plain text link: https://bluglass.com/app/uploads/Annual-Financial-Statements-30-June-2025.pdf

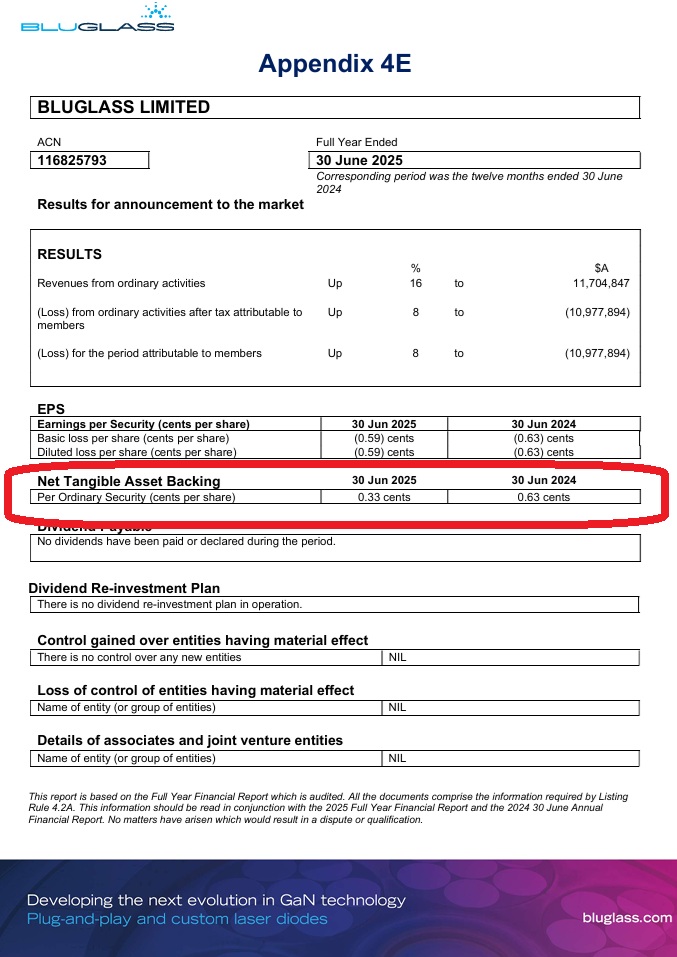

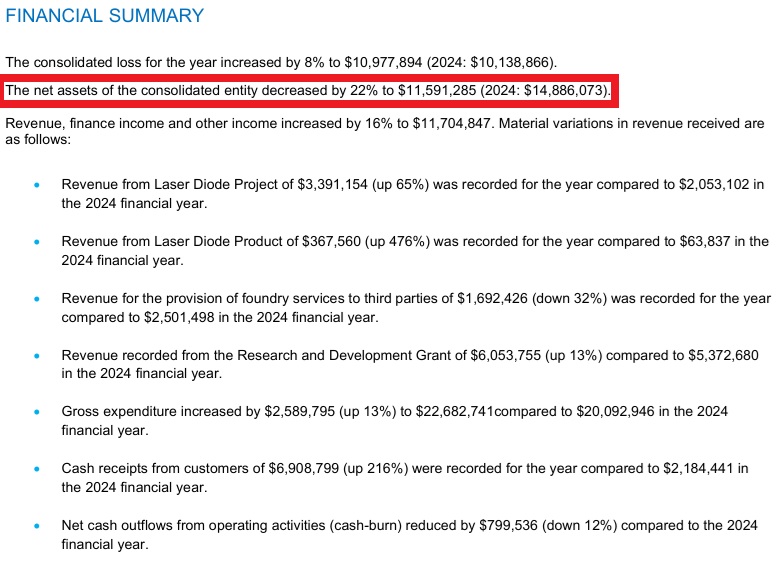

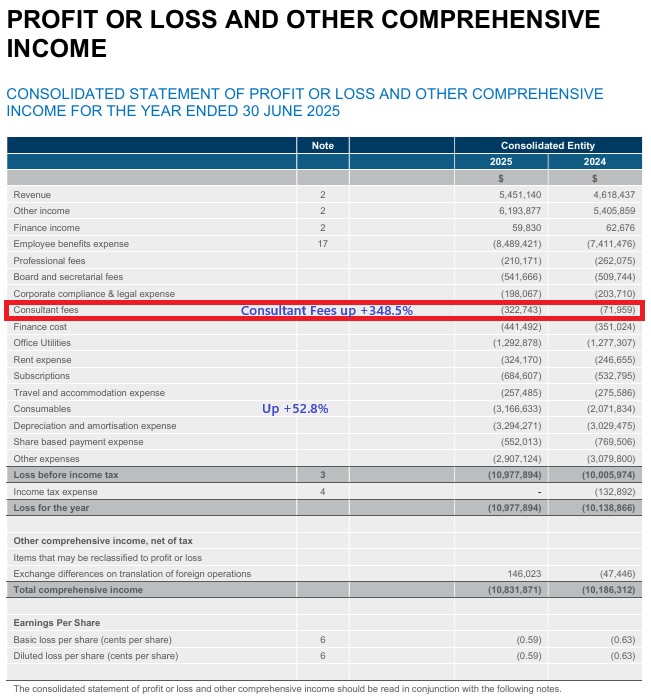

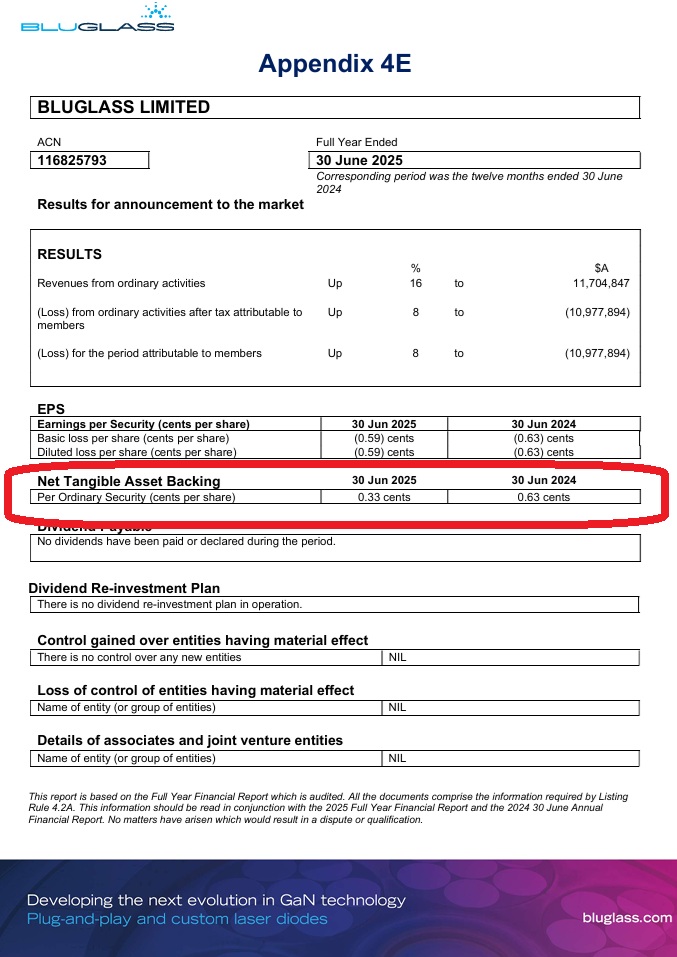

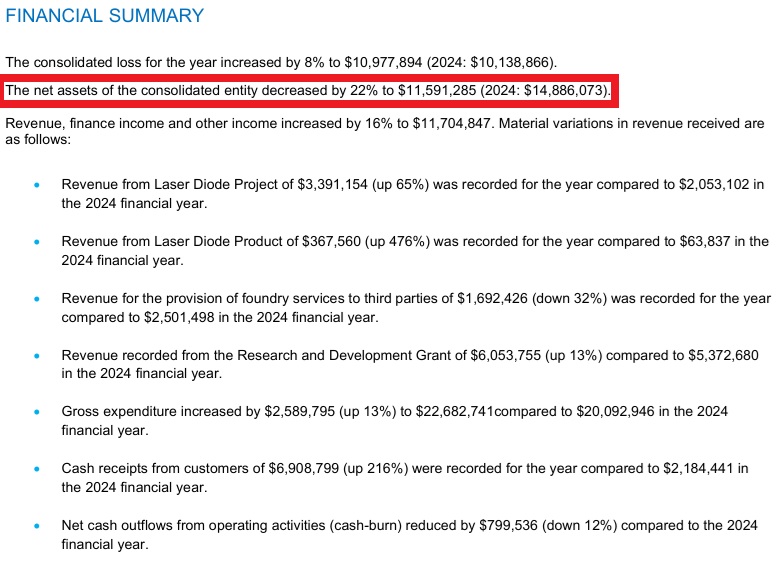

This NTA drop caught my eye:

I don't mind a company in their pre-profit growth phase (when they are earning money but spending more than the earn) posting losses, and I note that their FY25 loss was slightly lower than their FY24 loss, so at least the losses aren't getting worse, but for their NTA to almost halve from 0,63 cps down to 0.33 cps screams "Writedown(s)" to me - so I'll look further.

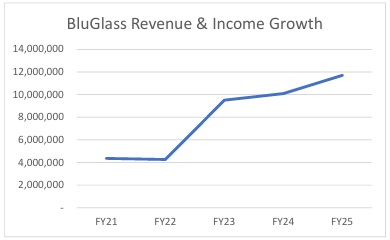

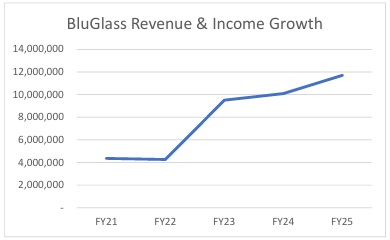

OK, revenue growth is there:

BluGlass strengthened its balance sheet during the year, receiving $5.4 million R&D tax rebate for development activities carried out in Australia and the USA in FY24, and raising $7.6 million to accelerate laser production to fulfil new and existing contracts, implement new fab equipment, and support working capital. The raise comprised a $2.3 million Placement to institutional and sophisticated investors at an issue price of $0.013 per share, and a well supported $5.3 million Share Purchase Plan at $0.00975 per share. Each new share is inclusive of one free attaching option, exercisable at $0.013 and expiring on 31 May 2026 or 30 days from the announcement of a contract win from a Tier-1 company for a total contract value of $3 million. Every attaching option exercised will include an additional piggyback option, exercisable at $0.019 and expiring 31 May 2028.

Hmmm, OK, old news but they're living on R&D tax rebates and CRs - not unusual for a company at their stage - however the options are interesting, half exercisable at $0.013, where they closed today. So another rise of any magnitute, most likely one tenth of one cent when you're trading below 2 cents/share, would see those options "in the money".

Before I go on, I watched the meeting recording with Stef a few days back (here on SM) and she came across as super-impressive in terms of her passion and knowledge about the industry, and the investment proposition that BluGlass is. I even bought a small $3K position yesterday to keep myself interested. I am prepared to add to that when they kick some more goals and my conviction builds - they're fairly low conviction for me at this early stage.

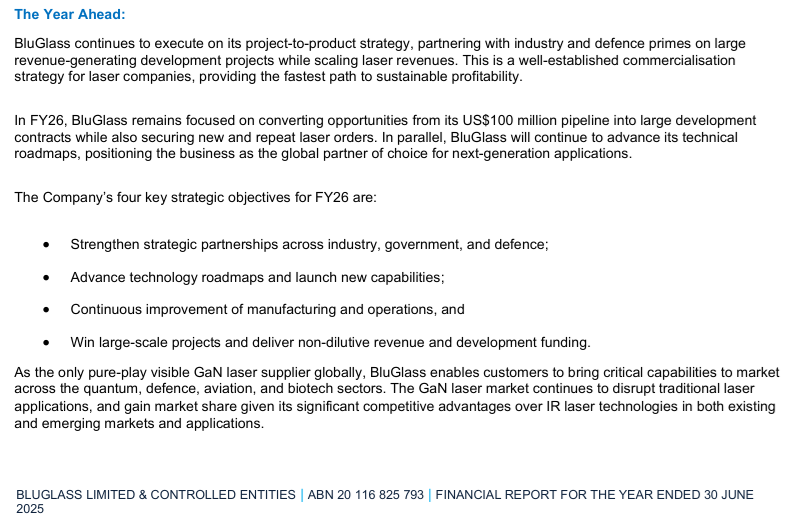

OK, what did they have to say for themselves?

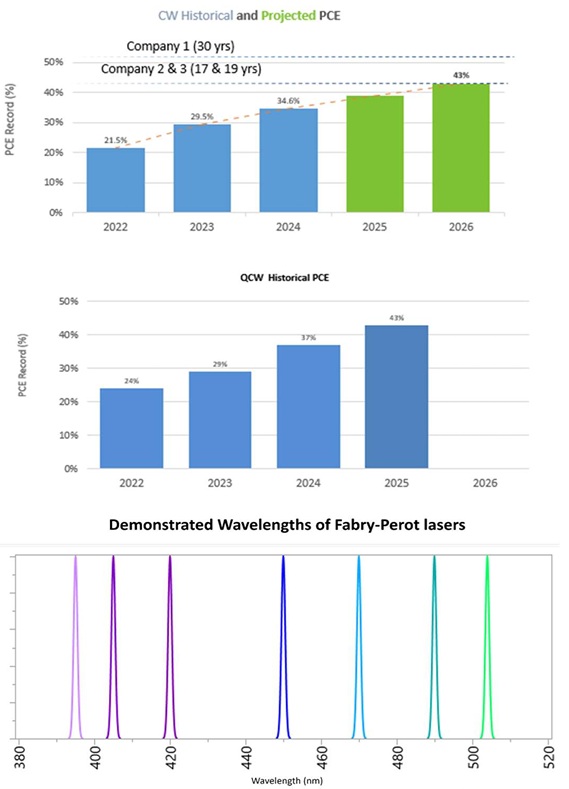

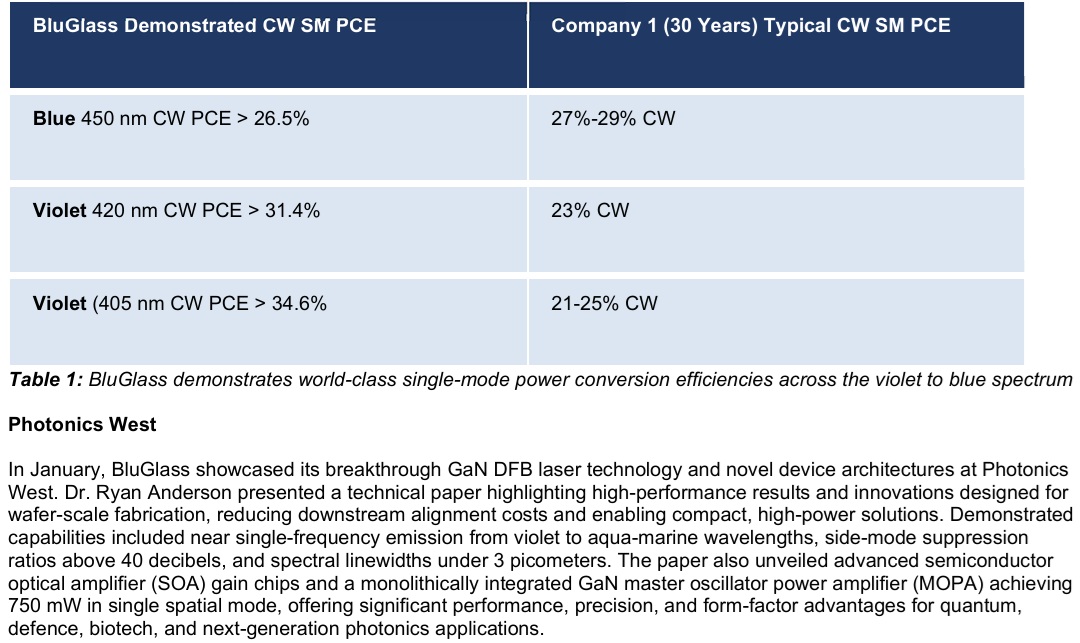

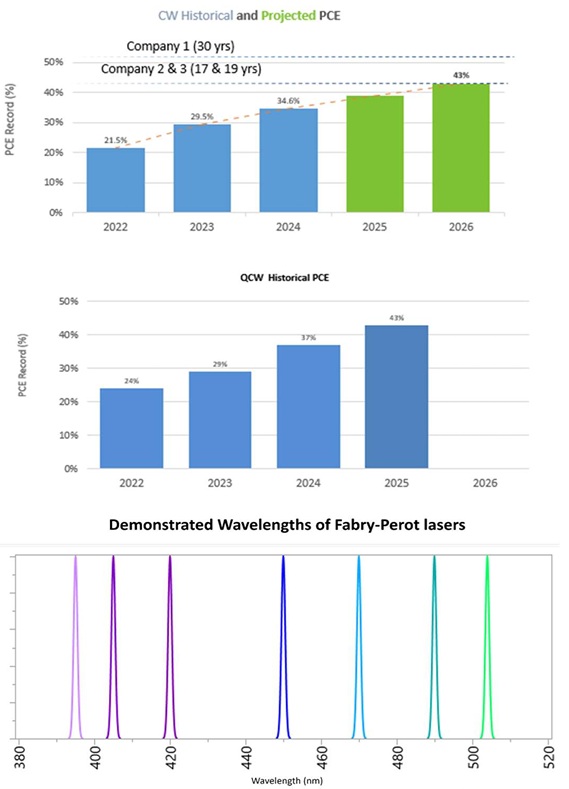

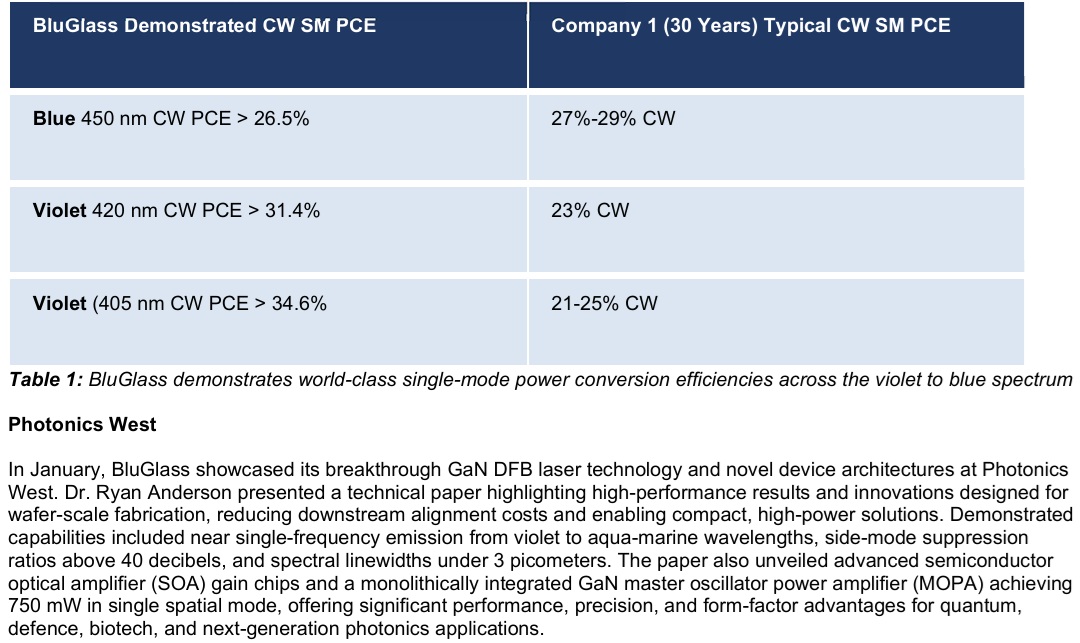

OK, there are only 4 companies in the world that do GaN laser tech, or can build the chips, one or the other, and above BLG are comparing themselves to a much larger global player (right side of the table) and BluGlass (left side of the table above) are doing better in 2 out of 3 of those spectrum colours in the table, which are the smaller wavelength ones between 380 and 420 nm.

Stef had me sold with the recent SM meeting/presso on their potential. It's all about whether they can execute now and exploit their competitive advantages, whch as I understand it are being smaller, more nimble, more able to customise solutions to suit customers that are too small for the majors, and having their own end-to-end supply chain - all done in-house - design and build and install - all covered by multiple global patents, without having to outsource any part of it to anyone else.

[Please correct me if I get any of this stuff wrong or sound like I lack proper understanding of it]

This is not within my wheelhouse, but I'm giving it a go.

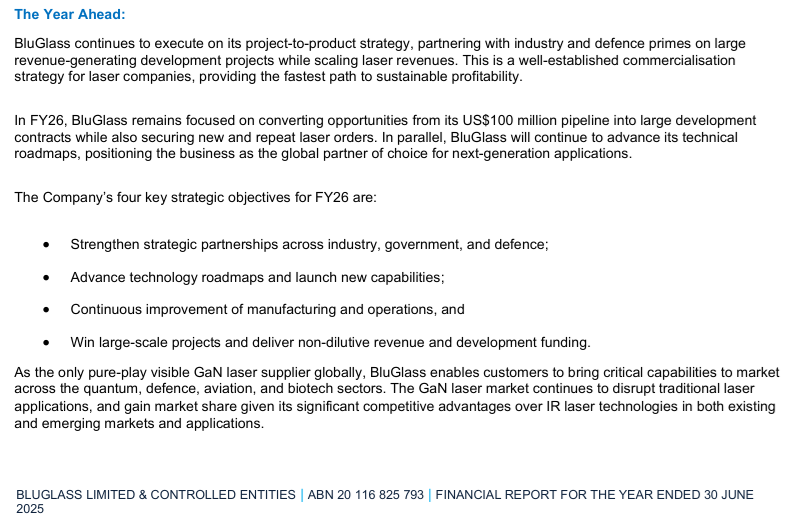

Outlook Statements:

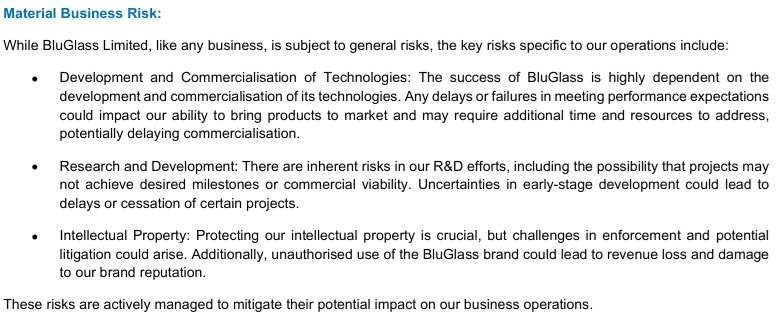

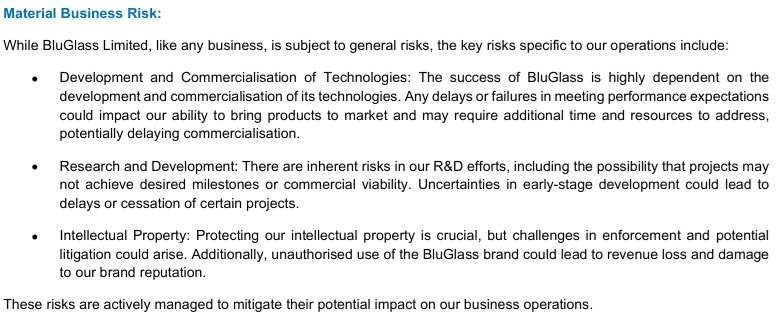

Risks:

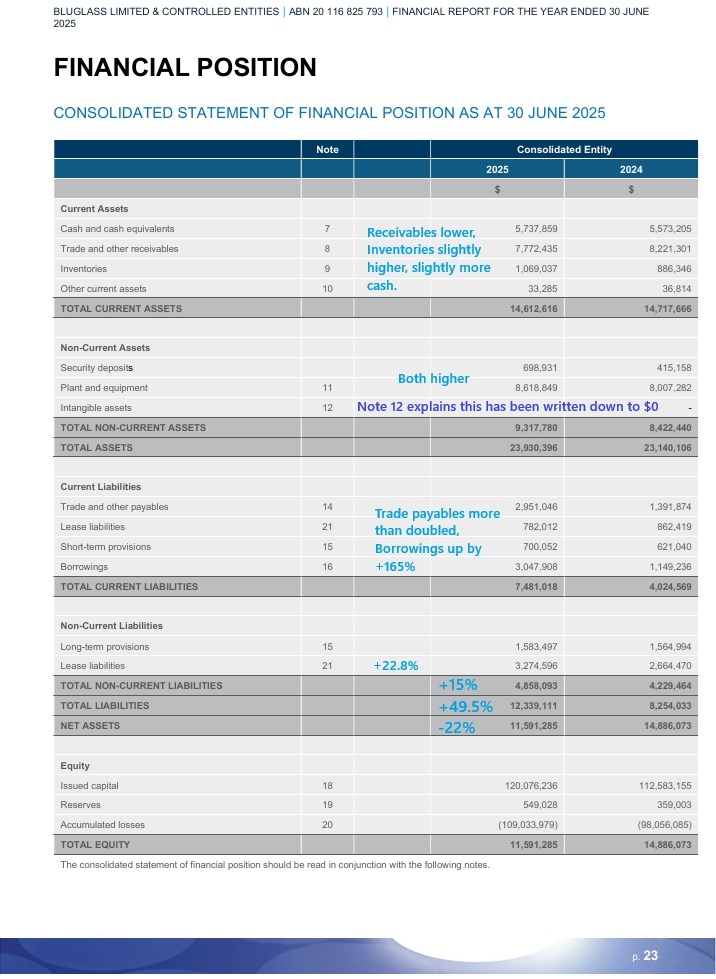

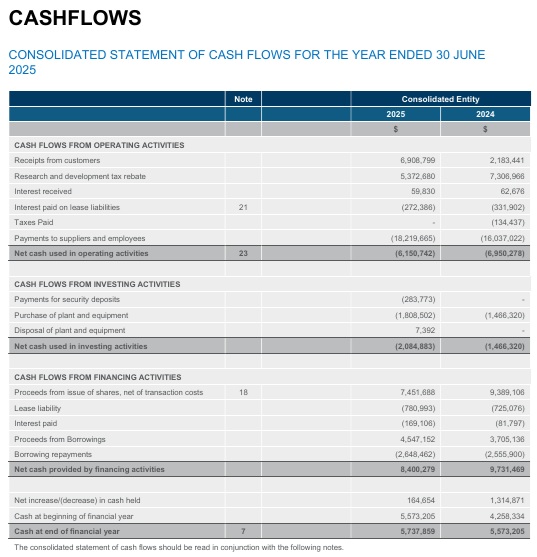

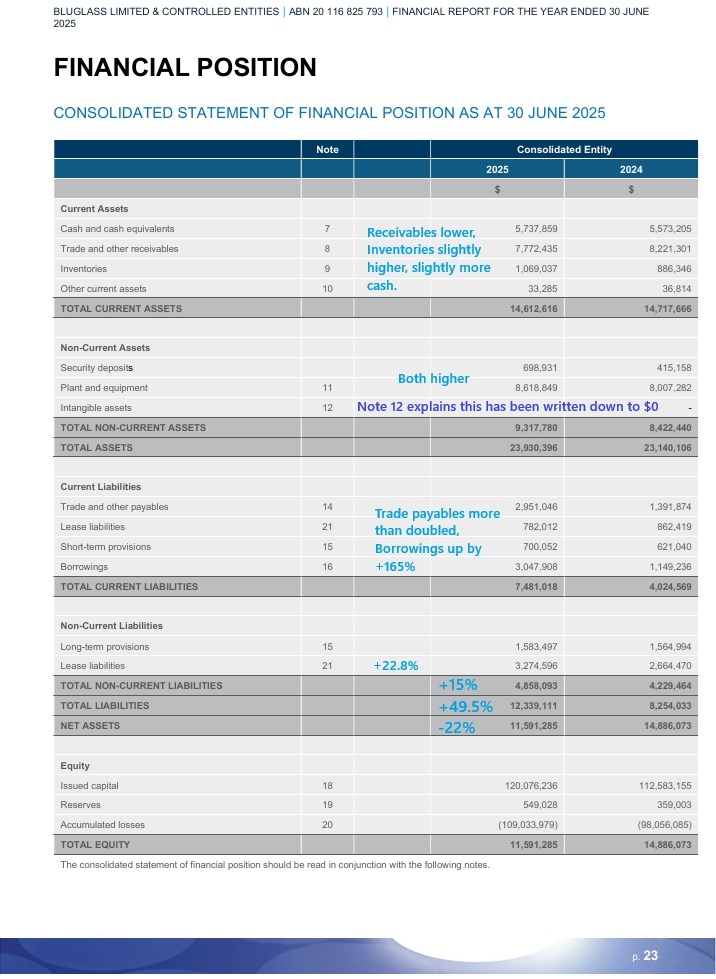

Financials:

That +165% increase in borrowings is possibly an orange glag when combined with their NTA halving from $0.0063/share to $0.0033/share. I know we're buying into these sort of companies for their future growth potential rather than their current book value, but both of those items are certainly worthy of note.

As is the +50% increase in total liabilities, with $7,481,018 of their $12,339,111 total liabilities being CURRENT liabilities.

To put that another way, 60.6% of their total liabilities are current liabilities and that 60.6% represents $7.5 million when the company's entire market cap is around $30 million.

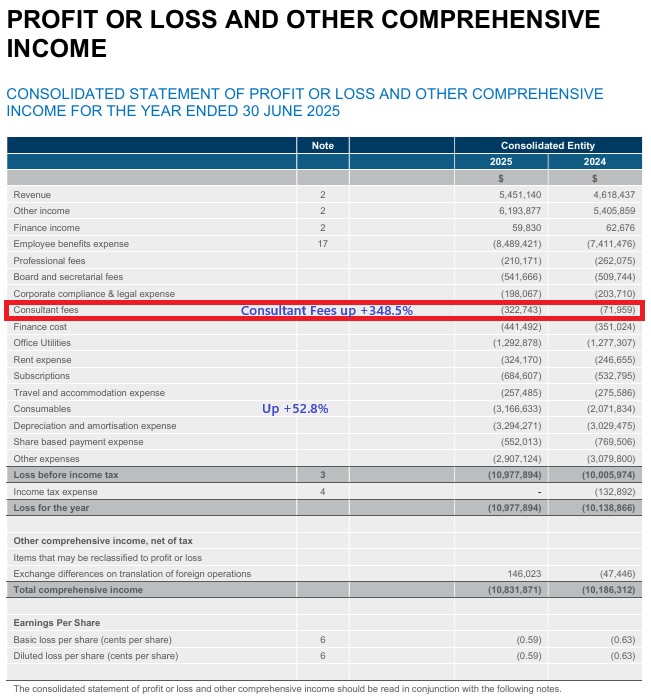

Those consultancy fees being up +348% is a bit of an orange flag. Hope they delivered some value!

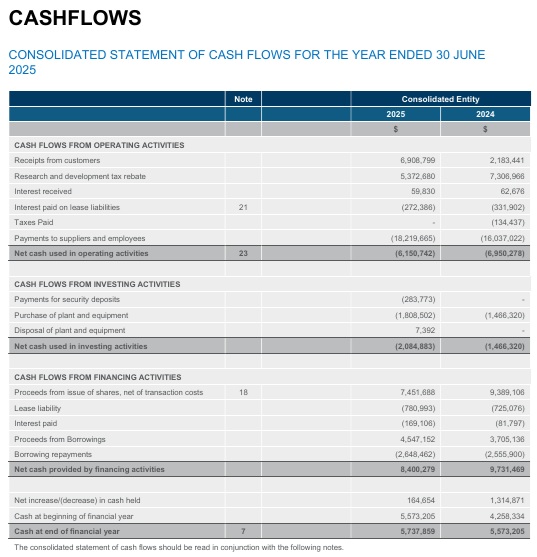

Cashflows look OK for a company at this stage of their growth, i.e. struggling to gain traction but making some inroads into their TAM. Well they look OK compared to FY24 anyway.

They did close up +8.33% today, but that needs to be considered in the context that +8.33% is the SMALLEST amount they could rise by when their share price closed yesterday at $0.012. They rose one tenth of one cent today to $0.013, which is what I bought my small real-money position for yesterday.

They are clearly lightly traded, i.e. low liquidity, with only $75K worth of shares changing hands today, being a total of 45 trades for the whole day. You can't buy them here on SM because they're trading at below 2 cents/share, and that's probably a good thing.

Some CRs to come before this one takes off and shoots to the moon methinks... It won't happen overnight...

Discl: Held (small speculative position).