Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Bye bye, Brickworks. Today is its last day on the boards

Despite the fact that not much will really change with the day to day running of the business, it’s sad to see such a long-standing stalwart of the ASX disappear from my (RL) portfolio.

My principle style is long and is based upon management. I have invested in BKW for a long time. I went back and found a person involved in the Bristile acquisition and the fact that LP actually wanted to know activity at each of the sites. This and other things informed me that he and the team really do an indepth research before investments.

Added to this they really seem to analyze the longer term benefits so these plant upgrades seems to be on the back of optimizing the cost structures. Reminds me of Sanitarium who kept developing a more automated production environment and did that as early as 2007.

The key issues for me was this nugget: "Major capital program across building products nearing completion."

Then supporting that this comment: "Capital expenditure was $56 million during the period, with the Company nearing the end of a significant investment program. The majority of major project spend was the construction of a new brick plant at Horsley Park in New South Wales."

The USA consolidation and upgrades are also being done. So whilst Australia is an expensive labour market USA has a cheaper market and yet they see the benefit of upgrades as they did here.

On the basis of constraints I believe that around $100 million of investment has been under perming and when the cycle turs back in favour there are significant profits to be generated by the Building Products division. So the 3 parts to this business are complimentary and in fact better than an entry via SOL in my opinion.

September 20, 2018: Retail investors explain Soul Patts and Brickworks value gap (afr.com)

Plain text link: https://www.afr.com/chanticleer/retail-investors-explain-soul-patts-and-brickworks-value-gap-20180920-h15mh4

Retail investors explain Soul Patts and Brickworks value gap

The two companies at the heart of the longest cross shareholding in Australian corporate history have reported full-year financial results which have reaffirmed a significant divergence in the way they are valued by the market.

It is a bit of a mystery why the two companies controlled by the Millner family, Washington H Soul Pattison and Co and Brickworks trade at vastly differently levels relative to the inferred value of their net assets.

Soul Patts shares trade at about the same as the value of its inferred net assets while Brickworks shares trade at about a 28 per cent discounts to its inferred net assets. Recent movements in share prices have changed the value of inferred net assets but the discount gap remains about the same.

Todd Barlow, chief executive, and Rob Millner, chairman of Washington H Soul Pattinson have defended the Brickworks cross shareholding. [photo: Louie Douvis]

Of course, the biggest shareholdings of each company are shares in each other. Soul Patts owns about 44 per cent of Brickworks which, in turn, owns about 43 per cent of Soul Patts.

One logical explanation for the discount to net assets gap is that Robert Millner and Todd Barlow at Soul Patts have been much better at attracting retail investors than Lindsay Partridge at Brickworks.

Millner, who is executive chairman of Soul Patts and Brickworks, says retail investors like investing in Soul Patts because of its dividend growth and its defensive qualities in times of volatility.

Soul Patts is one of only two companies listed on the ASX that has raised its dividend every year for the past 18 years. The other company is Ramsay Health Care.

'Look through' valuation

Barlow, who is chief executive of Soul Patts, spends a lot of his time speaking to media outlets and brokers reliant on retail investors.

He says that over the past three years Soul Patts has seen a 58 per cent increase in retail investors on its share register from about 12,000 to 19,000.

Millner says Partridge, who is chief executive of Brickworks, will be doing more to attract retail investors.

One of the long-standing criticisms of the Soul Patts/Brickworks shareholding structure has been around its governance including its family control.

But Partridge says the family-owned nature of the business has allowed it to do things other companies could not.

He says the Soul Patts subsidiary New Hope Corporation was able to sit on $1 billion in spare cash for seven years before buying Rio Tinto's 40 per cent ownership in the Bengall coal mine joint venture at the same time coal prices had bottomed.

"Only family companies can do that sort of thing," Partridge said.

Last year, fund manager Perpetual failed in a court action to break up the cross shareholding.

Partridge says that while it is true that Brickworks has now published a "look through" valuation of its investments for the first time, this had nothing to do with the Perpetual court action.

"We are trying to show the inherent value in the group," he says.

Barlow said the market did not seem to have appreciated that about $1 billion in value was added to Soul Patts' investment portfolio in the month of August.

Soul Patts governance

Soul Patts shares were trading at $23.90 on Thursday morning, which is just above the inferred value of net assets of about $22.72. But if you add in the market value increases in August, the inferred value of net assets is $27.22.

Brickworks shares were trading at $16.31 on Thursday morning compared to a value for its inferred assets of $21.66.

If retail investor interest explains the difference in the valuation of the two companies that would fit with the analysis of leading fund manager Peter Cooper from Cooper Investors.

He said in an interview with Livewire earlier this year that Soul Patts is very unpopular with proxy advisers and institutional investors because of its governance.

But he said it is run by independently minded people who invest when values are on offer and are "very conservative and risk-averse when risk is abundant".

by Tony Boyd, AFR, Chanticleer

--- ends ---

Sure, it's over 4 years old (penned in September 2018) but it does explain a fair bit - and I (for one) did find it interesting. I think my online subscription to the AFR is one of the better decisions I've made over the years. I highly recommend it. I think it's costing me $59/month currently, as my cheaper introductory offer has expired and now I'm paying full price, but that only works out to $13.62/week (or $708/year), so it is what it is. I think it's worth it anyway.

23 Sept - Morgans raised to PT $24.00

23 Sept - Citi's raised to PT $28.00

Didn't realise how much of a brick manufacturer it IS NOT.

This is more of a listed investment company with a side gig to help with cashflow.

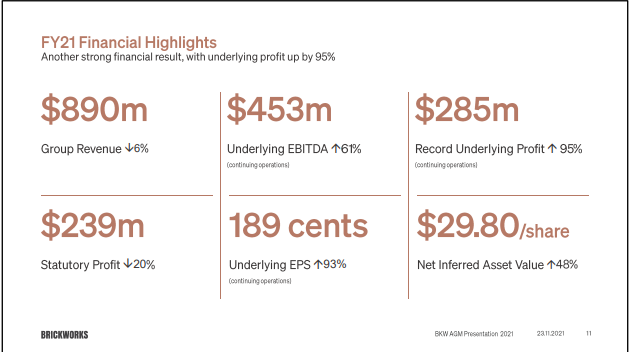

- Record underlying profit up 95%

- P/E of 8.1

From their AGM:

"Revenue of $890 million was down 6%. The decrease was primarily due to land sales revenue recorded last year, and the impact of exchange rate movements on Building Products North America revenue, when reported as Australian dollars.

EBITDA from continuing operations of $453 million, was up 61%, primarily driven by increased earnings from Property, Investments and Building Products Australia.

As the Chairman mentioned, underlying net profit after tax from continuing operations was a record, at $285 million.

This translates to underlying earnings per share of 189 cents.

After including significant items and discontinued operations, the statutory profit was $239 million, down 20% from FY2020, which included a large one-off profit in relation to our shareholding in WHSP."

Australia Post has joined the likes of Amazon, Coles and Woolworths with plans to set up a high-specification property at Oakdale West Industrial Estate in Sydney’s west - a joint venture development from Goodman Group (ASX: GMG) and Brickworks (ASX: BKW).

Larger than the suburb of Pyrmont, Oakdale West at Kemps Creek is a zoned, masterplanapproved fully-serviced site, and is on the doorstep of the Western Sydney Aerotropolis with easy access to the M7 and M4 motorways.

BRICKWORKS DELIVERS SOLID 1H21 RESULT

- Statutory NPAT up 22% to $71 million

- Value of WHSP stake up $720 million during period, currently valued at $2.9 billion1

- Share of Property Trust value increased by a further $50 million to $777 million, strong structural tailwinds

- Building Products Australia EBIT up 60%, with momentum building

- North American earnings down, significantly impacted by the COVID-19 pandemic

- Interim dividend 21 cents per share, 45-year record of maintaining or increasing dividends

- Dividend reinvestment plan terminated

- DISC: I hold...this & SOL were 2 of my COVID buys...first time since I'd been investing that they were cheap enough to buy.

02-Jun-2020: FNN CEO Presentation (with 4 month Trading Update to 31 May)

That's a link to a Company Presentation (including four month Trading Update to 31 May 2020) and additional comments to be given by the MD of BKW at the Finance Network News CEO Showcase today.