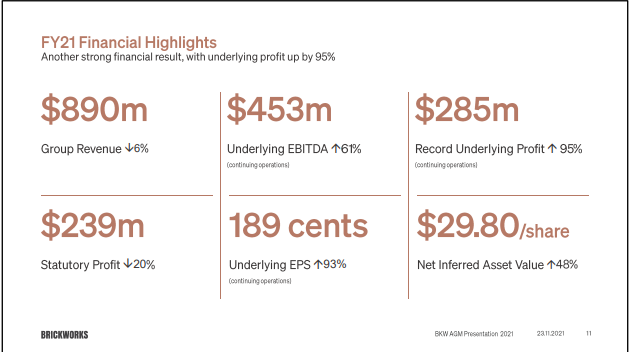

- Record underlying profit up 95%

- P/E of 8.1

From their AGM:

"Revenue of $890 million was down 6%. The decrease was primarily due to land sales revenue recorded last year, and the impact of exchange rate movements on Building Products North America revenue, when reported as Australian dollars.

EBITDA from continuing operations of $453 million, was up 61%, primarily driven by increased earnings from Property, Investments and Building Products Australia.

As the Chairman mentioned, underlying net profit after tax from continuing operations was a record, at $285 million.

This translates to underlying earnings per share of 189 cents.

After including significant items and discontinued operations, the statutory profit was $239 million, down 20% from FY2020, which included a large one-off profit in relation to our shareholding in WHSP."