Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

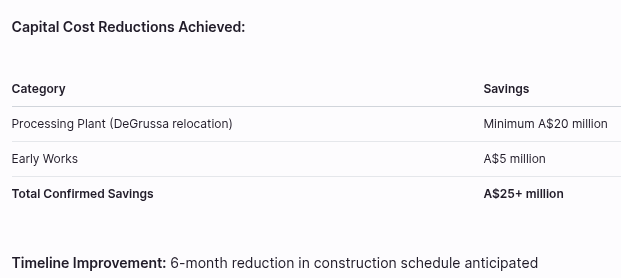

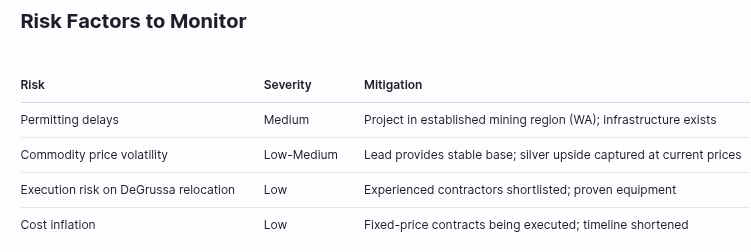

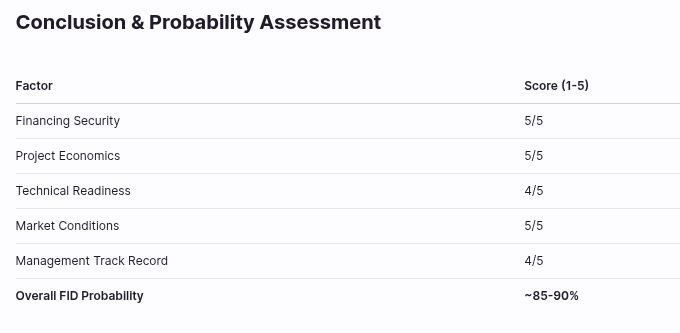

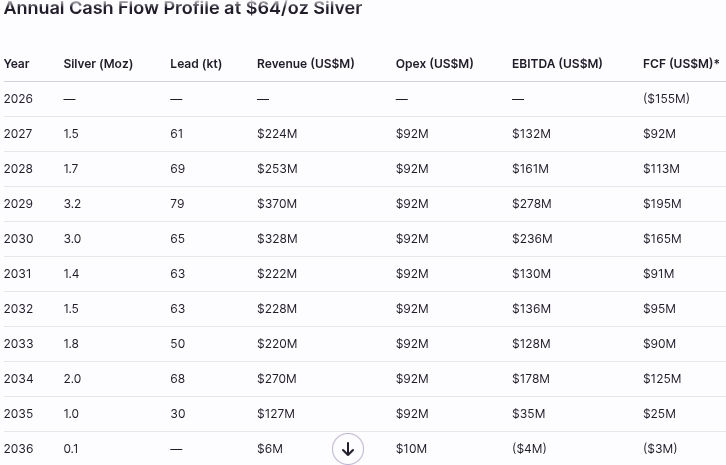

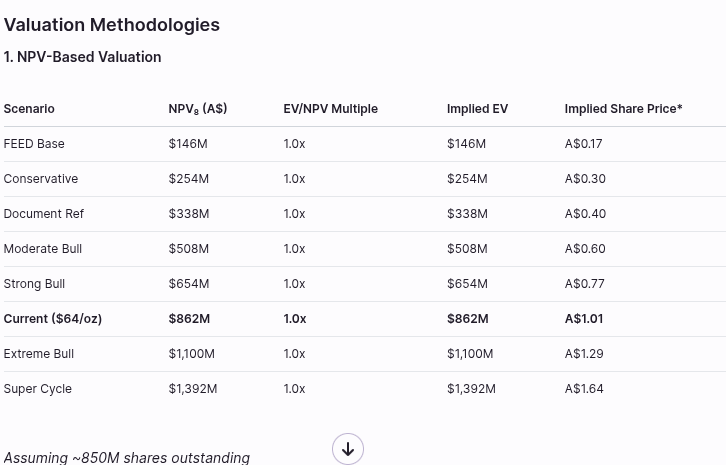

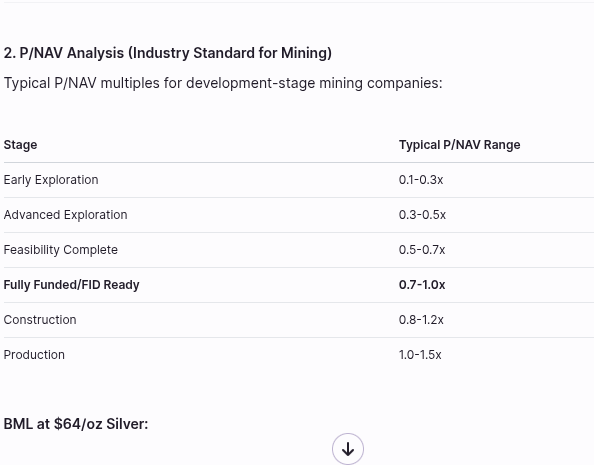

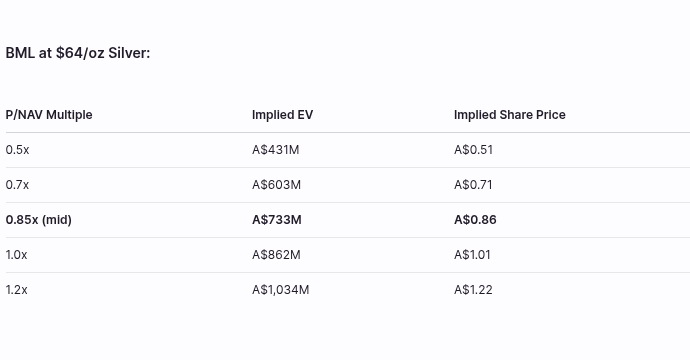

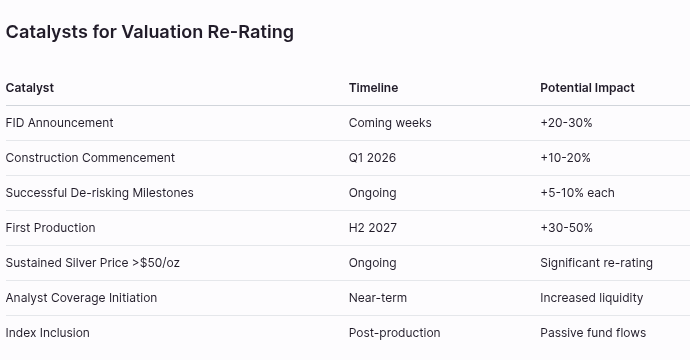

Inspired by @reddogaustin I decided to give Claude Opus 4.5 ( I get access through doing some AI training work for Outlier AI) the most recent announcements from BML and ask for the likelihood of achieving a positive FID.

The silver price has popped lately and I asked it to review some data based on the current value.

It then prompted me (I particularly liked this aspect) as to whether I would like it to complete the following:

Model detailed cash flow scenarios at various silver prices?

Analyze potential valuation implications for BML shares?

Assess risks if silver prices retreat from these levels?

The response was very long and detailed and I have not checked the calculations yet but I have taken a few screenshots of some interesting sections. Downside was that the response when copied lost the formatting hence the screenshots.

Lots to check and consider but does support my participation in the SPP @40c.

As a learning tool the model's suggestions and processes are awesome in getting a better understanding of higher level analysis of a company rather than the summarising of announcements that I currently complete.

Increasing silver price and silver and lead being listed as critical minerasl in the US has finally brought some attention to BML with a good boost in the SP.

If the FID comes in this half as forecast could see a rerate.

"Potash, silicon, copper, silver, rhenium and lead were recommended for inclusion to the list"

Latest corporate presentation released. Focus now looking at the silver price which was originally a bonus on top of the major resource which is lead. However lead price has not gone anywhere but silver has appreciated.

I had just about given up on this project but there has been two recent announcements and a possible FID by 2nd half 25. I won't hold my breath.

Still going to need additional funding to get to production. Held in RL and SM

"A Near-Term Producer with a Margin Highly Leveraged to the Silver Price"

Concentrate Offtake awarded and Binding US$30M Prepayment Term Sheet executed with Trafigura

High-Quality used Processing Plant secured from Sandfire Resources DeGrussa project

Engagement with additional debt Financiers ongoing

Targeting a Final Investment Decision H2 2025

Acquisition Terms Total price of A$10M, comprising:

Deposit: A$0.5M cash and A$1.0M shares issued to Sandfire Resources

Tranche 1 Payment: A$6.0M paid upon completion (incl. Final Investment Decision) and funded from proceeds of the Sorby Hills construction equity raise.

Tranche 2 Payment: A$2.5M paid within 12 months of first sale of concentrate from the Sorby Hills Project.

All major components for the Sorby Hills Process Plant have been secured via the DeGrussa Process Plant acquisition

Fit for purpose specifications to deliver the targeted 2.25Mtpa throughput with minimal changes

Extensive list of new spares included in the acquisition.

Boab to commence a competitive tender to price the relocation, reconstruction and refurbishment ahead of FID.

Terms of the Agreement with Trafigura

Binding Prepayment Term Sheet • US$30M for the development and construction of Sorby Hills.

5 Year Term, 18 Month Repayment Grace Period. • Interest Rate of Term SOFR + 5%.

Repaid via monthly instalments following the Grace Period. Binding Offtake Agreement

75% of the lead-silver Concentrate produced at Sorby Hills.

Minimum Quantity of 531kt (~7 years based on the FEED Study).

Market standard metal pricing and metal payabilities.

Ability for Boab to scale back Offtake Percentage and Minimum Quantity should the Prepayment Facility not proceed or Boab’s sources alternative financing.

Clearly BML is struggling to gain financing in the current environment. This update explains how they are looking at improvements to get it over the line. Looks like there will be no change till early 24 so expect SP to fall further. Claiming no CR needed.

On the back of the DFS, Boab ramped up engagement with potential Project financiers including Commercial Banks, Government Agencies, and specialist mining Credit Funds. Discussions with these parties have highlighted the funding challenge facing junior project developers in a high inflation environment and provided Boab with a clear focus to further optimise the Project.

The Company is currently working through the completion, documentation and modelling of the Project optimisation exercise and intends to deliver the results via a Sorby Hills FEED Study to be released to the market in Q1 2024.

The Company retains a cash balance of over A$3 million and is sufficiently funded to complete the ongoing optimisation

Boab Managing Director and CEO, Simon Noon, stated:

“Securing funding for projects in general has been tough within the current economic environment. Boab and Sorby Hills have not been immune from this challenge.

Whilst progress with financiers has not advanced as quickly as we had hoped, the feedback we have received has provided the Company with an opportunity to execute opportunities to enhance economic outcomes and shareholder value.”

BML massaging the figures to get the project over the line. Trying to get ESG improvement by removing the need for diesel back up, cost savings. Negotiations of offtake terms substantially complete but working on financing. FID by end of year?

Front End Engineering & Design and Project Optimisation workstreams progress

o Finalisation of Project Design Criteria, Process Flow Diagrams and, optimised Plant Layout with preferred EPC Contractor GR Engineering Services (“GRES”);

o Re-optimisation of Mining Schedule and Tailings Strategy Update to increase Project cash flows over the initial production years;

o Rationalisation of Contract Packages to realise cost-saving synergies across the mining and bulk earthworks activities; and

o Boab, GRES, and Horizon Power working towards an optimised solution to reduce, and potentially remove, the need for a diesel-fuelled back-up to the grid power delivered from the Ord River Hydro Power Plant.

• Phase VII drill program commenced with 19 diamond holes targeting mine life extensions and enhanced metallurgical recoveries at the Norton Deposit.

• Approvals workstreams progressing with positive determinations anticipated to be received in Q3 ahead of a Final Investment Decision.

Financing and Offtake

Boab continues to progress constructive discussions with potential project financiers of the Sorby Hills Project. In parallel, the lender’s Independent Technical Expert is finalising its review of the Project, including the optimised mining schedule and updated tailings strategy.

Negotiation of offtake terms with multiple Tier-1 counterparties is substantially complete. Boab is now exploring options for offtaker financing with these groups, to work in tandem with senior secured debt.

Timeline to Production

Receipt of EPA amendments approval and EPBC referral outcome, completion of FEED, and awarding of Offtake are all scheduled for completion during Q3 2023, paving the way to finalisation of project financing arrangements and subsequently a Final Investment Decision.

SP has had a significant recovery following a couple of commissioned broker reports with a price target of 75c+ almost 3x current SP. Suggesting a raise at 35c. Received a speeding ticket from ASX. Investor presentation still suggesting offtake agreements and FID Q3.

Held in RL and SM

Further progress on process plant design. FID now Q3 23? Still no mention of offtake agreements.

Boab Metals Limited announce that GR Engineering Services has commenced Front End Engineering & Design for the process plant and associated infrastructure at the Company’s flagship Sorby Hills Lead-Silver-Zinc Project

HIGHLIGHTS

Engineering Services Agreement (“ESA”) executed with GRES to undertake FEED for the Sorby Hills process plant and associated infrastructure.

The ESA includes provision for the tender and early procurement of long lead items.

Work under the ESA is scheduled for completion in Q3 2023, after which the parties intend to enter into an EPC contract and commence full detailed design, subject to a Final Investment Decision (“FID”) on the Project.

BML pumping up the resource with assays from the latest drilling with more to come before the DFS.The headline is strong but the detail more vague.

Phase VI Assay Results Confirm Impressive Grades.

Encouraging drilling results from the Beta Deposit confirm the current mineralisation model and open the prospect for mineralisation extensions.

The most recent Mineral Resource estimate highlighted high-grade zones of mineralisation in the northeast portion of the Norton Deposit that are not included in the Sorby Hills mining inventory (Figure 1). Boab took the view that tighter drill hole spacing in this area may bridge the interpreted continuity gap in the high-grade zone and may enable its inclusion in the future mine plan.

SHRC_143 delivered a significant intercept that can contribute positively to the reserves revision. The significance of the results will depend on the results from the outstanding drill holes completed in the area.

A total of approximately 1,700 drill samples were submitted to Intertek Laboratories in Darwin of which about 65% have been analysed for a broad spectrum of element analysis including Lead, Silver and Zinc.

Further assay results from phase VI drilling expected early in the New Year.

We look forward to providing updates from the remaining samples.”

SP has had a bit of a run in anticipation of the DFS release projected by year end but delay announced and SP in decline.

As previously stated, the Company has adopted a strategy of focusing on project execution workstreams required to bring about a Final Investment Decision on the Project in Q2 2023. The Company remains on track to achieve this objective.

In this context, the Company has worked hard to ensure major cost items included in the DFS are based on tendered pricing. The Company has adopted this approach to minimise the risk of significant cost blow-outs between the DFS release and a Final Investment Decision, as has been increasingly observed across the industry in the current economic environment.

To this end, Boab has completed competitive tenders of the Early Works Package, the Process Plant EPC (for which GR Engineering Services has been named preferred tenderer - ASX release 21 November 2022) and the Mining Contract, all of which will be included in the DFS.

For similar reasons, the Company has adopted a staged approach to an independent technical review of the Project whereby the review of key disciplines such as Geology and Metallurgy has been completed ahead of the DFS release. Feedback provided by the independent review, undertaken on behalf of potential financiers, has provided us with further confidence that the foundations of the Project are sound.

The processes outlined above and associated workstreams have necessarily incurred additional time as tender details and Project schedules have been refined and optimised. The DFS is now intended to be released early in the New Year.

Boab Managing Director and CEO, Simon Noon, stated:

“We are disappointed to not have finalised our study by the end of 2022 as planned, however, we are confident that our strategy will deliver a robust DFS based on real-time costs that will provide confidence to potential project financiers and ultimately, a better outcome for shareholders.

We look forward to releasing the results of the DFS early in the new year and proceeding toward a Final Investment Decision.”

BML does a CR that does not include retail despite previously stating that they were fully funded to DFS which is due soon.

$5.5 Million to Kick-Start Development of Sorby Hills

Firm commitments received for a A$5.5 million Share Placement.

Use of Funds includes:

Front End Engineering Design (“FEED”) and Detailed Design of the Sorby Hills process plant by preferred EPC Contractor GR Engineering Services

Commencement of on-site Early Works to prepare the project area for the commencement of process plant construction following a Final Investment Decision.

Finalisation of Independent Technical Due Diligence to support Project Financing of the Sorby Hills Project.

Final Payment completed for the 178-room Accommodation Camp (ASX release 15 September 2022) and the camp has now arrived at Sorby Hills.

“Boab’s ongoing strategy has been to advance project execution workstreams in parallel with the completion of the Definitive Feasibility Study. We look forward to delivering the DFS results in the coming weeks and reaching a Final Investment Decision in H1 2023.”

SP has had a boost of late. Contractor for process plant announced. GRES has a good history of completed projects. Definitive Feasibility Study due for completion in Q4 2022 which probably explains the increase in SP.

GRES selected as Preferred EPC Contractor for the Process Plant at Sorby Hills.

Scope of work includes a process plant with a capacity of 2.25Mtpa, representing a 50% increase over that considered in the Sorby Hills Pre-Feasibility Study (“PFS”).

Tendered Price is commensurate with the proposed capacity expansion and will form the basis of capital cost estimates for the Definitive Feasibility Study (“DFS”).

Commercial Agreement and Contract Award to be finalised over the coming months as Sorby Hills progresses toward a Final Investment Decision.

Parties to execute a Detailed Design and Procurement Agreement to advance key workstreams ahead of finalising the full EPC contract.

Boab Managing Director and CEO, Simon Noon, stated: “The selection of GRES as the Preferred EPC Contractor for the Process Plant at Sorby Hills is a significant project milestone. GRES is a market leading engineering firm that is highly regarded within the industry for their technical ability and track record of project delivery. Having GRES on board will complement the project delivery team and add immense value to the Sorby Hills Project.

“GR Engineering is pleased to have been selected by Boab as the preferred tenderer for the delivery of the Project. GR Engineering has a strong track record of successful project delivery in the base metals space. Aligned with GR Engineering’s core values, it is exciting to work on this important regional project that has already implemented tangible green initiatives. We look forward to working with the Boab team.”

Disc held in SM and RL

3Q of funding left, no update on DFS completion date but competitive contract tenders completed. Previous announcement gave a DFS in H2 22 and finalising offtake agreements after. CR to come when that happens.

Drilling of the deep Keep Seismic Target has been postponed to 2023. A total of approximately 1,700 drill samples have been submitted to Intertek Laboratories in Darwin for a broad spectrum of element analysis including Lead, Silver and Zinc.

“The quarter has seen Boab continue to focus on the delivery of project execution workstreams. Securing the camp, and the amendment to the EPA Approval, are both key enablers for the Project. Furthermore, completion of competitive contract tenders sees the company well positioned to rapidly ramp up construction upon a Decision to Mine and, where appropriate, bring forward targeted elements of early works, detailed design and procurement. We are now looking forward to completing our Definitive Feasibility Study and finalising Offtake and Financing workstreams.”

Start of Sorby Hills construction goes to tender

Amendments to the Sorby Hills EPA Approval have been received, a key regulatory prerequisite for the commencement of Site Establishment and Early Works including:

o establishment of all-weather access to the Project;

o development of a materials laydown and hardstand area to facilitate construction of the expanded processing plant and associated infrastructure and construction of an accommodation village at the Project site.

Competitive Tender for the related construction packages will now commence.

Sorby Hills Project Execution Update

DFS delayed to 2H 22 due to Covid but project execution should be on schedule. Market doesn’t like it and down 10% at time of writing.

Competitive EPC tenders received from a suite of highly experienced engineering firms.

• Boab to commence competitive tender process for the Sorby Hills Mining Contract.

• Connection Study underway to firm up engineering and pricing for the transmission of cleaner and cheaper power between the Ord River Hydroelectric Plant and Sorby Hills.

• Major approvals received with respect to the commencement of Site Establishment work at Sorby Hills to allow for ongoing Project development during the wet season.

• Finalisation of the Definitive Feasibility Study expected in 2H 2022 to allow for the incorporation of the above workstreams.

Unfortunately, the spread of COVID in Western Australia has impacted the timely delivery of key DFS inputs, thus necessitating a deferral of its release. While we are disappointed not to be releasing the DFS this quarter as planned, we have decided that, in the current economic environment, it is prudent to take time to seek and incorporate tendered pricing for major capital and operating costs, including our open-pit mining contract, to ensure they are as accurate and competitive as possible.

Importantly, our multi-stream approvals strategy has allowed us to advance to a point where we are confident that we can commence Site Establishment works ahead of the 2022 wet season. Given the ongoing progress of project execution workstreams, completion of the DFS in 2H 2022 should not have a material impact on the Project execution schedule.”

DFS groundwater study that has indicated water flow into the pits will be less than previously anticipated.

Power supply agreement improves the environmental profile of the project and cheaper than the all diesel plant in the PFS.

Heads of Agreement executed to Supply Cleaner and Cheaper Power to the Sorby Hills Project

Delivery of firm power over a 10-year term with an option for Boab to extend;

Cleaner, cheaper electricity sourced from Ord River hydroelectric plant to provide majority of the energy demand of the Project; and

On-site diesel plant to provide 100% back-up power.

Preliminary supply modelling indicates that the integrated hydro-diesel power solution will provide material economic benefit to the Project versus the Build Own Operate “BOO” diesel power solution contemplated in the Sorby Hills Pre-Feasibility Study.

Another key aspect of BML feasibility with a Port Access Agreement Executed and offtake agreement update. Looks like they are now not going to announce details until after DFS. The Company is presently completing a Definitive Feasibility Study (“DFS”) on the Project, the results for which are due in early Q2 2022. The Company is targeting a Final Investment Decision on the Project in mid 2022.

Agreement for Access and Stevedoring Service executed with Cambridge Gulf with respect to Wyndham Port, the only deep-water port between Broome and Darwin.

• Term extending to April 2034 with an automatic rollover on a 12 monthly basis thereafter.

• Wyndham Port is located 150km by existing sealed road from the Sorby Hills Project.

Update on the Offtake Tender Process

Boab has received offtake offers that, in total, far in exceed the planned production capacity. Negotiations with a selected range of international traders and domestic smelters have now advanced to the point where detailed offtake terms sheets, including associated debt financing facilities, are being considered and finalised.

The Company has determined that a final decision concerning the placement of production under offtake will closely follow the release of the Sorby Hills DFS. This timing will provide Boab the opportunity to evaluate the offtake terms with the benefit of the DFS results and consider how the proposed offtake debt facilities may sit alongside potential debt facilities from Northern Australian Infrastructure Facility and commercial banks.

Corporate presentation summarising all the recent announcements, still has offtake agreement this quarter.

Competitive tender for Boab’s share of the Sorby Hills concentrate nearing conclusion. Strong proposals have been received from a suite of international and domestic traders and smelters.

• The objective of the tender is to maximise value to Boab and secure terms that will support project financing of Sorby Hills.

• Targeting Binding Offtake Agreement within Q1 2022.

Project Financing

• Boab has engaged BurnVoir Corporate Finance to advise on and arrange a project finance solution for the Sorby Hills Project.

• The Company has engaged with Australia Government financing agencies Northern Australian Infrastructure Facility (“NAIF”) and Export Finance Australia (“EFA”), Australia’s export credit agency.

• Additionally, Boab has had ongoing positive discussions, including a site visit of Sorby Hills, with Australian and international commercial banks.

• Boab is targeting a Final Investment Decision by mid 2022.

Positive drilling results possibly expanding inventory for DFS and mineralisation envelope.

Boab Managing Director and CEO Simon Noon stated:

“The high-grade results from our RC drilling program provide further support for the inclusion of the Beta Deposit in the DFS mine plan. We look forward to building on these positive results, and those observed at our exploration prospects, in our next drilling program.

• New high grade drilling results at the Beta Deposit provide further support and confidence to the recently updated Mineral Resource Estimate at Sorby Hills.

• Exceptional drilling results include:

• SHRC_123: 27m @ 3.47% Pb & 37g/t Ag from 34m: Including 3m @ 7.04% Pb & 95g/t Ag from 35m; o 5m @ 5.60% Pb & 44g/t Ag from 45m; and 6m @ 4.50% Pb & 49g/t Ag from 55m.

• SHRC_124: 17m @ 3.51% Pb & 46g/t Ag from 49m: Including 8m @ 6.93% Pb & 90g/t Ag from 57m.

• Assays confirm elevated silver grades at Beta with some metre intervals recording up to 360g/t Silver (SHRC_124 from 57m).

• The results are anticipated to have a positive impact on the inclusion of Beta Deposit in the Sorby Hills Definitive Feasibility Study (“DFS”) mining inventory.

• Furthermore, drilling has extended the mineralisation envelope at the Wildcat Prospect and intersected prospective host rocks at the Eight Mile Creek Exploration Project.

Quarterly and trading update today. No real news. Still waiting on the results of the offtake tender process.

Boab is targeting completion of the Sorby Hills DFS in Q2 2022 and reaching a Decision to Mine at in late Q2 / Q3 2022.

Offtake agreenments originally scheduled for this calendar year now Q122. Strong interest but no further details.

• Strong Demand Confirmed for Sorby Hills Lead-Silver Concentrate from Leading Domestic and International Offtakers.

• Offtake Proposals received to date have offered attractive terms and confirmed the high quality of the Sorby Hills Lead-Silver concentrate.

• Shortlisting of proposals has occurred.

• Competitive offtake tender process for the Sorby Hills concentrate is on track for completion in Q1 2022.

Boab Managing Director and CEO, Mr Simon Noon stated:

“We are strongly encouraged by the offtake proposals we have received from a host of international and domestic lead concentrate smelters and traders. The strength of responses demonstrates the depth of market demand for our Sorby Hills Lead-Silver concentrate, and gives us every confidence that we will conclude binding offtake on highly competitive terms.

We look forward to completing this process with our shortlisted offtake proponents in calendar Q1 2022.”

Continuing progress towards DFS with expanded resource.

• A 5.6Mt increase (+78%) in Measured Resources versus the Mineral Resource Estimate that underpinned the Sorby Hills Pre-Feasibility Study (PFS).

• Inaugural 1.0Mt Indicated Resource reported for the Beta Deposit. It is anticipated that the Beta Deposit will now form part of the Sorby Hills DFS Mining Inventory where previously it had been excluded.

• Total Resources to 47.3Mt at 4.1% Pb Eq (3.1% Pb, 35g/t Ag) and 0.4% Zn containing 1.47Mt Pb, 53Moz Ag and 0.21kt Zn representing a 14% increase in Measured and Indicated Resources to the PFS Resource, and 5% increase in Total Resources on the same basis.

• Measured and Indicated Resources of 23.6Mt at 4.6% Pb Eq (3.5% Pb, 39g/t Ag) and 0.4% Zn containing 0.8Mt Pb, 0.1kt Zn and 30Moz Ag representing a 14% increase versus the PFS Resource, and a 7% increase versus the April 2021 MRE.

• Increase in Resource Quantity and Confidence expected to have a positive impact on the Sorby Hills Ore Reserve and DFS.

BML metallurgical test results appear to confirm high quality and grade of ore to support offtake tender. Some changes to process in PFS. Next up plant design.

• Results reveal separate flotation of Oxidised and Fresh Ore will deliver significant uplift in metal recovery across the Life of Mine versus blended ore treatment.

• Flotation results confirm recoveries of:up to 95%Pb(FreshOre)and90%Pb(OxidisedOre);and up to 87%Ag (Fresh Ore) and 92%Ag (Oxidised Ore).

• Primary grind size, reagent regimes and residence times have been optimised ahead of finalising the Sorby Hills DFS Process Plant design criteria.

A comprehensive assay was undertaken on Lead-Silver Concentrate produced. The results of these assays have been provided to potential offtakers as part of the ongoing tender for the right to Boab’s share of the Sorby Hills Lead-Silver concentrate production. These results have once again confirmed the high quality and high grade of the Lead-Silver concentrate to be produced from the Sorby Hills project.

The separate flotation of Oxidised and Fresh Ore delivers an uplift in recovery over the Life of Mine versus the sequential treatment of an Oxidised / Fresh Ore Blend adopted in the Sorby Hills PFS and is anticipated to have a positive impact on Project economics.

HLS Testwork

The PFS identified DMS as an opportunity to enhance low grade ore prior to milling and flotation to allow processing of ore that otherwise would be deemed uneconomic. The DFS Metallurgical Testwork Program further explored this concept.

The DFS Oxidised Ore Pb recovery performance estimate is below that used in the 2020 PFS, while the Ag recovery is higher. However, the estimated DFS Fresh Ore performance is lower than that of the PFS for both Pb and Ag. Furthermore, a high observed variability in mass recovery response creates difficulties in plant design (e.g. highly variable stream flows) and in plant operation (difficulty controlling to target parameters). This is believed to be a result of variable gangue density, which is due to its variable shale content.

While the financial result for the DMS option in the 2020 PFS indicated a similar NPV compared with Base Case non-DMS, the DFS testwork results for the DMS option have demonstrated a reduced recovery and highlighted additional process design and operation risk.

Therefore, the DMS option is not recommended and will not be considered further within this DFS.

Next Steps - Project Development Timeline from the quarterly

Over the upcoming quarter, the Company anticipates completing the following milestones.

• Providing the results of the DFS Metallurgical Testwork Program.

• Completing an Offtake tender process for Boab’s share of the Lead-Silver concentrate produced from Sorby Hills.

• Commencing DFS Mine and Process Plant Design.

• Commencing tenders for the Mining, Process Plant and Infrastructure Contract.

A Project Development Timeline to a Decision to Mine is shown in (Figure 5).

Boab has determined to run competitive tenders for major mining and construction contracts in parallel with the Sorby Hills DFS. Whilst the decision could extend the delivery date of the DFS to early Q2 2022, the Company is confident that the process will provide accurate market data to underpin the DFS and consequently provide enhanced comfort to potential financiers undertaking due diligence on the Project.

Definitive Feasibility Study well advanced with completion expected March/April 2022

A competitive offtake tender process for the Sorby Hills concentrate has commenced. Boab is targeting binding agreements by December 2021

Detailed Investor briefing

BML Financiers visit site. Continues to show progress towards decision to mine.

Representatives from the Federal Government’s Northern Australia Infrastructure Facility (“NAIF”), together with representatives from a number of Australian and international commercial mining banks, joined Boab management on a two-day site visit of the Sorby Hills Project and surrounding infrastructure including Kununurra township and Wyndham Port, as part of their ongoing due diligence of the Project.

Engagement with Potential Project Debt Financiers

Sorby Hills has passed through the Stage 1 Initial Review of NAIF’s Assessment and Approval process. Boab will continue to work closely with NAIF as they undertake due diligence on the Project in conjunction with the completion of the Definitive Feasibility Study (“DFS”).

In addition to NAIF, Boab has also received a Letter of Support from Export Finance Australia (“EFA”) confirming that, subject to further due diligence and credit assessment, they would consider participating in the project financing of Sorby Hills.

Projects which boost the ability to extract and process minerals in Australia for export, such as the Sorby Hills Project, may be eligible for support from EFA.

During the June quarter, Boab held meetings with a number of Australian and international mining banks to progress their interest in the Sorby Hills Project. The meetings were well received, and feedback from the banks was very positive and will be incorporated into the DFS and project execution workstreams.

bml announces promising results from phase V drilling showing expansion of the mineral resource estimate.

Phase V Drilling Program

Boab’s Phase V drilling program was designed to expand the mining inventory and increase the production capacity in the upcoming Definitive Feasibility Study (“DFS”) above the 1.5Mtpa contemplated in the Sorby Hills Pre-Feasibility Study.

The primary focus of the Phase V drilling program was to test and validate the interpretation of portions of the Sorby Hill’s Resource located near, but outside the current open-pit design with a view to incorporate these prospective tonnes into the DFS mine plan.

Furthermore, this program also aimed to investigate the high silver Alpha and Beta deposits which to this point in time have not been drilled by Boab nor included in the Project’s mining inventory.

At the conclusion of the diamond drilling, 59 diamond drill holes (5,284m) were completed including 16 new drill holes (1,600m) which were added during the course of the program to follow up prospective leads arising from the ongoing drilling (Figure 1).

Near pit targets included shallow, high-grade portions of the Sorby Hills deposit presently not included in the Mineral Resource or mining inventory.

Boab intends to provide an updated Mineral Resource Estimate (MRE) to the market during the upcoming quarter incorporating the result of the Phase V diamond drilling.

Drilling of Beta deposit represents a significant and relatively low-risk opportunity to materially expand the Sorby Hills mining inventory.

Managing Director and CEO Simon Noon stated: “We are particularly encouraged by the very near-surface, free diggable Pb-Ag mineralisation at the Wildcat Prospect which appears expandable.

We hold high expectations for the contribution that the RC drilling can contribute to the Beta Deposit and its potential inclusion in the upcoming DFS.

Very detailed bull case report from Brent Connolly

https://drive.google.com/file/d/1mKfW2UOpcCoclbjhmt4V9qxchgDqermA/view

Share price at 52wk lows

Definitive feasibility study due 1HCY22.

10 year mine life with projected EBITDA of $75M pa

1.6 year payback (based on what appear to be conservative figures)

Costs 5M FY21

Cash 12M

Post a valuation or endorse another member's valuation.