If there's one phrase I've come to fear as an investor, it's "strategic review".

You'll never hear that in any positive context.

And given shares in Bravura are down 52% today, it seems that heuristic is holding true.

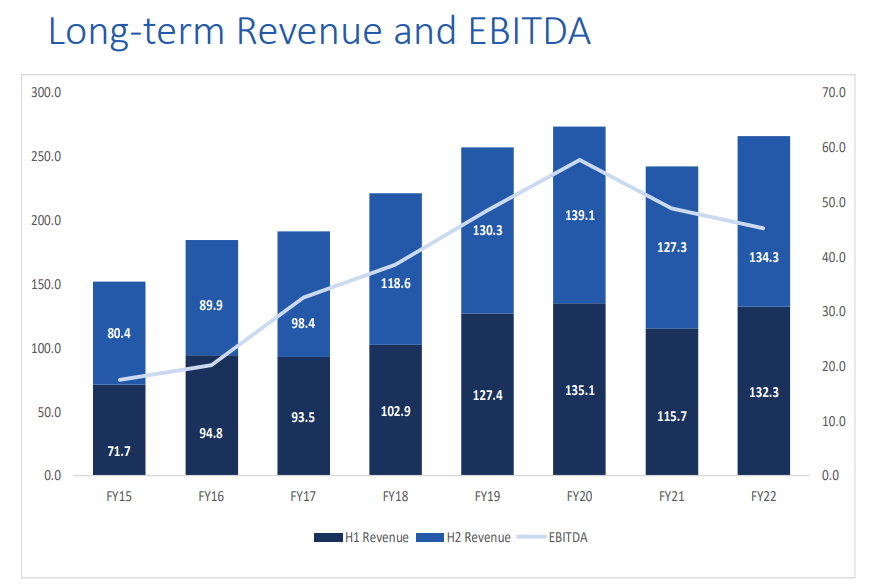

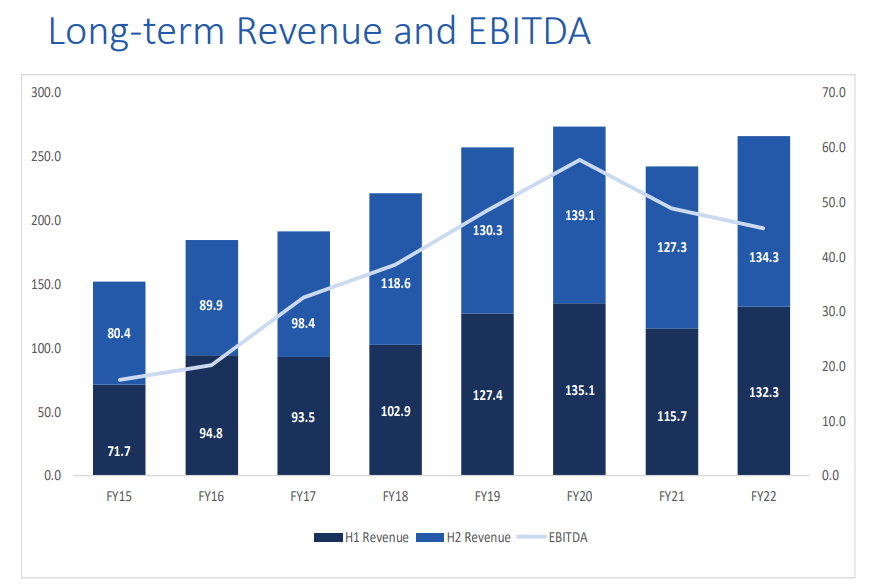

Man, the magnitude of that fall really is amazing -- we're not talking a unprofitable, cash burning nanocap meme stock -- this was (prior to today) a >$300m market cap company doing a quarter of a billion revenue, CF +'ve, zero debt and even paid a dividend.

Today's announcement is here in all its gory detail, but the key points are:

- FY23 Revenue expected to "increase modestly" from FY22, but...

- Operating costs to increase 16-20%

- FY23 NPAT to be between -$5m and zero (last year it was $25m!)

Basically, the new CEO is looking reconfigure the entire business. This could well be the result of underinvestment in prior years, which might explain why the fundamentals looked so strong (they were doing 15% net margins a couple years back). Indeed, that's what had attracted me to the business, which had long displayed high margin growth.

Thankfully, as you'll see in my SM portfolio, I sold out at the start of this year at $1.66 (taking a 34% loss at the time!). My reasoning at the time is here.

Looks like we dodged a bullet @BoredSaint ?