undecided especially with how the year has started. A lower price or more information that suggests a turn around on the current trajectory would get me across the line. As usual, we will know if it’s a bargain or not with perfect hindsight in the future.

GROWTH PLAN The Company continues to have a valuable portfolio of growth opportunities across its core banners and new businesses, including:

• The continued roll-out of new stores, with significant further store roll-out opportunity in both its core banners and new businesses over the next 5 years. At least 50 new stores are planned to open in FY25.

• Improved underlying gross margin from continued growth in the Company’s “moat” brands, being its distributed and vertical owned brands. Along with the margin improvements, these brands continue to provide an un-replicable competitive advantage through exclusive product access, forward visibility to global product trends, and end-toend customer access in ANZ and exclusive products.

• Growth in Nude Lucy from the continuing roll-out of new stores and online growth. Nude Lucy now has 36 stores including online with additional stores planned to open in FY25. The company has also launched a US focussed online store for Nude Lucy (www.nudelucy.com) to test customer demand for the brand.

• Growth in Stylerunner which was profitable in FY24, currently 28 stores trading, including online with around 10 stores to open in FY25

• Continued profit growth in TAF from profit margin expansion, and franchise stores continuing to be re-acquired (current network of 99 corporate stores inclusive of online stores and 60 franchise stores as at 30 June 2024). FY24 franchise store sales of $170m, up 0.2% on FY23.

• Continued growth in current and new distributed brands in particular Skechers, HOKA and UGG with further store roll out and online growth planned in these brands

Observation:

Australian Retailers showing Resilience: The people with no mortgage are spending!! ..Wish i knew that in advance of the good #s

The USA bearish sentiment from last night could a 'beta' element.

Return (inc div) 1yr: 32.02% 3yr: 9.99% pa 5yr: 16.99% pa

Board of Directors

Reasonable trading update from $AX1 at the AGM today.

Revenue for 1st 19 weeks of FY24 up 2.1% over PCP, and LFL down 2.0%.

Of note, is that after first 7 weeks LFL was down 1.8%, indicating a reasonably stable retail environment in its categories.

Disc: Not held in RL and SM

From Morgan Stanley after the trading update: (Overweight; PT $1.85)

AX1 provided a positive trading update ahead of its AGM today. Key points:

Top line tracking ahead. Total sales +52% in first 18 weeks of 1H23 ... this is an acceleration from +49% in the first 7 weeks ... and ahead of cons 1H23 sales growth of 20%

Gross margins also beat. +570bps on FY22, which appears to be ahead of cons 1H23 margins of 56.4%

Upside to store targets. Expecting to open 50 new stores in 1H vs. previous full-year FY23 target of 50

Our view – Keep OW. Another strong trading update from AX1, with momentum building into the seasonally important Nov/Dec period. We see upside to consensus 1H23 EPS expectations from strong sales growth, gross margins and store roll-out. However, we expect the market to remain cautious on 2H23 EPS, given the challenging macro backdrop

We view this as a positive read-through for the rest of our apparel & footwear coverage – PMV, KMD and CCX

DISC: Small amount held on SM and IRL

Update on trade for the first 18 weeks of FY23:

- Total Group owned sales YTD are up 52% compared to FY22

- FY23 gross margin % YTD is up 570 bps on FY22

Total sales of $594 million

Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) of $99.5 million Earnings Before Interest and Tax (EBIT) of $30.3 million

Net Profit After Tax (NPAT) of $14.8 million

Earnings Per Share (EPS) of 2.73 cents

An interim dividend of 2.50 cents per share (fully franked)

Digital sales up 47.9% to 31.2% of sales

Inventory levels in line with expectations, and aged stock levels clean

Available liquidity including cash on hand and undrawn debt facilities of 192.6 million,

Accent Group Limited (ASX: AX1) today reports EBIT of $30.3 million and NPAT of $14.8 million for the half year ended 26 December 2021.

Accent Group CEO, Daniel Agostinelli, said “Trade in the first half of the year was severely impacted by the COVID related disruption and lockdowns that occurred across Australia and New Zealand. At times through the months of July to October more than 55%, or 400 of the groups 700 stores were required to close due to government mandated lockdowns. In this context I am pleased with the results that have been achieved along with the continued progress the group has delivered against its growth plan objectives. The continued focus on VIP (our loyalty customers), Vertical and Virtual, along with our integrated digital and store operating model, has enabled the group to grow online sales, continue to grow its customer database and loyalty programs and successfully trade through our inventory. Key achievements for the half include opening 104 new stores, growing our customer database by a further 600,000 customers, signing a 10-year distribution agreement for Reebok and continuing to drive our key growth business. I would like to thank our team, suppliers and landlords for their efforts and resilience and our customers for their continued loyalty.”

H1 FY22 OPERATING REVIEW

• Total online sales3 of $159.8 million were up 47.9% on the prior year and represented

31.2% of total retail sales.

• Contactable customers grew by 600,000 to 9 million customers.

• The Group opened 104 new stores during the half and closed 4 stores where required rent outcomes could not be achieved. Total store numbers now 738 stores

• Owned Retail sales of $443.3 million, (management estimated impact of COVID lockdowns and disruption on owned retail sales of at least $95m)

• Wholesale sales of $81.9m up 47.7% on prior year. Acquired a new 10-year exclusive distribution agreement for Reebok in Australia and New Zealand

• Sales of vertical owned brands and products continue to grow strongly. The group now has 10 owned vertical brands.

• Stylerunner: 19 stores now trading (15 stores opened in H1 FY22) Strong growth in Stylerunner The Label, driving vertical mix.

• Glue store turnaround and growth strategy. 5 new concept stores opened (4 new stores and 1 refurbishment) with the new concepts performing well. Momentum and performance across the Glue business in November and December with all stores open was strong.

I believe NPAT expectations were $15.7M so they’ve missed that. They’ve been heavily affected by Omicron but the market hasn’t been kind to retailers that’ve missed

Disc: Held IRL so hopefully the market shows some mercy!

27-Apr-2020: Business Update

DIGITAL SALES SURGE AND ALL STORES REOPENING WITH NEW SAFETY PROTOCOLS

On 25 March 2020, Accent Group Limited (AX1) announced the closure of Company owned stores in Australia (Group Stores) from 5pm on 27 March 2020 for a period of 4 weeks. Today, we are pleased to provide a further business update, including the significant acceleration we have seen in digital sales, and to announce our plans to progressively re-open our stores in compliance with Government directives and with the safety of our team and our customers our priority.

Digital sales surge

Continuing its 5 year investment and further energised focus on digital, Accent Group has seen a surge in the Company’s digital sales. Digital sales have grown from an average of approximately $250,000 per day prior to our stores closing in March, to between $800,000 and $1.1 million per day for the last 2 weeks of April.

Whilst our stores were closed to the public during April, some Group Stores were opened and staffed to operate as ‘dark stores’ [stores closed for trade to the public and used as fulfillment points for digital click-and-dispatch to customers] using our endless aisle technology to access our entire inventory base and to enable click-and-dispatch of product to our customers. Our digital business has also responded to this shift in consumer behaviour with targeted consumer content and offers to drive traffic and conversion. As our digital sales continued to escalate, the number of Group Stores opened as dark stores increased progressively through April. All of our Group Stores and a number of our NZ company owned stores are now staffed and operating as dark stores, working together with our distribution centres to fulfil our digital sales.

During this period, we have also developed and implemented new in-store protocols to help ensure a safe working environment for our team members working in our dark stores.

Accent Group CEO, Daniel Agostinelli said “After years of investment by Accent Group in our digital team and technology, I am delighted with the growth in our digital sales. It is clear that there has been a seismic and most likely enduring shift in consumer behaviour away from traditional shopping centres to shopping online. With 18 websites and our leading digital capability, Accent Group is capitalising on this trend. We will continue to drive digital growth as the number one priority in our company.”

Re-opening stores and new safety protocols

In Australia, shopping centres have been required to implement the Government’s measures to manage the COVID-19 virus (such as social distancing and public gathering measures) but have remained open. Whilst many stores in shopping centres have temporarily shut during the COVID-19 pandemic period, a number of retailers have also continued trading in the centres where the Company’s stores are located.

During this time, we have seen an increased demand for footwear for essential workers, such as the Skechers range for health professionals. We are also seeing strong demand for active footwear and apparel as more people are taking part in physical activities, with strong trading in these categories, particularly on The Athlete’s Foot and Stylerunner websites.

Accordingly, we have made the decision to progressively re-open all Group Stores with our new safety protocols in place to comply with all Government directives and to prioritise the health and safety of our team members and our customers. We will review and adapt these in-store measures as the environment evolves.

The initial protocols will include:

- Protective items such as hand sanitiser stations, face masks, gloves, disposable try on socks and disinfectant spray

- Social distancing measures of 1.5 metres between customers and team members, including at counters and seating areas

- Contactless serving of customers and payments

- Customer capacity limits in stores

- Training for team members on social distancing and additional hygiene measures

These protocols have been trialled successfully in several stores over the last 2 weeks and we will now be progressively re-opening all Group Stores to the public by May 11.

We believe that the significant increase in our online business most likely marks a permanent shift in consumer habits in Australia and NZ and we expect our online sales to represent a much larger share of our total sales in the future. Our store network, along with our surging online business, is a fundamental competitive advantage to the Company, however we will not operate stores on unsustainable or uneconomic rental deals. Accordingly, in the coming months, we will be re-evaluating the location, size and format of our store network to ensure the appropriate balance between digital and store sales.

--- click on link above for full announcement - including:

- Leases and landlord negotiations

- Supplier negotiations

- Wage subsidies

- Banking facilities

--- AX1 closed at $1.045 today, up +16%, but were up +36% earlier (at $1.28).