Some notes from today's meeting. First off, thanks to @Duffshot38 for the suggestion -- I found Paul to be very knowledgeable and definitely aligned with a lot of my investing philosophy.

Since listing in late 2014, the share price has gone from around $1 to $1.32. Add in a special dividend and you get an average annualised return of around 7% per annum. That's pretty ordinary, but at the same time there seems to be a big disconnect with what the company itself has done.

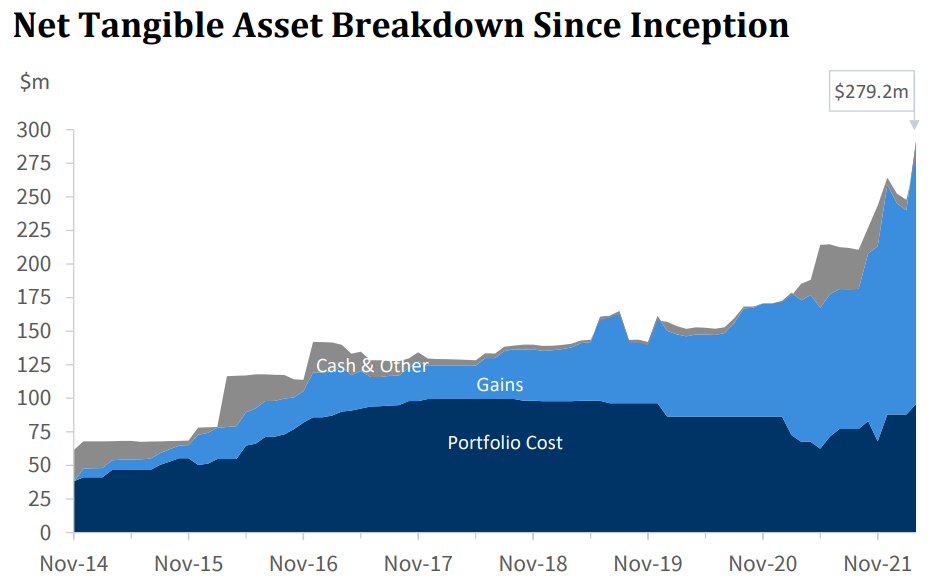

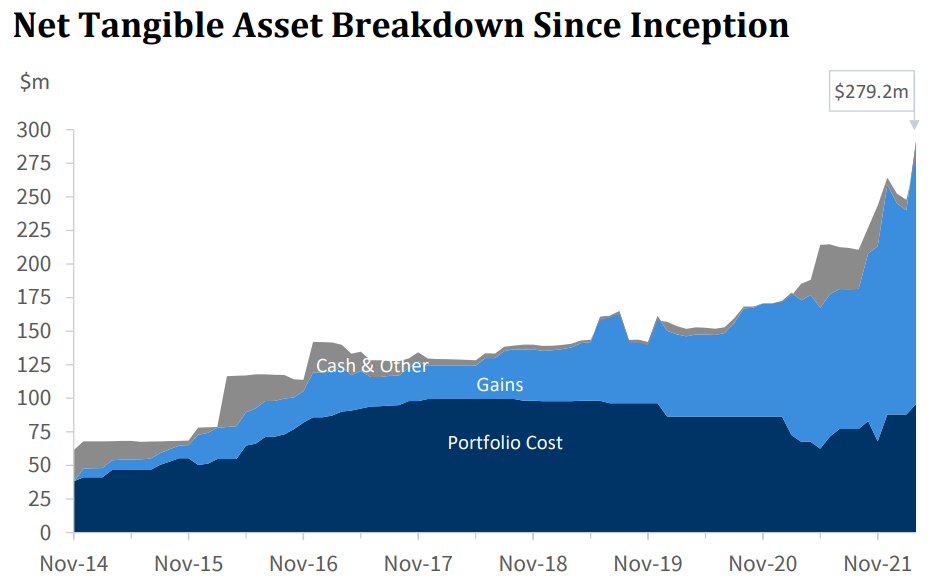

As I noted in the meeting today, net tangible assets have compounded at over 20% per annum over the period. That may be understated given the conservative way in which they ascribe the carrying value of their assets.

Indeed, as Paul said, shares are trading at a 20% odd discount to NTA on a per share basis, and likely a lot more given how they track this figure. Of course, LIC's will always talk a good game here, but as Paul said they have a 100% strike rate in terms of exits occurring at valuations that were far higher than the carrying value.

With 10 holdings in the portfolio, they are extremely concentrated and -- given they research 100's of companies each year -- very selective. They hold equity stakes of between 10-40% and also take an active role in these businesses, as either directors or advisors.

Paul was very candid on those investments that didn't work out (eg viastream), and how the carrying value of these were quickly written down when it was apparent the investment thesis wasn't working out.

I also liked how they seemed to be very mindful of cash burn for their investments, and how adverse they were to relying on ongoing capital injections to sustain operations.

It was also good to see both Paul and his co-founder each buying a further $500k worth of stock each a couple of weeks ago -- and AFTER they disclosed they (very successful) exit from Instaclustr.

At the end of the day, this is a bet on management, and whether they can continue to find, invest and exit from private companies. But they do certainly seem to have great form here (although, at the same time, there could be a good bit of 'key man' risk). It's also a great way to get exposure to early stage, private tech companies, and still have all the liquidity of an ASX company.

It's also hard not to notice the seemingly large discount to NTA. That being said, there's no law of nature that says these valuation gaps should close, and even if they do it can take a long time. Also worth noting that the financials are going to be very lumpy, and will depend on transaction events in the underlying companies for them to record revenue. From a cash perspective, it's going to be especially lumpy.

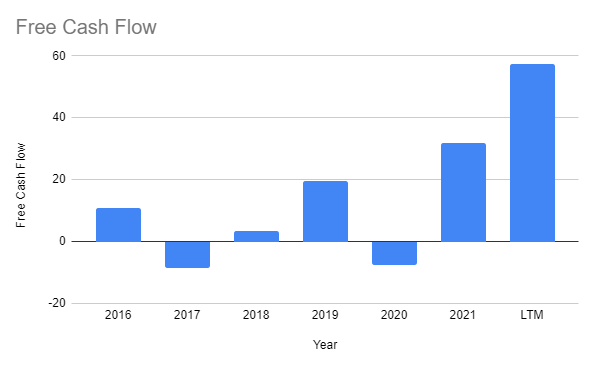

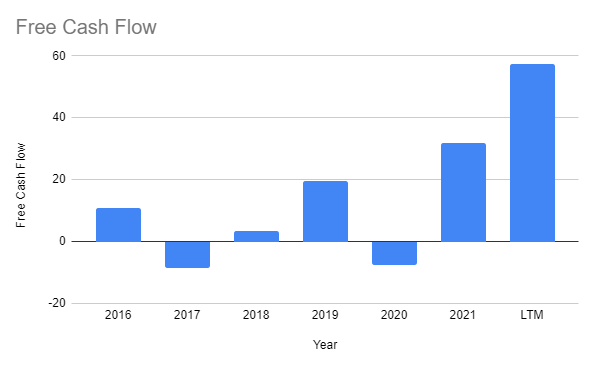

Here's what their free cash flow looks like since 2016 (using data from S&P) -- it'll be even better when the current half is reported, but the point to note is that it can and will go backwards for a while if they don't manage to get any successful exists from their portfolio companies. When they put some profits back to work, we'll see a big drop in FCF too.

To the uninformed, there'll be periods where it'll look like the business is doing nothing, even if their portfolio companies are genuinely improving their intrinsic value. In other words, things like revenue and cash flows aren't going to be particularly informative metrics in isolation -- as Paul said, NTA is the figure to watch. And one needs to have some trust that that is based on reasonable valuations.

Remember that their investments are very illiquid. And getting them away at good valuations will depend a lot on what current market conditions are like.

Investors in Bailador need to be cognizant of these factors, and as such I'd suggest you need a long term focus. Much of the market will likely miss a lot of the nuance for a company like this.

Valuing the company is also tricky -- unless we're able to individually value the component companies accurately, which we can't.

So, again, a lot depends on the faith and trust you have in management. With Paul and David holding over 10% stake in the business, it does provide some good alignment.