Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

2nd October 2025: BluGlass is up +40% so far today, and there's significant volume building on the buy side:

I imagine they're too small for broker coverage, so I'm thinking it's not a broker upgrade. They did release their annual report on Monday (29th Sept) along with this: BluGlass-to-host-Semiconductor-Australia-2025.PDF

Any thoughts on this move @Clio ?

I have a small ($5K) position in this one to keep me interested because I think they have huge potential - but could also go broke hence my tiny weighting to them at this point. My first thought was that it's just the types of moves you get with companies trading at under 2 cents per share, but then I noticed the volume build on the left side and that there were buyers chasing 81 million BLG shares and less than 16 million on the sell side, so I'm thinking they may have bottomed for now?

The biggest issue with a company this small is getting people to notice them at all, and I do note that despite their SP rising +40% today, that's been (so far) on less than $245 K worth of BLG shares changing hands, so it's a big move on low volume, due to low liquidity, due to them being a nanocap that nobody's heard of I guess.

They were always going to be volatile but +40% in 4 hours made me take some notice.

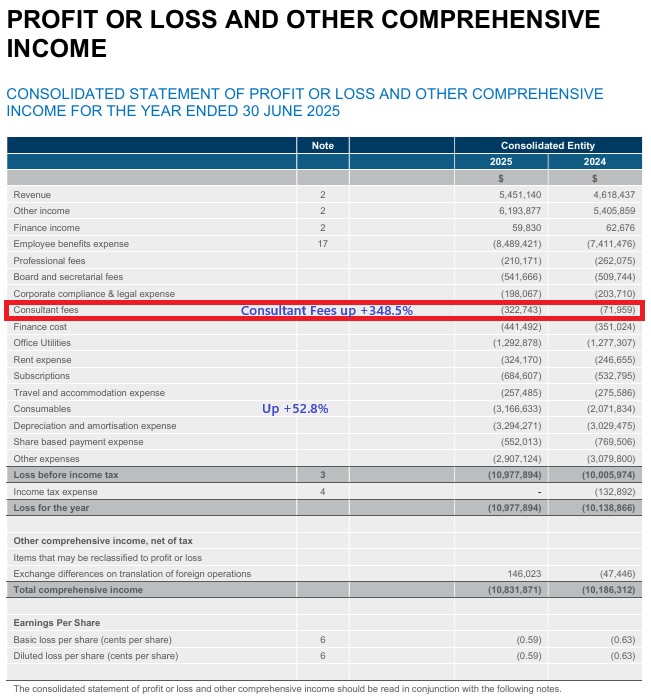

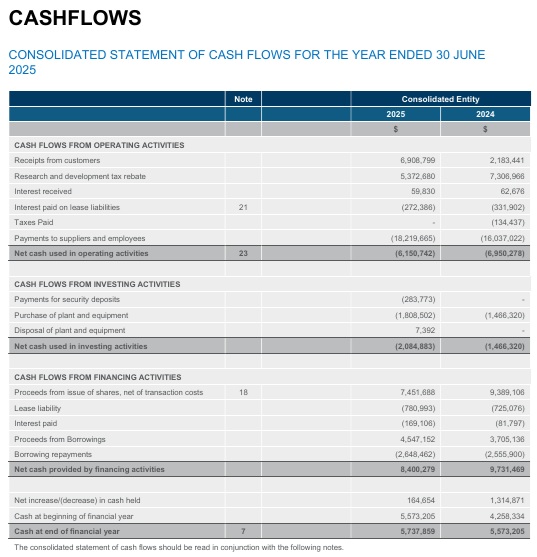

27th August 2025: Appendix 4E and 2025 Annual Report

plain text link: https://bluglass.com/app/uploads/Annual-Financial-Statements-30-June-2025.pdf

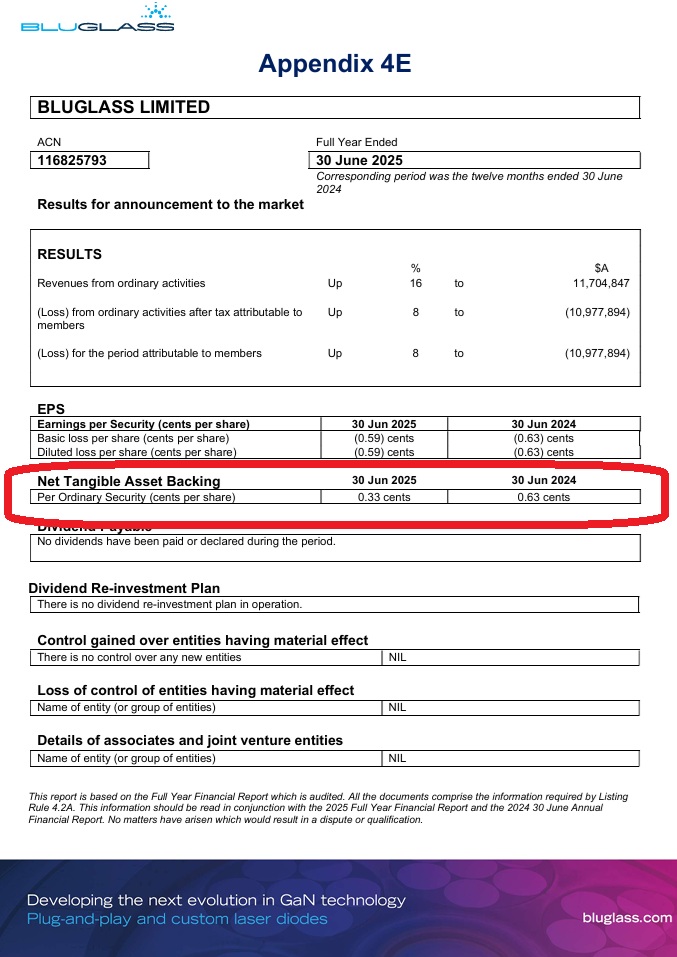

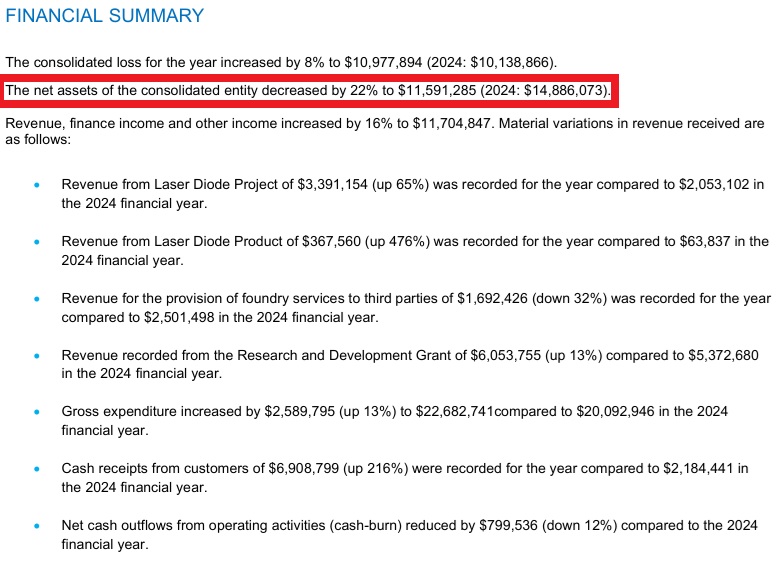

This NTA drop caught my eye:

I don't mind a company in their pre-profit growth phase (when they are earning money but spending more than the earn) posting losses, and I note that their FY25 loss was slightly lower than their FY24 loss, so at least the losses aren't getting worse, but for their NTA to almost halve from 0,63 cps down to 0.33 cps screams "Writedown(s)" to me - so I'll look further.

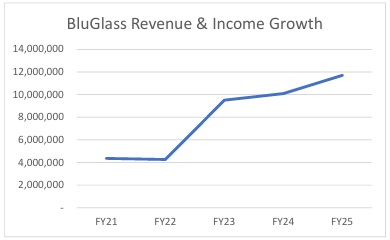

OK, revenue growth is there:

BluGlass strengthened its balance sheet during the year, receiving $5.4 million R&D tax rebate for development activities carried out in Australia and the USA in FY24, and raising $7.6 million to accelerate laser production to fulfil new and existing contracts, implement new fab equipment, and support working capital. The raise comprised a $2.3 million Placement to institutional and sophisticated investors at an issue price of $0.013 per share, and a well supported $5.3 million Share Purchase Plan at $0.00975 per share. Each new share is inclusive of one free attaching option, exercisable at $0.013 and expiring on 31 May 2026 or 30 days from the announcement of a contract win from a Tier-1 company for a total contract value of $3 million. Every attaching option exercised will include an additional piggyback option, exercisable at $0.019 and expiring 31 May 2028.

Hmmm, OK, old news but they're living on R&D tax rebates and CRs - not unusual for a company at their stage - however the options are interesting, half exercisable at $0.013, where they closed today. So another rise of any magnitute, most likely one tenth of one cent when you're trading below 2 cents/share, would see those options "in the money".

Before I go on, I watched the meeting recording with Stef a few days back (here on SM) and she came across as super-impressive in terms of her passion and knowledge about the industry, and the investment proposition that BluGlass is. I even bought a small $3K position yesterday to keep myself interested. I am prepared to add to that when they kick some more goals and my conviction builds - they're fairly low conviction for me at this early stage.

OK, what did they have to say for themselves?

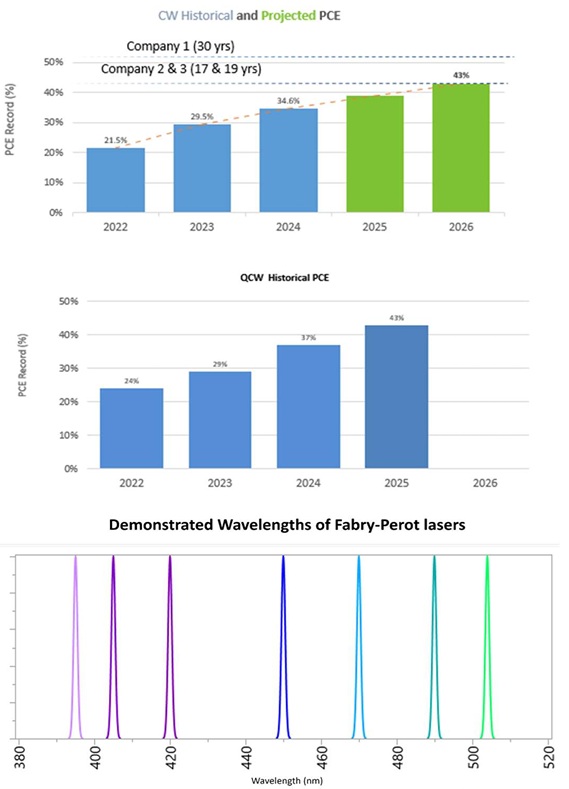

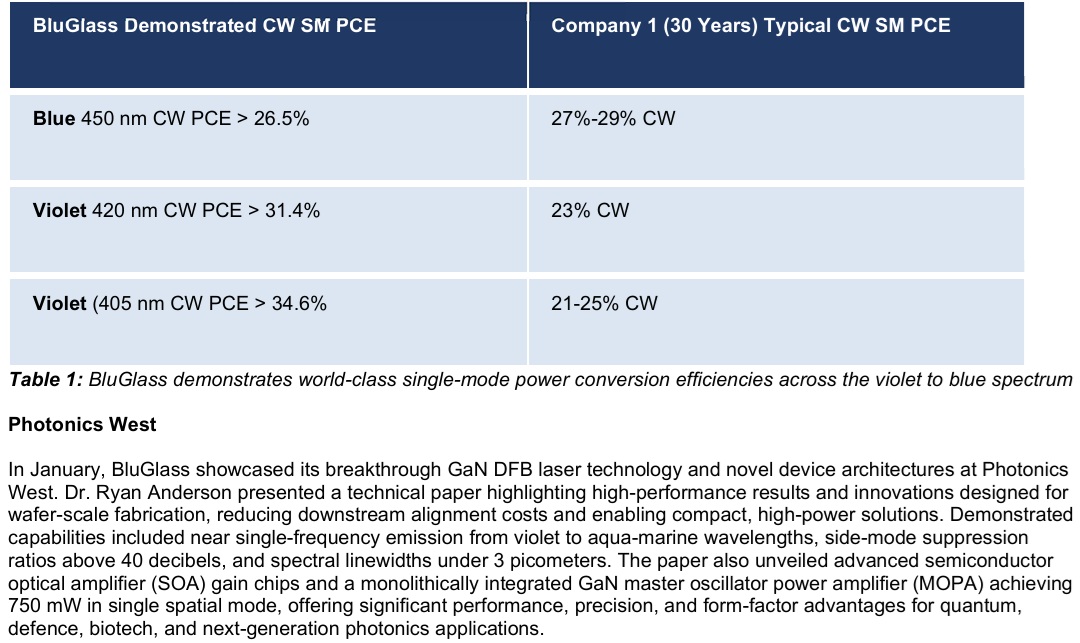

OK, there are only 4 companies in the world that do GaN laser tech, or can build the chips, one or the other, and above BLG are comparing themselves to a much larger global player (right side of the table) and BluGlass (left side of the table above) are doing better in 2 out of 3 of those spectrum colours in the table, which are the smaller wavelength ones between 380 and 420 nm.

Stef had me sold with the recent SM meeting/presso on their potential. It's all about whether they can execute now and exploit their competitive advantages, whch as I understand it are being smaller, more nimble, more able to customise solutions to suit customers that are too small for the majors, and having their own end-to-end supply chain - all done in-house - design and build and install - all covered by multiple global patents, without having to outsource any part of it to anyone else.

[Please correct me if I get any of this stuff wrong or sound like I lack proper understanding of it]

This is not within my wheelhouse, but I'm giving it a go.

Outlook Statements:

Risks:

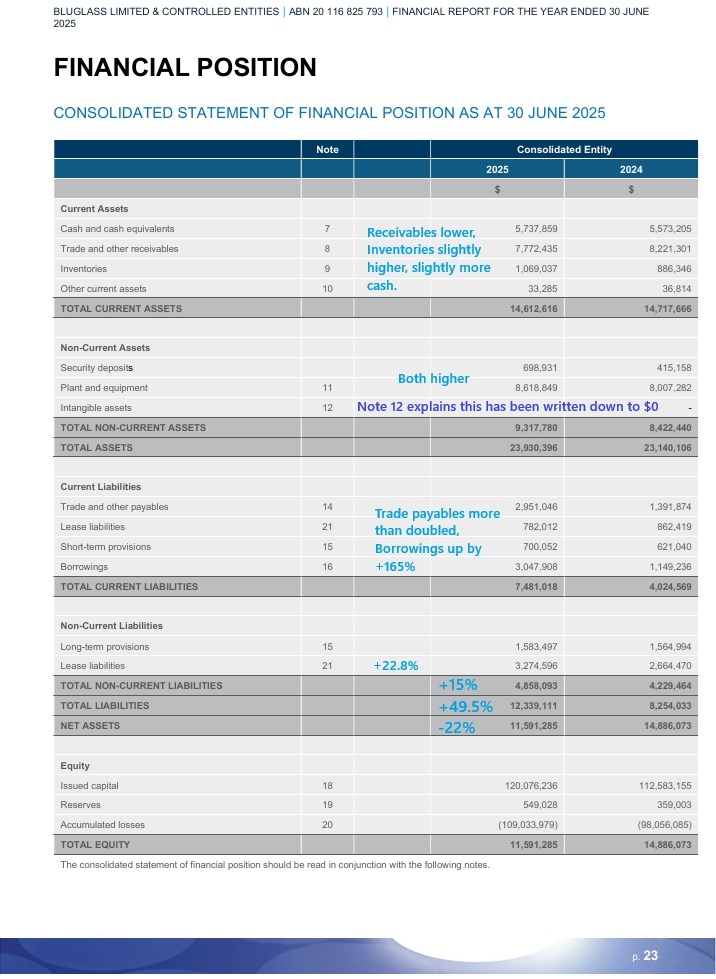

Financials:

That +165% increase in borrowings is possibly an orange glag when combined with their NTA halving from $0.0063/share to $0.0033/share. I know we're buying into these sort of companies for their future growth potential rather than their current book value, but both of those items are certainly worthy of note.

As is the +50% increase in total liabilities, with $7,481,018 of their $12,339,111 total liabilities being CURRENT liabilities.

To put that another way, 60.6% of their total liabilities are current liabilities and that 60.6% represents $7.5 million when the company's entire market cap is around $30 million.

Those consultancy fees being up +348% is a bit of an orange flag. Hope they delivered some value!

Cashflows look OK for a company at this stage of their growth, i.e. struggling to gain traction but making some inroads into their TAM. Well they look OK compared to FY24 anyway.

They did close up +8.33% today, but that needs to be considered in the context that +8.33% is the SMALLEST amount they could rise by when their share price closed yesterday at $0.012. They rose one tenth of one cent today to $0.013, which is what I bought my small real-money position for yesterday.

They are clearly lightly traded, i.e. low liquidity, with only $75K worth of shares changing hands today, being a total of 45 trades for the whole day. You can't buy them here on SM because they're trading at below 2 cents/share, and that's probably a good thing.

Some CRs to come before this one takes off and shoots to the moon methinks... It won't happen overnight...

Discl: Held (small speculative position).

Here's the transcript from today's interview: BluGlass Transcript.pdf, and the recording is up on the Meetings page.

First off, apologies to @Clio and others as I forgot to ask the questions you submitted!! I've emailed Stef and she'll get back to me with answers to your questions ASAP.

My 2 sats worth:

Super interesting tech, and it's encouraging they are generating a bit of revenue and seem to have a decent pipeline of opportunities. Also good to know that there's no necessary CAPEX at this stage, and the cost base seems to be largely set for the foreseeable future. They have capacity to support $160m annual revenue, so lots of capacity.

All that being said, they will almost certainly run out of cash and you can expect a good number of capital raises before they are able to stand on their own feet. That's not necessarily a problem if they get anywhere close to their ambitions, but we know things tend to take longer and cost more than what people tend to think, and lots of potential goes unfulfilled. Business is tough, and cutting edge tech in a field with massive and dominant players is especially so.

So huge upside, but loads of risk -- at least at this early stage.

here's a chatGPT5 summary of the meeting:

Summary

- Who: Andrew interviewing Stef Winwood (Blueglass, ASX: BLG).

- What: Overview of Blueglass’ gallium nitride (GaN) semiconductor lasers, status update on commercial traction, manufacturing, and funding.

- Why GaN: Higher efficiency, smaller form factor, better thermal performance and durability versus many incumbent laser materials; enables compact, high-power devices.

- Use cases: Quantum computing, defense, industrial manufacturing/processing, scientific and sensing applications.

Commercial & Strategy

- Model: Leaning to a foundry/partnering approach with OEMs and primes rather than going it alone on every vertical.

- Traction: Recent commercial contracts signed; customer engagement across defense and quantum; qualification cycles under way.

- Capacity: Current production footprint in place; expansion considered if contract volume ramps.

- Differentiation: Device performance and reliability from GaN process know-how; positioning as an enabler for partners’ end products.

Financial & Capital

- Cash/Runway: Discussed current cash position and expected inflows (including Australian R&D rebate). Last capital raise referenced.

- Use of funds: Scale manufacturing, customer qualifications, and engineering to meet near-term contracts.

Risks & Constraints

- Customer qualification timelines can be long (especially defense).

- Execution risk moving from prototypes to volume.

- Capex/scale decisions tied to visibility on orders.

Near-term Focus

- Complete customer qualifications and convert pilots to volume orders.

- Deepen OEM partnerships in priority verticals.

- Prepare manufacturing scale-up playbook contingent on demand.

Open Questions (flagged or implied)

- Expected timelines from current evaluations to revenue shipments.

- How far Blueglass will integrate vs stay a specialist supplier.

- Trigger points for capacity expansion and associated capex.

- Longer-term gross margin ambition once at scale.

We have a meeting with BLG (Investor Relations person Stefanie Winwood) on Wednesday. I’ve owned BLG since March 23, which was before I started paying lots more attention to what I was buying. So yes, I’m well underwater, but whenever I’ve looked again at the company, intending to sell, I’ve come away feeling that’s it’s worth holding just to see what comes. I.e. they have been progressing in what, I judge, for their niche, is a reasonable way.

For those unfamiliar with the company, in their own words, “BLG is the world’s first pure-play gallium nitride (GaN) laser company supplying to the global photonics industry. GaN lasers are advanced semiconductor devices essential to the function of a wide variety of applications, including advanced manufacturing, defense, aerospace, navigation, automotive, AR/VR displays 3-D printing, bio-medical devices, quantum sensing and computing, and more.”

They currently supply to the global photonics industry - industrial, defense, biomedical and scientific. Current estimate of the global GaN laser serviceable market is $2B.

Products - cutting-edge custom laser diode development and manufacturing, from small batch custom lasers to medium and high-volume off the shelf products.

The company produces GaN lasers using patented technology at two foundries they operate - one in Silverwater, Sydney, and the other in Silicon Valley.

Their “proprietary low-temperature, low-hydrogen, remote plasma chemical vapor deposition (RPCVD) manufacturing technology and novel device architecture are internationally recognized and provides the potential to create brighter, better-performing lasers to power the devices of tomorrow.”

They partner with companies to design and supply lasers for those companies’ specific needs.

Current partners:

- CLAWS hub at North Carolina State University- US Defense Dept Microelectronics Commons project

- Applied Energetics - MoU developing advanced laser systems for military and communications

- Uviquity (US-Venture Cap backed startup) - joint development agreement for novel photonic chips

- UC Santa Barbara Solid State Lighting and Energy Electronics Consortium

- Macquarie University & Aurizn (Defense Co) - Ocean temp mapping LiDAR

- Uni Central Florida College of Optics and Photonics

- Indian Govt DoD Solid State Physics Lab

I’ve looked through all their announcements back to 4Qtr FY24 to get the above, and the best summation is the presentation they put out in May 25 for their CR.

https://bluglass.com/app/uploads/FOR-RELEASE-BluGlass-BLG-Capital-Raising-Presentation-April-2025-vF-1.pdf

Most of what you need to know about the company as it is today is there, reasonably clearly communicated.

Financially: over the past 3+ years

Revenues (from customer receipts) have been steadily increasing

EPS loss has been steadily decreasing (but still in loss)

LT debt steadily decreasing

Shareholder Equity steadily increasing.

End of FY24 equity was 86%

Over the last year, their expansion in staff costs appears to have flattened. I.e. staff costs are reasonably stable and not increasing dramatically.

What I am not clear on:

1) Ga supply - 31/12/24 Dec Qtr update noted they were not affected by China blocking Ga exports. No short term impact. They say they source from Japan and US. My suspicion is both those sources are stockpiles. US has no domestic Ga supply, and I don’t think Japan has either.

[Without Ga, BLG have no business, so do they have contingency plan(s) for supply?]

2. Page 23 of the CR presentation mentions 26 project opportunities (USD 90 - 100M in value) at various stages of engagement, negotiations that might take months or years to mature and not all will result in revenue-generating contracts. Have any of these firmed to contracts?

3. Can current staff and facilities meet the hoped-for escalation in demand? Or does BLG expect they will need to add capacity to meet the projects in the pipeline for FY26 - FY29?

In my view, Pt1 above is the biggest risk (existential) to the business. Pt2 and Pt3 will signal how far away the point of turning profitable lies.

I’ll put the questions into the meeting SLIDO and see what we learn!

Global semiconductor developer BluGlass Limited (ASX: BLG) invites shareholders to attend an interactive virtual group briefing with BluGlass management, on Tuesday 27 February 2024 at 11.00am AEDT.

Hosted by Automic Group, CEO Jim Haden and Chair James Walker will provide an update on BluGlass' Q3 FY24 activities, Photonics West, customer engagement, and its recent capital raise.

Investors are invited to email questions through to [email protected] by Thursday 22 February to provide the best opportunity to address the maximum number of shareholder questions on the call.

Attendance is free; however, registration is required. Register to attend at: https://us02web.zoom.us/webinar/register/WN_eJWhARG1Rg-Puz0X21VM7w