Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

EV/EBIT now at 7x. Missed their FY24 estimate by $50M

Old valuation $2.95 from Ord Minnett initiating coverage

Valuation & Recommendations ▪ We initiate coverage of BRI with BUY recommendation ($2.95 PT). Valuation weighted 50/50 between a DCF and Peer Multiples approach. ▪ Key risks relate to the impact of rising domestic interest rates upon the construction cycle, adverse weather conditions, persistent supply chain pressures and increased competition. ▪ We believe these risks are more than reflected in current valuations, with BRI trading at 3.6x, representing a 40%+ discount to domestic peer group at 7.5x

The strength of BRI’s supply chain and manufacturing was a key point of difference throughout the pandemic, enabling it to consistently win market share. Our BUY recommendation is predicated upon BRI’s (1) material organic growth opportunities, particularly within its Panels and Building Trade Centre divisions, (2) strong balance sheet and accretive M&A optionality, and (3) steep valuation discount relative to Australian Building Materials and Distribution peers.

Within the Trade distribution market, Bunnings Trade (separate to its ‘Big-box’ style retail hardware stores) and Metcash Hardware (which operate under various banners) are the dominant players. Outside these large players, the market remains highly fragmented. BRI estimates that there are ~700+ privatelyowned operators. BRI has been particularly acquisitive within its Building Trades Centres division. We expect this to continue, with smaller independent operators to remain the focus of its M&A strategy in the space. In total, BRI estimates the total addressable market (excluding retail distribution) is ~A$15bn. On this basis, we assume BRI currently has 1-1.5% market share. Over the medium-term, we believe BRI could increase its market share via a combination of organic and inorganic growth to 2-3%, which would imply an additional ~A$120m-$270m revenue opportunity.

Coffee Microcaps interview of CEO and CFO following the release of the results and Investor Presentation.

Well, I was certainly wrong about the bottom and my reentry of $1.80 has proven to be a poor decision. Sell down looks over done considering they are still paying a dividend and the EPS is 35% higher than when the share price was last around this level in 20/21. Long term view is positive in light of need for housing but might be a quiet 12-18 months.

After a very strong 22/23 the market had priced in continued growth at an accelerated rate but the slowdown in housing construction has hit hard. NPAT down 64% leading to a drop from the recent highs of $1.70 to the $1.30s.

The following graphic tells the story.

Revenue down 7.7% driven by lower residential activity, impact of continued labour shortages and site delays.

• Gross margin down 142 basis points versus FY23. This was due to reduced Frame & Truss volumes and increased competitive pressures.

• Finance cost increase due to additional borrowings and interest rate changes. Net debt increased by $16.4m resulting primarily from additional borrowing for acquisition of Specialised Laminators, payment of contingent consideration and prior year income tax liability.

• Operating expenses: like-for-like operating cost (+1.3%) is well managed in the current inflationary macro-economic environment as we continue to invest in people, processes and systems for future growth.

Outlook

Consumer confidence around residential building remains subdued. Expect market to be soft for next 12 months. Medium term outlook is more positive given demand, low vacancy rates, expected interest rate decreases and government initiatives.

We will take advantage of growth segments particularly in Queensland, Western Australia and South Australia.

The Group has seen increased vendor activity for M&A. We will continue to asses opportunities to add strategically aligned and value accretive businesses to the group.

Held in RL and SM

BRI continuing to roll up companies and be in a strong position as building recovers. SP looks to have bottomed out for now so looking to reenter a position. 9% dividend yield on previous earnings will drop back a bit but still solid.

Big River Industries to acquire the trading business and assets of Specialised Laminators (SLQ) located in Brisbane, Queensland.

This acquisition continues the expansion of the Big River network and will add to the Panels Division a complementary business, with differentiated manufacturing of premium products coupled with a strong value-add solution-based service offering. SLQ is a manufacturer and distributor of decorative, functional, and specialised premium value products and services for the panels market, achieving $26.2m revenue for FY2023.

It will add increased capabilities in specialised products to Big River customers, synergies to the Group through new and existing products and markets, as well as supply and logistics benefits.

One of the founders of the business, John Closter, along with General Manager Wayne Austin, will remain with Big River to manage the business.

The purchase consideration of $10m at completion comprises $7m of cash and $3m in BRI ordinary shares. There is the potential for the vendors to receive an additional earnout of up to $4.3m, payable 70% cash / 30% BRI ordinary shares over a three-year period if certain profit growth targets are achieved.

The acquisition is expected to be earnings per share accretive from year one and will be funded by the Company’s existing cash and debt facilities.

BRI results down as expected off last year's. Heading for 52 week lows. $7M NPAT for a market cap of $166M is solid. Forecasting possible revenue fall in second half due to site delays.

John Lorente, Big River CEO, said: ‘It is satisfying to deliver solid results, in a challenging macro environment as we continue to invest in the business for future growth. We strive to deliver an average 10% EBITDA margin through the cycle, and we remain on that trajectory while managing costs and cash extremely well. Project pipelines continue to be solid across all segments with a positive medium-term outlook for our markets.”

The market outlook is supported by buoyant residential housing and commercial demand in the short to medium term, with the Group’s market segment diversity positioning us well to capture market opportunities through the cycle. Extended site delays have pushed the pipeline into the second half of CY2024 and there are signs that the market in the short-term will be less predictable than previous years. If projects continue to be delayed then 2HFY24 revenue could be below the first half result.

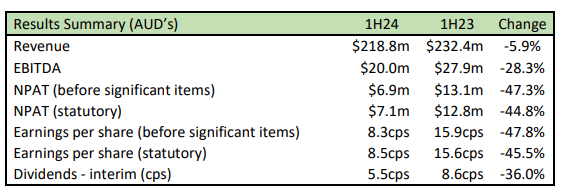

The Group’s 1HFY24 revenue of $218.8m was broadly consistent with the prior half, up 0.8% on 2HFY23 and down 5.9% as we cycle off a stronger than usual performance in 1HFY23.

Continued strong EBITDA margin to revenue at 9.2%. EBITDA for the half of $20.0m (before significant items) was however down 28.3%, against 1HFY23 on the back of lower sales.

Operating expenses were well managed given the macro inflationary environment and were up 3.8%, however flat on a like for like basis, as the business continued to invest for future growth while maintaining prudent cost management across the group.

Continued improvements in operational efficiencies and disciplined cash management delivered a strong Balance Sheet, with Working Capital to Revenue ratio at 15.7% compared to 17.7% in pcp. EBITDA to Cash conversion at 98.0% in 1HFY24 compared to 74.9% in 1HFY23.

Ample capacity for future acquisitions with a gearing ratio of 13.6%. The Group is continuing to actively explore opportunities for value-accretive acquisitions.

An interim dividend of 5.5 cents per ordinary share fully franked was determined by the Board.

Investor presentation and some media coverage (Rask Investor NAOS) proposing BRI as a solid small cap dividend (fully franked at 50-70% of profits) share. SP has bounced around over the last 6 months. Presentation suggests lower results this year due to investment in the business.

Margins expected to be under pressure in the coming year. Alignment with our key partners and our supply chain diversity has us well positioned to mitigate.

We will continue to increase investment in the business over the coming year to deliver efficiencies, synergies and long-term growth.

• This will have a short-term impact but position the business for continued expansion.

• The daily sales run rate has been consistent over the past 6 months, this is expected to continue into 2HFY24.

Headlines

- • Revenue of $133.5m was up 5.9% on 1H20, driven by strong growth in Q2, where revenue exceeded the prior period by over 7% on a like for like basis. The growth also reflected contribution from the Pine Design acquisition completed in March 2020.

- • Comparable store sales grew 1% in 1H21, as construction sector trends turned more positive after declining for the previous 2 years.

- • Queensland, SA, WA and ACT all experienced strong sales growth results, while NSW and Victoria trailed the corresponding period, where the continued decline in multi-residential building impacted the most.

- • Underlying EBITDA of $10.0m, was up 14.8% on 1H20, with a particularly strong result from manufacturing operations being the highlight. • Underlying NPAT of $3.1m, was up 38.8% on the 1H20 result, and well ahead of the guidance provided in the Timberwood acquisition capital raise documents released to the market in December 2020.

- • On 3 November 2020, the Company announced the decision to consolidate the Company’s two plywood manufacturing sites onto a single site at Grafton. This decision was triggered by the impact to the long term wood supply available to the Wagga Wagga site following the major fires in the region in early 2020, and the successful awarding of $10m to the Company under the Government’s Bushfire Grants scheme. Whilst this has resulted in non-cash asset impairment during the period of $9.4m, the impact on both future earnings and cash flow of the project are very positive.

- • Working capital continued to be tightly managed, with cash conversion of 77% (or ~ 100% when the impact of deferred government covid-19 payments is adjusted). This was achieved despite some changes in the Company’s supply chain that saw materially higher volumes of imports.

- • The Board have determined a final dividend of 2.6 cents per ordinary share, fully franked. The Company’s dividend reinvestment plan (“DRP”) will be in effect for this dividend.

10-Dec-2020: CCZ Equities Research: Big River Industries (BRI): Acquisition consistent with growth strategy

Analyst: Raju Ahmed, email: [email protected], phone: +61 2 9238 8237

- Recommendation: BUY

- Target Price: 230cps (unchanged)

- Market Capitalization: $118m*

- Index: None

- Share Price: 147cps (150cps on Fri 11-Dec-2020)

- Sector: Materials

* Market capitalization assumes settlement of the Timberwood Group acquisition transaction by the end of March 2021.

Report:

- Forecasts updated on the latest company specific changes: BRI recently updated the market with an upgraded 1H-FY21 earnings guidance, a strategic acquisition, and further clarity on the Wagga Wagga site closure plans.

- Upgrade to guidance: The company will now deliver an 1H-FY21 NPAT +10% above pcp on the back of positive 2Q-FY21 sales performance in the residential construction and alterations & additions markets, as well as in the Formwork segment. We note BRI’s pre-COVID NPAT margin was circa 2%, implying any small change in sales has a leveraged effect on NPAT. We previously forecast 1H-FY21 NPAT decline of -9.8%pcp (to $2.2m, vs $2.3m in pcp) on the back of -4.6%pcp same store sales decline. We have now refreshed our 1H-FY21 same store sales forecast to -3.5%pcp, leading to a sharp improvement in 1H-FY21 NPAT to $2.5m, +10%pcp. Revised FY21 and FY22 NPAT are now +17.9% and +14.4% respectively vs last published, driven by +1.3% improvement in our 2yr sales forecast. The early Grafton/Wagga Wagga consolidation upside guidance of >20% in U/EPS accretion from FY23 is not a surprise per our last published forecasts.

- Timberwood Group acquisition: BRI announced the acquisition of plywood and architectural panels business Timberwood Group. Timberwood generated $51.3m in sales and $6.0m EBITDA ($4.7m pre-AASB16) in FY20, with the key sales mix being 40% commercial, 46% remanufacturing, and 12% housing. BRI will pay $22.5m upfront ($18.5m cash, $4.0m scrip) and up to $6.0m in earnouts subject to FY22, FY23 & FY24 U/EBITDA pre-AASB16 on a $4.5m-$5.5m straightline sliding scale range. Inclusive of earnouts (but excluding $1.5m to be paid for working capital contribution), the EV/EBITDA pre-AASB16 is 6.1x. This multiple is within range of what BRI has historically paid for its other plywood/timber segment acquisitions. Given the size of the acquisition, we see synergies in both revenue and procurement functions, albeit the former may not be immediate. This acquisition (with assumed 31 Mar’21 settlement worst case) has resulted in FY22 NPAT addition of +54% on the upgraded ex-acquisition NPAT forecasts discussed above. The acquisition is being funded with a $20.4m equity capital raise ($1.35/share), plus the aforementioned $4.0m in BRI scrip.

- Investment thesis: Our valuation and thesis are unchanged, given the acquisition is in line with BRI’s growth strategy.

--- click on the link at the top to view the full CCZ report on BRI ---