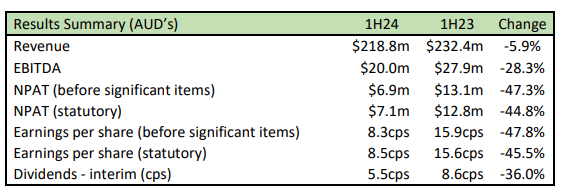

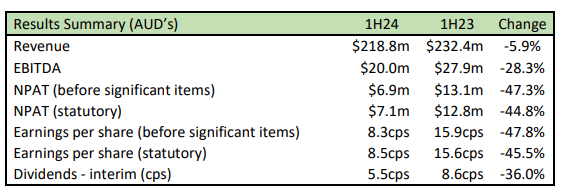

BRI results down as expected off last year's. Heading for 52 week lows. $7M NPAT for a market cap of $166M is solid. Forecasting possible revenue fall in second half due to site delays.

John Lorente, Big River CEO, said: ‘It is satisfying to deliver solid results, in a challenging macro environment as we continue to invest in the business for future growth. We strive to deliver an average 10% EBITDA margin through the cycle, and we remain on that trajectory while managing costs and cash extremely well. Project pipelines continue to be solid across all segments with a positive medium-term outlook for our markets.”

The market outlook is supported by buoyant residential housing and commercial demand in the short to medium term, with the Group’s market segment diversity positioning us well to capture market opportunities through the cycle. Extended site delays have pushed the pipeline into the second half of CY2024 and there are signs that the market in the short-term will be less predictable than previous years. If projects continue to be delayed then 2HFY24 revenue could be below the first half result.

The Group’s 1HFY24 revenue of $218.8m was broadly consistent with the prior half, up 0.8% on 2HFY23 and down 5.9% as we cycle off a stronger than usual performance in 1HFY23.

Continued strong EBITDA margin to revenue at 9.2%. EBITDA for the half of $20.0m (before significant items) was however down 28.3%, against 1HFY23 on the back of lower sales.

Operating expenses were well managed given the macro inflationary environment and were up 3.8%, however flat on a like for like basis, as the business continued to invest for future growth while maintaining prudent cost management across the group.

Continued improvements in operational efficiencies and disciplined cash management delivered a strong Balance Sheet, with Working Capital to Revenue ratio at 15.7% compared to 17.7% in pcp. EBITDA to Cash conversion at 98.0% in 1HFY24 compared to 74.9% in 1HFY23.

Ample capacity for future acquisitions with a gearing ratio of 13.6%. The Group is continuing to actively explore opportunities for value-accretive acquisitions.

An interim dividend of 5.5 cents per ordinary share fully franked was determined by the Board.