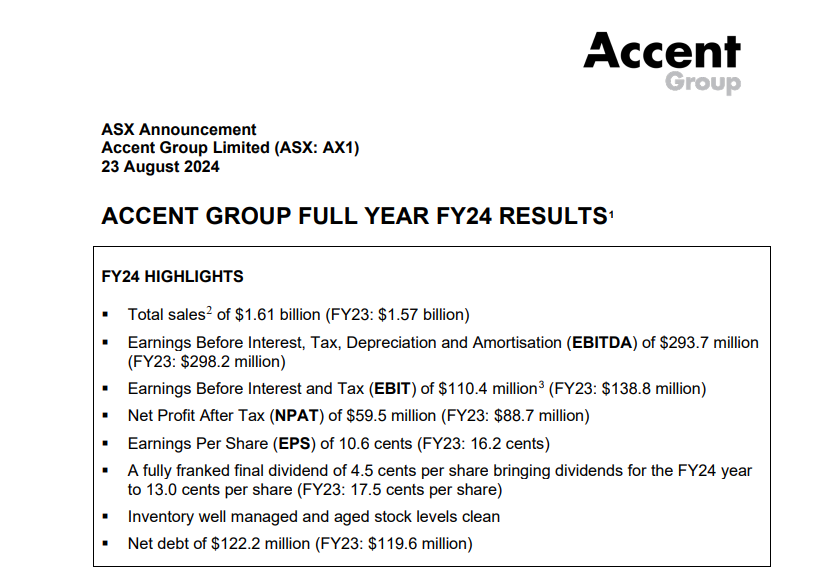

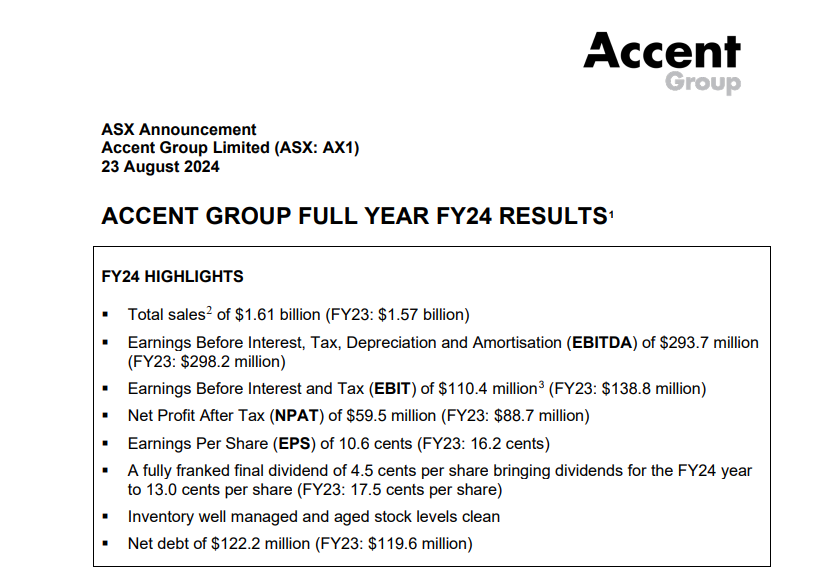

GROWTH PLAN The Company continues to have a valuable portfolio of growth opportunities across its core banners and new businesses, including:

• The continued roll-out of new stores, with significant further store roll-out opportunity in both its core banners and new businesses over the next 5 years. At least 50 new stores are planned to open in FY25.

• Improved underlying gross margin from continued growth in the Company’s “moat” brands, being its distributed and vertical owned brands. Along with the margin improvements, these brands continue to provide an un-replicable competitive advantage through exclusive product access, forward visibility to global product trends, and end-toend customer access in ANZ and exclusive products.

• Growth in Nude Lucy from the continuing roll-out of new stores and online growth. Nude Lucy now has 36 stores including online with additional stores planned to open in FY25. The company has also launched a US focussed online store for Nude Lucy (www.nudelucy.com) to test customer demand for the brand.

• Growth in Stylerunner which was profitable in FY24, currently 28 stores trading, including online with around 10 stores to open in FY25

• Continued profit growth in TAF from profit margin expansion, and franchise stores continuing to be re-acquired (current network of 99 corporate stores inclusive of online stores and 60 franchise stores as at 30 June 2024). FY24 franchise store sales of $170m, up 0.2% on FY23.

• Continued growth in current and new distributed brands in particular Skechers, HOKA and UGG with further store roll out and online growth planned in these brands

Observation:

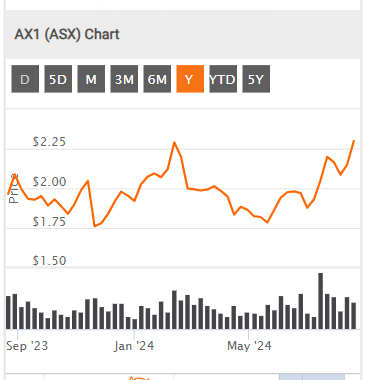

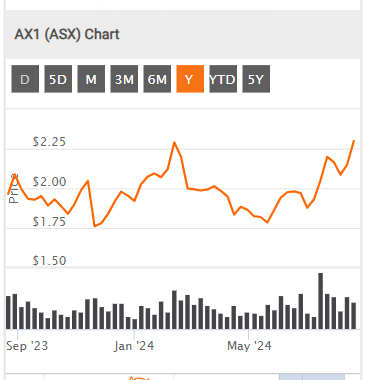

Australian Retailers showing Resilience: The people with no mortgage are spending!! ..Wish i knew that in advance of the good #s

The USA bearish sentiment from last night could a 'beta' element.

Return (inc div) 1yr: 32.02% 3yr: 9.99% pa 5yr: 16.99% pa

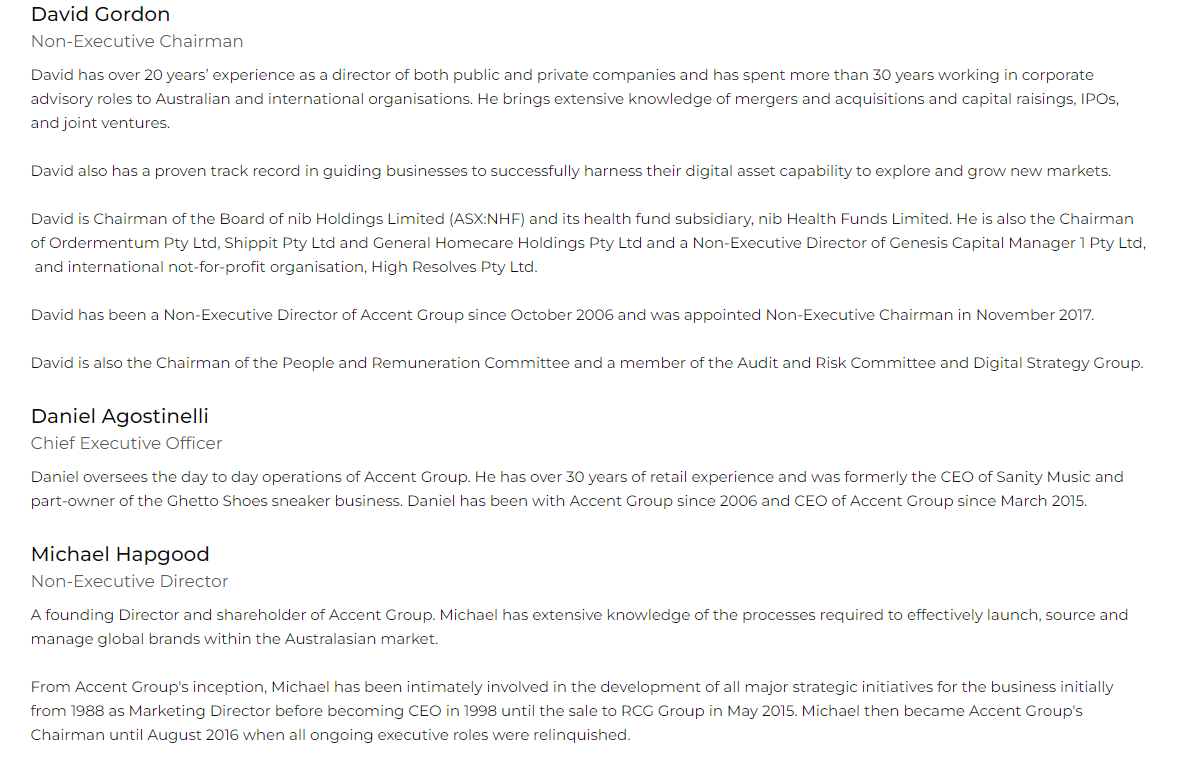

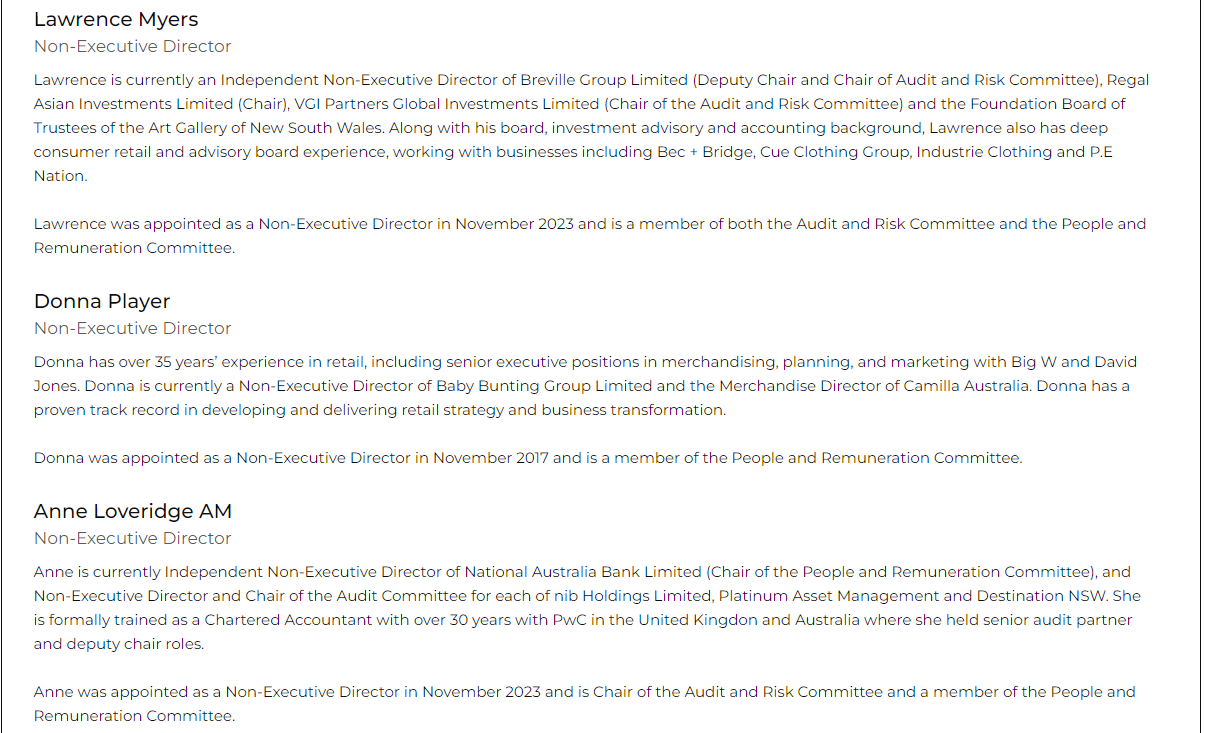

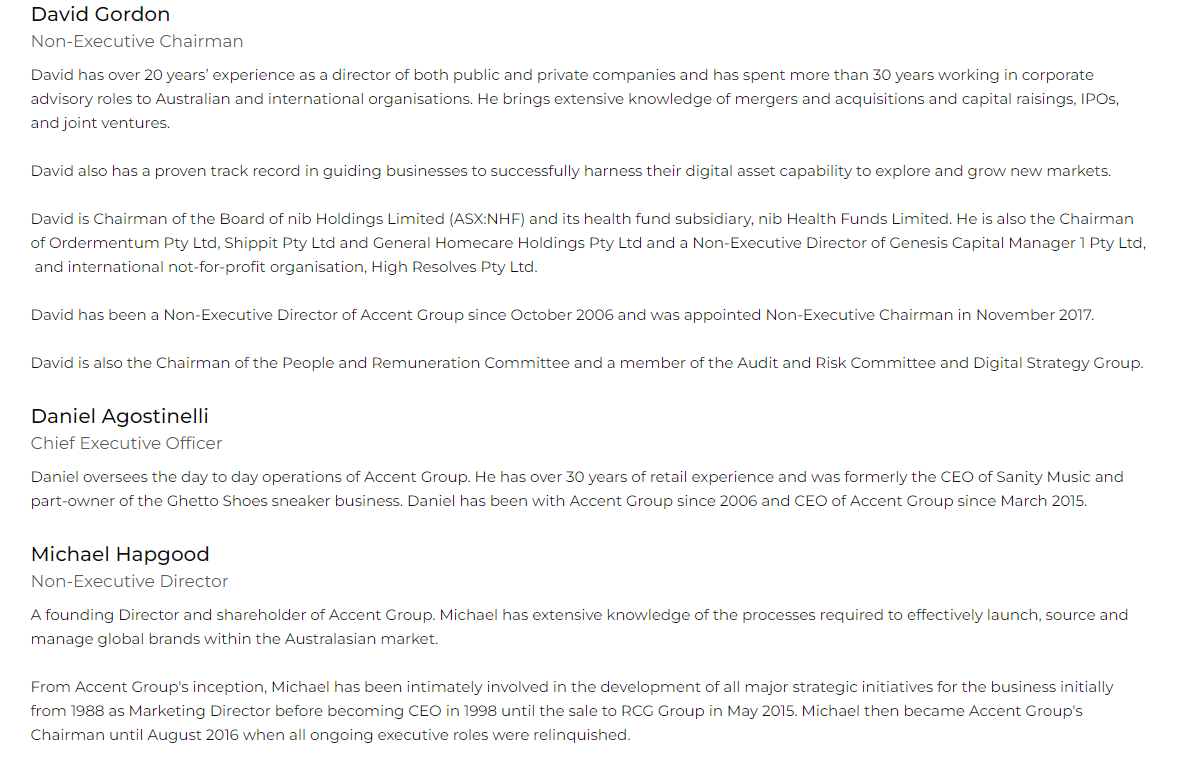

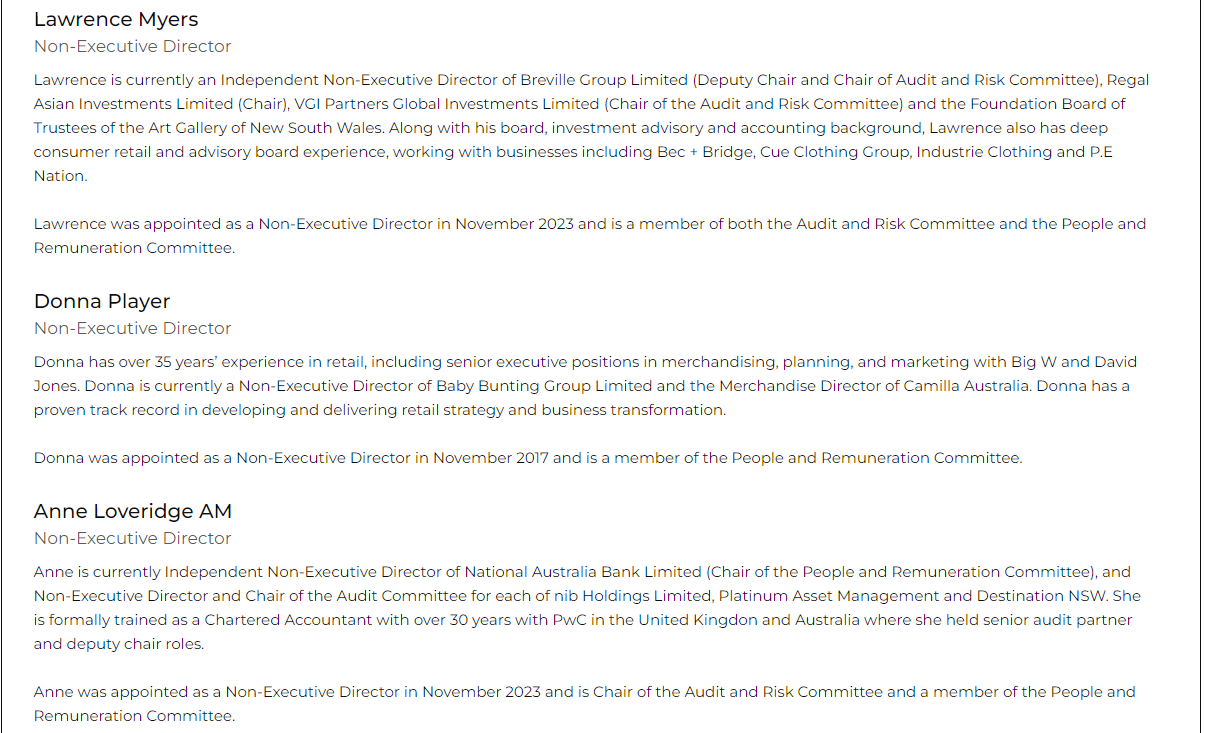

Board of Directors