Overview of Bailador:

Bailador is an LIC focusing on investing in private information technology and media companies. It is run by David Kirk (previous Fairfax CEO and All Blacks captain) and Paul Wilson (experienced in private equity).

The characteristics of the companies that Bailador likes to invest in are listed below (from their website):

- 2-6 years of operation

- Run by the Founders

- Proven business model with attractive KPIs

- Ability to generate repeat revenue

- International revenue generation

- Huge market opportunity

- Require capital to grasp this opportunity

- Important verticals within the technology sector: eCommerce, subscription-based internet businesses, online marketplaces, software, SaaS, high value data, online education, telecommunication applications and services.

"Bailador typically invests $2-10M of equity into an investee company. They target minority investments alongside highly motivated founders and management who have best-in-class technology or business systems." They typically don't invest without board representation.

Main Thesis:

When starting out my investing journey about 3 years ago I did look into BTI, however, at that stage only Siteminder had made significant gains and represented a large part of the NTA. Given I was only at the stage of investing in ETFs didn't know the risks in BTI so put it on the to watch list. The recent Strawman interview reminded me to take another look.

Bailador's list of characteristics and the point in which they invest I think is key to Bailador's success. They do not buy an idea or concept company. They buy a company with real traction in the market in which it operates. However, the target companies aren't large enough for public markets (or even large private equity), they require capital to grow and also need some experienced investors to assist with how to grow the business, Bailador fills this void. Bailador seems to have found a very nice sweet spot to invest in these growing companies.

Bailador has consistently shown that they are conservative in their valuations of the companies they hold and in recent times have been able to realise some of their investments to cash or companies held are now marked to market through IPOs. BTI has a consistent record of always having third-party valuation events that come in at or above the current carrying value. Therefore, the monthly NTA presented to shareholders is a conservative number and potentially provides investors with hidden value yet to be uncovered.

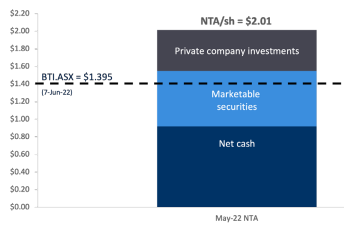

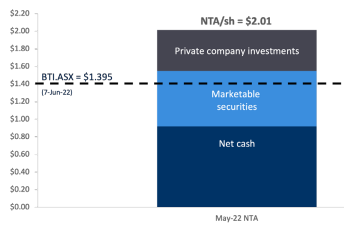

The downside risk of investment at this point in time is very small. The company is currently heavily backed by cash after realisations. See image below for a breakdown of NTA from the May 22 NTA update. I think investing at this point of time is the prefect time to buy BTI given markets have significantly reduced the valuations of tech companies that BTI likes to buy. Having a large amount of cash available in this market means BTI can buy the new additions to the portfolio at lower valuations. Additionally, BTI is trading at a 15% discount to the conservative post-tax NTA and more than 25% discount to the pre-tax NTA.

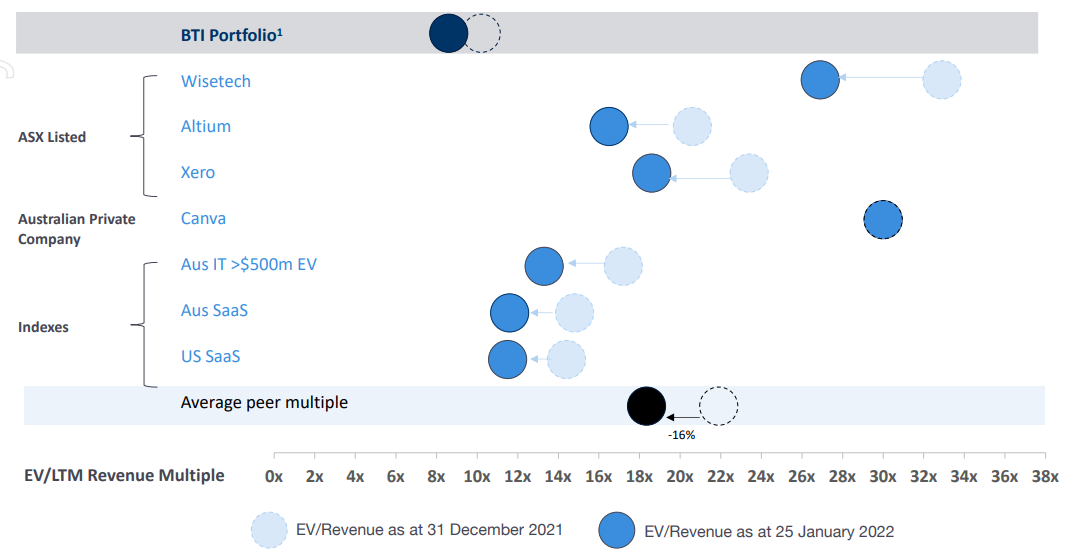

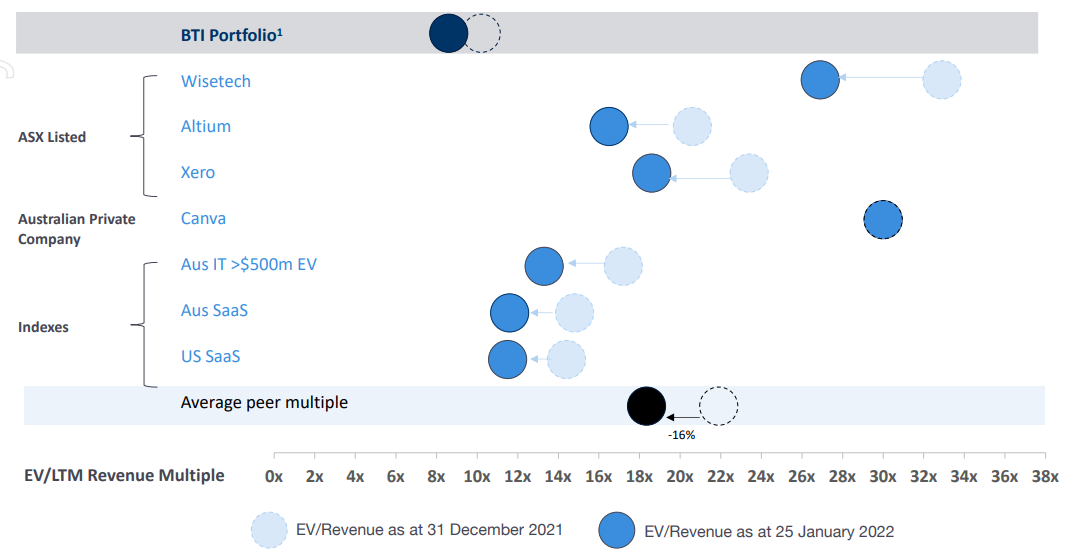

Bailador's valuations are somewhat conservative for the sector they operate in. Especially given the early stages of many of the companies they purchase I would expect the EV/revenue multiple to be higher than the average but this is not the case. See image below from 1HFY22 presentation:

General Notes:

- Companies held are predominately based in Australia but some holdings are based overseas.

- Stats from 1HFY22 presentation:

- Portfolio revenue $341m with 43% growth

- 66% gross margin

- 91% recurring revenue

- Management fees are expensive. 1.75% of pre-tax NTA and compound performance hurdle of 8%.

Positives:

- Large margin of safety given the cash backing, discount to NTA and conservative valuations of companies held.

- Plans to provide a 4% fully franked dividend based on pre-tax NTA.

- Currently many smaller investments $20 mil or less. Besides for recent additions to the portfolio all have had positive revaluations. Recent additions have yet to be revalued.

- Chart appears to have positive sediment.

- Very conservative NTA valuations which are validated by 3rd party transactions. As of 1HFY22 there had been 29 3rd party valuations and these all came in at or above BTI carrying value. This shows the NTA is likely under the real market value and a lagging indicator of actual value of all investments.

- BTI is trading at a significant discount to NTA. May 22 NTAs:

- Pre tax $2.01

- Post tax $1.70 - 15% discount to NTA.

- Management of the LIC have skin in the game:

- David Kirk owns around 6.2% of the company.

- Paul Wilson owns around 2.8% of the company.

Risks:

- Key person risk - David Kirk and Paul Wilson.

- Next round of companies BTI invests in are unsuccessful.

- Current market conditions result in cash realisations for BTI becoming hard execute.

- Potential for little insight into the companies that Bailador holds due to the commercial in confidence agreements that are likely especially given the board positions.

- Current weak capital availability limits short term valuations from increasing.

- The lag factor in valuation. This has shown to be very much on the conservative side but this potentially supresses the short term valuations and could have a shock downgrade.

- High fees eat away at performance.

When to get out:

- It is clear the current investments aren't working out.

- Trim if there is a significant premium to NTA (unless justified due to conservative nature of valuations).

- Key person risks eventuate.