Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Director Matthew Quinn has sold out of his entire stake of 200k shares to net $588k.

He has done well given he was buying when this name was still on the mat. Is he indicating that the upside is about done?

Upgraded guidance from Bravura. Market seems to have been anticipating it given the price run up in recent weeks.

Bravura Solutions Limited

ASX Release

1 October 2025

Guidance Update

Bravura Solutions Limited (ASX: BVS) (Bravura) is updating its FY26 guidance as follows:

• Revenue expected to be between $265m and $275m (previously in-line with FY25 revenues1).

• Cash EBITDA2 expected to be between $55m and $65m (previously at least $50m).

This guidance assumes an average GBP/AUD exchange rate of 2.05 for FY26.

The key drivers of the updated forecast are:

• Continued strength of the GBP.

• A higher level of project revenues, particularly with our Wealth customers in EMEA.

• A continued focus on operational efficiency.

Group CEO Appointment

Bravura Solutions Limited (ASX: BVS) (Bravura) announces that Colin Greenhill will be appointed as

Group CEO commencing on 1 January 2026 and will be based in our London office.

The Board has undertaken an extensive global search through an executive search agency to recruit a

Group CEO.

Mr Greenhill has over 15 years’ experience operating as a Chief Executive with wide-ranging experience

leading software businesses serving the financial services and insurance sectors. He recently served as

Chief Executive Officer at SSP Worldwide, a global supplier of software to the insurance industry, and

led an international portfolio of banking, wealth management and insurance software businesses.

Bravura Chair Matthew Quinn said “We are delighted to welcome Colin as our next Group CEO.

Following an extensive search process, the Board unanimously agreed that Colin is the best candidate

to take Bravura forward.”

Mr Greenhill said “I am excited to be joining Bravura at this important stage. With 1,000 talented

colleagues worldwide and a strong portfolio of critical systems supporting leading financial institutions,

we have a solid foundation for the future. I look forward to working with our customers and our teams

to deliver long-term value.”

Shezad Okhai will remain as interim CEO until Mr Greenhill commences as Group CEO, at which time Mr

Okhai will return to his role as Non-Executive Director of Bravura and will assist Mr Greenhill to ensure

a smooth transition.

Another sizable set of purchases from Damien Leonard of L6/PineTree, committing over $3m on market at close to $2.15/share.

The market has responded in kind, sending the shares up 6.5% today.

Old news now but the CEO has put in his notice.

BVS sank 15% at one stage.

Think it was an overreaction as I can't see anything to worry about but it is a negative still. So after dipping to 1.86, I added under $2 when buying returned.

I'm sure we'll get the usual lecture from other members and the usual lecture from Jim Cramer that we should start running from the hills instead of buying the dip!

[held[

Damien Leonard is at it again, buying ~1.9m shares at between $2.24-2.30/share.

I guess he doesn't think it is too late to buy more.

I held off too late on this one mainly because of a past post by Strawman

So I was late to the party even though I know this looked like a decent business riding teh Fintech tailwinds of wealth management.

Anyway it looks like Bravura Solutions put out some decent results today. Up 20% at one stage.

Cash is king

Not only that, upgrade guidance as well

As Buffet says, buy when blood is on the street. This is true when Strawman is selling and continued to be short on the announcement of "Strategic Review".

This is similar to what happened with Strawman's comment on Gentrack and AMP

There is a definite pattern here....

Buy when Strawman says to sell on strategic review or change in management. And definitely load up when the business really turns the corner.

Now too late to buy I guess.... The turnaround train has now truly left the station and maybe better to have jumped back in after dodging that bullet.

[held]

Forager's Alex Shevlev covers BVS here - https://www.livewiremarkets.com/wires/the-asx-stock-whose-turnaround-story-may-have-more-to-come

FY25 upgraded guidance and intention to recommence dividend payments

Bravura Solutions Limited (ASX:BVS) (Bravura or the Company) is upgrading its FY25 guidance as follows:

• Cash EBITDA1 to a range of $33m - $36m (previously $28m to $32m)

• EBITDA1 to a range of $41m - $44m (previously $36m - $40m)

• Revenue1 to a range of $240m - $245m (previously $235m - $240m)

The upgraded FY25 guidance follows the successful transformation and execution of the business strategy over

the past 18 months.

Dividend update

As a result of the Company’s return to profitability and cash generation, Bravura intends to recommence the

declaration of dividends in February 2025 when the 1H25 results are announced, with payment in March 2025.

This is in addition to the capital return of at least $0.163 per share to be paid on 30 January 2025, reflecting the

Company’s improved financial performance and strong balance sheet.

Bravura’s Group CEO Andrew Russell said:

“We are pleased to inform shareholders that our Cash EBITDA, EBITDA and revenue performance is anticipated to

be ahead of the guidance previously provided. This is further confirmation of the execution progress of our

strategy to reset and energise the Bravura business. We have returned to profitability and have a healthy balance

sheet. As a result, we intend to recommence the payment of dividends which will be announced as part of our half

year results.”

Damien Leonard (son of Mark Leonard of Constellation Software) has bought a large dollop of shares (~ 1.75m) between $1.39 and $1.46 on-market. That is significant insider activity, especially with the shares hovering near 52w highs after a very good run already.

If there's one phrase I've come to fear as an investor, it's "strategic review".

You'll never hear that in any positive context.

And given shares in Bravura are down 52% today, it seems that heuristic is holding true.

Man, the magnitude of that fall really is amazing -- we're not talking a unprofitable, cash burning nanocap meme stock -- this was (prior to today) a >$300m market cap company doing a quarter of a billion revenue, CF +'ve, zero debt and even paid a dividend.

Today's announcement is here in all its gory detail, but the key points are:

- FY23 Revenue expected to "increase modestly" from FY22, but...

- Operating costs to increase 16-20%

- FY23 NPAT to be between -$5m and zero (last year it was $25m!)

Basically, the new CEO is looking reconfigure the entire business. This could well be the result of underinvestment in prior years, which might explain why the fundamentals looked so strong (they were doing 15% net margins a couple years back). Indeed, that's what had attracted me to the business, which had long displayed high margin growth.

Thankfully, as you'll see in my SM portfolio, I sold out at the start of this year at $1.66 (taking a 34% loss at the time!). My reasoning at the time is here.

Looks like we dodged a bullet @BoredSaint ?

Some might be interest that BVS has won a new contract in Australia, I believe CFS FirstChoice is now owned by KKR.

CFS partners with Bravura, Tech Mahindra to improve FirstChoice

Bravura has continued its musical chairs approach to senior management by announcing Optus executive Libby Roy will be taking over from Nick Parsons as CEO. Nick Parsons had only been in the role since September last year, taking over from Tony Klim. Bravura also rotated their CFO earlier this year. Libby Roy looks well credentialed with vast experience across many companies and industries. She will be well compensated for her time though. Is it just me or does this look pretty generous for a $350m market cap company?

Maybe I've just been looking at too many nano caps lately (or maybe it's just that all my micro caps have turned into nano caps).

[Not held]

Bravura Solutions released their results for 1H FY22 today. From their release:

- Revenue up 14% to A$132.3m (A$115.7m in 1H21)

- EBITDA up 61% to A$25.3m (A$15.8m in 1H21)

- NPAT up 69% to A$15.3m (A$9.0m in 1H21) • EBITDA margin increased to 19% (14% in 1H21)

- 1H22 EPS up 68% to 6.2cps

- Unfranked interim dividend declared of 3.7cps, bringing the dividend payout ratio to 60% of 1H22 NPAT

On the surface this looked like a fairly good result with Revenue, EBITDA and NPAT all substantially higher than PCP. However management have flagged that while they expect revenue growth of 10% for the FY22 compared to FY21, operating costs are rising at a similar rate.

NPAT guidance was once again downgraded to $25-30m. This means that their NPAT has decreased from FY21 which was already decreased compared to FY20 even after an acquisition which cost them $42m. They have stated that this is the result of some projects being delayed till FY23.

I have decided to exit my position at a loss which I will detail in a forum post later.

Disc: Not held - Exited my position today after results were announced.

At the risk of sounding too much of a pumper in the #Bull case post I thought might be good to post the Bear case as well.

- CEO left in Sept 2021 without much notice and the new CEO (Former COO) is based in London

- Although management have stated they expect growth in FY22, it would seem Revenue and Profit would still be less than FY20 even with the acquisition of Delta.

- Delta only contributed $1.1m in NPAT at a cost of $40m to the business, so you would hope that there would be ongoing growth from this part of the business to justify to cost

- Covid-19 could continue to impact UK market especially if there is talk of a 4th wave sweeping through during their Winter which could once again slow their expected projects

- Wealth and Funds management is a competitive field and even in Australia there are plenty of alternatives which seem to be growing at much faster levels (NWL, HUB, PPS)

- Potential for a takeover if there is further consolidation in this sector

Failure to execute a few years in a row, shifts in accounting for recurring revenue, and the CEO walking away in rather rushed circumstances.

Is this another GBST? Warning signs aren't looking good.

Disc: Held, but confidence wavering, especially after being burned by GBST a few years back.

It wasnt a great year for financial software developer Bravura. Revenue was down 11% to $243m and NPAT was 19% weaker at $32.3m.

Professional services work (implementations and upgrades etc) in all segments was impacted by covid, but underneath this the contracted recurring revenue was up 15% and 84% of revenue was recurring in nature

The balance sheet remains strong with over $73m in cash, there was good cash conversion and the company is forecasting mid-teens growth for Net Profit in FY22.

Bravura is having to bed down some acquisitions and is spending big on R&D to build out it's offering, and follow a more targeted "microservices" product set.

But it also has a backlog of services work that should pick up now economies are opening in places like the UK.

Given it has very favourable economics and high profitability (even in a bad year they declared a record 6cps final dividend), as well as a good history of growth, it's hard to spot anything too dire in these results.

If the business can resume some good revenue momentum the current PE of 22 doesnt seem too onerous. Especially with a 2.5% dividend yield.

That being said, it's a tough competitive environment and customers operate in a cyclical industry -- any continued stall in growth wont be treated kindly by the market.

I'm maintaining my small holding for now.

Valuation Detail (1/7/21)

Attached is the valuation detail and the valuation has the general information and analysis of the company and products, below are the assumptions that drive the calculation of the IV.

IV = $6.05 (base case)

Valuation Assumptions:

· The base case assumes BVS will grow its share of the Wealth Management and Funds Administration markets in ANZ and the UK with only a small contribution from other markets. I have accepted FY21 guidance (see summary below) and the first year forecasted in FY22 to FY31.

· Sales Growth: I expect a Covid recovery and return to strong sales growth as BVS cycles into its new subscription-based revenue model, producing mid to high teens % growth for a few years lead mainly by the UK market which grows to double ANZ by 2031.

· Gross Margin: Expect this to tick up from already very high 92% to 94% over the next 10 years on the back of scale and process efficiencies.

· EBITDA%: Opex spend at 75% will benefit from operating leverage and I have this reducing to 65% by 2031 which drives EBITDA% growth from 27% to 37%.

· Tax: Normally not a variable, but due to AU and UK tax rate differences and tax effects of investments and R&D the average tax rate is well below corporate tax rates, so I have assumed a 25% average effective rate which is very conservative when compared to history.

· Capex: BVS has been and will continue to be driven by investment in it’s products, but the need to generate FCF will persist so I have this growing at half the rate of sales.

· Share Count: Nominal growth of 1% for ESOP, assume that any capital raisings for acquisitions are EPS accreditive so would have neutral or positive value impact.

· Discount: Take average long term market risk rate of 10%, terminal value based on EV/EBITDA multiple of 10 which is equivalent to a P/E of 15 and perpetual growth of 3%, again around market long term averages.

· Risk & Opportunity: No discount for risk due to a strong cash position, large and relatively secure customer base as well as the likely entry of a buyer if BVS becomes distressed in any way. Opportunities in terms of markets outside of ANZ & UK that are not factored into the base case as well as upside from additional acquisitions I am allow for a 10% premium.

BVS is somewhere between a dividend and growth stock, which means that both upside and down side are limited. It is clear that the industry is growing but it is also consolidating and due to the diversity of products and services BVS offers to those in the finance industry it is hard to get a handle on a revenue KPI to guide assumptions on growth.

None the less it has up until Covid grown strongly and I expect that as the UK opens up more with vaccination rates sales will recover and growth return. Management have done well so far with organic and acquired product and sales growth, so the money is on them to continue.

I own BVS as a bit of ballast in what is generally a high growth portfolio, but my position is in the red. I am looking for them to return to growth post Covid but more importantly I am looking for them to return to FCF’s positive. It may be another 6-12 months before we see evidence of either.

Company FY21 guidance:

The impact of COVID-19 in the UK and South Africa is expected to continue to affect the business in 2H21. However, the sales pipeline is strong. Accordingly, Bravura anticipates delivering revenue growth from 1H21 to 2H21 in excess of 10% and achieving FY21 NPAT of A$32m to A$35m.

Restructuring: As a result of reduced professional services work, headcount was reduced by ~5%. The reduction in headcount resulted in A$2.6m in restructuring costs in the period. Restructuring is expected to reduce costs by ~A$5.5m in 2H21 compared to 1H21 and deliver A$11.5m on an annualised basis.

It was a tough half for Bravura, with revenue down 14% and Net profit 54%.

Lower UK project work due to covid was blamed, and the result was broadly within guidance.

This is another one where you have to try and look through the covid anomoly. If it is a genuine one-off speed bump before growth resumes at its previous levels, then I think shares are really attractive.

This is a healthily profitable business with a strong balance sheet and a high degree of contracted recurring revenue. There's a big addressable market and demonstrated growth (on average). The economics are really nice at scale.

The largest segment, Wealth Management, saw a 17% lift in contracted revenue. And there seem to remain good industry tailwinds.

The company is guiding for a 10% lift in revenue from the first to second half (so around $241m in total for FY21, or ~10% lower than FY20), with NPAT between $32-35m (a 17% drop). So it could be some time before we will see any tangible return to growth. I think it could take until FY23 before revenues completely recover. But from there i'd like to think 10-15% sales growth is achievable.

This is however a competitive industry, and there are plenty of other good solutions available to users. The moats for Bravura aren't massive, so execution will be key.

24-Nov-2020: AGM addresses by the Chairman and the CEO

{I hold BVS shares.]

Bravura has signed a 7 year contract with Award Super (previously First State) -- Australia's second largest super fund that manages ~$130b in funds and has >1 million members. Bravura will provide an "integrated ecosystem" of its products, underpinned by Sonata Alta.

No financials were provided, though clearly this is a material win. Certainly good news.

Although implementation work has started, it hasnt changed the outlook for a flat 2021 NPAT. Moreover, the second wave of UK lockdowns and stalling Brexit negotiations is slowing the progress of sales, and the FY21 result will be significantly weighted to the second half.

The market remains unimpressed and shares continue to drift back towards the March lows. Should BVS resume growth in subsequent years -- even relatively modest growth -- I think shares remain a good long term opportunity.

Announcement here

27-Oct-2020: Bravura signs long-term contract with Aware Super [plus FY21 Outlook]

Aware Super are the mob who have been in the bidding battle with Uniti (UWL) over the acquisition of OptiComm (OPC), which Uniti appear to have won at this stage. Aware Super (previously First State Super) is Australia’s second largest superannuation fund, managing nearly A$130b in retirement savings for more than 1m members. Aware Super supports its members with superannuation, retirement, investments and advice.

Aware Super has selected Bravura to provide the technology to power its mission-critical operations, which support the administration of the retirement savings of its members. Aware Super is implementing an integrated ecosystem of Bravura products, underpinned by Sonata Alta and encompassing AdviceOS, Babel SuperStream messaging and member and adviser digital offerings. Bravura’s products will underpin Aware Super’s provision of superannuation, income stream, unit trust and advice offerings. Bravura will also provide a dedicated Sonata Alta support team. The contract is for an initial term of 7 years.

Sonata Alta is a new, digital-first operating model, underpinned by Bravura’s highly regarded Sonata platform with in-built industry standard process orchestration to achieve high levels of automation and supported by a best-inclass ecosystem with the flexibility to evolve alongside client needs. Sonata Alta’s cloud BPaaS (Business Process Automation as a Service) platform provides clients control over their customers’ data, operations and end customer experiences.

Tony Klim, Chief Executive Officer at Bravura Solutions said:

“We are delighted to provide Bravura’s world-class technology to Aware Super. Sonata Alta and Bravura’s ecosystem of products are ideally suited to providing Aware Super unprecedented control, flexibility and a highly personalised member experience at scale to support their members for and in retirement.”

Deanne Stewart, CEO at Aware Super said:

“After a rigorous selection process, Aware Super selected Bravura as its technology partner for this key initiative. We look forward to working closely with Bravura to deliver exceptional outcomes for our members.”

Implementation work at Aware Super has commenced.

FY21 outlook

As noted at Bravura’s FY20 results, while the new sales pipeline remains strong, due to the wider impact of COVID19 there is greater uncertainty in the timing of deal closures when compared to prior years. It is possible that FY21 NPAT will be similar to FY20.

There is no change to FY21 Outlook as a result of the Agreement signed with Aware Super, however the second wave UK lockdowns and stalling Brexit negotiations have increased uncertainty and are slowing the progress of pipeline opportunities in the UK. As a result, Bravura expects FY21 NPAT to be significantly weighted to the second half of FY21.

– ENDS –

[I hold BVS and UWL shares.]

12-Oct-2020: Bravura acquires Delta Financial Systems

Key points

- Bravura to acquire Delta Financial Systems (Delta) for a total consideration of up to GBP23.0m (A$41.5m*)

- The acquisition complements Bravura’s core Sonata offering and broadens Bravura’s growing ecosystem of products and services

- Building on FY20 pro forma revenue of GBP6.0m, Delta is forecast to achieve revenue growth in the range of 20- 30% with margins similar to Bravura’s Wealth Management segment

- Expected to be EPS accretive in FY21 and funded from existing cash reserves

Bravura Solutions Limited (ASX:BVS) (Bravura) has today announced the acquisition of Delta for a total consideration of up to GBP23.0m (A$41.5m*).

Delta is a UK software company that provides technology to power complex pensions administration in the UK market. Delta’s highly regarded products support the administration of SIPPs (self-invested personal pensions) and SSASs (Small Self-Administered Schemes), including the full range of complex client drawdown options available under the pension freedoms legislation. Delta’s technology currently supports the needs of more than 30 UK clients.

The acquisition broadens Bravura’s product suite. Delta’s products represent a natural extension to Bravura’s core Sonata offering and expand Bravura’s ecosystem of products and services. The acquisition also provides an opportunity to offer Bravura’s other products to Delta’s client base.

Commenting on the acquisition, Tony Klim, Chief Executive Officer said:

“We are delighted that Delta is joining Bravura. Both businesses have complementary products that together, provide a compelling offering to support the mission-critical operations of wealth management firms in the UK.”

Commenting on the acquisition, Michael Power, CEO and Co-Founder of Delta said:

“Bravura is a leader in the UK wealth management marketplace and Delta’s products sit perfectly alongside Bravura’s offering. The Delta management team look forward to working together with Bravura to deliver outstanding service to both Bravura’s clients and Delta’s clients.”

The transaction is expected to be completed by the end of October 2020 subject to regulatory approvals.

* Based on the AUD/GBP exchange rate of 0.55 on 9 October 2020.

– ENDS –

[I bought BVS shares this morning. I was actually planning to buy some before this announcement and this acquisition did not change my mind. BVS is trading at a discount to their peers, or they were before today certainly - and probably still are. Their share price has risen +8% so far today (from their $3.38 close on Friday to $3.65 now) on this news. The market seems to like it. I think it will draw attention back to BVS, which has been left behind as others in this space have done well and their share prices have powered ahead (NWL, MAI, HUB). I consider BVS to be the value play in the funds administration and wealth management software space.]

I need to do more work on this, but from what i've read so far Bravura seems like an interesting opportunity. Encouraged to see some support from some of our experienced members too.

A provider of software to the finance industry, with about 2/3rds of revenues coming from Wealth Management and the rest from Funds administration.

A high margin, scalable business with high customer retention and recurring revenues (77% of total). Also some good regulatory drivers and a rock solid balance sheet.

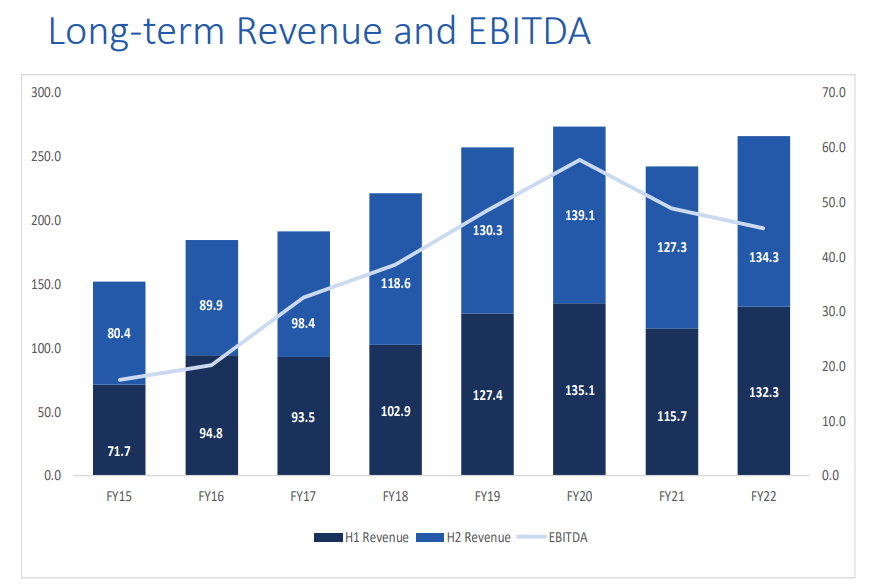

Historical growth in sales has been strong, about 12% per year on average since FY15, with EBITDA growth up around 27%pa over the same period.

That being said, revenues grew only 6% in FY20 and profit was 10% higher on a per share basis. And covid-19 seems to have caused an extension in the sales cycle.

These do not appear to be structural issues, and with shares on a PE of roughly 21, with a 3% yield, it seems attractively priced if the group can sustain anything near low double digit growth.