Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Inspired by @reddogaustin I decided to give Claude Opus 4.5 ( I get access through doing some AI training work for Outlier AI) the most recent announcements from BML and ask for the likelihood of achieving a positive FID.

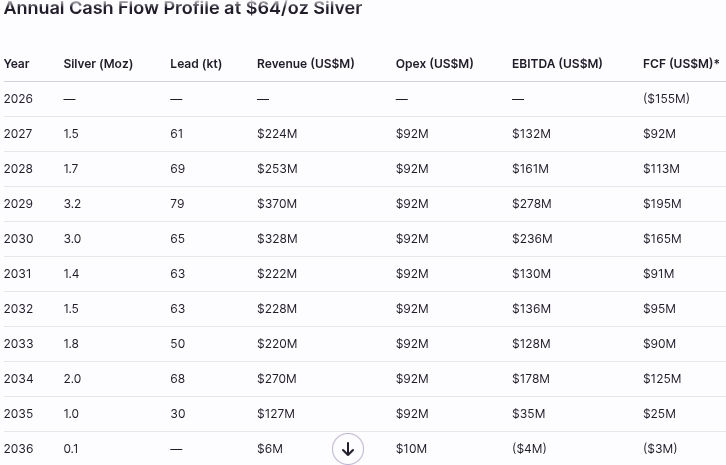

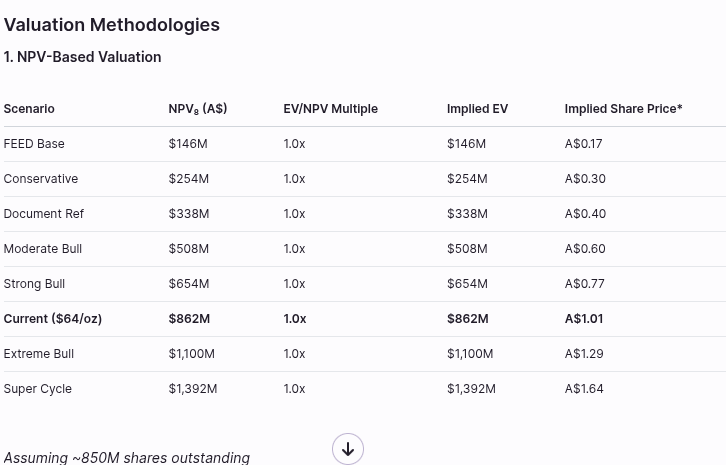

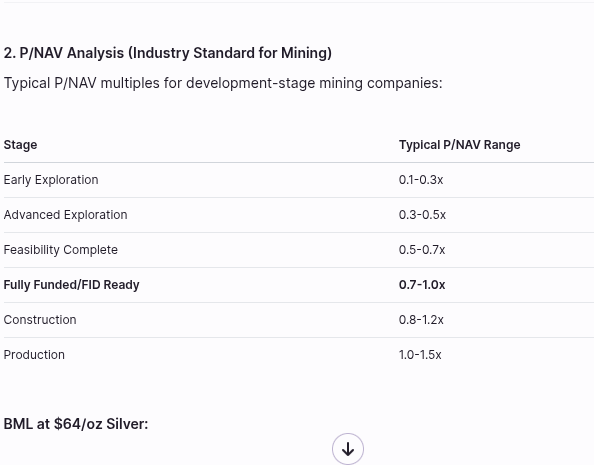

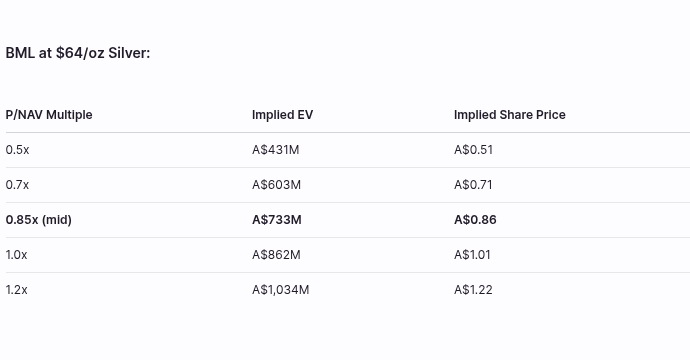

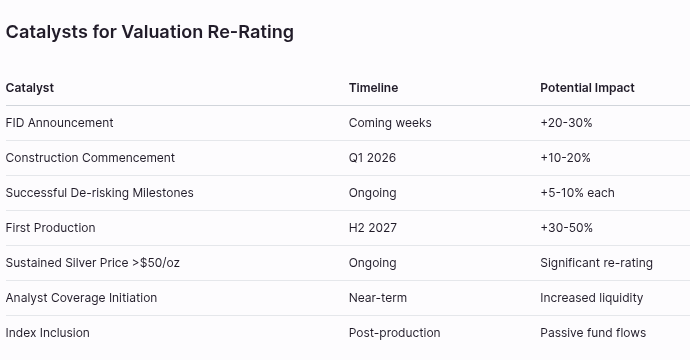

The silver price has popped lately and I asked it to review some data based on the current value.

It then prompted me (I particularly liked this aspect) as to whether I would like it to complete the following:

Model detailed cash flow scenarios at various silver prices?

Analyze potential valuation implications for BML shares?

Assess risks if silver prices retreat from these levels?

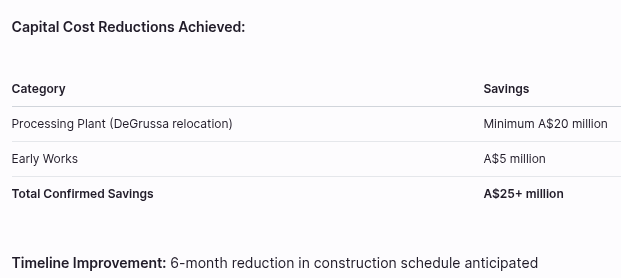

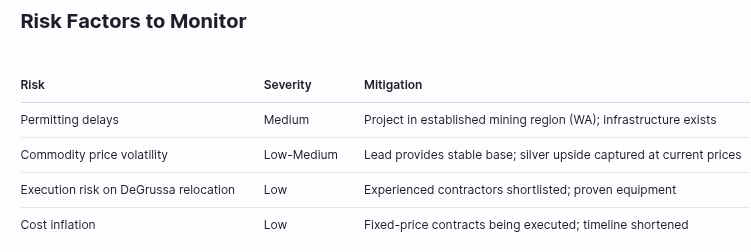

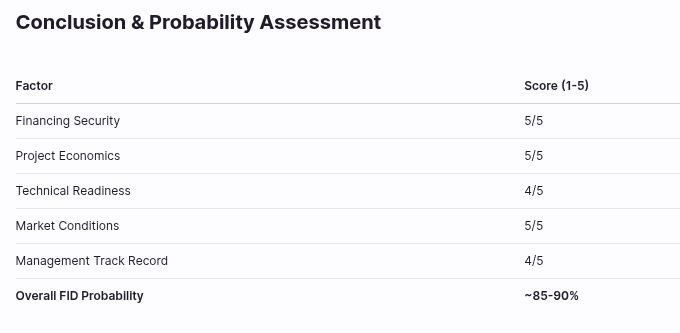

The response was very long and detailed and I have not checked the calculations yet but I have taken a few screenshots of some interesting sections. Downside was that the response when copied lost the formatting hence the screenshots.

Lots to check and consider but does support my participation in the SPP @40c.

As a learning tool the model's suggestions and processes are awesome in getting a better understanding of higher level analysis of a company rather than the summarising of announcements that I currently complete.

Increasing silver price and silver and lead being listed as critical minerasl in the US has finally brought some attention to BML with a good boost in the SP.

If the FID comes in this half as forecast could see a rerate.

"Potash, silicon, copper, silver, rhenium and lead were recommended for inclusion to the list"

Latest corporate presentation released. Focus now looking at the silver price which was originally a bonus on top of the major resource which is lead. However lead price has not gone anywhere but silver has appreciated.

I had just about given up on this project but there has been two recent announcements and a possible FID by 2nd half 25. I won't hold my breath.

Still going to need additional funding to get to production. Held in RL and SM

"A Near-Term Producer with a Margin Highly Leveraged to the Silver Price"

Concentrate Offtake awarded and Binding US$30M Prepayment Term Sheet executed with Trafigura

High-Quality used Processing Plant secured from Sandfire Resources DeGrussa project

Engagement with additional debt Financiers ongoing

Targeting a Final Investment Decision H2 2025

Acquisition Terms Total price of A$10M, comprising:

Deposit: A$0.5M cash and A$1.0M shares issued to Sandfire Resources

Tranche 1 Payment: A$6.0M paid upon completion (incl. Final Investment Decision) and funded from proceeds of the Sorby Hills construction equity raise.

Tranche 2 Payment: A$2.5M paid within 12 months of first sale of concentrate from the Sorby Hills Project.

All major components for the Sorby Hills Process Plant have been secured via the DeGrussa Process Plant acquisition

Fit for purpose specifications to deliver the targeted 2.25Mtpa throughput with minimal changes

Extensive list of new spares included in the acquisition.

Boab to commence a competitive tender to price the relocation, reconstruction and refurbishment ahead of FID.

Terms of the Agreement with Trafigura

Binding Prepayment Term Sheet • US$30M for the development and construction of Sorby Hills.

5 Year Term, 18 Month Repayment Grace Period. • Interest Rate of Term SOFR + 5%.

Repaid via monthly instalments following the Grace Period. Binding Offtake Agreement

75% of the lead-silver Concentrate produced at Sorby Hills.

Minimum Quantity of 531kt (~7 years based on the FEED Study).

Market standard metal pricing and metal payabilities.

Ability for Boab to scale back Offtake Percentage and Minimum Quantity should the Prepayment Facility not proceed or Boab’s sources alternative financing.

Clearly BML is struggling to gain financing in the current environment. This update explains how they are looking at improvements to get it over the line. Looks like there will be no change till early 24 so expect SP to fall further. Claiming no CR needed.

On the back of the DFS, Boab ramped up engagement with potential Project financiers including Commercial Banks, Government Agencies, and specialist mining Credit Funds. Discussions with these parties have highlighted the funding challenge facing junior project developers in a high inflation environment and provided Boab with a clear focus to further optimise the Project.

The Company is currently working through the completion, documentation and modelling of the Project optimisation exercise and intends to deliver the results via a Sorby Hills FEED Study to be released to the market in Q1 2024.

The Company retains a cash balance of over A$3 million and is sufficiently funded to complete the ongoing optimisation

Boab Managing Director and CEO, Simon Noon, stated:

“Securing funding for projects in general has been tough within the current economic environment. Boab and Sorby Hills have not been immune from this challenge.

Whilst progress with financiers has not advanced as quickly as we had hoped, the feedback we have received has provided the Company with an opportunity to execute opportunities to enhance economic outcomes and shareholder value.”

SP has had a significant recovery following a couple of commissioned broker reports with a price target of 75c+ almost 3x current SP. Suggesting a raise at 35c. Received a speeding ticket from ASX. Investor presentation still suggesting offtake agreements and FID Q3.

Held in RL and SM

BML pumping up the resource with assays from the latest drilling with more to come before the DFS.The headline is strong but the detail more vague.

Phase VI Assay Results Confirm Impressive Grades.

Encouraging drilling results from the Beta Deposit confirm the current mineralisation model and open the prospect for mineralisation extensions.

The most recent Mineral Resource estimate highlighted high-grade zones of mineralisation in the northeast portion of the Norton Deposit that are not included in the Sorby Hills mining inventory (Figure 1). Boab took the view that tighter drill hole spacing in this area may bridge the interpreted continuity gap in the high-grade zone and may enable its inclusion in the future mine plan.

SHRC_143 delivered a significant intercept that can contribute positively to the reserves revision. The significance of the results will depend on the results from the outstanding drill holes completed in the area.

A total of approximately 1,700 drill samples were submitted to Intertek Laboratories in Darwin of which about 65% have been analysed for a broad spectrum of element analysis including Lead, Silver and Zinc.

Further assay results from phase VI drilling expected early in the New Year.

We look forward to providing updates from the remaining samples.”

3Q of funding left, no update on DFS completion date but competitive contract tenders completed. Previous announcement gave a DFS in H2 22 and finalising offtake agreements after. CR to come when that happens.

Drilling of the deep Keep Seismic Target has been postponed to 2023. A total of approximately 1,700 drill samples have been submitted to Intertek Laboratories in Darwin for a broad spectrum of element analysis including Lead, Silver and Zinc.

“The quarter has seen Boab continue to focus on the delivery of project execution workstreams. Securing the camp, and the amendment to the EPA Approval, are both key enablers for the Project. Furthermore, completion of competitive contract tenders sees the company well positioned to rapidly ramp up construction upon a Decision to Mine and, where appropriate, bring forward targeted elements of early works, detailed design and procurement. We are now looking forward to completing our Definitive Feasibility Study and finalising Offtake and Financing workstreams.”

Start of Sorby Hills construction goes to tender

Amendments to the Sorby Hills EPA Approval have been received, a key regulatory prerequisite for the commencement of Site Establishment and Early Works including:

o establishment of all-weather access to the Project;

o development of a materials laydown and hardstand area to facilitate construction of the expanded processing plant and associated infrastructure and construction of an accommodation village at the Project site.

Competitive Tender for the related construction packages will now commence.

Sorby Hills Project Execution Update

DFS delayed to 2H 22 due to Covid but project execution should be on schedule. Market doesn’t like it and down 10% at time of writing.

Competitive EPC tenders received from a suite of highly experienced engineering firms.

• Boab to commence competitive tender process for the Sorby Hills Mining Contract.

• Connection Study underway to firm up engineering and pricing for the transmission of cleaner and cheaper power between the Ord River Hydroelectric Plant and Sorby Hills.

• Major approvals received with respect to the commencement of Site Establishment work at Sorby Hills to allow for ongoing Project development during the wet season.

• Finalisation of the Definitive Feasibility Study expected in 2H 2022 to allow for the incorporation of the above workstreams.

Unfortunately, the spread of COVID in Western Australia has impacted the timely delivery of key DFS inputs, thus necessitating a deferral of its release. While we are disappointed not to be releasing the DFS this quarter as planned, we have decided that, in the current economic environment, it is prudent to take time to seek and incorporate tendered pricing for major capital and operating costs, including our open-pit mining contract, to ensure they are as accurate and competitive as possible.

Importantly, our multi-stream approvals strategy has allowed us to advance to a point where we are confident that we can commence Site Establishment works ahead of the 2022 wet season. Given the ongoing progress of project execution workstreams, completion of the DFS in 2H 2022 should not have a material impact on the Project execution schedule.”

DFS groundwater study that has indicated water flow into the pits will be less than previously anticipated.

BML Financiers visit site. Continues to show progress towards decision to mine.

Representatives from the Federal Government’s Northern Australia Infrastructure Facility (“NAIF”), together with representatives from a number of Australian and international commercial mining banks, joined Boab management on a two-day site visit of the Sorby Hills Project and surrounding infrastructure including Kununurra township and Wyndham Port, as part of their ongoing due diligence of the Project.

Engagement with Potential Project Debt Financiers

Sorby Hills has passed through the Stage 1 Initial Review of NAIF’s Assessment and Approval process. Boab will continue to work closely with NAIF as they undertake due diligence on the Project in conjunction with the completion of the Definitive Feasibility Study (“DFS”).

In addition to NAIF, Boab has also received a Letter of Support from Export Finance Australia (“EFA”) confirming that, subject to further due diligence and credit assessment, they would consider participating in the project financing of Sorby Hills.

Projects which boost the ability to extract and process minerals in Australia for export, such as the Sorby Hills Project, may be eligible for support from EFA.

During the June quarter, Boab held meetings with a number of Australian and international mining banks to progress their interest in the Sorby Hills Project. The meetings were well received, and feedback from the banks was very positive and will be incorporated into the DFS and project execution workstreams.